What is the Seed Treatment Market Size?

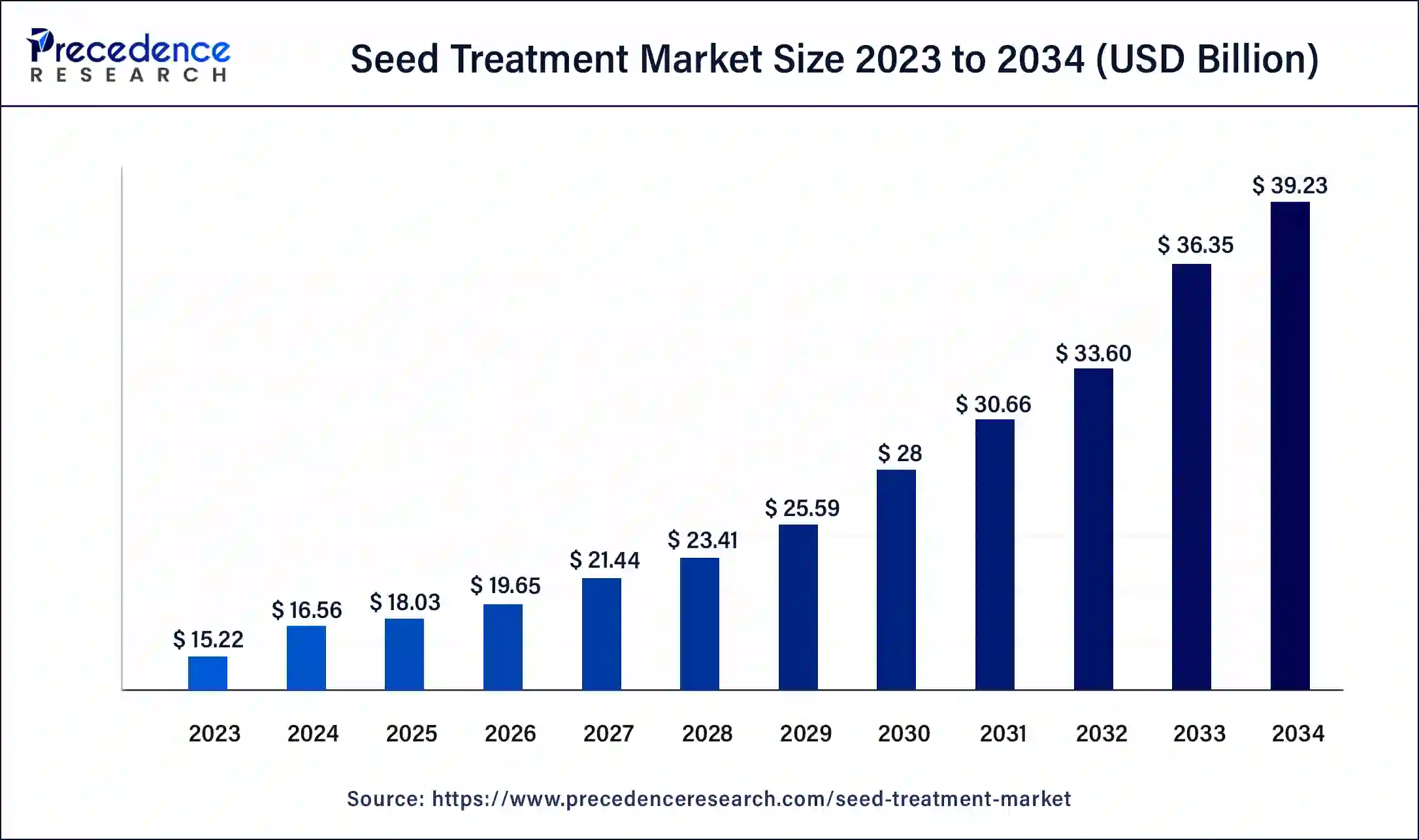

The global seed treatment market size is calculated at USD 18.03 billion in 2025 and is predicted to increase from USD 19.65 billion in 2026 to approximately USD 39.23 billion by 2034, expanding at a CAGR of 9% from 2025 to 2034.

Seed Treatment MarketKey Takeaways

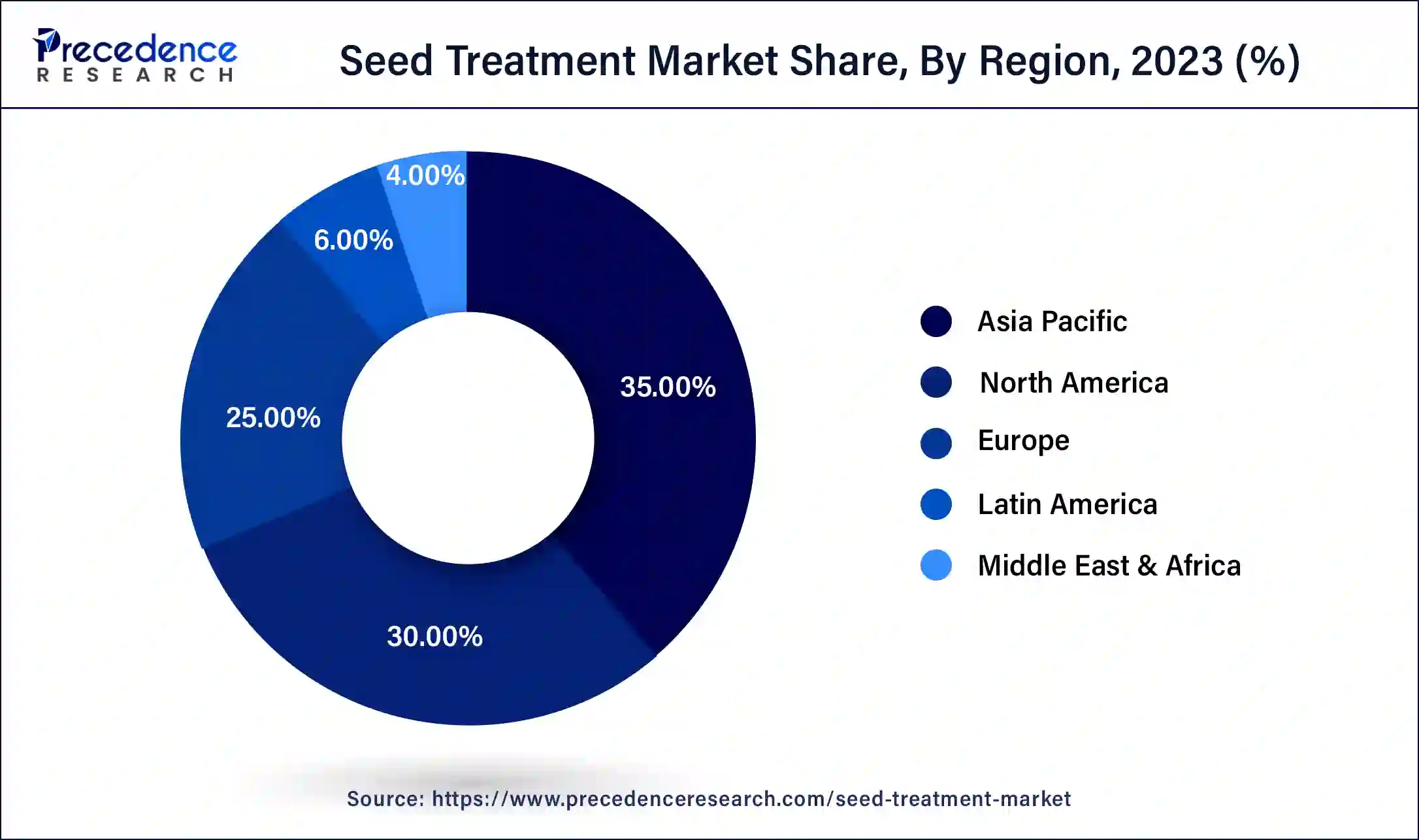

- Asia Pacific contributed more than 35% of revenue share in 2024.

- North America region is estimated to expand the fastest CAGR between 2025 and 2034.

- By type, the insecticides segment has held the largest market share of 33% in 2024.

- By type, the non-chemicals segment is anticipated to grow at a remarkable CAGR of 10.5% between 2024 and 2034.

- By crop, the wheat segment had the largest market share of 31% in 2024.

- By crop, the others segment is expected to expand at the fastest CAGR over the projected period.

Market Overview

The seed treatment market encompasses the agricultural strategy of subjecting seeds to a range of treatments, including pesticides, fungicides, and insecticides, prior to planting. This method is employed to shield seeds from pests, diseases, and adverse environmental conditions, ultimately enhancing crop yields and the overall vitality of plants. It plays a pivotal role in modern agriculture, bolstering the effectiveness and eco-friendliness of crop production.

This market comprises diverse technologies and products geared towards augmenting seed quality and performance, thereby contributing to the global agricultural sector's efficiency and sustainability. It is a constantly evolving and dynamic industry driven by advances in agricultural science and technology.

Seed Treatment Market Outlook

- Industry Growth Overview:The seed treatment market is expected to experience steady growth between 2025 and 2034, fueled by rising global crop losses due to pests and unpredictable weather that threaten early plant development. In North America, farmers are increasingly adopting treated seeds for their reliability, uniform emergence, and reduced replanting needs. Demand is also rising for hybrid crops such as corn, vegetables, and oilseeds, which offer enhanced genetic traits and economic value. With growing global concerns over food security, seed treatments are expected to become a standard input across both smallholder and large-scale farming systems.

- Sustainability Trends:Sustainability has become a transformative force in the seed treatment industry, speeding up the shift from traditional chemical-heavy methods toward biological and eco-friendly options. Regulatory restrictions in the EU, North America, and parts of Asia are eliminating certain highly toxic active ingredients and prompting companies to focus on low-residue solutions. This is causing a doubling in the adoption of microbial inoculants, plant-growth-promoting rhizobacteria (PGPR), and bio-stimulant-covered surfaces.

- Global Expansion:Seed treatment manufacturers are rapidly expanding their footprint around the world to address crop-specific requirements and regional regulatory standards. In Asia-Pacific, countries like India and China are driving adoption through increased hybrid seed use, government quality initiatives, and greater farmer awareness of early-stage disease management benefits. Emerging regions, particularly in Asia-Pacific and Eastern Europe, offer opportunities through expanding commercial farming, government seed quality initiatives, and growing farmer awareness of disease management and yield-enhancing technologies.

- Major Investors:Large agrochemical and agribusiness corporations such as Syngenta AG, BASF SE, Bayer AG, Corteva Agriscience, and UPL Ltd. are the major investors. They pour capital into R&D, formulation innovation, and global production and distribution networks. Their investments help launch advanced, crop- and region‑specific seed treatments, expand manufacturing capacity, and make treatments widely available, thereby improving crop yields, supporting sustainable agriculture, and driving adoption across large and small farms worldwide.

- Startup Ecosystem:The startup ecosystem in the market is evolving quickly, driven by advances in microbiology, nano-formulation, enzyme-based coatings, and plant-symbiotic technologies. Companies such as Pivot Bio, ABM (Advanced Biological Marketing), Laava Tech, and other new EU-based microbe innovators are receiving significant VC funding despite challenges in delivering nitrogen-fixing microbes, stress tolerance, and root health promoters. Additionally, the startup scene is expected to bring major innovations that will transform seed treatment chemistry, coating, and performance, further fueling market growth.

Seed Treatment Market Growth Factors

- With the global population on a steady rise, the demand for food production is continuously increasing. Seed treatment technology helps optimize crop yields, ensuring that agricultural systems can sustainably meet the growing food demand. As the global population swells, it is projected to reach 9.7 billion by 2050. Seed treatment is vital to boost crop productivity and bridge the gap between supply and demand for food, addressing food security concerns.

- Environmental consciousness is growing, leading to a shift towards more sustainable and eco-friendly agricultural practices. Seed treatment allows for targeted and reduced use of chemical inputs, minimizing environmental impact. Consumers and regulatory bodies are increasingly advocating for sustainable agriculture. Seed treatment aligns with these goals by reducing the need for broad-spectrum chemical pesticides, and promoting eco-friendly farming practices.

- Continuous innovation in seed treatment methods and products, such as novel formulations and application techniques, is expanding the market. These advancements provide better protection and improved crop performance. Technological innovations, like precision seed coating and biotechnology, offer more effective and efficient seed treatment solutions. These innovations attract investment and drive market growth.

- Rising instances of crop diseases and pests due to changing climate conditions and global trade are compelling farmers to seek more effective means of protection. Seed treatments offer a proactive approach in safeguarding crops from the outset. Climate change and globalization contribute to the spread of new pests and diseases. Seed treatment is a proactive defense, as it fortifies plants right from the germination stage, mitigating potential losses.

- Many governments are promoting and regulating the use of seed treatments for improved agricultural practices, reduced crop losses, and sustainable farming. Supportive policies and incentives encourage adoption. Government initiatives like subsidies, research funding, and regulations that prioritize safer and sustainable farming practices drive the seed treatment market forward.

- The adoption of genetically modified seeds is on the rise due to their potential for increased yield and pest resistance. These seeds often require specialized seed treatments, further propelling the market. GM seeds are engineered to exhibit specific traits, and seed treatment plays a crucial role in ensuring these traits are expressed optimally. As GM crop adoption increases, so does the demand for specialized seed treatments.

- The integration of precision agriculture techniques, including GPS and data analytics, is creating a demand for precise seed treatments. Tailored treatments that match specific soil and environmental conditions enhance crop performance. Precision agriculture enables farmers to fine-tune their seed treatment practices, optimizing resource use and improving crop outcomes, which in turn bolsters the seed treatment market.

- As farmers become more educated about the benefits of seed treatment in terms of increased yields, cost savings, and sustainable farming, they are more likely to adopt these practices. Educational programs, training, and information dissemination about the advantages of seed treatment help in expanding its adoption, making it a vital growth factor for the market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 39.23 Billion |

| Market Size in 2026 | USD 19.65 Billion |

| Market Size in 2025 | USD 18.03 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 9% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Crop, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing global food demand

The increasing global food demand is a major driving force behind the growth of the seed treatment market. With the world's population steadily rising, the demand for food is escalating, challenging the agriculture sector to produce more with limited resources. Seed treatment technology plays a pivotal role in meeting this demand by optimizing crop yields. As the need for higher agricultural productivity intensifies, farmers are turning to seed treatments to protect their crops from various threats such as pests, diseases, and adverse weather conditions. By enhancing the resilience of seeds, these treatments ensure that a larger portion of crops successfully reaches harvest, ultimately increasing the global food supply.

Furthermore, the demand for diverse and nutritionally rich food is growing. Seed treatments contribute to crop quality by improving disease resistance and nutrient uptake. This not only helps meet the increasing food quantity demand but also aligns with the evolving food quality expectations of consumers. In summary, the surge in global food demand is a compelling factor driving the seed treatment market, as it offers an effective solution to boost agricultural productivity and ensure food security in a world with a burgeoning population.

Restraint

Limited compatibility with certain crops

The limited compatibility of seed treatment with certain crops presents a significant restraint on the seed treatment market's growth. Not all crops are suitable for seed treatment, and this constraint affects the market in several ways. Firstly, it limits the scope of the application. Some crops, like root vegetables or certain ornamental plants, have characteristics that make seed treatment less effective or even impractical. This constraint reduces the overall market potential. Secondly, it hinders diversification.

The market may become overly dependent on a handful of widely treated crops, which can make it vulnerable to market fluctuations and economic shifts. A limited range of compatible crops limits the diversification and resilience of the seed treatment market. Thirdly, it reduces adoption rates. Farmers who primarily cultivate crops that aren't compatible with seed treatment may be less inclined to invest in the technology or may seek alternative pest and disease control methods, hindering the broader adoption of seed treatments. In summary, limited compatibility with specific crops constrains the seed treatment market's growth by restricting its applicability, diversification, and adoption rates.

Opportunity

Biological seed treatments

Biological seed treatments are emerging as a significant opportunity in the seed treatment market. With increasing emphasis on sustainable and environmentally friendly agriculture, biological seed treatments offer a compelling solution. These treatments leverage beneficial microorganisms, such as bacteria and fungi, to naturally enhance crop resistance to pests and diseases. They minimize the need for chemical inputs, aligning with the growing demand for eco-conscious farming practices.

Additionally, biological seed treatments can contribute to improved soil health, nutrient uptake, and overall crop vitality. As consumers and regulators increasingly favor organic and sustainable agriculture, the market for biological seed treatments is poised for substantial growth. This represents a promising avenue for innovation and investment, as companies focus on developing and commercializing effective and environmentally responsible biological seed treatment solutions to meet the evolving demands of the agriculture industry.

Segment Insights

Type Insights

The insecticides segment has held a 33% revenue share in 2024. The substantial share of the seed treatment market held by insecticides can be attributed to their indispensable role in shielding crops from a diverse array of harmful pests. Insects like beetles, aphids, and caterpillars pose a significant and constant threat to crop yields. The application of insecticides during seed treatment offers a proactive and precision-oriented defense strategy right from the inception of the crop. This reliability in managing pest-related risks, coupled with the considerable economic impact of pest damage on crop yields, underscores the prominence of insecticides within the seed treatment market, underlining their crucial role in ensuring productive and economically viable agricultural practices.

The non-chemicals segment is anticipated to expand at a significant CAGR of 10.5% during the projected period. The non-chemicals segment holds a major growth in the seed treatment market due to several key factors. Firstly, increasing environmental concerns and a shift toward sustainable agriculture have driven demand for non-chemical alternatives. Secondly, regulatory pressures to reduce chemical pesticide use have favored non-chemical options. Thirdly, biological treatments, such as beneficial microorganisms, provide effective and eco-friendly solutions that resonate with consumers and farmers alike. Additionally, non-chemical treatments align with the growing trend towards organic and eco-conscious farming practices, making them a preferred choice. As a result, the non-chemical segment has gained prominence in the seed treatment market, reflecting the evolving preferences and priorities of the agricultural industry.

Crop Insights

The wheat segment is anticipated to hold the largest market share of 31% in 2024. The wheat segment holds a significant share of the seed treatment market due to several factors. Wheat is one of the world's most widely cultivated staple crops, making it a crucial component of global food security. The susceptibility of wheat to various diseases and pests necessitates effective seed treatment to ensure optimal yields. Additionally, wheat farming practices are well-established and modernized, making it easier for farmers to adopt seed treatment technologies. The demand for high-quality wheat, driven by global food consumption patterns, further propels the need for effective seed treatments to protect and enhance wheat crops, cementing its dominant position in the market.

The others segment is projected to grow at the fastest rate over the projected period. The others segment in the seed treatment market holds a significant growth primarily because it encompasses a wide range of crops not individually classified. This category includes niche and specialty crops that are not as widely reported or analyzed. These crops often have unique treatment requirements that are not covered by standard categories.

Furthermore, as agriculture diversifies, the cultivation of newer and less conventional crop varieties is increasing. These crops may not fall into established categories, and their treatment needs are grouped under others. As the agriculture industry evolves and explores new crop types, the segment's share continues to grow, reflecting the industry's expanding diversity and adaptability.

Regional Insights

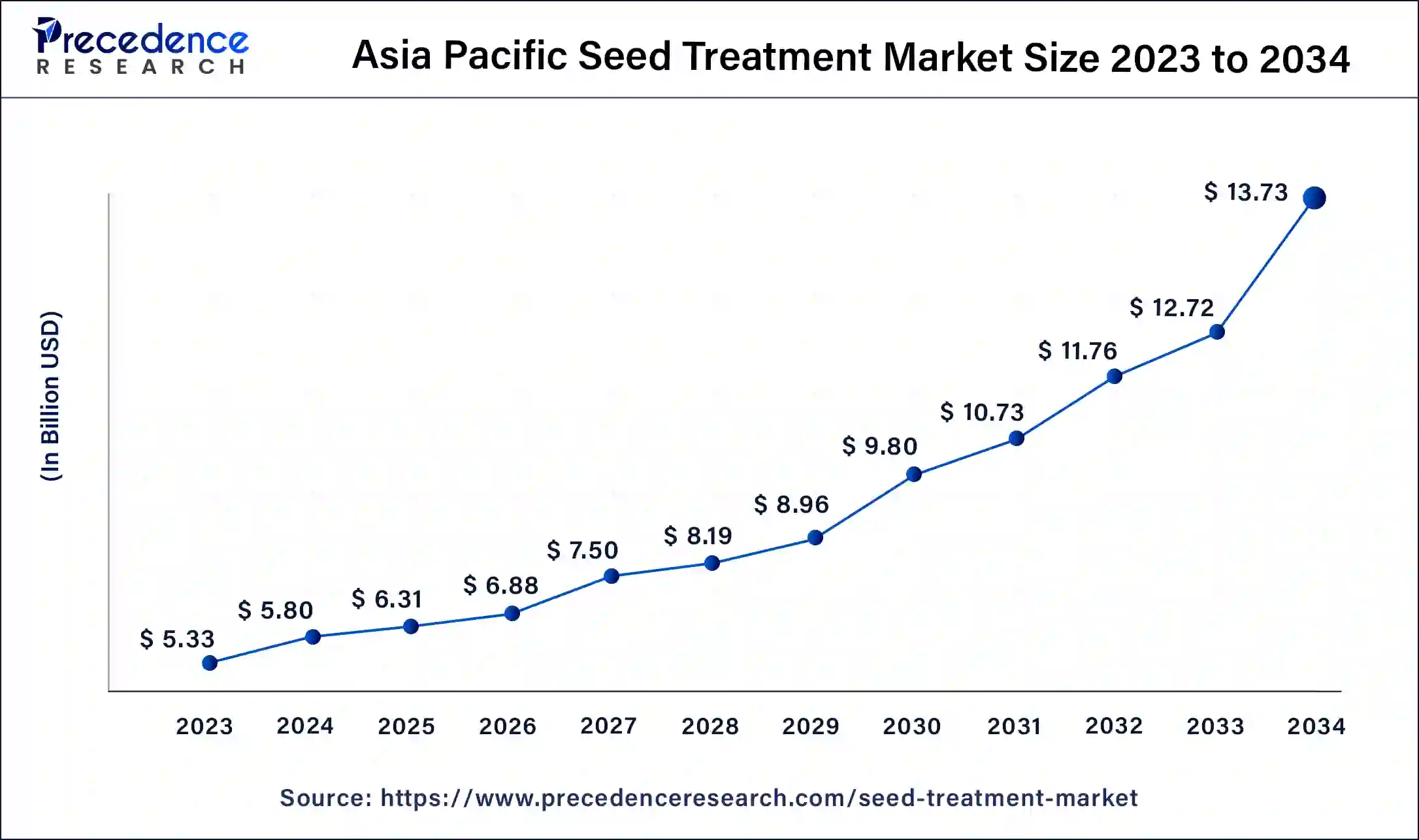

Asia Pacific Seed Treatment Market Size and Growth 2025 to 2034

The Asia Pacific seed treatment market size is valued at USD 6.31 billion in 2025 and is projected to reach USD 13.73 billion by 2034, registering a CAGR of 9.20% from 2025 to 2034.

Asia Pacific held the largest revenue share 35% in 2024. North America dominates the seed treatment market due to several key factors. First, the region is home to numerous major aerospace and defense companies, fostering a strong industrial base for electronics production. Second, North America's robust military and civil aviation sectors drive substantial demand for advanced electronics systems.

Third, significant investments in research and development and government contracts further bolster the industry's presence. Moreover, the region's commitment to innovation and technological advancements maintains its competitive edge. These factors collectively contribute to North America's significant share in the Seed Treatment market, setting it apart as a global leader in this sector.

India Seed Treatment Market Trends

India is leading the charge in Asia Pacific due to the increasing adoption of hybrid seeds for rice, corn, pulses, and vegetables. Government-funded seed quality improvement initiatives are expected to increase the use of treated seeds among small and marginal farmers. Unpredictable climate conditions in the country are likely to boost demand for seed protection when germination and crop establishment are consistent.

What Makes North America the Fastest-Growing Region in the Market?

North America is estimated to observe the fastest expansion. North America holds substantial growth in the seed treatment market due to several key factors. The region benefits from a well-established and technologically advanced agricultural sector, which emphasizes the adoption of innovative farming practices. Favorable government policies, stringent regulations, and a strong focus on sustainable agriculture drive the demand for seed treatments.

Additionally, North American farmers increasingly recognize the benefits of seed treatments in optimizing crop yields and quality. The region's diverse crop portfolio, including staple crops like corn and soybeans, further contributes to its dominant position in the global seed treatment market as these crops often require treatment for pest and disease protection.

U.S. Seed Treatment Market Trends

The U.S. is regarded as a major market player due to its robust commercial farming systems and widespread use of hybrid and genetically enhanced seeds. Additionally, stable regulations and well-established stewardship programs are expected to boost ongoing demand for high-quality insecticidal and fungicidal treatments in the country.

What Factors are Projected to Strengthen Europe's Position in the Global Seed Treatment Market?

Europe is expected to sustain its stronghold in the market due to stringent regulations that promote the adoption of safe, low-residue, and eco-friendly seed protection technologies. The market growth is expected to accelerate as demand intensifies for biological seed treatments, microbe-based inoculants, and biodegradable coating polymers across major agricultural economies. Additionally, the rapidly increasing production of cereals and oilseeds in Eastern Europe is likely to boost future demand for fungicide- and insecticide-based treatment products.

Germany Seed Treatment Market Trends

In Germany, the market is driven by its well-developed agricultural industry, which has the freedom to choose EU-approved, low-toxicity, and biological seed treatments. Strict restrictions on neonicotinoids are expected to speed up the adoption of seed treatment solutions. Additionally, the presence of leading market players such as BASF and Adama, known for their strong R&D efforts, is expected to support market growth.

How is the Opportunistic Rise of Latin America in the Seed Treatment Market?

Latin America is expected to experience significant growth in the market due to intensive production of soybean and corn, where treated seeds offer high agronomic benefits. It is estimated that Brazil and Argentina are likely to play major roles, as growers in these countries often face pressure at the start of the season from pests and diseases, making seed treatments an essential input. Additionally, the region's vast crop production is likely to maintain steady demand for premium seed treatment technologies. Brazil leads the market in Latin America, as soybean and corn are cultivated on a large scale in the country.

What Factors Contribute to the Seed Treatment Market in the Middle East & Africa?

The market in the Middle East & Africa is driven by the growing adoption of treated seeds for cereals, pulses, and horticultural crops grown in challenging climatic conditions. The high occurrence of soilborne pathogens, drought stress, and low soil fertility is likely to boost the importance of seed-applied fungicides, insecticides, and bio-stimulants. Additionally, increased awareness of yield stability and the high costs of replanting are expected to boost the use of seed treatments in the region. South Africa leads the market, supported by the high usage of treated seeds to overcome drought stress, soil erosion, and the prevalence of pathogens.

Seed Treatment Market - Value Chain Analysis

1. Raw Material Sourcing

The seed treatment industry begins with the procurement of active ingredients such as fungicides, insecticides, nematicides, polymers, colorants, and biological agents including microbes and bio-stimulants. These inputs form the core functional components of seed treatment formulations.

- Key Players: BASF (fungicides & polymers), Bayer (insecticides & fungicides), Syngenta (fungicides), Novozymes (microbial strains), Chr. Hansen (biologicals).

2. Formulation Development & Manufacturing

Active ingredients are blended with carriers, binders, coatings, and adjuvants to create commercially viable seed treatment formulations. This stage includes formulation chemistry, microencapsulation, stabilization, and biological strain optimization to ensure uniform coating and long-lasting seed protection.

- Key Players:Corteva Agriscience, FMC Corporation, UPL Limited, Adama Ltd., Nufarm Limited.

3. Seed Coating, Pelleting & Application Technology

Seed treatment products are applied onto seeds using specialized equipment such as rotary coaters, film-coating machines, and pelleting systems. This step ensures precise dosing, even distribution, and adherence of chemical or biological protective layers.

- Key Players: Germains Seed Technology, Clariant (coating polymers), BASF (application systems), Bayer SeedGrowth platform.

4. Seed Conditioning, Packaging & Quality Assurance

Treated seeds undergo conditioning processes, drying, and quality testing to ensure optimal germination, seed flowability, and storage stability. Seeds are then packed in accordance with crop-specific and regulatory requirements, ensuring traceability and safety.

- Key Players: Syngenta (quality testing units), Corteva Agriscience, Seed Dynamics Inc., Incotec (seed enhancement technologies).

5. Distribution to Seed Companies & Dealers

Finished treated seeds or treatment products move through established distribution channels involving agro-input distributors, seed companies, regional dealers, and cooperatives before reaching growers.

- Key Players:Bayer, Syngenta, UPL Limited, and regional agricultural distributors.

Seed Treatment Market Companies

- Syngenta (Switzerland): A global leader offering advanced chemical and biological seed treatments designed to protect crops against early-season pests and diseases while improving germination and plant vigor.

- Bayer (Germany): Provides a comprehensive portfolio of fungicidal, insecticidal, and biological seed treatments that enhance seedling establishment and strengthen resistance against pathogen pressure.

- Corteva Agriscience (U.S.): Delivers innovative seed-applied technologies combining chemistry and biologicals to ensure uniform emergence and strong early root development across key row crops.

- BASF SE (Germany): Offers advanced fungicide-based seed treatment solutions formulated to minimize seedling blights, improve plant vitality, and optimize stand establishment under stress conditions.

- FMC Corporation (U.S.): Specializes in insecticidal seed treatments that safeguard crops from soil-dwelling pests, improving early plant protection and maximizing field productivity potential.

- UPL Limited (India): Provides a diverse range of seed treatment products tailored for global crops, focusing on disease suppression, enhanced nutrient uptake, and improved plant robustness.

- Nufarm Limited (Australia): Supplies reliable fungicidal and insecticidal seed treatments that support healthy germination, early plant growth, and protection against broad-spectrum seedborne pathogens.

- Adama Ltd. (Israel): Known for cost-effective seed treatment chemistries that improve crop establishment by delivering consistent protection against early-season pest and disease pressures.

- Sumitomo Chemical Co., Ltd. (Japan): Offers high-performance seed treatment products integrating advanced chemistry for improved plant resistance and enhanced yield potential during early crop stages.

- Novozymes A/S (Denmark): A leading biological solutions provider offering microbial and enzyme-based seed treatments that promote root development, nutrient efficiency, and sustainable crop performance.

- Monsanto Company (U.S.): Delivers seed treatment technologies that complement its proprietary seed genetics by enhancing tolerance to early-season stresses and boosting emergence uniformity.

- Chemtura Corporation (U.S.): Supplies specialized seed protection chemicals designed to reduce fungal infections and improve seed safety, stability, and shelf-life during storage and planting.

- Germains Seed Technology (UK): Focuses on seed enhancement technologies such as pelleting, priming, and biological treatments aimed at improving germination speed, uniformity, and crop vigor.

- Valent U.S.A. LLC (U.S.): Offers a range of bio-rational and chemical seed treatments that support strong root growth, disease suppression, and enhanced seedling resilience.

- Advanced Biological Marketing, Inc. (U.S.): A key biological seed treatment innovator providing microbial formulations that boost nodulation, nutrient uptake, and overall plant health.

Leaders Announcements

- In December 2024, BioConsortia, Inc. announced a commercial agreement with New Zealand-based H&T (Hodder and Taylor Ltd). H&T and launched BioConsortia's FixiN 33 microbial seed treatment. This innovative seed coating will be available for corn, brassicas, and cereals, helping growers optimize nitrogen fertilizer use while reducing runoff and environmental impact by ensuring there is always nitrogen available to influence crop yield, converting atmospheric nitrogen into plant-accessible forms even after synthetic fertilizers dissipate.

Recent Developments

- In January 2025, UPL Corp announced the U.S. Environmental Protection Agency registration of ATROFORCE™ bionematicide, a new seed treatment for use in cotton to protect yield potential from a broad number of nematodes. This biosolution applied to cotton seed by commercial seed treatment utilizes a patented strain of Trichoderma atroviride as its active ingredient that effectively protects cotton plants from nematode pressure that can impact growth and leave them more susceptible to diseases and environmental stresses.

- In November 2024, Lallemand unveiled LalRise Shine DS Seed Treatment. This, a new seed treatment from Lallemand Plant Care for corn and dry bean growers. This is designed to improve root vigor and nutrient availability. this product combines the performance of Pizazz seed finisher with Lallemand's proprietary plant growth-promoting microbe (PGPM) by offering up to a 28% increase in phosphorus availability in the rhizosphere and boosts root mass growth by up to 20%.

- In September 2024, Indigo Ag launched its ground-breaking CLIPS™ device. The device is an automatic hands-free system, which saves time, removes the hassle factor in the seed treatment process, and potentially upends standard biological seed treatment applications, offering customers a more efficient and reliable solution for applying biological seed treatment to reduce the opportunity for product exposure and eliminate manual steps, making it a must-have tool for us and our growers

- In March 2022, Syngenta expanded its Seedcare offerings by introducing CruiserMaxx APX, a novel product designed to provide robust protection against a range of diseases, including Pythium and Phytophthora. This addition further enhances Syngenta's portfolio, reinforcing their commitment to crop health and productivity.

Segments Covered in the Report

By Type

- Insecticides

- Fungicides

- Chemicals

- Non-chemicals

By Crop

- Corn

- Soybean

- Wheat

- Canola

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting