What is the Body Armor Market Size?

The global body armor market size is accounted at USD 3.50 billion in 2025 and predicted to increase from USD 3.70 billion in 2026 to approximately USD 6.15 billion by 2035, representing a CAGR of 5.80% from 2026 to 2035.

Body Armor Market Key Takeaways

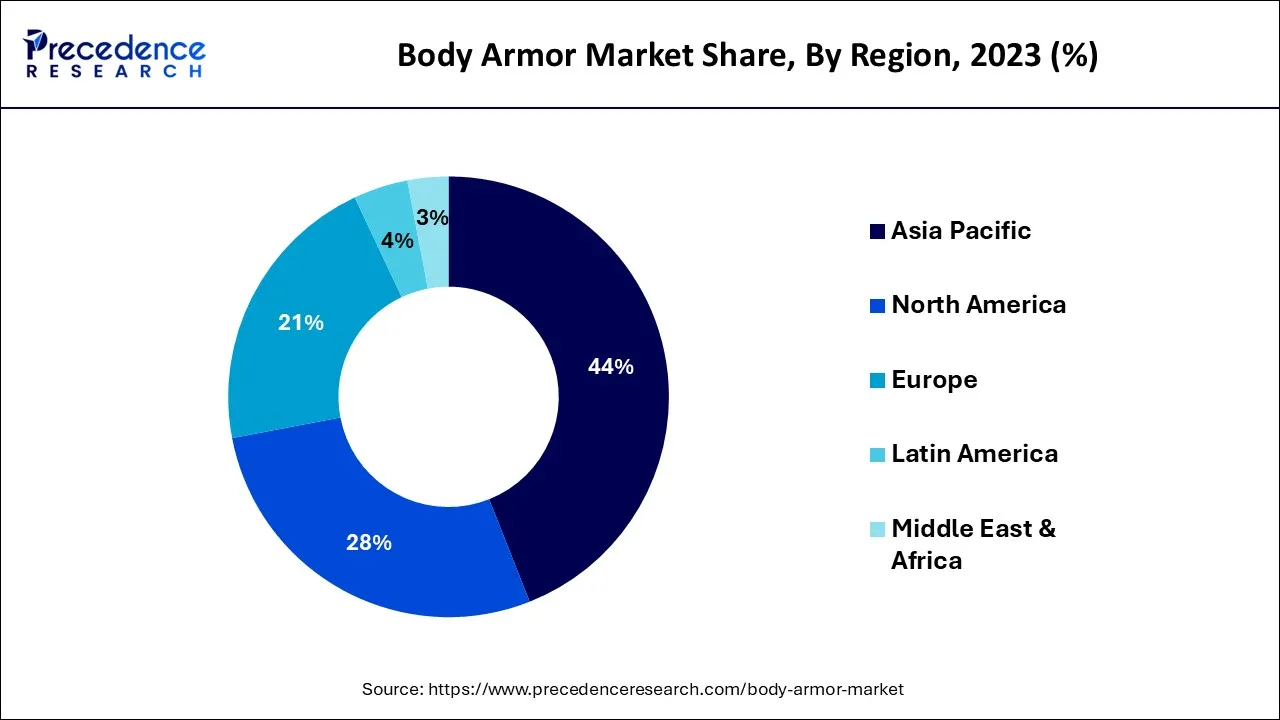

- Asia-Pacific led the market and captured more than 44% revenue share in 2025.

- Europe is expected to grow at a CAGR of 5.80% from 2026 to 2035.

- By protection level, the level III segment generated for more than 26% of revenue share in 2025.

- By protection level, the level II segment is predicted to grow at a 7.4% CAGR from 2026 to 2035.

- By end-user, the defense segment dominated the market and generated a maximum revenue share of around 59% in 2025.

- By end-user, the law enforcement section is estimated to record a significant CAGR of 7.9% from 2026 to 2035.

- By type, the vest segment captured for more than 56% of revenue shares in 2025.

- By type, the helmet segment is projected to grow at a CAGR of 6.9% between 2026 to 2035.

- By style, the overt segment generated the highest revenue share of around 78% in 2025.

Market Overview

High-performance body armor is incorporated with specialized equipment like video cameras, communication systems, oxygen systems, face protection, and other advanced technologies allowing the person to undertake a fight without any obstacles.

The heavy weight of body armor compelled dealers to finance research and development to optimize the manufacturing process and tone down its importance. They also formulate armor with health monitors and communication apparatus, growing the cost of the working and leading to challenges in taking full advantage of the price and weight of the product. This could significantly challenge the market's growth throughout the estimated period. Increasing emphasis on the security of military personnel throughout modern warfare practices is anticipated to build up the market in the upcoming years.

Body Armor Market Growth Factors

The development of lightweight raw matter is remarkably leading market growth. Dealers are focused on lightweight materials in the making process. For example, Fibrotex's partnership with Israel Defense Forces formulated FIGHTEX, a type of next-generation two-sided combat uniform that is light in weight, innovative fabric. These uniforms use advanced materials that bolster soldiers' survivability over critical missions.

These light uniforms are fire-resistant and can be incorporated with other items, that includes winter uniforms, jackets, and load carriers. With the increasing adoption of lightweight materials, the demand for lighter armor rises due to their benefits. This is predicted to foster the market's growth over the estimated period.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.50 Billion |

| Market Size in 2026 | USD 3.70 Billion |

| Market Size by 2035 | USD 6.15 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.80% |

| Largest Market | Asia-Pacific |

| Fastest Growing Market | Europe |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Protection Level, By End-User, By Type, and By Style |

| Regions Covered | North America, Europe, Asia-Pacific, Latin Americ,a and Middle East & Africa |

Market Dynamics

Drivers

Counter-terrorism, insurgency, and warfare operations illustrate contemporary warfare tactics that could induce fatal injuries to soldiers. This also arises in law enforcement, where felons, criminals, and other lawbreakers have the potential to fatally hurt correspondent officers, necessitating the acquisition of protective suits and related gear that eventually results in the growing demand for ballistic protection gear and claims to protect military forces worldwide. Likewise, modernization services have opened various doors for sector players, ensuing in contractual unions with armed forces organizations.

Restraints

Optimizing the weight of body armor is the major challenge hindering market growth. The importance of body armor rises even more when blended with equipment such as optics, radio, and ammunition. These devices add extra weight to the heavy armor, affecting the wearer's mobility, efficiency, and flexibility. The body armor market is fragile and subject to several laws and regulations. The guidelines for screening the level of keenness the body armor can endure against any danger must be met by dealers producing and marketing armor.

The United States Department of Defense (DoD), Underwriters Laboratories (UL India), as well as the National Institute of Justice (NIJ) are the three regulative bodies that check the standard of body armor. Further, the bar can determine the point of danger an armor plate can withstand. Regimes are being altered to secure more excellent security, making it challenging for market sellers to compete.

Opportunities

Modernizations in materials employed for bulletproof jackets are the primary tendency in the market. There has been significant progress in body armor, like bulletproof jackets. Conventional bulletproof jackets are made up of protective stuff called Kevlar. Kevlar is a commonly used matter as armor for bullet protection. Hence, the material bends up to 3.5 centimeters on impact inwards, and the material's safety is questionable. To enhance the drawbacks of traditional vests, a fresh fluid, considered a non-Newtonian liquid, has been developed.

Similarly, a new material called graphene is also being used to manufacture defense equipment. Thus, introducing these raw materials will improve the quality and security of bulletproof jackets, which is estimated to push the market's growth over the forecast period.

Segment Insights

Protection Level Insights

Protection level III accounted for the maximum global revenue share of over 26% in 2025. It is the most extensively used protection armor. These protection outfits are more flexible, lighter in weight, and concealable under clothing, capable of defeating a more comprehensive range of ammunition. It provides more excellent blunt protection than IIA. Suitable for council employees, civilians, and officers.

The level II section is expected to expand at a 7.4% CAGR from 2026 to 2035. It protects a typical handgun round and is even light in weight, comfortable and concealable. It provides excellent protection against blunt force trauma as compared to level II.

Different IIIA levels are used with other protective panels, assigning maximum protection. It is a soft armor, and the materials used to manufacture the level IIIA and group III choices differ. This type of body armor can be worn both covertly and overtly. Few makers also offer IIIA+ goods to protect against shotgun shells, for instance, 9mm civil defense rounds.

Lastly, the level IV goods offer protection from AP bullets of 30 calibers. It is used in military contexts and provides the maximum level of security. This gear is pricey and bulky compared to grade III and III+ products.

End-User Insights

The defense sections dominate the market with a maximum global revenue share of around 59% in 2025. This is due to the progression of battlefield threats, for instance, bone-breaking shrapnel or batons in improvised explosive devices, which has pushed for the approval of new tactical ballistic vest protection and pioneering body armor.

The law enforcement section is estimated to record a significant CAGR of 7.9% from2026 to 2035. This is mainly boosted by security personnel and first respondents as they carry out their duties to ensure safety and security and to defeat, prevent and prosecute offenses. An increase in government expenditure for internal protection and control in the country worldwide will likely propel the growth of this section.

Governments and companies worldwide are investing in manufacturing new lightweight vests with increased mobility over the integration of advanced technologies such as 3D printing and the utilization of composite materials. DRDO has announced the development of bulletproof with the implementation of new technology. This advancement focused on avoiding the enormous weight of the body armor that makes it difficult for military men to wear and move freely on the battlefield. As per the rules and regulations of the National Institute of Justice (NIJ), the enforced officers face numerous difficulties. Firearms are a significant need for lightweight shields with strict quality control and fast turnaround for law enforcement agencies.

Type Insights

The vest section generated for more than 56% of revenue shares in 2025, comprising stab-resistant and bulletproof vests that protect against the assault on the body's essential organs. Further, it provides the highest security in close combat situations and frontline defense battles. Depending upon the end-user and concern, covert and overt vests offer different levels of flexibility.

The helmet section is estimated to have a higher CAGR of 6.9% between 2026 and 2035. It can be found in different shapes and sizes, such as a ballistic helmet. Based on the design, the helmet can be high-cut, mid-cut, and full-cut. As level II ballistic helmets are light and comfortable, it is extensively used by police and law enforcement officers to protect from handguns, shrapnel, and blunt force.

The soft product offers highly comfortable and flexible pistols, mainly used by first respondents and for covert operations. Complex products feature durability property materials like steel, ceramics, polyethylene, ceramic composites, and materials such as kevlar. Other sections contain safety gear, for instance, eye protection, gloves, joint guards, groin protection, and neck guard. Transition and military combat eye protection are safety gear for the eyes.

Style Insights

The overt section is estimated for the highest revenue share of around 78% in 2025. It is due to a higher level of protection from larger spikes or blades and heavy gunfire. Basically, this type of armor is worn on top of the clothing even bulkier. These armors are heavier as it is prepared using different kevlar layers. It is used to protect against many different weapons comprises of knives, bullets, etc., and is available in all levels of protection.

This can be customized which acts as an advantage with multiple pockets and even protecting cover for arm and neck regions. It is made up of sturdier bulletproof panels and are preferred by personnel in high-risk sectors as in controlling riots, war zones and military operations.

Regional Insights

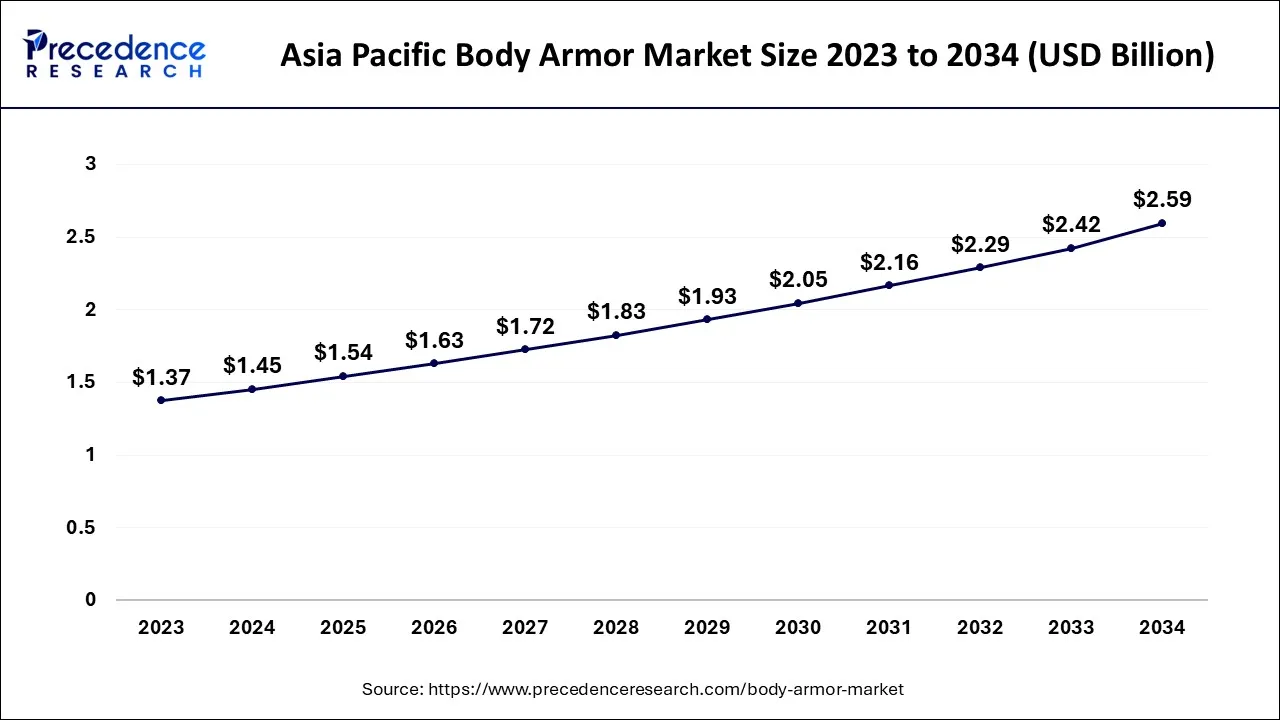

What is the Asia Pacific Body Armor Market Size?

The Asia Pacific body armor market size is exhibited at USD 1.54 billion in 2025 and is projected to be worth around USD 2.73 billion by 2035, growing at a CAGR of 5.80% from 2026 to 2035.

Asia-Pacific generated for more than 44% revenue share in 2025 by growing military expenditure. Countries like India, Japan and China with large military troops are recognized for substantial charges on military gear. Raising border disputes and warfare illustrates are foreseen to propel the need for body armor.

The region's dominance in the market is further attributed to high defense spending, large-scale military modernization programs, and strong demand for advanced personal, vehicle, and naval armor systems. The region's growing geopolitical tensions, expanding defense manufacturing capabilities, and increasing adoption of lightweight and high-performance armor materials further strengthen its market leadership.

India Body Armor Market Analysis

India's market is growing rapidly, fueled by military modernization, counter-insurgency efforts, and homeland security needs. Government initiatives supporting local defense manufacturing are speeding up the production of bulletproof jackets and helmets. Increased procurement for the armed forces, police, and central armed police forces helps sustain market growth.

What Makes Europe the Fastest-Growing Region in the Market?

Europe is predicted to observe a growing CAGR of 6.94% from 2026 to 2035. The increased spending is awaited military upgradation with personal safety and weapons. European nations like Germany, France, and Italy contribute a part of their defence spending to NATO, boosting the need for this product over the estimated period.

Increasing defense modernization programs, rising investments in law enforcement and homeland security, and growing demand for advanced personal and vehicle armor solutions also support market growth in the region. Additionally, stringent safety regulations, technological advancements in lightweight and high-performance materials, and government support for domestic defense manufacturing are driving market growth.

Why is North America Considered a Significant Region in the Market?

North America is a significant region in the body armor market due to substantial defense budgets, advanced military and law enforcement programs, and high adoption of next-generation armor technologies. The presence of leading body armor manufacturers, strong R&D capabilities, and stringent safety and compliance standards further reinforces the region's market prominence.

The U.S. is a major contributor to the market within North America. The U.S. has broadened its military spending to offset the aggressiveness of its strategic rivals as China and Russia. Additionally, the U.S. has provided Ukraine with military support to combat Russia amid heightened demand for armor in the coming years.

U.S. Body Armor Market Analysis

The United States registered a significant revenue share. The United States has broadened its military spending to offset the aggressiveness of its strategic rivals as China and Russia. Additionally, the U.S. has aggressively provided Ukraine with military support to combat Russia due to raised demand for armor in the upcoming months.

What Potentiates the Market in the Middle East & Africa?

The body armor market in the Middle East & Africa (MEA) is driven by regional conflicts, counter-terrorism efforts, and internal security challenges. High defense spending in select countries supports demand for advanced ballistic protection systems. Military and security forces prioritize multi-threat armor capable of withstanding ballistic, blast, and fragmentation threats in harsh environments.

Saudi Arabia Body Armor Market Analysis

Saudi Arabia is a major contributor to the MEA body armor market, supported by significant defense budgets and ongoing military modernization initiatives. The country invests heavily in advanced personal protection equipment for armed forces and security personnel. Localization initiatives and partnerships with global defense suppliers further strengthen market development.

How is the Opportunistic Rise of Latin America in the Body Armor Market?

Latin America is expected to experience lucrative growth in the market during the forecast period, driven by a shift toward expanding local manufacturing capabilities, increasing military spending, and the focus on public security. Countries such as Brazil and Colombia are investing in advanced personal protective equipment to address both urban crime and organized crime threats. This presents opportunities for both local manufacturers and international suppliers, particularly in lightweight, high-performance armor solutions tailored to regional needs.

Latin America: Brazil Body Armor Market Trends

Brazil's market is poised for continued growth, with demand driven by persistent urban crime, organized violence, and significant law enforcement and military procurement programs aimed at enhancing public safety and operational capability. Institutional buyers such as military police, federal forces, and state security units are major consumers of soft armor, tactical vests, and ballistic helmets, underpinning a steady rise in market revenues.

Domestic production is gaining importance as national procurement policies favor local manufacturers, bolstering Brazil's self-sufficiency and encouraging innovation in advanced materials and protective gear.

Body Armor Market - Value Chain Analysis

- Development & Processing

Body armor is made using advanced materials such as aramid fibers, ultra-high-molecular-weight polyethylene (UHMWPE), ceramics, and composite laminates. Manufacturing involves fiber weaving, ballistic panel molding, ceramic plate sintering, resin impregnation, layering, and ergonomic shaping to ensure high impact resistance while keeping the weight low.

Key Players: DuPont, Honeywell International, BAE Systems, Point Blank Enterprises. - Quality Testing & Certification

Body armor requires stringent certifications to ensure ballistic protection, durability, and user safety. Key certifications include NIJ ballistic standards, ISO quality management systems, STANAG standards for military applications, and environmental durability testing.

Key Players: NIJ (National Institute of Justice), ISO (International Organization for Standardization), NATO STANA Authorities, UL Solutions. - Distribution to End-Use Industries

Body armor is distributed to defense forces, law enforcement agencies, homeland security departments, private security firms, and civilian protection markets through government contracts and authorized defense suppliers.

Key Players: Safariland Group, Armor Express, Craig International Ballistics, and Arkay Plastics Inc.

Body Armor Market Companies

- Elmon SA: Produces specialized ballistic vests and helmets featuring high-performance interchangeable insert systems.

- Ballistic Body Armor Pty: Manufactures a wide range of personal protection equipment, including bullet-resistant vests and hard armor plates for security forces.

- Pacific Safety Products Inc.: Provides soft body armor, tactical vests, and fragmentation protection gear for the Canadian and international markets.

- EnGarde Body Armor: Offers high-quality concealable and tactical body armor solutions using advanced ballistic fibers for global military and civilian use.

- Safariland, LLC: Delivers a massive portfolio of concealable and tactical armor systems through established brands like Second Chance and ABA.

- Point Blank Enterprises, Inc.: Supplies high-capacity ballistic systems and modular tactical vests to major military and law enforcement agencies worldwide.

- Craig International Ballistics Pty Ltd.: Focuses on lightweight composite armor panels and personal protection gear for the Australian Defence Force.

- Hellweg International Pty Ltd.: Specializes in high-performance Australian-made ballistic vests and duty equipment for police and security personnel.

- BAE Systems plc: Develops large-scale integrated military body armor systems and modular scalable vests for global defense forces.

- Ceradyne Inc.: Designs and manufactures advanced ceramic hard armor plates and ballistic helmets to counter high-velocity rifle threats.

- Avon Protection plc: Produces integrated personal protection solutions, including ballistic helmets and armor compatible with respiratory systems.

- Sarkar Tactical Ltd.: Manufactures NIJ-certified ballistic helmets, plate carriers, and hard armor plates for international tactical teams.

- Armored Republic LLC: Focuses on accessible hard armor plates and modular plate carriers primarily marketed toward the civilian and private security sectors.

Recent Development

- In December 2025, Kevlar EXO, the next-gen aramid fiber, expands into hard armor applications, including helmets and ballistic plates. Previously the core of soft armor, Kevlar EXO now provides structural strength, boosting impact resistance and energy absorption in life protection gear.

(Source: https://www.defenseandmunitions.com ) - In September 2025, at DSEI UK 2025 in London, NP Aerospace unveiled a new body armor line designed specifically for women. Developed from the ground up, it addresses the unique needs of women operating in high-risk defense and security roles.

(Source: https://www.calibredefence.co.uk ) - In March 2022, the United Kingdom's armed forces proclaimed new body armor advancements for women in its armed forces. The upgraded protective apparatus: the Virtus Scalable Tactical Vest, results from a partnership between several Ministry of Defence and industry organizations, including the Source Tactical Gear, Defence Science and Technology Laboratory and Defence Equipment and Support.

- In February 2022, India advertised fresh "Veer" helmets for the Indian Army's soldiers. Global Defense drafted these helmets and Homeland Security Company MKU, which are consonant with the modular accessory connector system employed for multi-accessory installation.

Segments Covered in the Report

By Protection Level

- Level II

- Level IIA

- Level III

- Level IIIA

- Level IV

By End-User

- Defence

- Law Enforcement & Security Personnel

- Civilians

By Type

- Vest

- Helmets

- Others

By Style

- Covert

- Overt

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting