What is Contact Lenses Market Size?

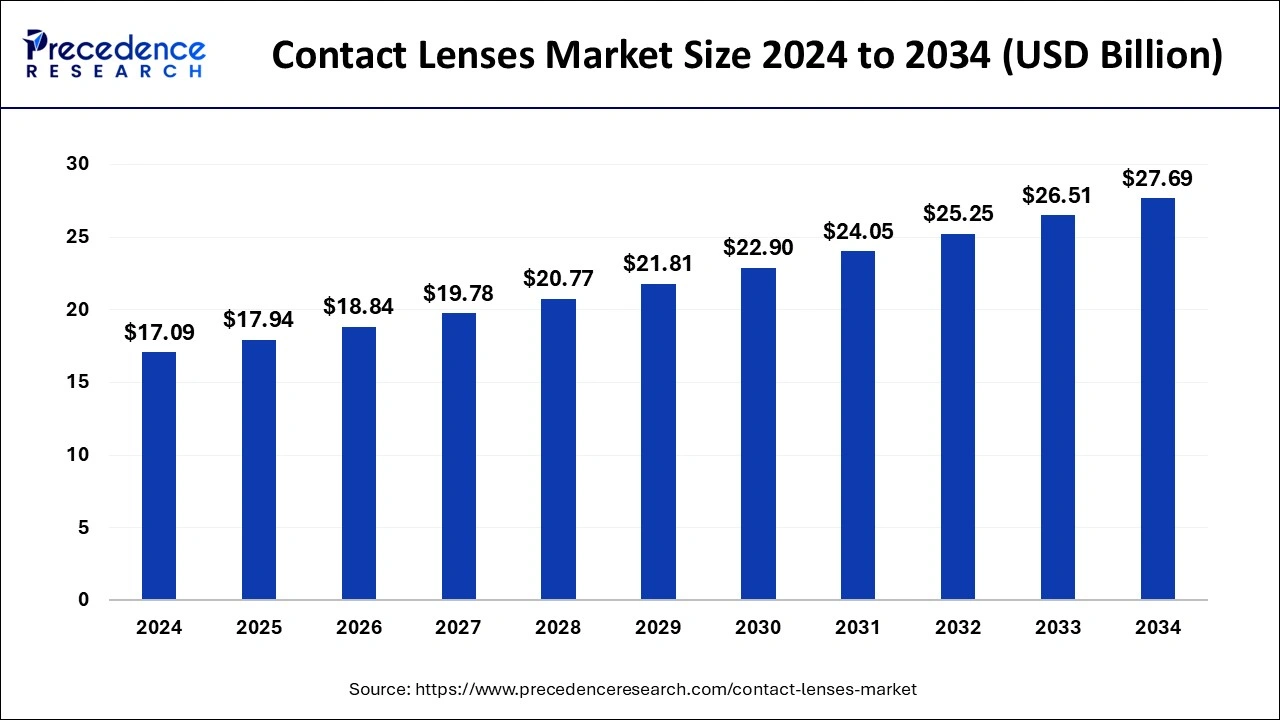

The global contact lenses market size is calculated at USD 397.50 billion in 2025 and is predicted to increase from USD 422.94 billion in 2026 to approximately USD 721.27 billion by 2035, expanding at a CAGR of 6.14% from 2026 to 2035.

Market Highlights

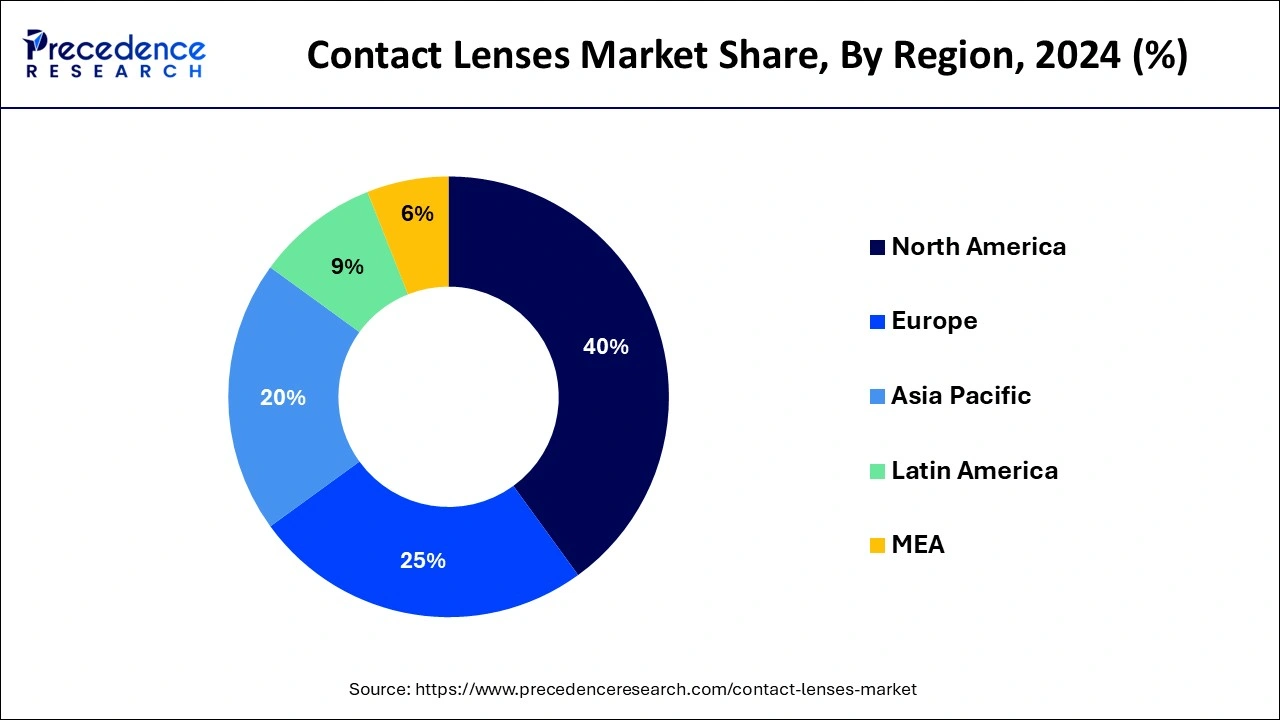

- North America led the global market with the highest market share of 40% in 2025.

- By material, the silicone hydrogel segment dominated the market in 2025.

- By design, the spherical lenses segment held a dominant presence in the market.

- By application, the corrective lens segment is dominating the contact lens market in 2025.

Market Overview

For the correction of the vision thin lenses are used which are placed on the surface of the eyes. Depending upon the comfort nature as well as the reusable nature of the lenses they either come in soft or art form. Although the market for the contact lenses has grown rapidly in the developed nations the market for these contact lenses is expected to grow well during the forecast period in the developing nations. Due to an increase in the number of disorders or the errors the market for contact lenses is expected to grow well during the forecast period. Due to the refractive errors the demand for contact lenses will grow well in the coming years. About 116 million people across the world have impaired vision due to the refractive error. Due to an increased awareness regarding the availability of the contact lenses which are easy to use and are extremely helpful in correcting the vision will drive the market growth in the coming years.

AI Impact on Contact Lenses Market

The impact of Artificial Intelligence in the contact lenses domain is inevitable due to the increasing potential of AI to process huge amounts of data and to discover novel concepts which further offer intriguing applications in contact lenses. Many smart contact lenses have been developed for medical applications. According to recent data, in August 2024, South Korean researchers announced the development of contact lenses that are capable of projecting 3D holograms, which will be further helpful for wearable AR. Another application is AI-powered smart contact lenses, which diagnose blood sugar levels and are able to track various ocular health indicators. China also developed eye-tracking smart contact lenses in May 2024, which could lead to cutting-edge applications like human-computer interaction and smoother control of digital interfaces. In another application, researchers are also working on AI-driven fitting for orthokeratology lenses, which aims to solve vision problems at night.

Are Technology Advances Unlocking New Opportunities in the Contact Lenses Market?

The contact lenses market is in a period of dynamic growth fueled by technology advances, including smart lenses, drug by delivery lenses, and better materials and designs for comfort and oxygen delivery. Current trends include augmented reality (AR) lenses and lenses for specific medical purposes, like lenses that collect and monitor health indicators, like glucose levels. Lens options are also expanding by being multifunctional and creating new opportunities, like medical and consumer lens options. As technology continues to evolve, the future for enhanced contact lens options, including personalized high performance lenses, is changing rapidly.

In December 2024, XPANCEO, a deep-tech company developing smart contact lenses, and Konica Minolta Sensing Europe, an imaging and optical solutions company, announced the launch of a system for testing augmented reality (AR) smart contact lenses. According to the companies' announcement, the XPANCEO-Konika Minolta system incorporates optics specifically engineered for measuring near-eye displays (NEDs), such as those used in virtual, mixed and augmented reality headsets.

Contact Lenses Market Growth Factors

- Increasing trend of cosmetic and colored lenses which is majorly demanded by consumers for aesthetic purposes.

- Athletes and sports people are turning to opt for contact lenses for their increased convenience and active lifestyle.

- Ongoing innovation and new product launches from market players is also a driving factor for the contact lenses market.

- Increasing level of merger and acquisitions activities in the global market.

- Regulatory bodies like U.S. FDA imposes strict regulations on manufacturing practices, safety, testing and labelling for contact lenses.

- Increasing awareness about eye healthcare is another major factor driving the market.

Contact Lenses Market Outlook

- Industry Growth Overview: The contact lenses market is set for strong growth from 2026 to 2035. This expansion is primarily driven by the increasing global prevalence of refractive errors and rising consumer preference for contacts over eyeglasses. Advancements in lens materials and the growing popularity of daily disposables also fuel market growth. The contact lenses market is expanding at a rapid pace due to advances in material science and lens design, with manufacturers focusing on features such as moisture retention, oxygen permeability, and antimicrobial coatings. Customized and condition-specific lenses are gaining importance, while regulatory compliance and clinical validation remain critical for market entry. Strengthened distribution networks through collaborations with eye care professionals and a gradual shift toward patient-centric, digitally enabled care models are further shaping the market.

- Adoption of Advanced Materials: The adoption of advanced materials such as silicone hydrogel is on the rise, improving comfort and oxygen permeability. The market is also seeing a rise in multifocal and toric lenses to correct presbyopia and astigmatism. Furthermore, the integration of smart technology for health monitoring and augmented reality (AR) is an emerging trend.

- Global Expansion: The market is expanding worldwide, driven by global awareness of eye health and vision correction. Emerging regions offer significant opportunities due to increasing disposable incomes, urbanization, and a high prevalence of myopia, which accelerate market penetration. The market is expanding worldwide due to rising eye health awareness and improved access to optometry services. Emerging economies are increasingly adopting contact lenses, driven by urbanization and income growth, while manufacturers enhance distribution networks and local production to offer cost-effective pricing. Digital commerce platforms enable direct-to-consumer sales across borders, and regionally customized products are becoming a key strategy, collectively reshaping the competitive landscape and extending market reach.

- Major Investors: Large eye care and technology corporations such as Johnson & Johnson Vision, Alcon, and The Cooper Companies are the primary investors. Venture capital firms are also funding the development of cutting-edge smart lens technologies. Key investors in the market include large global ophthalmic companies, private equity firms, and healthcare-focused venture capital funds, driving product innovation, clinical research, and geographic expansion. Significant investments are directed toward smart lenses, subscription platforms, and digital eye care solutions, while strategic acquisitions help companies expand portfolios and enter emerging markets. Capital is also allocated to sustainable manufacturing and eco-friendly products, supported by a stable demand that maintains strong investor confidence.

- Startup Ecosystem: A startup ecosystem focuses on disruptive innovations, particularly in smart contact lenses and sustainable materials. Startups like XPANCEO have attracted significant funding to develop AR-enabled contact lenses. Others, like BVS Insight, are leveraging biotech for specialized solutions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 397.50 Billion |

| Market Size in 2026 | USD 422.94 Billion |

| Market Size by 2035 | USD 721.27 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.14% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Material, Design, Application, Distribution Channel, and Usage |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Material Insights

Depending upon the material, the silicone hydrogel segment dominated the market in 2024. Silicone hydrogel-based lenses allow for very high oxygen permeability. More oxygen exposure to the cornea leads to longer wearability, comfort, and good eye health. There are a great number of benefits to the use of these lenses. This has led to high demand in the segment.

By material, the gas permeable segment is predicted to witness significant growth in the market over the forecast period. These lenses have many unique benefits due to their smaller diameter. They allow for clearer vision and are gaining popularity for correcting astigmatism. These lenses are more durable and intended for daily use, with most people adjusting to them and reporting more comfort when compared to soft lenses.

Design Insights

By design, the spherical lenses segment held a dominant presence in the market. Spherical lenses are commonly used to treat both myopia and hyperopia. Spherical lenses have a low cost of production since they are easier to manufacture compared to other lens types. Their simple curvature requires simple manufacturing methods, allowing for faster production. These lenses are also versatile, available in several different powers, and have increased softness with the use of advanced materials.

By design, the multifocal segment is anticipated to grow with the highest CAGR in the market during the studied years. Aging populations globally are opting to use bifocal or multifocal lenses to reduce their dependency on reading glasses. These lenses provide clear vision at all distances and allow for a seamless transition between different eye powers. The demand for the multifocal lenses is expected to show a steady growth in the coming years.

Application Insights

On the basis of application, the corrective lens segment is dominating the contact lens market. Lenses in this application category are widely used to correct vision for people with myopia, hyperopia, astigmatism (cylindrical power), and for people looking to replace their reading glasses. There has been consistently high demand in this segment as many consumers are switching from spectacles to lenses.

By application, the cosmetic segment is predicted to witness significant growth in the market over the forecast period. Changing global beauty standards and the growing popularity of makeup-based art forms such as drag and cosplay are leading to the growing popularity of cosmetic lenses in markets in North America and Asia Pacific. This is expected to spur notable demand in the cosmetic lenses sector in the coming years.

Usage Insights

Depending upon the usage, the disposable lens is expected to grow well in the coming years period this segment will dominate the market and it is expected to grow at a compound annual growth rate of 5.1% during the forecast. This account has generated revenue of about 35% of the total market share.

The segment will dominate the market in the coming years due to an increased preference for the disposable lens across the developing as well as the developed nations. These len lenses are extremely comfortable for use. these contact lenses are suggested by the opthalmologists and they are preferred more by the consumers due to the safety factor.

Regional Insights

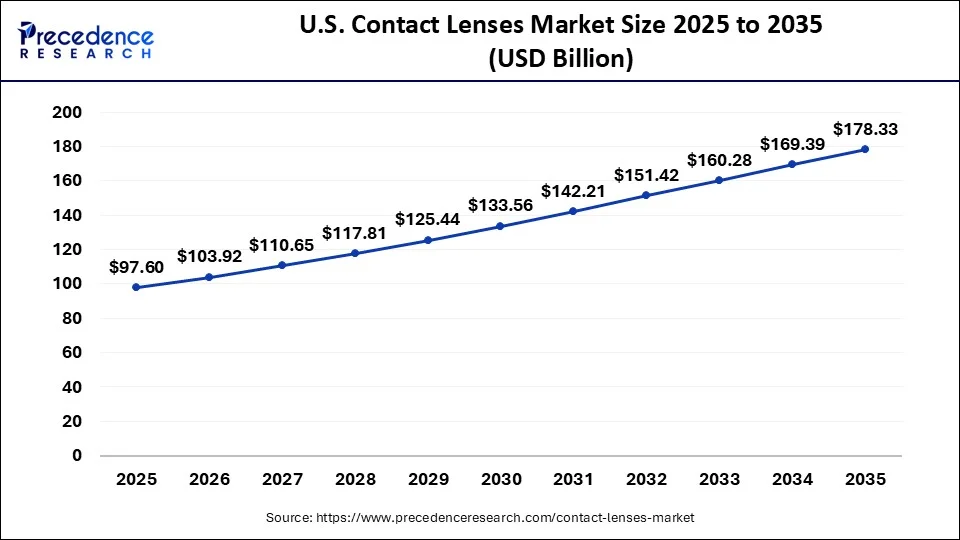

U.S. Contact Lenses Market Size and Growth 2026 to 2035

The U.S. contact lenses market size is estimated at USD 97.60 billion in 2025 and is predicted to be worth around USD 178.33 billion by 2034, at a CAGR of 6.21% from 2026 to 2035.

The market for contact lenses is expected to generate maximum revenue for the North American region. The demand is expected to grow in the coming years. The North American region had a share of about 40% in terms of revenue in the past. As there has been an increase in the number of patients suffering with different refractive errors the market will keep growing. The presence of many market players in this region and the collaborations between these market players we will drive the market growth in the coming years. Increased partnerships amongst these market players will drive the market growth during the forecast period. There is an increased demand for therapeutic glasses which shall be beneficial in preventing the progression or preventing the increase of myopia especially in the children.

The market in North America is also driven by high disposable incomes, an advanced healthcare system, and a significant population with vision issues. Key factors include rapid innovation in materials such as silicone hydrogel and a strong market presence of major players that heavily invest in R&D. The region is also experiencing a growing shift toward disposable lenses, valued for their convenience and hygiene, while e-commerce platforms expand accessibility and offer competitive pricing.

- In May 2025, Bausch + Lomb announced the launch of Zenlens Chroma HOA scleral contact lenses in the U.S., that is specifically designed to reduce symptoms such as halos and glare and correct advanced higher-order aberrations. The lenses decrease higher-order aberrations via personalized inverse aberrations applied to the lens.

The demand for contact lenses has grown well in the Asia Pacific region. The demand for the contact lenses of the soft type have a greater demand in the European region as well as the North American region. Constant research and development activities have led to the introduction of various innovative products. Increased purchasing power in the Asia Pacific region has led to an increased demand for contact lenses in this region. Exposure to entertainment and media has led to an increased use of cosmetic lenses.

- In April 2025, Alcon, a global leader in eye care, announced the launch of a new campaign, ‘Switch to PRECISION1', to introduce its next-generation daily disposable contact lenses, designed for all-day comfort. The advertising campaign, created by Scarecrow M&C Saatchi and Alcon, highlights the challenges currently faced by contact lens users in India. With SMARTSURFACE innovative technology, these lenses contain >80% water on the surface, providing up to 16 hours of comfort.

U.S. Contact Lenses Market Trends

Within North America, the U.S. is a major player, with market growth driven by a large population with vision impairments and high adoption of new technologies. The U.S. market focuses on specialized lenses, such as multifocal and toric, and is exploring AI-integrated lenses. The FDA's regulatory framework promotes continuous innovation while maintaining safety, and online retail, boosted by relaxed teleoptometry laws, is a rapidly growing distribution channel.

What Makes Asia Pacific the Fastest-Growing Region in the Contact Lenses Market?

Asia Pacific is the fastest-growing region in the market, largely due to a sharp increase in myopia and other vision disorders among younger, urban populations, driving widespread demand for corrective and vision-care products. Rising disposable incomes, changing lifestyles with increased digital screen use, and growing interest in convenience and cosmetic appearance are boosting demand not just for corrective lenses but also for daily disposables and colored lenses. Improved healthcare infrastructure, expanding retail and e-commerce access, and wider availability of vision-care services further accelerate adoption across diverse demographic groups.

China leads the market due to its large consumer base and rising myopia rates, particularly among students. Japan remains a mature market, focusing on innovative products and high adoption of daily disposable and premium lenses. South Korea shows strong demand for cosmetic and colored lenses driven by fashion trends, while India is emerging as a promising market with growing eye care infrastructure and increasing consumer purchasing power. Australia is experiencing steady growth due to high awareness of eye care and stringent regulatory standards that ensure product quality.

How is Europe Contributing to the Contact Lenses Market?

Europe is a major contributor to the global market, characterized by high consumer awareness of eye health and vision correction options. The market is primarily driven by the increasing prevalence of vision disorders, the growing aging population's need for multifocal solutions, and the strong consumer preference for the convenience and hygiene offered by daily disposable lenses. The region benefits from strong regulatory oversight and an established network of eye care professionals that support market growth to maintain a competitive edge and meet diverse consumer needs.

Germany Contact Lenses Market Trends

Germany holds a leading position in the market, driven by high living standards and a strong focus on quality and innovation. The country is a hub for technological advancements in lens materials and designs, with a high adoption rate of specialized lenses for astigmatism and presbyopia (multifocal). The market is heavily influenced by global leaders such as Carl Zeiss and a strong network of optometrists recommending advanced solutions, shaping the German landscape.

How is the Opportunistic Rise of Latin America in the Contact Lenses Market?

Latin America is experiencing an opportunistic rise in the market, fueled by increasing urbanization, rising disposable incomes, and growing awareness of eye health. The region's large population and high myopia incidence are driving demand for corrective vision solutions, particularly in urban areas where screen time is increasing. The market is also propelled by the growing adoption of daily disposable and colored/cosmetic lenses, reflecting lifestyle changes and aesthetic preferences among younger demographics, enhancing accessibility and distribution across the region.

Brazil Contact Lenses Market Trends

Brazil is leading the market in Latin America, driven by significant investments in healthcare infrastructure and the need to upgrade vision care options. The demand for high-speed connectivity has led to an urban lifestyle that often causes digital eye strain, accelerating the adoption of comfortable silicone hydrogel lenses. A growing focus on convenience and hygiene is boosting the daily disposable segment, supported by local initiatives and the strong presence of global manufacturers.

What Potentiates the Growth of the Middle East & Africa Contact Lenses Market?

The market in the Middle East & Africa (MEA) is driven by increasing awareness of eye health, rising disposable incomes, and the expansion of healthcare infrastructure. Demand is strong for both corrective and cosmetic lenses, with a notable preference for daily disposables for their hygiene and convenience. Investments in smart city projects and an increasing demand for medical diagnostics and aesthetic treatments, stimulating the market.

UAE Contact Lenses Market Trends

The UAE plays a crucial role in the contact lenses market because of its forward-looking technology goals and smart city projects, which boost healthcare and digital infrastructure. The country is experiencing high demand for cosmetic and colored lenses, fueled by fashion aware and young, image-focused residents. There is also significant demand for advanced healthcare applications, such as sophisticated diagnostics and therapeutic lenses.

Value Chain Analysis

- Research and Development (R&D)

Focuses on innovating lens materials and designs.

Key Players: Johnson & Johnson Vision Care, Alcon, CooperVision, Bausch + Lomb. - Clinical Testing and Regulatory Approval

Ensuring product safety and efficacy through clinical trials and securing regulatory clearance from bodies like the FDA or EASA.

Key Players: Johnson & Johnson Vision Care, Alcon, CooperVision, and Bausch + Lomb. - Manufacturing and Production

Mass production of approved lenses, with a trend toward high-volume daily disposable lenses.

Key Players: Johnson & Johnson Vision Care, Alcon, CooperVision, Bausch + Lomb, and Menicon. - Distribution and Supply Chain Management

Distributing products to optical stores, hospitals, clinics, and e-commerce platforms.

Key Players: ABB Optical Group and Henry Schein. - Retail & Patient Support

Selling lenses to the consumer and providing ongoing support, including education and subscription services.

Key Players: Lenskart and Amazon.

Contact Lenses Market Companies

- Johnson & Johnson Vision Care: Dominates with the ACUVUE brand (e.g., Acuvue Oasys MAX), focusing on daily disposables and new technologies like light filtering.

- Alcon: Known for premium daily disposables like Dailies Total 1 (water gradient technology) and monthly Air Optix lenses.

- CooperVision: Offers popular lines such as Biofinity (monthly) and MyDay (daily), with a strong focus on specialty and myopia control lenses.

- EssilorLuxottica/Hoya Corporation: Global leaders in overall eyewear, offering diverse contact lens portfolios and investing in general vision science and myopia management.

Other Key Players

- Abbott Medical Optics, Inc.

- X-Cel Specialty Contacts

- Medennium

- Seed Co., Ltd.

- STAAR Surgical Company

- SynergEyes, Inc.

Recent developments

- In April 2025, Alcon, a global leader in eye care, has launched a new campaign ‘Switch to PRECISION1' to introduce its next-generation daily disposable contact lenses, designed for all-day comfort. With SMARTSURFACE innovative technology, these lenses contain >80% water on the surface, providing up to 16 hours of comfort. (Source: https://www.afaqs.com)

- In November 2024, Alcon announced the launch of Precision7, a 1-week replacement contact lens containing a new technology that provides up to 16 hours of comfort and precise vision in both sphere and toric designs. “Now, patients can start and end every week fresh with a first-of-its-kind contact lens featuring Activ-Flo technology,” Max Wolf, Alcon general manager and head of vision care and contact lenses stated. (Source: https://www.healio.com)

- In March 2025, Bausch Lomb Corporation, a leading global eye health company dedicated to helping people see better to live better, announced the U.S. launch of Arise, a lens fitting system that uses intelligent, cloud-based technology to streamline the orthokeratology lens design process. These lenses include the first orthokeratology lens design with toric peripheral curves* approved by the U.S. Food and Drug Administration to treat myopia overnight. (Source: https://www.biospace.com)

- In October 2024, Alcon, the global leader in eye care, is reaffirming its dedication to innovation by introducing the Alcon Innovator Program, an initiative to partner with influential Eye Care Professionals to identify gaps in contact lens offerings and address the market's unmet needs. As part of the inaugural program in the U.S., Alcon selected 20 Innovators to receive and offer their patients exclusive access to upcoming Alcon product launches.

- In February 2025, Bupa announced a partnership with Opticycle to recycle glasses, contact lenses. Australians are now able to recycle their old glasses, contact lenses, and contact lens packages at Bupa Optical & Hearing stores around Australia as part of a new partnership with Opticycle. More than 50% of Australians live with one or more long-term eye conditions, resulting in between 250 and 500 million contact lens packages being sent to landfills in Australia each year.

- In March 2025, XPANCEO, a deep tech company developing the next generation of computing, unveiled three new smart contact lens prototypes at MWC 2025, including a lens with a wireless powering companion, an IOP sensor, and biochemical sensors.

- In June 2024, Bausch +Lomb launched its INFUSE for astigmatism silicone hydrogel lenses. These are daily disposable lenses designed with highly delicate and advanced materials encompassing ProBalance technology, and proprietary optic align designs.

- In March 2024, a leading eye care industry player known as Alcon introduced the Clareon series of intraocular lenses in India. These are precisely designed for clear vision. The Clareon platform is now available in the country in two types of Presbyopia correcting IOL technologies, namely the Clareon PanOptix and Clareon Vivity.

Segments Covered in the Report

By Material

- Gas Permeable

- Silicone Hydrogel

- Hybrid

By Design

- Spherical

- Multifocal

- Toric

- Others

By Application

- Corrective

- Prosthetic

- Cosmetic

- Therapeutic

- Lifestyle-oriented

By Distribution Channel

- E-commerce

- Eye Care Practitioners

- Retail

By Usage

- Daily Disposable

- Frequently Replacement

- Disposable

- Traditional

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting