What is the Buy Now Pay Later Market Size?

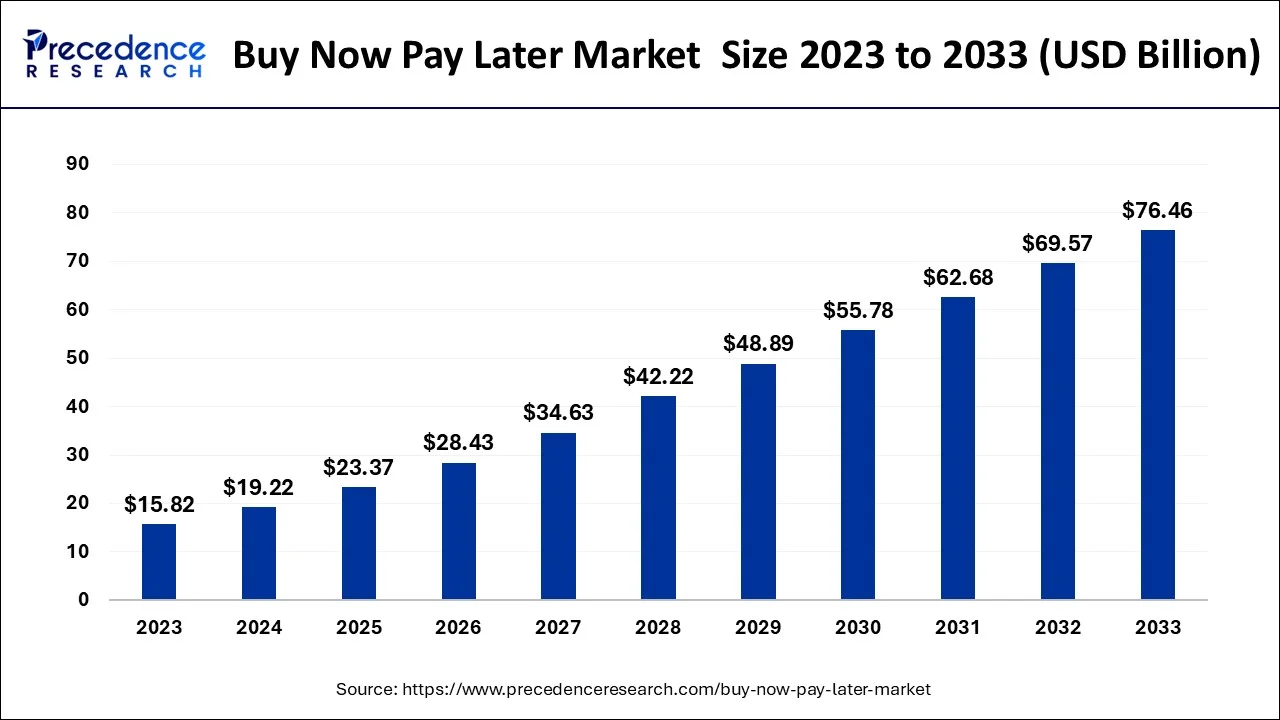

The global buy now pay later market size is accounted at USD 23.37 billion in 2025 and predicted to increase from USD 28.44 billion in 2026 to approximately USD 83.36 billion by 2034, expanding at a CAGR of 15.18% from 2025 to 2034. The buy now pay later market is observed to grow with the implementation of interest-free installment plans on e-commerce platforms.

Key Takeaways

- In terms of revenue, the global buy now pay later market was valued at USD 19.22billion in 2024.

- It is projected to reach USD 83.36 billion by 2034.

- The market is expected to grow at a CAGR of 15.18% from 2025 to 2034.

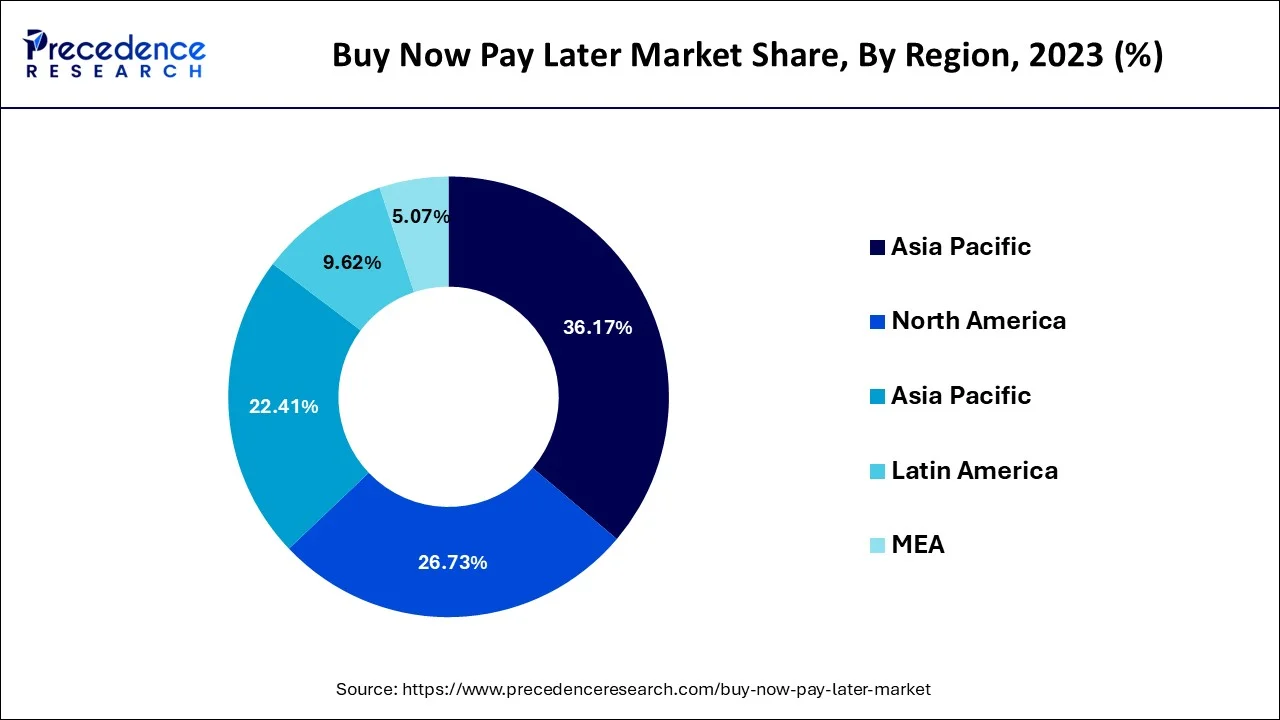

- Asia Pacific dominated the globalbuy now pay later market with the largest market share of 36.42% in 2024.

- North America is expected to grow at the fastest CAGR of 15.11% during the period.

- By component, the platform/solution segment held the biggest revenue share of 67% in 2024.

- By purchase ticket size, the small ticket item (Up to US$ 300) segment captured the highest market share of 42.98% in 2024.

- By purchase ticket size, the mid ticket items (US$ 300 - US$ 1000) segment is expected to grow at a notable CAGR of 15.84% during the forecast period.

- By business model, the business driven segment contributed the major revenue share of 70.99% in 2024.

- By business model, the customer-driven segment is expected to expand at a solid CAGR of 15.49% during the forecast period.

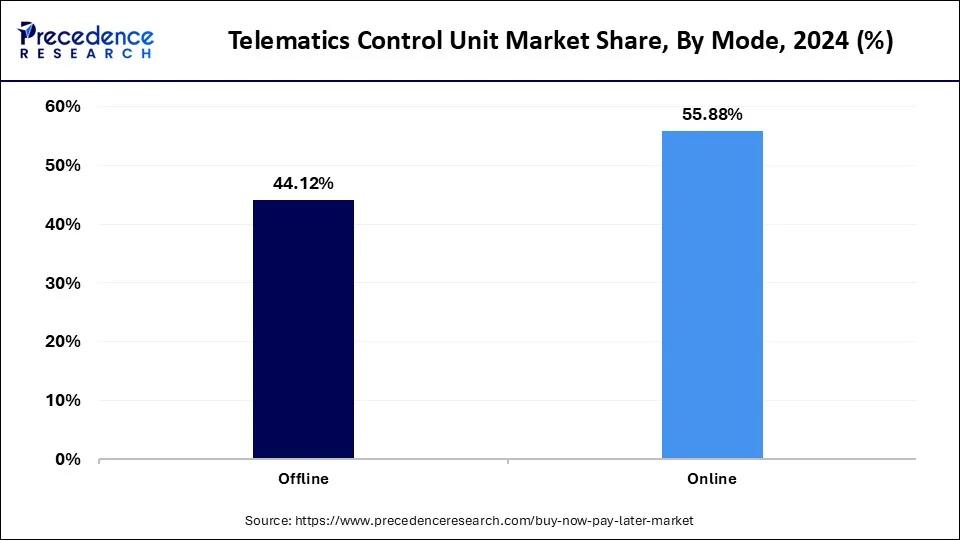

- By mode, the online segment held the largest revenue share of 55.88% in 2024.

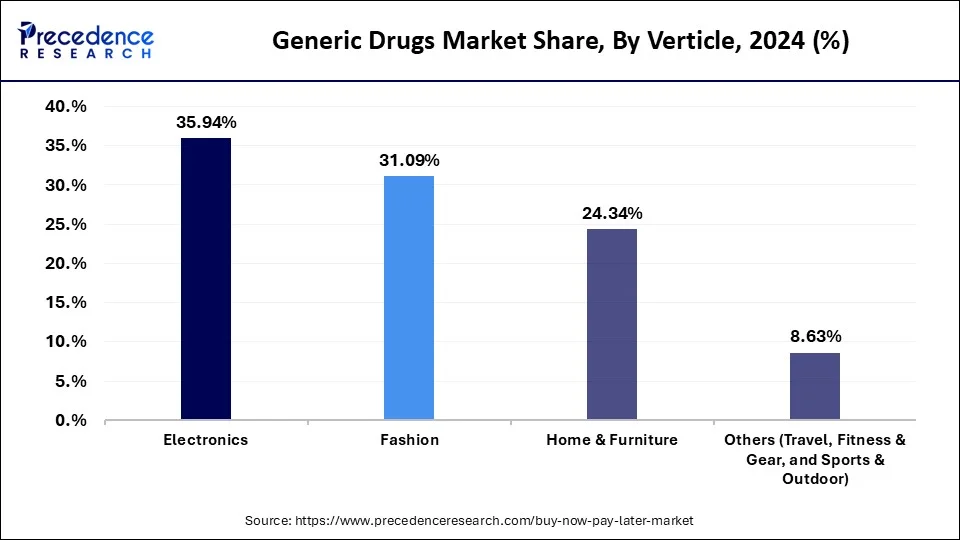

- By vertical, the electronics segment generated the major revenue share of 35.94% in 2024.

- By vertical, the fashion segments are expected to grow at a notable CAGR of 15.53% during the forecast period.

Data and statistics

- The Future of Financial Service Report published in March 2022 stated that 28% urban Indians are likely to choose to buy now, pay later service in next 12 months.

- The Forbes Advisor Survey published in February 2023 stated that only 9% of Americans used cash payment for shopping. While 54% of Americans used debit cards and credit cards for purchases as a primary payment method.

- As per Adobe Analytics, during the Amazon Prime Day Sale in 2023, the number of consumers preferring to buy now pay later plans increased by 20% as compared to the previous year.

- United Kingdom-based, Clearpay, a major player in buy now pay later industry was able to generate 739 million pounds in incremental sales as of 2021. While exploring the consumer trait for ClearPay, the company stated one in every 4 pounds was spent on clothing by choosing buy now pay later service.

Market Overview

Buy now pay later is a sort of a short-term financing that allows people to buy everyday items like home consumer goods, electronics, and clothes. It is a point of sale (POS) installment loan mechanism that allows customers to buy things and administers the repayment.

The e-commerce enterprises, fintech companies, and even banks have begun to offer buy now pay later services to customers. This payment option is available on Amazon and Flipkart's websites, as well as banks like ICICI bank and HDFC bank. The buy now pay later loans are also extended by a number of applications based fintech firms, including LazyPay, PayTM, Moneytap, PhonePe, and CASHe, among others. This option is now accessible for a wide range of purchases, from gadgets to fashion, as well as meal delivery, travel booking, grocery shopping, and other expenditures.

Growth Factors

The introduction of online payment methods by people in developing countries is speeding up the growth of the buy now pay later market. The economical and convenient payment service of buy now pay later platforms, as well as the global e-commerce industry's expansion, are the primary reasons driving the growth the global buy now pay later market.

The retailers are now offering buy now pay later options, allowing customers to acquire everyday necessities by selecting a reasonable financing plan and paying in installments rather than paying the entire cost up front. Several business owners around the world have been using the buy now pay later platform to finance huge equipment, purchase raw materials, and pay staff salaries, which is propelling the global buy now pay later market growth.

Furthermore, as a result of the surge in acceptance and adoption of buy now pay later payment technology among the young people, which provides benefits such as purchasing high-cost laptops and smartphones, paying the canteen bill, paying tuition fees, and purchasing the stationary products, the buy now pay later market is expected to grow during the forecast period.

Buy Now Pay Later Market Outlook

- Industry Growth Overview: The Buy Now Pay Later (BNPL) market was anticipated to experience rapid growth during the forecasted period from 2025 to 2030 due to increasing e-commerce, digital adoption, and consumer preferences to use flexible payment options. The Asia-Pacific region and North America continued to account for the largest markets for the ever-increasing demand driven by fintech innovations and increasing spending online.

- Sustainability Trends: Sustainable BNPL platforms were working collaboratively to foster responsible lending, transparency in fees, and an emphasis on financial literacy. Companies were attempting to not only reduce the risk for debt but also increase affordability. In addition, many BNPL providers launched eco-conscious programs to educate consumers to think about sustainability when making purchases, adopt sustainable purchasing behavior through these programs, and partnered with ethical retailers.

- Global Expansion: Leading BNPL companies entered developing markets, including Southeast Asia, Latin America, and Eastern Europe, to reach the unbanked consumer. They forged strategic partnerships and alliances with e-commerce platforms, payment processors, and networks to leverage their cross-border expansion and reach consumers more broadly.

- Major Investors: Private equity and fintech investors have financed BNPL companies, attracted to the characteristics of recurring revenues, digital scalability of product offerings, and access to consumer data. Notable investors such as SoftBank and Sequoia Capital pushed money into firms like Klarna, Afterpay, and Affirm to support their growth and aspirations of market expansion.

- Startup Ecosystem: The BNPL start-up scene expanded quickly, matched up with the mobile-first economies. New entrants like ZestMoney (India) and Tabby (UAE) focused on credit inclusion and risk analysis through AI, and are also historically able to access venture capital funding for their new point of sales funding propositions.

MarketScope

| Report Coverage | Details |

| Market Size in 2026 | USD 28.44Billion |

| Market Size in 2025 | USD 23.37 Billion |

| Market Size by 2034 | USD 83.36 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 15.18% |

| Base Year | 2024 |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Vertical, Mode, Business Model, Purchase Ticket Size, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Trends

Rising Integration of Artificial Intelligence (AI) Technology with Apps to Augment Growth

- Artificial intelligence (AI) and machine learning technology assist service providers in developing models in real-time and improving decision-making performance. Several players in the market are developing custom-built AI-based models to accelerate their consumer penetration in the market.

- In October 2020, Max Life Insurance, a life insurance company based in India launched buy now, pay later service for its insurance customers. The service is applicable for life and health insurance policy purchases through online purchases. The customers can buy now and pay later through an online portal.

- In February 2021, Credit Intelligence Limited, an Australian based company partnered with the Sydney-based University of Technology to enhance AI capabilities. Also, Credit Intelligence Limited acquired YOZO Finance an Australian based company, in 2020 a fintech platform, for adopting advanced technology AI for business expansion in several areas such as debt restructuring, debt collection, and debt factors in Australia and Asia.

Strategic Partnerships & Product Launches Intended to Strengthen Market Position

- The companies operating in Japan market are engaged in strategic collaboration and partnerships in order to strengthen their market position and enhance their offerings.

- For instance, in October 2020, Paidy, Inc., a Japan-based fintech startup, introduced 3-Pay, enabling consumers of its Paidy Plus service to split their purchases into three installments.

- In November 2019, Paidy Inc. entered into partnership with Amazon.com, Inc., a multinational technology company based in the U.S. The aim of the partnership was to offer buy now pay later option for Japanese consumer's on Amazon.co.jp.

- Moreover, in October 2019, Paidy Inc. established a US$ 52 Million warehouse facility by partnering with Goldman Sachs Japan Co., Ltd.

Market Drivers

Rising Green Energy Sources Coupled with Growth of Solar Power Industry

- The increasing adoption of online payments in industries such as banking, health insurance, retail & consumer goods, and others has fueled the growth of the global buy now pay later market. According to the United Nations Conference on Trade and Development (UNCTAD) in 2020, more than 80% of global consumers have shopped online and used digital payment.

- For Instance, In Japan, fintech start-ups are increasing at a rapid rate, which will significantly increase the demand for buy now pay later systems.

- Moreover, start-ups in Japan are adopting strategies of product launches in order increase the customer base. For instance, in October 2020, Paidy Inc., a Japan-based buy now pay, later provider launched a new service enabling users of its Paidy Plus service to split their purchase into three equal monthly instalment with no added interests or fees.

Market Opportunity

Adoption of Buy Now Pay Later Pay Method in Online Shopping

- Buy now pay later (BNPL) is the most convenient and fastest form of financing. The registration process is seamless. It is conveniently available at checkout on most of the e-commerce platforms in Japan. E-commerce companies are offering buy now pay later (BNPL) as a payment option to consumers by partnering with buy now pay later platforms. The buy now pay later platform charges 2% to 7% as a commission fee to e-commerce platforms on selling products.

- Furthermore, buy now pay later (BNPL) companies such as Paidy, a start-up company, partnered with multiple companies such as CROOZ SHOPLIST, Tansu Gen (Tans Gen Main Store.), la belle vie Inc. (GLADD Inc.), and others to offer its post-payment service, a BNPL pay method, enabling the consumers to use Paidy's post-payment service while purchasing products.

Increasing Adoption of Online Payment Method Among People

- The growing acceptance of online payment methods among people in developing countries is propelling the growth of the buy now pay later market. Mobile payments, debit cards, and credit cards are the leading digital payment technologies that provide people with numerous benefits such as lowering transaction costs and streamlining fund transfer services. The availability of high-speed internet connectivity, a surge in smartphone adoption, and increased awareness of digital payment services are all contributing to market growth.

- For instance, according to report published by Razorpay in April 2021, the Indian digital payment transaction rate in January-February-March 2021 increased by 76% as compared to same time period in 2020. Thus, an increase in the adoption of online payment method among people accelerates the market growth.

Restraint

Regulatory scrutiny

Regulatory scrutiny in the buy now pay later market acts as a major restraint while imposing potential restrictions and compliance requirements on providers. This scrutiny aims to ensure consumer protection. However, increased regulations may lead to operational challenges, additional practices to maintain the regulatory framework and even can cause limitations on certain business practices.

Component Insights

The platform/solution segment led the buy now pay later market while holding a share of 67% in 2024. Platform providers play a crucial role in facilitating customer acquisition and user engagement for BNPL services. They offer marketing support, promotional tools, and analytics capabilities to help merchants promote BNPL offers, target specific customer segments, and optimize conversion rates. By leveraging data analytics and machine learning algorithms, platform providers enable merchants to identify trends, personalize offers, and maximize the effectiveness of their BNPL marketing campaigns. Effective risk management is essential for the sustainable growth of BNPL services. Platform providers develop sophisticated fraud detection algorithms, credit risk models, and compliance protocols to mitigate risks associated with offering deferred payment options. By monitoring transaction data in real-time and implementing dynamic risk assessment strategies, platform solutions help merchants minimize losses due to fraud, delinquencies, and default rates, while maintaining a positive customer experience.

Mode Insights

In 2024, the online segment held the dominating share of 55.65% in the buy now pay later market. The increasing prevalence of mobile commerce aligns with BNPL dominance in the online segment. BNPL services are well-suited for mobile-friendly platforms, catering to the growing number of users making purchases through smartphones and tablets.

- According to Adobe Analytics, on the first day of Amazon Prime Day Sale in 2023, the transactions with buy now pay later plan accounted for 6.4% of all orders.

In recent years, multiple e-commerce platforms have started forming partnerships with buy now pay later service providers to offer their services directly within the checkout process. This strategic collaboration enhances the visibility and adoption of BNPL options in the online shopping ecosystem.

The rising emphasis on offering zero interest or low-interest EMI and buy now pay later services on e-commerce platforms is observed to promote the segment's growth in the upcoming period.

- E-commerce giant amazon announced the expansion of its Amazon Pay Later services beyond its app and website. In August 2023 Amazon stated to start the offering of buy now pay later services on retailers' websites to make the service access easy for consumers.

Buy Now Pay Later Market Value (US$ Mn), by Mode, 2022 – 2024

| Mode | 2022 | 2023 | 2024 |

| Online | 2,870.1 | 3,486.0 | 4,237.9 |

| Offline | 2308.9 | 2,778.2 | 3,345.9 |

Purchase Ticket Size Insights

The small ticket item (up to $ 300) segment led the market with the largest share of 42.98% in 2024. Small ticket items, typically priced at $300 or below, are often impulse purchases or everyday essentials. Offering BNPL options for these items makes them more affordable and accessible to consumers, especially those who may not have immediate access to funds or prefer to spread out payments over time. The convenience of BNPL allows consumers to make purchases without upfront payment and budget more effectively.

Business Model Insights

The business driven segment held the largest share of 70.99% in 2024. Businesses, especially e-commerce retailers and online marketplaces, have widely adopted BNPL solutions as a way to offer flexible payment options to their customers. By integrating BNPL services into their checkout processes, merchants can attract more shoppers, increase conversion rates, and drive higher average order values. The business-driven segment benefits from the widespread adoption of BNPL by merchants across various industries. Businesses play a significant role in promoting BNPL services to their customers through targeted marketing campaigns, promotions, and incentives. By highlighting the benefits of BNPL, such as interest-free installment payments, no credit checks, and instant approval, businesses can encourage more consumers to choose BNPL as their preferred payment method.

Verticle Insights

The electronics segment dominated the buy now pay later market in 2024 and has garnered 35.94% market share. Electronics, such as smartphones, laptops, and other gadgets, often have higher price points compared to many other consumer goods. BNPL services are attractive to consumers making significant purchases as they can spread the cost over time without the need for immediate payment.

- A survey conducted by eCommerce DB concluded that electronics and media are the most popular category for shoppers in Germany with 57% of consumers choosing to buy now pay later plans.

The fashion segment is expected to drive remarkable growth over the forecast period. The customers enjoy a huge number of discounts on products. If the customers are provided with the option to buy now pay later, it has been observed that sales of fashion and garment sectors rise on a large scale.

Buy Now Pay Later Market Value (US$ Mn), by Verticle, 2022 – 2024

| Verticle | 2022 | 2023 | 2024 |

| Home & Furniture | 3,149.30 | 3,837.03 | 4679.1 |

| Electronics | 4,703.60 | 5,697.73 | 6908.2 |

| Fashion | 4,007.99 | 4,891.83 | 5975.8 |

| Others | 1,178.39 | 1,397.88 | 1658.9 |

Regional Insights

Asia Pacific Buy Now Pay Later Market Size and Growth 2025 To 2034

The Asia Pacific buy now pay later market size is evaluated at USD8.57 billion in 2025, and it is predicted to be worth around USD31.59 billion by 2034, with a CAGR of 15.60% from 2025 to 2034.

Asia Pacific has accounted highest revenue share 36.42% in 2024.Emerging economies in countries including India, China, South Korea, and Japan are observed to contribute to the growth of the market. Meanwhile, the emergence of e-commerce services is observed to integrate even more accessible buy now pay later services to boost the market's potential in Asia Pacific. Surrounded by a huge tech-savvy generation, China is observed to become the fastest growing cashless nation.

- A report published by YouGov in 2022 stated that customers between the 32-54 age group are more likely to prefer to buy now pay later services in India.

- China buy now pay later market size was valued at USD 2,396.7 million in 2024.

- Japan buy now pay later market size was valued at USD 1,507.0 million in 2024.

- South Korea buy now pay later market size was estimated to be around USD 918.6 million in 2024.

- India buy now pay later market size was exhibited USD 1,097.2 million by 2024.

North America hit remarkable revenue share in 2024. The presence of major credit card and fintech companies in the region has supplemented the growth of the market over the past few years. Credit cards remain the most popular and primarily used payment method by most of the Americans. With the increasing consumer base for online shopping, multiple businesses in the region have started offering buy now pay later, EMI or credit card payment services.

- The Small Business Administration stated that there are approximately 32.5 million businesses in the United States. Among these, 11.2 million businesses accept payments via credit cards.

- U.S. buy now pay later market size was estimated at USD 4,095.6 million in 2024.

- Canada buy now pay later market size was exhibited at USD 1,038.4 million in 2024.

China Buy Now Pay Later Market Analysis: The BNPL Titan

China led the BNPL market in the Asia-Pacific due to its advanced digital payments and large online platforms, such as Alibaba. Strong fintech growth, government support, and rapid consumer adoption resulted in China developing the largest and most expansive BNPL market in the region.

United States: The Trendsetter of Smart Spending, Expected to Expand

The United States was the leader in North America's BNPL market, dominated by firms such as Affirm and Afterpay. The high cost of credit cards and the demand for more flexible payment options drove consumers to BNPL and made BNPL a more mainstream payment option for both online and in-store purchases.

Europe - The Responsible Revolution

Europe is expected to grow at a considerable rate in the global BNPL market due to strong Fintech adoption, aided by increased levels of regulation, as well as a large population of online consumers who have seen verified and trusted platforms.

The U.K. is the largest BNPL market in the European region, with companies such as Klarna and Clearpay. Within the U.K., consumers widely use e-commerce and prefer flexible payment options, greatly establishing one of the strongest and trusted BNPL markets in Europe.

The Credit Liberation Wave in Latin America

In Latin America, overall BNPL growth has continued to be rapid as the region is home to a youthful population that largely does not have access to credit cards, combined with rapid growth in e-commerce and online shopping. BNPL offers a huge opportunity for financial inclusion as well as in mobile-based payment systems.

Brazil is leading the region's BNPL market, supported by full uptake of Fintech and rapidly growing e-commerce platforms and use. Companies like Koin and Mercado Pago offer consumers access to installments, helping millions of consumers purchase online using BNPL without securing traditional credit cards.

Middle East & Africa - The Digital Leap Forward

The Middle Eastern and African market in BNPL is largely attributed to the rapid digital adoption in the region, coupled with an increase in smartphone usage, and due to the large youth spending segment. The market offered significant opportunities in retail, travel, and small business financing.

The UAE dominated the BNPL market with its innovations such as Tabby and Tamara. The vast amount of online spending, tech-savvy consumers, and supportive regulations of the financial sector have made the UAE the dominant hub for BNPL development in the region.

Buy Now Pay Later Market Top Companies

- Sezzle

- Afterpay

- Klarna Bank AB

- Laybuy Group Holdings Limited

- Quadpay

- Splitit

- Affirm Holdings Inc.

- Payl8r (Social Money Ltd.)

- PayPal Holdings Inc.

- Perpay

Recent Developments

- In September 2024, Zepto revealed a plan to launch its own buy now, pay later (BNPL) service, Zepto Postpaid, offering users up to ?5,000 in interest-free credit. Currently in early rollout, the feature is being promoted via a waitlist on the app for exclusive early access. This move positions Zepto to compete with rivals like Blinkit, which already offer BNPL options through partners like LazyPay and Simpl. (Source: https://www.business-standard.com/)

- In March 2023, Apple Inc (AAPL.O) launched its "buy now, pay later" (BNPL) service in the U.S. The service, Apple Pay Later, enables users to split purchases into four payments spread over six weeks with no interest or fees. ( Source: https://www.reuters.com )

Segments Covered in the Report

By Component

- Platform/Solutions

- Services

By Purchase Ticket Size

- Small Ticket Item (Up to US$ 300)

- Mid Ticket Items (US$ 300 - US$ 1000)

- Higher Prime Segments (Above US$ 1000)

By Business Model

- Customer Driven

- Business Driven

By Mode

- Online

- Offline

By Vertical

- Home & Furniture

- Electronics

- Fashion

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting