What is the U.S. Action Camera Market Size?

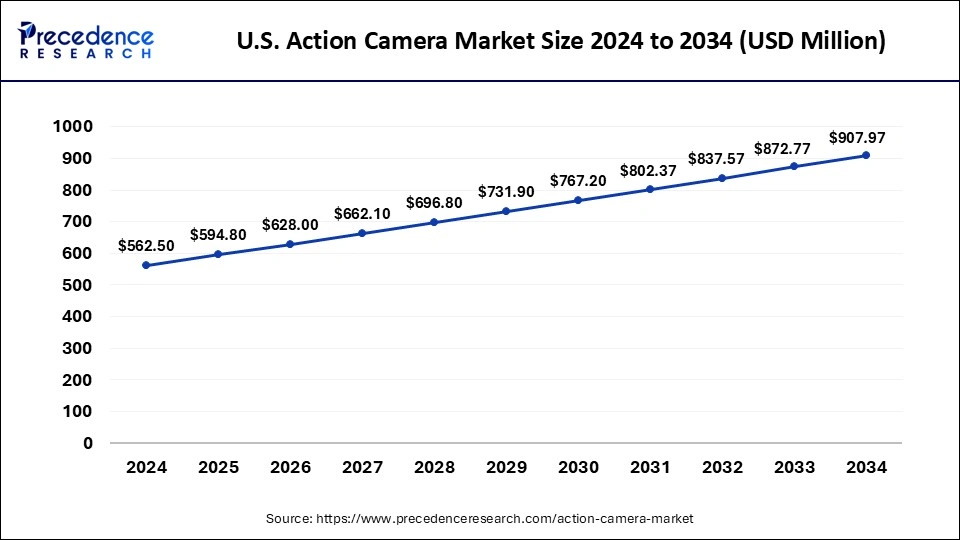

The U.S. action camera market size is accounted at USD 594.80 million in 2025 and is predicted to increase from USD 628.00 million in 2026 to approximately USD 907.97 million by 2034, expanding at a CAGR of 4.80% from 2025 to 2034.

U.S. Action Camera Market Key Takeaways

- In terms of revenue, the global U.S. action camera market was valued at USD 562.50 million in 2024.

- It is projected to reach USD 907.97 million by 2034.

- The market is expected to grow at a CAGR of 4.80% from 2025 to 2034.

- By end use, the professional segment held the dominating share of the market in 2024.

- By application, the sports segment dominated the market in 2024. The segment is observed to sustain the trend throughout the forecast period.

- By application, the recreational activities segment is observed to grow at the fastest rate of CAGR during the forecast period.

- By resolution, the high definition segment held the dominating share of the market in 2024.

- By resolution, the ultra HD segment held the dominating share of the market in 2024.

- By distribution channel, the offline segment held the largest share of the market in 2024.

Rugged and Compact: The U.S. Action Camera Market

The U.S. action camera market offers compact and ruggedized camera that are designed for capturing dynamic activities and extreme sports. These cameras are typically small, lightweight, and feature a wide field of view. They are popular for activities such as biking, skiing, surfing, skydiving, and other high-motion adventures. The design of action cameras focuses on durability, portability, and ease of use in challenging environments.

According to the data published by OBERLO, U.S. e-commerce sales are estimated to be around USD 1.04 trillion in 2022, an increase of 8.5% compared to that in 2022.

U.S. Action Camera Market Growth Factors

- The growing popularity of adventure sports and outdoor activities, such as skiing, mountain biking, surfing, and hiking, has been a significant driver for the U.S. action camera market. Enthusiasts use these cameras to capture and share their experiences.

- The surge in social media platforms and the desire to share personal experiences through visually compelling content has boosted the demand for action cameras, while promoting the growth of U.S. action camera market. Users often share their action-packed videos and photos on platforms like Instagram, YouTube, and other social networks.

- Ongoing advancements in camera technology, such as improved image sensors, higher resolution, enhanced image stabilization, and better low-light performance, have contributed to the appeal of action cameras. Consumers seek devices with the latest features and capabilities.

Market Trends

- Recent advancements in camera technology, featuring 4K/8K video options, image stabilization, and compact designs, have drawn consumers in search of high-performance and portable cameras. The incorporation of cutting-edge features like 4K video recording, Wi-Fi connectivity, and waterproof functionality enhances the appeal of these cameras to a wider audience. Utilizing sophisticated stabilization technologies like HyperSmooth (GoPro) and FlowState (Insta360) guarantees the capture of stable footage even amidst vigorous movement.

- Recent advancements in sensor technologies have improved the low-light performance of these cameras, allowing users to capture higher quality images and videos in difficult lighting situations. In addition, the downsizing of components has resulted in slimmer and lighter designs, enhancing the portability and usability of these cameras across different settings for users. These advancements increasing the demand for the action camera.

Market Outlook

- Industry Growth Offerings: The U.S. market is driven by advanced imaging technologies, robust waterproof designs, and strong demand from adventure sports, travel, and content creators, with companies offering high-resolution video, stabilization, connectivity, and AI-powered editing for enhanced user experience.

- Global Expansion: The global expansion of the U.S. action camera market is supported by rising adventure tourism, increasing content creation worldwide, and growing e-commerce penetration, enabling U.S. brands to strengthen their international presence through enhanced durability, advanced features, and strategic global distribution networks.

- Startup ecosystem: The U.S. action camera startup ecosystem is fueled by rising demand for compact, high-quality content tools, encouraging innovation in 360° imaging, AI stabilization, modular designs, and affordable alternatives. Startups leverage social media trends, crowdfunding, and niche sports communities to gain market traction.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 594.80 Million |

| Market Size in 2026 | USD 628.00Million |

| Market Size by 2034 | USD 907.97 Million |

| Growth Rate from 2025 to 2034 | CAGR of 4.80% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | End Use, Application, Resolution, and Distribution Channel |

Market Dynamics

Driver

The increasing acceptance of online shopping

Action camera manufacturers, including the market leaders now rely heavily on online retail and e-commerce platforms as their primary sales channels. These sites include Amazon.com. This internet channel turns out to be quite profitable, enabling manufacturers to provide competitive prices free from major regional restrictions. Additionally, by eliminating the need for customers to visit actual establishments, it improves convenience. Strong advertising chances are also provided by online retail, which uses ad analytics and SEO tools to promote effectively.

Prominent producers of cameras and accessories, like Canon, Nikon, Samsung Electronics, and Panasonic, have embraced online distribution via their platforms or joint ventures with Amazon, eBay, and Alibaba. Action camera usage, accessibility, and affordability are all on the rise in the United States, and these factors, together with increased internet access, make the online retail channel one of the key trends propelling the growth of the U.S. action camera market.

Restraint

Rising competition in the industry

Sellers of action cameras are finding that their profit margins are shrinking. The main cause of this is the rise in raw material costs. Many new suppliers have joined the industry as a result of the enormous growth potential. The goal of vendors is to provide action cameras that are within the reach of the average user, particularly in developing nations. This reduces the potential for sales and revenue for current vendors. To draw customers and set their items apart, suppliers also constantly add new features.

Opportunity

Rising partnership

The increasing partnership in the U.S. action camera market industry is expected to propel revenue growth. Such collaboration and ventures are inspired by the increasing interest of investors in the industry's potential combined with steady growth in the recent decade.

- In August 2023, MotoGPTM and GoPro, Inc. announced a new collaboration. Under the terms of the new multi-year deal, GoPro will once again serve as MotoGP's official wearable action camera starting in 2023.

Segment Insights

End Use Insights

The professional segment held the largest share of the U.S. action camera market in 2024. Professionals in the sports and entertainment industry, including athletes, coaches, and filmmakers, use action cameras to capture immersive and dynamic footage. In sports, action cameras can provide unique perspectives and angles for training analysis and highlight reels.

In certain situations, action cameras are used by filmmakers and videographers to get shots that are hard or impossible to get with traditional cameras. Action cameras are useful tools for recording behind-the-scenes footage, action sequences, and unusual angles in film and television production because of their small size and versatile mounting options. Thus, this is expected to drive the segment growth over the forecast period.

Application Insights

The sports segment dominated the U.S. action camera market in 2024. This is attributable to the growth in the number of adventure sports and strong exposure from the media. The market is being driven further by the rise in the number of people who enjoy sports like racing, riding, skydiving, surfing, skiing, skateboarding, climbing, and other sports. Additionally, using digital technology with its sophisticated lens and resolution greatly aids in taking high-quality action photos and films. The expansion of sports leagues and activities in the nation is also contributing to the segment's growth.

The recreational activities segment is observed to grow at the fastest rate in the U.S. action camera market during the forecast period. The rise in popularity of extreme sports such as surfing, snowboarding, mountain biking, and skydiving has fueled the demand for action cameras. Enthusiasts in these recreational activities seek compact, rugged cameras that can capture their adventures in high-definition quality, driving the growth of the market.

The proliferation of social media platforms and the growing trend of content creation have contributed to the increased demand for action cameras among recreational users. Individuals engage in various outdoor activities to capture breathtaking footage and share their experiences with friends, family, and followers on social media platforms, boosting the adoption of action cameras.

Resolution Insights

The high definition (HD) segment held the dominating share of the U.S. action camera market in 2024. HD footage provides viewers with a more immersive and engaging experience, whether they are watching action sports, travel adventures, or everyday moments. The crispness and clarity of HD videos make them more captivating and enjoyable to watch, driving demand for HD action cameras. As high-definition displays become increasingly prevalent in TVs, monitors, and mobile devices, there is a growing demand for content captured in HD format. HD action cameras are compatible with these displays, allowing users to enjoy their footage on large screens with stunning clarity and detail.

The ultra HD (UHD) segment is expected to grow at a significant rate in the U.S. action camera market during the forecast period, as it provides the consumer with several benefits. UHD filming offers versatility in both high definition and normal definition. Demand is being driven mostly by sophisticated devices with UHD features being commercially accessible. The trend of consumers choosing to shoot in 4K/UHD rather than 1080p or 720p significantly fuels the segment's expansion.

Distribution Channel Insights

The offline segment held the largest share of the U.S. action camera market in 2024. Customers would rather inspect the device and its characteristics in person. A significant influence on the company may be seen in the growing requirement for channel partners to simplify sales strategy. Additionally, because aftermarket service is available for a small fee, retail businesses have a high customer retention rate. Additionally, the retail channels could deal only in one of the two divisions or provide a combination of accessories and cameras.

Value Chain Analysis

1.Product Conceptualization and Design

- Focus on innovative designs inspired by strong U.S. brands leading the market.

- Prioritize advanced features such as 360°capture, modular add-ons, and smart connectivity.

- Emphasize rugged build, simple controls, and portability to support adventure sports users.

- Align designs with consumer demand for durable, high-performance cameras suitable for extreme conditions.

Key Players: GoPro, Insta360, DJI, Garmin, Sony.

2.Raw Material Procurement

- Raw materials include optical glass, impact-resistant plastics, lightweight metals, and essential electronic parts sourced globally.

- Designs emphasize ruggedness, compact size, waterproofing, and efficient integration of sensors, processors, and high-quality lenses.

- Product development is shaped by market needs, user preferences, and competitive innovation.

Key Players: GoPro, DJI, Insta360, Garmin, Sony.

3.Manufacturing and Assembly

- Production begins with DFMA-driven planning, ensuring simplified structures and efficient material use.

- Components like lenses, sensors, chips, and casings are manufactured with precision for durability and performance.

- Final assembly involves automated lines, quality testing, and waterproofing validation to meet rugged-use standards.

Key Players: GoPro, DJI, Insta360, Sony, Garmin.

U.S. Action Camera Market Companies

- Garmin Limited: Garmin offers rugged, GPS-integrated action cameras with strong durability, voice control, and sensor data overlays, serving adventure sports users who need performance tracking and outdoor-ready recording.

- GoPro, Inc.: Insta360 delivers 360-degree and modular action cameras with advanced stabilization, immersive capture, and AI-powered editing, targeting creators who want versatile and innovative shooting capabilities.

- TomTom NV: TomTom provides GPS-enabled action cameras integrating navigation, location tracking, and intuitive editing tools, appealing to users seeking geo-tagged footage and seamless connectivity for sports and travel.

- Veho: Veho offers compact, affordable action cameras designed for everyday users and outdoor enthusiasts, focusing on ease of use, durability, and value-driven features suited for casual adventure recording.

Other Major Key Players

- Nikon Corporation

- insta360

- Olympus Corporation

- Sony Corporation

- Drift Innovation

- Yi Technology

Recent Developments

- In April 2024, U.S. Sailing, the national authority for the sport of sailing, declared GoPro as the Official Action Camera of U.S. Sailing & The U.S. Sailing Team for the 2024 season. GoPro's HERO camera series has become essential in the sailing community.

- In January 2024, today, GoPro revealed a collaboration with X Games Aspen 2024 to serve as the official action camera for the prestigious winter ski and snowboard event. Over 100 renowned figures in action sports will compete before live audiences in Aspen, Colorado, while an extra 2.4 million viewers will watch from home on ABC and ESPN broadcasts, making this one of the year's largest snow events featuring highly sought-after action sports medals beyond the Olympics.

- In March 2025, Insta360, a pioneer in 360° and action cameras, revealed an expansion of its collaboration with Leica Camera AG, the iconic brand celebrated for more than a hundred years of imaging excellence. This ongoing partnership seeks to enhance the top-tier performance of Insta360's lineup of AI-driven action cameras and beyond.

- In November 2022, the Global distribution of the GoPro Hero 11 Black series cameras was announced by GoPro Inc. There are three different Hero 11 Black camera models available: the Hero 11 Black, the Hero 11 Black Creator Edition, and the Hero 11 Black Mini.

- In October 2023, a new electronic device called the Pro Xtreme Cam is intended for thrill-seekers who want to record their experiences. In a time where experiencing experiences is not as essential as sharing them, this action camera is revolutionary.

Segments Covered in the Report

By End Use

- Professional

- Personal

By Application

- Recreational Activities

- Sports

- Emergency Services

- Others

By Resolution

- Standard Definition

- High Definition

- Ultra HD

By Distribution Channel

- Offline

- Online

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting