What is the Advanced Process Control Market Size?

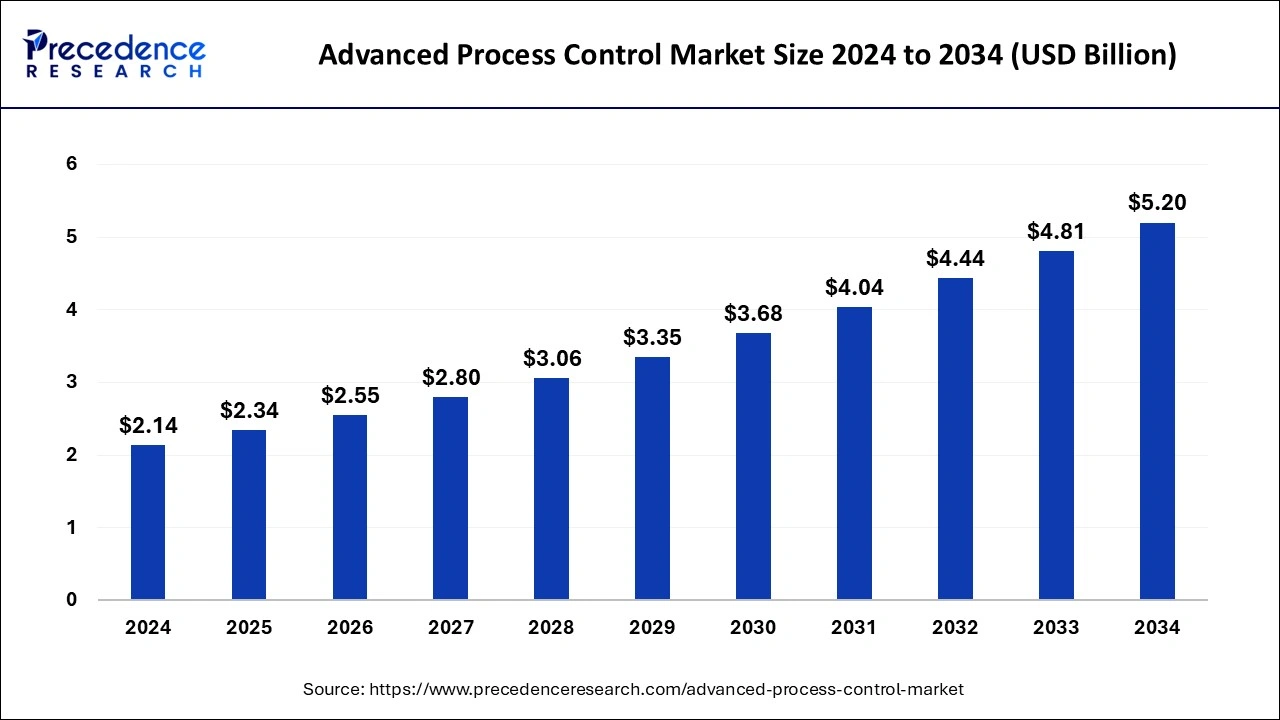

The global advanced process control market size is calculated at USD 2.34 billion in 2025 and is predicted to increase from USD 2.55 billion in 2026 to approximately USD 5.58 billion by 2035, expanding at a CAGR of 9.08% from 2026 to 2035. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advanced process control which is estimated to drive the global advanced process control market over the forecast period.

Market Highlights

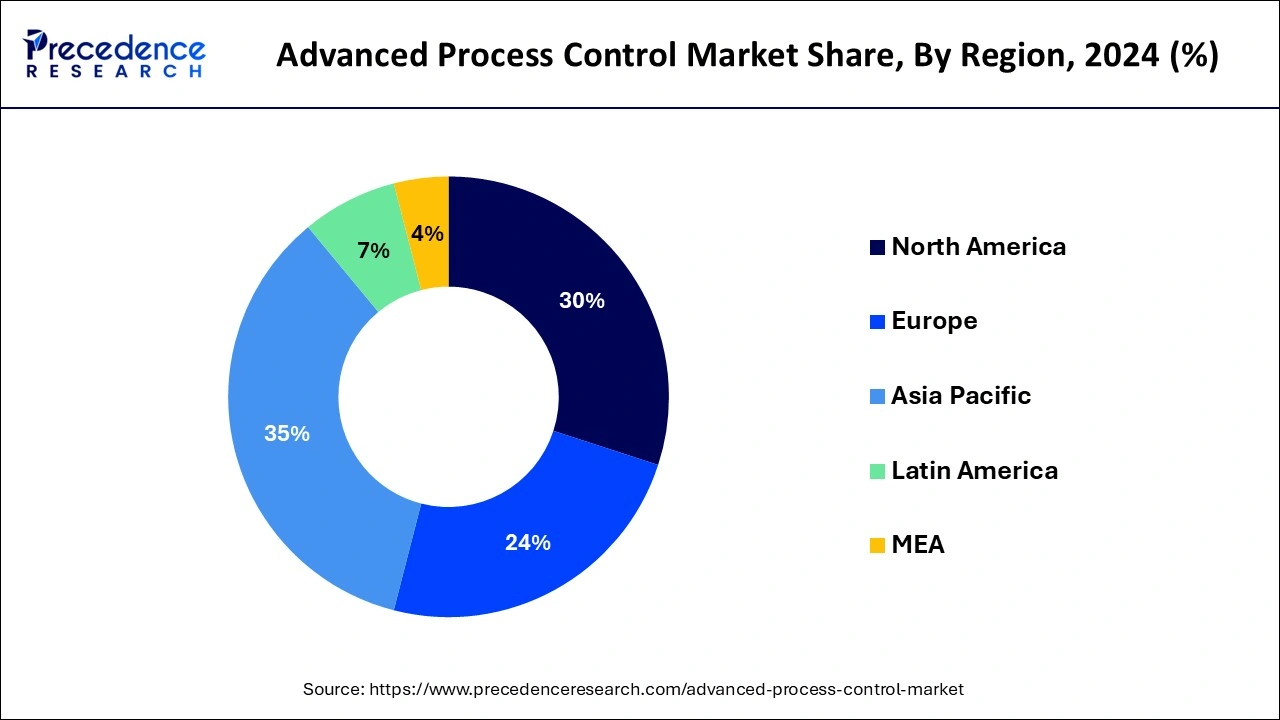

- Asia Pacific dominated the global market with the largest market share of 35% in 2025.

- North America is projected to expand at the fastest CAGR during the forecast period.

- By product, the service segment contributed the highest market share in 2025.

- By fuel, the lithium-ion segment captured the biggest market share in 2025.

- By end user, the oil and gas segment has held the largest market share in 2025.

What is an Advanced Process Control?

Advanced process control utilizes sophisticated algorithms and software , such as model predictive control and AI, to improve complex industrial processes beyond basic controls, driving yield, reducing energy usage, and stabilizing operations by handling multiple variables simultaneously for better economic as well as performance outcomes in industries such as chemical, oil & gas, and manufacturing.

How Can AI Improve the Advanced Process Control Industry?

Artificial Intelligence -powered systems analyze data in real-time to optimize process variables, improving efficiency and product quality. AI integration significantly enhance the Advanced Process Control (APC) market by introducing advanced capabilities that optimize processes, improve decision-making, and boost efficiency. AI algorithms helps in predicting equipment failures before they occur, minimizing downtime and maintenance costs.

AI process vast amounts of data to provide actionable insights for operators. AI leverages Industrial Internet of Things (IIoT) data to enhance process visibility and control. AI at the edge ensures faster response times and reduces dependency on centralized systems. AI algorithms can identify unusual patterns in process data, signaling potential issues before they escalate.

AI models can automatically retrain and even update themselves in real-time, utilizing live data streams, eliminating the demand for time-consuming manual tuning by engineers when process conditions or any feedstocks change. Firms are leveraging AI-improved APC to meet stringent environmental regulations as well as corporate ESG objectives by enhancing energy efficiency and minimizing waste.

Advanced Process Control Market Growth Factors

- Increasing demand for energy efficiency has risen demand for advanced process control which has estimated to drive the growth of the market over the forecast period.

- Growth in automation across industries has increased demand for the advanced process control.

- Adoption in emerging economies and developing regions are increasingly automating processes, driving the growth of the advanced process control market over the forecast period.

- Complex operations in industries like oil & gas, chemicals, and pharmaceuticals require advanced process control for real-time optimization and control, which has driven the growth of the market.

- Rise in process optimization needs has boomed the growth of the advanced process control market in the future.

- Increasing regulatory support is estimated to drive the growth of the market over the forecast period.

Advanced Process Control Market Outlook

- Industry Growth Overview: The market is driven by rising automation, efficiency needs, and even sustainability mandates across industries such as Oil & Gas, Chemicals, and Pharma, with forecasts showing significant growth propelled by technologies such as MPC, AI, and cloud integration.

- Major Investors: It includes global industrial giants such as Honeywell, Siemens, Rockwell Automation, ABB, Emerson Electric, and General Electric (GE), alongside software/solutions manufacturers such as Schneider Electric, Aspen Technology, and AVEVA.

Advanced Process Control Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.34 Billion |

| Market Size in 2026 | USD 2.55 Billion |

| Market Size by 2035 | USD 5.58 Billion |

| Growth Rate From 2026 to 2035 | CAGR of 9.08% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Companies Mentioned | Schneider Electric, Siemens, Rudolph Technologies, Aspen Technology, Inc., Emerson Electric Co., and ABB |

Market Dynamics

Drivers

Customization and Scalability

Various sectors have distinct needs and procedures. For advanced process control solutions to meet these particular requirements, they must be adaptable. The specifications for APC in chemical manufacturing, for instance, could be very different from those in semiconductor manufacture. Even within the same industry, processes might differ greatly depending on raw materials, equipment setups, and ambient conditions. Through customization, advanced process control solutions can adjust to these changes and maintain maximum performance in a variety of process conditions. Scalability is provided via modular advanced process control solutions, which enable the addition or removal of components as needed. Organizations can grow their advanced process control deployments in response to shifting operational demands and resource limitations thanks to this modular methodology.

Restraint

Data Privacy and Security Concerns

Large volumes of sensitive data, including trade secrets, proprietary information, and possibly personally identifiable information (PII) of personnel, are gathered and analyzed by advanced process control systems in relation to industrial operations. Stricter laws and compliance requirements pertaining to data privacy and security, such as the General Data Protection Regulation (GDPR) in Europe or industry-specific laws like the North American Electric Reliability Corporation (NERC) standards for the energy sector, are frequently applicable to industries using advanced process control systems. Workers with access to private systems and data may unintentionally reveal confidential information or intentionally abuse their privileges for sabotage or personal benefit. While access restrictions guarantee that only authorized people can view or edit crucial system parameters, encryption aids in preventing unwanted access to data.

Opportunity

Industry 4.0 Integration

Large volumes of data can be collected from a variety of sources in the manufacturing environment, such as production lines, sensors, and equipment, thanks to Industry 4.0 . advanced process control systems can use prescriptive and predictive analytics in conjunction with Industry 4.0 integration to proactively modify control settings in order to maximize performance and foresee possible process aberrations or breakdowns. IoT-enabled sensors and actuators in the context of advanced process control allow for remote access and management of manufacturing activities from any location in the world, in addition to real-time process monitoring and control. Because it offers scalable computing resources and storage capacities for managing massive volumes of data generated by advanced process control systems, cloud computing is essential to Industry 4.0 integration.

Segment Insights

Product Insights

The market is subdivided into hardware, services, and software. Because of the large installed base of advanced process control systems in developed regions such as North America and Europe, the service type dominates the market. The service type is further classified into advanced regulatory control, multivariable model predictive control, inferential control, sequential control, and compressor control.Model-predictive control is the most widely used automated multivariable control technology today (MPC). MPC distinguishes itself through the use of detailed process models, embedded optimizers, and a large-matrix approach to application design, in which dozens of variables and often hundreds of models emerge and evolve.

End-User Insights

Based on the end-use industries, oil & gas took the largest share in 2024. The term "advanced process control" (APC) refers to a wide range of sophisticated technologies and tools used to optimize oil and gas plant performance in a variety of applications. It is used to improve plant performance and stabilize operations by reducing fluctuations in key process variables.

Advanced process control (APC) projects in the chemical industry have been shown to increase capacity by 3% to 5%. APC debottlenecking the process, or a portion of it, by reducing variability and operating closer to limits. This allows for higher production rates. The total global revenue of the chemical industry in 2019 was approximately 3.94 trillion US dollars. In 2014, the chemical industry's global revenue reached a record high of 5.4 trillion US dollars. The chemical industry is critical to the global economy. Such high growth in the chemical industry will create a positive impact on the APC market.

Further, energy and power types are expected to grow at a high CAGR in the APC market. According to reports, energy savings from APC implementation range from 3% to 15%, depending on the process and current operations. Most of the time, utility management is a complex control issue that affects the entire site and, at times, the electric grid. These system applications can be designed to provide benefits by lowering utility costs by up to 60%. The system can also be used to optimize energy production, such as boiler loads, gas turbines and so on.

Regional Insights

What is the U.S. Advanced Process Control Market Size?

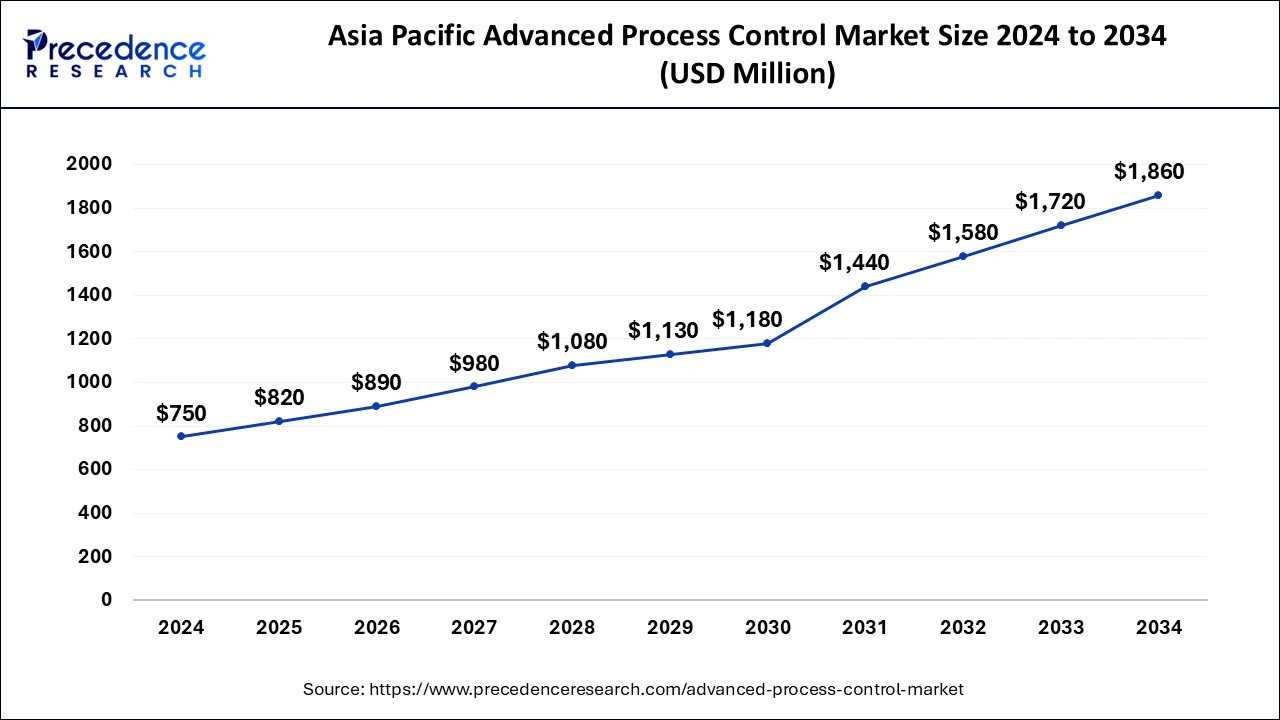

The Asia Pacific advanced process control system market size is exhibited at USD 820 million in 2025 and is projected to be worth around USD 2,000 million by 2035, growing at a CAGR of 9.33% from 2026 to 2035.

The Asia Pacific captured the biggest revenue share of 35% in 2024. The Asia Pacific region's advanced process controls market is dominated by India and China. This is because infrastructure development is increasing and there is a high demand for energy-efficient production systems. APC development and continuous improvement are aimed at improving the performance of manufacturing processes, resulting in higher product quality. APC implementation contributes to improved process safety while also lowering environmental emissions. Using advanced software, the manufacturers can easily maintain the plant's operation.

North America is expected to grow at a high CAGR in the forecast period. Early adoption of automation across end-use industries in countries such as the United States and Canada has resulted in this region becoming a mature market for advanced process control solutions. High R&D investment, combined with stringent environmental regulations, is driving up demand for APC systems for sustainable manufacturing processes. Increasing E&P activities in the region's oil and gas sector will contribute to the growth of the North America Advanced Process Control market during the forecast period.

Advanced Process Control Market Companies

- Schneider Electric

- Siemens

- Rudolph Technologies

- Aspen Technology, Inc.

- Emerson Electric Co.

- ABB

- Yokogawa Electric Corporation

- Panasonic Corporation

- Rockwell Automation, Inc.

- Honeywell International Inc.

- Control Soft

Latest Announcements by Industry Leaders

- In February 2024, Richard Kenedi, General Manager for GE Vernova's Proficy Software and Services, stated that the Proficy for Sustainability Insights software's persona-based dashboards for quicker, more focused troubleshooting can help provide visibility into sustainability progress and give operators, frontline managers, and operations leaders a better understanding of the main factors influencing performance.

Recent Developments

- In January 2024, ABB, automation company revealed that it has reached an agreement to purchase the majority of Meshmind, a software service provider, in order to increase its capacity for Al, Industrial LoT, and machine vision research and development. With this acquisition, ABB will combine software expertise, engineering experience, and Al to create a new worldwide R&D center that will significantly speed up the creation of cutting-edge automation solutions within its Machine Automation division (B&R).

- In June 2024, Apple Inc., technology company revealed a collection of cutting-edge new tools and resources aimed at empowering developers everywhere to produce more potent and effective apps for all Apple platforms. Thanks to features like Swift Assist and predictive code completion, developers can get more done in less time with Xcode 16. Developers can enhance their apps and add innovative features with the help of new and expanded APIs.

Segments Covered in the Report

By Product

- Hardware

- Control Systems

- Interface and Display

- Computing Systems

- Others

- Service

- Advanced Regulatory Control

- Multivariable Model Predictive Control

- Inferential Control

- Sequential Control

- Compressor Control

- Software

By End-User

- Oil and Gas

- Chemicals

- Pharmaceuticals

- Energy & Power

- Mining, Minerals, and Metals

- Food & Beverages

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting