What is Aerosol Market Size?

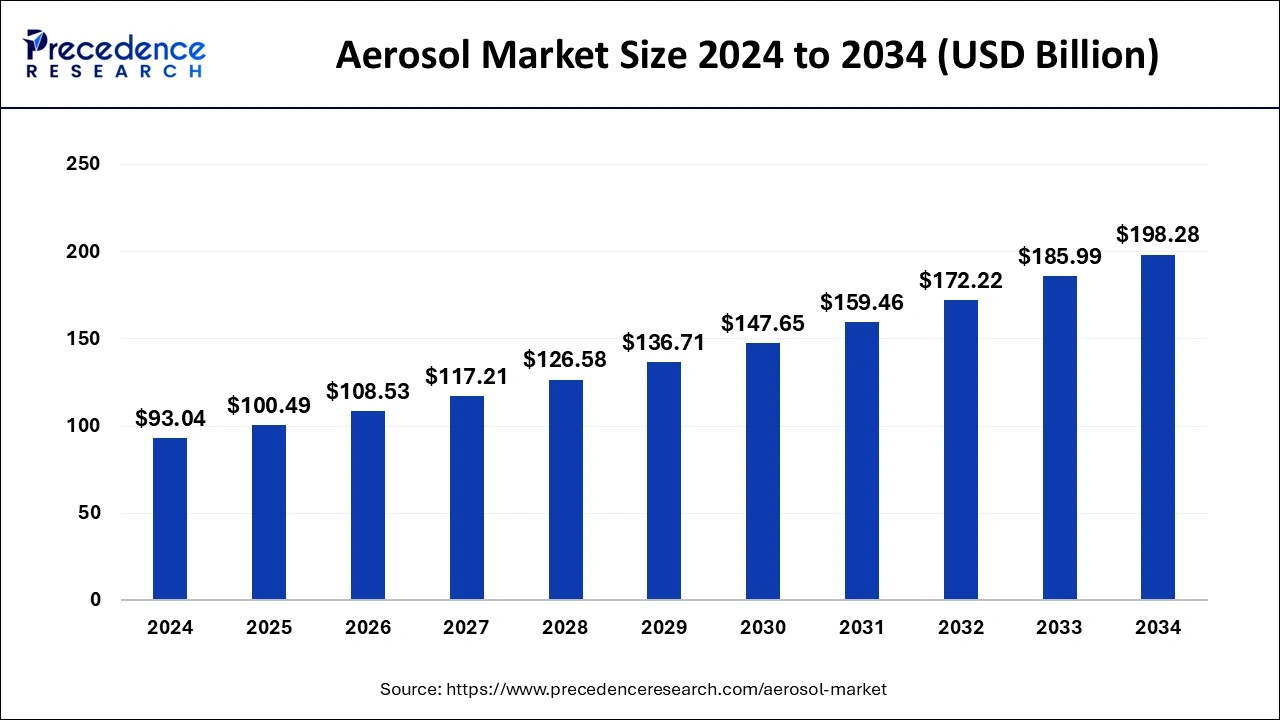

The global aerosol market size is accounted for USD 100.49 billion in 2025 and is predicted to increase from USD 108.53 billion in 2026 to approximately USD 211.56 billion by 2035, expanding at a CAGR of 7.73% from 2026 to 2035. The aerosol market is driven by the growing demand for personal and grooming products.

Market Highlights

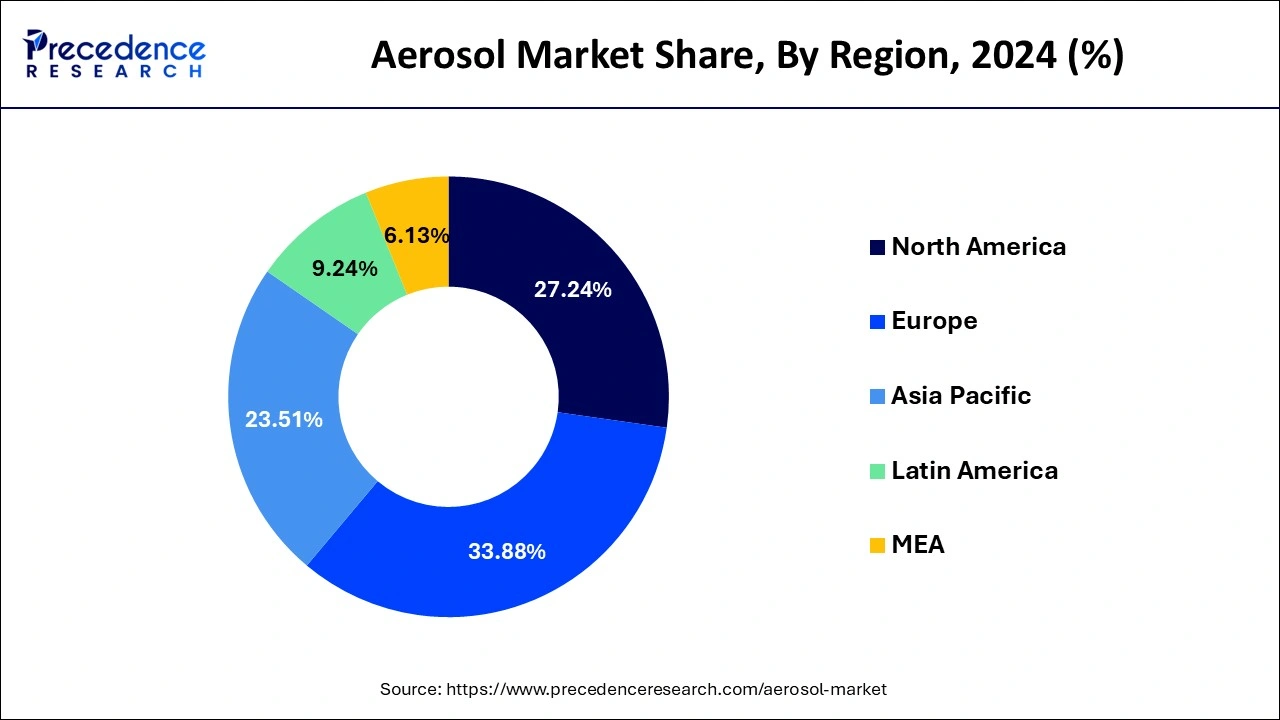

- Europe region accounted highest revenue share of over 33.88% in 2025.

- By material, the aluminum material segment accounted highest revenue share of 62% in2025.

- By type, the standard segment has surpassed revenue share of over 85% in 2025.

- By application, the personal care segment has contributed a market share of 42% in2025.

Aerosols in Demand: Driving Growth Through Lifestyle and Hygiene Trends

A suspension of particles in the atmosphere called an aerosol. When pine trees release the oil alpha-pinene, which suspends as a haze, they may naturally form. Air pollution, haze, and smoke are examples of artificial aerosols. An aerosol is typically referred to as a spray that disperses a substance from a can. Aerosol sprays can be used to provide both pesticides and medications. The prediction for the aerosol market indicates growing demand for personal care products including body creams, deodorants, sunblock, and other cosmetics, which is beneficial for the aerosol sector. It is projected that the market will benefit from the presence of a strong manufacturing base of personal care firms including Estee Lauder, Johnson & Johnson, Procter & Gamble, and more.

The fast-rising population, rising disposable income, changing lifestyles, and expanding selection of personal care products are all contributing factors to the rising demand for personal care products, which is primarily seen in emerging nations. The market for aerosols has expanded as a result of rising usage and demand for household goods including sanitizers and disinfectants, room and car air fresheners, and more.

What Impact does AI have on the Aerosol Market?

Aerosols are found to play a crucial role in increasing or decreasing the surface temperature and suppressing the precipitation. By leveraging AI techniques, such as deep learning or ensemble models, researchers can start sophisticated models that can learn from the data, determine complex patterns, and produce accurate predictions about aerosol concentrations.

Aerosol Market Growth Factors

- The market has grown due to rising disposable income and a growing awareness of personal appearance and hygiene. Thus, increasing demand for pharmaceutical and personal care packaging propels the aerosol market globally.

- The benefits of using aerosol containers also raise the demand for aerosol in the market. One of the most important benefits of an aerosol bottle is safety. These containers are hermetically sealed, which prevents their contents from leaking or spilling, making them leak-proof. If you live with a young child or a pet, this packing proves to be more practical. The product stays secure in the container since it is tamper evident.

- Aerosols are utilized in some common culinary and kitchen goods in addition to the home and cosmetic industries, such as whipped cream, icing, chocolate, and coffee powders. Many condiments, including salad dressing, ketchup, mustard, and cooking oils like PAM, are available in aerosol cans.

Market Outlook

- Industry Growth Offerings- The market is growing due to rising demand for personal care, household, and hygiene products. Innovations in eco-friendly formulations, convenient ready-to-use sprays, and expanding manufacturing capabilities are driving adoption across emerging and developed markets.

- Global Expansion- The global aerosol market is expanding as manufacturers enter emerging markets and strengthen distribution in developed regions. Growing demand for personal care, household, and healthcare products, combined with e-commerce growth and international collaborations, is fueling worldwide market growth.

- Startup ecosystem- The aerosol startup ecosystem is thriving, with new companies developing eco-friendly, sustainable, and multifunctional spray products. Support from incubators, venture capital, and innovation-driven partnerships is enabling rapid growth, particularly in personal care, household, and hygiene segments.

- Sustainability Trend: The sustainability trend is reshaping the market as manufacturers increasingly adopt eco-friendly propellants, recyclable packaging, and low-carbon production processes. This shift not only reduces environmental impact but also meets growing consumer demand for sustainable personal care, household, and industrial products.

- Major Investors: Major investors in the market include multinational consumer goods companies, chemical manufacturers, and private equity firms focused on personal care, household, and industrial products. Their investments support product innovation, expansion of manufacturing capacity, adoption of eco-friendly propellants, and development of sustainable and high-performance aerosol solutions.

Aerosol Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 100.49 Billion |

| Market Size in 2026 | USD 108.53 Billion |

| Market Size by 2035 | USD 211.56 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 7.73% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Propellent Type, Propulsion, Valve Type, Material, Type, End Use, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Propellent Type Insights

Compared to other propellant sources, the liquefied gas propellant has a higher revenue share. The consumer packaged goods industry uses liquefied gas propellants widely for a variety of products, including body deodorant, hair mousse spray, moisturizer, insect killer spray, room fresheners, and many others. The three readily flammable naturally occurring hydrocarbons such as propane, butane, and n-butane, are combined to form autogas, also known as liquefied gas propellants. It is frequently utilized in the packaging of consumer goods because it also produces odorless, toxin-free gas.

The category for compressed gas propellants accounts for a stable portion of income. Expensive compressed gas propellants are sensitive to low pressure. Healthcare, inhalers, anaesthetic solutions, and disinfectants are just a few industries that use compressed gas propellants. In the aerosol tin, the area above the fluid is occupied by compressed gas fuels. While initially maintaining a constant amount of gas, the disadvantage of compressed gas propellants is that they gradually lose the majority of their pressure, enabling the gas to escape from the aerosol container.

Valve Type Insights

The mechanical actuator has the highest expected revenue growth rate among valve types over the forecasted period. Mechanical actuators for aerosol fluid product dispensers come in a pump type and are simple to operate. Different aerosol-pressurized metal, glass, and plastic containers use this kind of actuator. Mechanical actuators use a discharge cavity and a channel to connect their input and output. A number of axial fins, each of which may have a stop shoulder, are supported by a central post that is a component of the discharge chamber. For ease of usage, mechanical actuators offer visually pleasing designs.

Over the forecast period, the non-mechanical actuators segment is anticipated to experience consistent revenue growth. In comparison mechanical actuators with, non-mechanical actuators are more cost-effective and efficient. Aerosols for agriculture use non-mechanical actuators. Water and insecticide can be sprayed with an atomizing form through the nozzle of non-mechanical actuators. Numerous end users continue to adopt this conventional approach because it is more effective. Additionally, no pressure energy of any type is needed. The benefits of this type of valve are efficiency and low cost that propel the segment's sales growth.

End User Insights

On the basis of end use, the consumer packaged products segment is predicted to see the highest revenue growth rate based on end use. The swift adoption of aerosol compressed containers and packaging in beauty, health, and cosmetics products as well as domestic cleaning products is the primary factor driving the segment's revenue growth. Aerosol packaging's sealed solutions decrease the possibility of breakage, spills, and leakage. The aerosol's USP is its ability to provide consumers with convenience (USP). Additionally, aerosol compressed packing has a lot of cost-saving and environmentally friendly benefits, which are what are driving the segment's sales growth.

The pharmaceutical segment is also anticipated to experience consistent revenue growth. Pharmaceutical aerosols are stored in a container because they are tiny drug or medicine particles that are housed in a highly pressurized spray bottle and discharge a small mist when a button is depressed. For the treatment of obstructive airway illnesses such asthma, chronic obstructive pulmonary disease, and tuberculosis, aerosols are widely used in the pharmaceutical industry. For the treatment of asthma and airway illnesses, people employ nebulizers, dry powder inhalers, and metered dose inhalers (MDIs). Within an inhaler tube, pharmaceutical aerosols are squeezed under low pressure. Drugs are shielded from gastrointestinal tract breakdown by pharmaceutical aerosols.

Regional Insights

What is the Europe Aerosol Market Size?

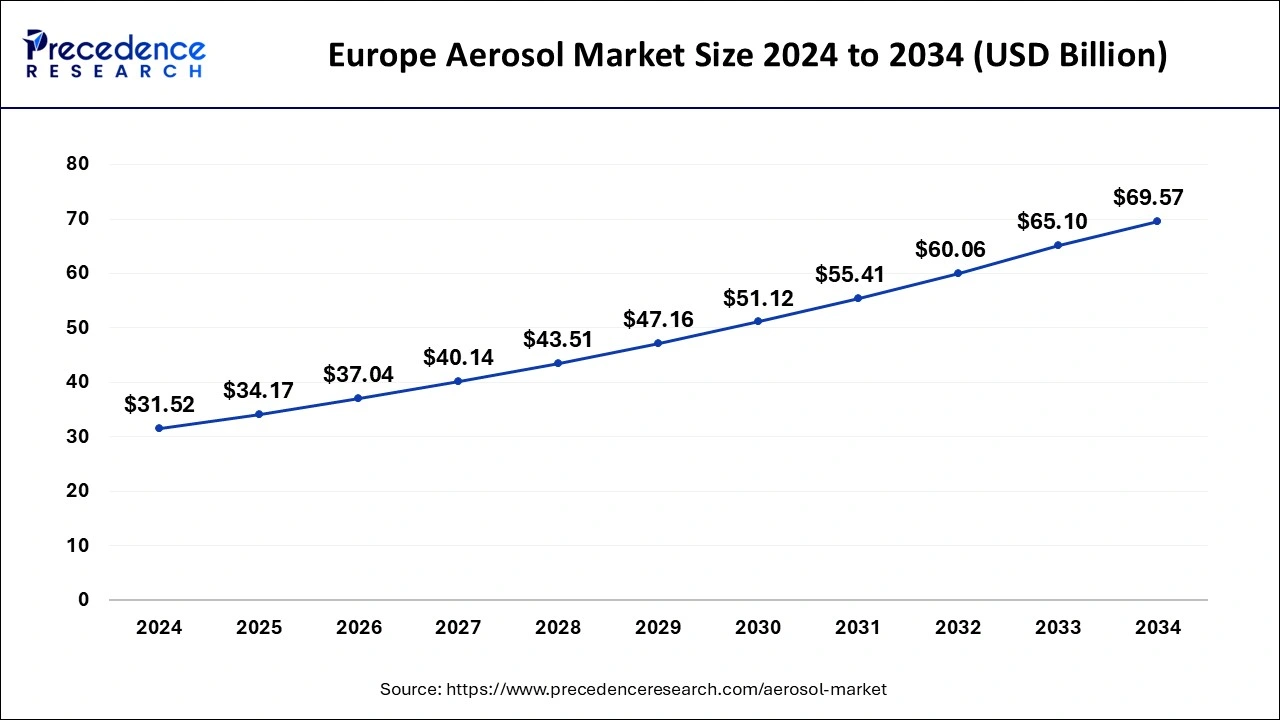

The Europe aerosol market size is estimated at USD 34.17 billion in 2025 and is predicted to be worth around USD 74.42 billion by 2035, at a CAGR of 8.09% from 2026 to 2035.

Increase in the sales of household goods is likely to make Asia-Pacific the aerosol market's fastest-growing region. Driven by an increase in the demand for deodorants and hair care products. Due to changing lifestyles, a focus on gender-specific products, and increased consumer expenditure, the market for personal care products has seen a strong increase in emerging nations. Demand for pharmaceutical products from consumers is on the rise, which is boosting revenue in this sector. Due to rising incomes and shifting customer preferences, the market for consumer household items in Asia is changing, which raises the need for products created from aerosol cans. Asthma, chronic obstructive pulmonary disease, and other obstructive airway diseases are only a few of the obstructive airway diseases that are becoming increasingly common, which has a substantial impact on the rapid use of compressed aerosol propellants in this domain.

The European market is anticipated to have consistent revenue growth. This is anticipated to be fueled by the region's rapidly expanding use of aerosol spray propellant in the cosmetics, skincare, and fragrance industries. Liquid aerosol compressed body spray and lotion are used by renowned cosmetics brands including Avene, Caudalie Paris, and others. Rise in living standards of the people and preference for using more cosmetics and skin care products are driving the market. Skin care industries are rising due to rise in number of skin problems.

How Europe Dominates the Market Revenue in 2024?

Europe dominated the aerosol market revenue in 2024. The market growth in the region is driven by factors such as the increasing consumer spending on various personal and grooming products, rapid growth in the fragrance industry and growing personal care industry. Germany, UK and France are dominating countries driving the market growth. In terms of cosmetics and household product demand, German aerosol business has developed positively. There is an increase in the antiperspirants and deodorants category, which saw a growth of 3.2% in Germany. There are 415 million spray cans are manufactured in 2024. the production of household aerosols increased by 5.1% to 41 million units in 2024, which may accelerate the demand for aerosol in Germany.

The UK is Seeing Rapid Growth in Aerosol Products

The UK market is growing due to rising demand for personal care products, including deodorants, hair sprays, and skincare items, as well as household products like air fresheners and disinfectants. Increasing consumer awareness of hygiene, lifestyle changes, and a preference for convenient, ready-to-use solutions are driving adoption. Additionally, innovation in eco-friendly formulations, improved packaging, and the presence of leading manufacturers like Unilever and Procter & Gamble are further supporting market growth in the region.

Asia Pacific Aerosol Market Trends

Asia Pacific is expected to grow fastest during the forecast period. The segment growth in the region is attributed to the growing working millennial population, increasing consumer preference towards personal care products and growing middle-class population. China, India, Japan and South Korea are the fastest growing countries driving the market growth.

India is expected to grow fastest during the forecast period, driven by the increasing demand for aerosol products, increasing consumption of aerosol products in household uses and growing large population.

China is Driving Increased Adoption of Aerosol Products

China's market is expanding due to rapid industrialization and the increasing popularity of ready-to-use consumer products. Rising e-commerce penetration and online retail growth are making aerosol products more accessible. Additionally, innovations in sustainable, low-VOC aerosols, rising tourism, and demand from the automotive and cleaning sectors are driving market expansion, while aggressive marketing by domestic and international brands is further boosting consumer adoption across the country.

North America is Experiencing Rising Demand for Aerosol

The North American market is expanding due to strong demand for personal care products like deodorants, hair sprays, and skincare items, as well as household products such as air fresheners and disinfectants. Rising consumer preference for convenient, ready-to-use solutions, coupled with innovation in eco-friendly and sustainable formulations, is driving growth. Additionally, the presence of major manufacturers, advanced distribution networks, and increased awareness of hygiene and lifestyle products are contributing to the market's steady expansion across the region.

The U.S. is Expanding its Use of Aerosol Products

The U.S. market is increasing due to growing consumer demand for personal care products such as deodorants, hairsprays, and skincare, alongside household items like disinfectants and air fresheners. Rising health and hygiene awareness, busy lifestyles favoring convenient products, and innovations in eco-friendly, low-VOC formulations are driving adoption. Additionally, strong presence of key manufacturers, effective distribution channels, and marketing strategies targeting both urban and suburban consumers are contributing to the steady growth of the U.S. aerosol market.

What potentiates the Market in Latin America?

The aerosol market in Latin America is potentiated by growing demand for aluminum can products. Increasing urbanization and rising disposable incomes are expanding the consumer base, while strong recycling initiatives support sustainable market development. Additionally, the adoption of convenience-oriented aerosols in personal care and food, along with innovations in eco-friendly propellants like DME and methyl ethyl ether, further enhances performance and growth opportunities for regional brands and packaging companies.

How is the Opportunistic Rise of the Middle East & Africa (MEA) in the Market?

The Middle East & Africa (MEA) aerosol market is witnessing opportunistic growth due to rising urbanization, increasing disposable incomes, and growing demand for personal care, household, and food aerosol products. Expanding retail networks, modernization of packaging infrastructure, and adoption of sustainable propellants are creating new avenues for market players. Additionally, countries like the UAE, Saudi Arabia, and South Africa are driving growth through investments in innovative aerosol solutions and eco-friendly packaging initiatives.

Value Chain Analysis

- Clinical Trials and Regulatory Approvals

Aerosol-based drug products undergo complex clinical trials and regulatory approvals due to the dual focus on drug formulation and delivery device.

Regulatory authorities such as the U.S. FDA and European Medicines Agency (EMA) provide strict guidelines for combination products.

Key players: GlaxoSmithKline, AstraZeneca, Teva Pharmaceuticals, and Boehringer Ingelheim, who actively develop and commercialize inhalation therapies and aerosolized medications. - Formulation and Final Dosage Preparation

The final aerosol dosage is produced through a multi-step process including formulation of the drug and excipients, selection of a suitable propellant system, and container filling.

Manufacturing steps vary depending on the delivery system, such as metered-dose inhalers (MDIs) or nebulizers.

Key players: AstraZeneca, Teva Pharmaceuticals, Boehringer Ingelheim, and Cipla, specializing in inhalation therapies and aerosolized medications. - Packaging and Serialization

Aerosol packaging uses a pressurized container, valve, and propellant to dispense the product effectively.

Serialization assigns a unique identifier to each package, particularly for pharmaceuticals, enabling tracking and tracing.

Combining packaging and serialization enhances product safety, prevents counterfeiting, and facilitates efficient recalls.

Key players: West Pharmaceutical Services, AptarGroup, Lonza, and Berry Global, providing solutions for drug delivery and consumer aerosols.

Key Players in Aerosol Market and their Offerings

- Sandvik AB – Provides precision components, stainless steel solutions, and advanced materials used in aerosol can manufacturing, supporting durability and safety of pressurized containers.

- Metso Corporation – Offers aerosol-related equipment for metal processing, valve components, and material handling systems that aid in efficient aerosol production and packaging.

- Epiroc AB – Supplies industrial tools and machinery that assist in the production of aerosol containers and related infrastructure, enhancing manufacturing efficiency.

- Deere & Company – Provides agricultural and industrial machinery that can be adapted for aerosol product handling, filling, and packaging processes in large-scale production.

- Doosan Corporation – Delivers industrial solutions, including automation and manufacturing equipment, that support aerosol container production, propellant handling, and assembly lines for personal care and industrial sprays.

Recent developments

- In August 2024, the Food and Drug Administration accepted the first needle-free treatment for adults and kids with severe allergic reactions. The approval introduces a competitor from ARS Pharma to older epinephrine products, like the EpiPen.

- In June 2024, Sonoco Products Company, a global leader in high-value sustainable packaging, declared it has agreed to acquire Eviosys, Europe's leading food cans, ends, and closures producer, from KPS Capital Partners, LP, for approximately $3.9 billion.

Segment Covered in the Report

By Propellent Type

- Liquefied Gas Propellants

- Compressed Gas Propellants

By Propulsion

- Diesel

- CNG/LNG/RNG

By Valve Type

- Mechanical Actuators

- Non-mechanical Actuators

- Others

By Material

- Steel

- Aluminum

- Plastics

- Others

By Type

- Bag-In-Valve

- Standard

By End Use

- Consumer Packaged Goods (CPG)

- Pharmaceutical

- Automotive & Industrial

- Others

By Application

- Personal Care

- Household

- Automotive & Industrial

- Food

- Paints

- Medical

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content