What is the Autoinjectors Market Size?

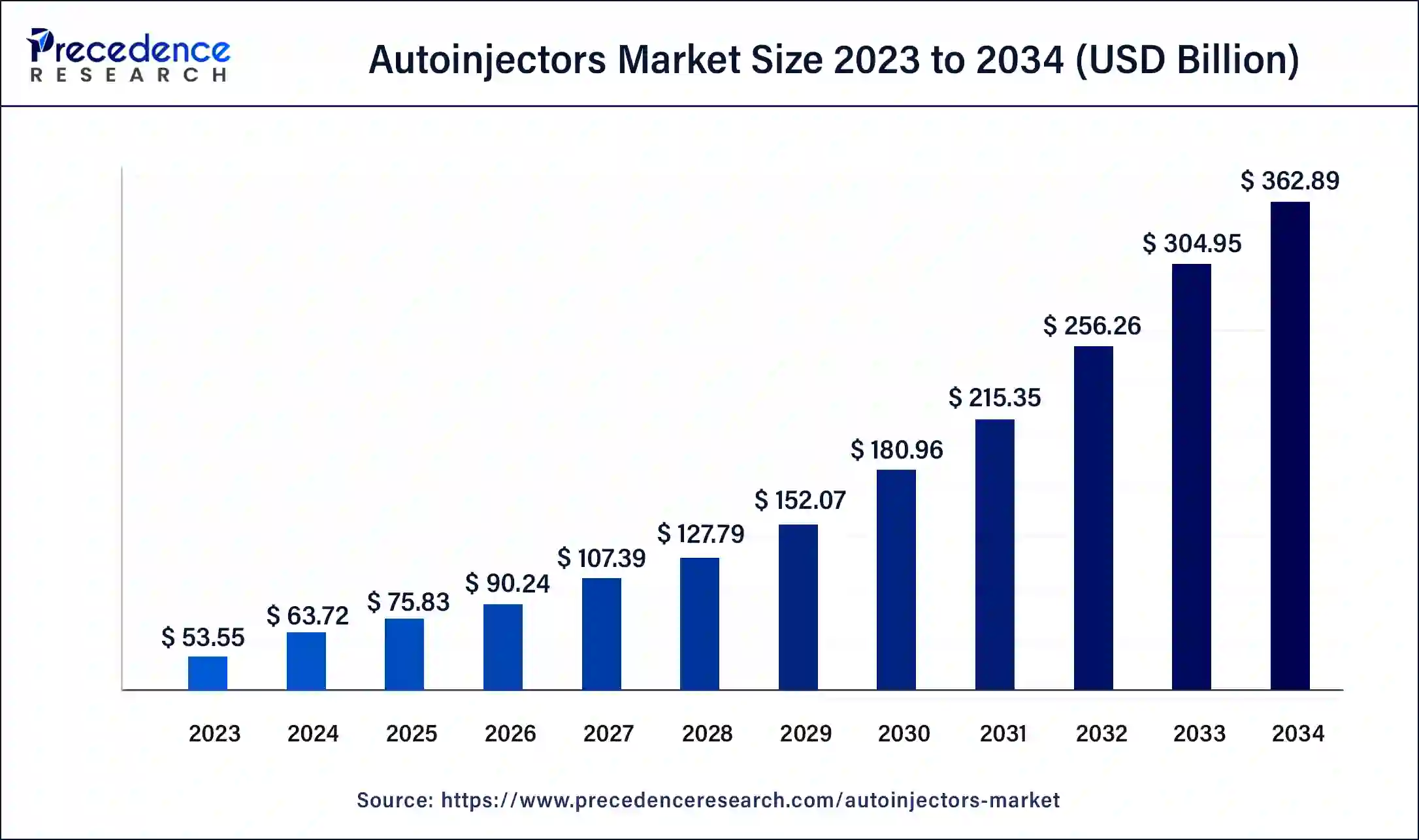

The global autoinjectors market size accounted at USD 75.83 billion in 2025 and is predicted to increase from USD 90.24 billion in 2026 to approximately USD 414.66 billion by 2035, at a CAGR of 18.52% from 2026 to 2035.

Autoinjectors Market Key Takeaways

- In terms of revenue, the autoinjectors market is valued at $75.83billion in 2025.

- It is projected to reach $414.66billion by 2035.

- The autoinjectors market is expected to grow at a CAGR of 18.52% from 2026 to 2035.

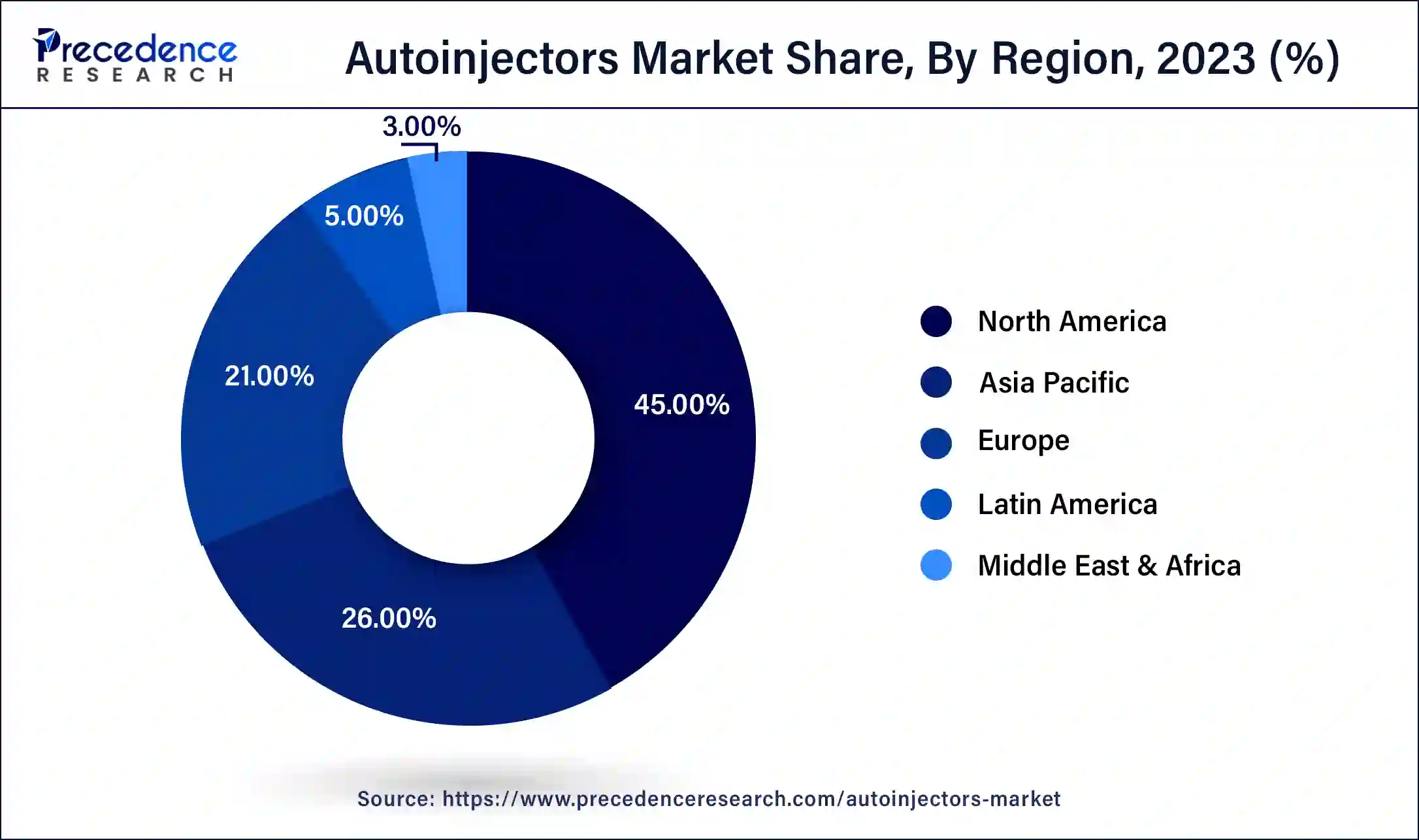

- North America accounted highest revenue share of over 45% in 2025.

- The Asia-Pacific market is growing at a CAGR of 18.9% from 2026 to 2035.

- By end user, the home care segment has the highest revenue share of 53% in 2024 and it is growing at a CAGR of 18.5% over the forecast period.

- The disposable autoinjectors segment is growing at a CAGR of 18.7% from 2026 to 2035.

- The anaphylaxis segment is growing at a CAGR of 18.5% from 2026 to 2035.

Artificial Intelligence: The Next Growth Catalyst in Autoinjectors

AI is transforming the autoinjector industry by enabling the shift from traditional mechanical devices to smart, connected systems that enhance patient adherence and safety. Next- generation autoinjectors utilize AI-driven sensors and Bluetooth technology to track dosage in real time, provide personalized feedback, and deliver usage data to both patients and care providers. In manufacturing, AI and automation streamline production, optimizing ergonomics and safety mechanisms while significantly lowering operational cost and human error.

Autoinjectors Market Growth Factors

The growth of the autoinjectors market is majorly driven by the increasing prevalence of targeted therapies, the growing occurrence of anaphylaxis, increasing consumer preferences for self-administration of drugs, advantages of usability, the rising number of regulatory body approvals, the easy accessibility of generic autoinjectors, government assistance, and advantageous reimbursements, and advancement of technology and others.

Additionally, according to a study published in 2019 by the European Journal of Allergy and Clinical Immunology, global Overall anaphylaxis in children occurs at a rate of 1 to 761 per 100,000 person-years, while food-related anaphylaxis occurs at a rate of 1 to 77 per 100,000 person-years. Anaphylaxis is a severe, potentially fatal allergic reaction caused due to food, latex, Hymenoptera stings and medicines. Thus, the growing incidence of anaphylaxis is propelling the market growth.

Anaphylaxis is treated with epinephrine as the first line of defense. For anaphylaxis, pharmaceutical companies are developing technologically enhanced epinephrine autoinjectors (EAIs). This technological advancement includes portable devices, innovative designs, autoinjectors with two auto-injectable doses in one device, temperature-stabilized autoinjectors and longer shelf life for epinephrine, gadgets that alert patients when a dose has been administered effectively and others. Therefore, such technological advancements is expected to fuel the demand for autoinjectors in the upcoming years contributing towards the market growth.

Market Outlook

- Market Growth Overview: The autoinjectors market is expected to grow significantly between 2025 and 2034, driven by the rising prevalence of chronic and allergic diseases, patient preference for self-administration, and the shift towards home healthcare.

- Sustainability Trends: Sustainability trends involve the rise of reusable autoinjectors, eco-friendly material selection, and modular and separable designs.

- Major Investors: Major investors in the market include SHL Medical AG, Ypsomed Holding AG, Becton, Dickinson, and West Pharmaceutical Services, Inc.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 75.83Billion |

| Market Size in 2026 | USD 90.24 Billion |

| Market Size by 2035 | USD 414.66Billion |

| Growth Rate from 2026 to 2035 | CAGR of 18.52% |

| Largest Market | North America |

| Fastest Growing Market | Asia-Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Therapy, Type, Route of Administration, Type of Molecule, and End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Therapy Insights

Based on therapy, the autoinjector market is divided into rheumatoid arthritis, anaphylaxis, diabetes, multiple sclerosis, multiple sclerosis, and others. In 2025, the rheumatoid arthritis segment accounted for the lion market share. This was majorly attributable to its high rate of occurrence globally. According to the CDC, arthritis, rheumatoid arthritis, gout, lupus, and fibromyalgia affect an estimated 43.7 million individuals (22.7 percent of the total population) in the United States each year. Thus, the growing incidence of rheumatoid arthritis propelling the demand for autoinjectors ultimately contributing towards the growth of the market.

Type Insights

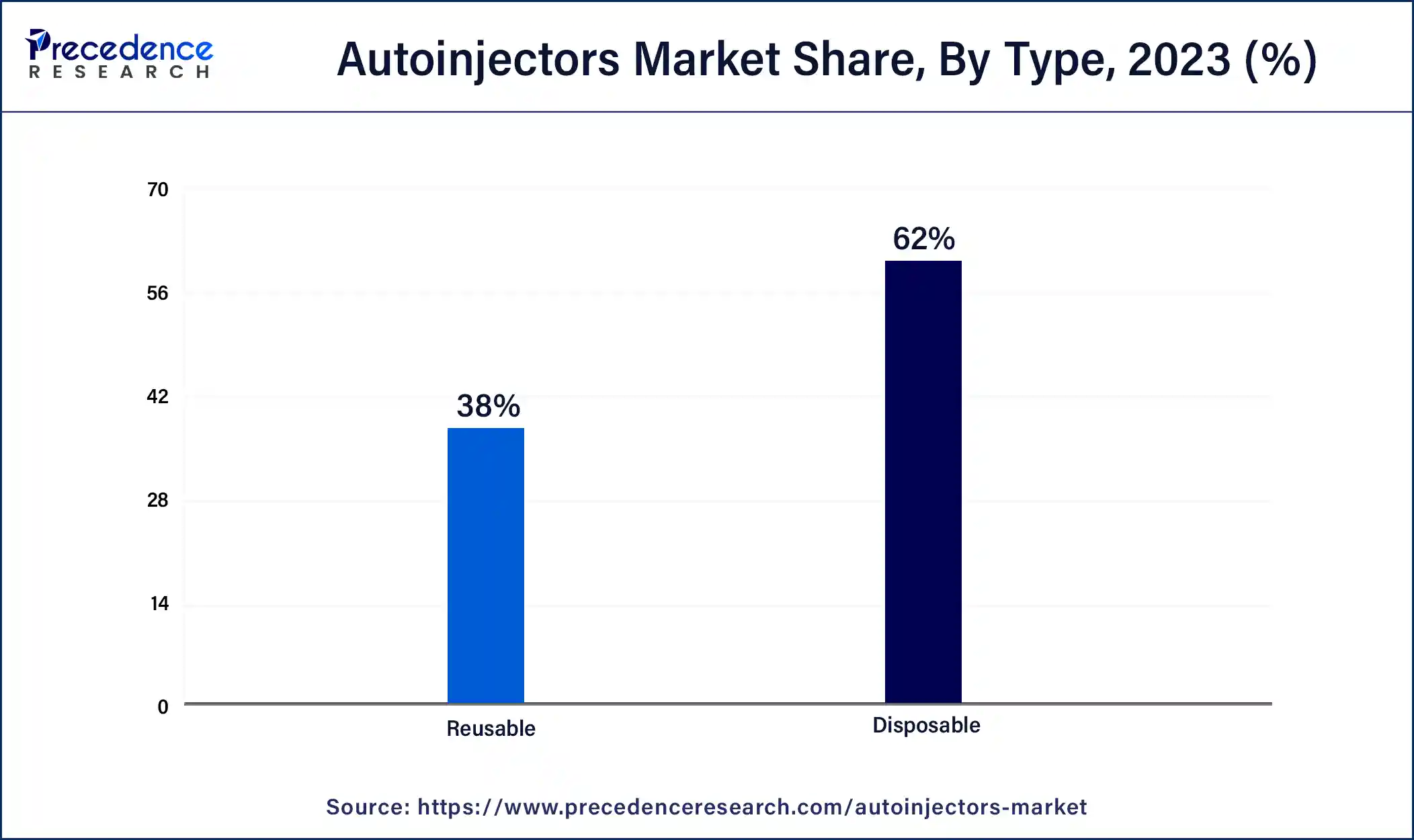

By type, the autoinjectors market is bifurcated into disposable and reusable autoinjectors. In 2025, the disposable autoinjectors segment accounted for the highest share of the autoinjectors market.

This is attributable to its ease of use and the existence of a built-in glass syringe (which eliminates the need to manually load a glass syringe), making it the most popular autoinjectors among patients with poor dexterity or visual impairments.

Route of Administration Insights

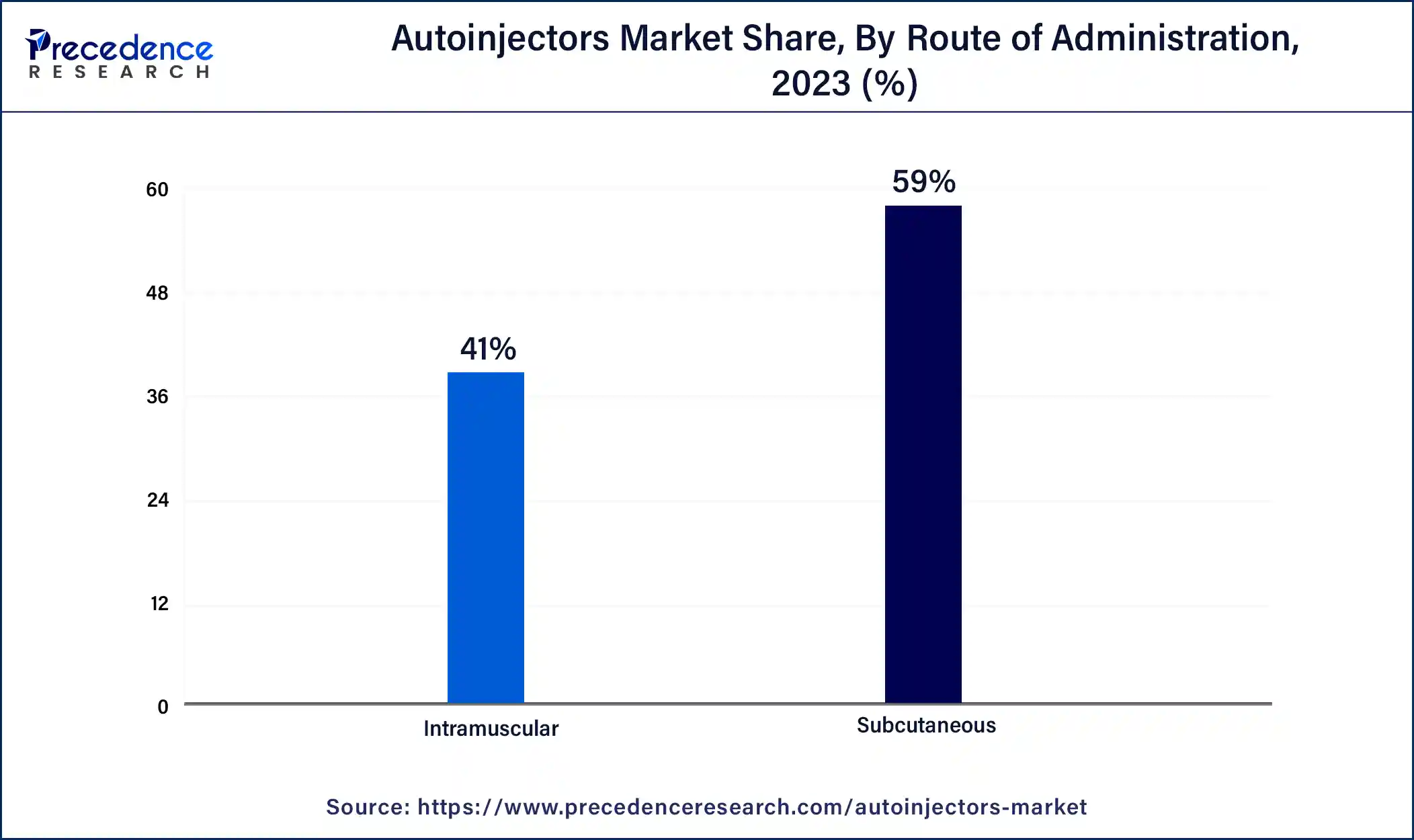

Based on the route of administration, the market is divided into subcutaneous and intramuscular. The subcutaneous segment accounted for the highest market share and is anticipated to be the fastest growing segment during the forecast period.

This is mainly attributable to the rising number of product acceptance by the regulatory bodies for chronic disease treatment.

End-User Insights

Based on end users, the autoinjectors market is segregated into hospitals & clinics, ambulatory care settings and home care settings. The home care settings segment holds the largest market share in the year 2023, owing to the speedy growth in the aging population globally coupled with the growing demand for low-cost drug administration.

Regional Insights

What is the U.S. Autoinjectors Market Size?

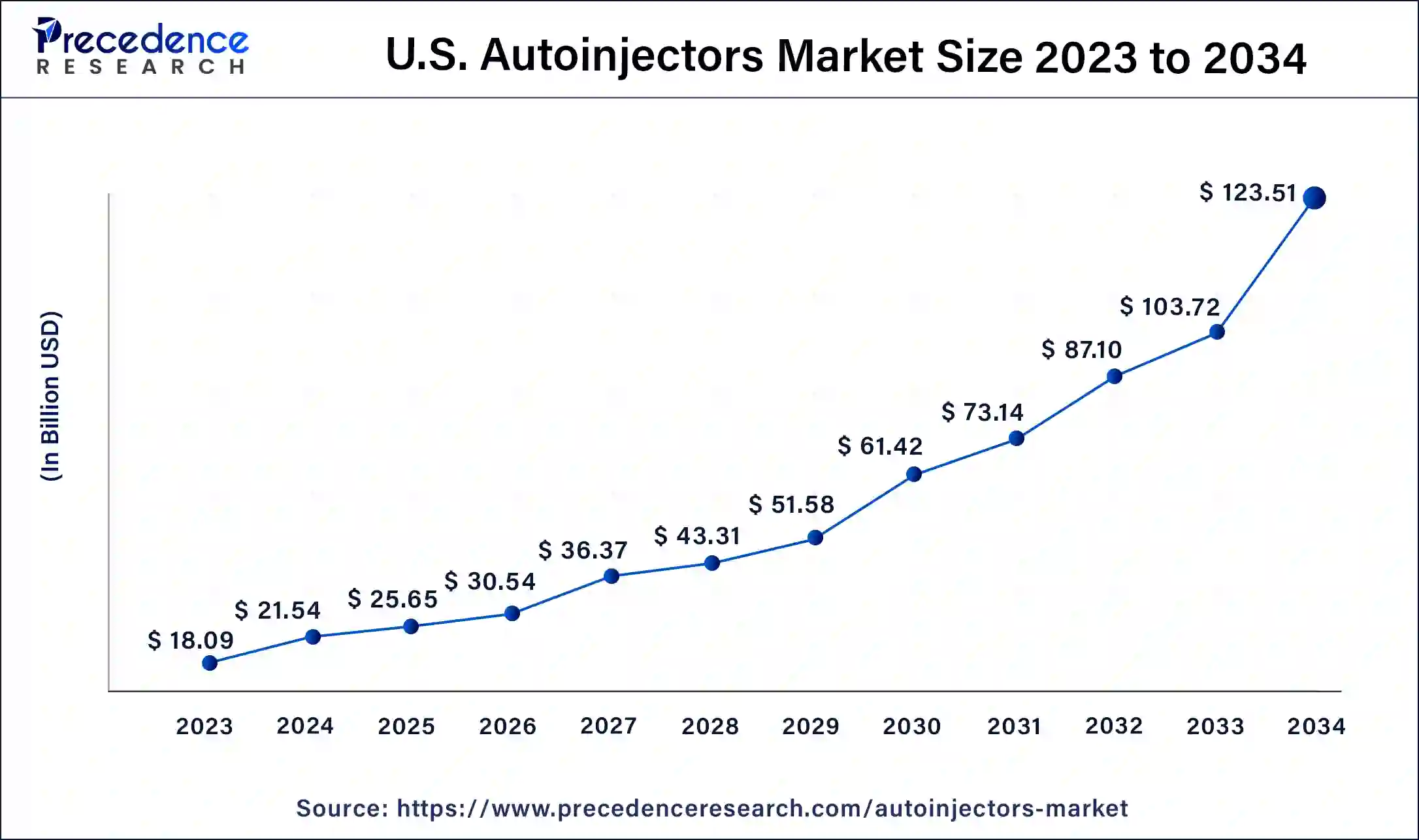

The U.S. autoinjectors market size was estimated at USD 25.65 billion in 2025 and is predicted to be worth around USD 141.19 billion by 2035, at a CAGR of 18.60% from 2026 to 2035.

North America is the largest market for autoinjectors market, followed by Europe and the Asia Pacific. Factors such as the increased incidence of anaphylaxis and the availability of advantageous reimbursements are driving growth in the North American market. Furthermore, the United States and Canada are developed economies with high consumer awareness and the use of modern devices such as autoinjectors, which is favorable to market expansion. Other microeconomic elements that contribute to market growth include increased healthcare expenditures, a high rate of affordability, and an improving regulatory environment.

U.S. Autoinjectors Market Trends

The United States is the largest autoinjector market in North America, with a sophisticated healthcare system, pharmaceutical companies having a solid foothold, and rising incidences of chronic conditions, such as diabetes and multiple sclerosis. In addition, growing patient awareness and favorable reimbursement policies lead to the rapid adoption of autoinjector technology.

Asia-pacific is anticipated to be the fastest growing market during the forecast year. The huge diabetic population and rising healthcare expenditures in Asia Pacific region are driving the market expansion which in turn is attracting a number of key autoinjector device manufacturers to this region. The key players are increasingly expanding their presence in the Asia Pacific market in a variety of ways, including opening sales offices and forming partnerships with local pharmaceutical companies.

Japan Autoinjectors Market Trends

Japan has unique advantages in the Asia Pacific autoinjector market by virtue of its aging population and a higher incidence of chronic conditions needing regular self-injection therapies. Furthermore, Japan has an advanced medical device industry that is leveraging more user-friendly, home-based drug delivery solutions, which are increasingly accepted among patients.

How Did Europe Experience A Notable Growth in the Autoinjectors Market

Europe's shift toward self-managed care for chronic conditions like multiple sclerosis and diabetes. This growth is solidified by a robust regulatory framework that fast-tracks the approval of biosimilars and "smart" connected devices, which enhance patient adherence. Consequently, the combination of advanced pharmaceutical infrastructure and high healthcare expenditure ensures that Europe remains a global leader in medical delivery innovation.

Germany Autoinjectors Market Trends

Germany's increasing rates of diabetes, rheumatoid arthritis, multiple sclerosis, and allergies, combined with the growing adoption of self-care and home healthcare, are leading to higher demand. Additionally, the integration of smart features, connectivity, and improved design is facilitating better patient adherence.

Value Chain Analysis of the Autoinjectors Market

- R&D and Design (Upstream): This initial phase focuses on the engineering of user-friendly devices, incorporating advancements like Bluetooth connectivity for data tracking, improved ergonomic designs, and compatibility with high-viscosity drugs.

Key Players: SHL Medical AG, Ypsomed AG, Becton, Dickinson and Company (BD), and Oval Medical Technologies. - Component Manufacturing and Sub-assembly (Midstream): This stage involves the production of crucial sub-components such as specialized glass syringes, plastic housing, spring mechanisms, and needle shields, often handled by contract development and manufacturing organizations (CDMOs).

Key Players: West Pharmaceutical Services, Inc., Gerresheimer AG, Phillips-Medisize, and Stevanato Group. - Final Assembly and Filling (Midstream): In this stage, the drug is filled into the primary container and integrated into the final autoinjector device.

Key Players: SHL Medical (Molly platform), Ypsomed (YpsoMate), and Recipharm AB

Autoinjectors Market Companies

- AbbVie Inc.: AbbVie is a major player in the autoinjector market through the widespread use of its Humira (adalimumab) pen, which has set standards for patient-friendly self-administration of biologics.

- Mylan: Mylan significantly impacted the market by introducing the first authorized generic for the EpiPen, providing affordable, life-saving, and readily available epinephrine autoinjectors.

- Eli Lilly and Company: Eli Lilly dominates the diabetes care segment by offering advanced insulin autoinjector pens, such as those used for Mounjaro (tirzepatide), which feature hidden needles to reduce user anxiety.

- Ypsomed: Ypsomed is a leading developer and manufacturer of injection systems, providing versatile, user-friendly, and custom-designed autoinjector platforms like YpsoMate for other pharmaceutical companies.

- Amgen: Amgen drives the market by utilizing its proprietary, easy-to-use SureClick autoinjector for various high-value biologics, including those for rheumatoid arthritis and bone health.

- Becton: BD is a prominent supplier of advanced, pre-fillable, and user-centric autoinjector technology that is integrated into many pharmaceutical companies' finished drug products.

Other Major key Players

- Dickinson and Company

- Antares Pharma

- GlaxoSmithKline plc

- Johnson & Johnson

- Teva Pharmaceutical

- Merck KGaA

Recent Developments

- In May 2025, Sandoz, the global leader in generic and biosimilar medicines, announced the European launch of its Pyzchiva* (ustekinumab) autoinjector. The Pyzchiva autoinjector supports a more comfortable self-administration experience with accurate automatic dosing, less frequent injection pain, a compact design, and flexible storage options, offering the potential for improved adherence to patient treatment plans. (Source: https://www.globenewswire.com)

- In May 2025, IDE Group unveiled OKO, its new ophthalmic auto-injector for improving drug delivery precision and efficiency. The company says its auto-injector provides up to 59 times greater dosing accuracy compared to prefilled syringes and reduces procedural steps by 45%. OKO also significantly enhances patient throughput to cut costs by up to 78% per injection, the company says. (Source: https://www.drugdeliverybusiness.com)

- In June 2024, Instron announced the release of the next generation Autoinjector Testing System for full functionality testing of pen and autoinjectors to ISO 11608. The system then automatically runs through the test sequence and provides results including cap removal and activation forces, injection time, needle depth measurements at the start and end of injection, click detection, delivered volume, and safety check results. (Source: https://www.news-medical.net)

- In June 2024, the Food and Drug Administration (FDA) approved a new single-dose autoinjector presentation of Adbry (tralokinumab-ldrm). The new single-dose autoinjector is available in a 300mg/2mL dosage strength and is intended for use in adults only as an additional administration option to the single-dose prefilled syringe (150mg/mL). For pediatric patients 12 years of age and older, treatment should be administered via the prefilled syringe. (Source: https://www.empr.com)

Segments Covered in the Report

By Therapy

- Rheumatoid Arthritis

- Multiple Sclerosis

- Diabetes

- Anaphylaxis

- Other Therapies

By Type

- Disposable

- Reusable

By Route of Administration

- Subcutaneous

- Intramuscular

By Type of Molecule

- Monoclonal Antibody

- Peptide

- Protein

- Small Molecule

By End-User

- Home Care Settings

- Hospitals & Clinics

- Ambulatory Care Settings

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting