What is the 5G NTN Market Size?

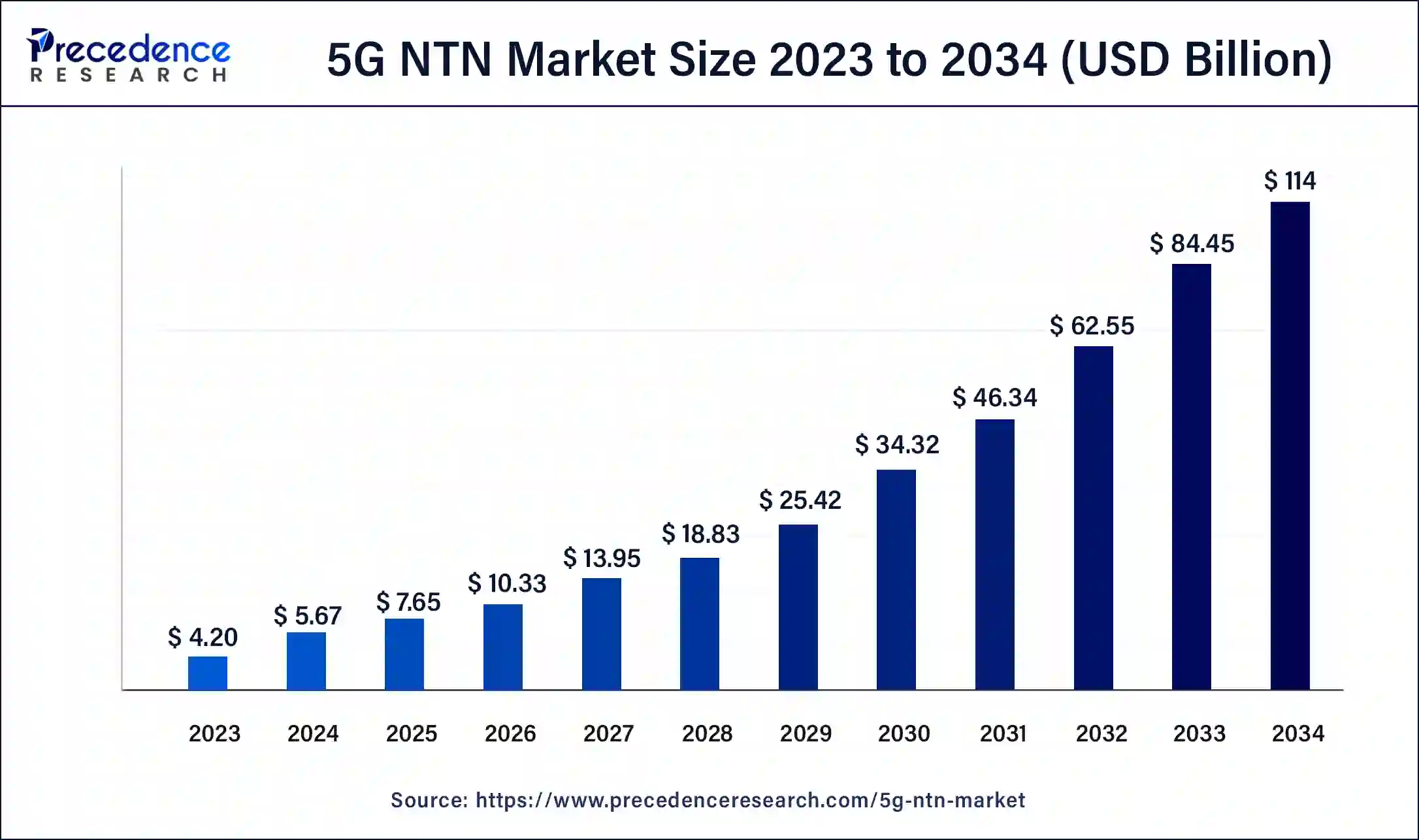

The global 5G NTN market size was estimated at USD 7.65 billion in 2025 and is predicted to increase from USD 10.33 billion in 2026 to approximately USD 138.45 billion by 2035, expanding at a CAGR of 33.59% from 2026 to 2035.

5G NTN Market Key Takeaways

- In terms of revenue, the market is valued at 7.65 billion in 2025.

- It is projected to reach 138.45billion by 2035.

- The market is expected to grow at a CAGR of 33.59% from 2026 to 2035.

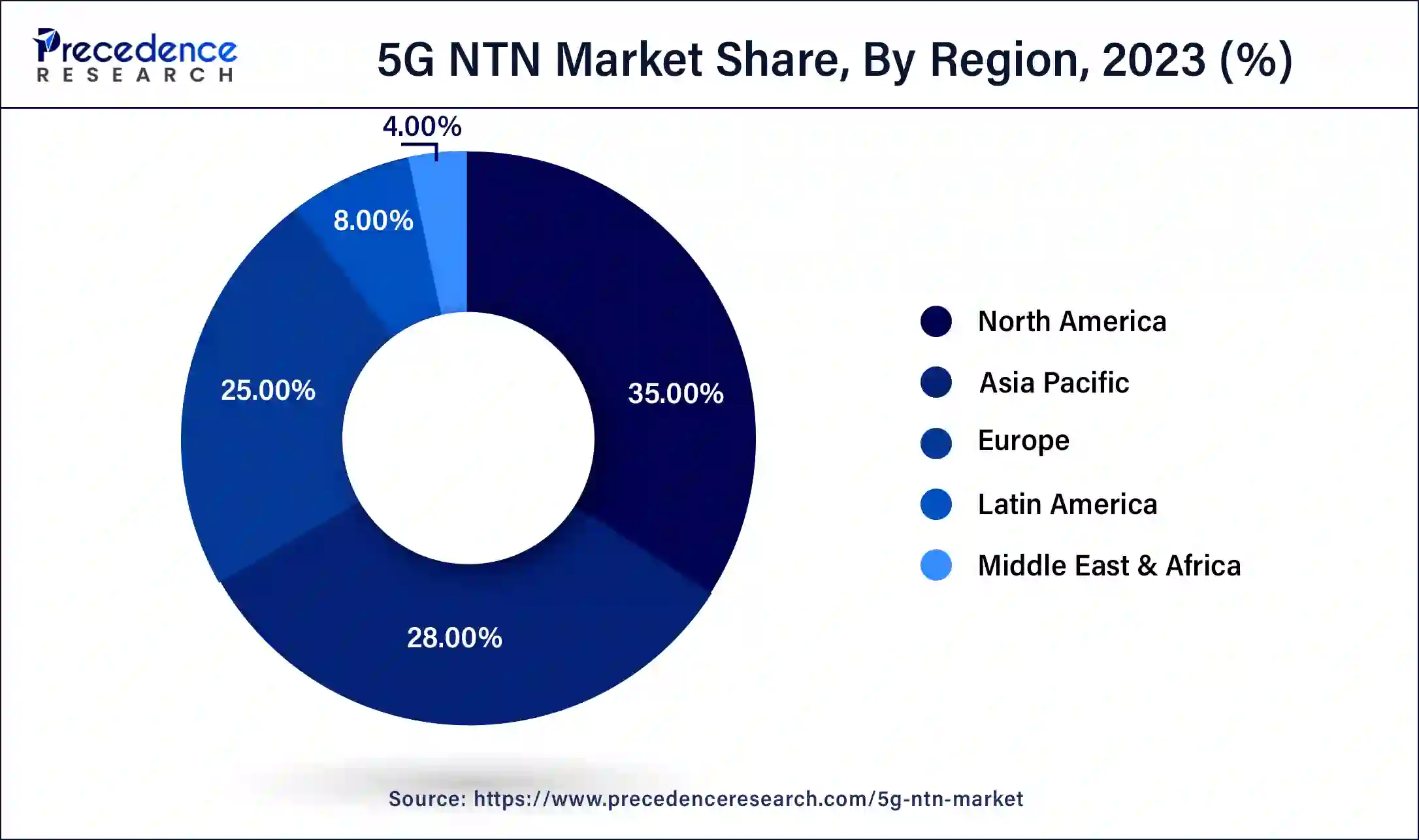

- North America led the global market with the highest market share of 35% in 2025.

- By end-use, the aerospace and defense segment dominated the market in 2025.

- By component, the hardware segment dominated the 5G NTN market in 2025.

- By application, the eMBB segment captured the biggest market share in 2025.

5G NTN Market: Accelerating Global Connectivity and Next Generation Networks

5G Non-Terrestrial Networks (NTN) refer to the use of satellite or high-altitude platforms, such as drones or balloons, to provide 5G wireless connectivity to users. These networks are being developed to address the challenges of providing connectivity in remote or hard-to-reach areas where traditional terrestrial networks are not practical. 5G NTN is expected to provide a wide range of benefits, including improved coverage and capacity, reduced latency, and increased reliability. It is also expected to support a wide range of applications, including internet of things (IoT) devices, autonomous vehicles, and remote healthcare services.

5G NTN Market Growth Factors

5G Non-Terrestrial Networks (NTN) can also have potential applications in mining operations. In the mining industry, remote areas are often difficult to reach and traditional terrestrial networks may not be available or reliable. NTN can be used to provide high-speed and reliable wireless communication to mining sites, enabling real-time monitoring, control, and communication between workers, equipment, and operations.

To enhance operations, mining companies are integrating the most recent automation technologies. The swedish mine operator boliden, for instance, collaborated with Ericsson to build an autonomous gold mine, where ericsson installed the 5G network. The demand for 5G NTN solutions is also rising as more vessels are required to support high data rates for applications like video and data file transfer.

The integration of the terrestrial network with LEO satellite to create a 5G networking system is being supported by governments in numerous nations. The government of Canada and telesat agreed to a deal for USD 600 million in July 2019 to use Telesat's LEO satellite constellation to close the connectivity gap across Canada.

- In August 2022, MediaTek and Rohde & Schwarz worked together to execute a NodeB network (gNB) test over an LEO satellite to show off the ability of 5G NTN to give a more dependable and quick connection. By using a 5G network connection to power a smartphone for the first time, the business has reached a new 5G milestone.

5G NTN Market Outlook

- Industry Growth Overview: The 5G NTN market is expected to experience robust growth from 2025 to 2034, driven by rising demand for global connectivity in remote, maritime, aviation, and rural areas. The expanded use of LEO and MEO satellite constellations is enabling high-speed broadband connections in regions without terrestrial network coverage. This market growth is further supported by the development of reusable launch vehicles and ongoing advancements in satellite manufacturing.

- Technology and Innovation Trends: The continuous growth of the market lies in technological advancements, with companies focusing on developing hybrid satellite-terrestrial solutions, phased-array antennas, and NTN-compatible 5G chipsets. Leading players such as SpaceX, OneWeb, AST SpaceMobile, and Omnispace are innovating satellite designs featuring multi-beam, low-latency payloads. Additionally, edge computing and AI-based network management are enhancing NTN efficiency, reliability, and scalability.

- Global Expansion: 5G NTN operators are expanding coverage globally to optimize spectrum use and comply with regional regulatory standards. Companies like SES, Inmarsat, and Intelsat are boosting capacity in Africa, Latin America, and the Middle East, while OneWeb, SpaceX, and AST SpaceMobile are targeting North America, Europe, and Asia-Pacific. Joint ventures between satellite operators and mobile network providers are accelerating deployment, enabling hybrid 5G NTN connectivity across both urban and remote regions. This expansion is further driven by global businesses' demand for secure, reliable, and low-latency communication networks.

- Major Investors: High technical barriers and recurring revenue opportunities are attracting both strategic investors and private equity firms to the 5G NTN sector. Major investors such as SoftBank, Temasek, BlackRock, and KKR are actively funding satellite launches, direct-to-device communication technologies, and hybrid NTN startups. Declining launch costs, reusable rocket innovations, and increasing global demand for broadband and IoT connectivity are reinforcing investor confidence. These strategic investments are accelerating technology commercialization and large-scale network rollouts.

- Startup Ecosystem: The 5G NTN startup ecosystem is rapidly expanding, with companies developing satellite hardware, software, IoT connectivity, and integrated end-to-end solutions. Many startups are deploying LEO satellites and hybrid networks to deliver low-latency global coverage for smartphones, sensors, and industrial applications. Additionally, innovations focused on energy efficiency, satellite miniaturization, and low-cost ground terminals are improving accessibility and adoption, particularly in emerging markets.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 7.65 Billion |

| Market Size in 2026 | USD 10.33 Billion |

| Market Size by 2035 | USD 138.45 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 33.59% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, End-Use, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Excessive coverage expansion must be addressed.

The fifth generation (5G) Revolution mobile network technologies aim to ultimately increase coverage such that wireless services are accessible everywhere since connectivity in the future are going to be prevalent. Present a new 5G Evolution architecture that incorporates extraterrestrial networks in order to achieve that goal (NTN).

The cooperative NTN design that has been developed is interesting since it allows for greater cost efficiency through equipment sharing and frequency resource conservation through shared frequencies. Also, consumers may connect to 5G networks everywhere without knowing the connection destination by fully utilizing wireless technologies including handover, available bandwidth, and dual connection between Sites.

Restrain

Meeting demand on ground stations.

Ground stations are necessary to communicate with the satellite or high-altitude platform, and a sufficient number of ground stations must be deployed to ensure reliable communication coverage. One way to address this challenge is to use a combination of NTN and traditional terrestrial networks. Terrestrial networks can be used to provide connectivity in areas where ground stations for NTN are not available or practical.

This hybrid approach can ensure that reliable connectivity is available throughout the coverage area. Additionally, it is important to consider the regulatory and logistical challenges associated with deploying ground stations for NTN. Governments and regulatory bodies may have restrictions on the use of certain frequencies and may require permits or licenses for the deployment of ground stations. Logistics such as power, internet connectivity, and maintenance also need to be addressed.

Opportunity

Need for NTN in the evolution toward 5G and 6G.

Worldwide, 5G networks have been installed in several locations. So far, these commercial networks have provided foundational knowledge. Also, the 3GPP has started standardization linked to 5G Accelerated systems due to the requirement for the continued growth of 5G networks by embracing innovative verticals and use cases. Moreover, 5G advanced offers stepping stones for the future 6G network, connecting 5G and 6G.

The growing expectations have set a clear goal for the business and research communities: 6G should use constantly available intelligent communication to support an effective, humane, and sustainable society. Nonetheless, some of the aforementioned 5G advanced technological elements can be considered as forerunners to some of the 6G fundamentals.

In order to deliver an even better experience, XR, for instance, may progressively develop into immersive interaction for human-machine interaction, which may place additional demands on 6G.

Segment Insights

Component Insights

The growing use of the internet throughout the world will support industry expansion. The expanding telecom and broadband sectors have increased access to reasonably priced internet connectivity options. Nearly 4.9 billion people worldwide utilized the internet in 2021, up from 4.1 billion in 2019, based on the International Telecommunication Union (ITU).

More people will have access to e-learning platforms as more people are using the internet and taking courses or finishing degrees on them. Corporations have been pushed to adopt work-from-home policies to maintain daily operational activities in response to the growing personnel safety concerns.

Practices for working remotely to maintain everyday operations. Several businesses are concentrating on providing specialized learning solutions to meet the growing demand. For instance, LinkedIn Corporation said in April 2021 that it had plans to create an online site for businesses to offer their staff video tutorials & materials on topics like effective management and machine learning.

End-Use Insights

Manufacturers of smartphones are concentrating on baseband development to expand their 5G portfolio. As an illustration, Huawei and Samsung have been creating their own baseband for their own devices to lessen their reliance on other chip producers and boost their ability to differentiate their products through the integration of software and hardware. Vivo stated that the Exynos 980 5G chipset from Samsung would power its x30 smartphone in November 2019.

The production of 5G smartphones reached a significant peak in 2019. Samsung has revealed that it shipped more than 6.8 million Galaxy 5G phones globally in 2019, enabling users to enjoy the utmost in speed and efficiency. With five Galaxy 5G devices available to customers worldwide, such as the Galaxy Note10 5G, Galaxy s11 5G, directly addressing+ 5G, as well as the recently introduced Galaxy Fold 5G and Galaxy A90, Samsung currently holds more than 40% of the global market for 5G smartphones.

Application Insights

In order to deliver high bandwidth with reasonable latency, maintain high mobility of about 500 Kmph, and manage 10,000 times more traffic, 5G NTN concentrated on the implementation of eMBB. In release-18, eMBB application cases such as mobility improvement, MIMO, and system power reduction are listed. Some top players are using upgraded mobile broadband to provide LTE-like 5G network connection. On initiatives, such as planes and ships, 5G NTN's eMBB services offer great broadband access in remote and underserved places.

Regional Insights

What is the U.S. 5G NTN Market Size?

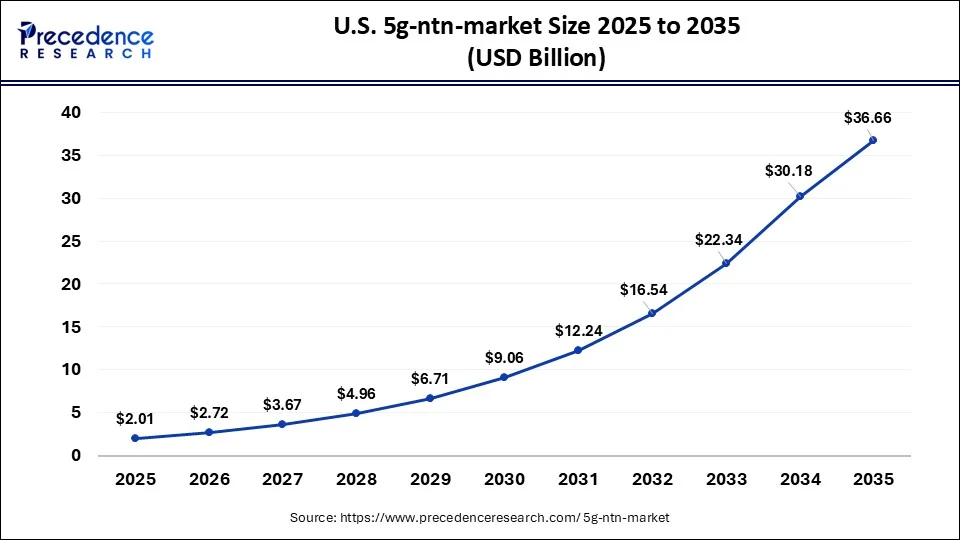

The U.S. 5G NTN market size was estimated at USD 2.01 billion in 2025 and is predicted to be worth around USD 36.66 billion by 2035, at a CAGR of 33.69% from 2026 to 2035.

North America led the 5G NTN market with the largest share of 35.0% in 2025. The growing demand for high-speed connectivity, particularly in remote and underserved areas, has propelled the adoption of NTN solutions. North American telecommunications providers are leveraging satellite communication to enhance network coverage, ensuring that even the most challenging terrains can access 5G services.

Market growth in North America is being driven by substantial investments from private space ventures such as SpaceX and OneWeb. The region's advanced terrestrial 5G infrastructure complements satellite initiatives, enabling hybrid connectivity and broader network coverage. Momentum is also being fueled by growing enterprise and industrial applications, including IoT integration and remote communication solutions. Furthermore, the increasing collaboration between telecommunications and satellite operators is reinforcing North America's leadership in 5G NTN development.

U.S. 5G NTN Market Trends

The U.S. leads the North American 5G NTN landscape, supported by major investments from SpaceX, OneWeb, and other private satellite operators. Network deployment is accelerating due to Federal Communications Commission (FCC) approvals and strategic spectrum allocations. The rollout of hybrid satellite-terrestrial systems is expanding connectivity across rural and underserved regions, while ongoing innovations in ground terminals, phased-array antennas, and low-latency technologies continue to drive nationwide growth and reliability.

A big population, expanding infrastructure, and emerging technologies all contribute substantially to the expansion of the 5G NTN market in the Asia Pacific region. A significant factor in this region's deployment of 5G NTN technologies is the necessity to increase public safety in emergency and disaster circumstances.

There is a growing demand for public security and safety technologies like surveillance technology, scanning and screening devices, and essential communication networks as a result of the region's boom in smart infrastructures, such as initiatives for smart cities.

To improve network coverage in various areas, a number of industries, including aerospace, maritime, defense, and others, are implementing integrated 5G networking and satellite-based solutions. The maritime sector has embraced maritime satellite technology to make use of cutting-edge communication networks to connect with staff members working in far-flung offshore sites.

What Factors Support the Expansion of the 5G NTN Market in Asia Pacific?

Asia Pacific is experiencing strong adoption of 5G NTN due to the need to connect vast, remote, and rural areas. The market's momentum is driven by the rapid growth in IoT deployment, smart city initiatives, and enterprise digital transformation. LEO and MEO satellite networks are being deployed faster with support from public-private partnerships. Growth is also boosted by rising demand in maritime, aviation, and industrial connectivity.

China 5G NTN Market Trends

China is at the forefront of the Asia-Pacific 5G NTN market, driven by substantial government funding for satellite programs and rural connectivity initiatives. The deployment of LEO and MEO satellite constellations is enabling direct-to-device and IoT services in remote and underserved regions. Rapid industrialization, smart city development, and the expansion of maritime and transport networks are further accelerating demand. Supportive spectrum allocations and proactive government policies are fostering large-scale network rollouts, positioning China to sustain strong adoption as enterprise and consumer applications continue to grow.

How is the Opportunistic Rise of Europe in the 5G NTN Market?

The 5G NTN market is growing steadily across Europe, supported by EU and national regulatory initiatives as well as satellite programmes from the European Space Agency. Telecom operators are collaborating with satellite manufacturers to build hybrid networks that provide coverage both in remote and metropolitan areas. Adoption is further driven by the increasing focus on industrial IoT and maritime connectivity. Long-term growth is expected to continue, supported by innovations in satellite payloads and integration with edge networks.

Germany 5G NTN Trends

Germany is emerging as a leader in 5G NTN implementation, supported by robust regulatory frameworks, collaboration with the European Space Agency, and significant investment in GEO, MEO, and LEO satellite programmes. Telecommunications providers are integrating satellite and terrestrial networks to deliver high-speed connectivity across both urban and rural areas. Government initiatives such as smart city projects and industrial IoT programmes are further driving adoption. Germany's advanced infrastructure also facilitates the faster commercialisation of NTN services.

How Big is the Opportunity for the 5G NTN Market in Latin America?

Latin America offers significant opportunities for market expansion, driven by connectivity gaps across rugged terrains and offshore regions. Operators are investing in satellite gateways, antennas, and NTN-capable infrastructure, which is accelerating adoption. Partnerships between satellite providers and mobile network operators are enabling hybrid network solutions for both enterprises and rural users. Growing demand from industries such as mining, maritime, and agriculture is further driving market growth. Brazil is leading Latin America in 5G NTN deployment, driven by the need to address connectivity gaps in rural, jungle, and offshore regions. The adoption of 5G NTN is accelerating across the country, positioning Brazil as a leader.

What Drives the Growth of the Middle East and Africa 5G NTN Market?

The growth of the 5G NTN market in the Middle East and Africa (MEA) is driven by the need to extend connectivity across desert, island, and rural regions. Telecom operators and governments are investing in satellite infrastructure to serve the energy, maritime, and enterprise sectors. The deployment of NTN-capable devices and ground terminals is accelerating through private-sector partnerships. Market expansion is further supported by industrial applications in oil and gas, mining, and logistics.

UAE 5G NTN Market Trends

The UAE is a leading country in the Middle East and Africa (MEA) for 5G NTN adoption, driven by strategic government initiatives, investment in satellite infrastructure, and private-sector partnerships. Telecom companies are deploying hybrid networks to extend services to desert, island, and rural regions. Growing demand from industrial applications in energy, logistics, and maritime further supports market expansion. The sector is expected to experience steady growth as enterprise and consumer applications continue to expand nationwide.

Value Chain Analysis of the 5G NTN Market

- Satellite Design & Manufacturing - The foundation of 5G NTN deployment lies in the design and production of satellites, including LEO, MEO, and GEO platforms, equipped with advanced payloads for broadband, IoT, and direct-to-device 5G connectivity.

Key Players: SpaceX (Starlink), OneWeb, SES, Inmarsat, AST SpaceMobile, Boeing, Airbus Defence and Space. - Ground Segment Equipment & Infrastructure - Satellites require complementary ground infrastructure such as gateways, antennas, user terminals, modems, and base stations capable of integrating terrestrial and non-terrestrial networks.

Key Players: Gilat Satellite Networks, NexGen, Keysight Technologies, Rohde & Schwarz, Anritsu, GateHouse Satcom, NELCO. - Satellite Network Operation & Management - This stage includes the management, control, and operation of satellite networks, ensuring seamless coverage, network reliability, and QoS for terrestrial and NTN integration.

Key Players: Intelsat, EchoStar, Globalstar, Omnispace, SES, Inmarsat, Skylo. - 5G NTN Network Integration & Services - Integration of satellite connectivity with terrestrial 5G networks to deliver end-to-end solutions for mobile operators, enterprise clients, and IoT applications, including edge computing and B2B services.

Key Players: Ericsson, Nokia, Huawei, Qualcomm, MediaTek, SoftBank, Verizon, AT&T, Vodafone. - End-User Solutions & Applications - Final deployment stage where 5G NTN connectivity supports applications in mobility (maritime, aviation, automotive), remote broadband, IoT, industrial automation, and smart cities.

Key Players: Mobile Network Operators (Verizon, AT&T, T-Mobile, China Mobile), Enterprise IoT Providers, Automotive OEMs, Maritime & Aviation Service Providers.

Key Players in 5G NTN Market & Their Offerings:

- Anritsu: A leading provider of test and measurement solutions, Anritsu offers advanced network testing and signal analysis tools essential for validating 5G and non-terrestrial network (NTN) performance.

- Ast Spacemobile: Specializing in space-based cellular broadband, AST SpaceMobile is building the first satellite network designed to deliver direct-to-mobile 5G connectivity globally.

- EchoStar Corporation (USA): A key satellite communications provider, EchoStar delivers broadband, IoT, and enterprise connectivity solutions through its Hughes and EchoStar Satellite Services divisions.

- Ericsson (Sweden): One of the pioneers in 5G infrastructure, Ericsson is developing NTN-ready base stations and software to integrate terrestrial and satellite communication systems.

- GateHouse Satcom (Denmark): Known for its satellite communication software, GateHouse provides protocol stacks and test tools that enable seamless interoperability in 5G NTN environments.

- Gilat Satellite Networks (Israel): A global leader in satellite networking technology, Gilat offers ground-based satellite communication systems supporting 5G backhaul and mobility services.

- Globalstar (USA): Operating a low-Earth orbit (LEO) satellite constellation, Globalstar provides satellite voice, data, and IoT connectivity solutions supporting hybrid 5G-NTN use cases.

- Inmarsat (UK): A leading satellite operator, Inmarsat delivers high-speed global mobile broadband and IoT services across aviation, maritime, and defense sectors, advancing 5G NTN integration.

- Intelsat (Luxembourg): One of the world's largest satellite service providers, Intelsat supports 5G NTN initiatives through its GEO and MEO satellite networks for broadband and mobility.

- Keysight Technologies (USA): A global leader in electronic design and testing, Keysight provides 5G NTN validation solutions for RF, mmWave, and end-to-end satellite communication systems.

- MediaTek (Taiwan): As a top semiconductor company, MediaTek develops 5G chipsets with integrated NTN support to enable satellite-to-smartphone and IoT device connectivity.

5G NTN Market Companies

- Nelco: Partnering with Omnispace, Nelco provides 5G satellite direct-to-device connectivity and IoT solutions to enterprise customers across South Asia.

- Nokia: Offers an AirScale Radio Access Network (RAN) portfolio and AI-ready baseband solutions that support 3GPP-compliant 5G-Advanced and NTN integration.

- Omnispace: Operates a global NGSO satellite network based on 3GPP standards to deliver 5G NTN services directly to mobile devices and IoT sensors.

- OneWeb: Utilizes a Low Earth Orbit (LEO) constellation to provide 5G-Advanced NTN broadband and direct-to-cell services through partnerships with mobile operators.

- Qualcomm: Develops specialized 5G modems, such as the Snapdragon X80, which include integrated support for satellite-based non-terrestrial networks.

- Rohde & Schwarz: Provides validated test and measurement solutions for 5G NR-NTN, covering RF, Radio Resource Management (RRM), and protocol testing.

- SES: Offers 5G-ready mobile backhaul services and high-performance connectivity through its O3b mPOWER MEO satellite constellation.

- Skylo: Acts as an NTN service provider that allows standard smartphones and IoT devices to connect to existing satellites via a software-defined vRAN.

- SoftBank: Is developing a "Ubiquitous Network" by integrating terrestrial 5G with NTN solutions, including its own HAPS (High Altitude Platform Station) and partner satellite services.

- SpaceX: Provides Starlink Direct to Cell capabilities, allowing unmodified LTE/5G phones to access messaging, voice, and data via its massive LEO constellation.

- Spirent: Offers a specialized NTN Digital Twin test solution to emulate satellite conditions and validate 5G NTN performance in the lab.

Recent Development

- In November 2025, the world's first successful 5G-Advaced Non-Terrestrial Network (NTN) technology trial was conducted by the European Space Agency (ESA), the Industrial Technology Research Institute (ITRI), MediaTek Inc., Eutelsat, Airbus Defense and Space, and Rohde & Schwarz (R&S). The technology trail is over Eutelsat's OneWeb low Earth orbit (LEO0 satellites compliant with Rel-19 NR-NTN configurations. (Source: https://www.intelligentcio.com)

- In February 2023, for direct communication between smartphones and satellites, particularly in distant places, Samsung Electronics Co., Ltd., a global leader in advanced semiconductor technology, has acquired standardized 5G non-terrestrial networks (NTN) modem technology. Samsung intends to include this technology into its Exynos modem offerings, speeding up the commercialization of 5G satellite communications and laying the groundwork for the Internet of Everything (IoE) era, which will be driven by 6G.

Segments Covered in the Report

By Component

- Hardware

- Solutions

- Services

By End-Use

- Maritime

- Aerospace And Defense

- Government

- Mining

By Application

- EMBB

- URLLC

- MMTC

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting