Capacitor Market Size and Forecast 2026 to 2035

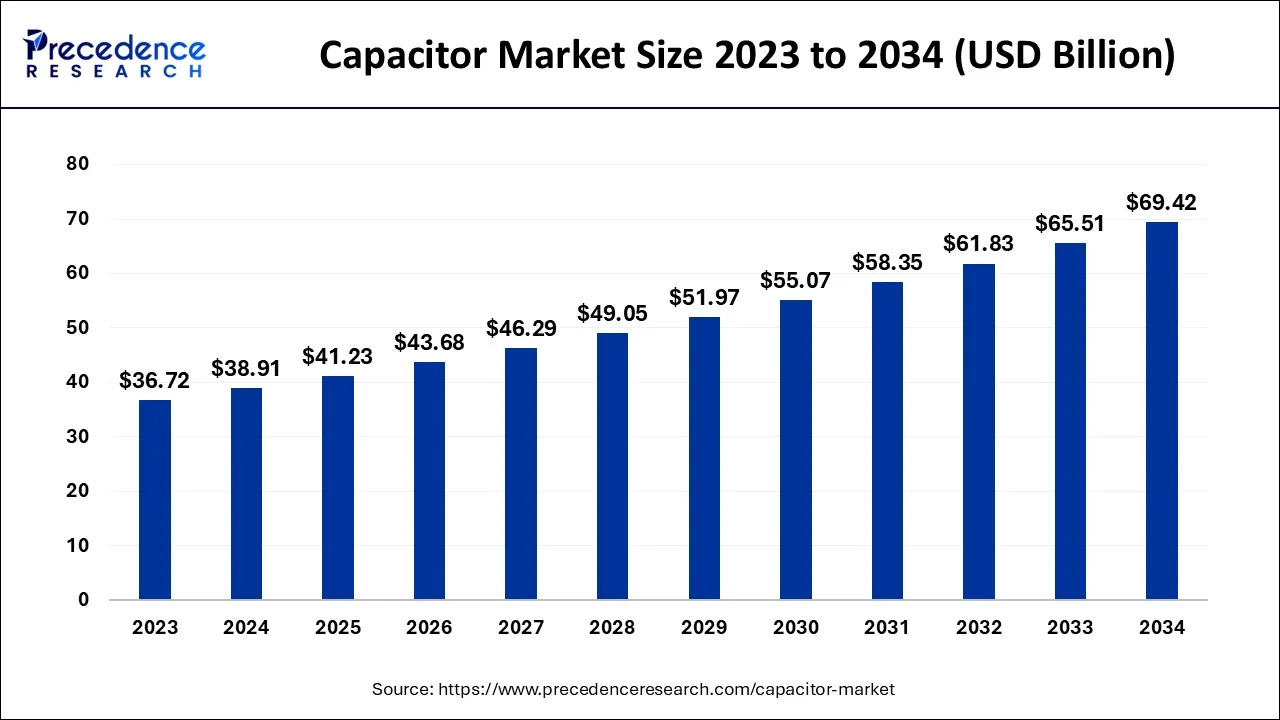

The global capacitor market size is valued at USD 41.23 billion in 2025 and is predicted to increase from USD 43.68 billion in 2026 to approximately USD 73.18 billion by 2035, expanding at a CAGR of 5.91% from 2026 to 2035.

Key Takeaways

- By geography, the North American region will continue to dominate the global market.

- By type, the ceramic capacitors segment are anticipated to hold the most significant market share in 2025.

- By application, the consumer electronics market is increasing swiftly.

What is a Capacitor?

Market opportunities for capacitors have gone through several periods of development. The complexity and diversity of electronic device usage and increased consumer demand for premium players from emerging industry sectors will fuel the capacitor market growth. Business players are now choosing high-velocity and low-energy consuming products due to the advancement of creative activities in the consumer electronics sector, particularly across the cell phone segment.

Additionally, expanding organizations across ventures in the automotive and transmission & distribution (T&D) industries that require a blend of high capacitance and voltage will enhance the business outlook in the following years.

How is AI contributing to the Capacitor Market?

The utilization of AI technology has become a part of the capacitor industry. It has significantly sped up the whole process of coming up with new materials, predicting their performance, and even optimizing manufacturing. One of the main steps, layering dielectric and electrode materials, was eliminated due to fast identification, so engineers can now proceed directly to producing advanced components.

With machine learning predicting the dielectric's life cycle and performance right from the start, the need for premature testing is done away with, and that means faster innovations. AI has really helped when it comes to capacitor manufacturing since it not only monitors but also controls the overall quality, finds defective products, and operates the machinery with great accuracy.

Market Outlook

- Industry Growth: Miniaturization of electronics, scaling up of electric vehicle demand, and efficient integration of power systems are the main factors driving the growth.

- Sustainability Trends: The use of biodegradable materials is going up, and the designs with zero losses are helping to achieve the environmental goals in manufacturing.

- Global Expansion: The regions where the electronics market is penetrating are becoming very strong in terms of innovation beyond traditional electronics.

- Major Investors: Murata, TDK, and Samsung Electro-Mechanics are the companies that not only invest in technology but also influence the market through their strategies.

- Startup Ecosystem: The startups are working on dielectric materials, ultra-thin form factors, and new capacitor chemistry breakthroughs to advance the field.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 41.23 Billion |

| Market Size in 2026 | USD 43.68 Billion |

| Market Size by 2035 | USD 73.18 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.91% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

The capacitor market is expanding due to the electronics industry's increasing demand for capacitors. This is due to the proliferation of devices with greater specifications that are being used more frequently. The global market for capacitors is expanding quickly due to the rising demand for tablets and smartphones and the affordable prices of ceramic capacitors. For instance, according to estimates, there will be approximately 6.6 billion smartphone users worldwide in 2022, representing around 4.9% yearly growth.

Additionally, LCD and LED televisions are increasingly incorporating capacitors. Electronic gadgets like computers, and televisions, among others, mainly drive the demand for capacitors, and manufacturers of high-end electrical devices employ capacitors more often. Global economies, businesses, and people's lives are all being transformed through electronic system design and manufacturing (ESDM). For instance, according to information provided by Invest India, India pledged to attain $300 billion in electronics manufacturing and exports by 2025–2026.

Capacitors are also being utilized more frequently in auto elements, including infotainment equipment, vehicle frames, and powertrain components, further increasing their popularity. Because capacitors can withstand the high temperature needed by control circuits, they are now used more frequently in electric vehicles. Therefore, the sum of these variables will drive the market for capacitors in the following years.

However, capacitors can continue to store energy and spontaneously produce a hazardous residual discharge even after the device has been de-energized. Liquid dielectrics or combustion byproducts from some capacitors could be toxic. Arc faults are made when high-voltage capacitors have metal or dielectric connection issues. The dielectric fluid vaporizes in oil-filled units, leading to case bulging and breaking. Thus, many capacitors can produce weak X-rays while operating normally. These factors put both people and the ecosystem in danger. Due to the probable adverse consequences of capacitors, the market will face challenges soon.

Nonetheless, the capacitor industry is developing potential due to the rising demand for electric vehicles. In electric vehicles, a capacitor is mainly used to improve the stability of the DC bus voltage and avoid ripple currents from going back to the power source. Batteries are used in electric vehicles (EVs) to power them and for decoupling and preserving semiconductor components. They also protect EV subsystems from voltage surges, electromagnetic interference, and peaks by serving as filters.

In 2021, the market share for electric vehicles was about 10% worldwide, up from just 2% in 2019. This increased the overall number of electric vehicles on the road compared to prior years to almost 16.5 million. With 2 million electric vehicle sales in the first quarter of 2022, a 75% increase over the same time in 2021, the market for electric vehicles has continued to multiply, according to the data given by IEA.

Capacitor Market Segment Insights

Type Insights

The capacitor market is divided based on type into ceramic, film/paper, aluminum, tantalum/niobium, double layer/super capacitors, and others. Due to the growing popularity of the internet of things (IoT), ceramic capacitors are anticipated to hold the most significant market share in 2023. In the creation of IoT systems and devices, MLCCs are essential. Sensors are utilized by many IoT devices to gather data, and the circuits that power and regulate these sensors frequently include ceramic capacitors.

IoT devices communicate data using wireless communication technologies, including Bluetooth, wi-fi, and cellular networks. Additionally, ceramic capacitors are used to store and regulate the power supply in the power management systems of IoT devices, assisting in maintaining a stable power supply for the devices. As a result, it is projected that the demand for ceramic capacitors in the industry will grow rapidly, considering these reasons.

Application Insights

Industrial, automotive, consumer electronics, energy, and other segments make up the global capacitor market. Due to the significant manufacturing of electronics such as cutting-edge computers, mobile phones, TVs, and defense-related gadgets, the consumer electronics market is growing swiftly. The market environment requires manufacturers of capacitors to stay current with cutting-edge technology because these attributes are crucial when selling to higher-income groups.

Capacitor Market Regional Insights

In 2025, the North American region will continue to dominate the global capacitor industry. The development of ultra-small case-size capacitors for portable electronic gadgets and the rising production of electric vehicles have ramped up growth in North America.

In contrast, the Asia Pacific market is anticipated to increase due to the region's growing automotive sector. Due to the rapid expansion of their electronic industries, India, China, and Japan are the top three revenue-producing nations in the Asia Pacific. India is the country in the Asia Pacific region that consumes the most electronics. However, due to growing vehicle sales and robust urbanization, China is determined to lower car exhaust emissions.

The country's aim to reduce its reliance on oil imports would increase demand for electric vehicles, increasing the market for capacitors. Growing government rules promoting the use of electric vehicles and aggressive development plans by regional OEMs and suppliers to meet increased demand from China's automotive industry are anticipated to enhance market growth for the projected period. For instance, the Chinese government promotes the use of electric automobiles.

To encourage the sale of electric vehicles, the Chinese government has invested in the construction of charging stations all around the nation. For instance, the Chinese government declared plans to construct sufficient charging stations for 20 million electric vehicles by 2025 in January 2022. As a result, the abovementioned factors drive the Asia Pacific capacitor market.

The major market location is primarily because of the robust demand and supply of consumer electronics, industrial manufacturing, and electric mobility. High innovation and capacity for production, and present, through the consumers' electronics supply chains, are the factors contributing to growth.

China Capacitor Market Trends:

The country is playing a key role in the global supply chain, especially in consumer electronics and electric vehicles. The government is taking steps to support manufacturing, and thus, the demand for capacitors in the areas of communications, autos, and electronics will be high due to the strong innovation trend.

The main pillars for the market to grow are the continuous improvement of data centers, the rising demand for automotive electronics, and the ever-increasing use of renewable energy. To do so, they will also invest in local production and innovation. The increasing focus on next-generation applications will undoubtedly attract manufacturers from different industries and thus create new opportunities.

United States Capacitor Market Trends

The combination of significant research spending and the vision for a clean energy future is the driving force behind the development of capacitors. The building of data centers and the power plant of the industrial sector necessitate the use of very reliable components. The aerospace and defense industry is further contributing to this trend by adopting and supporting the technological advancement of the capacitor manufacturing industry.

The powerful automotive sector and the imposition of strict sustainability standards are the main factors that make the adoption of advanced capacitors necessary. The priorities of the electric grid and the mobility of the future will be the main areas that the market will participate in. The materials that are less harmful to the earth, the technologies, and the designs will be the areas of growth for the regional market, as they will be the ones that will be growing in demand.

Germany Capacitor Market Trends:

The use of capacitors is mainly driven by the strong automotive manufacturing and commitment to renewable energy. The focus on the development of advanced EV technology and sustainable systems has led to the integration of high-voltage components. The strong industrial ecosystem is creating the basis for innovations in power electronics and inverter applications.

Latin America's market shows notable growth during the forecast period. It is driven by the rising need for efficient power management solutions, and the proliferation of renewable energy sources such as solar and wind, along with the modernization of aging electrical grids across Latin American countries. Governments as well as private sector stakeholders are increasingly investing in smart grid technologies and energy storage systems, which heavily depend on high-quality capacitors for voltage stabilization, power factor correction, and energy storage applications.

Argentina Capacitor Market Trends

It is primarily driven by increasing need from the electronics and electrical industries, including automotive, consumer electronics, and industrial applications. The country's expanding renewable energy sector, mainly solar and wind power projects, significantly boosts the need for power management and energy storage solutions.

MEA's market shows rapid growth during the forecast period. Generally, customers are looking for fuel-efficient vehicles as fuel prices rise along with restrictions tightening. Electric vehicles and hybrid electric vehicles are highly fuel-efficient, and EVs do not use fossil fuels or harm the environment. The acceptance of electric capacitors in EVs is rising due to various benefits, including enhanced fuel efficiency, energy storage, and longer battery life.

Saudi Arabia Capacitor Market Trends

Significant expansion in industrial and renewable energy sectors is driving increased need for high-capacity energy storage solutions, thus positioning capacitors as critical components in grid stabilization, along with power quality enhancement. Medium- and low-voltage capacitors, including polypropylene film and ceramic types, are being adopted in industrial machinery, consumer electronics, and automotive applications, complemented by rising digital infrastructure deployment.

Capacitor Market - Value Chain Analysis

- Raw Material Procurement: Silicon and specialty gases are sourced and refined to create a substrate for capacitor chip production.

Key players: DuPont and Mitsui Mining & Smelting - Wafer Fabrication: Circuits are grown layer by layer on silicon wafers in a controlled and quality-assured semiconductor environment.

Key players: SK Siltron and GlobalWafers - Photolithography and Etching: The light method is applied to circuit design, and then the material is removed to end up with the required circuit structures.

Key players: ASML and Applied Materials - Doping and Layering Processes: The semiconductor's electrical properties are modified by adding impurities and depositing layers on it, and designing the component architecture.

Key players: Tokyo Electron and Lam Research - Assembly and Packaging: The manufacturing process of a usable capacitor component consists of separating, bonding, enclosing, testing, and ultimately producing the dies are produced.

Key Players: Murata Manufacturing and Samsung Electro-Mechanics

Top Companies in the Capacitor Market & Their Offerings:

- Samsung Electro-Mechanics: Producing miniaturized MLCCs with high capacitance that can be used in the automotive, communication, and AI sectors.

- Panasonic Corporation:Offers a variety of electrolytic, film, and polymer capacitor types suitable for industrial and automotive conditions.

- Shenzhen Sunlord Electronics: Manufactures dependable ceramic and film capacitors and passive elements for aerospace and electronics applications.

- TDK Corporation: Offers a massive range of ceramic, film, and aluminum electrolytic capacitors for power and automotive systems.

- Abracon LLC: Supplies specialized supercapacitors and power-density solutions for rapid energy storage.

- API Technologies (Spectrum Control): Designs ruggedized ceramic feed-through and EMI/RFI filtering capacitors for military and medical use.

- Eaton Corporation PLC: Primarily delivers high-capacity supercapacitors and industrial film capacitors for power management.

- Hitachi AIC (AIC tech): Concentrates on large-scale screw and snap-in aluminum electrolytic capacitors for industrial inverters.

- Nichicon Corporation: Leads in high-quality aluminum electrolytic and conductive polymer hybrid capacitors for power supplies.

- KEMET Electronics: Known for high-reliability tantalum, polymer, and film capacitors for aerospace and defense.

- Kyocera Corporation: Offers a wide selection of tantalum, MLCC, and power film capacitors via their AVX division.

- VINATech Co., Ltd.: Focuses exclusively on high-power supercapacitors and carbon nanotube hybrid energy storage.

- Vishay Intertechnology: Provides a comprehensive portfolio of all major capacitor types, including tantalum, ceramic, and aluminum.

Recent Developments

- In October 2025, Vishay Intertechnology unveils vPolyTan™ DLA NUM0 series polymer surface-mount chip capacitors, fully DLA NUM1 qualified. These capacitors are designed for aerospace, military, and space applications, offering exceptional reliability, strength, and power efficiency. (Source:https://www.bisinfotech.com)

- In August 2025, Samsung Electro-Mechanics launched a new automotive-grade MLCC for hybrid inverters. This expands its NUM0 x NUM1 mm, NUM2 V, X7 product line to address transient suppression and EMI mitigation needs. (Source:https://chargedevs.com)

Capacitor Market Segments Covered in the Report

By TypeÂ

- Ceramic Capacitor

- Film/Paper Capacitor

- Aluminum Capacitor

- Tantalum/ Niobium Capacitor

- Double-Layer/Super Capacitor

- Other

By Application

- Industrial

- Automotive Electronic

- Consumer Electronic

- Energy

- Other

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting