What is the Polyolefin Market Size?

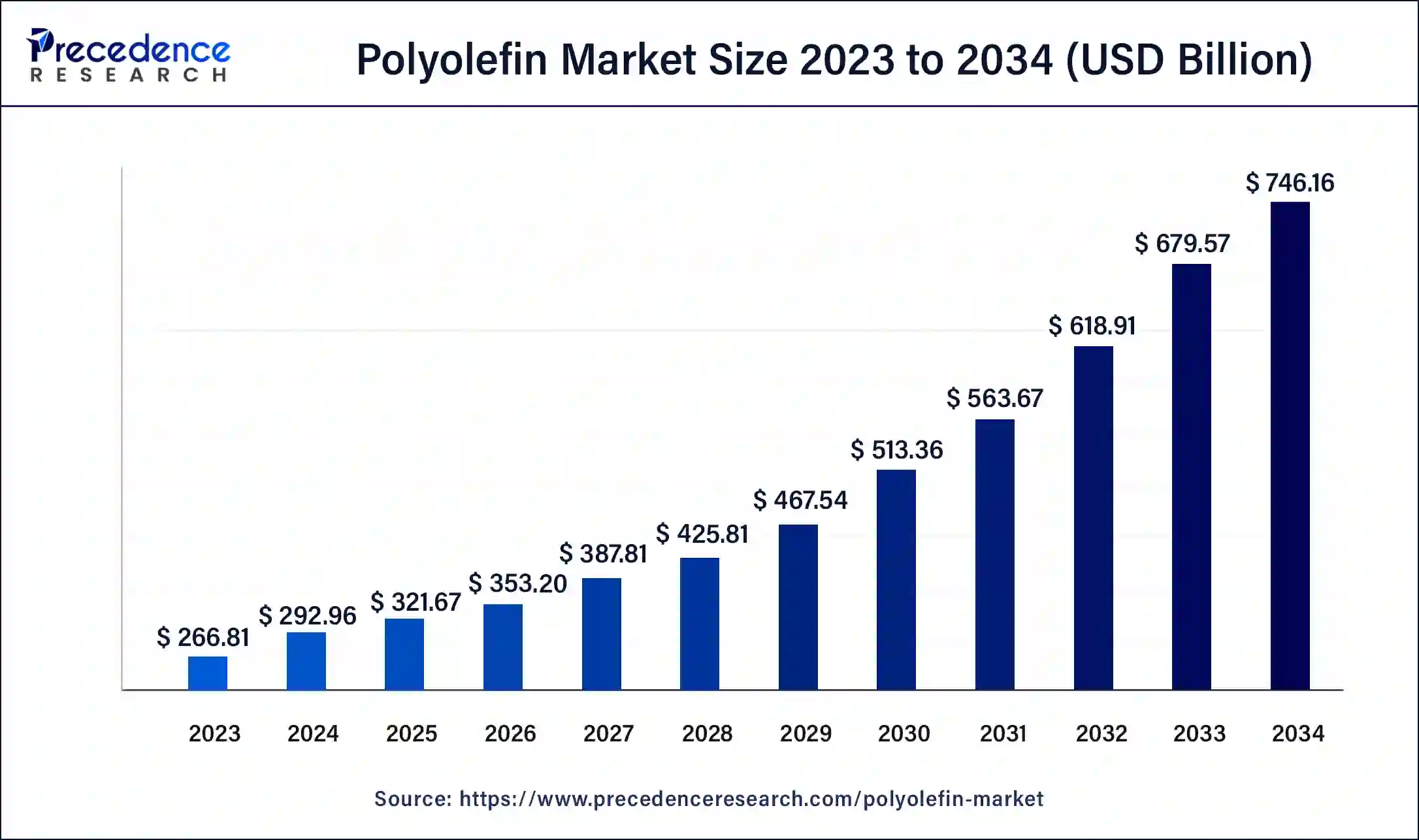

The global polyolefin market size is calculated at USD 321.67 billion in 2025 and is predicted to increase from USD 353.2 billion in 2026 to approximately USD 808.80 billion by 2035, expanding at a CAGR of 9.66% from 2026 to 2035. The polyolefin market is driven by the increasing need from the packaging industry. This requirement is fueled by the material's versatile properties along with the expansion of related sectors such as e-commerce.

Polyolefin Market Key Takeaways

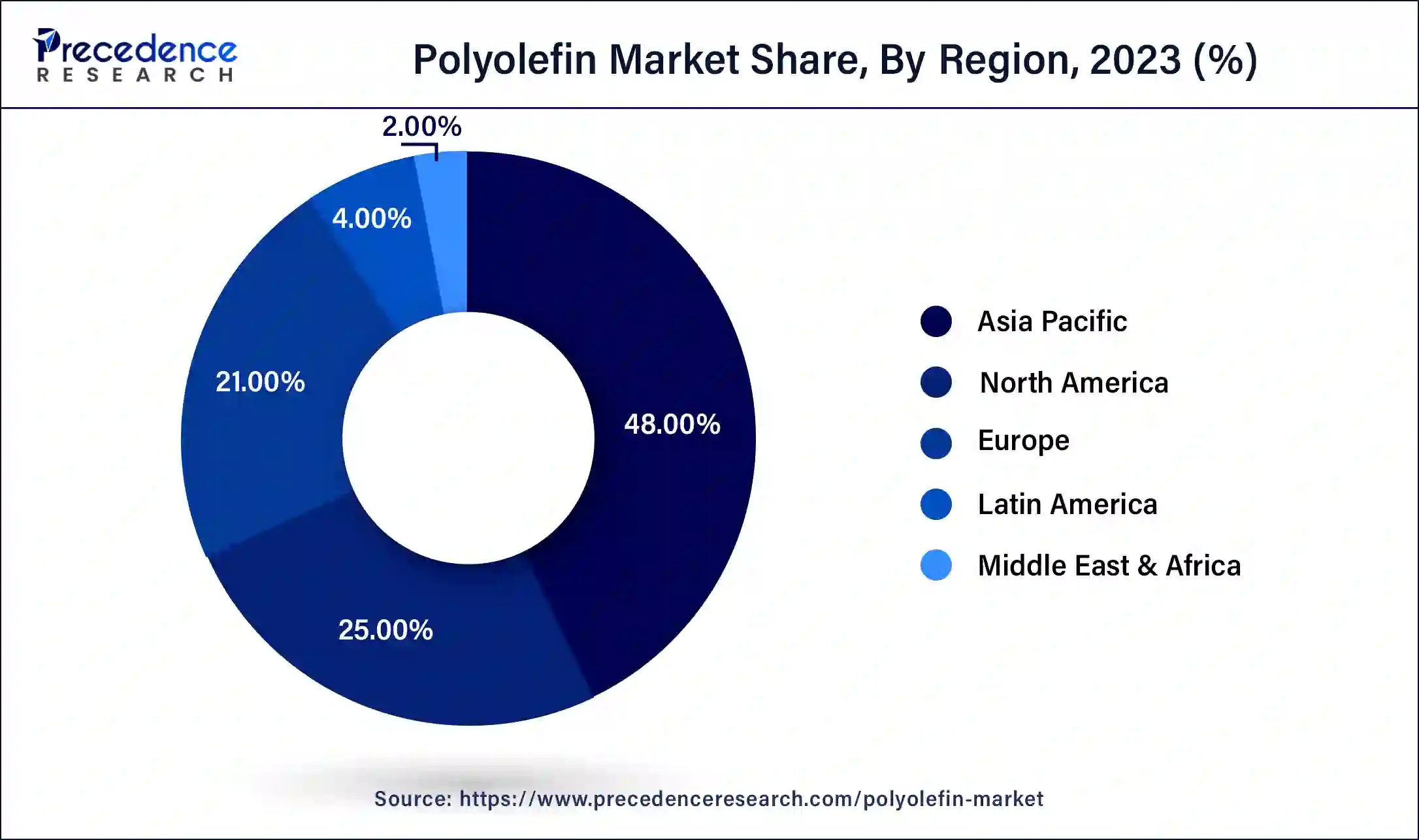

- Asia Pacific led the global market with the largest market share of 48% in 2025.

- By Type, the polyethylene segment has held the biggest revenue share of 35% in 2025.

- By Type, the polypropylene segment is expected to expand at a significantCAGR during the projected period.

- By Application, the film & sheet segment had the biggest market share of 45% in 2025.

AI in the Market

Artificial intelligence is another revolution ever existing for the polyolefin market on one side of the winds of time, bringing along efficiency, sustainability, and innovation. It optimizes processes in production, reduces waste, and in quality. AI-based quality control systems detect defects in the very early stage, reducing manual intervention. It assists in catalyst discovery, simulates polymerization results, and designs advanced materials with lesser impacts on the environment. Predictive maintenance reduces machine downtime and increases productivity. The system is put in place for forecasting demand on an accurate basis and tracks inventory optimization and streamlining logistics. It promotes sustainability by putting emissions in check, optimizing energy utilization, and improving recycling through smart sorting systems. These applications drive productivity with high-cost savings for the sustainable growth of the polyolefin market.

Polyolefin Market Growth Factors

- Polyolefins ensure durability, flexibility, and cost-effectiveness. The rising demands in the packaging sector constitute major growth drivers.

- Rising applications in the textile industry, which include non-woven fabrics, knitted materials, and yarns, boost demand.

- The consumption of polyolefin films in agriculture is increasing for crop protection and water efficiency; thus, development is supported.

- New approaches in polyolefin fiber technology give opportunities for development in the medical and hygiene industries.

- Going forward, research and development, especially the integration with nanotechnology, is likely to further enhance its versatility and applications.

Polyolefin Market Outlook

- Industry Growth Overview: Key drivers include e-commerce fueling packaging needs, efficiency demands in vehicles, and even new uses in renewable energy, along with 3D printing, though difficulties persist from sustainability concerns, along with volatile feedstock prices, with Asia-Pacific leading demand.

- Major Investors: The market is large, with multinational petrochemical firms, including LyondellBasell, SABIC, Dow Inc., China Petrochemical Corporation (Sinopec), and ExxonMobil. These firms compete primarily on integrated feedstock chains, production scale, and technological innovation.

MarketScope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 9.66% |

| Market Size in 2025 | USD 321.67 Billion |

| Market Size in 2026 | USD 353.2 Billion |

| Market Size by 2035 | USD 808.80 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application |

| Regional Scope | North America, APAC, Europe, Latin America, MEAN, Rest of the World |

Segment Insights

Type Insights

By Type, in 2023, the polyethylene dominated the market with around 35% share in terms of revenue of the total market. The demand for the polyethylene is higher due to its wide application in the packaging industry. Affordable prices coupled with easy availability of polyethylene has perfectly augmented the segment growth in the recent years. The development and growing adoption of bio-degradable polyethylene owing to the rising environmental concerns is expected to drive the segment growth in the forthcoming years.

On the other hand, the polypropylene is estimated to be the most opportunistic segment during the forecast period. This is attributed to the rising consumption of polypropylene in the production of fibers, films, sheets, and raffia due to its tensile strength. The adoption of polypropylene in manufacturing lightweight automotive vehicles is boosting its demand. Lightweight vehicles are fuel efficient and due to rising fuel prices and environmental concerns, the demand for light vehicles is on the rise.

Application Insights

By Application, in 2023, the film & sheet dominated the market with around 45% share in terms of revenue of the total market. The films and sheet are extensively used in the food and beverages sector, agricultural sector, cosmetics sector, and industrial packaging sector. The films and sheets are available in various ranges depending on the thickness. The films and sheets are commonly used in production of beverage bottles, for packing food items, and for making packages for cosmetic products. Moreover, new developments in the films and sheets include protection from UV rays of the sun, fluorescent films, and NIR blocking films. Therefore, growing application along with product advancements is fueling the growth of the segment.

Regional Insights

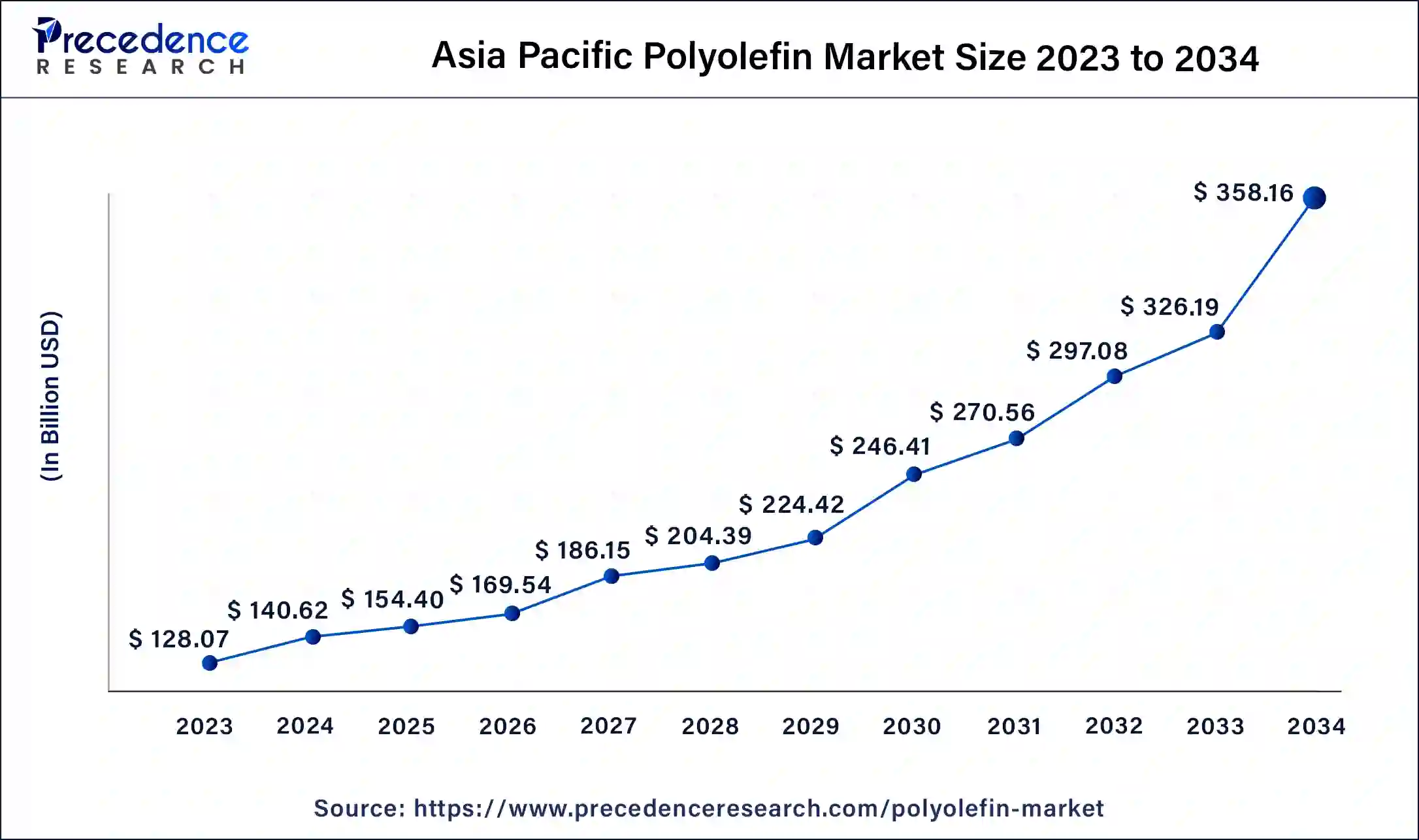

What is the Asia Pacific Polyolefin Market Size?

The Asia Pacific polyolefin market size is exhibited at USD 154.4 billion in 2025 and is projected to be worth around USD 388.22 billion by 2035, growing at a CAGR of 9.66% from 2026 to 2035.

Asia Pacific dominated the polyolefin market and accounted for the largest revenue share of 48% in 2023. Asia Pacific is the dominating and the fastest-growing market for polyolefin. The rapid industrial growth of economies such as China, India, and Indonesia is boosting the consumption of polyolefin in the region. The construction and building, automotive, food and beverages, and pharmaceutical industries in the Asia-Pacific is growing and expanding at a significant pace and is responsible for the exponential growth of the global polyolefin market.

The growth of the polyolefin market in North America and Europe is attributable to the consumer goods, transportation, and construction industries. Moreover, the consumers in Europe and North America are much concerned with deteriorating environmental issues and this factor is anticipated to propel the demand for the bio-based polyethylene.

China Polyolefin Market Trends

China's market is driven by large manufacturing, packaging, auto, and construction demand, plus government funds for EVs and recycling. The market faces difficulties from fluctuating crude oil prices, increased domestic capacity, and even intense export competition, with a major trend towards high-performance, sustainable materials.

U.S. Polyolefin Market Trends

The U.S. market is undergoing steady growth, driven mainly by strong demand from the packaging and even automotive industries and a remarkable push toward sustainable and recycled materials.

Value Cain Analysis

- Feedstock Procurement: The acquisition of feedstock, for instance, ethylene and propylene, is required for the manufacturing of polyolefins.

Key Players: ExxonMobil, Dow, and Reliance Industries

- Chemical Synthesis and Processing: The procured feedstocks are subjected to polymerization to produce different polyolefin resins.

Key Players: Dow Inc., Borealis AG

- Compound Formulation and Blending: The polyolefin resins are mixed with additives to modify their properties, such as strength, flexibility, and color, for particular applications.

Key Players: Avient Corporation, LyondellBasell, and SABIC

- Testing and Certification for Quality: Testing of polyolefins and of the compounded materials for conformity with required standards, and obtaining certification for their intended uses is carried out.

Key Players: Bureau Veritas, TÜV Rheinland, Eurofins Scientific

- Packing and Labeling: To protect the polyolefin products during storage and transit, the products are packed, and labels displaying all necessary product information and branding are applied.

Key Players: ExxonMobil, Dow, and Reliance Industries

- Distribution to Industrial Users: The packaged polyolefin products are transported and delivered to the industrial consumers who will further process or use them in their manufacturing operations.

Key Players: Brenntag Logistics Services, DHL Supply Chain

Polyolefin Market Companies

- Reliance Industries: Reliance Industries provides a comprehensive range of polyolefin items under the brand names Relene (Polyethylene), along with Repol (Polypropylene). These goods serve diverse applications across numerous sectors, including automotive, packaging, agriculture, and healthcare.

- Total SE: TotalEnergies is a major global manufacturer of polymers that provides a range of polyethylene, polypropylene, along polystyrene products for the polyolefin market. The firm's offerings focus on high-performance along with high-value-added plastics, with an increasing impact on sustainable and circular solutions.

Segment Insights

- Sinopec Corp.

- BASF SE

- Chevron Phillips Chemical Co.

- ExxonMobil Corp.

- Reliance Industries

- Total SE

- Formosa Plastic Corp.

- SABIC

- Repsol

- LyondellBasell Industries

Recent Developments

- In June 2025, Clariant launches AddWorks PPA product line, PFAS-free polymer processing aids for polyolefin extrusion applications, addressing industry demand for sustainable alternatives while maintaining performance standards.

https://www.clariant.com - In May 2025, Taghleef Industries introduces SHAPE360 TDSW, a high-performance floatable white polyolefin TD shrink sleeve label film, offering optimal opacity and low-density properties for recyclability.

https://www.packagingstrategies.com

Segments Covered in the Report

By Type

- Polyethylene

- Polypropylene

- Polyolefin Elastomer

- Ethylene Vinyl Acetate

By Application

- Film & Sheet

- Injection Molding

- Blow Molding

- Profile Extrusion

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting