What is the Leisure Boat Market Size?

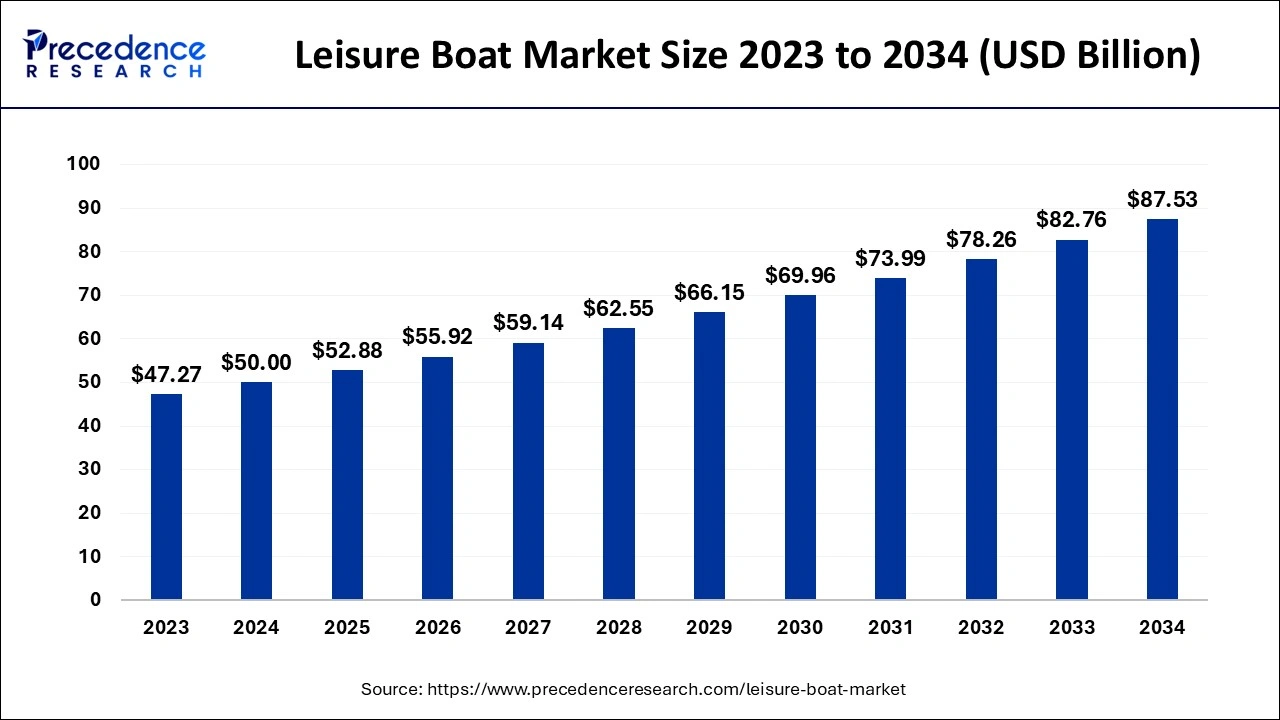

The global leisure boat market is expected to be valued at USD 52.88 billion in 2025 and is predicted to increase from USD 55.92 billion in 2026 to approximately USD 92.12 billion by 2035, expanding at a CAGR of 5.71% over the forecast period from 2026 to 2035.

Market Highlights

- Asia-Pacific region held the largest market share in 2025.

- By Type: the new leisure boats segment held the maximum market shares in 2025.

- By Product: the motorized segment held the largest market shares in 2025.

How Does the Diversity of Leisure Boats Support Industrial Growth?

The leisure boat market refers to the industry that encompasses the manufacturing, sale, and rental of boats designed for recreational purposes. The boats are primarily used for leisure activities such as cruising, fishing, watersports, and entertainment. An important sector of the worldwide boating market is recreational boats. Its size might change depending on local factors, including geography, population, and consumer desire for water-based leisure activities. Boats of many kinds, including motorized yachts, sailboats, pontoon boats, fishing boats, speedboats, personal watercraft, and opulent cruisers, are available in the market. Each variety is made to satisfy a certain recreational need or inclination. The traditional target market for recreational boats is made up for people or families who like to be in the water. They could have a variety of hobbies, from lovers of fishing and water activities to those looking for rest and luxury.

Technological improvements and changing customer tastes have an impact on the leisure boat industry. Innovative boat designs that improve comfort and convenience, eco-friendly propulsion options, and the integration of cutting-edge navigation and entertainment systems are all current trends. North America, Europe, Asia-Pacific, and coastal places with access to seas, lakes, and rivers are popular destinations for leisure boating. Related industries, including marinas, boat rentals, boat insurance, maintenance and repair services, and accessory producers, are also part of the leisure boat market. These sectors maintain the ecology and offer crucial assistance to boat owners.

As disposable incomes rise, lifestyles change, and interest in outdoor activities rises, the leisure boat industry has seen a steady rise in popularity around the globe. Significant developments in boat technology have been made in the industry, including the incorporation of cutting-edge navigation systems, increased fuel efficiency, eco-friendly propulsion systems, and improved safety measures. Electric and hybrid boats have become more popular as sustainability and environmental issues have gained more attention.

Due to their lower emissions and less dependency on fossil fuels, these boats are becoming more popular. Boat-sharing and rental services have increased as a result of the emergence of sharing economy concepts. These platforms make boating more accessible to a wider audience by enabling inexpensive access to boats without the requirement for ownership. Numerous factors including the state of the economy, governmental rules, and others, have an impact on the leisure boat market's development and trends. A wide variety of boats made for leisure activities are included in the leisure boat market. It is a multi-billion-dollar sector that serves the various needs of customers and consists of producers, dealers, service providers, and ancillary businesses.

Leisure Boat Market Growth Factors

The leisure boat market is expanding as a result of the growth of the tourist sector and the rising popularity of recreational activities. The demand for boat rentals and boat excursions has increased as more tourists and vacationers seek out boating activities in coastal regions, lakes, and rivers. The pursuit of a lifestyle centers around water-based recreation, and the demand for outdoor leisure activities fuels market growth. The market for leisure boats is fueled by the perception that boating is a means to unwind and spend quality time with family and friends.

The recreational boat industry is expanding as a result of the rising popularity of water sports, including wakeboarding, waterskiing, jet skiing, and paddleboarding. These activities frequently require specialized vessels or personal watercraft, which increases demand for different kinds of leisure boats.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 52.88 Billion |

| Market Size in 2026 | USD 55.92 Billion |

| Market Size by 2035 | USD 92.12 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.71% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type and By Product |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Tourism and travel

Boating is closely associated with tourism and travel, with many popular tourist destinations offering boat rental and leisure activities, contributing to market growth. Rising disposable incomes and economic growth in many regions have increased consumer spending on leisure activities, including boating. The desire for outdoor recreational activities such as fishing, watersports, and cruising has fueled the demand for leisure boats. The continuous development of innovative boat technologies and features has attracted consumers looking for enhanced safety, comfort, and convenience.

Restraint

High prices and cyclical demand

Potential purchasers may face considerable obstacles due to the price of buying and maintaining a recreational boat. Boats can have significant up-front expenditures, continuing maintenance costs, storage fees, insurance premiums, and fuel costs, especially bigger or more opulent versions. The hefty ownership costs can prevent some new key players from entering the market. Boating is frequently a seasonal pastime, occurring only during the warmer months or under certain weather conditions. Manufacturers, dealerships, and service providers may face challenges as a result of this seasonality since they may see changes in demand and income throughout the year. Seasonal commercial operations might affect their viability.

Opportunity

Electric and sustainable boating

The market for recreational boats has a lot to gain from the growing emphasis on sustainability and environmental responsibility. Eco-friendly materials, hybrid propulsion systems, and electric boat development and adoption might draw customers who are concerned about the environment and help the industry expand. The leisure boat industry has chances for innovation due to ongoing technological improvements. The boating experience may be improved and expanded upon by integrating smart features, cutting-edge navigation systems, digital connections, and upgraded onboard entertainment systems.

Challenge

Compliance with environmental regulations and safety

The recreational boat market may face difficulties as a result of environmental rules and limitations. Manufacturers and boat owners may incur higher expenditures as a result of regulations governing emissions, hazardous waste disposal, the preservation of marine ecosystems, and limits on boating in certain locations. Some firms may find it difficult to invest in environmentally friendly practices and adapt to changing rules. Compliance with boating rules and safety standards is essential, but it may be difficult for boat owners. It takes constant work and awareness to stay on top of evolving legislation, maintain safety gear, and promote appropriate boating practices.

Segment Insights

Type Insights

New leisure boats held the majority of shares in 2023. The market for brand-new, unused boats is represented by the sector of new leisure boats. Economic situations, customer tastes, and technological developments all have an impact on it. The desire for the newest boat models with cutting-edge features and designs is what fuels the growth of the leisure boat market. It serves customers who want the security of owning a brand-new boat, which is frequently supported by warranties and after-sales service.

Product Insights

Motorized boats held the maximum shares in 2023. Boats with engines, such as sterndrives, outboard motors, or inboard motors, fall under the category of motorized boats. These boats are more versatile, convenient, and fast for a variety of recreational uses. The demand is growing and rising from people and families that enjoy water sports, fishing, cruising, and other motorized boating activities, which account for a sizeable percentage of the leisure boat industry. They are selected as they can cover greater distances, accommodate more people, and operate more effectively on the water.

Regional Insights

What Made the Asia Pacific Dominant in the Market in 2025?

The leisure boat industry held the maximum shares in the Asia-Pacific region. The leisure boat market in the Asia-Pacific region is experiencing significant growth, driven by rising disposable incomes, increasing urbanization, and a growing interest in recreational boating among the expanding middle class. A recreational boating culture is emerging in the Asia-Pacific region, with a focus on speedboats, luxury yachts, and watersports.

India Leisure Boat Market Trends

With a major share, India is encouraging inventions in the leisure boat market, such as Navalt's Solar Boats, which provides diverse electric and solar-electric boats, such as the leisure craft Dialga and the workboat Barracuda, which represents India's effort in green marine tech. Technological improvements in boat design, fuel efficiency, and safety systems are enhancing user experience and operational reliability.

What made North America the Fastest-Growing Region in the Leisure Boat Market in 2025?

North America is expected to grow at the fastest rate in the market, owing to technological innovations that are driving sustainability, electrification, and advanced materials. In November 2024, Candela launched its first electric hydrofoiling ferry in the U.S. with the closing of $40 million in funding.

In January 2026, the National Marine Manufacturers Association (NMMA) reported that mixed economic conditions will shape the stable start to the year 2026 for the recreational boating industry in the U.S.

How is the Opportunistic Rise of the Leisure Boat Market in Latin America?

Latin America is expected to grow at a considerable rate in the market, driven by technological and material innovations, increased focus on sustainable boating, and more accessible and fuel-efficient boating services. Overall market revenue in the region is forecast to grow steadily through 2030, with used boats currently holding a large share while new boats show faster growth potential.

Growth is being supported by investments in marine infrastructure, boating events, and leisure activities, although limited docking facilities, high import exposure, and infrastructure gaps pose challenges.

Seeking Boating Adventures in Well-Known Sites is Propelling Europe

Europe is a significant market for recreational boats, dominating in boat production, sales, and boating activities and is expected to grow quickly in the near future. The leisure boat market in Europe benefits from a long history of boating, a love of sailing, and a vast network of rivers, waterways, and coasts. Local boaters and travelers looking for boating adventures in well-known locations generate demand for recreational boats. Sail boating has a long history throughout Europe. A thriving market for canal boats, river cruisers, and narrow boats is supported by Europe's enormous network of inland waterways, which includes canals and rivers.

French Leisure Boat Market Trends

Specifically, Sea Loft 480 (Jeanneau) is a new category, created as a "floating loft," focusing on open, fluid interiors and minimal COâ‚‚ emissions by 30-50% compared to conventional boats. On the other hand, MODX 70 (Ocean Development) is a 70-foot, 100% electric catamaran which integrates inflatable sails, electric motors, hydrogeneration, and 70 m� of solar panels for zero-emission autonomy.

Promotion of Impactful Events is Supporting MEA

In the leisure market, MEA has conducted substantial industry events, including the Dubai International Boat Show at Dubai Harbour and the Abu Dhabi International Boat Show, which served as significant platforms for global and regional product launches and networking. Technological advancements in boat manufacturing, including fuel-efficient engines and smart navigation systems, are enhancing product appeal across the region.

Regions with expanding leisure boat market include Latin America, the Middle East, and Africa. Large coasts, and expanding marina infrastructure in these regions all contribute to the market's development potential.

Value Chain Analysis of the Leisure Boat Market

- Raw Material Sourcing (Steel, Plastics, Electronics)

This stage is impacted by decarbonization, recycling, tariffs, eco-friendly resins, recyclability, smart integration, and supply strategy.

Key Players: ArcelorMittal Nippon Steel, Tata Steel, JSW Steel, Nucor Corp, Reliance Industries Limited, Elcome Integrated Systems. - Retail Sales and Financing

The retail sales and financing for leisure boats refers to the segment of the leisure boating industry that focuses on selling boats, such as yachts, motorboats, sailboats, and pontoons, directly to consumers and providing financial solutions to facilitate these purchases.

Key Players: Brunswick Corporation, MarineMax, Nautical Ventures Group, Boats Group, Boatzon. - Aftermarket Services and Spare Parts

This stage includes predictive and digitalized maintenance processes, a modernized spare parts supply chain, and enhanced service delivery models.

Key Players: Brunswick Corporation, Yamaha Motor Co., Ltd., Groupe Beneteau, MarineMax, Inc., Volvo Penta, West Marine.

Leisure Boat Market Companies

- Brunswick Corporation- It has introduced Sea Ray, Boston Whaler, Lund, Bayliner, and Harris Pontoons.

- Beneteau Group- This primarily covers monohull/multihull sailing, motorboats, and day boats, from small day sailors like First 14 to large luxury cruising yachts.

- Malibu Boats, Inc.- A firm explores Malibu (luxury), Axis (value-focused), and also offers fishing and sterndrive boats through its Cobalt, Pursuit, Cobia, Pathfinder, Hewes, and Maverick brands.

- Marine Products Corporation- This mainly comprises sterndrive & outboard sportboats, luxury bowriders, surf boats, center consoles, and bay boats.

- Yamaha Motor Co., Ltd.- It offers a variety of sport boats (jet boats), center console fishing boats, personal watercraft (WaveRunners), and sailboats across the globe.

Other Major Key Players

- Viking Yacht Company

- Azimut-Benetti Group

- Ferretti Group

- Bavaria Yachtbau

- Sunseeker International Ltd.

- Bombardier Recreational Products Inc.

- MasterCraft Boat Company

- Grady-White Boats, Inc.

- Chaparral Boats, Inc.

Recent Developments

- In November 2025, Vessev unveiled its latest electric hydrofoiling leisure vessel, the VS-9 Skye, widening access to hydrofoiling technology within the recreational boating sector. The VS-9 Skye employs a set of custom electric propulsion and hydrofoil systems, automatically adjusting to maintain balance and stability across different water conditions.

(Source- futurefive.co.nz/) - In October 2025, Zparq, a DeepTech company awarded �5.5 million in EU funding to complete the progression and scaling of its Z10 platform and to propel the marine industry's transition towards sustainable, zero-emission propulsion. The funding is a combination of an EIC grant and an equity investment via Zparq's existing investors InnoEnergy, Almi Invest Greentech, and Santander Climate Fund.

(Source- www.eu-startups.com/ ) - In January 2022, Highfield Boats was a world leader in aluminium rigid inflatable hull boats, having delivered more than 37,700 RIBS globally since 2011. Offering a complete line of RIBS from 2.4-metre tenders to the 5-metre-plus sectors where it is a global player. Featuring exclusive powder-coated aluminium hulls, Highfield boats are built in the company's state-of-the art production facility in Weihai, China, and operate under European management.

- In January 2023, Propeller technology which significantly reduces underwater noise was introduced by Oscar Propulsion and the University of Strathclyde which is suitable for yachts and all ship types.

- In July 2023, Rolls-Royce acquired an Italian yacht bridge specialist. Its Power Systems business unit expands MTU's product portfolio for the yacht market.

Segments Covered in the Report

By Type

- New Leisure Boat

- Used Leisure Boat

By Product

- Motorized

- Non-motorized

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content