What is the Antacids Market Size?

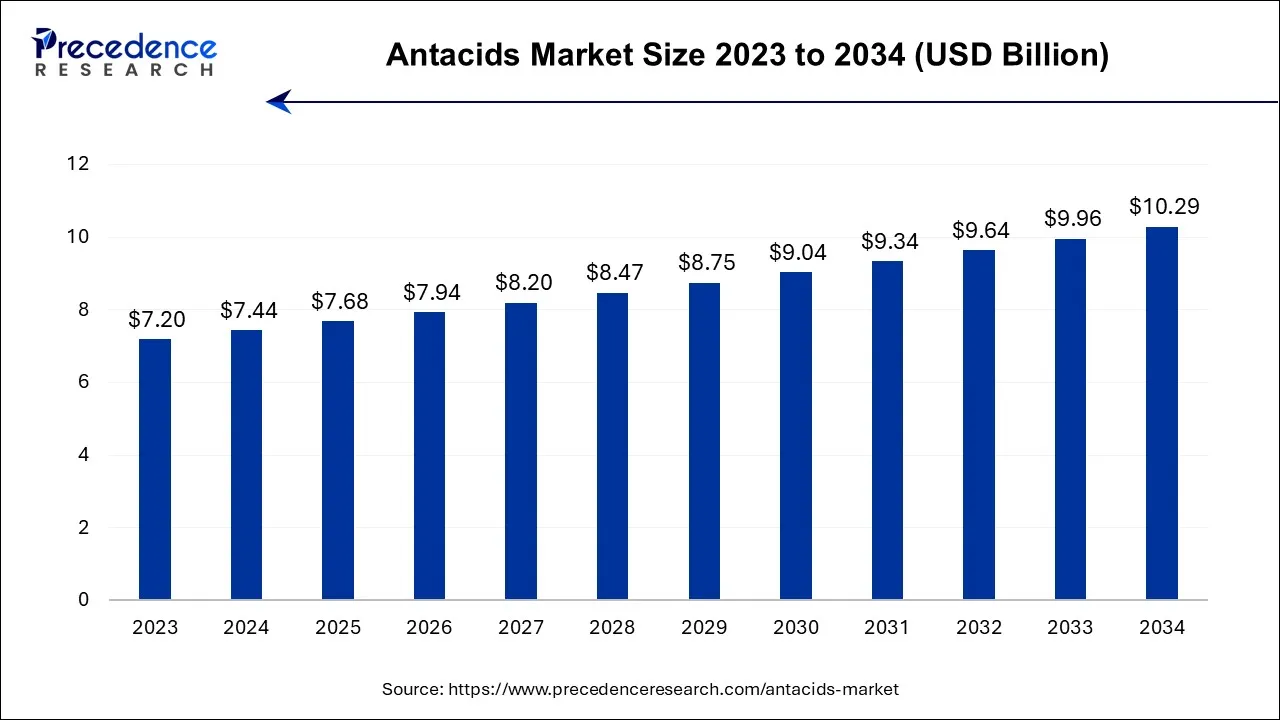

The global antacids market size is calculated at USD 7.68 billion in 2025 and is predicted to increase from USD 7.94 billion in 2026 to approximately USD 10.29 billion by 2034, expanding at a CAGR of 3.3% over the forecast period from 2025 to 2034.

Antacids Market Key Takeaways

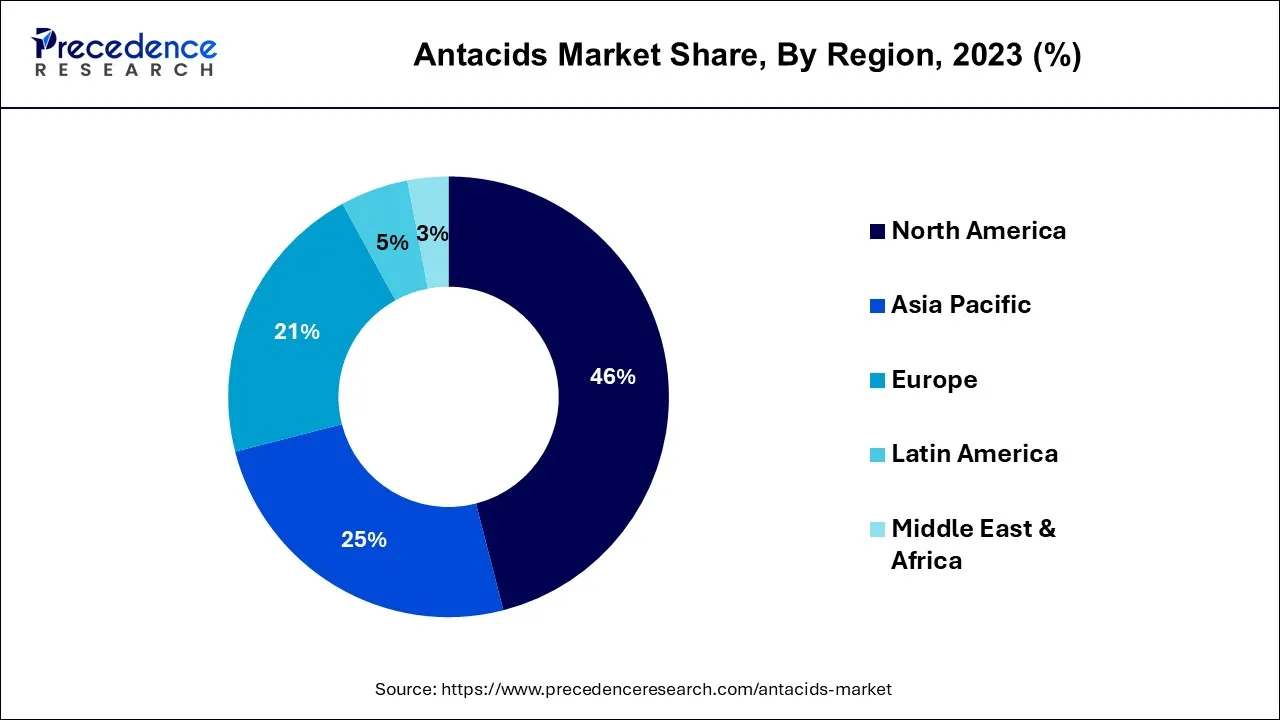

- North America contributed the highest revenue share of 46% in 2024.

- Asia Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By the mechanism of action, the non-systemic antacid segment has held the largest market share of 70% in 2024 and is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By formulation type, the tables segment generated the highest revenue share in 2024.

- By formulation type, the liquids segment is expected to expand at the fastest CAGR over the projected period.

- By distribution channel, the drug store & retail pharmacies segment generated the highest revenue share in 2024.

- By distribution channel, the online providers segment is expected to expand at the fastest CAGR over the projected period.

Market Overview

Antacids are a class of medications that are designed to neutralize excess stomach acid. It is generally used to offer relief from symptoms associated with conditions such as heartburn, acid reflux, and indigestion. Stomach acid is produced naturally in the stomach to help in the digestion of food. However, an overproduction of stomach acid or its reflux into the esophagus may lead to irritation and discomfort. It works by growing the pH (reducing acidity) of the stomach contents. It usually contains compounds that react with stomach acid, creating neutral substances and water. This reaction helps to alleviate symptoms by reducing the acidity in the stomach.

The antacids market includes a variety of over-the-counter (OTC) and prescription medications that are designed to alleviate symptoms associated with excessive stomach acid. The market is driven by various factors such as innovations in antacid formulations, changes in consumer health trends, advancements in medical research, regulatory developments, and the prevalence of conditions that require antacid treatment. Therefore, the antacids market is part of the broader pharmaceutical and healthcare industry, playing a significant role in addressing digestive health issues and improving the quality of life for individuals experiencing symptoms related to excess stomach acid.

Key Factors Influencing Future Market Trends

- Rising Prevalence of Gastrointestinal Disorders: Due to more acid reflux, GERD, and indigestion, caused by poor food intake, lack of exercise, and stress, the need for antacids has increased. Because more people are dealing with chronic digestive problems, the use of antacids, both those sold with a prescription and over the counter, is expected to rise in urban communities.

- Expansion of E-Commerce and Online Pharmacies: Most people can access online healthcare and pharmacy websites. Buying antacids is becoming less difficult for people in remote or underdeveloped regions as online services, delivery, and digital consultations are available.

- Demand for Natural and Herbal Antacids: A greater number of people are trying to find safer and more natural options rather than using prescription drugs. People commonly choose natural, herbal, and plant-based types of antacids since they are safer.

- Product Innovation and Combination Formulations: Pharmaceutical companies are now faster at making antacids and also incorporate more substances, for example, probiotics and anti-inflammatory substances. Many consumers are also attracted to chewable, dissolving tablets as well as flavored vitamin liquids.

Antacids Market Growth Factors

- An increase in the incidence of gastrointestinal disorders, such as acid reflux, gastroesophageal reflux disease (GERD), and indigestion, drives the demand for antacids as a means of symptom relief.

- Modern lifestyles, characterized by stress, irregular eating patterns, and diets high in spicy or acidic foods, can contribute to the development of digestive issues, leading to a higher demand for antacids.

- The aging population often experiences an increase in digestive problems. As the global population ages, there is a growing market for products addressing age-related gastrointestinal issues, further boosting the demand for antacids.

- Increased awareness of over-the-counter medications and the trend of self-medication contribute to the growth of the antacids market. Consumers often seek quick relief for mild digestive discomfort without the need for a prescription.

- Economic growth can lead to an increase in healthcare spending, including spending on over-the-counter medications. Improvements in economic conditions may contribute to the growth of the antacids market.

- Improved access to healthcare services and medications, especially in developing regions, can result in a higher adoption of antacids as more individuals seek relief from gastrointestinal issues.

- The over-the-counter availability of many antacid products makes them easily accessible to consumers, contributing to their widespread use.

- Changing lifestyles associated with globalization and urbanization can lead to dietary changes and increased stress levels, both of which contribute to digestive issues and the demand for antacids.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 10.29 Billion |

| Market Size in 2025 | USD 7.68 Billion |

| Market Size in 2026 | USD 7.94 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 3.3% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Mechanism of Action, Formulation Type, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Prevalence of gastroesophageal reflux disease (GERD)

Gastroesophageal Reflux Disease (GERD) is a chronic condition marked by the regurgitation of stomach acid into the esophagus, leading to symptoms such as heartburn, and is experiencing a global surge. This escalating occurrence is attributed to evolving lifestyles, including dietary shifts, heightened stress levels, and an increase in obesity rates.

The surge in GERD cases prompts a growing necessity for accessible and effective solutions to alleviate its distressing symptoms. Individuals grappling with frequent heartburn and acid reflux often turn to antacids as a swift remedy. By neutralizing excess stomach acid, antacids offer prompt relief, addressing the uncomfortable symptoms associated with GERD.

The aging demographic further propels the demand for antacids, given the heightened susceptibility to GERD with age. Elderly individuals, seeking relief from GERD-induced discomfort, frequently opt for over-the-counter antacids, contributing significantly to the overall market expansion. In addition, the over-the-counter availability of antacids aligns with the prevailing trend of self-medication.

This enables individuals to proactively manage mild GERD symptoms without the need for a prescription, emphasizing the convenience, accessibility, and efficacy of antacids. Consequently, antacids emerge as a primary choice for those looking to address immediate relief from GERD-related issues, highlighting their indispensable role in contemporary healthcare solutions.

Restraint

Emergence of alternative therapies

The burgeoning popularity of alternative therapies presents a potential restraint on the demand for the antacids market. As societal attitudes toward holistic and natural healthcare approaches evolve, individuals experiencing digestive discomfort, such as acid reflux and heartburn, may explore alternative remedies before turning to traditional antacids. Herbal treatments, dietary modifications, and lifestyle changes are increasingly sought after as viable alternatives to address gastrointestinal issues.

This shift in consumer preferences may impact the market for antacids, as some individuals may choose holistic methods over conventional medications. The perceived safety and holistic nature of alternative therapies can lead to a decrease in reliance on antacids for symptom management.

Furthermore, the wellness trend emphasizing preventive measures and overall lifestyle adjustments may influence individuals to adopt dietary habits and practices that aim to prevent digestive issues, potentially reducing the demand for antacids. As the awareness of alternative therapies grows, there is a likelihood that consumers will explore these options before considering antacids, posing a challenge to the traditional market. Despite the robust efficacy of antacids, the emergence of alternative therapies underscores the importance of a diversified approach in addressing digestive health, and market stakeholders may need to adapt to changing consumer preferences and educate individuals about the benefits of antacids in certain situations.

Opportunity

Rising global healthcare expenditure

The escalating global healthcare expenditure offers a significant opportunity for the antacids market. As nations worldwide increase their investment in healthcare infrastructure and services, there is a corresponding surge in accessibility to medications, including antacids. The rise in healthcare spending reflects a growing commitment to addressing health concerns, particularly those related to prevalent conditions such as acid reflux and heartburn. With expanded healthcare budgets, individuals have greater access to medical consultations, leading to increased diagnosis and subsequent prescription or recommendation of antacids. As healthcare systems strengthen, the availability of over-the-counter antacids also becomes more widespread, allowing consumers to manage mild digestive discomfort proactively.

Furthermore, the heightened expenditure fosters advancements in pharmaceutical research and development. This can lead to the introduction of innovative antacid formulations, addressing not only the symptoms but also the underlying causes of gastrointestinal issues. Such innovations can attract a broader consumer base, driving the growth of the antacids market. As global healthcare expenditure continues to rise, the antacids market stands poised to benefit from the increased emphasis on health and well-being. The expansion of healthcare services and the integration of antacids into treatment plans position these medications as essential components in the evolving landscape of global healthcare.

Mechanism of Action Insights

In 2024, the non-systemic antacids segment had the highest market share of 70% based on the mechanism of action and is anticipated to expand fastest over the projected period. Non-systemic antacids act primarily within the gastrointestinal tract and do not significantly enter the bloodstream.

The segment includes antacids containing aluminum hydroxide or magnesium hydroxide. While these antacids effectively neutralize stomach acid, their impact is more localized to the digestive system. Non-systemic antacids are often preferred for individuals who may need relief from acid-related symptoms without systemic effects.

Formulation Type Insights

In 2024, the tablets segment had the highest market share on the basis of the formulation type. Tablet formulations are a common and convenient way to deliver antacids. These solid dosage forms are easy to handle, transport, and consume. Tablets often come in chewable or swallow forms, providing a user-friendly option for individuals seeking a portable and discreet solution for acid-related symptoms.

The liquid formulations segment is anticipated to expand fastest over the projected period. Liquid formulations offer a more rapidly absorbed option for those who prefer a quicker onset of relief. These formulations often contain the active antacid ingredients in a liquid suspension, allowing for easier administration, especially for individuals who may have difficulty swallowing tablets. Liquids are advantageous for faster absorption into the bloodstream, providing prompt relief from symptoms.

Distribution Channel Insights

In2024, the drug stores and retail pharmacies segment had the highest market share on the basis of the distribution channel. Drug stores and retail pharmacies represent traditional brick-and-mortar establishments where consumers can purchase antacids without a prescription. These outlets provide a convenient and familiar option for individuals seeking over-the-counter antacids for self-medication. Retail pharmacies often offer a variety of formulations, catering to the diverse preferences of consumers.

The online providers segment is anticipated to expand fastest over the projected period. The online segment has gained prominence as an increasingly popular distribution channel for antacids. Online providers, including e-commerce platforms and virtual pharmacies, offer the convenience of purchasing antacids from the comfort of one's home. This channel is particularly advantageous for individuals who may prefer discreet and direct-to-door delivery or those with limited physical access to traditional pharmacies.

Regional Insights

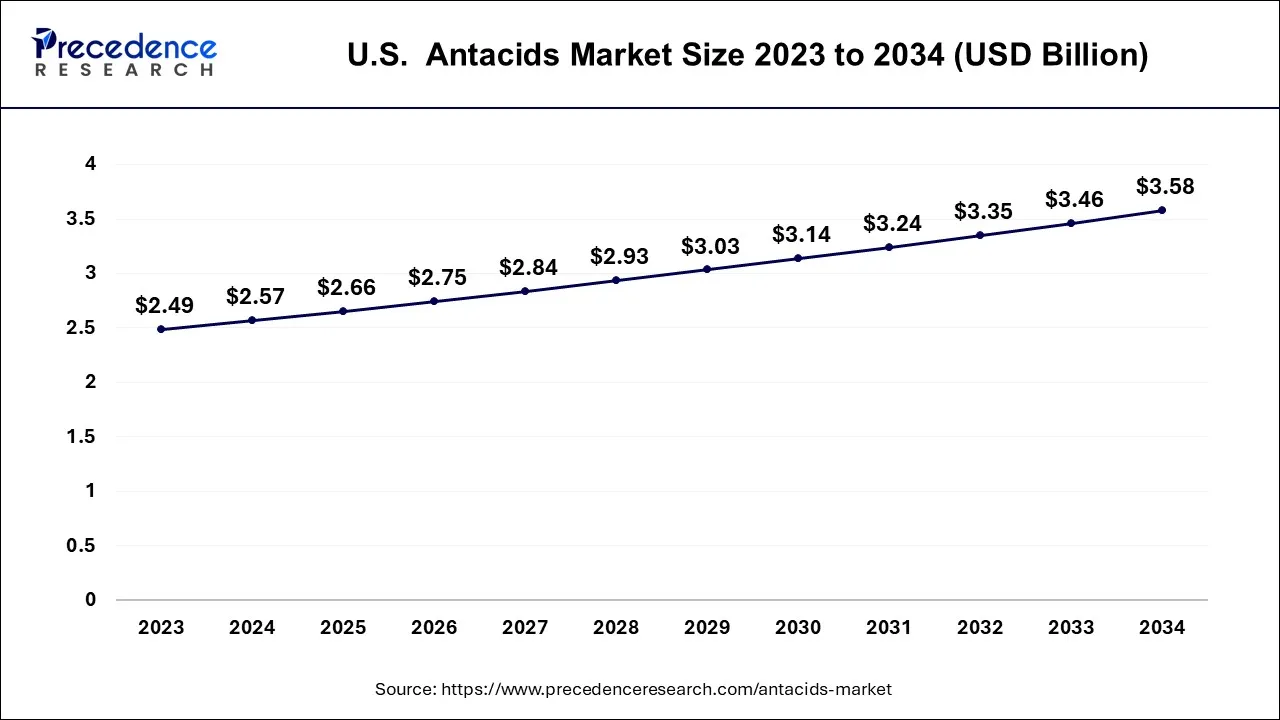

U.S. Antacids Market Size and Growth 2025 to 2034

The U.S. antacids market size accounted for USD 2.66 billion in 2025 and is projected to be worth around USD 3.58 billion by 2034, poised to grow at a CAGR of 3.4% from 2025 to 2034.

North America has held the largest revenue share of 46% in 2024. North America has a significant prevalence of gastrointestinal disorders, including acid reflux and GERD. Modern lifestyles in North America, characterized by stress, dietary habits, and obesity, contribute to the occurrence of digestive issues. Antacids are often sought after for quick relief from symptoms associated with these lifestyle factors. These factors contribute to a steady demand for antacids as a means of symptom relief.

Asia Pacific is estimated to observe the fastest expansion. Rapid urbanization and changing lifestyles in countries across Asia Pacific have led to alterations in dietary habits and an increase in stress, contributing to digestive issues and driving the demand for antacids. The expansion of the middle-class population in several Asia Pacific countries has increased healthcare awareness and affordability, leading to greater access to over-the-counter medications, including antacids.

Europe antacids market is driven by its aging population, and older individuals are more susceptible to digestive issues. This demographic factor can contribute to the demand for antacids as a remedy for age-related gastrointestinal problems. Moreover, the well-developed healthcare infrastructure in many European countries ensures widespread access to medications, including antacids. Also, high levels of consumer awareness regarding over-the-counter medications and self-medication practices contribute to the demand for antacids in Europe.

Middle East and Africa Antacids Market Trends:

The Middle East Africa antacids market is gradually expanding as lifestyle related gastric disorders rise, particularly in urban centers where fast-foods consumption is increasing. Improved pharmacy infrastructure and the growing presence of multinational OTC medicine brands have also enhanced product availability. Awarness regarding gastrointestinal health has been improving through targeted public health campaigns.

In the UAE and Saudi Arabia, high disposable incomes and strong retail pharmacy network drive the highest adoption of branded anatacids. In south Africa, generic formulas dominate due to affordability, yet consumption remains robust due to high rates of digestive discomfort and stress linked acidity.

Europe Antacids Market Trends:

It represents a mature yet steadily growing antacids market, supported by a strong healthcare system and high consumer trust in OTC gastrointestinal treatments. Diatery habits , increased coffee consumption, and the prevalence of grastroesophageal reflux disease continue to sustain market demand.

Germany and France lead the European market due to high healthcare awarness and widespread OTC medicine adoption. Meanwhile the UK is witnessing strong growth in online antacid growth.

Antacids Market Companies

- Infirst Healthcare Inc.

- Bayer AG

- Pfizer Inc.

- Abbott Laboratories

- Cipla Ltd

- Reckitt Benckiser Group PLC

- WellSpring Pharmaceutical Corporation

- Prestige Consumer Healthcare Inc.

- Alkem Laboratories Ltd.

- Haleon plc

Recent Developments

- In January 2025, UK-based Haleon decided to spend USD 54 million upgrading its research and development center in Northside Richmond, VA. Haleon was counting on the renovations being ready to use by the end of the year, so they could begin working in the new facility right away, building its platform for innovations.

- In October 2024, Akums Drugs and Pharmaceuticals, one of India's largest CDMOs, released a chewable heartburn relief tablet. It was made to soothe the discomfort of GERD as fast and gently as possible.

- In August 2024, ENO, Haleon launched a new ENO. It combined cumin, carom seeds, black salt, and ENO for the first ever in India. The formula was designed to help you get quick relief from acidity, indigestion, and other stomach problems.

- In November 2023, Reckitt, under its brand Gaviscon, launched Gaviscon Double Action offering consumers a solution to acid reflux in Tamil Nadu.

- In March 2023, A digestive health medicine company, Wonderbell, announced that the company is expanding its great-tasting, clean-ingredient, and sustainably packaged Wonderbelly Antacid chewable tablets in select Target stores and on Target.com.

Segments Covered in the Report

By Mechanism of Action

- Systemic Antacids

- Non-systemic Antacids

By Formulation Type

- Tablets

- Liquids

- Others

By Distribution Channel

- Hospital pharmacies

- Drug stores and retail pharmacies

- Online providers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content