Nanopesticides Market Size and Forecast 2025 to 2034

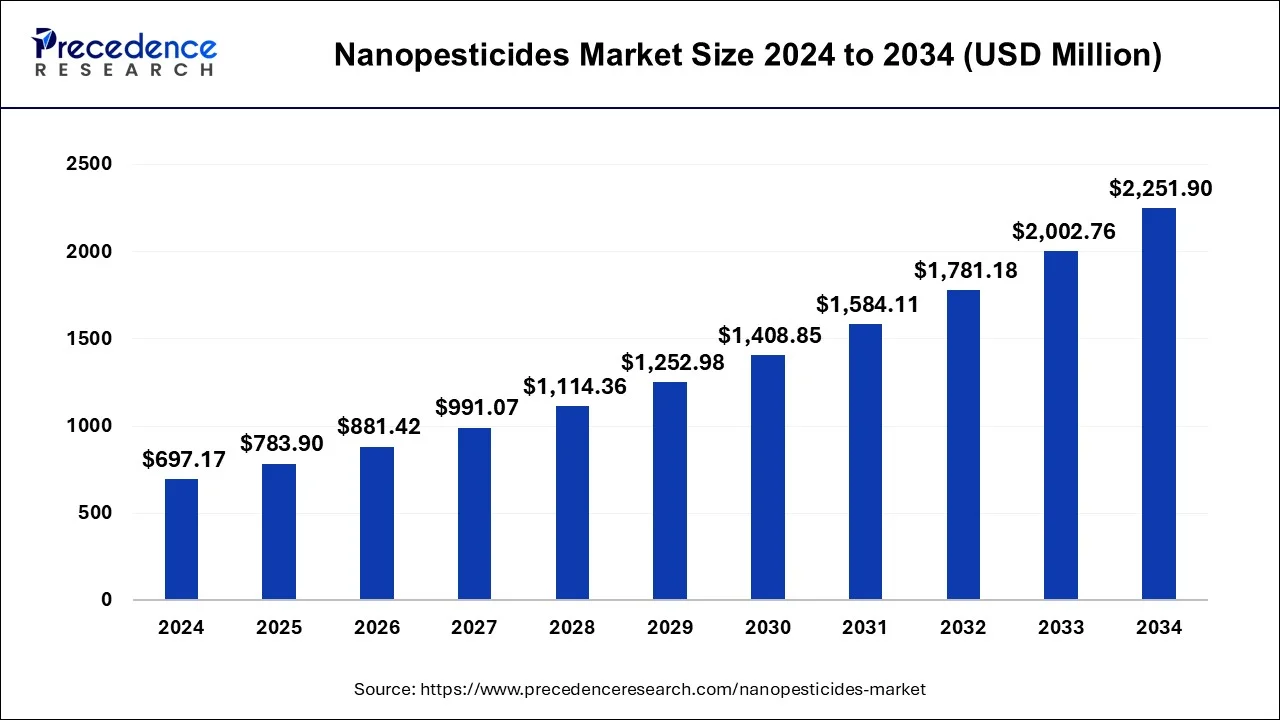

The global nanopesticides market size was worth around USD 697.17 million in 2024 and is anticipated to reach around USD 2,251.9 million by 2034, growing at a CAGR of 12.44% from 2025 to 2034. The growing demand for crop enhancing agents around the world boosts the growth of the nanopesticides market.

Nanopesticides Market Key Takeaways

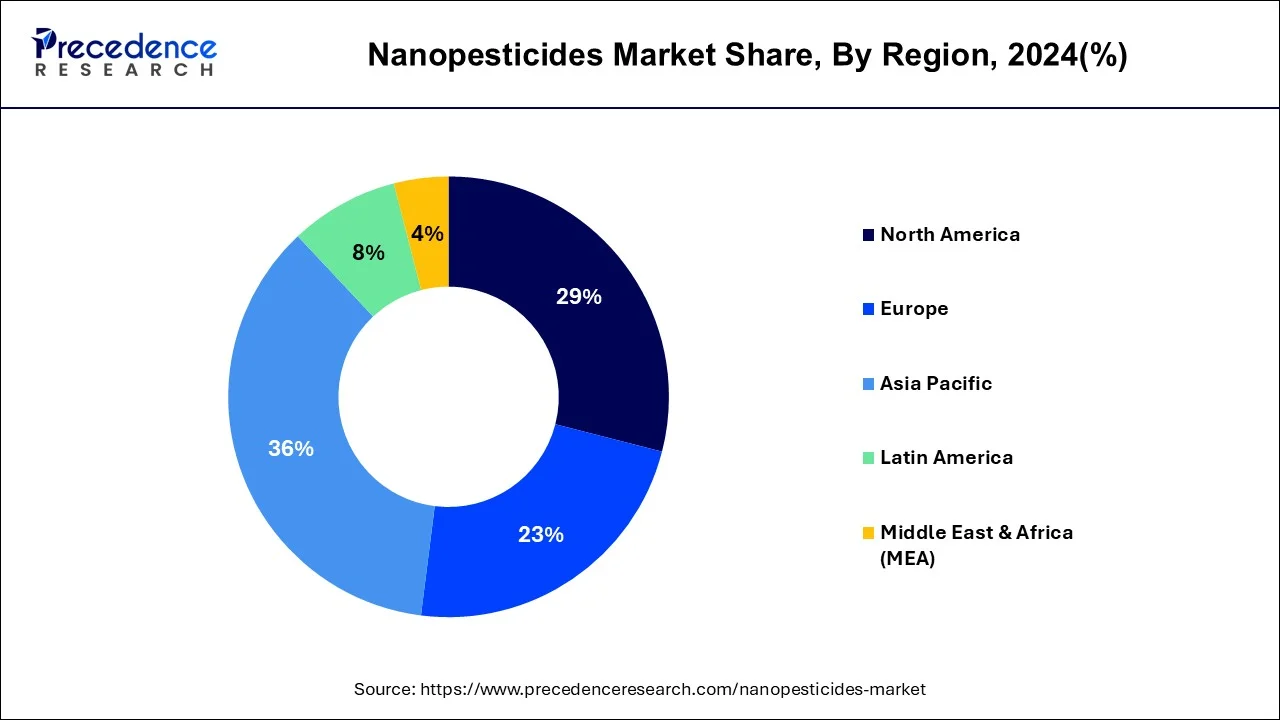

- Asia Pacific dominated the global market with the largest market share of 36% in 2024.

- North America is projected to expand at the notable CAGR during the forecast period.

- By type, the nanoinsecticides segment contributed the highest market share in 2024.

- By application, the pest control segment captured the biggest market share in 2024.

- By utility, the industrial crop segment has held the largest market share in 2024.

What is the Role of AI in Nanopesticides?

AI has played a major role in the chemical industry. In chemical sector, AI technology is adopted for improving the testing methodologies and reducing cost of manual labors. Nanopesticides industry is an integral branch of the chemical industry also integrates AI in their production facilities to enhance production process along with lowering errors in finished products. Also, the integration of AI in nanopesticide sector helps in detecting the effects of chemicals coupled with detecting the pest content that are crucial for the crop development. Moreover, AI helps in brand marketing and analyzing consumer preferences regarding any product. Thus, the advancements in AI is playing a significant role in shaping the nanopesticides market.

- In August 2024, the government of India launched National Pest Surveillance System (NPSS). This system is based on AI technology that helps in real time pest detection.

Asia Pacific Nanopesticides Market Size and Growth 2025 to 2034

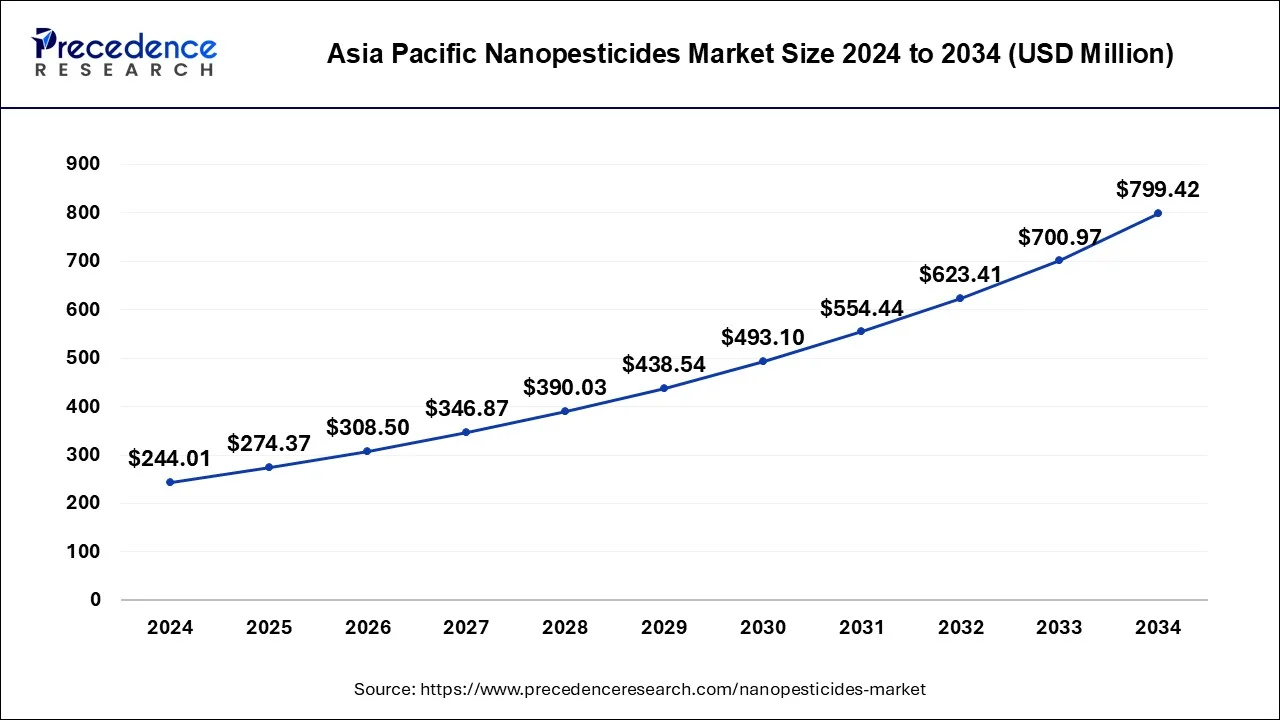

The Asia Pacific nanopesticides market size was exhibited at USD 244.01 million in 2024 and is projected to be worth around USD 799.42 million by 2034, growing at a CAGR of 12.60% from 2025 to 2034.

Asia Pacific dominated the nanopesticides market. The rising population in several countries such as India and China has increased the demand for food crops that in turn increases the demand for nanopesticides, thereby boosting the market growth. Also, the government of several countries are investing heavily for improving the agricultural sector that in turn boosts the industrial expansion in this region. Moreover, the increasing prevalence of crop diseases along with technological advancements in pesticides manufacturing sector has driven the growth of the nanopesticides market.

North America is projected to grow with the highest CAGR during the forecast period. The rising demand for industrial crops in U.S. and Canada has driven the market growth. Also, numerous government initiatives aimed at reducing emission along with rapid investment in crop management solutions has boosted the market expansion. Moreover, the presence of several market players of nanopesticides such as Marrone Bio Innovations, Valent BioSciences, Corteva and some others is expected to propel the growth of the nanopesticides market.

Market Overview

Nanopesticides are pesticides whose composition incorporates nanotechnology to improve their properties. Nanopesticides, which have use characteristics comparable to pesticides, comprise nanoparticles that preferably surpass the 100nm size limit specified for regulatory purposes by various governmental agencies. Polymer-based formulations have garnered the most attention in the continual evaluation of research gaps and future goals in nanopesticides, followed by formulations including inorganic nanoparticles as well as nanoemulsions.

To achieve maximum benefit, nano-pesticides are used because they provide sustained release kinetics with high stability, efficient solubility, and enhanced permeability. They also help to promote pest control effectiveness for a longer period of time and prevent degradation of the encapsulated molecules that are in challenging environmental conditions.

The usage of nanopesticides implies a large reduction in the environmental effect of plant protection product active ingredients, as well as an improvement in crop quality and quantity. Although much of the research in nanopesticides is still in its early stages, the product's future is linked to the balance of its advantages in terms of improving effectiveness and minimizing the use and effect of plant protection products, combined with its disadvantages related to nanoparticle contamination by people and the environment.

Nanopesticides are used in a variety of crop protection applications, including seed treatment, preservation of fresh produce and vegetables, crops, feeds and fodder, and so on.

The COVID-19 epidemic harmed the food and agriculture industries. COVID-19 has impacted food and agricultural productivity, including nutrition, as well as farmer livelihoods, as a result of social alienation. However, because to the health advantages associated with fruits and vegetables, population intake rose throughout the pandemic. Nanopesticides are used in the packing of fruits and vegetables to preserve the freshness of these perishable foods. These also boost the chemical content of vegetables and fruits such as beta carotene, naringenin, as well as chlorogenic acid, while also providing a nutritious source of fibre, which aids in weight management by reducing constipation, lowering cholesterol, regulating blood sugar levels, and lowering blood sugar levels. Nanopesticides are also commonly employed in food packaging, which contains nanoparticles with antimicrobial properties that improve the shelf life and freshness of packaged food. As a result, the increased consumption of fruits and vegetables, as well as an increase in demand for food packaging, are expected to boost the nanopesticide market over the forecast period.

Nanopesticides Market Growth Factors

- The rising demand for eco-friendly pest controlling agents.

- Rapid investment in nanoinsecticides industry.

- Technological advancements in pesticides manufacturing sector.

- Government initiatives for enhancing crop development.

- The rising focus on improving soil properties for crop growth.

- The increasing demand for food crops around the world.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 783.9 Million |

| Market Size by 2034 | USD 2,251.9 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.44% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Utility, Type, End-user, Target Organism, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Nanopesticides MarketDynamics

Drivers

- A growing concern regarding rising food wastes and losses - According to the FAO, food wastage and loss in developed nations total $680 billion USD, while underdeveloped countries lose $310 billion USD. Both industrialised and developing nations waste nearly the same amount of food, namely 670 and 630 million tonnes, respectively. The data illustrate the rising concern about food waste and its impact on the environment, society, and people's lives. Food waste and loss caused at various points in the chain process is increasing demand for the use of nanopesticides among crop growers and suppliers in order to reduce waste and gain control over GFLI.

- Increasing fresh fruit and vegetable exports - Consumers all across the world are increasing their consumption of fresh fruits and vegetables. The demand also meets the requirement for seasoned and unseasoned goods to be offered across the world all year. As a result, agro-economic nations are focused on exporting vegetables and fruits to close the demand gap, boosting the need for the use of nanopesticides in packing of these fresh items to reduce supply chain losses and retain product freshness. Exports of fresh fruits and vegetables increased from 0.67 billion USD in 2010-11 to 1.30 billion USD in 2018-19, according to the Agribusiness and Processed Food Products Export Development Authority (APEDA), Government of India (GOI). Furthermore, the export value for 2019-20 has already surpassed 0.21 billion USD until the month of May.

Challenges

- Concerns for food safety, ban on pesticides and restrictions in utilization in many economies - Pesticides have been outlawed in several economies across the world due to their damaging impact on people's livelihoods. Nations have devised several safety guidelines to address the issue and differentiate pesticides in its class depending on the sensitivity of the chemicals in use in pesticides. For example, the United States Department of Agriculture created the Pesticide Data Program (PDP), a nationwide pesticide residue monitoring programme that results in the most complete pesticide residue database in the United States. Furthermore, since 1985, the Government of India has adopted the Integrated Pest Management (IPM) programme as a cardinal concept and key pillar of plant protection in the overall agricultural production programme. The Government of India's Directorate of Plant Protection, Quarantine, and Storage has revised the list of pesticides that are prohibited, refused registration, or have limited usage in March 2019.

Opportunities

- Greater affects with lower chemical dose: Nanopesticides provide a means to both manage pesticide distribution and produce better effects with a lower chemical dose. The first sort of nanopesticides may be anticipated as active ingredient(s) that are either produced nanomaterials such as metal nanoparticles (e.g., silver as well as copper) or metal oxide nanoparticles (e.g. zinc oxide, titanium dioxide, manganese dioxide, copper oxide, silicon dioxide). The production and deployment of nanopesticides attempts to improve a pesticide's efficacy and longevity while also reducing the number of active chemicals present and minimising or eliminating any possible dangers. All of these reasons are propelling the nanopesticide industry forward.

- Usage in multiple applications - The worldwide nanopesticide business is expanding due to its widespread usage in areas such as pest control as well as packaging. Furthermore, the increased usage of nanopesticides in food packaging is likely to boost market expansion during the forecast period. Food waste and loss are increasing as a result of the various phases of the supply chain. According to the FAO, food waste costs developing nations $310 billion and industrialised ones $680 billion. The numbers illustrate the growing worry over food waste. Global consumption of fresh fruits and vegetables is growing. To close the demand gap, agro-economic nations are promoting the export of fresh fruits and vegetables. This is boosting the need for nanopesticides in the packaging of these fresh foods in order to reduce supply chain losses and maintain product freshness. Nanopesticides are mostly employed in food packaging that contains nanoparticles that impart antibacterial activity and boost barrier characteristics, hence extending the life span and freshness of packaged food.

Utility Insights

The industrial crop segment held the dominant share of the market. The rising demand for oilseeds and fiber crops has boosted the market growth. Also, the research and development activities related to nanopesticides for enhancing industrial crops propels the industrial expansion. Moreover, the growing focus on rubber crops by government of several countries along with increased demand for soyabean in developing nations drives the market in a positive direction.

Type Insights

The nanoinsectides segment led the industry. The rising emphasis on improving productivity of crops has driven the market growth. Also, the rapid adoption of nanotechnology for killing insects that are harmful for crop development boosts the market expansion. Moreover, nanoinsecticides can help in improving the effectiveness of insecticides by enhancing their solubility, durability, stability and permeability, thereby driving the nanopesticides industry.

End-User Insights

The non-agricultural segment held the largest share of the market. The rising trend of lawn gardening among the people boosts the market growth. Also, the growing use of nanopesticides for ornamental.

horticulture and forestry drives the market expansion. Moreover, the increasing demand for eco-friendly pesticides for residential use is driving the growth of nanopesticides market.

Nanopesticides Market Companies

- Marrone Bio Innovations

- Bioworks

- Valent Biosciences

- Andermatt Biocontrol

- Stockton

- Bayer

- Camson Bio Technologies

- Corteva

Industry Leaders Announcements

- In November 2024, Mr. Lin Qiwen, Board Chairman of Yuelian, announced to use nanotechnology for the production of crop protection solutions in the upcoming years.

Recent Developments

- In November 2024, Texas A&M University's engineering and agricultural colleges collaborated with University of California. This collaboration is done for developing a nanopesticide from neem seeds.

- In August 2024, Embrapa partnered with Campinas. This partnership is done for developing a nanopesticide in Brazil. · In April 2024, Bayer announced partnership with AlphaBio Control. This partnership is done for launching a bioinsecticide in UK.

Segments Covered in the Report

By Utility

- Food Crop

- Industrial Crop

By Type

- Nanoinsecticides

- Nanoherbicides

- Nanofungicides

- Others

By End-user

- Agriculture

- Non-agriculture

By Target Organism

- Algicides

- Avicides

- Bactericides

- Fungicides

- Herbicides

- Insecticides

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting