What is the Supercomputer Market Size?

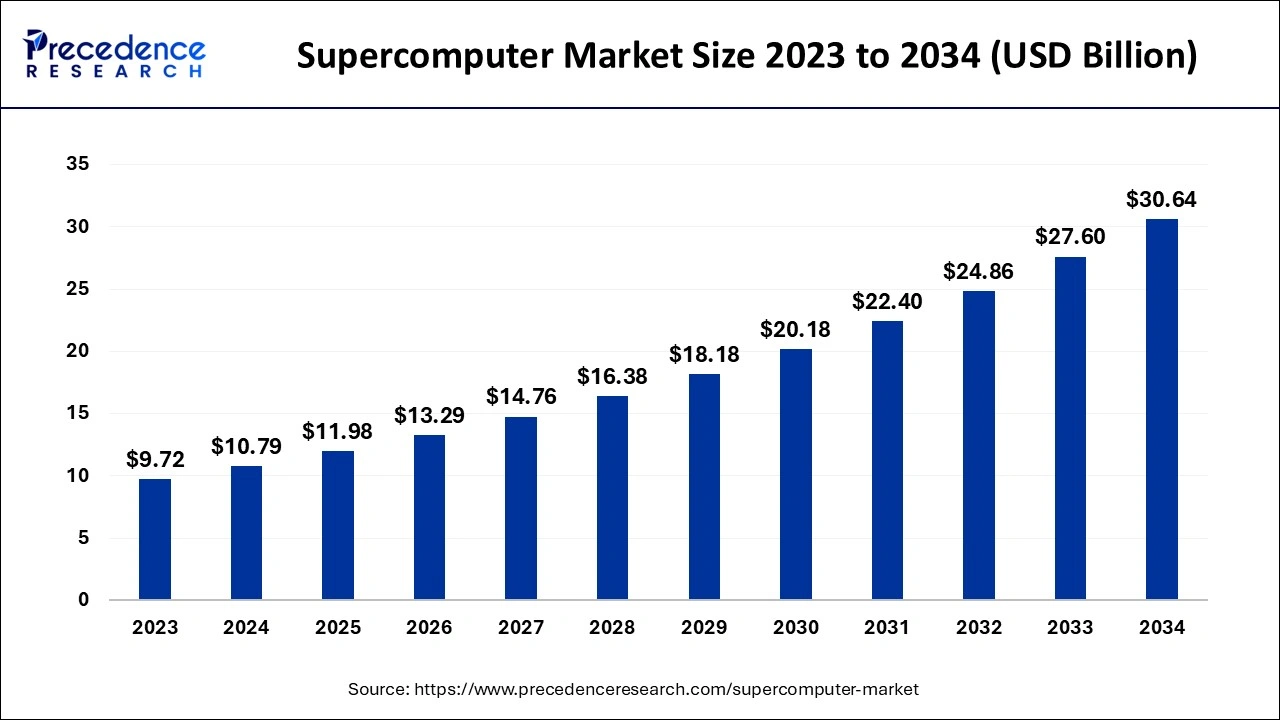

The global supercomputer market size is calculated at USD 11.98 billion in 2025 and is predicted to increase from USD 13.29 billion in 2026 to approximately USD 33.48 billion by 2035, expanding at a CAGR of 10.82% from 2026 to 2035.

Market Highlights

- By type, the vector processing machines segment accounted for the highest revenue share 43.4% in 2025.

- The government entities segment is growing at a CAGR of 9.6% over the forecast period.

Strategic Overview of the Global Supercomputer Industry

Supercomputers, in contrast to conventional computers, employ many central processing units (CPU). These CPUs are arranged into compute nodes, each of which consists of a memory block and a processor or group of processors (symmetric multiprocessing, or SMP). A supercomputer at scale may have tens of thousands of nodes. These nodes can work together to solve a particular problem thanks to their interconnect communication capabilities. Interconnects are another means by which nodes interact with I/O systems, such as networking and data storage. An important point to keep in mind is that data centers need cooling systems and appropriate facilities to accommodate everything due to the power consumption of modern supercomputers.

The first two purposeful supercomputers, IBM's 7030 Stretch and Sperry Rand's UNIVAC LARC, which were intended to be more powerful than the fastest commercial machines at the time, introduced the word supercomputer in the early 1960s. The development of cutting-edge, high-performance computer technology for military purposes first received regular financing from the US government in the late 1950s, which sparked a series of events that influenced the development of supercomputing.

The vast majority of installed modern mainstream computer systems cannot match the sustained performance offered by supercomputers. Supercomputers make it possible to generate information in applications like the analysis of intelligence data, weather forecasting, and climate modeling that would not otherwise be possible or that could not be produced in time to be useful. Scientific research in vital fields including physics, material sciences, biology, and medicine can be expedited by the use of supercomputing. In situations when tests are risky, expensive, or even impossible to perform or instrument, supercomputer simulations can supplement or replace experimentation. They can dilate space, allowing us to witness atomic phenomena, or contract space, allowing us to observe the core of a supernova. They can collapse time, allowing us to observe the change of the climate over centuries or the evolution of galaxies over billions of years. Better forecasts of a hurricane's landfall or the effects of an earthquake can save lives and money.

Artificial Intelligence: The Next Growth Catalyst in Supercomputers

Artificial Intelligence is fundamentally transforming the supercomputer industry by acting as both a primary workload and a tool for optimizing system operations. The increasing complexity and scale of AI models, particularly generative AI, are driving immense demand for the unprecedented computational power that only specialized supercomputing infrastructure can provide.

This synergy means AI accelerates scientific simulations and data analytics, enabling breakthroughs in fields like healthcare and climate modeling that were previously impossible. Consequently, the market for AI supercomputers is experiencing exponential growth, with significant investments from both the private sector and governments in advanced hardware like specialized GPUs and custom AI chips.

Supercomputer Market Growth Factors

The fast rise in access to and usage of open and big data is enabling the worldwide digital transformation. The economic potential of data is becoming more apparent, and data-driven innovations are emerging as a fundamental driver - a platform of innovation - for the fast spread of disruptive technologies and business model breakthroughs. HPC, Cloud Computing, and mobile web service innovations, together with fast increasing access and usage of Big Data, are altering enterprises, public services, and society as a whole. As a result, HPC infrastructure and services are critical enablers of far-reaching innovations in scientific research, industry, and SMEs.

Supercomputers produce new discoveries by processing and analyzing ever larger and more useful data sets. As a result, today's primary advancements in supercomputing address the sheer magnitude of such data sets by incorporating payment systems artificial intelligence tools, big data analytics, and edge computing.

Payment Systems- While supercomputers have many uses, one of the most important for preserving global and local economies is payment fraud detection. Customers are frequently accustomed to the convenience of rapid payment processing and approval, but this also implies that fraud may occur virtually instantaneously, at least without the proper security safeguards in place.

To combat fraud in real time, payment processing and fraud detection analysis must be similarly quick. When thousands of transactions must be completed every second, achieving real-time performance becomes increasingly difficult. Such high demands can only be met by supercomputers with super-processing capability. Financial services firms such as Mastercard and Visa make significant investments in HPC, harnessing the capability of high-performance computers to conduct data mining, machine learning, and fraud detection algorithms on thousands of financial transactions every second. Financial technology firms are also involved in payment fraud detection, providing machine learning technologies that try to improve fraud detection systems.

Artificial intelligence- AI approaches enable supercomputers to draw conclusions from ever huge data sets. However, AI requires computing capacity to evaluate all of that data, which exascale can do far faster. Scientists will be able to ask and receive answers that they could not previously.

Big data analytics- Big data has emerged as a significant motivator for new and extended HPC deployments. For the time being, the majority of HPC big data workloads are based on classical simulation and modelling. However, the technical and business forces shaping big data will lead to new types of HPC configurations to gain insights from unimaginably large data sets in the future.

Edge computing- Edge computing has exploded as a source of fresh data sets. These data sets are generated by both single instruments that capture massive volumes of data and billions of linked devices dispersed throughout the planet. The lidar telescope in the Andes, for example, and the Square Kilometre Array radio telescope in Western Australia and South Africa both create massive volumes of data. But so do the wise.

Major Trends of the Supercomputer Market

- Supercomputers are increasingly being designed with a focus on AI, as opposed to just numerical simulation workloads. The new architectures emphasize tensor processing as well as mixed-precision computing and scalable GPU fabrics. This change in focus is reshaping the definition of performance benchmarks across many different industries.

- Power efficiency is now a key priority in the design of supercomputers. Operators are using intelligent power orchestration, dynamic voltage scaling, and workload-aware scheduling as tools to minimize both operational costs and carbon footprint.

- Vendors are now providing modular supercomputers that can be incrementally upgraded. This minimizes the exposure to long-term capital costs and enables the organization to increase the level of performance that is aligned with the ever-evolving research needs.

- Countries are investing heavily to establish domestic supercomputer ecosystems as a way to reduce their dependence on foreign semiconductor supply chains. Each country's national HPC program will help to establish a localized manufacturing base, processor design, and software framework.

- The creation of hybrid environments where on-premise supercomputers are connected to cloud-based finite element analysis (FEA) supercomputers enables enterprises and researchers to access compute resources more efficiently and at a lower cost.

- In addition to supporting academic and defense applications, supercomputers have expanded their use in a variety of commercial industries. Recent examples include financial modeling, drug discovery, autonomous vehicle simulation, and digital twin development in the smart manufacturing sector, among others.

Supercomputer Market Trade Analysis

Components for supercomputers are primarily made up of processors, accelerators, and high-speed interconnects. Export control laws and regulations on semiconductors will redefine sourcing strategies. The growth of emerging economies' imports of supercomputing components is being driven by the need for digital transformation. Manufacturers are now conceptualizing the risks associated with location and supply chains and are shifting production to the region in order to avoid issues related to re-shoring, such as geopolitical and supply chain disruptions.

Market Outlook

- Market Growth Overview: The supercomputer market is expected to grow significantly between 2025 and 2034, driven by government funding and strategic initiatives, commercial adoption, and focus on energy efficiency.

- Sustainability Trends:Sustainability trends involve maximizing hardware energy efficiency, advanced cooling technology, and renewable energy integration and green data centers.

- Major Investors:Major investors in the market include Vanguard, BlackRock, and State Street, Draper Fisher Jurvetson (DFJ), Polaris Partners, and Proton Partners.

- Startup Economy:The startup economy is focused on areas that leverage innovation to bypass traditional hardware limitations, improve energy efficiency, and make high-performance computing (HPC) more accessible via novel software and cloud-based models.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 11.98 Billion |

| Market Size in 2026 | USD 13.29 Billion |

| Market Size by 2035 | USD 33.48 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 10.82% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Operating System, Type, End User, Application and Geography |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Segment Insights

Operating System Insights

The worldwide supercomputer market is divided into Linux and Unix. Over the projection period, Linux is expected to account for a sizable market share. Extreme scalability, consistency, and flexibility are expected to drive the expansion of this industry in the next years. According to the most recent Top 500 report, Linux now runs on all of the world's fastest 500 supercomputers. Back in 2017, the last two supercomputers ran Unix, therefore the previous number was 498.

Top 500 is a non-profit effort that began in 1993 to benchmark supercomputers. It distributes information on the top 500 fastest supercomputers in the world twice a year. When it comes to customization, Unix, being a closed source and proprietary operating system, is a costly proposition. In contrast, Linux is free and easy to modify. For each of the supercomputers, engineering teams may quickly design a Linux-based operating system.

Application Insights

The global supercomputer market is divided into commercial, space & research centers, hospitals & laboratories, and government entities. The government sector controlled a sizable portion of the entire supercomputer industry. The rising public awareness of the growing relevance of economic competitiveness and security is expected to fuel demand for these computers. Scientists utilize supercomputers to analyses solar systems, satellites, and other nuclear research fields in this discipline. Data mining is a technique used by large organizations to extract usable information from data storage warehouses or a cloud system. Life insurance firms, for example, employ supercomputers to lower actuarial risks.

Weather forecasting: A climatologist can use the forecasting capacity of supercomputers to anticipate the chances of rain or snowfall in the area. It can also forecast the actual route of storms and cyclones, as well as their likelihood of striking. Supercomputers are used by government intelligence organizations to monitor communication between private persons and fraudsters. These agencies primarily require supercomputers' numerical processing power to encrypt cell phones, emails, and satellite transmission.

Military and Defence: Supercomputing enables military and defence agencies to conduct simulated tests of nuclear explosions and weapon ballistics.

Automobile: Using supercomputers, an automobile firm may assist clients in acquiring vehicles by allowing them to test the simulation environment provided by supercomputers prior to purchasing a vehicle.

In the laboratory, many scientists and climatologists utilize supercomputers to anticipate fog and other pollution and smog levels in a certain location. Supercomputers are used in the entertainment sector to make animations. In addition, supercomputers are commonly used by online gaming businesses to generate animation games.

Regional Insights

Asia Pacific Supercomputer Market Size and Growth 2026 to 2035

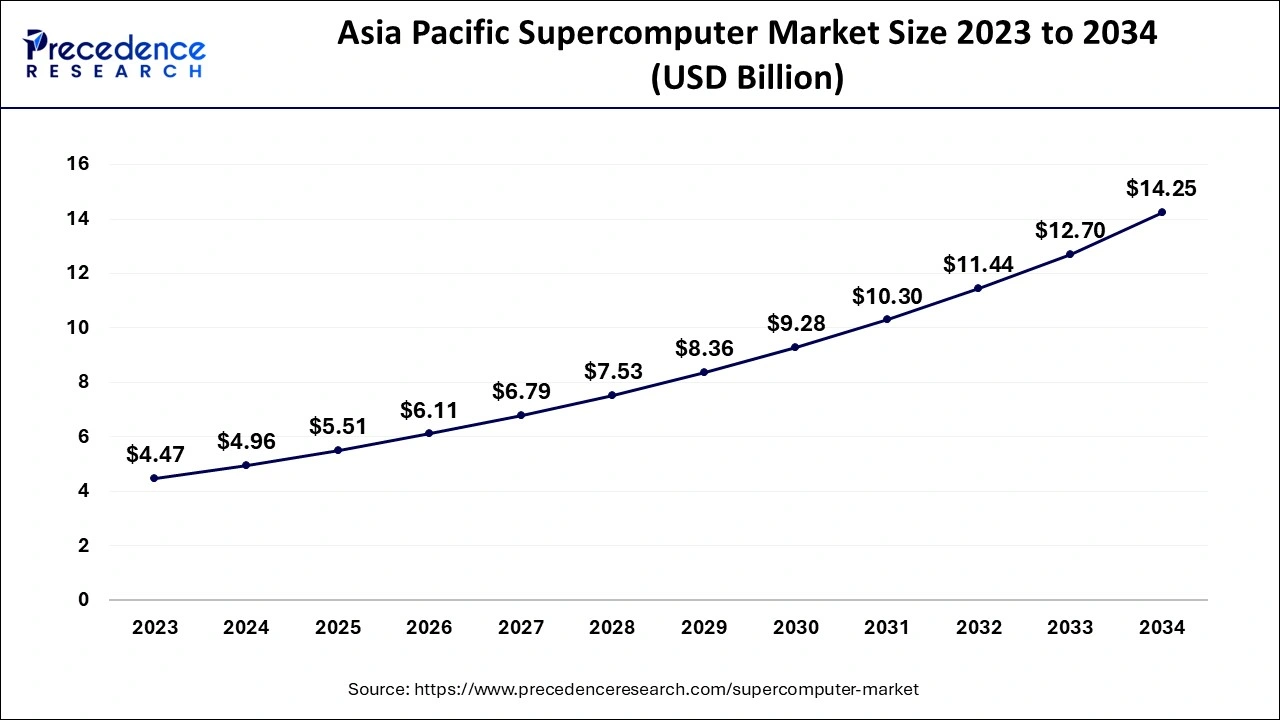

The Asia Pacific supercomputer market size is evaluated at USD 5.51 billion in 2025 and is predicted to be worth around USD 15.61 billion by 2035, rising at a CAGR of 10.97% from 2026 to 2035.

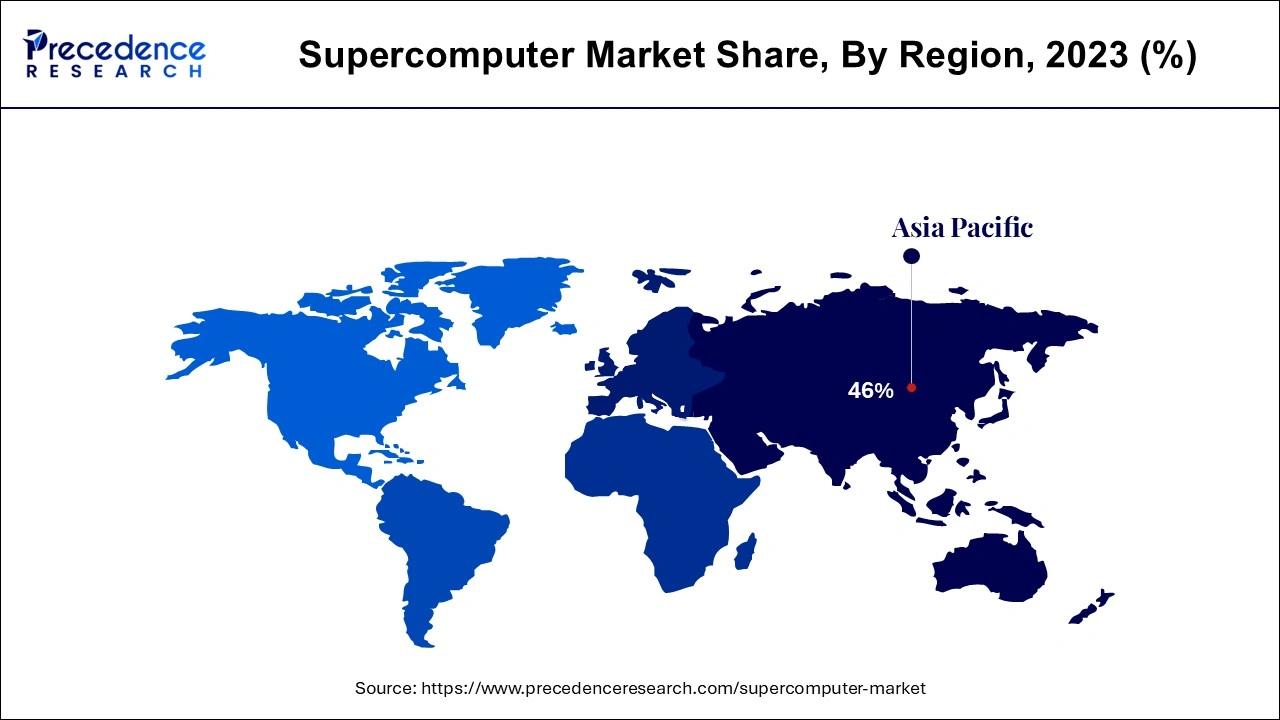

APAC has the highest installed base of supercomputers, accounting for over 46% of the total. Chinese enterprises are pursuing an ambitious approach to establish their own supercomputing systems based on locally generated software and hardware. In 2023, China covertly built the world's first exascale supercomputer, which was quickly followed by a second machine. The Next Platform originally reported on the supercomputers, but Kahaner explained them a few months later.

China Supercomputer Market Trends

China's massive government investment and strategic priority, technological self-reliance and domestic chips, and integration of AI and HPC. China continues to build and expand national-level supercomputing centers and intelligent computing centers, and the market is moving toward more cost-effective and scalable architectures.

The number of TOP500 installations in China has risen to 227, up from 219 six months earlier. Meanwhile, the percentage of systems headquartered in the United States remains near an all-time low of 118. However, systems in the United States are substantially larger on average, accounted for 37.9% of aggregate performance. China is close behind, with a performance share of 31.7%. However, as compared to six months ago, this performance disparity has narrowed. The United States accounted for 38.5% of the list's aggregate performance in June 2019, while China accounted for 29.8%.

Japan is still third in the number of TOP500 systems, with 29, followed by France (18), Germany (16), and the Netherlands (15). Lenovo (174), Sugon (71), and Inspur (70) are the top three system vendors in terms of number of installations, reflecting China's overwhelming dominance (65). Cray is fourth with 36 systems, while HPE is fifth with 35. Given that Cray is now owned by HPE, the two companies would essentially connect Sugon to 71 systems.

U.S. Supercomputer Market Trends

The U.S. market is driven by substantial government funding and public-private partnerships, alongside the increasing integration of AI and High-Performance Computing (HPC). A focus on energy efficiency through innovative designs and the expansion of cloud-based HPC (HPCaaS), although the market contends with supply chain vulnerabilities and benefits from application diversification across commercial sectors.

Germany Supercomputer Market Trends

Germany's robust government investment and a strong focus on energy efficiency and sustainability measures, like advanced liquid cooling systems. The accelerating convergence of AI with High-Performance Computing (HPC), supported by public-private partnerships and the development of specialized infrastructure like the JUPITER exascale project.

Value Chain Analysis of the Supercomputer Market

Research & Development (R&D) and Fundamental IP: This initial stage involves basic research into physics, materials science, and computer architecture to develop the core technologies that make extreme performance possible.

- Key Players: IBM Research, Intel Labs

Component Manufacturing (Processors, Accelerators, Memory): This stage focuses on the design and fabrication of the specialized hardware necessary for high-performance computing.

- Key Players: Nvidia (with its H100/Blackwell GPUs), AMD (EPYC CPUs and Instinct accelerators), and Intel (Xeon CPUs and Max Series GPUs).

System Integration and Assembly: This involves designing the complete supercomputing system architecture, assembling thousands of components into racks, and integrating complex cooling and networking infrastructure.

- Key Players: Hewlett Packard Enterprise (HPE), Cray (an HPE Company), Lenovo, and Dell Technologies.

Software and Middleware Development: This stage focuses on developing the specialized operating systems, programming models, compilers, and management middleware required to run applications efficiently across thousands of processors.

- Key Players: Microsoft (Azure HPC) and various Linux distribution providers.

Service Provision and HPC-as-a-Service (HPCaaS): The final stage involves selling access to this massive computing power, often through cloud-based models or direct facility management.

- Key Players: Amazon Web Services (AWS), Google Cloud, and Microsoft Azure

Top Companies in the Supercomputer Market & Their Offerings

- Nvidia (Japan): Nvidia is the dominant supplier of powerful GPUs and accelerators, which are essential for the AI workloads driving modern supercomputing performance.

- NEC Corporation (Japan): NEC develops and sells supercomputers, focusing on specialized vector processors that excel at specific types of scientific simulations. They contribute a strong presence in the Japanese market and collaborate on international research projects.

- Lenovo (China/Hong Kong)

Lenovo is a leading global supplier of HPC server infrastructure and system integration services. They hold a large share of the Top500 supercomputer installations by volume, providing reliable hardware platforms for research and commercial use. - Intel (US):Intel supplies a vast majority of the CPUs that power general-purpose computing nodes in supercomputers globally. They continuously innovate their Xeon processors to meet the demanding performance and efficiency requirements of data centers and HPC facilities.

- IBM (US):IBM has a legacy of building some of the most powerful supercomputers in the world, such as Summit and Sierra. They contribute unique Power architecture processors and advanced integration expertise for large-scale, complex projects.

- HPE (US):Hewlett Packard Enterprise (HPE) is a primary system integrator, incorporating technology from various partners to build customized supercomputing solutions. Their acquisition of Cray solidified their leadership in delivering exascale-class systems and software stacks.

- Fujitsu (Japan):Fujitsu is known for developing highly efficient, indigenously designed supercomputers, most notably the Fugaku system. They contribute unique processor architecture and system design expertise primarily within the Asian market.

- D-Wave:D-Wave contributes by pioneering quantum computing systems, offering a distinct approach to solving optimization problems that traditional supercomputers struggle with. They are creating a new segment within the high-performance computing ecosystem.

- Honeywell (Canada/US):Honeywell primarily contributes indirectly through environmental control systems, specializing in advanced cooling and power management technologies crucial for the high-density infrastructure of supercomputers.

- SpaceX: SpaceX's contribution is tangential to the market itself; however, their need for extreme computational fluid dynamics (CFD) for rocket design is a classic example of a leading-edge application driving demand for supercomputing power. They are a high-profile user rather than a vendor in this specific market.

- Dell (US):Dell is a major provider of server and data center infrastructure that forms the basis of many commodity cluster supercomputers. They offer scalable and cost-effective solutions for a wide range of academic and commercial HPC users.

- Cisco (US):Cisco provides essential high-speed networking and interconnect technologies that link the thousands of nodes within a supercomputer. Their hardware ensures that data moves between processors efficiently, which is vital for system performance.

- Advanced Micro Devices (US):AMD has become a critical supplier in the modern supercomputer market with its high-performance EPYC CPUs and Instinct MI accelerators. They are integral partners in numerous exascale projects, offering highly competitive hardware for both general and accelerated computing tasks.

Recent Developments in the Supercomputer Industry

- In Nov 2025, AMD and Eviden (Atos Group) announced Alice Recoque, Europe's second exascale system exceeding 1 ExaFLOP. The system is powered by cutting-edge EPYC Venice CPUs and Instinct MI430X accelerators set for deployment 2027-28. (Source:https://www.tomshardware.com)

- In May 2020, Microsoft stated that, in collaboration with OpenAI, it has developed one of the top five publicly reported supercomputers in the world to train massive artificial intelligence models. The Azure-hosted supercomputer was expressly developed to train the company's AI algorithms. The new supercomputer designed for OpenAI includes more than 285,000 CPU cores, 10,000 graphics processing units, and 400 gigabits per second of connection for each GPU server, according to the statement made at its virtual Build developers conference.

- D-Wave has announced the public availability of their quantum computer D-Wave, a firm located in Canada, has announced the general availability of its quantum computer with 5000 Qubits connection. Advantage as the business calls it, will be made available to clients via the Leap quantum cloud service. The platform includes new hardware, software, and tools designed to allow and speed the delivery of in-production quantum computing applications. It also offers a hybrid solver service with over 5000 qubits, which can answer large issues.

Segments covered in the report

By Operating System

- Unix

- Linux

By Type

- Vector Processing Machines

- Tightly Connected Cluster Computer

- Commodity Cluster

By End User

- Commercial Industries

- Government Entities

- Research Institutions

By Application

- Cloud Infrastructure

- Commercial

- Space & Research Centers

- Hospitals & Laboratories

- Government Entities

- Defense

- BFSI

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting