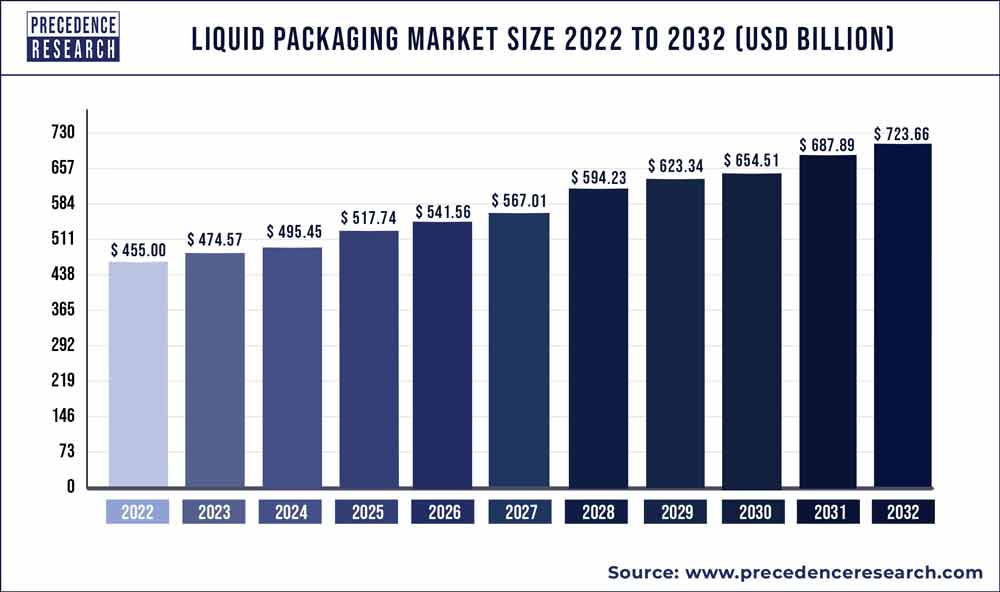

The global liquid packaging market size was valued at USD 455 billion in 2022 and is predicted to hit around USD 723.66 billion by 2032 with a remarkable CAGR of 4.8% from 2023 to 2032.

Access our Packaging Data Intelligence Tool with 10000+ Database, Visit: Towards Packaging

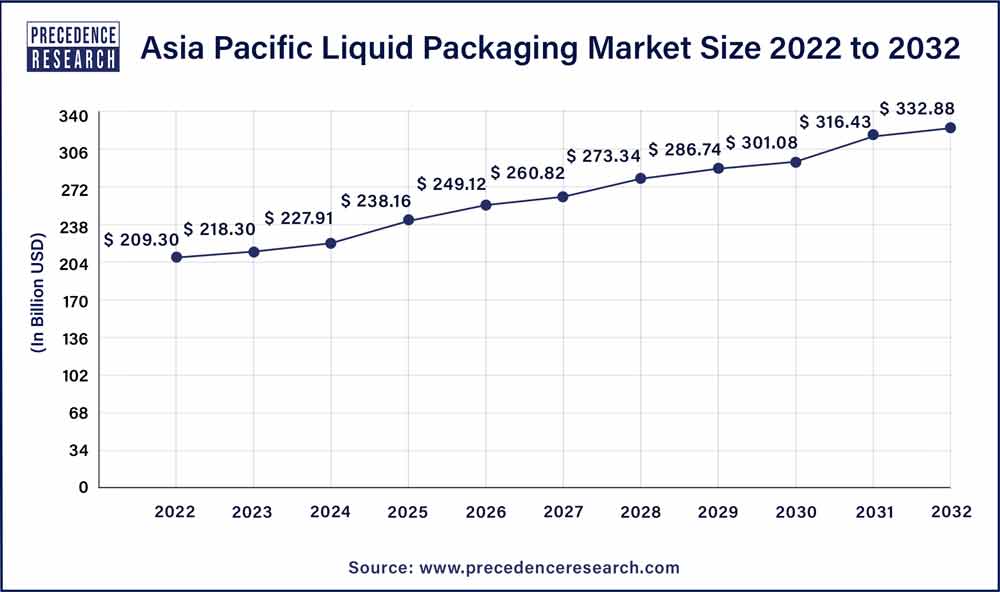

The Asia-Pacific liquid packaging market size was valued at USD 209.30 billion in 2022 and is estimated to reach around USD 332.88 billion by 2032, growing at a CAGR of 4.80% from 2023 to 2032.

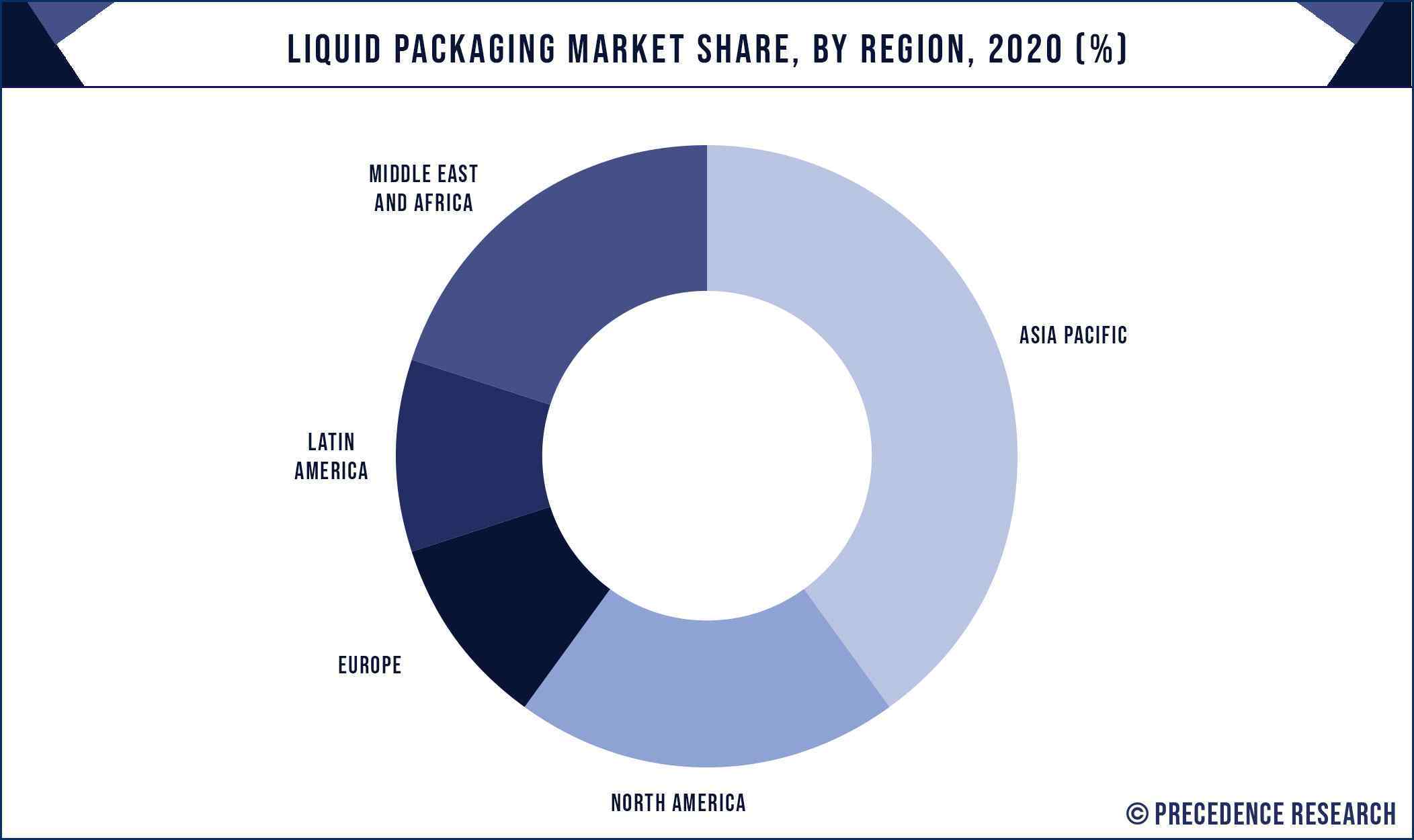

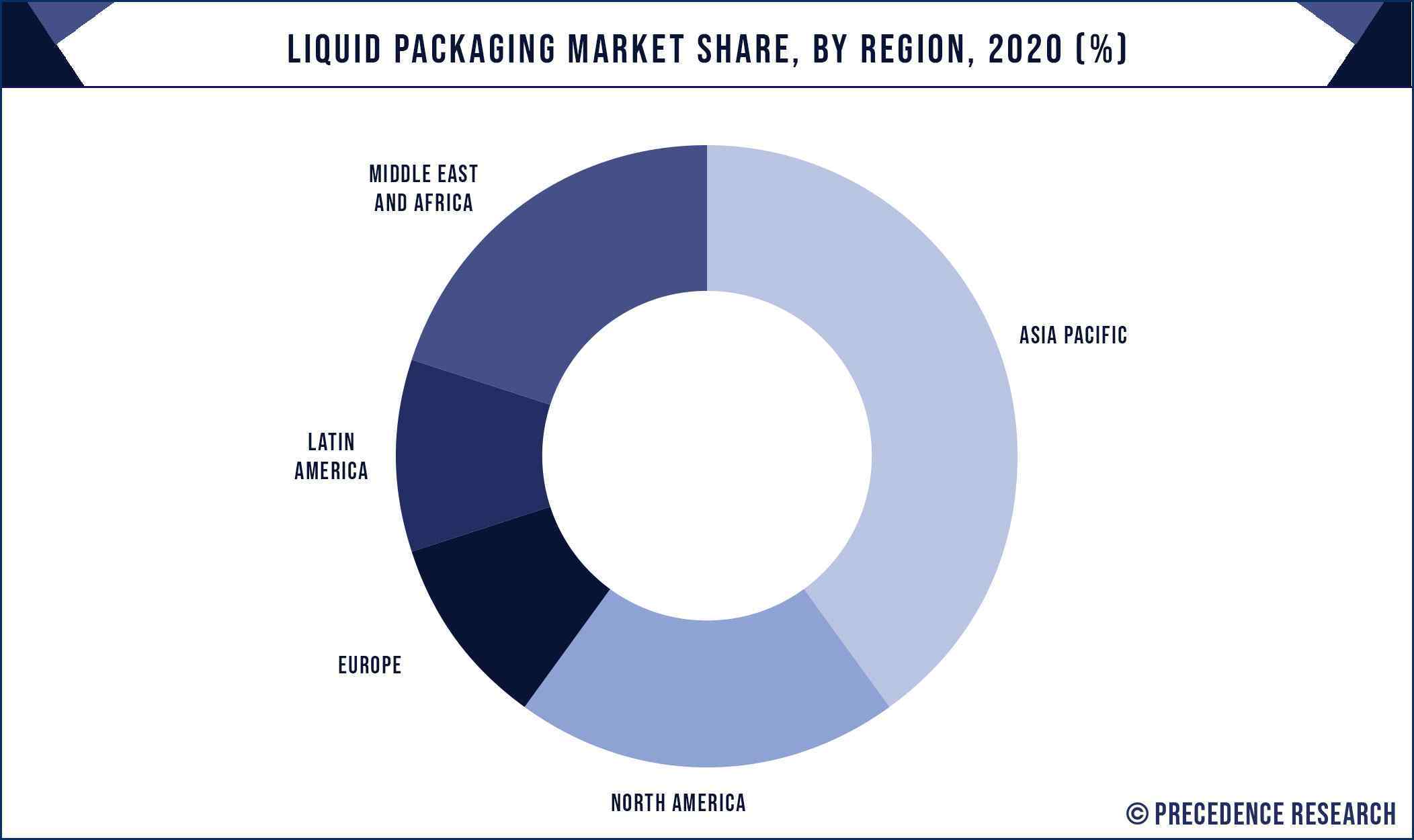

In terms of region, the Asia Pacific exhibits the highest demand for liquid packaging and accounted for around 44% value share in the year 2022. This is primarily because of the favorable government policies for manufacturers, expansion in pharmaceutical and food & beverage sectors, and the shifting of the production facilities in the region due to low operating and labor costs.

Besides this, North America expected to grow at a moderate rate over the forecast period. The U.S. is considered as the leading contributor towards the growth of the region because of prominent demand for liquid packaging along with rising implementation of paper products over other harmful materials in the region expected to propel the demand for liquid packaging in North America in the coming years.

Glass, paper & paper boards, metals (tinplate, foils & laminates, aluminum, & tin-free steel), and plastics are the materials that have traditionally been uses in the food packaging. Further, emergence of aluminum films for packaging application expected to upend the food packaging industry and further propels the growth of liquid packaging market over the upcoming years. In addition, rising trend towards freshness and quality of the food in the duration of storage and distribution expected to impel the market growth for liquid packaging.

Furthermore, increasing application of plastics for beverage packaging because of its low cost compared to other materials such as glass and tin-plates likely to prosper the growth of the market. Plastics offer some functional advantages over other packaging materials that include microwavability, thermo-sealability, unlimited sizes & shapes, and optical properties is the other prime factors that boosts the growth of the liquid packaging. Use of plastic material separates the contact of product from environment that protects it from moisture and bacteria, thereby increasing its shelf life.

In addition, large number of people shifting towards urban areas expected to propel the growth of liquid packaging in for supporting transportation of liquid products over long distance along with increasing their shelf life. Attraction towards lifestyle coupled with greater opportunity for income in the urban areas draws large number of population towards cities.

| Report Highlights | Details |

| Market Size in 2023 | USD 474.57 Billion |

| Market Size by 2032 | USD 723.66 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 4.8% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

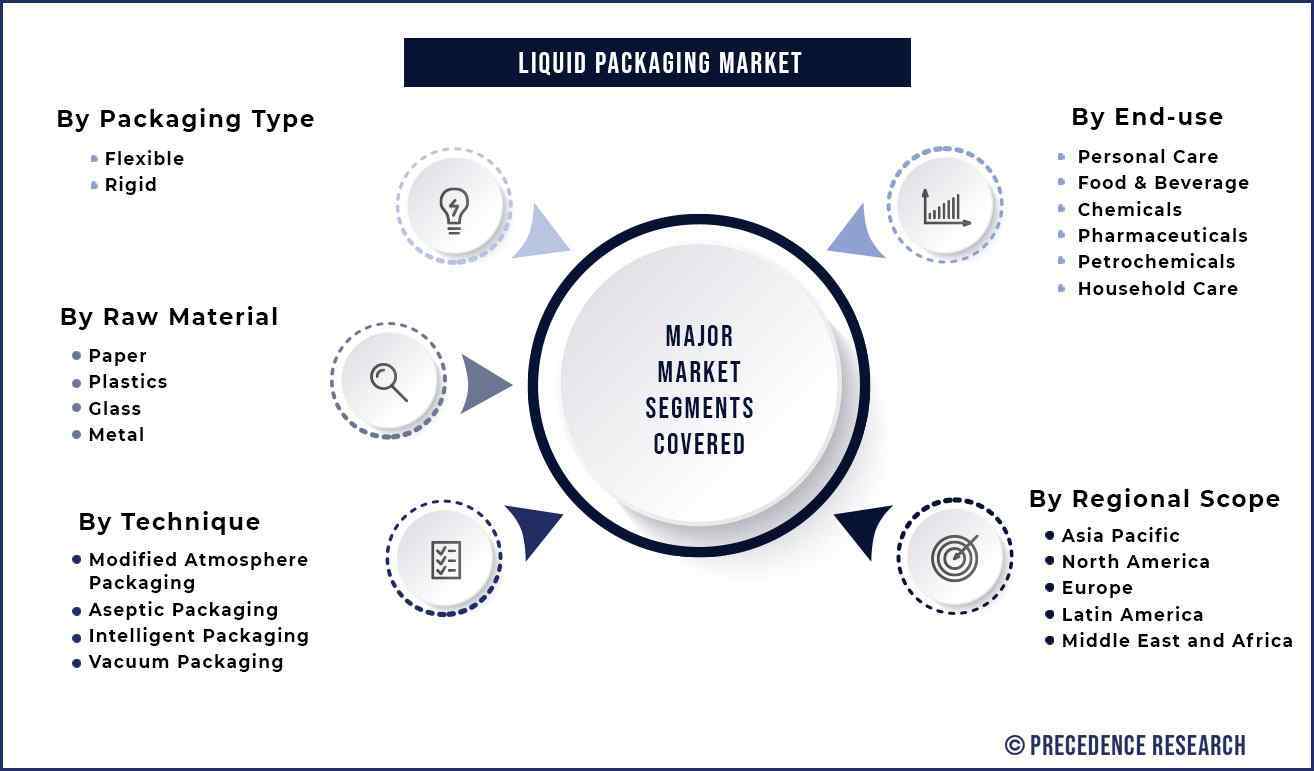

| Segments Covered | Packaging Type, Raw Material, Technique, End-use |

| Regional Scope | North America, APAC, Europe, Latin America, MEAN, Rest of the World |

| Companies Mentioned | Comar LLC, Tetra Laval International S.A., Liqui-Box Corporation, Evergreen Packaging Inc., International Paper Company, BillerudKorsnäs AB, Nippon Paper Industries Co., Ltd. |

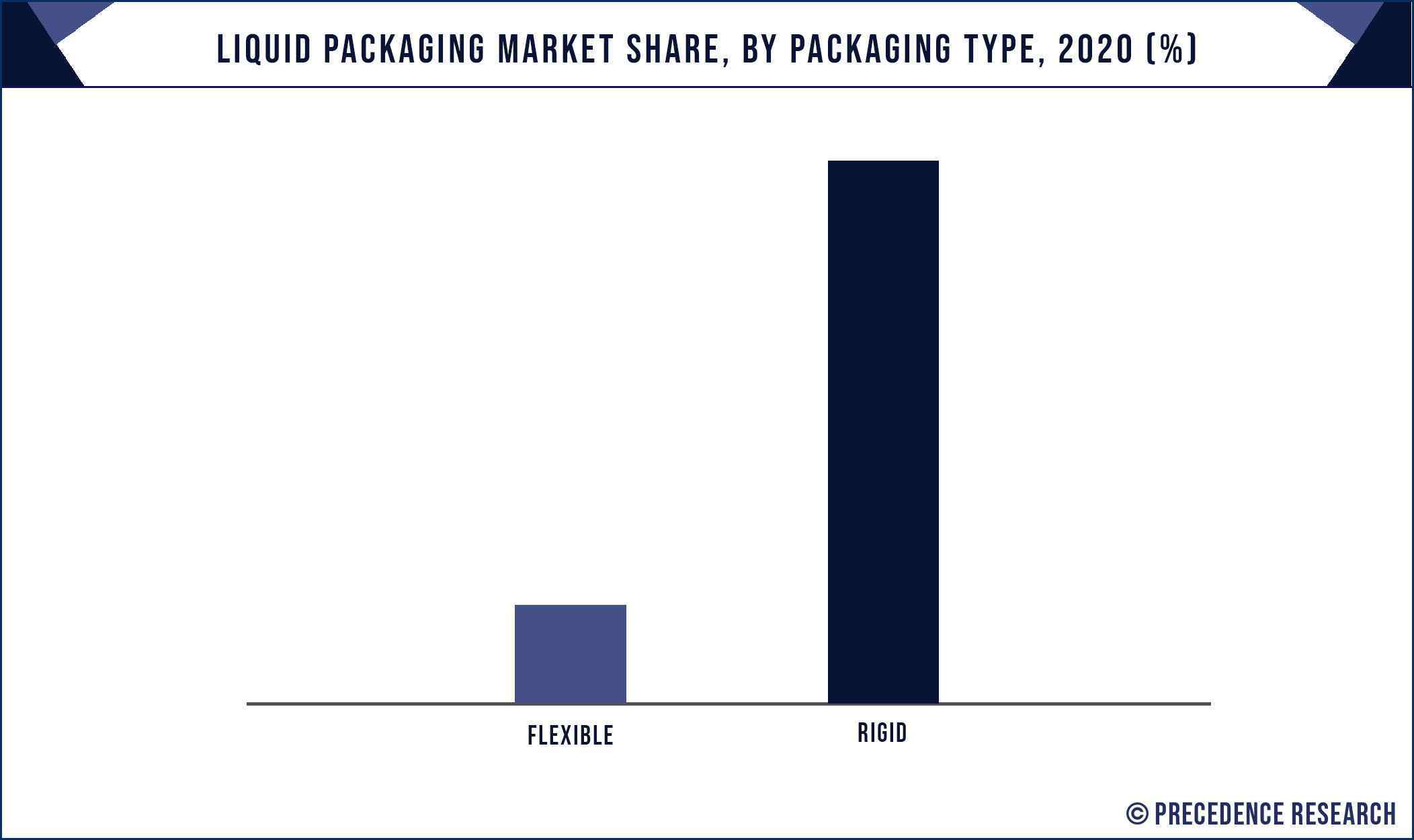

In terms of value, rigid packaging emerged as a dominant segment, accounting for the major market share of over 85.5% in 2020. Rigid packaging is extensively used to manufacture the packaging solutions for pharmaceutical drugs and beverages. This is mainly because of the exceptional properties of rigid packaging over other packaging type that includes excellent shelf-life and ease of transport & carrying.

On the other side, increasing application of flexible packaging materials owing to light weight, low transportation cost, and flexibility in the size & shape of the package anticipated to boost the growth of flexible packaging solutions over the upcoming years.

In terms of raw material, plastics led the global liquid packaging market and accounted for more than half of the value share in the year 2022. Plastics are the most preferred material in the manufacturing of packaging solutions for different end-use verticals such as pharmaceutical, food & beverage, household care, and personal care.

However, paper segment likely to exhibit significant growth over the coming years owing to its excellent properties that include better environmental protection and high recyclability. A further, stringent government norm on restricting the usage of non-degradable plastics is the other major factors that impel the demand for paper materials. Suppliers of paper packaging solutions such as paperboard containers and boxes have increased their production capacities in response to meet the dynamic market conditions.

In terms of region, the Asia Pacific exhibits the highest demand for liquid packaging and accounted for around 44% value share in the year 2022. This is primarily because of the favorable government policies for manufacturers, expansion in pharmaceutical and food & beverage sectors, and the shifting of the production facilities in the region due to low operating and labor costs.

Besides this, North America expected to grow at a moderate rate over the forecast period. The U.S. is considered as the leading contributor towards the growth of the region because of prominent demand for liquid packaging along with rising implementation of paper products over other harmful materials in the region expected to propel the demand for liquid packaging in North America in the coming years.

The global liquid packaging market seeks intense competition among the market players because of rapid changes in the consumer preference that drive large number of innovation and product development. Further, the brand managers are largely focused towards grabbing maximum market share on the global scale on account of product differentiation and customization. For instance, in March 2020, Smurfit Kappa’s new Top Clip solution was launched by a beer brewer Royal Grolsch as a paper-based material replacement for the plastic shrink wrap that are currently used on their can multi-packs.

Some of the prominent players

Segments Covered in the Report

This research study comprises complete assessment of the market by means of far-reaching qualitative and quantitative perceptions, and predictions regarding the market. This report delivers classification of marketplace into impending and niche sectors. Further, this research study calculates market size and its development drift at global, regional, and country from 2016 to 2027. This report contains market breakdown and its revenue estimation by classifying it on the basis of packaging type, raw material, technique, end-use, and region:

By Packaging Type

By Raw Material

By Technique

By End-use

By Regional Outlook

PROCEED TO BUY :

ASK FOR SAMPLE

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client