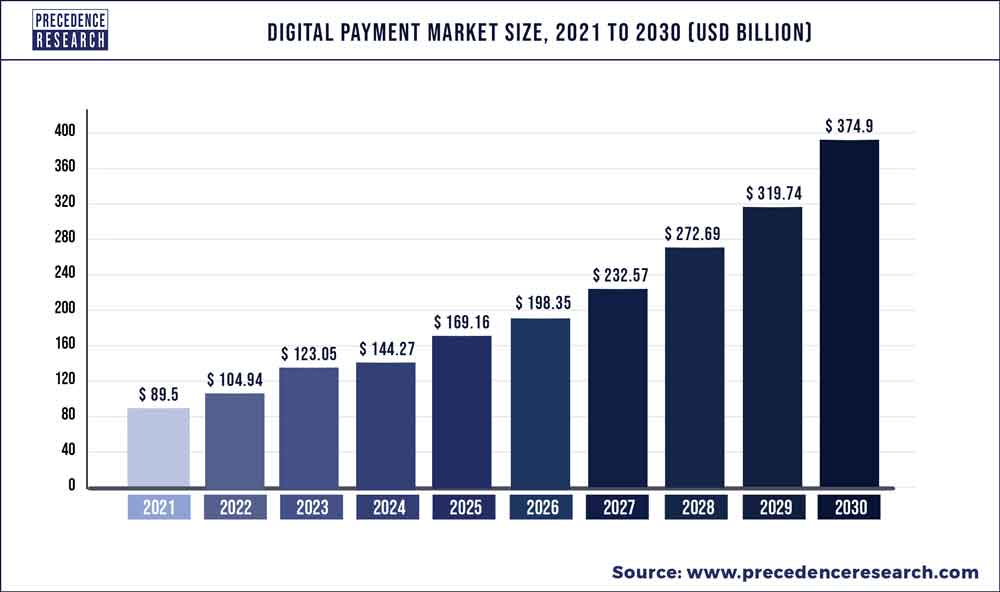

The global digital payment market size was accounted for USD 104.94 billion in 2022 and is expected to hit around USD 374.9 billion by 2030, poised to grow at a compound annual growth rate (CAGR) of 17.25% from 2022 to 2030.

To Access our Exclusive Data Intelligence Tool with 15000+ Database, Visit: Precedence Statistics

Digital payment or an electronic payment refers to the transmission of value from one payment account to another with no exchange of hard cash involved. Such payments use a digital device such as a mobile phone, computer, and Point of Sales (PoS) along with the digital channel communications including Society for the Worldwide Interbank Financial Telecommunication (SWIFT) or mobile wireless data. Entities involved in processing of digital payment transaction include the merchant, the consumer, the payment network, and the bank. It offers considerable benefits such as cost savings and transparency & security for individuals, governments, companies, and international development organizations. The facility of transition to digital payments and receipts has significantly helped small business around the globe for faster and secured payments at no risk and charges.

Worldwide governments are pushing digital payment systems to enable increased transparency among monetary transactions for people. On the other hand, COVID-19 pandemic has forced governments, educators, businesses, and citizens to adapt to a “new normal” for conducting their daily activities. For instance, the pandemic has augmented digital transformation across geographies in areas including e-government, e-commerce, and remittances. For instance, according to the International Finance Corporation, the internet usage has seen growth of 1.3% in lower-middle-income countries amid January and March 2020. This has led to the shift in consumer preferences and their buying behavior, enabling them to use digital means for conducting retail, business, financial, and government transactions.

| Report Coverage | Details |

| Market Size in 2022 |

USD 104.94 Billion |

| Market Size by 2030 |

USD 374.9 Billion |

| Growth Rate from 2022 to 2030 | CAGR of 17.25% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segments Covered | Component, Deployment Type, Organization Size, Industry Vertical, and Geography |

| Companies Mentioned | PayPal, Fiserv, FIS, Global Payments, Mastercard, Square, ACI Worldwide, JPMorgan Chase, Apple Inc., 2Checkout now Verifone, and OpenWay Group. |

Factors including increasing movement away from cash and rising usage of smartphones has driven growth of the global digital payment market. In addition, the wide adoption of the Internet has boosted global e-commerce sector. E-commerce is further driving evolution of services such as digital payments, insurance, and credit that are being offered at the point of sale by non-financial companies. Also, in recent times, e-commerce platforms such as Alibaba, Jumia, MercadoLibre, and Amazon started adding payments facilitation across their platforms. This is called the embedding finance trend which is anticipated to further accelerate digital payment transactions. This growth of the e-commerce has contributed to an upsurge in digital financial services associated with small businesses and consumers, boosting growth of the global digital payment market. For instance, most of the e-commerce platforms are seeing surge in usage of digital payments, especially digital wallet which is a payment system for helping consumers with safe and instant transactions.

On the other hand, an expanding digital payments industry has scaled up over the past years across emerging economies around the globe due to availability of affordable smartphones and succeeding Internet penetration. Also, the governments and regulators across emerging markets including Bangladesh, Sri Lanka, and Nepal have worked on roadmap for digital transformation to encourage citizens to go cashless. For instance, government of India set up the National Payments Corporation of India (NPCI), a separate entity to promote retail payments. Also, the country has earlier created RuPay, a truly open domestic cards scheme to expand its digital payments ecosystem. Such government initiatives focused on evolution of digital payments is opportunistic for growth of the global market. Also, emergence of 5G technology along with rapid digital transformation trend is expected to create lucrative growth opportunities for the global market. This trend will massively increase network speed and connectivity by empowering both banks and their competitors to enhance and streamline digital payments.

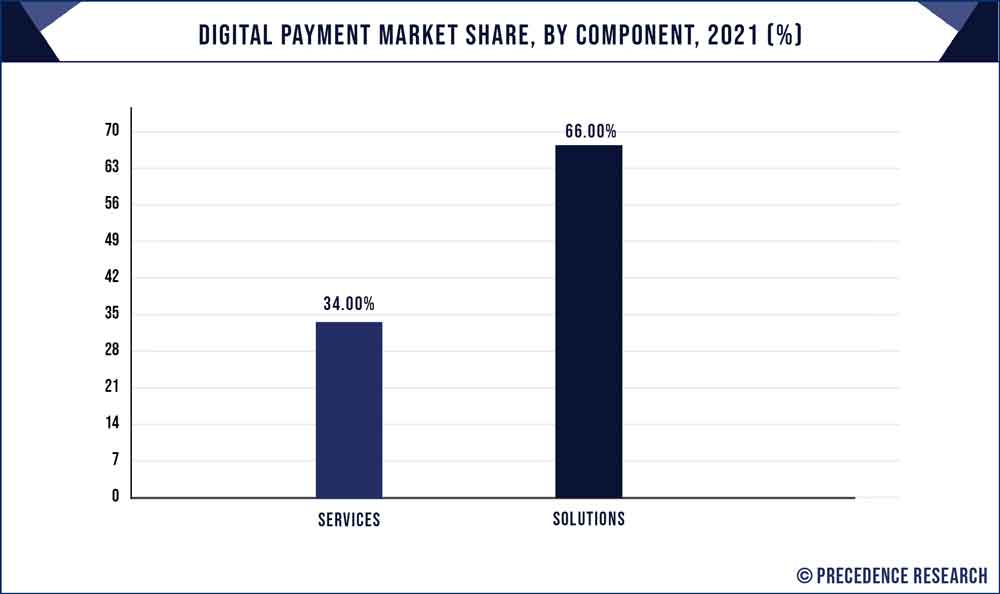

Depending upon the component, the solutions segment accounted largest market share in 2021. Solution segment comprises of various segments including payment gateway, payment processing, payment wallet, payment security and fraud management, and point of sale (PoS). Growth of this segment is attributed to wide adoption of payment processing solutions to enable customers with seamless online shopping experiences.

In addition, use of multi digital wallets is further advancing growth of solutions segment. For instance, according to latest data from FIS PACE, 32% of mobile wallet users across the globe have three or more mobile wallets such as Google Pay, Apple Pay, and others downloaded on their smartphones. The study has also indicated that, Millennials and Gen Z are increasingly using digital wallets. Further, technological advancements in digital wallets is projected to enable them store and allow for extensive payment transactions along with seamless and on-demand access to alternative digital assets such as cryptocurrency.

Moreover, the spread of digital payment methods has significantly transformed point of sale. For instance, in current times, new POS can be a smart phone, watch, or TV; a retail kiosk or even an embedded sensor in a thermostat or refrigerator. This innovations across the digital commerce is anticipated to create lucrative growth opportunities solutions segment.

Depending upon the industry vertical, the Banking, Financial Services and Insurance (BFSI) segment is the dominant player and is anticipated to have the biggest impact on digital payment market. In past several years, insurance, financial services, and stockbroking businesses have observed a massive change in the way they disburse and receive funds. Therefore, upsurge in demand for digital payment for domestic and cross-border transactions mainly boosts growth of the BFSI segment. Also, BFSI sector is seeing rising preferences for digital payments among consumers due to increased internet usage and rapid smartphones adoption trend.

On the other hand, banks are enhancing their offerings associated with digital payments to compete with other solution providers, such as Google, Facebook, and Amazon. For instance, in February 2022, The Bank of America Corporation, an American multinational investment bank and financial services company collaborated with Banked Ltd. to launch Pay by Bank, the online payment solution to enable customers of e-commerce companies to pay straight from their bank account. According to the company, this strategy is a part of its continual series of technology investments.

However, retail & e-commerce segment is expected to witness highest growth rate during the forecast period due to significant growth in use of mobile-based payment solutions among consumers for retail payments. In addition, ongoing trend of unmanned convenience stores is further anticipated to create lucrative growth opportunities for this segment. For instance, in December 2021, LG Electronics extended its unstaffed retail stores with the announcement of 30 unstaffed stores up and running by the June 2022 to meet demand for contactless shopping.

Digital Payment Market Share, By Region, 2021 (%)

| Regions | Revenue Share in 2021 (%) |

| North America | 35% |

| Asia Pacific | 22.4% |

| Europe | 29.5% |

| Latin America | 8% |

| MEA | 5.1% |

The North America region dominated the market with largest revenue share in 2021. This region includes U.S. and Canada. Growth of the market in this region is mainly attributed to continuous adoption of digital wallets and mobile payments by U.S. consumers. For instance, according to the recent survey, over four in five Americans uses some form of digital payment including in-app or browser-based online purchases, person-to-person (P2P) payments, and in-store checkout by using mobile phone.

Technological advances in digital payment industry in North America is expected to create lucrative growth opportunities for the market. This platform offers feature to split payment of online purchases through combinations of credit and debit cards, without interest or added costs. This way, the platform is projected to help user reduce cost burden on individual cards, increase financial privacy, and build credit scores.

Asia-Pacific is considered as highest growing region in digital payment market. This region includes China, India, Japan, South Korea, and rest of the world. Initiatives undertaken by major countries in this region to enhance digital payment sector is one of the major factors driving growth of the market. For instance, government of India is actively working on its strategy to digitize the economy and financial sector. The country has recently introduced Bharat Interface for Money-Unified Payments Interface (BHIM-UPI) which has emerged as one of the preferred payment modes for Indian citizens. Also, huge growth of digital payment sector in China is driving growth of Asia-Pacific region. More than 90% of Chinese urban consumers uses Alipay or WeChat Pay, the two premier digital payment in country.

On the other hand, China is developing Digital Currency Electronic Payment (DCEP) or e-CNY, a digital currency which is possibly only months away from a country-wide launch. This emphasis on digital currency by government of China is projected to create lucrative growth opportunities for the digital payment market.

Segments covered in the report

By Component

By Deployment Type

By Organization Size

By Industry Vertical

By Geography

PROCEED TO BUY :

ASK FOR SAMPLE

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client