What is the Rectifiers Market Size?

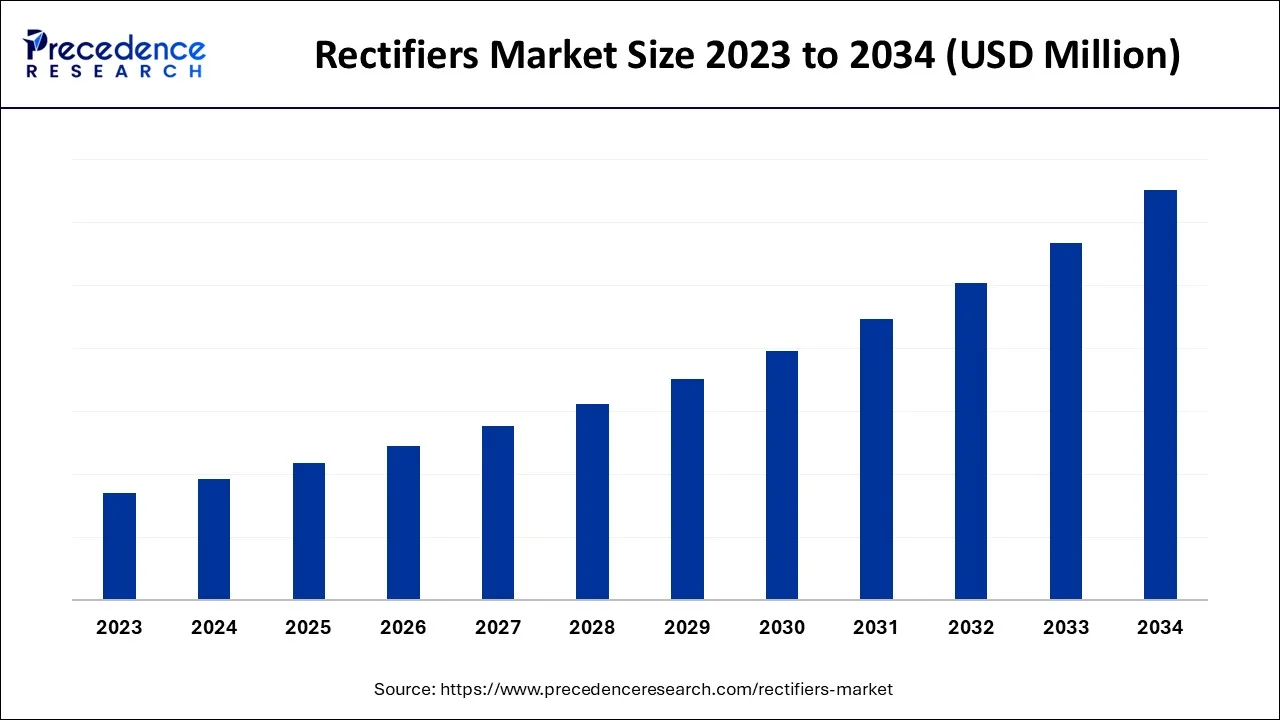

The global rectifiers market size is expected to rise with an impressive CAGR and generate the highest revenue by 2035.

Rectifiers are frequently employed as circuit guards to stop human error-caused supply voltage reversal in electronic components. Additionally, the industry is being driven forward by the rising usage of high-frequency rectification and improved energy efficiency in consumer electronics like laptops, smartphones, and PCs.

How is AI contributing to the Rectifiers Industry?

AI is one of the major game changers in the rectifier industry as it brings smarter control, real-time optimization, and predictive maintenance to the table, subsequently enhancing the efficiency, reliability, and power quality of the systems.

The AI processing algorithms are capable of managing the complex converter dynamics, minimizing the losses, adjusting to the different loads, utilizing the energy in an optimal way, overseeing the parameters, anticipating the failures, tackling the harmonic problems, improving the design processes and facilitating the renewable integration through demand and power flow forecasting thus securing the stable performance of the conversion systems across different industries which in turn effectively increases the operational life through intelligent decision making and automation.

Rectifiers Market Growth Factors

One of the main reasons fueling the market's expansion is the increasing deployment of smart grids in different parts of the world. Semiconductor rectifiers are frequently employed in circuits as guards to prevent unintentional supply voltage reversal in electronic components. Additionally, the widespread use of the device for high-frequency rectification and improved energy efficiency in consumer electronics like laptops, cellphones, and desktops is encouraging market growth. Additionally, a number of product breakthroughs, such the creation of environmentally friendly semiconductor rectifiers made from biocompatible and biodegradable materials, are boosting market expansion.

Accordingly, the market expansion is being favorably impacted by the rising product use in automobile electronics, such as central body control, contemporary electric power steering, brake system, and seat control. It is projected that further factors, including as the growing downsizing of electronic components and the adoption of several government efforts on contemporary power production and distribution infrastructure, will propel the market toward expansion.

- The increased usage of automobile electronics, such as advanced electric power steering, brake systems, charging, and seat control, is positively influencing the market growth.

- The industry is expected to advance due to several government initiatives on modern power generating and distribution infrastructure.

- Growing demand in the automobile industry for renewable energy supplies and rectifier-based electrical components

Market Outlook

- Industry Growth Overview:

The market is getting bigger due to the demand for power electronics, electric vehicles, and renewable systems, which are all driving innovations in diverse areas of application all over the world at a steady pace. - Sustainability Trends:

The rectifiers that are energy-efficient and made from wide-bandgap semiconductors are the main focus, and recycled manufacturing materials for greener production practices are the ones that ensure sustainability. - Global Expansion:

Asia-Pacific is the leading region in manufacturing, while North America and Europe are the ones that drive specialized advancements, thus facilitating the worldwide growth and successful market diversification. - Major Investors:

ABB, Siemens, Toshiba, Mitsubishi Electric, Infineon, onsemi, Vishay, they are all the big names that invest in technology development for enhancing market progression and innovation. - Startup Ecosystem:

Startups are the ones that come up with the idea of miniaturized smart rectifiers and IoT for predictive maintenance that is supporting Industry digital transformation through advanced designs.

Market Scope

| Report Coverage | Details |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Product and By Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Key Market Drivers

Rectifier diodes are in increasing demand for a range of automotive & power sector applications

Applications for power electronics in vehicle power generation and control have multiplied in recent years. For instance, a brand-new load-matching technique has been used by the car sector. This technique greatly reduces inefficiency and significantly increases peak and average power production from a traditional Lundell alternator using a simple switched-mode rectifier.

Power electronic components being incorporated into cars and the overall power control, as well as a management system, opens up new opportunities for utilizing rectifiers. In-vehicle electronics may also offer appealing opportunities, which is another expectation. Modern electric power steering, seat control, central body control, and braking systems, are a few examples of potential business opportunities in this market.

Key Market Challenges

Technical difficulties and expensive rectifiers

Rectifiers are often used in electrical components to reference voltage, modify signal size, decouple the signal from the source, and adjust the voltage. By utilizing semiconductor rectifiers in electronic component circuits, inadvertent supply voltage reversal risks can be reduced. As a result, if connected incorrectly or inappropriately, it might cause damage to the machinery or pose a safety hazard.

The rectifier may malfunction for a variety of reasons, including a weak or loose battery, poor grounding, or a worn-out connection to the battery. For instance, it could be costly and time-consuming to replace the regulator rectifier in a car when it malfunctions. However, a key element acting as a barrier that may hinder market development is the high cost of acquiring semiconductor rectifiers. For instance, a bridge rectifier costs more since it needs four diodes to function.

Smart grids are being adopted more widely

China, India, and Brazil are just a few of the countries that are making great strides in the design and creation of smart grid technology. These innovations contribute to the development of a more adaptable power grid, which enables the incorporation of diverse renewable energy sources. By integrating ICT at various stages of the power generation, power consumption, and delivery processes, also raises the degree of service dependability and service given to end users.

The adoption of smart grid technology in emerging nations helps to coordinate the requirements and capabilities of all electricity market participants, including end users, generators, grid operators, and others, in order to operate every aspect of the system as economically and environmentally as possible while enhancing system reliability, stability, and resilience. Semiconductor rectifiers are one of the crucial elements required to guarantee the effective implementation of smart grid technology. The need for semiconductor rectifiers is being driven by this aspect.

Government spending has increased on modern infrastructure for electricity production and distribution in developing countries

For the world economy to run smoothly, reliable and economic power must be provided. As a result, governments all over the world, especially in less developed nations, are boosting their expenditures on cutting-edge infrastructure for the production and delivery of power.

Additionally, the emissions that arise from a variety of energy production techniques raise environmental issues that may have a negative impact on human health, the economy, and national security. In order to assure a reduction in emissions or their complete removal throughout the power generating process, governments in developing nations all over the world are putting cutting-edge technology into practice.

ProductInsights

The automobile sector is a significant application for the rectifier industry. The automotive industry's rapid technological advancements are having an impact on the rectifier market since typical IC engine vehicles only need a small number of electrical components.

Due to the growing popularity of electric cars (EVs) and autonomous vehicle technologies, the majority of market vendors are increasing their investments in the automotive sector. The demand is anticipated to increase as rectifiers are utilized more often in the On-Board Charging and Battery Management Systems (BMS) of electric vehicles (EVs).

Government mandates for (Advanced Driver Assistant System) ADAS systems and the expanding use of smart technologies in vehicle production are also fostering the development of the industry under study.

For instance, the IEA estimates that 6.6 million electric cars were sold globally in 2021. 9% of all automobiles sold globally were electric vehicles. Even though there aren't many battery electric vehicles (BEV) on the road today, the development of the charging infrastructure and the diversity of BEV models may cause sales of these vehicles to outpace those of the whole auto industry in the coming years. Even if overall auto sales remain similar, this increase may increase the need for rectifiers. To meet the rising demand for environmentally friendly solutions, the majority of nations are supporting the use of electric vehicles.

For instance, according to the IEA, 6.6 million electric vehicles were sold worldwide in 2021. Around the world, electric vehicles made up 9% of all vehicle sales. Despite the fact that there aren't many battery electric vehicles (BEV) on the road right now, the growth of the infrastructure for charging them as well as the variety of BEV models may allow sales of these cars to exceed those of the whole auto industry in the years to come. Even if overall car sales stay about the same, this rise may make rectifiers more necessary. The majority of countries are promoting the usage of electric cars in order to fulfill the growing demand for ecologically friendly alternatives.

Type Insights

The three-phase, which dominates the worldwide rectifiers market, is anticipated to expand at a CAGR of 12.4% over the course of the projected period. Three single-phase rectifiers have been merged or linked to a single three-phase generator in three-phase rectifiers, which vary from single-phase rectifiers in that they convert A.C. input to D.C. output. It encourages electrical balance among power loads, boosting efficiency.

The majority of everyday products are D.C. devices, and as more industries, consumer electronics, home appliances, and other D.C. devices are needed, the demand for rectifiers rises. High-power appliances are the most typical place to find three-phase rectifiers. Demand has significantly increased over the past few years as a result of changes in the automotive, solar, and industrial sectors.

The market will experience a growth in demand for rectifier goods like as charging stations, transformers, and other products due to new technologies such as Tesla's electric vehicles. Solid devices like chargers and inverters employ single-phase rectifiers to convert alternating current (AC) to direct current (DC) using a single-phase transfer secondary coil (direct current).

Even though the standard power supply in homes and business buildings uses alternating current, the majority of the devices used there are D.C.-compatible (direct current). A single-phase rectifier's market is expanded by half-wave rectification since it is more compatible with modern electronics. A single-phase supply being used in homes and workplaces produces an alternating voltage that is used by a variety of devices.

Regional Insights

Due to the enormous increase in demand for renewable energy products and rectifier-based electronic components in the automotive sector throughout the area, the Asia-Pacific is one of the regions with the fastest expanding rectifier markets. China is one of the top producers of rectifiers, with a sizable local business presence. Furthermore, while concentrating on the provision of consumer electronics items during the past few years, Chinese rectifier makers have been rapidly growing their businesses.

In 2030, excluding two- and three-wheelers, electric vehicle sales will make up 70% of all vehicle sales worldwide and 42% in China, according to the International Energy Agency. By 2030, Japan will still have 21% of the global EV market, followed by Europe with 26% and the United Kingdom with 57%. In order to encourage the usage of electric cars, many governments are developing a number of rules throughout the Asia Pacific area, which is generating a favorable market environment for the expansion of the investigated industry.

The latest commercial vehicles, such as lorries, utilize diesel fuel, which the Chinese government has started to phase out. The nation wants to do rid of all gasoline and diesel cars by 2040. Additionally, according to Business Korea, the ongoing trade spat between China and the United States is having an impact on Korean rectifier producers like Samsung Electro-Mechanics, which gets 40% of its income from China.

In response to the increased demand for rectifiers and other crucial consumer electronics components from China, the Republic of Korea, India, and Singapore, several companies are setting up production operations in the Asia-Pacific region. The abundance of raw materials available as well as the low starting and labor costs are encouraging reasons for businesses to locate manufacturing operations in this area.

How is Asia-Pacific leading in the Rectifiers Market?

The region of APAC has been recognized as the largest and fastest-growing market for rectifiers. This is due to several factors, such as industrialization, the electronic manufacturing market, the renewable energy sector, and the growth of automation.

China Rectifiers Market Trends:

China is the biggest player when it comes to the production of advanced rectifiers as the government invests heavily in the tech sector, concentrates on the electric mobility market, and the construction of 5G base stations as well as infrastructure growth which accelerates the demand for rectifiers in China that are aligned with the rapid industrial expansion and capable of being supported by domestic supply for global distribution and further innovation.

How is North America performing in the Rectifiers Market?

North America is a region that has been underpinned by innovation, the establishment of new data centers, electric mobility, modernization of smart grids, and a refurbishment programme for utilities with the possibility of high-efficiency modules, the integration of EV charging with support from funding initiatives and the provision of energy-efficient infrastructure that is resilient to demand and therefore fosters the growth of power electronics.

U.S. Rectifiers Market Trends:

The U.S. is the most advanced market in the region, characterized by its strong manufacturing capabilities, R&D in advanced materials such as SiC and GaN rectifiers backed by intensive energy efficiency regulations, and the continual development of high-performance applications in various sectors, and the upgrading of the infrastructure, which in turn is enhancing the country's technological competitiveness.

What are the driving factors of the Rectifiers Market in Europe?

Europe is at the forefront of the power supply market mainly due to the energy efficiency regulations, investment in sustainable transport, and grid modernization, which have turned the opportunities of high-voltage rectifiers for rail, renewable deployment growth, and telecom infrastructure upgrades into the adoption of technologically advanced rectifiers across industries that will ultimately lead to market innovations and sustainability.

Germany Rectifiers Market Trends:

Germany tops the European market with its investments in industrial upgrades, high-efficiency manufacturing, and demand for advanced technology that goes hand in hand with the adoption of sophisticated rectifier systems across the different industries, which are raising the bar through continuous improvement in the power technologies, and thus the strong engineering ecosystem is providing the drivers for that.

Rectifiers Market-Value Chain Analysis

- Raw Material Procurement: sourcing silicon wafers and gases, purifying them, and maintaining the substrate creation and processing environment stably

Key Players: Shin-Etsu Handotai, SUMCO, and GlobalWafers - Wafer Fabrication: manufacturing phase where microscopic circuits, including diodes, are built on a silicon wafer substrate in controlled cleanroom conditions

Key Players: TSMC, Samsung Foundry, and Intel - Photolithography and Etching: light is first used to transfer patterns, then layers are removed to accurately define components and interconnections

Key Players:ASML (lithography systems), Applied Materials, and LAM Research - Doping and Layering Processes: impurities are introduced for electrical property control, and conducting or insulating material layers are deposited

Key Players: Applied Materials, LAM Research, and TEL - Assembly and Packaging: wafers are diced into chips, attached to substrates, electrically connected, and encased for durability so they can be used.

Key players: ASE Technology Holding, Amkor Technology, Vishay Intertechnology, and ON Semiconductor

Top Companies in the Rectifiers Market & Their Offerings:

- ON Semiconductor: ON Semiconductor is the one that provides the smart power and sensing technologies, which include the standard and high-performance rectifiers such as Schottky and silicon carbide solutions.

- Vishay Intertechnology: Vishay has such a wide variety of rectifying products as Schottky, ultrafast, and standard recovery designs in different packages for different applications around the globe.

- Infineon Technologies: Infineon has developed silicon, silicon carbide, and gallium nitride-based rectifiers; moreover, these rectifiers deliver high power efficiency, which makes them suitable for advanced power conversion applications in a wide range.

Rectifiers Market Companies

- ON Semiconductor

- Vishay Intertechnology, Inc.

- Infineon Technologies AG

- STMicroelectronics

- Fuses Unlimited Inc.

- Toshiba Corporation

- Diodes Incorporated

- NXP Semiconductors

- Renesas Electronics Corporation

- Mitsubishi Electric Corporation

Recent Developments

- In December 2025, STMicroelectronics unveiled three new radiation-hardened low-voltage rectifier diodes developed for power circuits in Low Earth Orbit (LEO) satellites. This expands its portfolio of space-grade components. (https://www.newelectronics.co.uk)

- In November 2025, Hind Rectifiers Limited (HIRECT) started commercial production of specialized copper conductors at its Sinnar facility. This completes a significant backward integration initiative for improved supply chain and operational efficiency. (https://themachinemaker.com)

Segments Covered in the Report

By Product

- Power & Utility

- Automotive

- IT/Telecom

- Consumer Electronics

- Others

By Type

- Single Phase Rectifier

- Three-Phase Rectifier

ByGeography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content