What is the Chitosan Market Size?

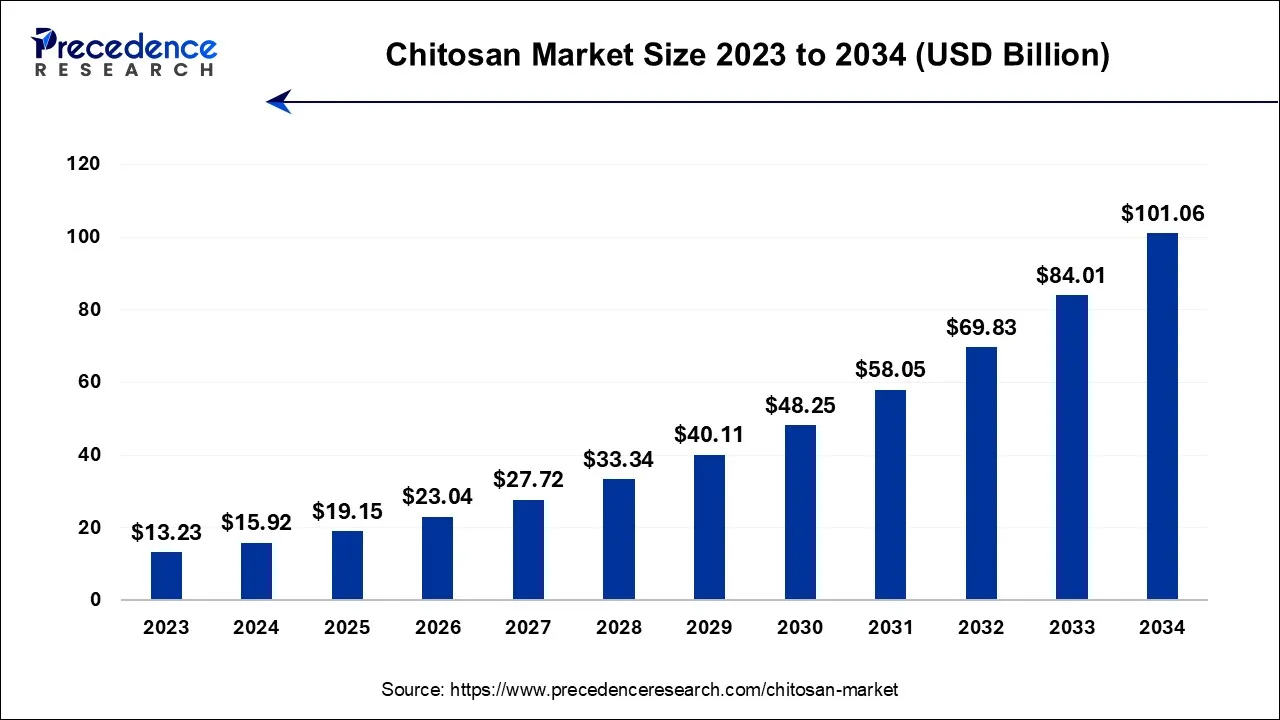

The global chitosan market size is accounted at USD 19.15 billion in 2025 and predicted to increase from USD 23.04 billion in 2026 to approximately USD 116.19 billion by 2035, expanding at a CAGR of 19.76% over the forecast period from 2026 to 2035

Market Highlights

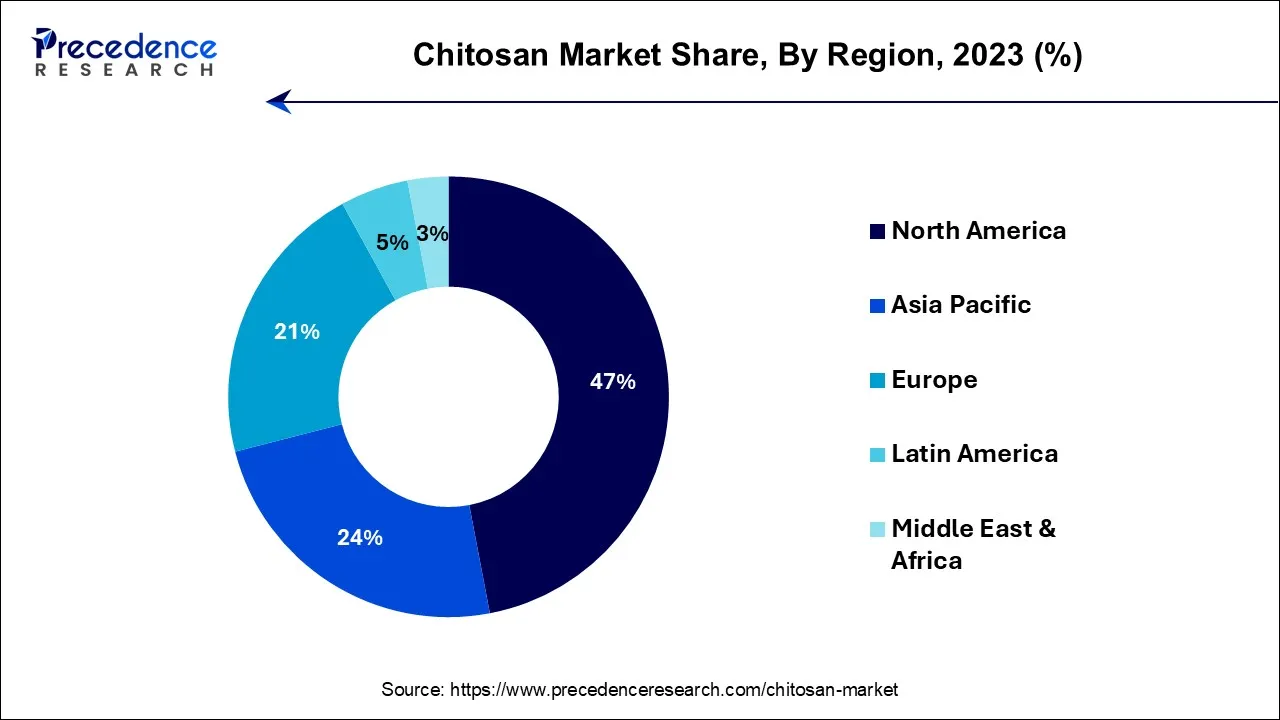

- Asia Pacific led the global market with the highest market share of 47% in 2025.

- By source, the shrimp segment has dominated the market with a 63% revenue share in 2025.

- By application, the water treatment segment has generated a revenue share of over 33.5% in 2025.

- By application, the cosmetics segment generated over 26% of revenue share in 2025.

Chitosan Market Growth Factors

The increasing demand of chitosan in the end user industries mainly in waste water treatment and food & beverages industry will proliferate the market growth. An important application is wastewater treatment with chitin or chitosan. For the removal of dyes from industrial wastewater (e.g., textile wastewaters), as well as other organic pollutants such as organochloride pesticides, organic oxidized or fatty impurities, and oil impurities. Chitosan has a number of appealing properties, including hydrophobicity, biocompatibility, biodegradability, non-toxicity, and the presence of highly reactive amino (–NH2) and hydroxyl (–OH) groups in its backbone, which is effective in the waste water treatment.

Chitosan's antioxidant and antimicrobial activity allows it to be used to extend the shelf life of foods, and its excellent emulsifying properties allow it to replace synthetic surfactants in food technologies. Chitosan can also be used as a functional ingredient against hypercholesterolemia, hypertension, and inflammations, as well as for nutrient encapsulation in functional food development. In 2021, revenue in the food & beverage industry is expected to reach USD 342,213 million. For the past two decades, the implementation of online retail in Food & Beverage has been lagging. It has, however, finally taken off, becoming the fastest-growing product category in eCommerce. Such factor will create a positive impact on the chitosan market.

Market Outlook

- Industry Growth Offerings- The market is growing through innovative applications in water treatment, pharmaceuticals, agriculture, food preservation, and cosmetics. Rising demand for biodegradable, eco-friendly materials, advancements in biopolymer technology, and increased R&D investments are driving market expansion.

- Global Expansion- The market is expanding globally through increased adoption in pharmaceuticals, food, agriculture, and water treatment. Rising demand for sustainable, biodegradable materials, international collaborations, and growing awareness of its versatile applications are driving worldwide market growth.

- Startup ecosystem- The startup ecosystem is growing with ventures focusing on sustainable biopolymers, eco-friendly packaging, water treatment solutions, and biomedical applications. Innovation, R&D investments, and rising demand for biodegradable materials are driving new entrants and technological advancements in the market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 23.04 Billion |

| Market Size in 2026 | USD 23.04 Billion |

| Market Size by 2035 | USD 116.19 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 19.76% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Source, and By Application and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Sources Insights

The chitosan market is dominated by shrimp followed by crab. Shrimp is considered the primary source of chitosan because it contains approximately 25% to 40% chitin, whereas crab shell contains approximately 15% to 20%. The chitosan can be produced cheaply and easily from these sources.India is at the second rank when comes to the production of shrimp and largest exporter of shrimp globally after China. For instance, in 2019, the India produced 800, 000 MT shrimp which is double digit growth over the previous decade. The high production of shrimp will enhance the market growth of chitosan market in the near future.

Application Insights

The water treatment segment is the most prominent segment in the market which contributed the largest share in the chitosan market. According to a 2015 Bluefield Research, municipal wastewater reuse would expand by 61 percent by 2025, requiring USD 11 billion in capital. With over 247 reuse projects in various stages of preparation in the United States, which is a significant market trend. According to the UN, the world's population will exceed nine billion people by 2050. It is projected that global food production has to be boosted by 70% to ensure there is enough food for everyone. This will create a burden on the natural resources. So, in various application such agriculture, industrial application waste water utilization can solve the problems which in turn propel the growth of the chitosan market.

The improper discharge of wastewater effluents is strictly enforced, which can render factories noncompliant. Chitosan has many appealing properties, including hydrophobicity, biocompatibility, biodegradability, non-toxicity, and the presence of highly reactive amino (–NH2) and hydroxyl (–OH) groups in its backbone, making it an effective adsorbent material for the removal of wastewater pollutants.

Further, the cosmetics industry has the considerable share in the market. Chitin, chitosan, and their derivatives are widely used in cosmetics, owing to their antioxidant, cleansing, protective, humectant, and antioxidant properties. In 2019, the global cosmetics market was valued at USD 380.2 billion. Cosmetics are now an essential component of most people's modern lifestyles. Furthermore, an increase in awareness of external beauty and an individual's internal intellect has driving the use of cosmetics in the global market. Along with women, men are increasingly using cosmetics in their daily lives, which are contributing to the market growth. Hence, such changing lifestyles, have led to growth of the global cosmetics market which in turn surge a market demand of chitosan in the forecast period.

Regional Insights

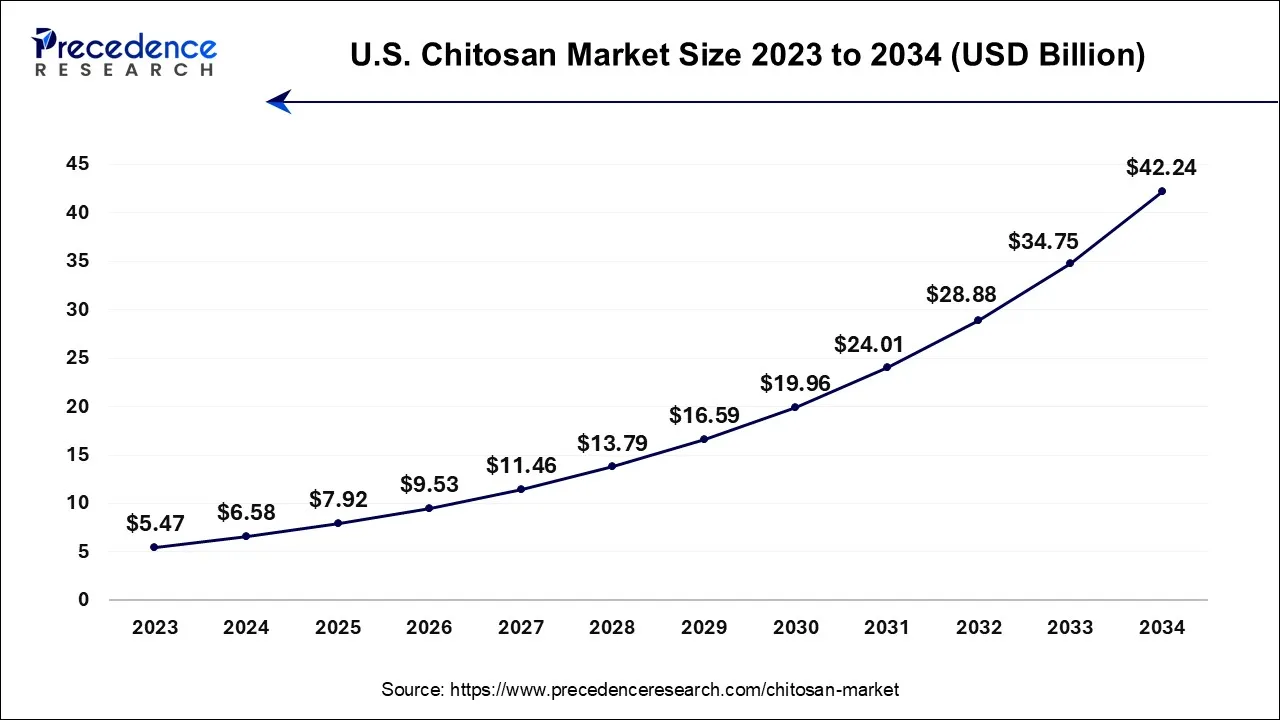

U.S. Chitosan Market Size and Growth 2026 to 2035

The U.S. chitosan market size accounted for USD 7.92 billion in 2025 and is projected to be worth around USD 48.65 billion by 2035, poised to grow at a CAGR of 19.90% from 2026 to 2035.

Regulation Strengthen and Manufacturing Power Fuel North America's Chitosan Market Leadership

North America led the chitosan market with the largest share of 47% in 2025. The regulatory environment in North America supports the use of chitosan in various applications, from food additives to pharmaceuticals. Regulatory bodies like the FDA (Food and Drug Administration) provide clear guidelines that facilitate the approval process for new products containing chitosan, thus encouraging its adoption across industries. North America has a well-established manufacturing base for chitosan products, enabling companies to efficiently produce and distribute these materials. The presence of major players in the region, coupled with advanced manufacturing technologies, enhances the competitiveness of the chitosan market.

Why the U.S. Chitosan Market is Rapidly Expanding?

The U.S. market is expanding due to rising demand for natural, biodegradable, and eco-friendly materials across industries such as pharmaceuticals, cosmetics, food processing, and water treatment. Increasing use of chitosan in wound care, drug delivery, and dietary supplements is boosting adoption. Additionally, growing awareness of sustainable products, advancements in biopolymer technology, and expanding applications in agriculture and environmental protection are driving market growth.

Asia Pacific Emerging as the Fastest-Growing Hub for Chitosan Production

The Asia Pacific is estimated to expand the fastest CAGR between 2026 and 2035. The easy availability of its raw material, obtained as a waste product from the fishery industry, is one of the key factors driving chitosan demand. Fishing is one of the most important industries in the Asia Pacific. For a long time, Asia-Pacific has dominated the shrimp market.

- In 2018, China produced 1,956.9 thousand metric tonnes of shrimp, with a CAGR of 1.6 percent over the forecast period. Shrimp production in China typically begins at the end of the calendar year.

India's Chitosan Market Accelerates: Regulatory Support and Rising Demand Drive Growth

The Indian chitosan market is expanding at a significant rate due to many approvals passed by regulatory bodies for chitosan and chitosan-based products. The expanding market in India is backed by growing demand for packaged food, and market players are heavily investing in chitosan-based products and launching them into the market. In addition to this, Indian marketers are actively engaged in research and development related to the medical applications and solutions offered by researchers for water treatment plants. Such initiatives are responsible for the chitosan market growth in India.

Europe Unlocks Chitosan Potential with String Research Support and Industry Investment

The European chitosan market is witnessing significant growth potential due to emerging mid-size and small-sized enterprises in the biotech sector, and support from various research organizations that are focusing on offering chitosan-based products. The region gets benefits due to growing research and development initiatives in leading countries like France, Germany, and the UK. European countries are majorly investing in water treatment infrastructure and research in the pharma sector, offering significant opportunities for various sectors to leverage chitosan applications.

Germany's Strategic Programs Propel Growth in the European Chitosan Sector

On a country level, Germany asserts its dominance in the European chitosan market. German authorities are actively offering programs related to the advancement of chitosan products. Initiatives like the CodeChi program showcase Germany's contribution to the expansion of the chitosan market, along with various research and development programs that support chitosan applications and its development in the region.

Value Chain Analysis

Compound Formulation and Blending

- Chitosan formulation and blending involve dissolving chitosan in acidic solutions (e.g., acetic acid) and combining it with polymers or bioactive agents like citric acid, curcumin, or other polysaccharides.

- Processing techniques include solution casting, ionic induction, and chemical cross-linking to achieve desired material properties.

- Modified properties include improved mechanical strength, flexibility, controlled drug release, and enhanced antibacterial activity.

Key Players: Primex, KitoZyme, FMC Biopolymer, Heppe Medical Chitosan, NovaMatrix.

Packaging and Labelling

- Chitosan should be stored in sealed containers at cool temperatures (2–8°C) due to its sensitivity to environmental conditions.

- It can be used to produce intelligent and active packaging films by adding essential oils for antimicrobial properties or colorimetric indicators for freshness monitoring.

- Labels must clearly indicate functionality, such as pH or freshness detection, and address dietary or source-related concerns.

Key players: Primex, KitoZyme, FMC Biopolymer, NovaMatrix, Heppe Medical Chitosan.

Distribution to Industrial Users

- Chitosan is mainly supplied to industrial users in the form of refined powder or flakes, sourced from crustacean shells and fungal waste worldwide.

- It is widely used across industries such as wastewater treatment, food and beverages, agriculture, cosmetics, and pharmaceuticals due to its versatile properties.

Key players: Primex, KitoZyme, FMC Biopolymer, NovaMatrix

Top Vendors and their Offerings

- Primex EHF: Primex EHF supplies high-quality chitosan and chitosan derivatives for applications in food, pharmaceuticals, cosmetics, and agriculture. Their products focus on sustainable sourcing, biodegradability, and functional performance across multiple industrial sectors.

- Vietnam Food: Vietnam Food offers chitosan-based products primarily for food preservation, water treatment, and dietary supplements. Their solutions emphasize eco-friendly, safe, and effective applications for both domestic and industrial use.

- Agratech: Agratech provides chitosan formulations for agricultural applications, including crop protection, seed treatment, and soil enhancement. Their products promote sustainable farming practices and improved crop yield.

- KitoZyme S.A.: KitoZyme S.A. develops chitosan and chitosan derivatives for medical, pharmaceutical, cosmetic, and food applications. They focus on high-quality, innovative biopolymers with functional and health-enhancing properties.

- FMC Corp: FMC Corporation produces chitosan for industrial, pharmaceutical, and environmental applications, including water treatment, biomedicine, and agriculture. Their offerings emphasize high purity, consistency, and versatile industrial use.

Chitosan Market Companies

- Primex EHF

- Heppe Medical Chitosan GmbH

- Vietnam Food

- KitoZyme S.A.

- Agratech

- Advanced Biopolymers AS (Norway)

- BIO21 Co., Ltd.

- G.T.C. Bio Corporation

- Taizhou City Fengrun Biochemical Co., Ltd.

- Zhejiang Golden-Shell Pharmaceutical Co., Ltd.

- Biophrame Technologies

- Heppe Medical Chitosan GmbH

- Meron Biopolymer

- Qingdao Yunzhou Biochemistry Co.

- Golden-Shell Pharmaceutical Co. Ltd

- FMC Corp.

Recent Developments

- In August 2024, a leading firm, Dyson, launched new styling products, namely the Dyson chitosan pre-style cream and Dyson chitosan after-style serum. These products are made with the chitosan variant, which is derived from oyster mushrooms.

- In May 2024, researchers from the Fraunhofer Institute's Department of Interfacial Engineering and biotech IGB have generated a functionalized flocculant, which is bio-based. It is particularly modulated for effectively treating intricate wastewater. Also, some enzymes are included in the chitosan matrix to capture and remove highly toxic phenols from the water.

Segments Covered in the Report

By Source

- Shrimps

- Prawns

- Crabs

- Other Sources

By Application

- Water treatment

- Cosmetics

- Pharmaceutical and Biomedical

- Food and Beverage

- Other Applications

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting