What is the Gypsum Plaster Market Size?

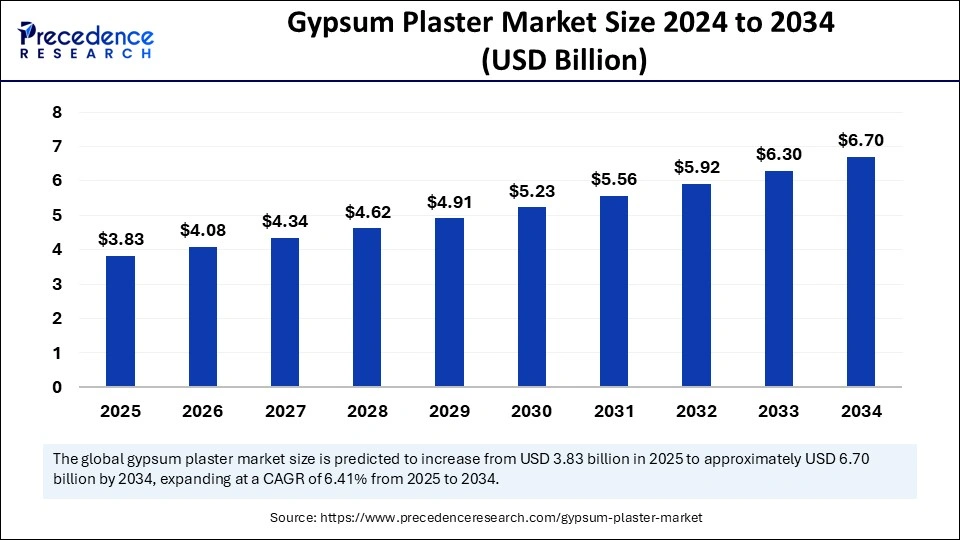

The global gypsum plaster market size is valued at USD 3.83 billion in 2025 and is predicted to increase from USD 4.08 billion in 2026 to approximately USD 6.70 billion by 2034, expanding at a CAGR of 6.41% from 2025 to 2034. The market is expanding rapidly due to increasing demand for lightweight, fire-resistant construction materials, offering advantages like easy application, quick setting, and better fire resistance than traditional cement plaster.

Gypsum Plaster Market Key Takeaways

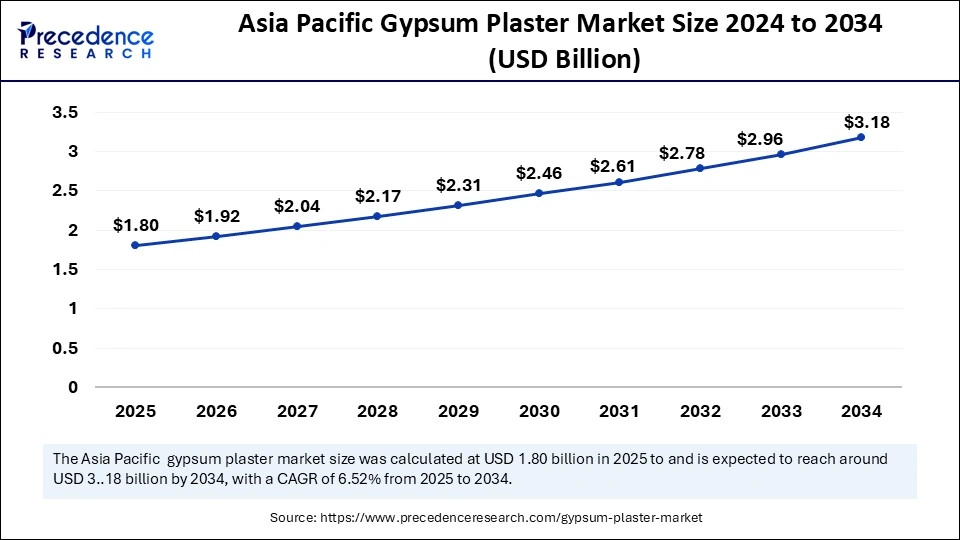

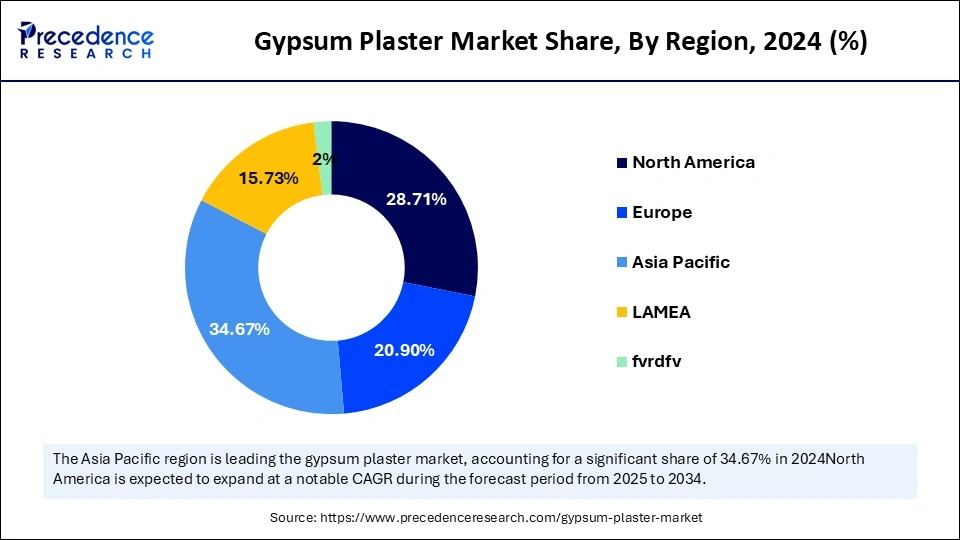

- Asia Pacific dominated the global market with the largest market share of 47% in 2024.

- The North American market is anticipated to grow at the fastest CAGR during the forecast period.

- By plaster system, the manually applied plaster segment held the major market share of 47% in 2024.

- By plaster system, the machine-applied plaster segment is expected to grow at a CAGR of 7.8% during the predicted timeframe.

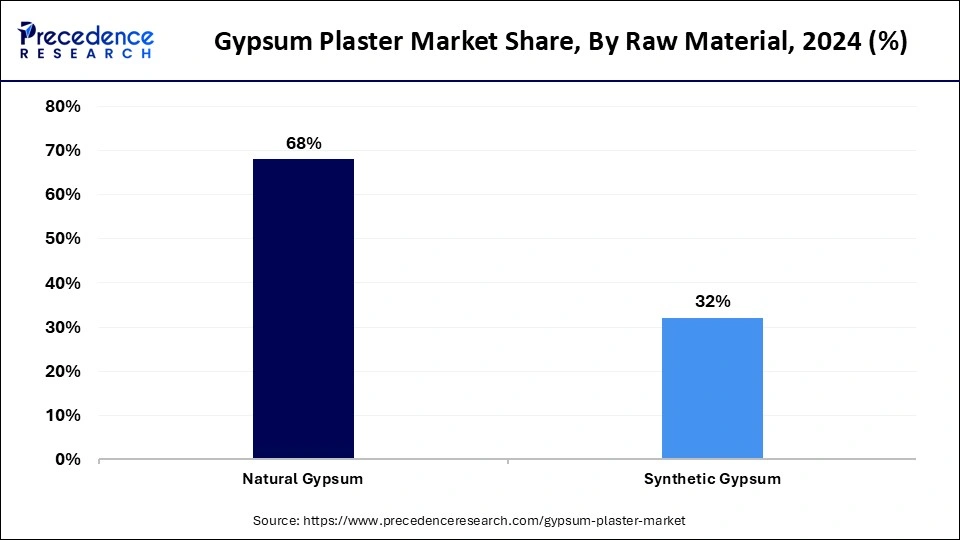

- By raw material, the natural gypsum segment contributed the largest share of 68% in 2024.

- By raw material, the synthetic gypsum is expanding at a notable CAGR 6.9% during the forecast period.

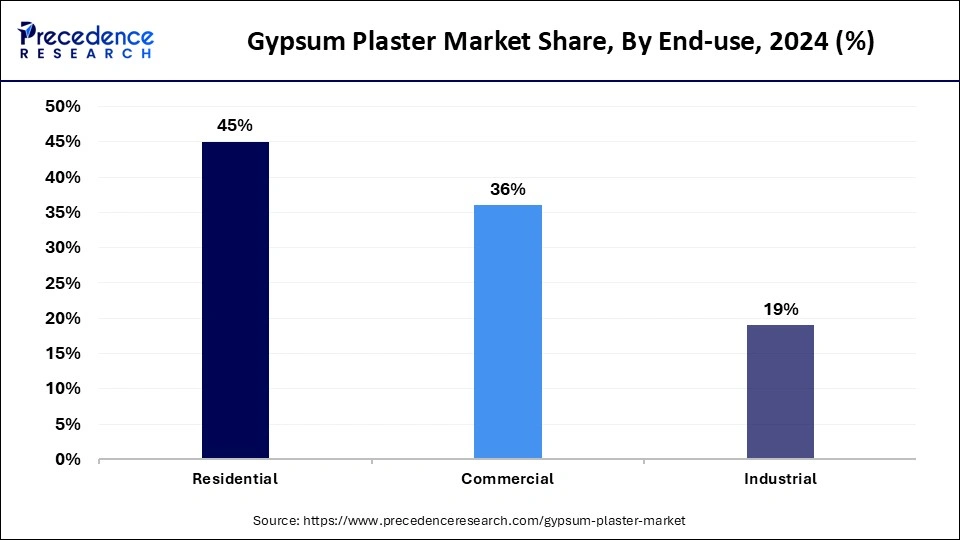

- By end-use, the residential segment captured the biggest market share of 45% in 2024.

- By end-use, the commercial segment is projected to grow at a CAGR of 7.9% upcoming years.

Artificial Intelligence: The Next Growth Catalyst in Gypsum Plaster

Artificial intelligence (AI) is revolutionizing the gypsum plaster market by enabling advancements in manufacturing, product development, and application, resulting in increased efficiency, quality, and sustainability. AI-powered systems can optimize production processes, automate tasks, and improve efficiency, reducing costs and increasing output. Recent advancements include AI-driven quality control, smart manufacturing techniques, and the development of new plaster formulations. AI can analyze customer data to develop tailored gypsum plaster solutions for specific construction needs, enhancing versatility and market competitiveness.

- In April 2025, a pharmaceutical company producing a critical diabetes medication in a hurricane-prone region could use GenAI to analyze historical weather patterns, including hurricane data, and predict potential disruptions to their raw material supply. The system could then recommend alternative sourcing options or suggest increasing production ahead of hurricane season to build a safety stock.

Strategic Overview of the Global Gypsum Plaster Industry

The gypsum plaster market involves the production and distribution of gypsum plaster, a common building material made from gypsum (calcium sulfate dihydrate), a naturally occurring mineral. The market is experiencing growth, particularly in developing regions, driven by the booming construction sector and the superior functional and physical properties of gypsum plaster compared to traditional cement plaster.

Gypsum Plaster Market Growth Factors

- Burgeoning construction sector: Rapid urbanization and increasing construction activities, especially in developing regions, are driving demand for gypsum plaster.

- Convenient properties: Gypsum plaster provides superior fire resistance, acoustic insulation, and ease of application properties compared to traditional cement plaster, contributing to the market growth.

- Technological advancements: Innovations in gypsum plaster products, such as enhanced strength and durability for different purposes, are making them more suitable for diverse applications.

- Sustainability and green building initiatives: Gypsum is a naturally occurring mineral, and its lower carbon footprint compared to cement-based alternatives makes it a more sustainable option. Thus, increasing emphasis on sustainable construction materials and green building practices is further driving the demand for gypsum plaster.

- Government backing: Government regulations and incentives promoting energy-efficient and eco-friendly construction materials, due to their durability and sustainability, are also contributing to market growth.

Market Outlook

- Market Growth Overview: The Gypsum Plaster market is expected to grow significantly between 2025 and 2034, driven by rising residential, commercial, and industrial construction, especially in developing regions. Rising demand for superior materials and green building trends.

- Sustainability Trends: Sustainability trends involve rising use of synthetic gypsum, a byproduct from industrial processes and extensive recycling, and enhanced energy efficiency in buildings.

- Major Investors: Major investors in the market include Saint-Gobain S.A., Knauf Gips KG, USG Corporation, Georgia-Pacific Gypsum II LLC., YOSHINO GYPSUM CO., LTD., and Holcim.

- Startup Economy: The startup economy is focused on sustainable alternatives & green composites, gypsum recycling services, and advanced gypsum formulations.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 6.70 Billion |

| Market Size in 2025 | USD 3.83 Billion |

| Market Size in 2026 | USD 4.08 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.41% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Plaster System, Raw Material, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Expansion of the building and construction industry

The primary driver in the gypsum plaster market is the expansion of the building and construction industry, particularly in emerging economies. This growth is driven by factors like rapid urbanization, infrastructure development, and increasing demand for affordable housing. As cities expand and infrastructure is built to support growing populations, coupled with innovations in manufacturing, like the development of specialized gypsum boards such as fire-resistant, moisture-resistant, etc., enhance the appeal of gypsum plaster for various construction applications.

- In March 2025, Etex subsidiary Siniat inaugurated a new line at its Bristol gypsum wallboard plant in the West of England. The plant will produce 98% of Siniat's portfolio of wallboard products for the UK and Ireland markets. It will incorporate 45% recycled content in its products, with zero waste to landfill.

Restraint

Raw material supply chain challenges and environmental concerns

The primary restraint in the gypsum plaster market is raw material supply chain challenges and environmental concerns. Alterations in raw material availability, transportation costs, and rising environmental concerns regarding the disposal of gypsum board waste hinder market growth. A recent example of a launch addressing the environmental restraint focuses on eco-friendly and sustainable gypsum plasterboard alternatives and the implementation of stricter environmental regulations.

Opportunity

Technological advancements and innovations

The key future opportunity in the market is technological advancements and innovations, particularly in sustainable and low-carbon solutions. This includes the development of ready-mix, high-quality gypsum plaster that is durable and easy to apply, along with a focus on using recycled gypsum and creating low-carbon plasters.

- In December 2023, Saint-Gobain Gyproc, a part of Saint-Gobain India Pvt Ltd., announced the launch of an innovative range of products designed to redefine architectural aesthetics and functionality. The new product line includes Habito Standard, a high-quality gypsum board made for heavy unplanned and planned loading applications.

Plaster System Insights

The manually applied plaster segment held a dominant presence in the gypsum plaster market in 2024, due to its cost-effectiveness, ease of application, and flexibility in achieving desired finishes, especially in residential and commercial projects. Manually applied plaster allows for greater control and customization, making it suitable for intricate architectural detailing and achieving specific aesthetic goals. Additionally, it requires less specialized equipment and labor compared to mechanized methods, making it more budget-friendly for many projects. It also demonstrates good adhesion to various surfaces and is easy to work with. Therefore, builders and contractors prefer it for its widespread use and suitability for various surfaces, including intricate detailing.

- In March 2024, Gyproc India introduced a significant development at its Tiruvallur facility, revealing the production of low-carbon plasters. The initiative is expected to result in a substantial 40-50 percent reduction in the carbon footprint compared to existing Gyproc plasters throughout their entire lifecycle.

The machine-applied plaster segment is expected to witness the fastest rate of growth during the predicted timeframe, because of its efficiency and cost-effectiveness in large-scale projects. This is achieved through advancements in technology, which utilize automated systems that ensure uniform thickness and consistent finishes, leading to uniform application, reduced labor costs, and faster project timelines, which is crucial for contractors and developers. Furthermore, machine application minimizes waste and reduces the need for manual labor, aligning with growing sustainability concerns in the construction industry.

Raw Material Insights

The natural gypsum segment dominated the market with the largest share in 2024. Because natural gypsum is a readily available mineral in different regions, this abundance contributes to a stable and reliable supply for the construction industry. Natural gypsum offers a consistent and predictable chemical composition, ensuring the quality and reliability of the final product, along requires minimal processing compared to other raw materials, making it a more efficient and cost-effective option. Compared to other building materials like cement or lime-based plasters, natural gypsum plaster has a lower carbon footprint. Its manufacturing process consumes less energy and generates fewer greenhouse gases, contributing to a more sustainable approach to construction.

- In February 2025, Gypsum supplier Gypsum Resources Australia joined 24 other organisations in calling on the state government of New South Wales to reconsider a planned relocation of the last working port of Sydney Harbour from Glebe Island in Sydney Harbour to the city of Newcastle, 150km away.

The synthetic gypsum is observed grow rapidly during the forecast period, because synthetic gypsum is a byproduct of industrial processes like flue gas desulfurization (FGD) in coal-fired power plants, making it a sustainable alternative to natural gypsum. Its increasing use as a sustainable and cost-effective alternative to natural gypsum, particularly in the construction and manufacturing industries, coupled with technological advancements in synthetic gypsum production and applications, further drives its growth. Furthermore, environmental regulations, a growing demand for sustainable building materials, and the ability of synthetic gypsum to reduce industrial waste and resource depletion also contribute to market growth.

End-Use Insights

The residential segment captured the biggest gypsum plaster market share in 2024, due to the advantages of the material in affordable housing and urbanization, coupled with its superior finish and ease of application. Additionally, the government initiatives promote sustainable and energy-efficient housing solutions. Gypsum plaster offers a smooth and crack-resistant finish, making it an ideal choice for interior walls and ceilings in residential buildings. Its ease of application and quick setting time also contribute to its popularity among builders.

The commercial segment is expected to grow at the fastest rate in the upcoming years, due to several factors, including the increasing necessitate for high-quality interior finishes in modern commercial buildings. Gypsum plaster offers a smooth finish, fire resistance, and durability, making it a preferred material for office spaces, hotels, shopping malls, and other commercial establishments. The rising trend of aesthetic and functional interior design in commercial spaces also drives demand, as gypsum plaster permits complex architectural details while maintaining structural integrity.

Regional Insights

Asia Pacific Gypsum Plaster Market Size and Growth 2025 to 2034

The Asia Pacific gypsum plaster market size is exhibited at USD 1.80 billion in 2025 and is projected to be worth around USD 3.18 billion by 2034, growing at a CAGR of 6.52% from 2025 to 2034.

Strong Government Backing in Asia Pacific

Asia Pacific dominated the gypsum plaster market in 2024, due to a combination of factors, including rapid urbanization, government-led infrastructure projects, and increasing demand for affordable housing. Countries in the region, such as China and India, are experiencing rapid growth, leading to a surge in demand for housing and commercial buildings, thus increasing the need for construction materials like gypsum plaster. Government initiatives like Housing for All and increasing Foreign direct investments in the construction sector are driving demand for gypsum plaster, a cost-effective and durable material.

- In February 2024, NBCC and HUDCO plan to work on advancing Corporate Social Responsibility (CSR) endeavors, with a primary focus on identified development and construction projects. This collaboration spans a comprehensive spectrum of activities, encompassing financing, design, construction, and procurement of essential materials and equipment.

India Gypsum Plaster Market Trends

India plays an important role in the gypsum plaster market because the rapid urbanization of India, propelled by population growth and migration to urban centers, creates a massive demand for new housing, commercial buildings, and infrastructure projects. The focus of the government of India on affordable housing and infrastructure development, including New India initiatives, is boosting construction activity, leading to increased demand for gypsum plaster.

China: A Key Force in the Gypsum Plaster Industry

China contributes significantly to the gypsum plaster market because of rapid industrialization and urbanization of China are driving the need for factories, manufacturing plants, stadiums, and office buildings, all of which require construction materials like gypsum plaster. As per capita income rises in China, consumers are increasingly opting for modern, more durable building materials like gypsum plaster, further driving its demand. The construction of high-rise buildings in major Chinese cities, like Shanghai and Beijing, exemplifies the impact of urbanization and industrialization on the market, as these projects require large quantities of this material for interior walls and ceilings.

Strong Healthcare Infrastructure of North America

North America is anticipated to grow at the fastest rate in the market during the forecast period, because of infrastructure development, government initiatives, and a growing preference for eco-friendly and efficient construction materials. Government support for affordable housing, sustainable building practices, and infrastructure development is fostering the adoption of gypsum plaster. Furthermore, technological advancements and manufacturing processes have led to the development of high-performance gypsum plaster products that offer improved durability and sustainability.

- In October 2024, Saint-Gobain, through its building products subsidiary CertainTeed Canada Inc., unveiled CarbonLowTM, a new line of low-carbon gypsum wallboard to be sold in Canada starting in 2025. With up to 60% less embodied carbon cradle-to-gate than traditional alternatives, CarbonLowTM will allow contractors and homeowners to utilize thequality CertainTeed solutions, reducing their environmental footprint.

U.S. Gypsum Plaster Trends

The U.S. dominated the gypsum plaster market in North America because the U.S. economy, with its robust growth and active construction industry, fuels significant demand for gypsum plaster. The increasing focus on green building practices and sustainable construction in the U.S. leads to higher demand for gypsum plaster. Furthermore, the U.S. has many prominent gypsum plaster manufacturers and producers, such as Georgia-Pacific Gypsum, National Company Gypsum Services, and Synthetic Materials play a key role in meeting the demand for gypsum plaster in the U.S.

Large and Developed Construction Sector of Europe

Europe is a notable region for the gypsum plaster market due to a large and developed construction sector, a strong focus on renovation and refurbishment, and the use of gypsum plaster in various applications, including interior walls and ceilings. Germany, for example, is a key player in the European market, driven by its technological advancements and the increasing use of plasterboard and other gypsum-based products in construction.

- In March 2025, Eco Avant-Garde launched a new product from its Eco Gypsum 64 gypsum wallboard recycling system. The system can now produce pulverised paper pellets as fuel for dryers at gypsum wallboard plants. Eco Avant-Garde highlighted the evident circular economic potential of the advances in a post on LinkedIn.

Germany Gypsum Plaster Market Trends

Germany's gypsum plaster market is driven by a high demand from the residential and non-residential sectors, bolstered by Germany's strong construction activity and stringent building codes. Manufacturers are innovating to enhance fire resistance, acoustic performance, and moisture resistance, leveraging both natural and synthetic gypsum sources.

Value Chain Analysis

- Raw Material Sourcing (Natural Gypsum & Synthetic FGD Gypsum)

This foundational stage involves mining natural gypsum rock from quarries or sourcing synthetic flue-gas desulfurization (FGD) gypsum as a by-product from power plants.

Key Players: Knauf Gips KG, Saint-Gobain (through subsidiaries like British Gypsum), USG Corporation (part of Knauf), various mining companies. - Manufacturing & Processing (Calcination and Formulation)

In this stage, the raw gypsum is processed by crushing, grinding, and heating (calcination) to remove most of the water, creating plaster of Paris (hemihydrate).

Key Players: Knauf Gips KG, Saint-Gobain (Siniat, British Gypsum, etc.), USG Corporation, CSR Limited, - LafargeHolcim (through subsidiaries).

Packaging, Storage, and Logistics

The manufactured gypsum plaster is packaged into bags or bulk containers, stored, and transported to distribution centres, retailers, and construction sites.

Key Players: Knauf Gips KG, Saint-Gobain, various third-party logistics (3PL) providers and packaging companies. - Distribution and Sales

The products are distributed through a network of wholesalers, construction material retailers (e.g., Home Depot, local builders' merchants), and direct sales channels to contractors and construction firms.

Key Players: Home Depot, Knauf Gips KG, Saint-Gobain, and a wide range of regional building material distributors/merchants - Application & Installation (Contractors and Plasterers)

This final stage involves the actual application of the gypsum plaster by skilled plasterers and construction contractors at building sites, primarily for interior wall and ceiling finishing.

Top Companies in the Gypsum Plaster Market & Their Offerings:

- Saint-Gobain: A global leader in sustainable construction, Saint-Gobain manufactures and supplies a wide range of gypsum-based products, including gypsum plaster and plasterboard.

- Knauf Gips KG: As a major global gypsum producer, Knauf develops and manufactures innovative gypsum products, including high-strength and machine-applied plasters for specific construction applications.

- Global Gypsum Company Co. Ltd.: Global Gypsum is a significant manufacturer and distributor of gypsum products, including plaster, especially within the Middle East and Africa regions.

- Escayescos, SL: A Spanish gypsum specialist, Escayescos produces high-grade gypsum plaster and has expanded its product range to include gypsum plasterboard.

- USG Corporation: Now part of Knauf, USG Corporation was a major American manufacturer of building materials, including gypsum plaster, contributing significantly to the North American market. The company provided a comprehensive range of gypsum-based products for residential and commercial construction.

- James Hardie Industries plc: Known primarily for fiber cement, James Hardie also contributes to the market with sustainable fiber gypsum boards and floor elements, particularly in Europe. They focus on manufacturing low-environmental impact, durable, and recyclable products for the construction sector.

- Georgia-Pacific Gypsum II LLC: Georgia-Pacific is a major U.S. manufacturer, heavily investing in the construction of new facilities to produce gypsum wallboard and other gypsum products. This strengthens their capacity to meet growing customer needs in residential and commercial construction markets.

- YOSHINO GYPSUM CO., LTD: As Japan's largest plasterboard manufacturer, Yoshino Gypsum plays a major role in the Asian market by producing a wide range of high-quality gypsum products.

- Vg-orth GmbH & Co. KG: A German gypsum producer, Vg-orth invests in upgrading its manufacturing facilities to produce high-quality gypsum wallboards. Their contribution is primarily focused on the European market, producing gypsum plaster and wallboards for construction.

- LA MARUXIÑA: This company is mentioned as a player in the gypsum plaster market, likely a regional producer or supplier, particularly in Spain, focusing on specific segments or local distribution.

Gypsum Plaster Market Companies

- Saint-Gobain

- Knauf Gips KG

- Global Gypsum Company Co. LTD

- Escayescos, SL

- USG Corporation

- James Hardie Industries plc

- Georgia-Pacific Gypsum II LLC

- YOSHINO GYPSUM CO., LTD

- Vg-orth GmbH & Co. KG

- LA MARUXIÑA

Leaders' Announcements

- In March 2025, Researchers at the National Autonomous University of Mexico developed Sargapanel, a sargassum seaweed-based alternative wallboard. The team says that Sargapanels can replace traditional gypsum-based boards and tiles in wall and ceiling applications.

- In April 2025, Beijing New Building Materials (BNBM) raised its revenues from its gypsum wallboard business in 2024, with a 56% rise in gross profit. The group said that it continues to strengthen its gypsum wallboard market presence. Home renovations have now risen to 35% of business sales. Taishan Gypsum increased its share of BNBM's high-end product sales to over 2%.

Recent Developments

- In March 2025, the National Association of Home Builders (NAHB) said that more than 71 percent of U.S, the total annual imports of gypsum originated in Mexico. The association has highlighted the possibility of scarcity and an acute, sustained rise in building materials costs because of new tariffs.

- In March 2024, Gyproc India introduced a significant development at its Tiruvallur facility, revealing the production of low-carbon plasters. The initiative is expected to result in a substantial 40-50 percent reduction in the carbon footprint compared to existing Gyproc plasters throughout their entire lifecycle.

- In January 2024, Etex, the Belgium-based global building materials manufacturer and pioneer in lightweight construction, closed the acquisition of Australian construction materials company BGC's plasterboard and fibre cement businesses. Through this deal, Etex expands its sustainable activities in the attractive Australian and New Zealand markets, with significant growth opportunities.

Segments Covered in the Report

By Plaster System

- Manually-applied Plaster

- Machine-applied Plaster

- Finishes

By Raw Material

- Natural Gypsum

- Synthetic Gypsum

By End-use

- Residential

- Commercial

- Industrial

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting