What is the Low-cost Carrier Market Size?

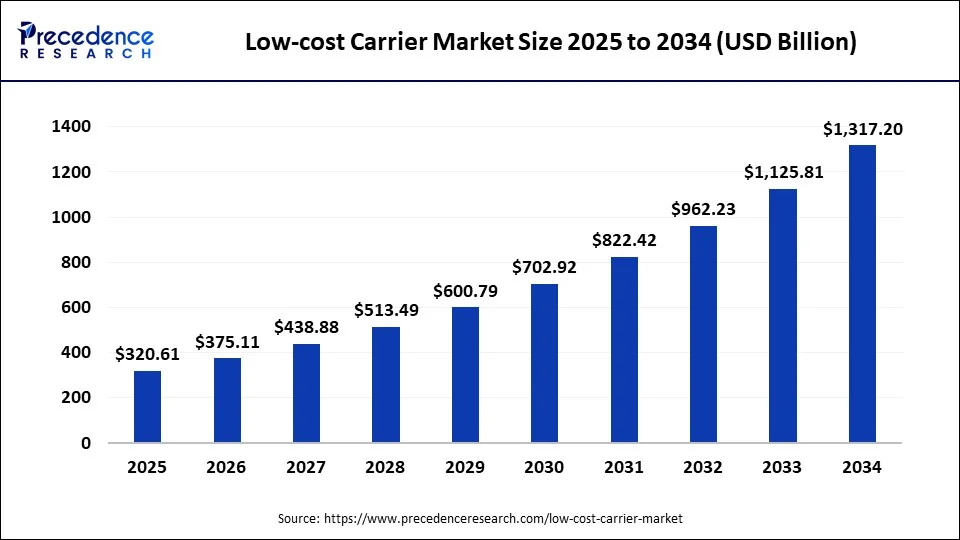

The global low-cost carrier market size accounted for USD 320.61 billion in 2025, and is predicted to increase from USD 375.11 billion in 2026 to approximately USD 1,490.05 billion by 2035, expanding at a CAGR of 16.61% from 2026 to 2035.

Low-cost Carrier Market Key Takeaways

- In terms of revenue, the market is valued at $320.61 billion in 2025.

- It is projected to reach $1,317.20 billion by 2035.

- The market is expected to grow at a CAGR of 2% from 2026 to 2035.

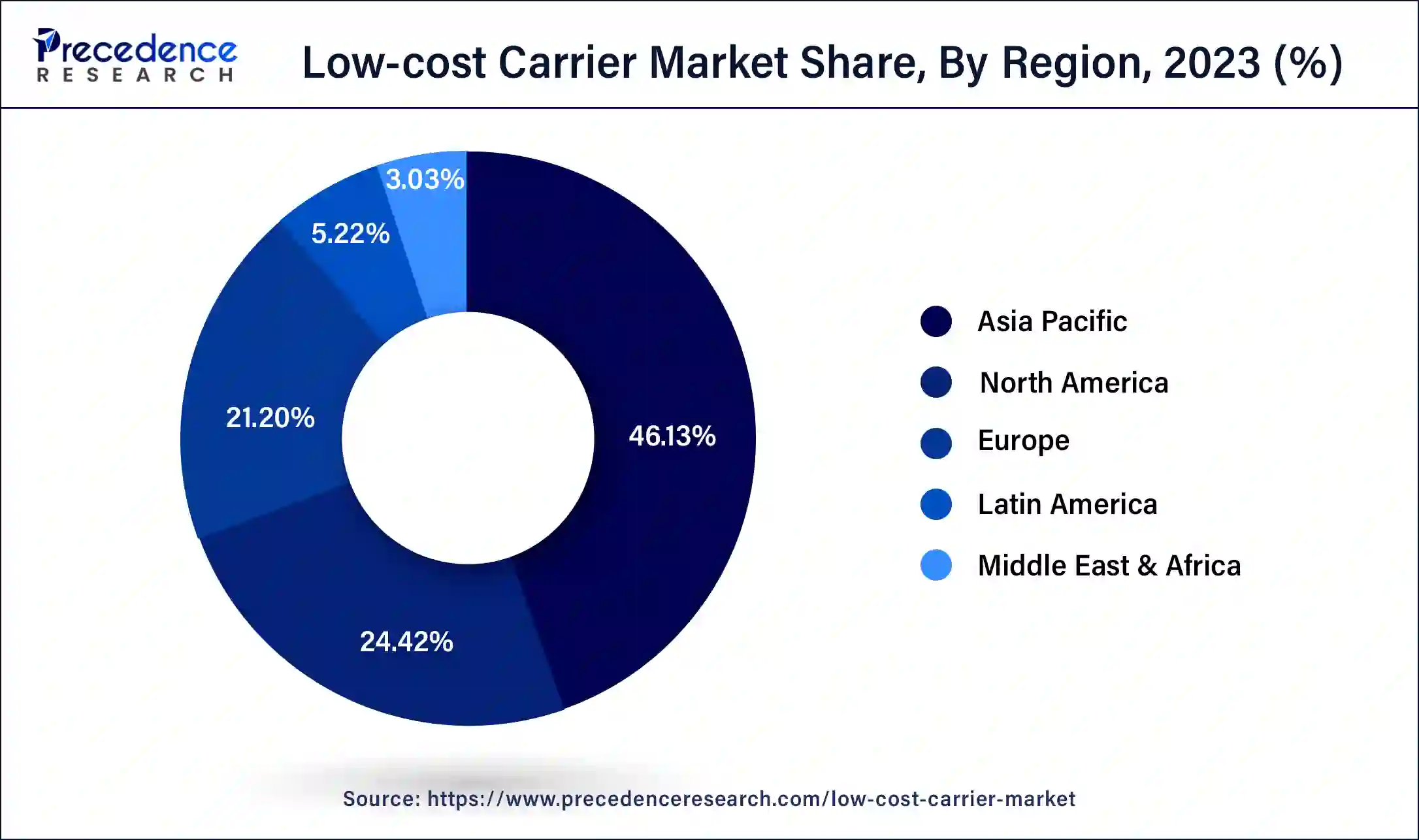

- Asia Pacific dominated the global market with the largest market share of 46.13% in 2025.

- The north American region is expected to expand at market share between 2026 to 2035.

- By Aircraft Type, the Narrow body segment led the market with the largest market share of 72% in 2025.

- By Aircraft Type, the long-haul segment has held a revenue share of 28% in 2025.

- By Application, the individual segment dominated the market with the largest revenue share in 2025.

Market Overview

The low-cost carrier market is one of the leading segments in the global airline industry, the market revolves around offering cost-effective air traveling options. Low-cost carriers offer affordable traveling experiences, especially for short-distance travel. Such carriers also employ various cost-saving strategies to maintain affordability. These may include operating a single aircraft type to simplify maintenance or using secondary airports with lower fees and maximizing aircraft utilization through quick turnaround timings. Low-cost carriers (LCCs) have revolutionized the aviation industry by upending the status quo of the legacy flag carriers and revolutionizing the way that passengers are served.

Additionally, a lot of low-cost airlines only have one kind of aircraft in their fleet, which lessens the training needed for the crew. Some of them even land at minor airports in crowded cities rather than the busiest ones for affordability purposes. Market liberalization and the expansion of low-cost carriers have coexisted.

- Southwest Airlines, a leading player in the market stated its annual revenue for 2022 to be $23.81 billion, which is a 50.82% increase from the year 2021.

- In the quarter ending on 31st March 2023 revenue for Southwest Airlines was $5.706bn and an increase of 21.56% over the prior year.

- EasyJet reported revenue of $5.77bn, 64.89% higher than the industrial sector.

- In the first quarter ending revenue for JetBlue was $2.3bn and an increase of 34.1% over the prior year.

Artificial Intelligence: The Next Growth Catalyst in Low-Cost Carrier

AI is significantly impacting the low-cost carrier industry by boosting operational efficiency and maximizing ancillary revenue, which are critical in a low-margin industry. Through predictive analytics, AI optimizes flight routes and enables predictive maintenance, reducing fuel consumption and costly unscheduled aircraft downtime. AI-driven dynamic pricing models analyze real-time demand, competitor behavior, and passenger data to optimize ticket fares and personalize ancillary offers like seat upgrades and baggage add-ons, increasing overall profitability.

Low-cost Carrier Market Growth Factors

The low-cost carrier market is experiencing significant growth due to the increasing popularity of short-haul flights and the rising demand for domestic flights. The sustainable solution offered by low-cost carriers is observed as a growth factor for the market as sustainability concerns are growing across the globe. Airlines are concentrating on enhancing aircraft sustainability by lowering carbon emissions, utilizing sustainable aviation fuel, and using carbon capture technology. This is because sustainability is becoming a big concern. Additionally, growing analytics implementation to manage fixed assets, expanding asset management solution integration, and rising mobility solutions are the aspects that have been predictably predicted to positively impact the business of the global low-cost carrier market.

The low-cost carrier has opened broader options for the airline industry across the globe, it allows multiple services for passengers traveling for business purposes and even it has offered an opportunity for tourism businesses to grow. Such well-known advantages of low-cost carriers highlight the market's growth for the upcoming period.

Market Outlook

- Market Growth Overview: The low-cost carrier market is expected to grow significantly between 2025 and 2034, driven by the rising demand for affordability, rising disposable income, and rising mobile adoption. Online booking and AI-driven dynamic pricing significantly reduce cost and boost ancillary income.

- Sustainability Trends: Sustainability trends involve building customer relationship management, rising sustainable aviation fuels, and integrating technological investment.

- Major Investors: Major investors in the market include BlackRock, Vanguard, Southwest, Ryanair, easyJet, IndiGo, AirAsia, and Wizz Air.

- Startup Economy: Startup economy focuses on the lowest possible operating cost, point-to-point model, and secondary airports.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 320.61 Billion |

| Market Size in 2026 | USD 375.11 Billion |

| Market Size by 2035 | USD 1,490.05Billion |

| Growth Rate from 2026 to 2035 | CAGR of 16.61% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Aircraft Type, Distribution Channel, Operations, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising demand for affordable air travel services

Passengers/tourists are observed to avoid air traveling options due to the hefty prices of tickets and taxes applied for the services. Airlines that offer low-cost carriers happen to establish a basic fare for the ticket that is cheap. These carriers even enable the passengers to choose their tickets according to the budget for reaching their destination. For instance, Frontier Airlines assesses extra fees for priority boarding, selecting your seat, and bag checking. Regular incentives are also provided by low-cost carriers.

The low-cost carriers often rely on the direct sales of tickets, this offers cost-effective distribution channels for the airline companies by making the traveling option affordable. Moreover, the cost-conscious approach, utilization of secondary airports, high load factors, and simplified services and operations collectively make the journey with low-cost carriers affordable. Thus, the rising demand for affordable air travel is observed to propel the growth of the market during the forecast period.

Restraints

Lack of refund policies

The lack of refund policies with low-cost carrier services is observed to act as a major restraint for the market's growth. The airlines that offer low-cost carrier services frequently refuse to issue refunds. As a result, tourists are advised to plan their flights in advance and stick to them. Rescheduling might result in additional costs. When purchasing a low-cost plane ticket, the added costs might pile up. Baggage check fees, seat position fees, and processing costs are all possibly added to it, which sometimes may boost the overall price of the ticket. Such services often have stricter refund or cancellation policies as compared to traditional airline services that may offer a complete refund in case of cancellation. Low-cost carriers typically operate with a strong emphasis on cost control and operational efficiency. Offering flexible refund policies can increase administrative costs which may lead to revenue loss.

Opportunities

Increased collaboration between airlines

Cheaper airfares have increased demand for low-cost carrier services, which has boosted market competitiveness since more airlines are now vying for travelers. The low-cost carrier business model has also made it possible for carriers who had no incentive or desire to pursue new prospects to fly routes that had never before been serviced. Multiple business activities such as collaboration, partnerships and acquisitions are done to promote such businesses. Airlines now provide service to more locations as a result, enabling passengers to travel to more locations. Several major airline companies are focused on offering collaborative strategies to operate low-cost carrier services, this element is observed to open lucrative opportunities for the market's growth.

Segment Insights

Aircraft Type Insights:

The narrow body segment dominated the market with the highest market share in 2024. The segment will continue its dominance due to the lower fare prices. The short-haul low-cost carrier operates on a maximum of four-hour routes. The low-cost carrier is preferably used for short routes rather than longer routes. Low-cost carriers mostly focused on the short-haul segment due to the higher profitability than the long-haul segment.

The wide body segment is anticipated to experience significant growth during the forecast period. The long-haul carriers contain more than 200 passengers at a time. They provide all the facilities to their passengers. The long-haul carrier includes the most popular aircraft like the Boeing 777 variant, a larger version of the 787, another larger version of the 767, the Airbus A330 variant, the Airbus A350 variants, Airbus A340 variants, Airbus A380, and the iconic Boeing 747.

Application Insights

The individual segment dominated the market with the highest revenue share in2024. The growth of the segment is attributed to the increasing use of low-cost carrier aircraft for tourism purposes. The larger amount of the population is looking for an affordable and quick source of transportation, this element is observed to promote the growth of the individual segment.

The commercial segment is expected to dominate the market with the highest share during the forecast period. The growth of the segment is attributed to the increasing commercialization across the world. Low-cost carriers offer many benefits with regard to the commercial traveler resulting in greater demand for the segment.

Regional Insights

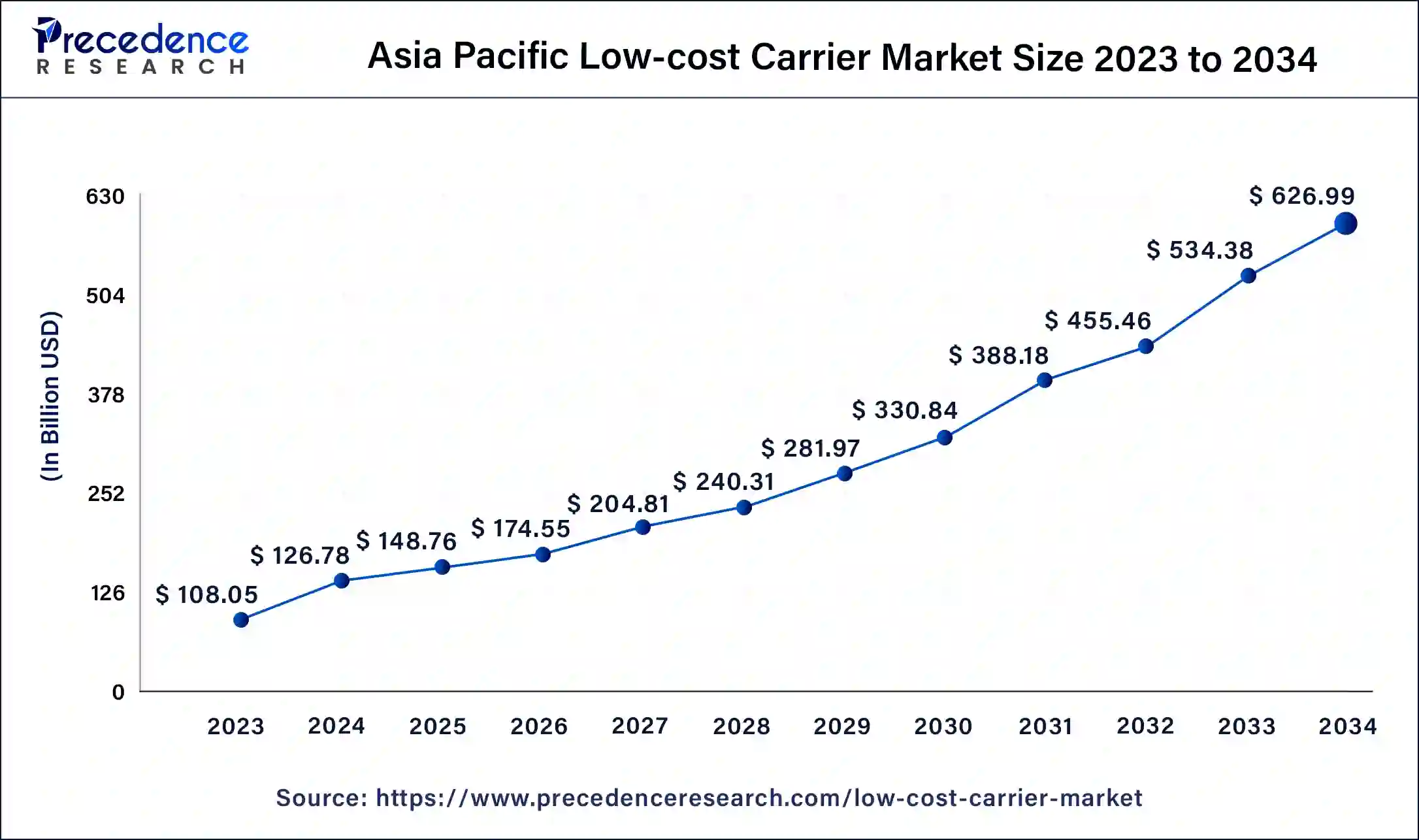

What is the Asia Pacific Low-cost Carrier Market Size?

The Asia Pacific low-cost carrier market size is estimated at USD 148.76 billion in 2025 and is predicted to be worth around USD 710.47 billion by 2035, at a CAGR of 16.92% from 2026 to 2035.

Asia Pacific dominated the market with the largest market share in 2024,the market in Asia Pacific is expected to maintain its position during the forecast period. The growth of the market is attributed to the increased population in the region. The increasing population mainly increased in middle-class and upper-middle-class populations is expected to drive the growth of the market in the region. The shift in lifestyle preferences and traveling habits would also be likely to fuel the growth of the aviation market. Increasing government initiatives for affordable air travel services mainly in countries such as China and India are predicted to highlight the market's growth in Asia Pacific.

China Low-Cost Carrier Market Trends

China's industry is pivoting toward an agile, digital-first operational model, leveraging AI and mobile platforms to maximize ancillary revenue streams and enhance operational efficiency across the continent's diverse and rapidly growing aviation landscape. Chinese low-cost carriers are improving operational efficiency through shorter turnaround times, higher seat densities, and enhanced digital services such as mobile check-in, while also boosting ancillary revenues from baggage fees and other services.

North America is expected to increase its market share during the forecast period.The growth of the region is attributed to the increasing disposable income of the consumers in these regions. The United States carries 30% of the global domestic airline market. The growth of the low-cost carrier is due to its lower fare prices. The rising domestic flights for commercial and personal purposes along with the competitive nature of the overall aviation industry in the region promote the growth of the market.

U.S. Low-Cost Carrier Market Trends

U.S.'s entrenched reliance on ancillary revenue, with unbundled fares and fees for baggage or seating comprising over half the total income for some ULCCs. This model underpins a highly efficient point-to-point network structure that leverages secondary airports to maintain low base fares and high aircraft utilization.

Europe is expected to grow significantly in the low-cost carrier market during the forecast period. The growing tourism in Europe is increasing the demand for low-cost carriers. At the same time, the increasing online bookings and advancements in airports are decreasing the cost associated with travel and are encouraging the use of low-cost carriers. Thus, these developments, along with the government support, are promoting the market growth.

Germany Low-Cost Carrier Market Trends

Germany significant cost burden from government aviation taxes and airport fees. Consequently, the industry is seeing a structural shift in the LCC share of the domestic market.

Low-cost Carrier Market Companies

- Southwest Airlines Co. operates a highly efficient, point-to-point network using an all-Boeing 737 fleet, which significantly reduces operational and maintenance costs, allowing for consistent low base fares in the U.S. domestic market.

- AirAsia Group Berhad revolutionized air travel in Asia with a true "no-frills, now everyone can fly" philosophy that leverages secondary airports and high aircraft utilization rates to dominate regional short-haul markets.

- easyJet plc established the LCC model in Europe by focusing on primary and secondary airports rather than remote regional ones, effectively attracting a mix of price-sensitive leisure and business travelers.

- JetBlue Airways Corporation operates a hybrid model, positioning itself as a "low-cost, high-value" carrier that offers more amenities (e.g., free Wi-Fi, seat-back screens) than typical ultra-low-cost competitors while still maintaining a cost structure below that of legacy carriers.

- Norwegian Air Shuttle ASA was a pioneer in the low-cost, long-haul market, using fuel-efficient Dreamliner aircraft to offer intercontinental flights at significantly reduced fares until strategic shifts following the pandemic.

- Spirit Airlines, Inc. is a pure ultra-low-cost carrier (ULCC) that relies heavily on a "bare fare" model, where ancillary fees for everything from carry-on bags to soda often account for over half its total revenue.

Other Major Key Players

- IndiGo

- Wizz Air Holdings plc

- Allegiant Travel Company

Recent Development

- In July 2025, to disrupt long-haul low-cost travel, an agreement of $12.25 billion was signed between AirAsia Berhad, which is a subsidiary of Capital A Berhad, with Airbus for the purchase of 50 A321XLR aircraft, along with rights for 20 more. Hence, to become the world's first low-cost narrow-body network carrier, which is expected to expand its reach throughout Europe, Asia, Central Asia, and the Middle East, this collaboration will be a strategic move. The goal of AirAsia is to carry 150 million guests annually by 2030, with a total of 1.5 billion since inception, will be supported by this launch, which is anticipated between 2028 and 2032.

- In June 2025, to redeem and earn miles when flying with flyadeal, which is the low-cost carrier of Saudia Group, a collaboration between flyadeal and the AlFursan loyalty program was announced. The current digital transformation of AlFursan, as well as the increasing operational footprint across domestic and international routes of flyadeal, will be supported by this collaboration. The agreement was signed by the Chief Executive Officer of flyadeal, Steven Greenway, and the Vice President of AlFursan Loyalty Program, Essam Akhonbay, where the Director General of Saudia Group, H.E. Engr. Ibrahim Al-Omar also attended this signing ceremony held at Saudia.

- In June 2023,Norse Atlantic Airways launched a flight between Rome and New York. The new flight is a low-cost traveling alternative for passengers in the summertime. The flights will be in operation on a Boeing 787 Dreamliner.

- In June 2023,Japan's All Nippon Airways CEO Shinichi Inoue said on the sidelines of an aviation conference in Istanbul want to expand their short and medium-haul fleet by 2023, especially the Boeing 787 planes.

- In June 2023,the low-cost carrier launched passenger flights on Almaty-Tashkent routes by Uzbekistan My Freighter. They will be opening 3 times a week between Almaty and Tashkent.

- In June 2023,WestJet announced that it is planning to integrate Sunwing Airlines as a low-cost carrier in its main business within 2 years. According to the news, WestJet's current priority remains the acquisition of Swoop in the company's business.

Segments Covered in the Report

By Aircraft Type

- Narrow Body

- Wide Body

By Distribution Channel

- Online

- Travel Agency

By Operations

- Domestic

- International

By Application

- Individual

- Commercial

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting