3D Rendering Market Size and Forecast 2025 to 2034

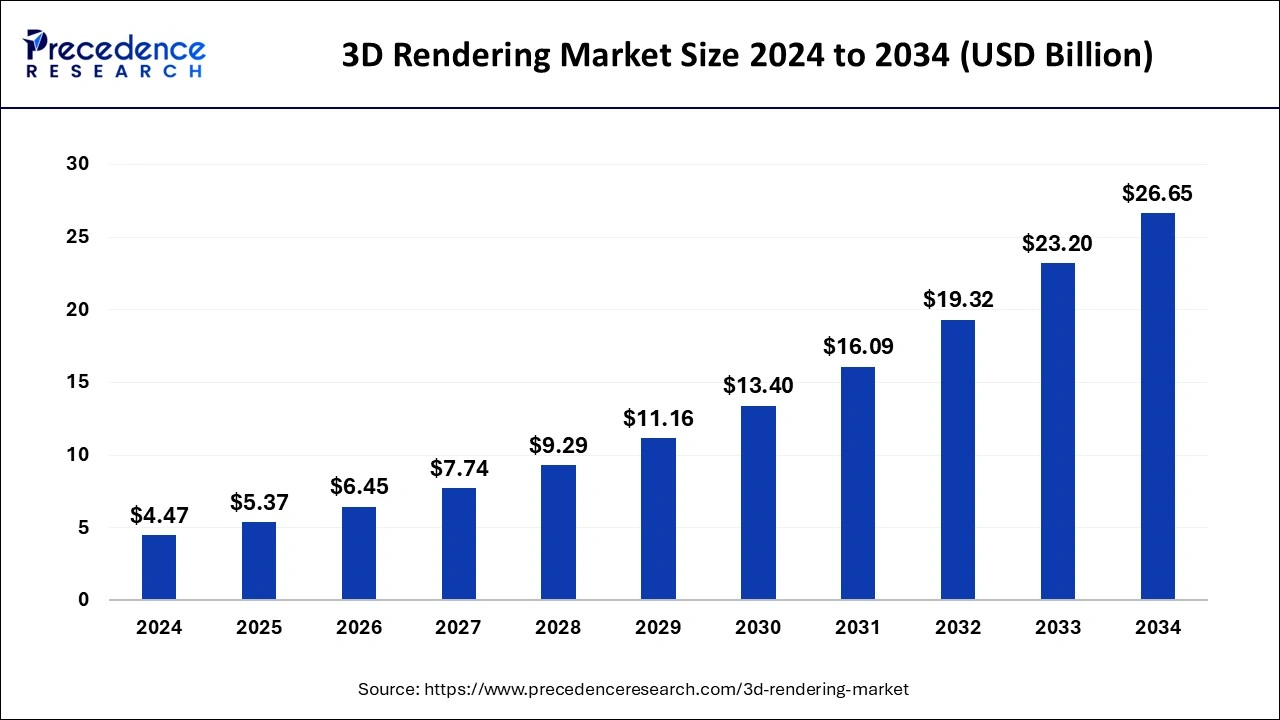

The global 3D rendering market size was estimated at USD 4.47 billion in 2024 and is predicted to increase from USD 5.37 billion in 2025 to approximately USD 26.65 billion by 2034, expanding at a CAGR of 19.55% from 2025 to 2034. Rising demand for real-time rendering with innovative simulations for products in the various sectors bolstering 3D rendering market growth globally.

3D Rendering Market Key Takeaways

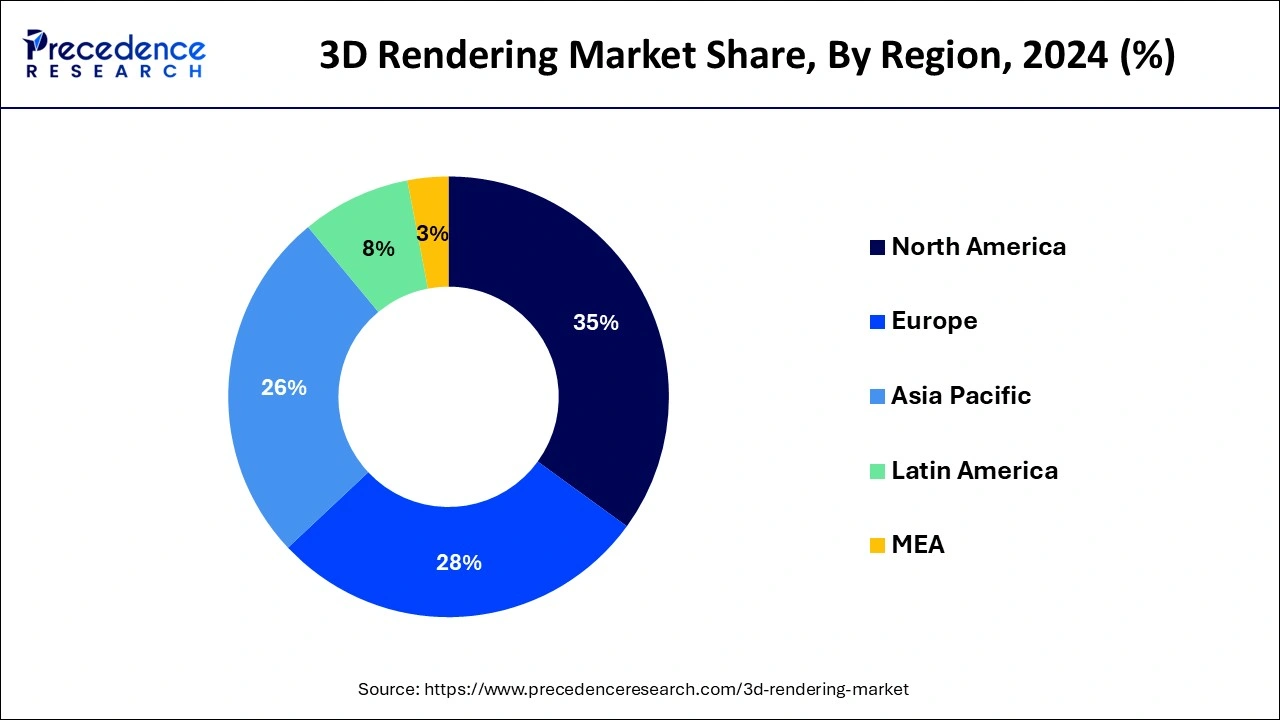

- North America dominated the market with the largest market share of 35% in 2024.

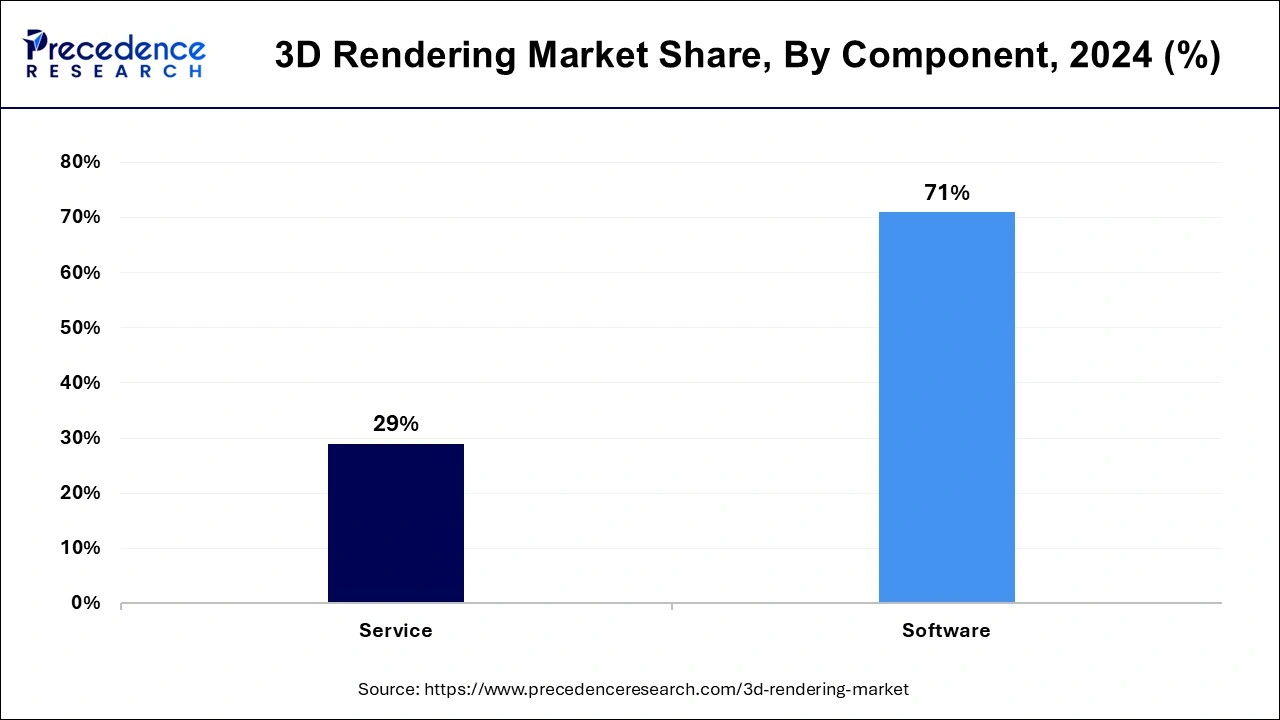

- By component, the software segment has held the largest market share of 71% in 2024.

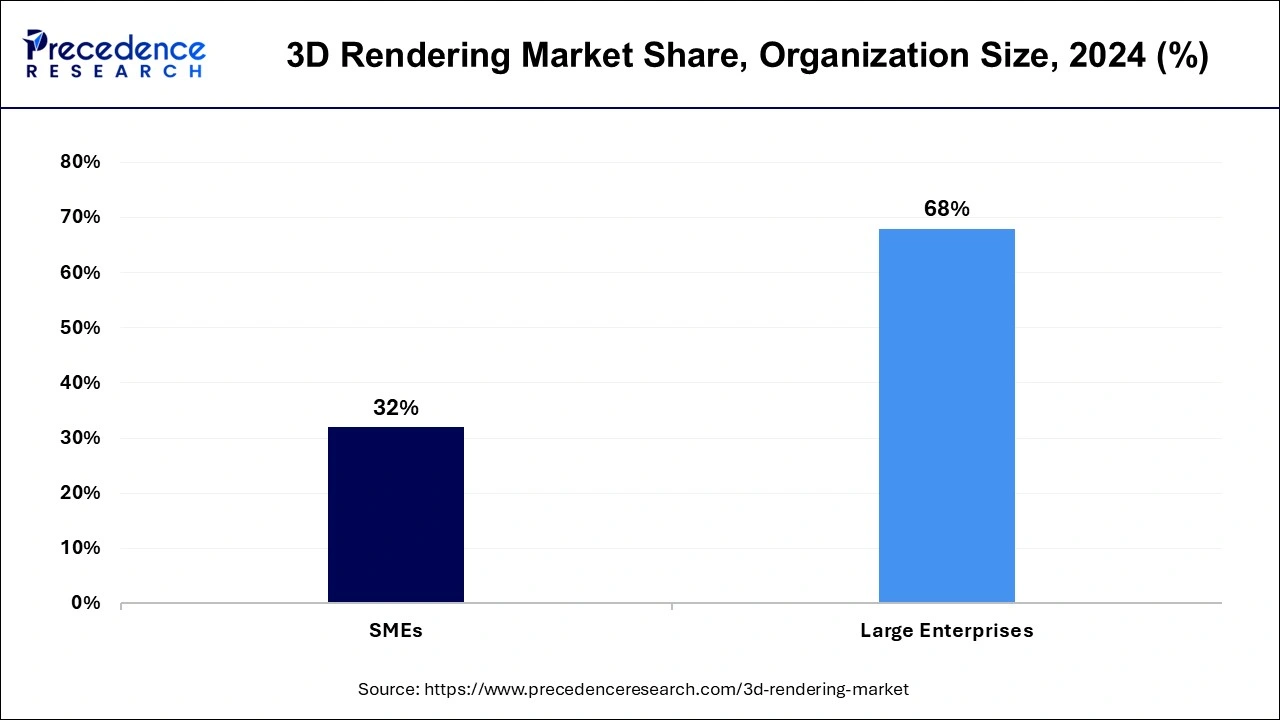

- By the organization size, the large enterprises segment has contributed more than 68% of market share in 2024.

- By operating system, the windows segment has held the major market share of 84% in 2024.

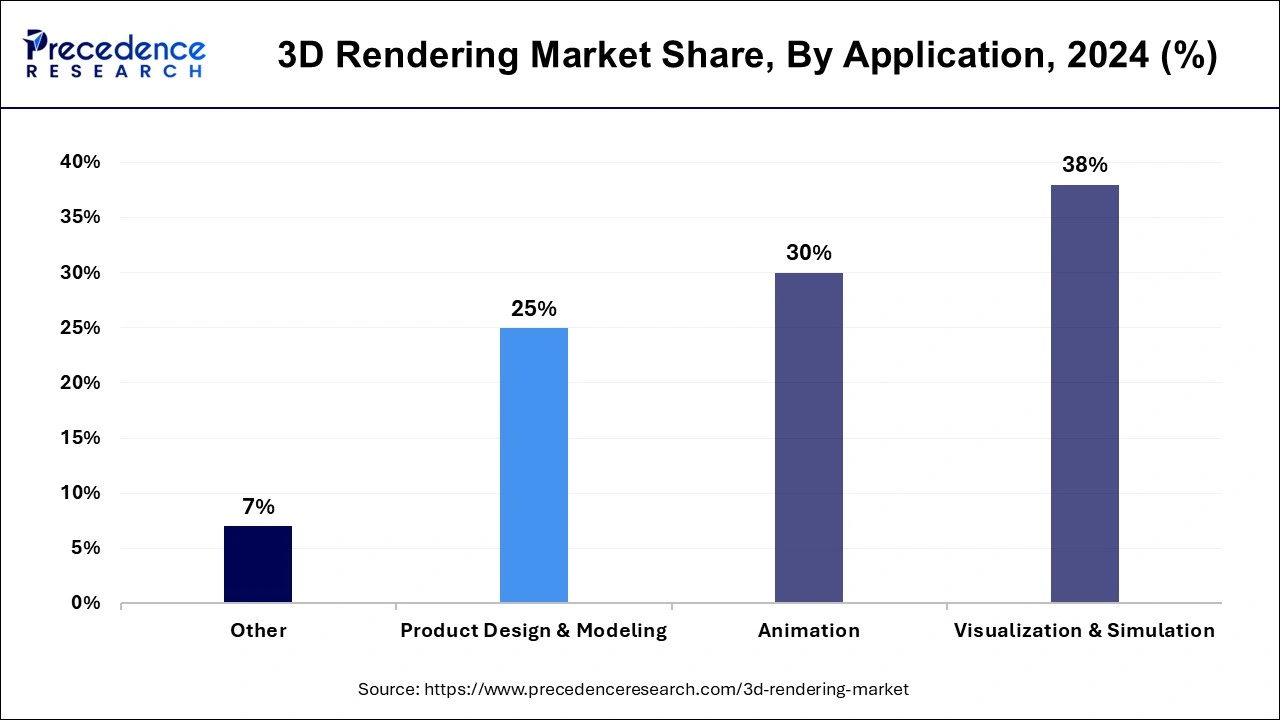

- By application, the visualization and simulation segment has recorded the largest market share of 38% in 2024.

- By end use, the automotive segment is predicted to grow at a significant rate during the forecast period.

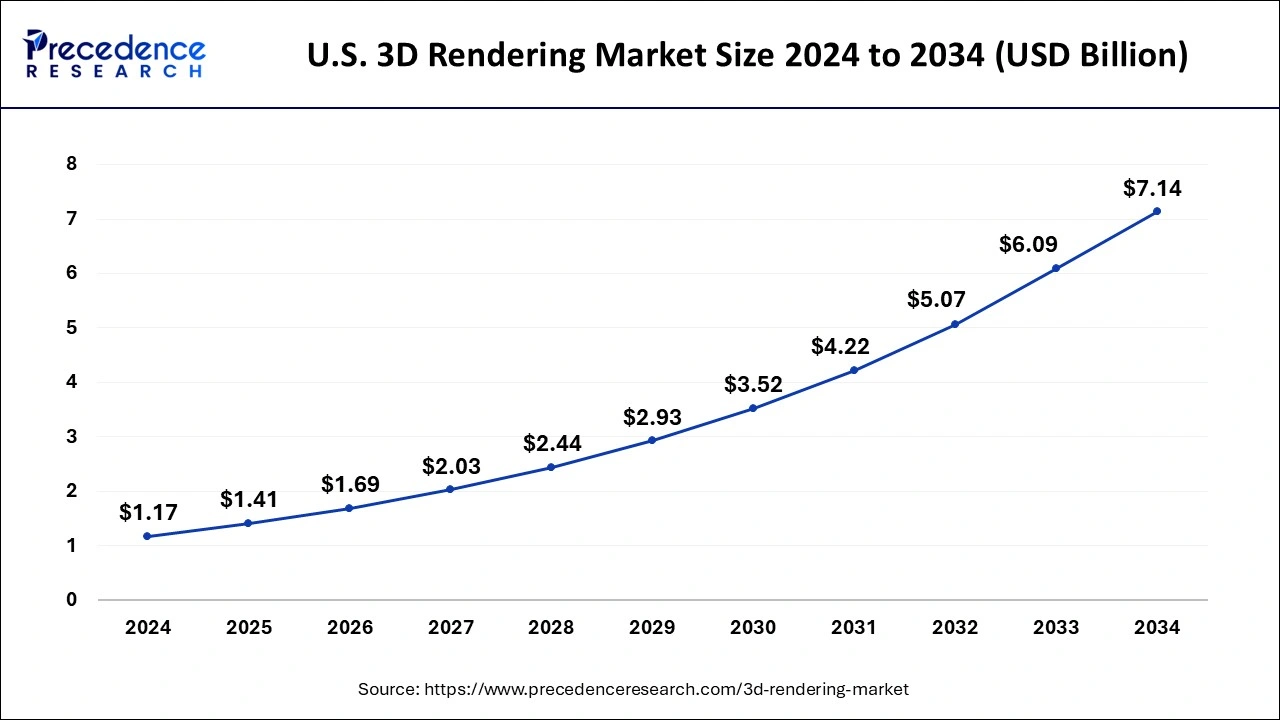

U.S.3D Rendering Market Size and Growth 2025 to 2034

The U.S. 3D rendering market size was estimated at USD 1.17 billion in 2024 and is predicted to be worth around USD 7.14 billion by 2034, at a CAGR of 19.83% from 2025 to 2034.

North America has dominated the 3D rendering market in 2024owing to the rising use of rendering applications in sectors like construction, manufacturing, health care, education, and real estate in the North American region. For instance, in December 2022, Mohawk College in Hamilton announced the launch of its first program regarding 3D visualization program. The program is equipped with 3D rendering tools and various other applications for construction, design, and maintenance services to enhance the working skills of aspirants.

This region is expected to increase in 3D rendering and visualization software due to the reliable wireless connectivity. The fastest adoption of the latest trends in technology in several sectors has positively impacted the 3D rendering market growth in the North American region. Along with these, the presence of major key players like Adobe and Dassault Systems also made a contribution to fuelling the growth of the market by influencing the masses.

Market Overview

The 3D rendering market offers services and solutions that are used to translate 3D objects or visuals into 2D images or videos to build an interactive environment for visual effects on the screen. With software editors' aid, presented graphics and videos in graphical format are converted by 3D rendering software into 2D pictures as required. This rendering software has extensive applications in various fields such as telecommunication, aerospace, visual and art industries, and other businesses.

However, architecture and design businesses use 3D rendering software more often than other industries. These tools are used to see keen details for products on the online platform to give customers a great visual representation of the product that they need to purchase. Rendering is basically a final stage where 2D animation is created from the designed scene. User-created 3D objects or images are taken or selected by software and placed in the 3D picture.

For 3D rendering systems, media developers and graphic designers have a significant role. Advances in 3D modelling are driving the rendering market on a broader scale. The two main factors affecting businesses are the rising need for new technology and recent technological campaigns. The software helps software engineers or graphic designers, marketers, architects, and professionals in the construction sector use such technological advancement to strategically proceed with their products on sale in the market, which enhances their product portfolio. The benefits of the 3D rendering software include clear communication, better visuals for future predictions, precise light effects, accuracy in measurements, and streamlined marketing.

3D Rendering Market Growth Factors

- Rising influence of augmented reality and virtual reality driving the 3D rendering visualization market

- User friendly approach and real time insights driving the 3D rendering market on a global scale.

- Rise of digital marketing and popularity for visual content has been increased since past years.

- Advertising campaign for simulation and 3D structures influence the masses and further rising demand for 3D rendering market.

- rendering software has extensive applications in various fields such as telecommunication, aerospace, visual and art industries, and other businesses.

- outburst of real estate projects among public and government places has bolstered a need for 3D rendering software for modelling and designing to experience future projections on a screen.

- The fastest-growing digitalization in most companies and the prevalence of adoption of cloud services among several industries.

- Increasing demand for customized products

- Outsourcing of 3D rendering services fuelling growth of the market.

- Growing adoption rate of 3D rendering services in real estate and construction sector.

- Rising demand for innovative and real time rendering stimulates the markets growth globally.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 19.55% |

| Global Market Size in 2025 | USD 5.37 Billion |

| Global Market Size by 2034 | USD 26.65 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Component, By Organization Size, By Operating System, By Application, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Easy to use interface

The most anticipated factor of rendering software is that they are effortless to use and does not need any higher degree or specified skill to use it. Such ease makes them more popular and encourages their adoption in almost every sector of the market, such as construction sites and buildings, architecture, healthcare and life sciences, media and entertainment, etc. It has absolute compatibility with other plugins, which makes it further constructive and approachable so that it can be utilized effectively even by non-professionals. It can create 360-degree visuals, 3D and 2D floor plans, animated scenes, and other virtual information in the form of streaming or pictures. Modernization and aesthetic aspects of every sector have surged over the past years.

Moreover, the outburst of real estate projects among public and government places has bolstered a need for such software for modelling and designing to experience future projections on a screen. All these factors are driving the 3D rendering market on a larger scale across the globe. And it will further expand in the forecast period.

Restraint

Risk of utilization of unlicensed software

A major factor affecting the growth of the 3D rendering market is piracy concerns regarding the software uses. Due to the software piracy issues, many software developers are facing financial loss and a lack of profitability in the market. A trade group of Microsoft company, the software alliance BSA, has reported overall, 1.5 thousand unlicensed software users and installations have been made improperly. Such pirated use of the software is impeding the reliability of existing software and may decrease the company's financial results. Nonetheless, several research and development activities are now set to solve such piracy concerns and address hindrances in the 3D rendering market.

Opportunity

Several technological advancements

The rendering market is based on innovations and technological development to strengthen its presence worldwide. They develop strategies for product development and marketing. For instance, in 2022, an image rendering company named Chaos Software developed V-Ray 6 for MAYA; it's a new version for repeating geometrical aspects of the images, procedural clouds, and next-generation analytics for rendering. These advancements aim to improve businesses' reach and let them be ahead of time in the market to strengthen their position globally.

Component Insights

The software segment accounted for the dominating share in 2024. The primary reason behind the growth of the 3D rendering market is that ongoing innovations in the area make it more influential among the end user, increasing its utilization on a broader scale. That's why several software enterprises are merely focused on product scalability and its improvisation by including new features that are user-friendly.

- For instance, in October 2022, Adobe, a leading software expert in the market, updated its 3D software product to enhance METAVERSE experiences for the end users. Now, it can yield metaverse collections for 3D rendering and modelling as well.

The cloud sub-segment is further observed to grow at a notable rate in the market. The fastest-growing digitalization in most companies and the prevalence of adoption of cloud services among several industries are some of the significant factors that have impacted the market growth for this segment. Many business enterprises are in the race to provide proficient rendering services collaborating with cutting-edge cloud-based tools, surging the cloud segment of the 3D rendering market across the globe.

- For instance, in September 2022, a software corporation named Autodesk Inc. upscaled its cloud-based Autodesk system to harness and contemplate BIM data aid to business owners to convert data digitally within a 3D matrix.

Organization Size Insights

The SME segment is expected to meet a notable rate of growth in the total share of the 3D rendering market by 2034. The primary factor that has driven this segment is that small enterprises can create and take advantage of recent visualization techniques with lower budgets and with lesser end to end-contract results. These methods aid in lowering the overall capital investment and labour costs to adopt 3D rendering software in small-scale enterprises.

Whereas the large enterprises segment held a significant share of the 3D rendering market in 2024. Large enterprises typically have more resources and higher budgets compared to small and medium-sized businesses. This allows them to invest in advanced 3D rendering software, hardware, and skilled professionals to create high-quality visualizations for various purposes, such as product design, architectural visualization, marketing, and entertainment. Large enterprises often undertake complex projects that require sophisticated 3D rendering solutions to visualize and communicate ideas effectively. These projects may include architectural designs for skyscrapers, urban planning, industrial machinery simulations, automotive prototypes, and blockbuster films. 3D rendering software enables large enterprises to visualize and iterate on these projects with precision and realism.

Operating System Insights

The Windows operating system segment accounted for the dominating share in 2024. Windows operating system has already a large user base, and in addition to that, technical advancements like mixed reality are driving the higher demand for 3D rendering output using Windows. Windows has many advantages, such as upgrading with time and better-quality services compared to others, fuelling this segment in the market and influencing the users for 3D rendering applications. According to recent data, Windows is used by 76% of desktop operating system users across the globe.

Application Insights

The visualization and simulation application segment, has held the largest market share in 2024. Vigorous efforts and marketing tactics by many software enterprises have led to a growing visualization and simulation segment. Also, updating software versions includes factors that reduce the risk associated with final products and enhance user experience, bolstering factors for the 3D rendering market.

For instance, in January 2023, an AI computing solutions enterprise, Nvidia, launched a product named Nvidia Omniverse. Its platform provides immensely variable ways to simulate, visualize, and code for industries' designs and discoveries.

End-use Insights

The automotive segment is predicted to grow at a significant rate by the year 2034. Automotive industry players are set to switch entirely to 3D printing solutions for streaming the development of the automotive system of vehicles. Automakers make use of simulation and modelling services for the management of the designing process. For instance, a Japanese automotive enterprise named Toyota has completely switched to 3D printing solutions for its Poland-based vehicle production firm with the help of Zrtrax 3D printers' solutions.

3D Rendering Market Companies

- Adobe systems Inc

- Autodesk, Inc

- Act3-D B.V

- Blender institute

- Chaos software

- BluEnt CAD

- Corel corporation

- Christie digital systems USA,Inc.

- Dassault systems,Inc.

- Easy render

- Luxion, Inc

- Foundry

- Map systems

- Next limit technologies

- Maxon computer GmbH

- NVIDIA Corporation

- SideFX

- Pixologic incorporated

- Tesla outsourcing services

- Vrender

- Unity technologies

- Trimble, inc.

- XR3D studios

- Xpress Rendering

Recent Developments

- In June 2022, adobe made essential updates to the Adobe 3D substance. Adobe 3D Substance includes several tools and services that aid in the creation of desired content throughout the project workflow. One of the critical updates is the material software development kit, SDK, specially designed for developers to customize materials for their project work.

- In February 2022, Autodesk Inc. And ModuleWorks GmbH collaboratively launched the Fusion 360 software platform to enhance unified workflow and consistent user experience for the manufacturing process and product design.

- In June 2022, 3D Cloud and Kingfisher plc launched innovative 3D visualization, planning, and design technology for select markets. A range of new features will be offered, including virtual reality capabilities and 3D product configuration.

- In April 2021, Luxion Inc., a leading global company in 3D product design rendering software, partnered with GRO Capital to increase its influence in the worldwide market. It includes a clause such as GRO capital will collaborate with Luxion to aid ongoing technical swift and marketing initiatives and expand the company's network on a global scale.

Segments Covered in the Report

By Component

- Software

- On Premises

- Cloud

- Service

By Organization Size

- Large Enterprises

- SMEs

By Operating System

- Windows

- MacOS

- Linux

By Application

- Visualisation and Simulation

- Animation

- Product, Design and Modelling

- Others

By End-use

- Automotive

- Gaming

- Healthcare

- Media and Entertainment

- Manufacturing

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting