What is Chromium Market Size?

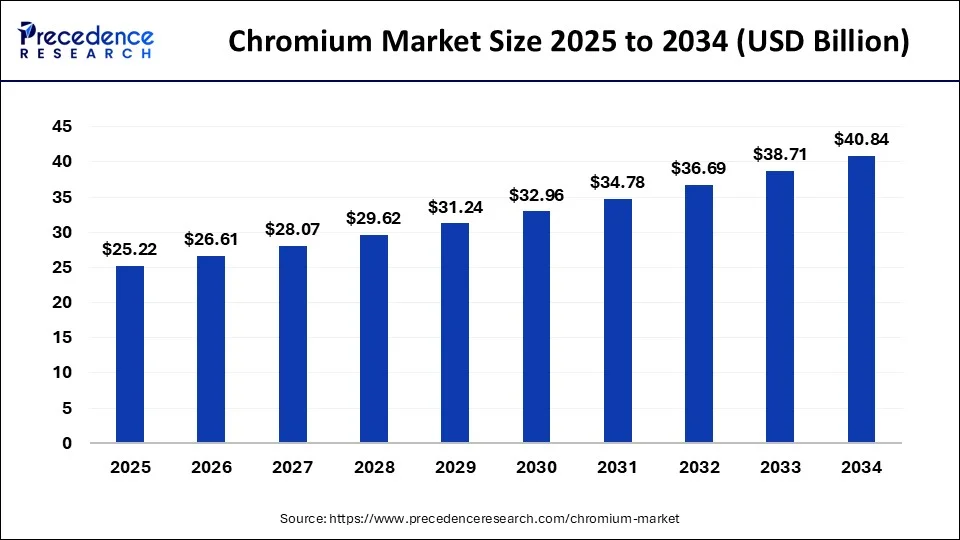

The global chromium market size accounted at USD 25.22 billion in 2025 and is expected to be worth around USD 40.84 billion by 2034, at a CAGR of 5.50% from 2025 to 2034.

Market Highlights

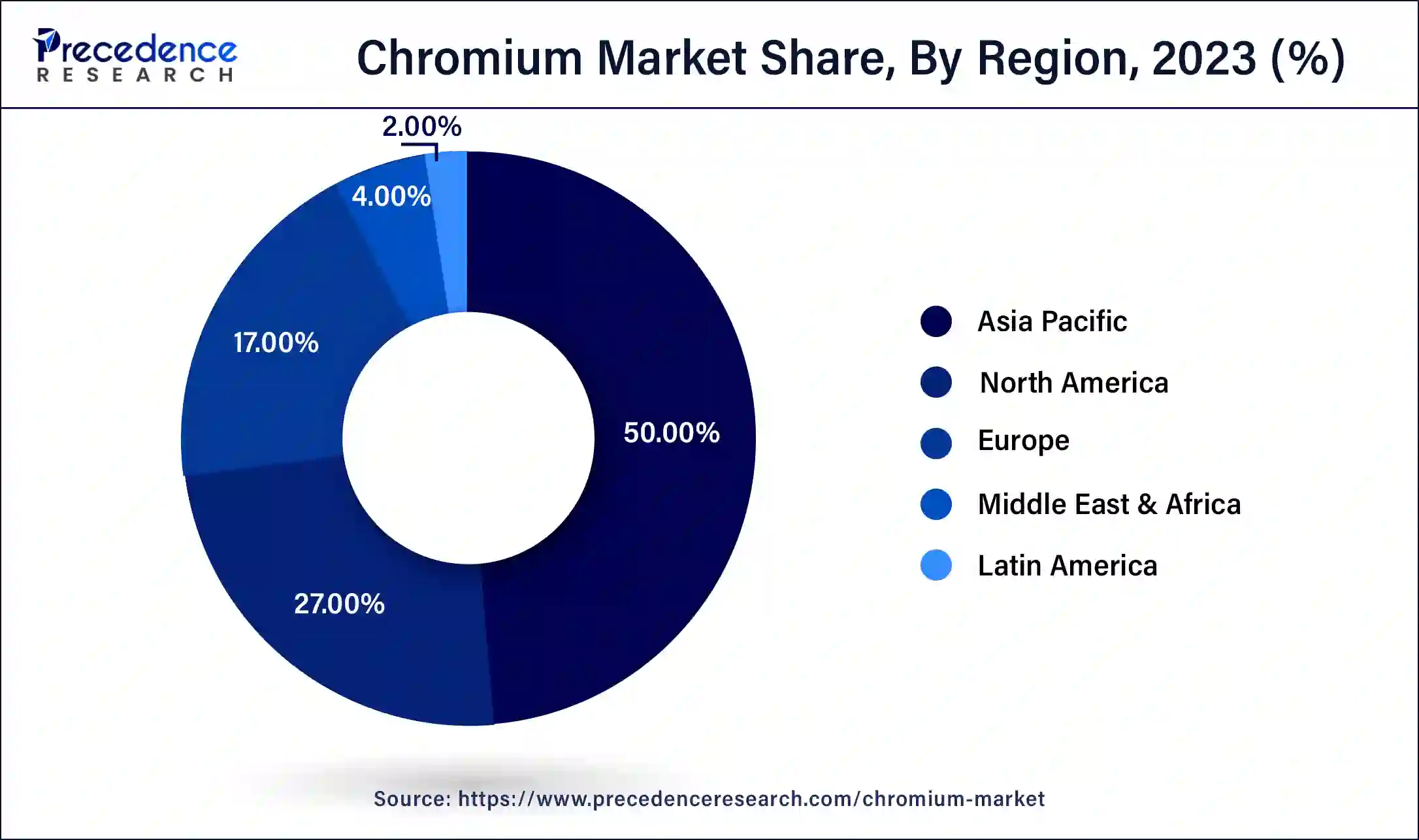

- Asia-Pacific contributed more than 50% of revenue share in 2024.

- North America is estimated to expand the fastest CAGR between 2025 and 2034.

- By material, the ferrochromium segment has held the largest market share of 32% in 2024.

- By material, the chromium metals segment is anticipated to grow at a remarkable CAGR of 6.1% between 2025 and 2034.

- By application, the metallurgy segment generated over 92% of revenue share in 2024.

- By application, the chemicals segment is expected to expand at the fastest CAGR over the projected period.

How AI is Changing the Chromium Market?

Artificial Intelligence: The Next Growth Catalyst in Chromium

Artificial Intelligence is significantly impacting the Chromium market by revolutionizing the upstream stages of the value chain, specifically mining and production, to enhance efficiency and sustainability. In the mining sector, AI algorithms analyze vast geological data to identify potential mineral deposits more accurately and quickly than traditional methods, reducing exploration time and costs. In production and processing, AI optimizes resource usage (like energy and water), improves ore sorting and grade control, and enables predictive maintenance for equipment, which minimizes downtime and operational costs.

Strategic Overview of the Global Chromium Industry

Chromium is a shiny and tough metal widely used for its good looks and durability. It adds a glossy finish to things like jewelry, kitchen items, and car parts. Not just about looks, chromium is a key ingredient in making strong stainless steel, preventing it from rusting. This makes it a big player in building sturdy structures, gadgets, and machines that last a long time. Chromium also pops up in different industrial jobs, like making colors, speeding up chemical reactions, and treating leather.

Chromium Market Data and Statistics

- In 2022, the global production of chromium amounted to roughly 41 million metric tons, and South Africa claimed the lion's share at 45%, contributing a substantial 18 million metric tons, as outlined by the US Geological Survey.

- The 63 nations reporting to the World Steel Association disclosed a total production of 145.3 million tons in January 2023. This figure represents a modest uptick of 3.5% compared to the production quantity in the preceding month.

- According to projections from the Organization Internationale des Constructeurs d'Automobiles (OICA), the collective new car sales and registrations in OICA member nations are anticipated to approach 69 million units in 2022. A surge in vehicle transactions or manufacturing is poised to generate an increased market demand for chromium.

- The Chinese Association of Automotive Manufacturers conveyed a 3.4% year-over-year rise in car production for the year 2022. Approximately 27 million automobiles were estimated to roll off production lines in China during 2022, marking an increase from the 26.08 million units produced in 2021.

Chromium Market Growth Factors

- The increasing need for stainless steel in various industries is a key driver for the chromium market, as chromium is a crucial component in its production.

- The expanding global production of automobiles is fostering a heightened demand for chromium, especially in the form of corrosion-resistant alloys used in critical automotive components.

- Growing investments in infrastructure projects worldwide contribute to the demand for chromium, particularly in the production of construction materials like stainless steel bars.

- Chromium compounds play essential roles in various chemical processes, including the production of pigments, catalysts, and tanning agents, thereby propelling the chromium market forward.

- The production of visually appealing consumer goods, including jewelry and electronic devices, relies on chromium, with increasing consumer spending driving the demand for these chromium-enhanced products.

- Ongoing research and development endeavors to explore new applications for chromium, coupled with advancements in extraction and processing technologies, are instrumental in shaping the growth landscape of the chromium market.

- The aerospace sector relies on chromium for its corrosion-resistant properties in the production of aircraft components. As global air travel continues to rise, the demand for chromium in aerospace applications is expected to grow.

- Chromium is utilized in the energy sector for the production of corrosion-resistant alloys in power plants and oil and gas facilities. The expansion of energy infrastructure, including renewable energy projects, contributes to increased demand for chromium.

- Chromium's biocompatible properties make it valuable in medical equipment manufacturing. The growing healthcare industry and advancements in medical technology are driving the demand for chromium in the production of surgical instruments and implants.

- Chromium plays a role in environmental cleanup, especially in treating industrial wastewater. As environmental standards become stricter, there is a rising demand for chromium in technologies addressing water pollution and contamination challenges.

Market Outlook

- Market Growth Overview: The Chromium market is expected to grow significantly between 2025 and 2034, driven by the rising demand for stainless steel and advanced alloys. Investments in research and development are enhancing extraction and processing techniques, rising automotive production and growth in emerging economies.

- Sustainability Trends: Sustainability trends involve transition to trivalent chromium, enhanced recycling and circular economy, and digital traceability and ethical sourcing.

- Major Investors: Major investors in the market include Glencore, Yildirim Group, Eurasian Resources Group (ERG), Samancor Chrome, Assmang Proprietary Limited, Odisha Mining Corporation Ltd.

- Startup Economy: The startup economy in mining technology, resource management and sustainability, and advanced materials.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 25.22 Billion |

| Market Size in 2026 | USD 26.61 Billion |

| Market Size by 2034 | USD 40.84 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.50% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Material and By Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Infrastructure demand

The Semiconductor Industry Association (SIA) reports that the United States allocated around US$ 142.2 billion for computer production and approximately US$ 53 billion for consumer electronics, including cell phones, TVs, and similar applications.

The chromium market gets a substantial boost from the increasing demands of the electronics industry. Chromium's pivotal role in electronics lies in its use for protective coatings on devices, ensuring they remain sturdy and visually appealing. As the use of smartphones, laptops, and other gadgets continues to rise globally, there is a noticeable uptick in the demand for chromium in manufacturing processes. The corrosion resistance of chromium becomes particularly crucial, contributing to the durability and reliability of electronic devices and making it an indispensable component for industry growth.

Furthermore, as technology continues to advance, and new electronic applications emerge, the demand for chromium further intensifies. The ongoing innovation in electronic device development, coupled with the expanding consumer electronics market, underscores the vital contribution of chromium in meeting the escalating needs of the electronics industry. Consequently, the increasing incorporation of chromium in electronic manufacturing processes serves as a key driver behind the heightened market demand for this essential metal.

Restraint

Mining and extraction challenges

Mining and extraction challenges present significant restraints on the market demand for chromium. The intricate processes involved in extracting chromium from ores, often found in remote locations, lead to increased extraction costs. Additionally, environmental concerns related to mining activities, including habitat disruption and water pollution, can result in heightened regulatory scrutiny and community resistance, impacting the overall supply chain. Resource depletion is another factor affecting the chromium market.

As accessible high-grade chromium deposits become scarcer, extraction becomes more challenging and costly. This scarcity can lead to supply chain disruptions, affecting industries reliant on chromium, such as stainless-steel manufacturing and aerospace. These mining and extraction challenges not only limit the availability of chromium but also contribute to market uncertainties, influencing pricing dynamics and potentially impeding the growth of the chromium market.

Opportunity

Recycling initiatives

In the chromium market, aerospace innovations are creating exciting opportunities. As the aerospace industry constantly seeks better performance and durability, chromium's alloys and coatings have become crucial. Chromium's special qualities, like resistance to harsh conditions and corrosion protection, make it a valuable material for crafting aircraft components. The ongoing advancements in alloys and coatings for aerospace applications not only ensure aircraft safety and longevity but also open up new possibilities for increased use of chromium in this rapidly growing sector.

As aerospace technologies progress, particularly in designing more fuel-efficient and environmentally friendly aircraft, chromium's importance grows. Opportunities lie in research and development efforts aimed at producing materials that are both lightweight and robust, with chromium's corrosion-resistant properties contributing to fuel efficiency and prolonged component life. This aligns with the aerospace industry's dedication to innovation, providing a fertile ground for the expansion of the chromium market.

Segment Insights

Material Insights

The ferrochromium segment had the highest market share of 32% in 2024. Within the chromium market, ferrochromium is an alloy combining chromium and iron, widely employed in crafting stainless steel. This alloy significantly improves the strength and corrosion resistance of stainless steel, playing a pivotal role in diverse industries. Noteworthy in the ferrochromium segment is the escalating demand attributed to the expanding stainless-steel industry. As construction and infrastructure projects surge worldwide, there is a heightened requirement for stainless steel, thereby increasing the significance and demand for ferrochromium, indicating a positive trajectory in this specific market segment.

The chromium metals segment is anticipated to expand at a significant CAGR of 6.1% during the projected period. In the chromium market, the chromium metals segment encompasses alloys and compounds where chromium plays a key role. These materials, valued for their durability and resistance to corrosion, find extensive applications in industries like aerospace, automotive, and construction. Recent market trends highlight a rising need for advanced chromium alloys, particularly in aerospace innovations and the automotive sector. The shift towards lightweight and resilient materials in these industries is fueling the demand for chromium metals, reflecting a trend towards their expanded use in cutting-edge applications.

Application Insights

According to the application, the metallurgy segment held 92% revenue share in 2024. Within the chromium market, the metallurgy segment focuses on utilizing chromium in crafting alloys, notably stainless steel. By incorporating chromium, the corrosion resistance and durability of steel are significantly improved, making it a vital element across industries. A prevailing trend in this segment is the increasing need for top-tier alloys, particularly in construction and automotive applications. As these sectors flourish, the metallurgy segment sees ongoing growth, propelled by the essential contribution of chromium in enhancing alloy properties for a wide range of industrial uses.

The chemicals segment is anticipated to expand fastest over the projected period. In the chromium market, the chemicals segment pertains to the diverse applications of chromium compounds, including pigments, catalysts, and tanning agents. Chromium's versatile chemical properties make it valuable in numerous industrial processes. Recent trends indicate a growing demand for environmentally friendly chromium compounds, aligning with the increasing emphasis on sustainable practices. Additionally, innovations in the development of new chromium-based chemicals for various industrial applications contribute to the evolving landscape of the chemicals segment in the chromium market.

Regional Insights

Asia Pacific Chromium Market Size and Growth 2025 to 2034

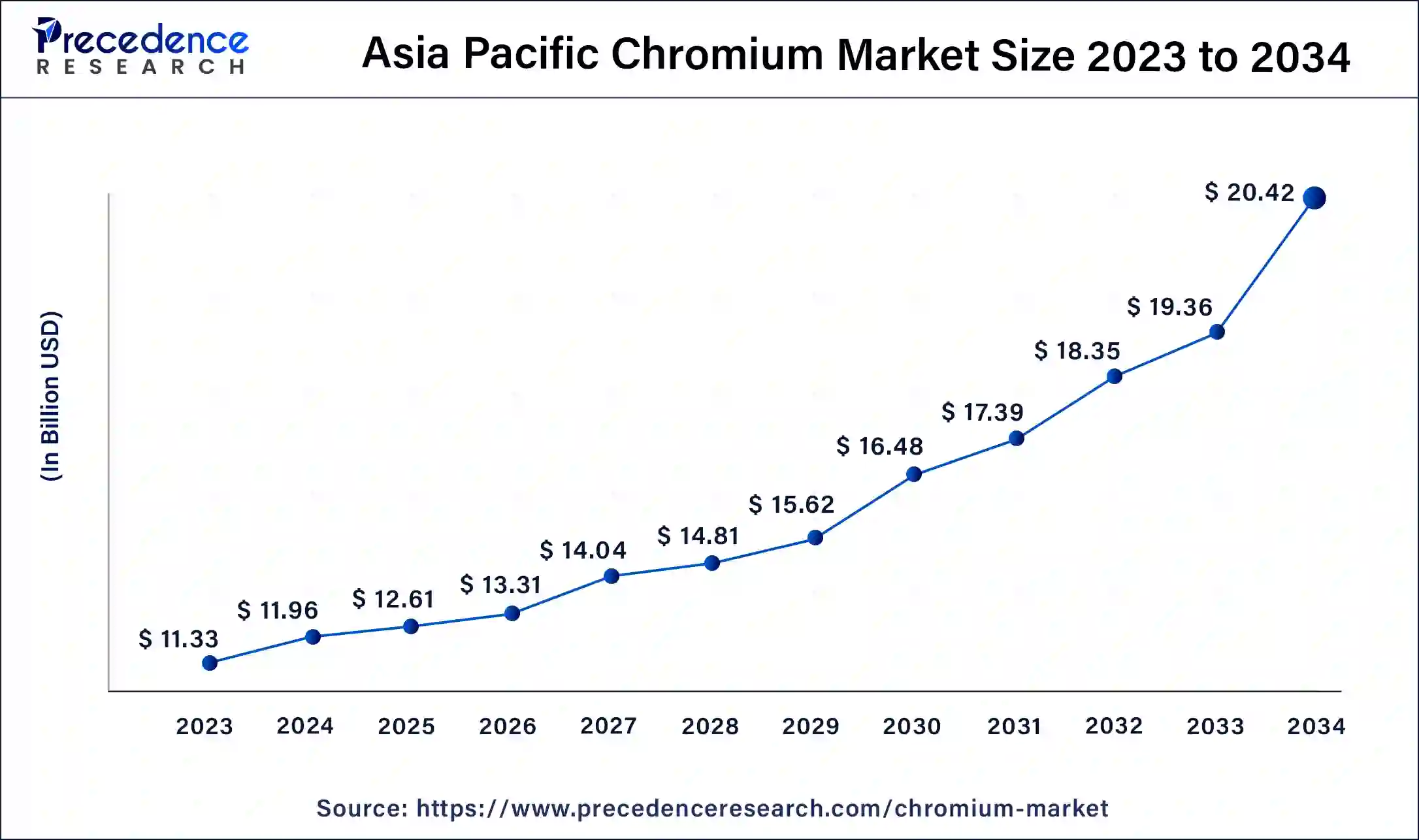

The Asia Pacific chromium market size is estimated at USD 12.61 billion in 2025 and is predicted to be worth around USD 20.62 billion by 2034, at a CAGR of 5.60% from 2025 to 2034.

Asia-Pacific holds a share of 50% in the chromium market owing to vigorous industrial growth, infrastructure expansion, and thriving manufacturing in nations like China and India. The widespread application of chromium in producing stainless steel for construction and automotive sectors, along with the rising demand for electronics, contributes to the region's market dominance. Furthermore, Asia-Pacific's pivotal role as a global manufacturing hub, fueled by economic development and urbanization, underscores its significant influence in shaping the chromium market landscape.

- As per information from the International Stainless Chromium Chemicals Forum (ISSF), India's stainless-steel production stood at 3.3 million tons at the conclusion of 2016. Subsequently, there was a notable uptick, and by the conclusion of 2017, the overall production had risen to 3.6 million tons.

North America is poised for rapid growth in the chromium market due to increasing demand from key industries. The region's robust aerospace and automotive sectors drive the need for corrosion-resistant materials, where chromium plays a pivotal role. Moreover, infrastructure development projects and a surge in renewable energy initiatives contribute to the growing demand for chromium in construction and green technologies. With a focus on technological advancements and sustainable practices, North America stands as a key player in the expanding chromium market, presenting significant growth opportunities.

Meanwhile, Europe is experiencing noteworthy growth in the chromium market due to several factors. The region's robust industrial and manufacturing activities, particularly in the aerospace and automotive sectors, drive increased demand for chromium, especially in stainless steel production. Additionally, stringent environmental regulations and a focus on sustainable practices contribute to the rising popularity of chromium in various applications. The ongoing emphasis on infrastructure development and the adoption of green technologies further amplifies the demand for chromium, positioning Europe as a key growth market in the chromium industry.

China Chromium Market Trends

China's Government policies emphasizing industrial upgrades and environmental protection are influencing the market by pushing for higher-value production and cleaner technologies. Consequently, the market is seeing a shift in stainless steel production towards higher-grade alloys, which is altering the overall demand profile for chromium. While domestic ferrochrome capacity is expanding.

The Middle East and Africa are expected to grow significantly in the chromium market during the forecast period. A rise in the mining operation in the Middle East and Africa is increasing the investments in chromium ore. This, in turn, is making various countries the major players in its production. At the same time, the growing industrialization is increasing the demand as well as the use of chromium-based materials. Moreover, their use in the architectural sector is also increasing, as they can be used as a catalyst or coating agent. At the same time, the growing use of advanced technologies is enhancing their mining as well as improving their application, and is also creating durable alloys to enhance their sustainability. Hence, all these developments are also supported by the investment or initiatives provided by the government. Thus, this is promoting the market growth.

U.S. Chromium Trends

The U.S. Chromium market is driven by the demand for stainless steel and high-performance alloys in key sectors like aerospace and automotive. The market is characterized by high import reliance from a few key nations, making it sensitive to global supply chain dynamics and price volatility. Stringent environmental regulations are forcing a significant shift from toxic hexavalent chromium to safer trivalent alternatives in various applications.

Germany Chromium Trends

Germany's Chromium market has robust demand from its automotive and stainless steel industries, but remains highly dependent on imports from key producing nations. The market is increasingly shifting towards safer trivalent chromium alternatives due to strict EU environmental regulations like REACH. Strong sustainability efforts, including recycling, are a key trend, even as the market navigates price volatility influenced by global supply dynamics.

Chromium Market Value Chain Analysis

- Mining & Ore Extraction

This is the first stage where chromite ore is mined from geological deposits. The quality and type of ore are crucial for determining its end-use, with different grades used for metallurgical, chemical, and refractory applications.

Key Players: Glencore, Kermas Investment Group, Assmang Proprietary Limited, Odisha Mining Corporation Ltd., CVK Madencilik, Yildirim Group. - Processing & Ferrochrome Production

The chromite ore is processed in a smelter to produce ferrochrome, an alloy of iron and chromium.

Key Players: Glencore, Yildirim Group, Indian Metals and Ferro Alloys (IMFA), Tata Steel, Jindal Steel & Power Ltd.. - Chemical Manufacturing

A smaller portion of the chromite ore and ferrochrome is used to produce chromium chemicals, which have applications in tanning, plating, and pigments.

Key Players: Yildirim Group (following acquisition of Elementis' chromium business). - End-Product Manufacturing

This stage includes the use of ferrochrome and chromium chemicals by diverse industries to produce finished goods.

Key Players: ArcelorMittal, POSCO, Baosteel Group Corporation, Jindal Stainless Group (stainless steel producers)

Key Players in Chromium Market and Their Offerings

- Yildirim Group is a key player with significant market share, involved in both mining chromite ore and producing ferrochrome through its Yilmaden Holding subsidiary.

- Hernic Ferrochrome is a ferrochrome producer that contributes to the global supply of this crucial intermediate product, essential for stainless steel manufacturing.

- Eurasian Resources Group (ERG) is a global metals and mining company that plays a role in the chromium market by supplying raw materials and intermediate products. ERG has invested in innovative technologies, such as direct flotation of chrome from tailings, to process waste and increase chromite recovery.

- Outokumpu is a stainless-steel producer and a significant consumer of ferrochrome, thereby influencing demand and market trends. They are also investing in new technology to produce low-COâ‚‚ enriched ferrochrome and high-purity chromium metal, targeting premium markets like aerospace and defense.

- Samancor Chrome is a major chrome ore producer, particularly in South Africa, contributing significantly to the raw material supply for the global chromium market. As a leading supplier, Samancor's production capacity and output directly affect the global availability and price of chrome ore and ferrochrome.

- Assmang Proprietary Limited is involved in both the mining of chromite ore and the production of ferrochrome. Their operations contribute to the supply of these materials, which are important for stainless steel and other industrial applications.

- Afarak Group is engaged in both mining chromite ore and producing ferrochrome, with operations primarily in South Africa. The company is actively working to improve its value chain and increase its production of metallurgical chrome concentrate.

- Tata Steel is a significant contributor to the chromium market through both its stainless-steel production, which consumes ferrochrome, and its ferro alloys division, which produces ferrochrome. By operating chromite mines and ferro-alloy plants, Tata Steel has an integrated value chain, from mining to the final stainless-steel product.

- Jindal Stainless is a major stainless-steel manufacturer in India and a significant consumer of ferrochrome. The company influences market demand and trends, and it has expanded its capacity through strategic acquisitions to capitalize on growing domestic demand.

- Shanxi Taigang Stainless Steel Co., Ltd. is a major stainless-steel producer in China and is a significant consumer of ferrochrome. The company's large-scale production influences demand and market trends, particularly in the Chinese and broader Asian-Pacific regions.

- Baosteel Group is a major steel producer and a significant consumer of ferrochrome. The company's production volume drives demand for chromium, especially in the context of China's immense steel industry.

- POSCO is a major steel producer and therefore a significant consumer of ferrochrome. As a large-scale manufacturer, its production volumes directly influence the demand and market trends for chromium alloys, particularly in the Asian market.

- Acerinox is a global leader in stainless steel production, making it a significant consumer of ferrochrome. The company's operations and investments in advanced stainless-steel technologies contribute to the consistent demand for ferrochrome.

- Allegheny Technologies Incorporated (ATI) is a major producer of specialty metals and alloys for high-performance applications, making it a key consumer of chromium.

Recent Developments

- In January 2025, the supporters of chromium-based browsers were launched by the Linux Foundation, which is a nonprofit organization enabling mass innovation through open source. To enhance projects as well as to provide funding for open development within the Chromium ecosystem, which will ensure the sustainability and support for the open-source contributions for promoting technological advancement, will be the main goal of this initiative.

- In April 2025, a price adjustment letter was issued for metal chromium by Sichuan Yinhe Chemical Co., Ltd. An increase of 5,000 yuan/mt in the original price, was decided by the company for all of its chromium-based new material products, this was because of continuous rise in raw material prices which increased the production costs, as well as continuing the principles of honest operation and win-win cooperation, and will be effective immediately.

(Source: https://finance.yahoo.com/) - In November 2022, Yildirim Group made a significant move by acquiring 100% shares of Elementis plc's chromium business for USD 170 million. This strategic acquisition includes Elementis Chromium's production facilities in Corpus Christi (TX), Castle Hayne (NC), Amarillo (TX), Dakota (NE), and Milwaukee (WI), strengthening Yildirim Group's presence in the chromium market.

- In June 2022, Tenaris announced a substantial investment of nearly USD 29 million in its Dalmine steel shop. The investment aims to enhance the facility's capabilities in producing specialty steels, particularly those with a high chromium content, like chromium 13. The multi-stage investment is slated for completion in the first part of 2023.

- In January 2022, Yildirim Group further expanded its footprint in the chromium market by acquiring Albchrome Holding, an Albanian chrome and ferrochromium company. This strategic move aligns with Yildirim Group's objective to reinforce its position in global markets and support its ongoing progress in the industry.

Segments Covered in the Report

By Material

- Ferrochromium

- Chromium Chemicals

- Chromium Metals

- Others

By Application

- Metallurgy

- Chemicals

- Refractory

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting