What is the Surgical Sutures Market Size?

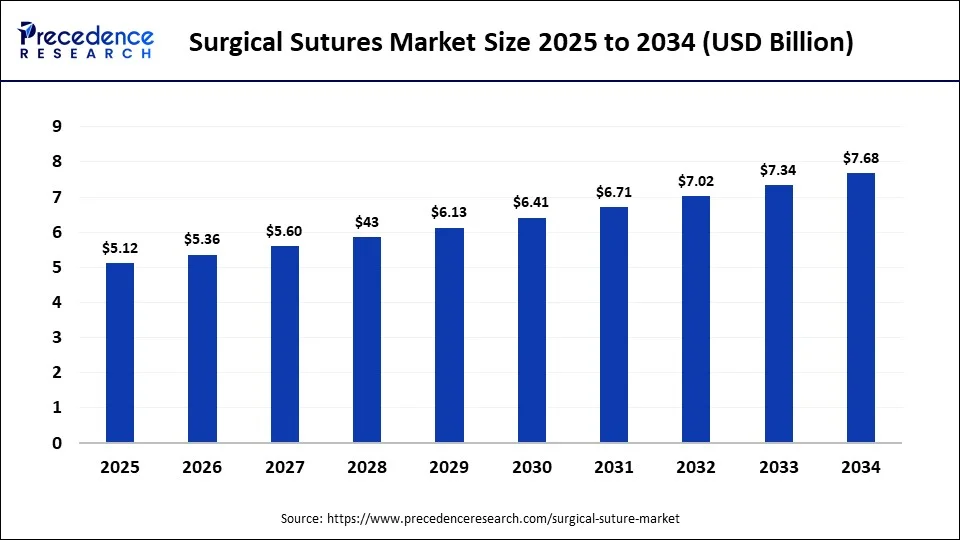

The global surgical sutures market size estimated at USD 5.12 billion in 2025 and is predicted to increase from USD 5.36 billion in 2026 to approximately USD 8.01 billion by 2035, expanding at a CAGR of 4.58% from 2026 to 2035.

Market Highlights

- By type, the absorbable segment accounted market share of 56% in 2025.

- By filament, the multifilament segment has had highest revenue share of 55% in 2025.

- By application, the others segment held 37% revenue share in 2024.. However, the cardiovascular surgery segment hit second-largest market share in 2025.

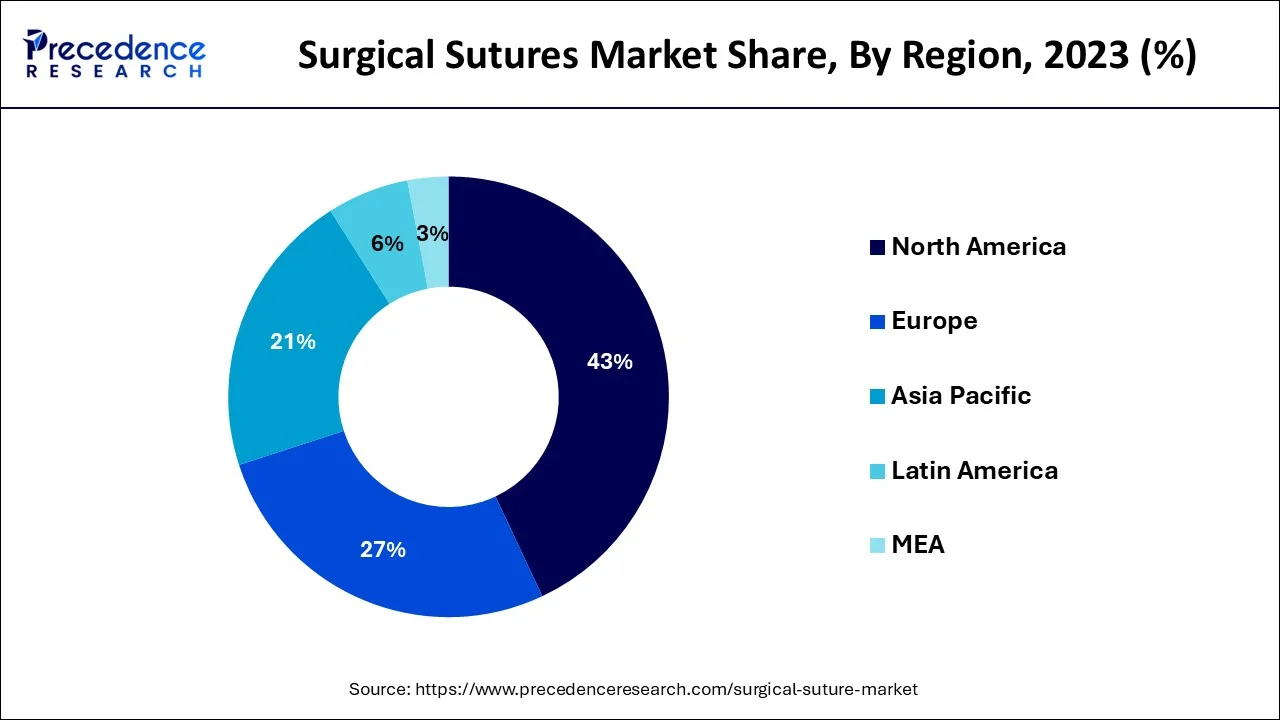

- The North America region accounted 43% revenue share in 2025.

Surgical Suture Essential Tools for Wound Healing

Surgical sutures fall under category of equipments used in the medical sector for closing of open wounds. Wide variety of wounds are presented by the patients resulting from local injuries or road traffic accidents and surgical wounds. The various suturing materials that are used by the health care sector with a view to perform a perfect closure of the open wounds has boosted the market for surgical centers. The quality and material of the sutures depends upon the type of wound and the location of the injury on the body.

The surgical sutures are also divided according to the various shapes and sizes of the needles that are attached to the suturing material. The pattern of suture that has to be performed on the body of the individual also affects the selection of the suturing material. Almost every major surgery is completed by the use of surgical sutures which helps in closing the body part and restoring the normal external anatomy of the person. Other than the thread type of surgical sutures which are commonly used, staples form totally different type of sutures which makes the work faster and provides quick healing. These are mainly used in the orthopedic sector to avoid sepsis and infection in the body of the individual.

Surgical Sutures Market Growth Factors

The advanced suturing material that are utilized by the healthcare industry to facilitate faster healing of open wounds has boosted the market for surgical sutures in the present times. The different sizes of needles that are available in the market according to the location and size of the wound has attracted the people towards this line of treatment. Surgical sutures play an important role during the loss of heavy blood from the arteries and veins which can be controlled easily with the help of a simple suture. The use of the different materials to ligate the nerves and arteries have also formed another segment under this category.

The orthopedic sector includes various surgical procedures such as total hip replacement surgeries, total knee replacement surgeries, alignment of fractured wounds and plating which requires opening up of the particular body part which is affected. the use of advanced suturing material which prevent easy sepsis have been used in the healthcare sector with a view to attract potential consumers and gain confidence of the patients. the use of advanced devices and equipments which assist and suturing has also emerged as a major growth factor for this market.

- Increasing number of high velocity accidents.

- Increasing prevalence of chronic diseases.

- Their number of surgical procedures taking place in the developed countries.

- Advanced suturing material present in the market.

- Huge geriatric population undergoing various surgical procedures.

- Increasing demand for advanced suturing instruments.

Market Outlook

- Industry Growth Offerings: Industry growth in the surgical sutures market is driven by rising surgical procedures, improved healthcare infrastructure, demand for advanced wound closure materials, and adoption of absorbable, antimicrobial, and barbed sutures. Innovation in minimally invasive surgeries further accelerates market expansion.

- Global Expansion: Global expansion of the surgical sutures market is supported by growing healthcare investments, rising surgical volumes in emerging economies, wider hospital access, and increased adoption of advanced suturing technologies. International manufacturers are strengthening distribution networks and expanding production capabilities worldwide.

- Startup ecosystem: The startup ecosystem in the surgical sutures market is expanding with innovators developing antimicrobial, absorbable, and bioengineered sutures. Startups focus on infection control, faster healing, and sustainability while partnering with hospitals, research institutes, and medical device accelerators to scale commercialization.

- Sustainability Trends: Sustainability trends are reshaping the market, encouraging the development of biodegradable, bioabsorbable, and eco-friendly suture materials. As a result, manufacturers of surgical sutures are increasingly using biodegradable materials and environmentally friendly packaging options to reduce waste.

- Major Investors: Major investors in the market include leading medical device manufacturers, private equity firms, and healthcare-focused venture capitalists. They contribute by funding R&D, expanding manufacturing capacities, and introducing innovative and high-performance suture products.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.12 Billion |

| Market Size in 2026 | USD 5.36 Billion |

| Market Size by 2035 | USD 8.01 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.58% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Type, Raw Material, By Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

- Increasing prevalence of RTA- The increasing number of vehicle users all over the world has boosted the number of road traffic accidents that take place on a daily basis. This results in two or huge number of cases with fractures and bone deformities which increases the prevalence of surgical procedures in the health care system and hence the use of suturing material increase to a great extent.

- Huge number of people belonging to the geriatric population- The number of people belonging to the geriatric age group adults in two a huge number of surgical procedures which requires the use of suturing material. Pathological changes in the body at this age helps to drive the market for surgical sutures.

- Aesthetic and cosmetic surgical procedures- With the increasing importance of asthetics among the people, the number of cosmetic surgical procedures have increased tremendously. Various body parts are restructured and altered to obtain the desired shape and increase the aesthetic value of the individual.

challenges

- High cost of advanced suturing materials- The advanced suturing material that are introduced into the market by key market players have a high cost as compared to the ordinary materials that are available. This makes it difficult for the people to opt for such advanced technologies which in turn challenges the growth of the market during the forecast period. A lower disposable income available with the people also hampers the growth of the market to a great extent.

- Lack of skilled workforce- Introduction of advanced equipments and suturing materials in the healthcare system demands the presence of skilled professionals into the sector. A lack of skilled workforce in the healthcare system has hampered the growth of the market to a great extent. This leads to a loss of confidence among the patients which hinders the growth of the market tremendously.

- Variability of tensile strength- The tensile strength of the suturing material where is according to the type of sutures and materials used. A fault in the suturing pattern may disturb the arrangement of the suture and hampers the healing process of the wound. Such conditions may result into sepsis and complicate the surgical procedure.

Opportunities

- Emerging underdeveloped countries- The rapid demand of advanced health care facilities among the people residing in the developing nations has helped to boost the market for surgical sutures. Rapid acceptance of advanced technologies and equipment among the people has it driven the market to new heights. Advanced equipments that are used by the health care system for suturing the wounds has attracted the potential consumers which helps the market to record a considerable revenue over the period of time.

- Advanced health care facilities provided by government- The government of many countries have taken active participation with a view to enhance the facilities that are provided to their citizens. The facilities that are provided by the government include the use of high quality equipments and surgical materials that facilitate easy healing of wounds. Health insurance companies provide better reimbursement facilities to their consumers with a view to encourage the use of advanced suturing materials.

- Increasing investment by key market players- Extensive research and development programs which are carried out by the key market players with a view to introduce new and advanced suturing materials into the market which will increase the demand among the potential consumers has emerged as a major opportunity for the growth of the surgical sutures market during the forecast period. Huge investments are made by the key market players to encourage the development and use of advanced surgical techniques and materials which will in turn facilitate the growth of the market to a great extent.

Segment Insights

Product Insights

The market of suture threads has experienced the maximum growth due to the huge demand in the health care industry. the use of surgical threads in order to close a wound has been considered as the first choice in many healthcare sectors due to their cost-effective features which enables a common man to opt for such products.

Automated sharing devices on the other hand, impose an additional cost on the treatment procedure which makes this technology unaffordable for the common people. Surgical sutures are used extensively in the gynecological procedures which facilitates easy healing of wound. Automated suturing devices require a lesser amount of time to complete the surgical procedure.

Type Insights

The segment of multifilament as acquired a larger market share as compared to its competitors due to the rapidly increasing complex surgeries which have taken place all over the world. The huge number of people belonging to the geriatric population results into a number of complex surgical procedures which has helped this market to record a considerable revenue over a period of time.

The additional benefit of wound healing which is provided by this material behaves as a major growth factor for the market. The reimbursement facilities that are provided by the insurance companies encourage the use of such advanced materials by the health care industry.

Application Insights

The segment of cardiovascular surgeries has acquired the largest market share which has resulted from the huge number of surgical cases carried out all over the world. The number of people suffering with cardiovascular disorders as increased with the rapid increase in work stress and obesity among the people. The modern lifestyle practices followed by the people has hampered the health of the heart to a great extent.

Advanced surgical suturing options are opted for by the people with a view to facilitate the wound healing process. Advanced suturing materials are utilized for ophthalmic surgeries to facilitate the healing process within a shorter period of time. Orthopedic surgery and gynecological surgery also use varied type of suturing materials for the procedures.

End User Insights

The segment of hospitals has shown the fastest growth resulting from the huge number of patients that present themselves to a hospital in the event of an accident or a major pathological disorder. Surgical procedures are usually carried out in a hospital set-up where the presence of other multiple facilities helps the entire process to be carried out smoothly.

Regional Insights

What is the U.S. Surgical Sutures Market Size?

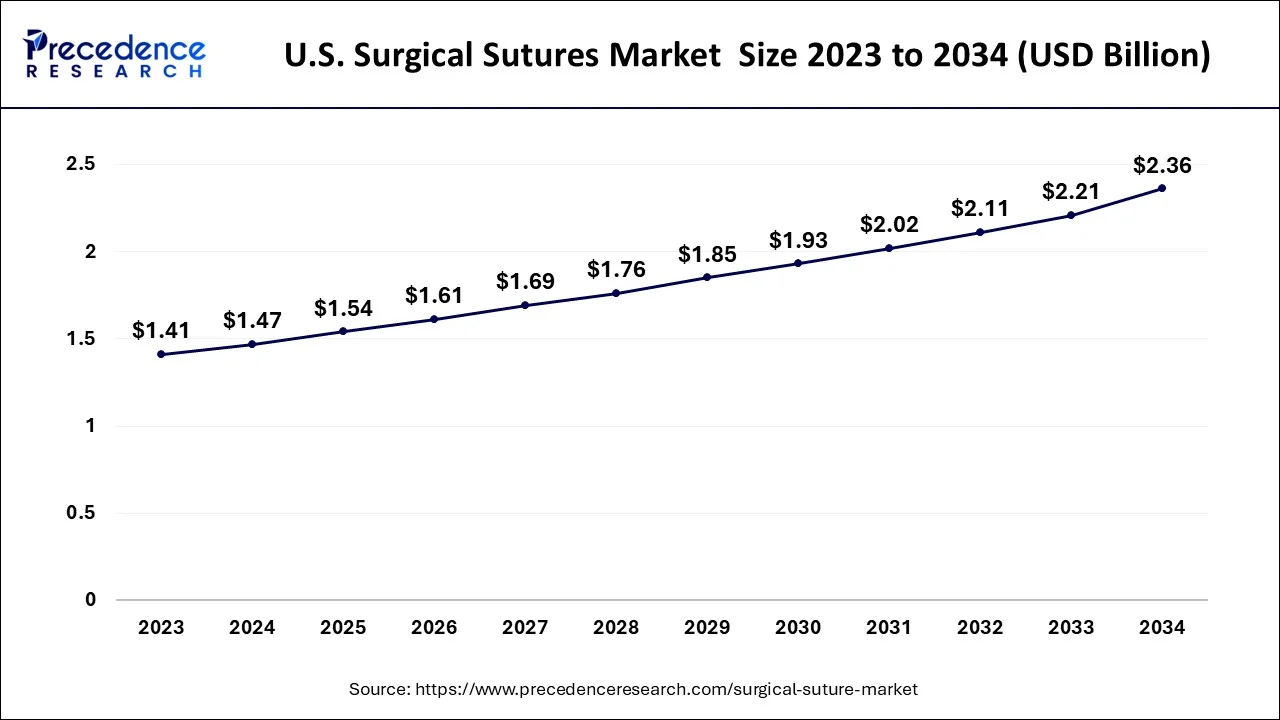

The U.S. surgical sutures market size is evaluated at USD 1.54 billion in 2025 and is predicted to be worth around USD 2.48 billion by 2035, rising at a CAGR of 4.88% from 2026 to 2035.

North America

The region of North America has acquired the largest market share resulting from the huge number of surgical procedures that are carried out in this region pertaining to the large number of people belonging to the geriatric population.The presence of advanced medical facilities and equipments in this region has helped the surgical sutures market to a great extent.

U.S. Market Trends

The U.S. holds the largest share in the global surgical sutures market, driven by an increasing number of surgeries a more developed healthcare system an aging population and the emergence of chronic illnesses. Favorable reimbursement regulations and significant investments in healthcare innovation allow the U. S. The market is still growing steadily. Technological developments like automated suturing equipment antimicrobial coatings and absorbable sutures have also increased demand. Important market participants like Medtronic Stryker and Johnson and Johnson (Ethicon) also help to fortify the competitive environment.

- In March 2023, Ethicon (Johnson & Johnson MedTech) launched a next-generation antibacterial suture in the U.S., enhancing post-surgical outcomes by reducing the risk of surgical site infections (SSIs). This innovation is part of the company's ongoing commitment to deliver safer and more efficient wound closure solutions across various medical specialties.

North America: Advancing Surgical Sutures through Innovation and Infrastructure

North America remains the primary surgical suture market due to its established healthcare infrastructure and innovative practices. This market has seen growth in cosmetic surgical procedures in recent years, reaching nearly 1.6 million in 2023, and including 202,000 liposuction procedures, which is a 7% rise over the previous year. With this increase in surgery comes the need for specialty sutures that provide precision and healing worth having. The goal is to ultimately mitigate surgical site infections (SSIs) using antimicrobial suture coatings to improve patient quality of care.

Asia Pacific: Rapid Growth Through Expanding Healthcare Development and Surgical Needs

Asia Pacific has the fastest rate of growth of the surgical suture market, due to developing healthcare infrastructure and increasing surgical needs. An aging population and increasing prevalence of chronic diseases in this region have led to rising demand for surgery. Innovative suture materials are being developed, including biodegradable suture materials, and are bioabsorbable due to the interest in developing advanced surgical techniques in this region.

Growth Momentum of the China Surgical Sutures Market

The China market is expanding due to a rising volume of surgeries driven by an aging population, higher rates of chronic diseases, and increased trauma and accident cases. Growth in advanced healthcare infrastructure, greater adoption of minimally invasive and specialized procedures, and rising healthcare spending also support demand. Additionally, continuous technological improvements in suture materials and strong investments from both domestic and global manufacturers further accelerate market development.

Market Expansion Forces Shaping Europe's Surgical Sutures Industry

The European market is expanding due to a growing number of surgical procedures driven by an aging population, rising prevalence of chronic diseases, and increasing demand for advanced wound management solutions. Well-established healthcare systems, strong reimbursement structures, and continuous technological advancements in absorbable and antimicrobial sutures further support market growth. Additionally, major manufacturers' focus on innovation, safety, and high-quality surgical materials strengthens adoption across hospitals and specialty clinics, boosting overall market expansion.

Why the UK Surgical Sutures Market Is Experiencing Steady Growth

The UK market is increasing due to a rising volume of surgeries linked to an aging population, higher incidence of chronic diseases, and growing demand for effective wound closure solutions. The country's advanced healthcare infrastructure, strong clinical standards, and rapid adoption of innovative suture materials such as absorbable, antibacterial, and barbed sutures further support growth. Additionally, investment in surgical specialties, minimally invasive procedures, and quality-focused healthcare practices boosts overall market expansion.

How is the Opportunistic Rise of Latin America in the Surgical Sutures Market?

Latin America is experiencing an opportunistic rise in the market. This is mainly due to increasing surgical volume, improved hospital infrastructure, and increased access to public healthcare programs. A large number of surgical facilities are being developed in countries like Brazil and Mexico to meet the growing surgical volumes. There is rising investment in minimally invasive surgery, leading to increased demand for absorbable sutures and antimicrobial (infection control) sutures. In addition, there is also growing medical tourism and an increase in the number of private healthcare facilities being developed, which is expected to boost the demand for surgical sutures.

What Opportunities Exist in the Middle East & Africa?

The Middle East & Africa (MEA) offers immense opportunities in the surgical sutures market. These opportunities arise from ongoing government initiatives focusing on the modernization of healthcare facilities. With the increase in trauma cases and birth rates, there is a rapid increase in surgical volumes. This, in turn, is boosting the demand for surgical sutures. Additionally, growing access to surgical care in Africa is likely to ensure the long-term growth of the market in the region.

Value Chain Analysis

R&D

- Research efforts center on improving suture materials, enhancing strength, flexibility, and biocompatibility.

- Companies are developing antimicrobial and drug-releasing sutures to reduce infection and support faster healing.

- Emerging innovations include smart sutures equipped with micro-sensors to track wound recovery.

- New structures like nanofiber-based sutures are being engineered for superior tissue bonding.

Key players: Ethicon (Johnson & Johnson), Medtronic, B. Braun, Smith & Nephew, Peters Surgical, Teleflex.

Formulation and Final Dosage Preparation

- Suture production involves several stages, starting with careful material selection, followed by extrusion or spinning to form the thread.

- The suture is then coated for improved handling, sterilized to ensure safety, and packed in specialized packaging.

- Instead of “dosage,” sutures are classified by attributes like size, strength, and length based on surgical requirements.

Key players: Ethicon, Medtronic, B. Braun, Smith & Nephew, Teleflex, Peters Surgical.

Patient Support and Services

- Patient guidance includes easy-to-follow wound care instructions and awareness of symptoms that may signal complications.

- Educating patients about various suture types helps them understand their healing process.

- Hospitals and clinicians play the main role in delivering this support, while manufacturers offer technical assistance to medical staff.

Key players: Ethicon (Johnson & Johnson), Medtronic, B. Braun, Smith & Nephew, Teleflex, Peters Surgical.

Top Vendors and their Offerings

- Johnson & Johnson: offers a broad portfolio of absorbable and non-absorbable sutures (e.g., Vicryl, Monocryl, Prolene), trusted worldwide for tissue closure across general, cardiovascular, orthopedic, and specialty surgeries.

- Medtronic Plc: supplies both absorbable (e.g., Biosyn™, Maxon™) and non-absorbable sutures (nylon, polyester, polypropylene) for general soft tissue, cardiovascular, vascular, and surgical specialty applications.

- Dolphin Sutures: offers a full range of absorbable and non-absorbable sutures (including PGA, Polyglactin, Catgut), plus specialty sutures for ophthalmic, cardiovascular, orthopedic, and general surgeries; also provides custom suture kits, surgical meshes, staples, and tapes.

- Zimmer Biomet: offers specialized suturing solutions for thoracic and cardiovascular surgeries, including sternotomy/ sternal closure sutures, temporary pacing wires, and related surgical tools for heart and chest operations.

Other Surgical Sutures Market Companies

- Advanced Medical Solutions Group plc (UK)

- Internacional Farmacéutica S.A. de C.V.(Mexico)

- B. Braun Melsungen (Germany)

- Smith & Nephew (UK)

- Deme TECH Corporation (US)

- Surgical Specialties Corporation (US)

- Boston Scientific Corporation (US)

- Peters Surgical (France)

- Derma Sciences (US)

- CONMED Corporation (US)

- Sutcon Sutures (Indonesia)

- Stryker Corporation (US)

- Healthium MedTech (India)

- GPC Medical (India)

- Lotus Surgicals (India)

- Vital Sutures (US)

- Sutumed

- CPT Sutures (India)

- Unilene (India)

- Mellon Medical B.V.(Netherlands)

- Riverpoint Medical (US)

Recent Developments

- In July 2025, Corza Medical launched its expanded Onatec Ophthalmic Suture Portfolio, broadening options for surgeons worldwide to find the right suture solutions for ophthalmic procedures.(Source: https://corza.com)

- In October 2024,Corza Medical, a leading global medical technology company committed to remarkable service, trusted performance, and outstanding value, announced the launch of its innovative new line of Onatec ophthalmic microsurgical sutures. Tom Testa, CEO of Corza Medical, stated, “Onatec represents Corza Medical's commitment to innovation and growth in the ophthalmic surgery market.”

- In September 2024, Meril announced the launch of its latest innovation, the New Edge Suture. Designed to elevate surgical performance, the New Edge Suture embodies precision, strength, and reliability, setting a new benchmark in suturing technology.

- In August 2023, Healthium Medtech, a global leader in medical technology solutions, announced that the company has launched TRUMASTM, a range of sutures meticulously designed to address challenges faced during suturing in minimal access surgeries.

- In January 2023, Able Medical Devices announced the launched of Valkyrie looped sternotomy sutures for use after open heart surgery. Compared to traditional wire sutures, Valkyrie doubles the surface area of single wires and provides a more robust sternal closure.

- On 29 March 2024, Mankind Pharma, in collaboration with ChrysCapital, announced a strategic bid to acquire Healthium Medtech, a leading surgical supplies company owned by Apax Partners. Healthium holds a significant market share of approximately 18% in India and is recognized as the fourth-largest surgical suture manufacturer globally. The acquisition aims to bolster Mankind Pharma's product portfolio and expand its footprint in the surgical sutures market, aligning with its long-term growth objectives and diversification strategy.

- On 5 February 2025, Ben Gurion University developed a semi-automated laser tissue soldering system. A research team at Ben-Gurion University demonstrated a semi-autonomous contactless surgical procedure using a novel Robot-assisted Laser Tissue Soldering (RLTS) system on live porcine models. The RLTS system utilizes laser energy to close bowel incisions without traditional sutures or staples, reducing the risk of leaks and improving healing outcomes. In vivo studies showed successful closure of small bowel incisions with no leaks and favorable histological healing, marking a pioneering step in automating gastrointestinal surgery incision closures.

- On 14 November 2024, Stryker Corporation introduced the next generation SurgiCount+ system, now integrated with the company's Triton technology. This enhances the system by addressing two critical challenges in the operating room: retained surgical sponges and accurate blood loss assessment. By combining these functionalities, SurgiCount+ offers a more efficient and streamlined workflow for hospitals, aiming to improve patient safety and surgical outcomes.

- In September 2020:Novostitch pro repair system which was used for meniscal repair was launched by Smith & Nephew to introduce automated devices that will help in the procedure.

- In December 2019:Biomatlante was acquired by AMS, the former being producer of surgical biomaterials. This acquisition was aimed at strengthening the product portfolio of the company. The market access and research and development were also considered as the main sector for business.

Segments covered in the report

By Product

- Automated Suturing Devices

- Disposable Automated Suturing Devices

- Reusable Automated Suturing Devices

- Sutures

- Natural Sutures

- Synthetic Sutures

- Vicryl Sutures

- Monocryl Sutures

- Polydioxanone Sutures

- Polyglycolic Sutures

- Others

- Nylon Sutures

- Prolene Sutures

- Stainless Steel Sutures

- Others

- Absorbable Sutures

- Nonabsorbable Sutures

By Type

- Monofilaments

- Multifilament

By Raw Material

- Polyglycolic Acid Absorbable Surgical Sutures

- Polyglactin Absorbable Surgical Sutures

- Catgut Absorbable Surgical Sutures

- Poliglecaprone Absorbable Surgical Sutures

- Polydioxanone Absorbable Surgical Sutures

- Polypropylene Non-Absorbable Surgical Sutures

- Nylon (Poylamide) Non-Absorbable Surgical Sutures

- Polyester Non-Absorbable Surgical Sutures

- Polyvinylidene Fluoride (PVDF)

- Non-Absorbable Surgical Sutures

- Silk Non-Absorbable Surgical Sutures

- Stainless Steel Non-Absorbable Surgical Sutures

By Application

- Cardiovascular surgery

- Orthopedic surgery

- Gynecological surgery

- Opthalmic surgery

- Cosmetic and plastic surgery

- General surgery

- Others

By End User

- Hospitals

- Clinics

- Ambulatory Surgical Centres

- Emergency Medical Services

- Veterinary Hospitals

- Veterinary Clinics

By Region

- North America

- Europe

- Asia-Pacific,

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content