What is Humanoid Robot Market Size?

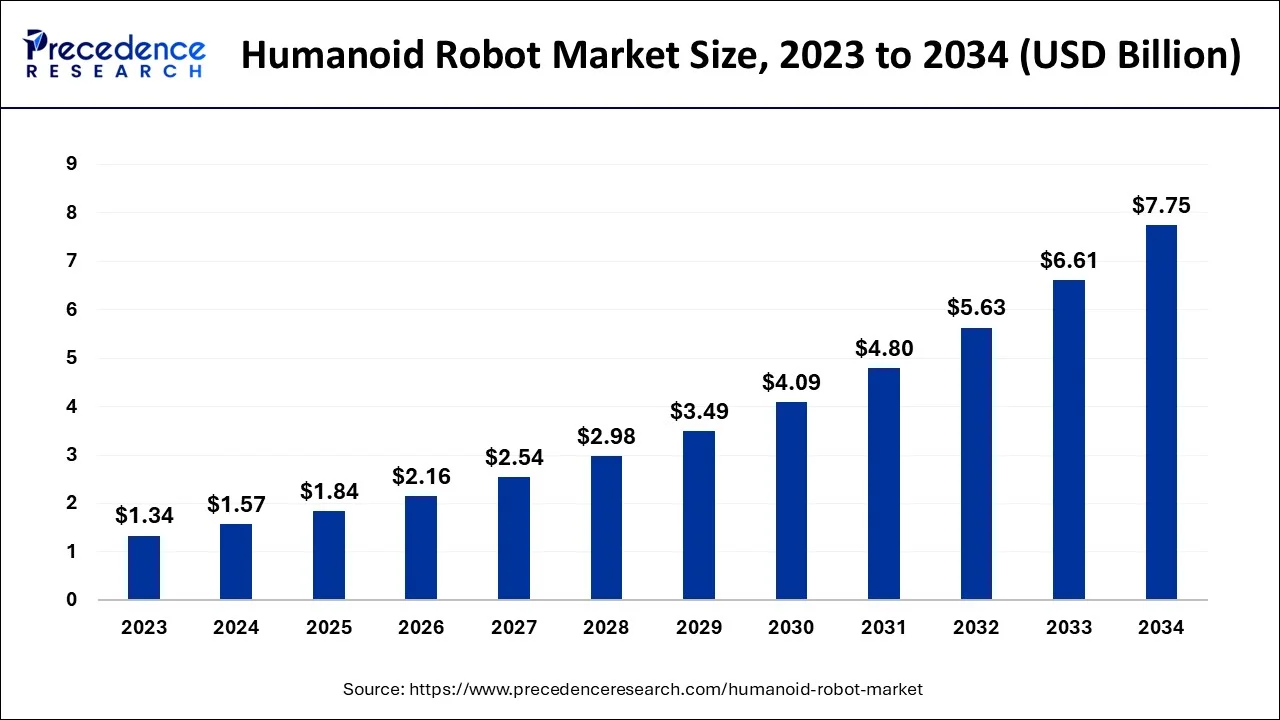

The global humanoid robot market size is calculated at USD 1.84 billion in 2025 and is predicted to increase from USD 2.16 billion in 2026 to approximately USD 8.78 billion by 2035, expanding at a CAGR of 16.91% from 2026 to 2035.

Market Highlights

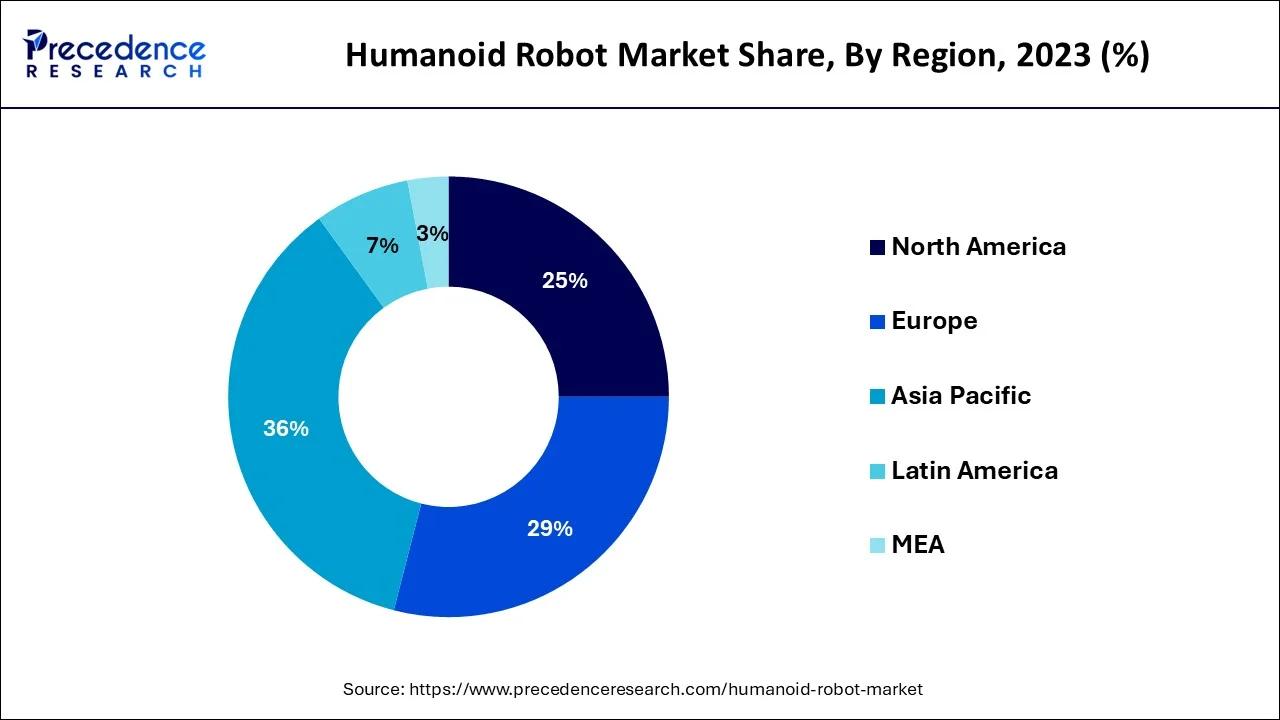

- By geography, the North America accounted for the maximum revenue share in 2025.

- By motion type, the wheel drive segment has the major market share from 2026 to 2035.

- By motion type, the biped segment had a maximum share in 2025.

- By component, the software segment had the biggest revenue share in 2025 and is predicted to have the highest CAGR from 2026 to 2035.

- By component, the hardware component is anticipated to grow at the quickest pace from 2026 to 2035.

- By application, the personal assistance & caregiving segment is predicted to dominate the market.

- By application, the entertainment segment is predicted to be the fastest growing in 2025.

Market Size and Forecast

- Market Size in 2025: USD 1.84 Billion

- Market Size in 2026: USD 1.79 Billion

- Forecasted Market Size by 2035: USD 8.78 Billion

- CAGR (2026-2035): 16.91%

- Largest Market in 2025: North America

- Fastest Growing Market: Asia Pacific

Market Overview

The primary factors driving the growth of the humanoid robot market are the enhanced use of humanoid robots for surveillance and security applications, including detection of unauthorized intrusion and terror activities, improved use of AI robots in dangerous areas, and research and space investigation enabling connectivity from a distant location.

A further market driver for humanoid robots is the rapid expansion of autonomous technologies to enhance customer interaction and experience and the growing demand for retail robots. For instance, RoboBee is a small robot able to partly untether flight built by a Harvard University research robotics team. The RoboBee project aimed to create a completely autonomous swarm of flying robots for surveillance, search and rescue, and artificial pollination.

Since people are becoming more eager to have robotic assistants around, the market for humanoid robots is also expanding. One of the reasons for this is that the population is aging. Humanoid robots help seniors with tasks that are too challenging or hazardous for them, such as washing heavy objects. Nursing home residents are frequently elderly and frail, making them more susceptible to accidents and diseases. As a result, the demand for humanoid robots for caregiving has increased.

Specifications of Various Humanoid Robots

| Name | ASIMO | NAO | iCub | REEM | SOPHIA |

| Height(cm) | 130 | 57 | 100 | 170 | 182 |

| Weight(kg) | 54 | 27 | 36.5 | 60 | 40 |

| Degrees of Freedom | 34 | 25 | 53 | 22 | 22 |

| Speed | 9 km/hr | 1.2km/ hr | N/A | 1.4 km/hr | N/A |

| Processor | Mobile | ATOM Z530 1.6 GHz CPU | PC104 | NVIDIA | N/A |

| Unit | Pentium III-M 1.2 GHz | 1/2/4/8 GB RAM |

Motherboard PB-945+, with Intel |

Jetson™ TX2 |

Market Outlook

- Start-up Ecosystem:The start-up growth has witnessed an immense transition due to the research-related prototypes and mass market production. Learning the count of demand, the start-ups have made their space with the rise of billions in equity funding.

- Industry Growth Overview:The industry growth is accelerating with the growing trend and demand for humanoid robots in most sectors to scale up the business and advance the existing human-centric infrastructure. Alongside the hardware and software space is also gaining massive profit in the humanoid robot market with the advancement in exemplifying AI.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.84 Billion |

| Market Size in 2026 | USD 1.79 Billion |

| Market Size by 2035 | USD 8.78 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 16.91% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Motion Type, By Component and By Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Increase in sales of the professional service robots

According to the International Federation of Robotics (IFR) "World Robotics 2022 - Service Robots" report published in 2022, sales of professional service robots increased by 37%. Europe had the highest growth rate, with a 38% market share, followed by North America (32%) and Asia (30%). At the same time, sales of new consumer service robots increased by 9%.

Restraints

Risk of job automation

The practice of replacing human labor in the workplace with computer-controlled devices and other electronics is known as job automation. Automation is gradually reshaping the workplace, from the production of AI tools to an increase in IoT usage statistics. Every year, numerous medium-skilled manufacturing and office jobs are lost.

According to the Office for National Statistics (ONS), 1.5 million people in England are at greater risk of losing their jobs due to automation in 2019. This hinders the expansion of the humanoid robot industry due to the possibility of unemployment.

Opportunities

Integration of AI

Across the global humanoid robot market, robotics research is becoming more focused on AI. Previously, humanoid robot research focused on developing automated machines that looked and behaved like humans. However, more researchers have begun to focus on integrating AI into these robots to improve their performance and make them more autonomous in recent years.

This shift is most visible in Fully Automated Living Systems (FALLS), which are robot systems that operate and learn without human intervention or supervision. So far, FALLS has performed well in tasks such as navigation and object manipulation—but there is still scope for improvement.

Challenges

In untested environments, robot performance is unpredictable due to a lack of high-level interfacing.

Robots now need to do much more than pick up things, put them in their proper places, and help humans. Due to the increased use of robots in various industries, including logistics, public relations, personal and caregiving, medical, education, and entertainment sectors, the demand for robots with advanced features is growing.

As a result, there is a need to develop humanoid robots with more efficient hardware, tilt, position, force, vision, and other sensors. But outer space environments are largely unknown and unexplored. The long distances that separate operators and deployed systems cause significant delays in communications, and GPS infrastructure needs to be created to provide necessary positioning information.

The unstructured, sandy, and rocky terrain of extraterrestrial body surfaces makes navigation challenging, and micro-gravity adds additional locomotion difficulties.

Segment Insights

Motion Type Insights

The market is divided into two segments based on motion type: wheel drive and biped. During the forecast period, the wheel drive segment has the largest market share. Wheel-drive robots are designed and programmed to navigate their surroundings.

As a result of their advantages, the demand for wheel-type robots in military and defense applications is expected to grow. Furthermore, wheel-drive humanoid robots are used as entertainment in amusement parks, science events, and theme parks. These factors are expected to drive market growth in the coming years.

In 2022, the biped motion type had a larger share of the global humanoid robot market. Humanoids look human-like if the robot walks on two legs like humans. A bipedal walking robot is a type of humanoid robot that mimics the human movement and is programmed to perform specific tasks.

The "Bipedal Walking Robot" not only performs locomotion with the help of a servomotor; it also automatically stands up when it falls and is controlled wirelessly with a remote control. Most humanoid robot manufacturers are concentrating on their designs for bipedal robots. Biped product types are also gaining popularity due to their widespread use in construction, manufacturing, and other industries.

For instance, Atlas is a bipedal humanoid robot produced primarily by the American robotics firm Boston Dynamics. Atlas has two vision systems and hands with advanced motor skill capabilities. Its limbs have 28 degrees of freedom.

Component Insights

Based on components, the market is divided into software and hardware. The software segment had the highest revenue share in 2023 and is anticipated to have the highest CAGR from 2025 to 2034. As technological advancements increase the complexity of features such as AI and autonomous operations, the value of the software component in the robot will grow faster.

The advantage of software over hardware is that the software assists the complex functionalities to process efficiently and accurately. For instance, the iCub-HRI is a Software Framework for Complex Human-Robot Interaction Scenarios on the iCub Humanoid Robot.

On the other hand, the hardware component is anticipated to grow at the fastest pace over the forecast period. Humanoid robots are greatly enhanced by hardware components that give them a human appearance. The traditional approach of highly rigid robots gradually shifts to compliant and dynamic ones for safer human interaction and more efficient locomotion.

The control system is an essential component of a humanoid as it processes data from the sensor system and sends commands to the actuators to act based on the decision output. This led to an increase in demand for hardware components.

Application Insights

Based on the application, the humanoid robot market is segmented into Research & Space Exploration, Education, Entertainment, Security & Surveillance, Personal Assistance & Caregiving, and Others. The personal assistance & caregiving segment, which provides patients with personal care at home and in hospitals, is expected to dominate the market.

Humanoids care for the elderly and patients, assisting them in daily activities such as delivering medicine on time. These humanoids are also programmed to perform routine tasks usually performed by caregivers, such as monitoring vital signs, administering medications, aiding feeding, and alerting healthcare professionals in an emergency.

On the other hand, the entertainment segment is expected to be the fastest-growing in 2022. Humanoid robots have a long history in the entertainment industry, from when the first robotic arms were used to transport cameras to difficult filming locations where humans were present. Furthermore, technological advancements have increased the reach of humanoid robots in movie production and filming by 45%.

Humanoid robots are mainly used to demonstrate actions that humans would be unable to perform. Another life-threatening test is the automobile test, in which humanoid robots are the only ones capable of adequately assessing the scenario and its consequences. This industry is growing by double yearly as safety certification is becoming mandatory for many products.

Regional Insights

What is the U.S. Humanoid Robot Market Size?

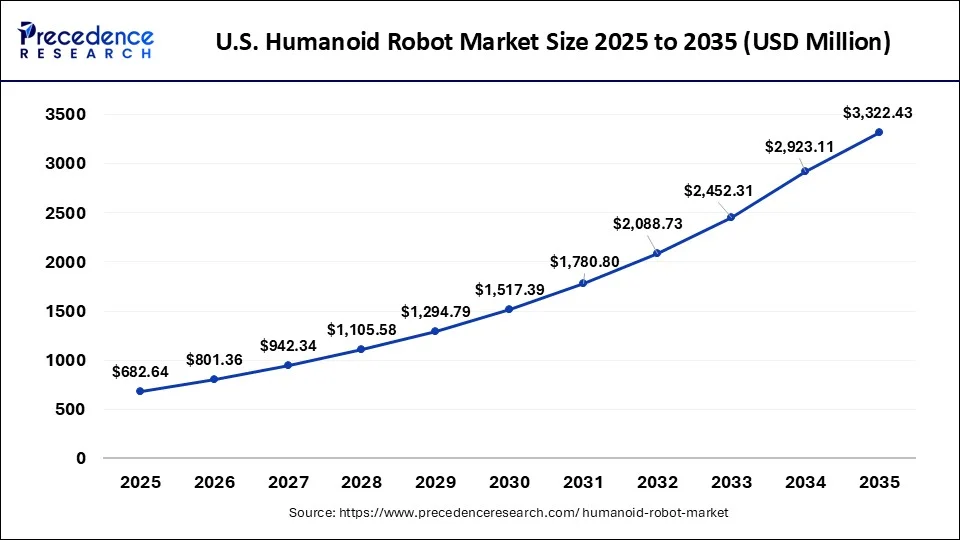

The U.S. humanoid robot market size is estimated at USD 682.64 million in 2025 and is expected to be worth around USD 3,322.43 million by 2035, rising at a CAGR of 17.15% from 2026 to 2035.

North America accounted for the largest revenue share in 2025, owing to humanoid robot technologies and enhanced infrastructure advancement. There is a rise in demand for humanoid robots in healthcare and the educational sector for caregiving and teaching in North America. Nonetheless, increasing investment by the government and key players for rising application areas is also driving the market's revenue. For instance, Nadine, manufactured by Hanson Robotic, is a gynoid humanoid public robot that responds to greetings, maintains eye contact, and remembers all conversations with it.

Nadine answers questions in various languages autonomously and simulates emotions through gestures and facial expressions depending on the subject of communication with the operator. Nadine spent six months at Bright Hill Evergreen Home in Singapore, from late 2020 to April 2021, assisting the elderly in playing Bingo and interacting with them.

U.S. Humanoid Robot Market Trends

The U.S. market is gaining momentum as advancements in artificial intelligence, machine learning, and sensor technologies significantly improve robot autonomy and human-robot interaction. Growing demand from sectors such as healthcare, logistics, retail, and defense is driving adoption, particularly for tasks involving assistance, inspection, and customer engagement.

The Asia Pacific market is expected to grow fastest due to technological advancement and increased demand to improve customer experience in China and Japan. Other market revenue growth factors include falling hardware costs and rising retail demand. Furthermore, the spread of coronavirus has increased the need for isolation and medical assistance, increasing the demand for robotic assistance and driving industry growth. For instance, Grace, a humanoid robot that the Hong Kong-based robotics firm expected to revolutionize healthcare, was introduced in 2021.

China Humanoid Robot Market Trends

China's market is rapidly evolving as the country prioritizes robotics and artificial intelligence as strategic industries to support industrial upgrading and economic growth. Strong government backing, including funding programs and policy initiatives, is accelerating research, development, and commercialization of humanoid robots. Rising demand from manufacturing, healthcare, education, and service sectors is driving adoption for tasks such as assistance, inspection, and customer interaction.

Grace, designed as a doctor's assistant, is equipped with sensors, such as a thermal camera that detects a patient's temperature and pulse, to assist doctors in diagnosing illness and administering treatments. Another example of a humanoid is Manav. It is India's first three-dimensional printed humanoid robot. It performs push-ups and headstands, and it plays football.

What Advancements of Europe are Bringing Success to the Humanoid Robot Market?

The major regional advancements are the brand-new marketing skills that are largely promoting ‘Physical AI'. Europe has fixed its position in this market with Neura Robotics in Switzerland/Germany, 1X in Norway, Oversonic Robotics in Italy, and PAL Robotics in Spain. These various specialised robot designs have boosted the regional market's growth. Europe's latest progress in the NVIDIA partnership and further acquisition strategy has long motivated the advancements to introduce variations to the robot design.

How is Latin America Supporting the Humanoid Robot Market?

Latin America's support for this market has stretched to the promising specialised social robotics, comprehensive technology, and general research and development (R&D). Mexico is popular for its most modernised humanoid robots that indirectly support the growth of the regional and global market. FRED and EVA, an affordable open source robotics platform established by researchers from Brazilian and Mexican institutions, is an inspiration to many regions. The popular support for this market is the Spanish speech transcription research.

Humanoid Robot Market Companies

- Samsung Electronics

- DST Robot Co. Ltd.

- Qihan Technology Co.

- Kawada Robotics

- Toshiba

- Robo Garage Co.

- Honda Motor Co. Ltd.

- Engineered Arts

- Instituto Italiano Di Technologia

- WowWee Group

- Toyota Motor Corporation

- ROBOTICS

- Ubtech Robotics

- Pal Robotics

- SoftBank Corporation

- Hanson Robotics

Recent Developments

- Xiaomi introduced its CyberOne Humanoid robot in August 2022, recognizing emotions with facial expressions and voice.

- After receiving an upgrade to its facial expression capabilities in August 2022, Ameca, Engineered Art's highly advanced humanoid robot, will be able to perform frowning, grinning, and winking in a mirror, as well as squeezing its lips.

- Tesla, an developing player in the worldwide humanoid robot market, declared in June 2022 that its humanoid robot Optimus would be available in September 2022.

- As the spread of COVID-19 for service automation accelerates in various world segments, a humanoid named 'Sophia' was mass-produced in January 2021.

- UBTECH Inc. collaborated with Ricoh Inc. in October 2021 to develop and maintain the UVC High Power Ultraviolet Disinfection System.

- Elon Musk, the co-founder of Tesla Inc., developed a humanoid for dangerous work that humans cannot perform for human protection in August 2021.

- Ford became the first client to incorporate Agility Robotics' humanoid robot, Digit, into a factory setting in January 2020.

Segments Covered in the Report

By Motion Type

- Wheel Drive

- Biped

By Component

- Software

- Hardware

By Application

- Research & Space Exploration

- Education

- Entertainment

- Security and Surveillance

- Personal Assistance and Caregiving

- Others

ByRegion

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting