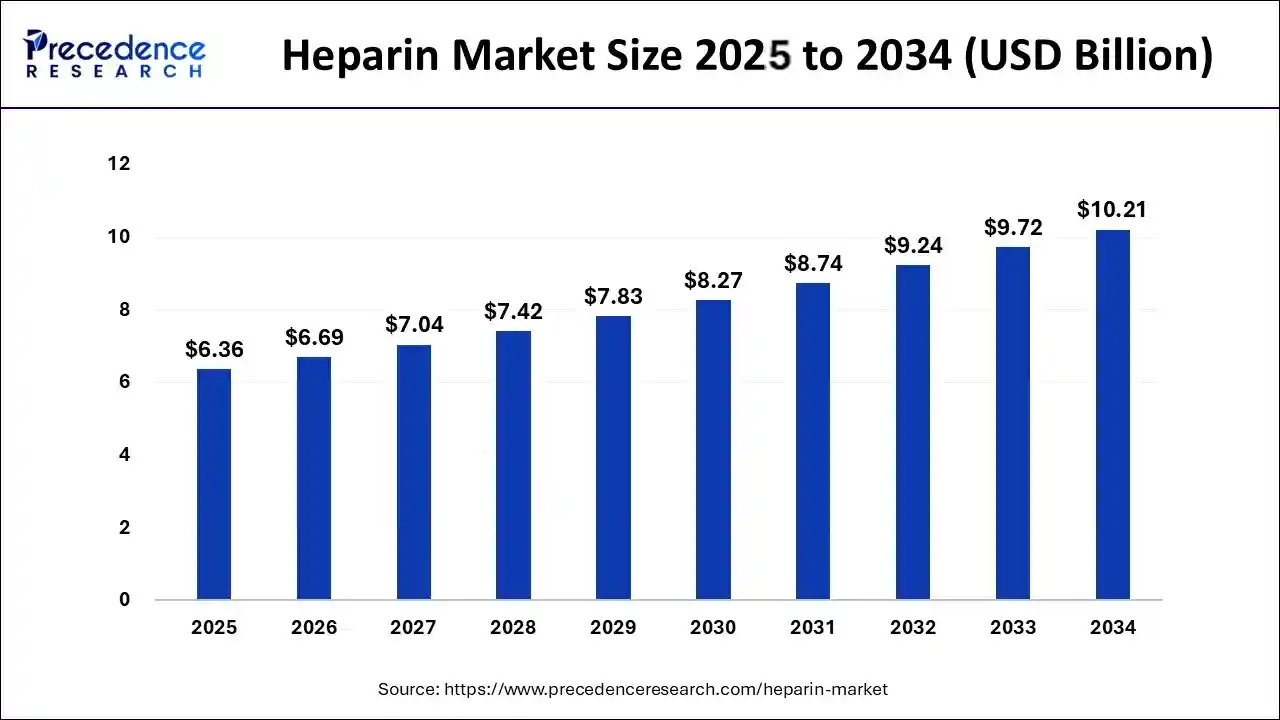

What is the Heparin Market Size?

The global heparin market size accounted for USD 6.36 billion in 2025, predicted to increase from USD 6.69 billion in 2026 to approximately USD 10.21 billion by 2034, growing at a CAGR of 5.37% from 2025 to 2034.

Artificial Intelligence: The Next Growth Catalyst in Heparin

AI is transforming the heparin market in three main areas: manufacturing, drug development, and patient management. AI not only automates production but also controls quality, and importantly, drives the company toward zero production errors. In drug discovery, AI accelerates the identification of new heparin therapies through predictive algorithms, rather than relying solely on trial and error. For instance, AI helps healthcare providers deliver personalized medicine by adjusting heparin dosages based on patient data, thereby improving safety and outcomes. AI also enables healthcare professionals to monitor patients in real-time during anticoagulant treatments. In logistics, AI predicts demand first and then reduces waste, making the supply chain more efficient. Additionally, AI-powered market intelligence tools analyze data to develop pricing and distribution strategies, ultimately enhancing market efficiency and access.

Heparin Market Growth Factors

One of the significant factors driving the growth of global heparin market is rising incidences of cardiovascular and venous thromboembolism. Deep vein thrombosis and pulmonary embolism harm around 900,000 people in the U.S. each year, as per the data published by the Centers for Disease Control and Prevention in 2018. This is expected to drive demand for heparin in the global market.

Another factor boosting the growth of global heparin market is rising geriatric population. The geriatric population is more vulnerable to various disorders such as orthopedic disorders and arthritis. In 2021, for example, it was anticipated that more over 350 million individuals worldwide had arthritis. As a result, the growing number of senior people suffering from orthopedic diseases drives up demand for surgical treatment, propelling the industry forward. Thus, this factor is supporting the growing demand for heparin in the market over the forecast period.

The COVID-19 pandemic was said to have had a positive influence on the global heparin market, boosting upper income for number of major players operating in healthcare sector. Furthermore, as the number of people infected with COVID-19 grows, so does the demand for heparin, which helps to control the symptoms of respiratory infections while also thinning the blood.

The technologically sophisticated products, regulatory approvals, and the launch of new products, cooperation agreement, and acquisition with other market players are all priorities for key competitors in the worldwide heparin market. These methods are likely to propel the global heparin industry forward. The government all around the world are collaborating with major market players for the growth and development of global heparin market. In addition, the government is also heavily investing in the launch of new products, which is contributing towards the global heparin market.

- The number of cardiovascular and thromboembolic disorder cases is increasing steadily, which in turn is leading to a higher demand for heparin therapies.

- The population of elderly people, who are more prone to getting orthopedic and circulatory conditions, is one of the main factors driving the need for anticoagulant treatments.

- The development of products through continuous innovations, better formulations, and the entry of biosimilar heparin products are all contributing to the increase in therapeutic outcomes.

- The pharmaceutical companies' strategic collaborations and investments, together with the government's initiatives, are making research on heparin and its global accessibility easier.

- Supportive regulations and approvals for advanced formulations are giving a boost to product portfolios and are also encouraging market expansion.

Strategic Overview of the Global Heparin Industry Market Outlook

- Market Growth Overview: The Heparin market is expected to grow significantly between 2025 and 2034, driven by the rising prevalence of coagulation disorders, rising surgical procedures, and innovation research and developments on creating new formulations and delivery systems for heparin and its various applications.

- Sustainability Trends: Sustainability trends involve the supply chain diversification and traceability, synthetic and bioengineered alternatives, waste reduction and green chemistry, measurement and reporting of environmental impact.

- Major Investors: Major investors in the market include Pfizer, Inc., Baxter International, Inc., and Sanofi.

- Startup Economy: The startup economy in the market is focused on biosynthetic and synthetic heparin, novel drug delivery systems, biosimilars and cost reduction.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 6.36 Billion |

| Market Size in 2026 | USD 6.69 Billion |

| Market Size by 2034 | USD 10.21 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.37% |

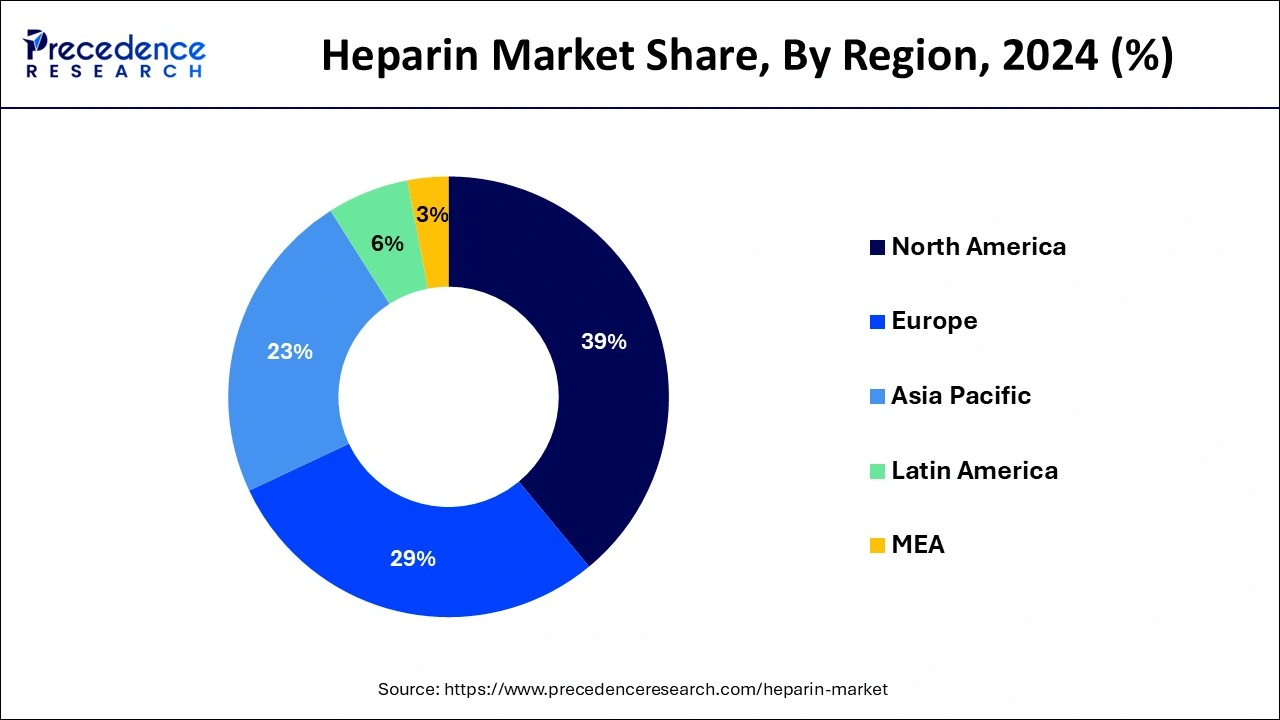

| Largest Market | North America |

| Fastest Growing Market | Asia-Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Route of Administration, Packaging, Container, Therapeutics, By Treatment, By Availability, By Application, By Source, By Ingredients, By Strength, By End Use, and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

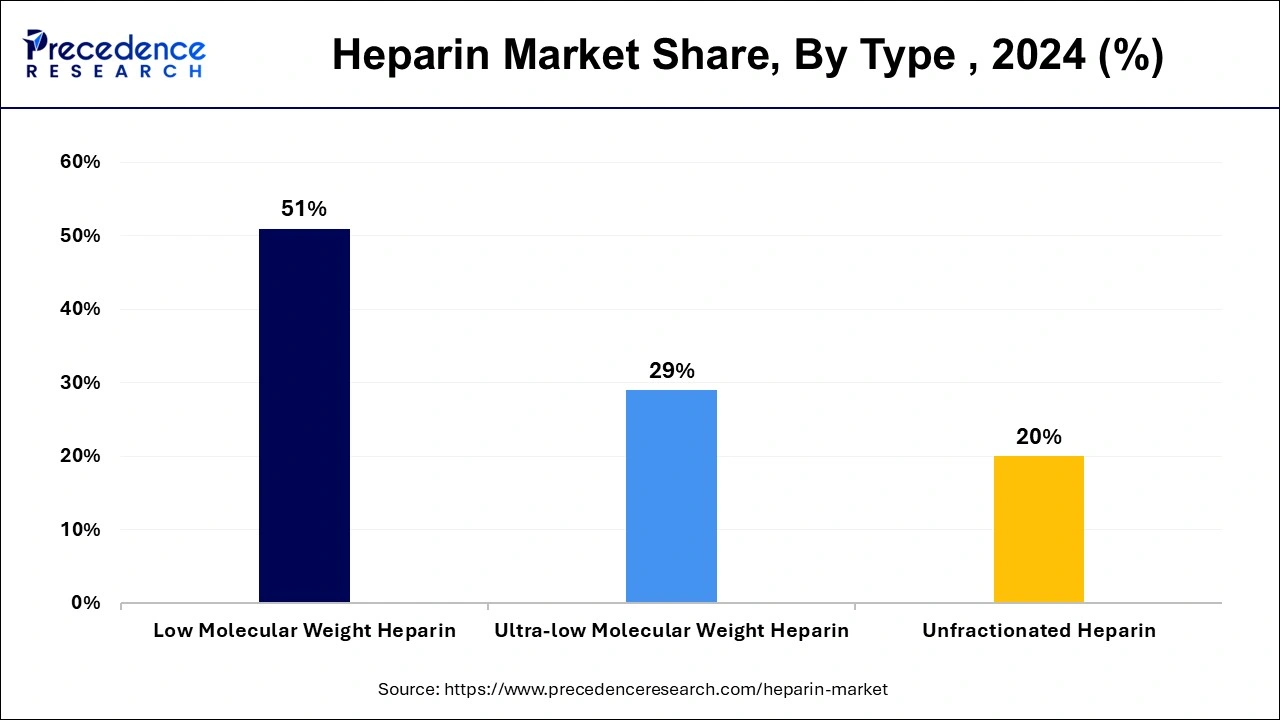

Type Insights

The low molecular weight segment accounted largest revenue share in 2023. The growth of the low molecular weight segment is being driven by growing adoption of this kind of products globally. In addition, the rising product launch by market players is driving the growth of segment. The introduction of low molecular weight heparin products to the global heparin market. For example, Valeo Pharma Inc., reported in November 2019 that they had submitted a new drug submission for a low molecular weight heparin biosimilar to Health Canada, which had been accepted for review.

The ultra-low molecular weight segment is fastest growing segment from 2024 to 2033. The growth of the ultra-low molecular weight is attributed to the launch of products with increased pharmacological properties.

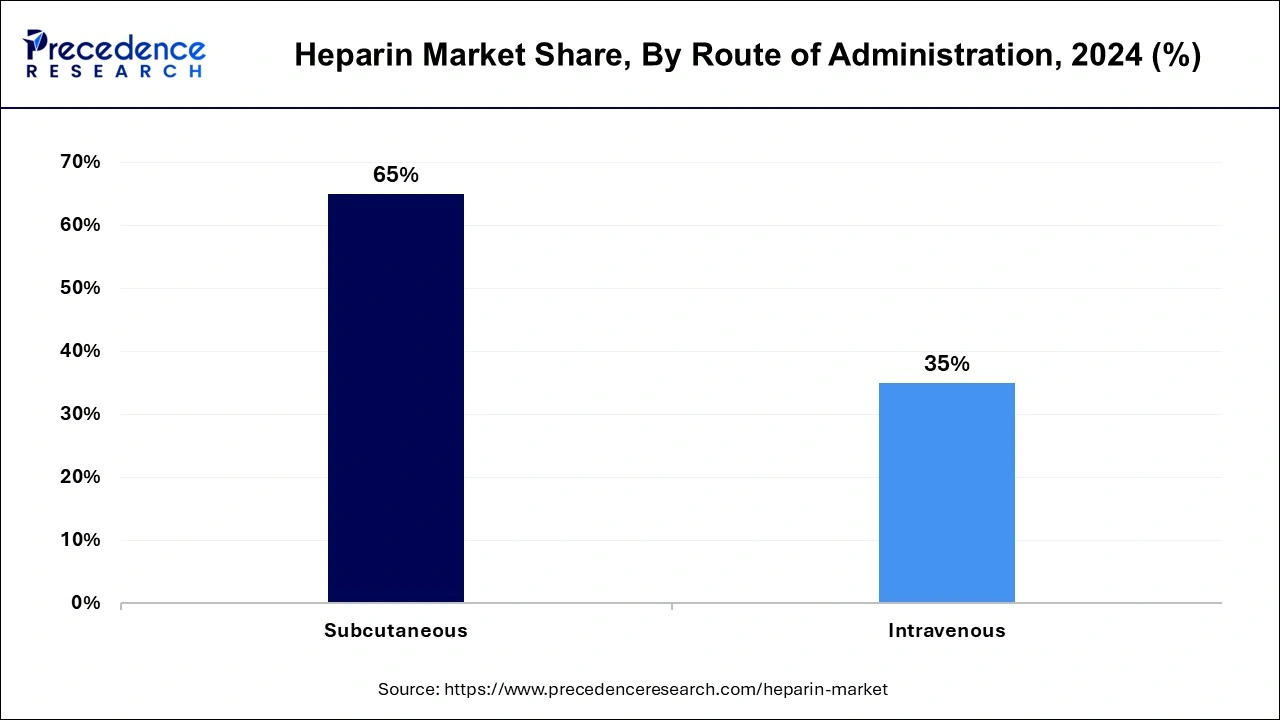

Route of Administration Insights

The subcutaneous segment dominated the heparin market in 2023. The growth of the subcutaneous segment is being driven by the growing adoption of low molecular weight heparin. The subcutaneous route of administration is a low-cost process that is carried out in hospitals.

The intravenous segment is fastest growing segment over the forecast period. It comprises a few of unfractioned heparin's most well-known intravenous product lines. The intravenous route of administration is widely adopted by healthcare practitioners.

Application Insights

The coronary artery disease segment has garnered highest market share in 2023. The growth of the segment is attributed to the rising prevalence of heart disorders. As per the American Heart Association, around 92.1 million American adults suffered from cardiovascular disease in 2018. Furthermore, cardiovascular disease is responsible for around one in every three deaths in the U.S., responsible for roughly 2,300 deaths per day.

The venous thromboembolism segment is expected to hit strong growth from 2024 to 2033. One of the key elements driving the growth of segment is increased awareness of thrombosis. The International Society on Thrombosis and Haemostasias, Inc. for example, has launched an online portal to raise thrombosis awareness among patients.

End Use Insights

The hospitals & ambulatory surgical centers segment dominated the heparin market in 2023. This is mostly due to an increased reliance on health care experts for product prescriptions and proper administration, particularly via intravenous infusion. In addition, growing hospital visits is also driving the growth of the segment.

Theclinics segment is fastest growing segment of the heparin market in 2023. Due to many of these medications are provided at dialysis clinics, among other places, the clinics category is predicted to account for highest market share in the global heparin market over the projected period.

Regional Insights

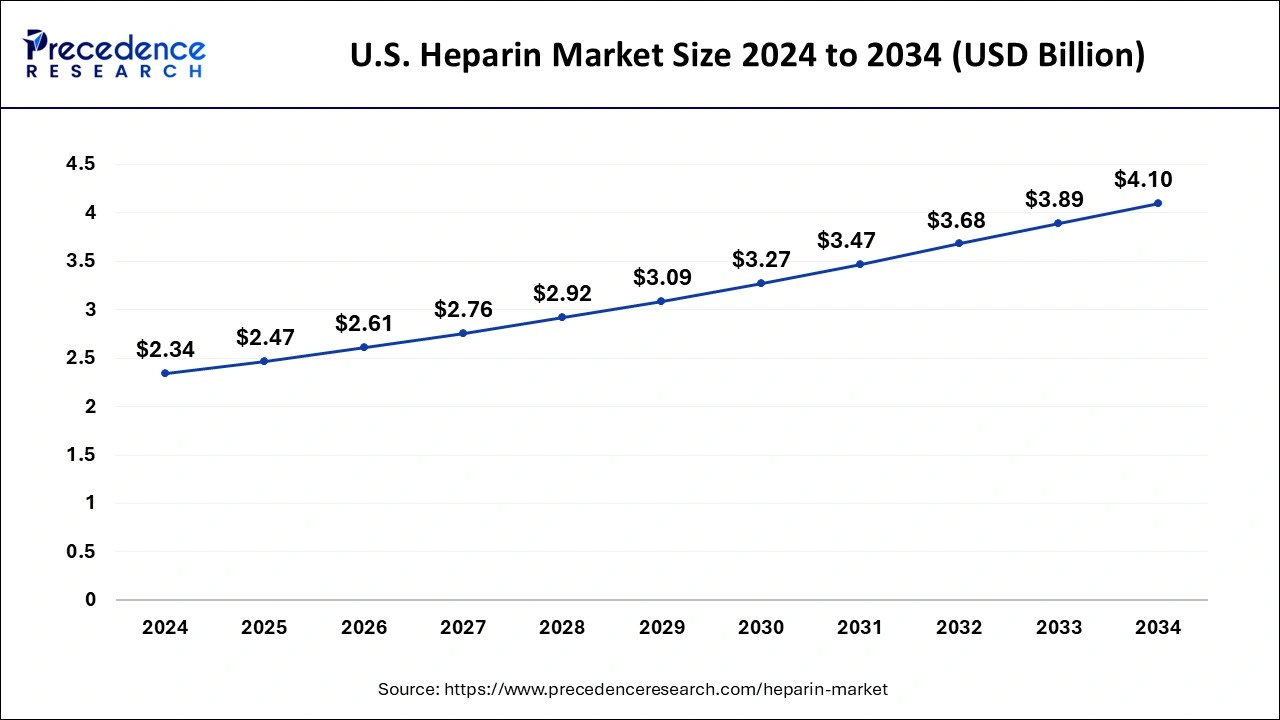

U.S. Heparin Market Size and Growth 2025 to 2034

The U.S. heparin market size is exhibited at USD 2.47 billion in 2025 and is projected to be worth around USD 4.10 billion by 2034, growing at a CAGR of 5.77% from 2025 to 2034.

North America has garnered the largest share in 2024. The growth of the heparin market in the North America region is being driven by rising incidences of cardiovascular disorders. As per the Centers for Disease Control and Prevention, approximately 12.1 million people in the U.S. will have atrial fibrillation by 2034. In addition, growing healthcare expenditure as well as expansion of healthcare industry are also driving the North America heparin market. The North America region was valued at USD 2.6 billion in 2024.

How is North America leading in the Heparin Market?

North America has the largest share in the heparin market mainly because of its great healthcare infrastructure, awareness about heart diseases, and modern diagnostic and treatment facilities. The demand for anticoagulants, the increasing number of old people, and continuous investments in pharmaceutical companies are all factors that support the growth of the market. On top of that, the availability of good reimbursement policies and the total acceptance of heparin-coated medical devices are other things that help the region grow.

United States Heparin Market Trends:

The U.S. occupies the primary position in the regional market with the application of heparin in a broad range of cardiovascular and surgical operations. State-of-the-art healthcare institutions, active clinical investigations, and a conducive regulatory environment are the main factors contributing to the constant demand. The introduction of new products in anticoagulant therapies and the diversifying of raw material sources are also the market's stability and sustainability.

Asia-Pacific is expected to develop at the fastest rate during the forecast period. China and India dominated the heparin market in Asia-Pacific region. The Asia-Pacific heparin market growth is attributed to the expansion of healthcare infrastructure. The other factors such as adoption of technologically advanced products, growing initiatives by government, and rising patient population are contributing towards the growth of Asia-Pacific heparin market.

How is Asia-Pacific performing in the Heparin Market?

Asia-Pacific is the area with the fastest growth rate, due to its large population, improvement in healthcare access, and increasing awareness about cardiovascular care. Heparin usage is being driven by the increase in surgical procedures and the prevalence of chronic diseases. The increased industrialization in pharma manufacturing and more investments in healthcare infrastructure are two of the factors that are continuing to push the market up.

China Heparin Market Trends:

China is a significant player in the heparin market, being both a leading producer and a rapidly developing consumer market. Healthcare reforms that are becoming more and more beneficial, R&D spending that is getting larger, and manufacturing capabilities that are being improved all contribute to the growth of the domestic market and the export potential. The country's heparin market is further stimulated by the broadened access to cutting-edge treatments and the government's adoption of supportive policies.

What are the driving factors of the Heparin Market in Europe?

Europe is a market that has already matured, which is supported by factors such as an increasing aging population and higher incidence of thromboembolic disorders, and also by advanced healthcare systems. The clinical practices and research initiatives never stop to improve, and that is one of the main factors driving the acceptance of heparin-based therapies. The regulations are very strict when it comes to quality and safety, and this, together with the increasing applications in surgery, leads to continuous market growth.

United Kingdom Heparin Market Trends:

The U.K. is a significant market among the regions as it uses a lot of heparins for treating heart diseases and in surgeries. The presence of advanced healthcare facilities, vigorous clinical research, and friendly regulatory settings guarantees a constant demand. New treatments for blood thinners and the opening up of new sources for raw materials contribute to the market's stability and sustainability.

Key Developments

- Fresenius Kabi declared 2 new presentations of heparin sodium in comfortable, ready to administer Freeflex IV bags in the U.S. in April 2021. In 2018, Fresenius Kabi introduced heparin sodium in ready to administer non DEHP Freeflex bags, expanding the firm's critical care portfolio.

- Meitheal Pharmaceuticals stated in February 2020 that the Food and Drug Administration had approved extra manufacturing capacity and future facility expansion plans for the manufacture of Heparin Sodium Injection, USP.

- B. Braun Medical Inc. introduced Heparin Sodium Injection, USP in April 2019, the first Heparin 5,000 USP Unit/0.5 ml prefilled syringe with attached safety needle for intravenous and subcutaneous usage in the U.S.

- Amphastar Pharmaceuticals Inc. gained Food and Drug Administration approval for semi-purified heparin at Amphastar Nanjing Pharmaceuticals and the manufacture of heparin sodium USP at International Medication Systems, Ltd. in June 2018. By enhancing its product offerings, the corporation was able to add value to its business portfolio.

- The U.S. Food and Drug Administration granted Mylan approval for its Abbreviated New Drug Applications for Heparin Sodium Injection USP, 5,000 USP/mL, 1,000 USP/mL, 10,000 USP/mL, and 20,000 USP/mL, all of which are wrapped in multi-dose vials, in December 2017.

- In September 2025, Bioiberica will celebrate its 50th anniversary at CPHI Worldwide 2025, launching a new brand identity and website, while exploring innovative applications for heparin molecules with global research partners.

https://nutraceuticalbusinessreview.com - In July 2025, B. Braun Medical Inc. launched Heparin Sodium Injections in the U.S., enhancing its portfolio with 25,000 Units in 0.45% Sodium Chloride, marking the largest Heparin Premixed bag offering available.

https://lvb.com/b-braun-launches-largest-u-s-premixed-heparin-line/

Heparin Market Value Chain Analysis

- R&D: It is all about the discovery, synthesis, and characterization of heparin compounds first to ensure therapeutic efficacy and then to guarantee biochemical stability.

Key Players: Pfizer Inc., Sanofi S.A., LEO Pharma A/S, Baxter International Inc. - Clinical Trials and Regulatory Approvals: The primary focus is on safety testing, efficacy testing, and the process of seeking approval for medical and therapeutic use.

Key Players: Pfizer, Sanofi, and LEO Pharma - Formulation and Final Dosage Preparation: This step entails transforming purified heparin into forms that can be injected or otherwise used while maintaining uniformity and sterility.

Key Players: Baxter International Inc., Fresenius Kabi, and B. Braun - Packaging and Serialization: Heparin products are packaged in such a way that their quality and authenticity are assured through traceable packaging.

Key Players: Baxter International Inc., Pfizer Inc., Sanofi - Distribution to Hospitals, Pharmacies: The responsibility of logistics and cold-chain transport is to deliver the drug in a manner that is both efficient and compliant.

Key players:McKesson, AmerisourceBergen, and Cardinal Health - Patient Support and Services: Patient education, dosage monitoring, and post-treatment support are some of the ways that therapeutic compliance and outcomes are improved.

Key Players: Sanofi and LEO Pharma

Heparin Market Companies

- GlaxoSmithKline plc (GSK):

GSK has a presence in the heparin market primarily through strategic alliances for distribution in emerging markets and, most recently, a collaboration with Sanofi to develop a new low molecular weight heparin (LMWH) biosimilar. Their contribution involves leveraging their commercial capabilities to expand market reach and diversify their product offerings. - Pfizer, Inc:

Pfizer is a dominant entity in the global heparin market with a strong product portfolio, including Fragmin (dalteparin, an LMWH) and Heparin Sodium Injection. They are a key manufacturer of heparin active pharmaceutical ingredients (API) and provide critical anticoagulant therapies used extensively in hospitals and clinics worldwide. - Baxter International, Inc:

Baxter is a major global supplier of heparin products, including Heparin Sodium & 0.9% Sodium Chloride Injection, and plays a key role in supporting the growth of the market. Their products are vital in various medical procedures, such as dialysis and cardiac surgery, contributing to overall operational reliability in healthcare settings. - Leo Pharma A/S:

Leo Pharma focuses on the development and marketing of heparin in niche therapeutic domains, with products like Innohep (tinzaparin) used for the treatment of venous thromboembolism. They are a prominent player in the European and North American markets for LMWH. - Sanofi:

Sanofi is a major global player in the heparin market, known for its leading product Clexane (enoxaparin), which is a standard LMWH used for preventing and treating blood clots. They are continuously engaged in R&D and strategic partnerships to strengthen their position in the thrombosis therapy area. - Dr Reddy's Laboratories Ltd.:

Dr Reddy's primarily contributes to the market by offering cost-effective generic versions of heparin products, thus increasing accessibility and affordability of this essential medication in various markets, particularly in emerging economies. - Aspen Holdings:

Aspen Holdings (Aspen Pharmacare plc) is a significant player in the global heparin market, contributing to the supply chain and manufacturing of heparin and LMWH products. They play a role in ensuring the availability of these critical medicines across various regions, with an emphasis on local manufacturing to capture market share. - B. Braun Medical Inc:

B. Braun is involved in developing, manufacturing, and marketing innovative medical products and services, including heparin solutions and advanced drug delivery systems. Their contribution lies in emphasizing the quality and delivery of heparin products within clinical settings. - Fresenius SE & Co. KGaA:

Fresenius Kabi, a subsidiary, is a key manufacturer and supplier in the heparin market, focusing on products for infusion, transfusion, and clinical nutrition. The company has expanded its manufacturing capacity and provides essential, high-quality heparin products to meet global demand in hospitals and clinics. - Teva Pharmaceutical Industries Ltd.:

Teva is a significant provider of generic pharmaceuticals, including various heparin formulations, making these medications more accessible and affordable to a wider population. They focus on the development and marketing of heparin in niche therapeutic domains and contribute to the competitive pricing landscape of the market.

Segments Covered in the Report

By Type

- Low Molecular Weight Heparin

- Ultra-low Molecular Weight Heparin

- Unfractionated Heparin

By Route of Administration

- Intravenous

- Subcutaneous

By Packaging

- Glass

- Plastic

By Container

- Bottles

- Bags

- Vials

- Others

By Therapeutics

- Cardiovascular

- Respiratory

- Oncology

- Nephrology

- CNS

- Others

By Treatment

- Deep Vein Thrombosis

- Pulmonary Embolism

- Arterial Thromboembolism

- Others

By Availability

- Raw

- Processed

By Application

- Venous Thromboembolism

- Atrial Fibrillation

- Renal Impairment

- Coronary Artery Disease

- Others

By Source

- Bovine

- Porcine

By Ingredients

- Sodium

- Calcium

- Others

By Strength

- 10 Unit

- 100 Unit

- 1000 Unit

- 5000 Unit

- 10000 Unit

- 25000 Unit

- Others

By End Use

- Hospitals

- Clinics

- Homecare

- Ambulatory Surgical Centres

- Others

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy and Drug Store

- Online Pharmacy

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting