What is Adhesives and Sealants Market Size?

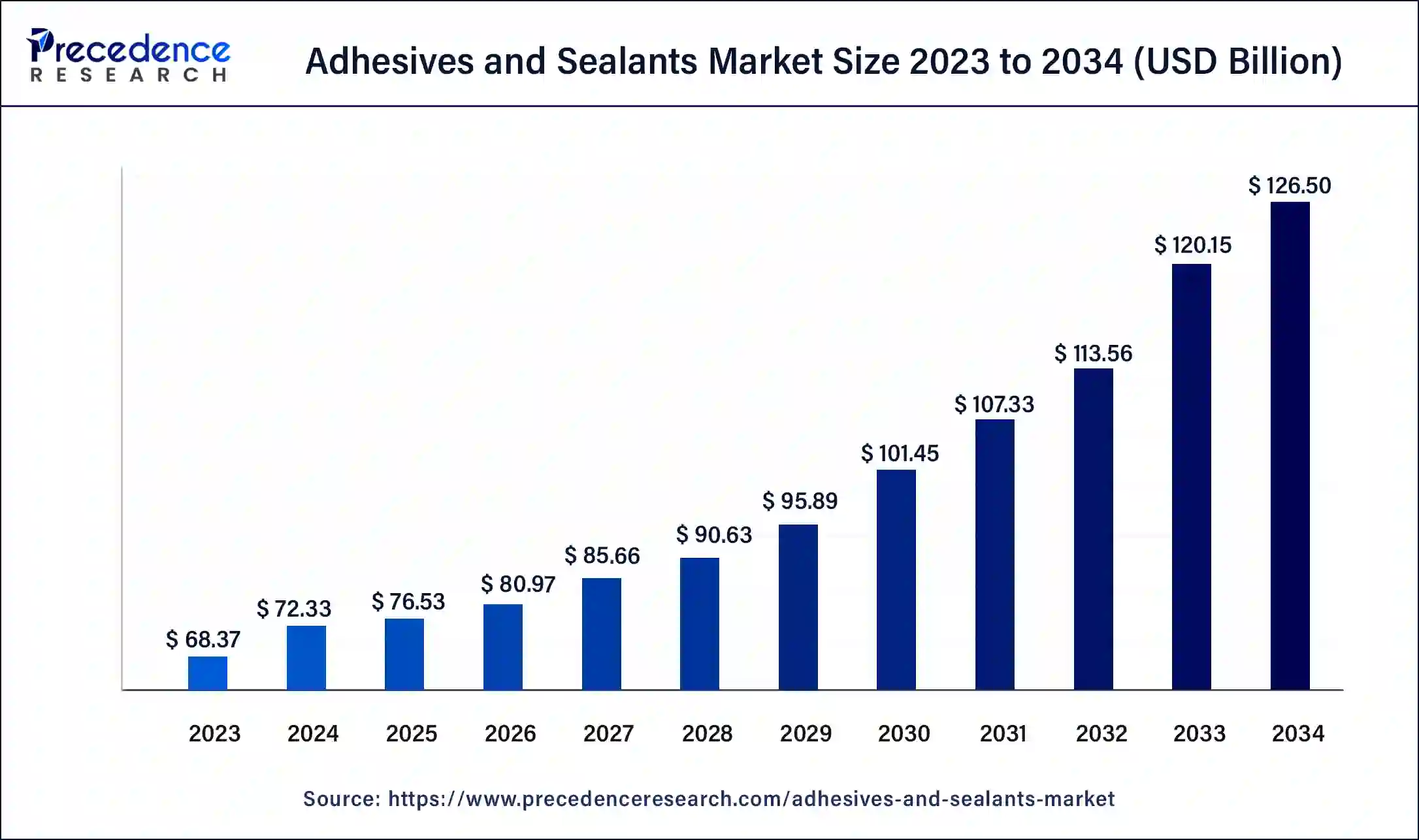

The global adhesives and sealants market size is estimated at USD76.53 billion in 2025 and is predicted to increase from USD 80.97 billion in 2026 to approximately USD 126.5 billion by 2034, expanding at a CAGR of 5.75% from 2025 to 2034.

Market Highlights

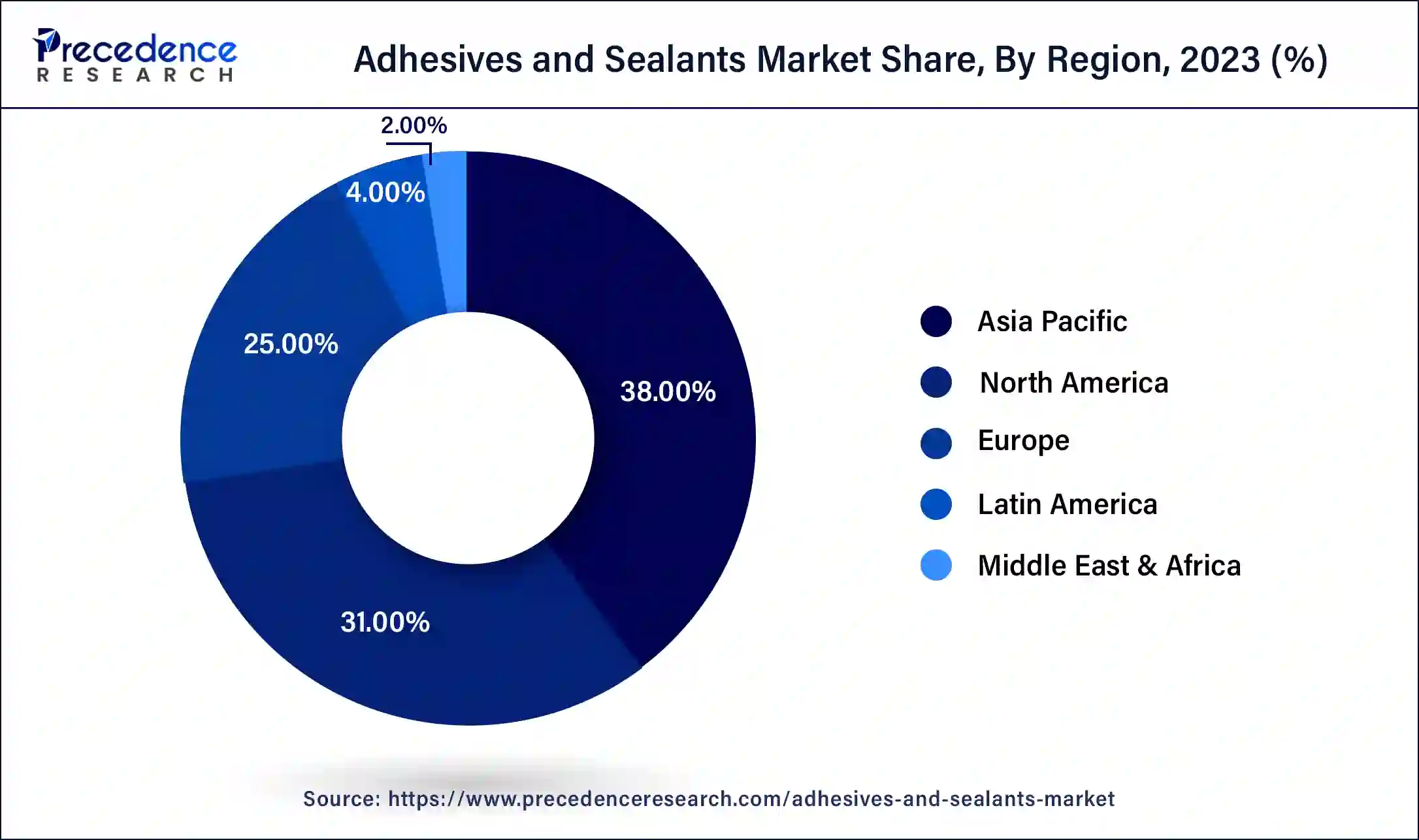

- Asia Pacific dominated the adhesives and sealants market with the largest market share of 38% in 2024.

- By technology, the reactive & others segment held the biggest market share of 48.4% in 2024.

- By product, the silicones segment captured the highest market share of 31.5% in 2024.

- By application, the paper and packaging segment generated the major market share of 30% in 2024.

Adhesives and Sealants Market Growth Factors

Increasing penetration of lightweight passenger vehicles together with lower emissions and higher fuel economy drives the sale of high-performance adhesives across the global automotive industry. These adhesives find numerous applications in both interior and exterior applications in the automotive industry. For instance, they can be used as a substitute of nuts & bolts in a vehicle that significantly reduces its weight and resulting in an improved fuel economy of vehicles. Consequently, traditional welding as well as other mechanical fastening methods predicted to be replaced by the enhanced adhesive materials with superior bonding capabilities.

The adhesives and sealants are prominently used for attaching drywall, tiling applications, bathroom flooring, ceiling applications, fixtures to walls, and molding applications in the construction sector. Thus, rapid growth in the construction industry particularly in the developing countries such as China and India projected to offer lucrative growth opportunities in the near future.

Market Outlook

- Industry Growth Overview: The adhesives and sealants market is growing, driven by rising demand for lightweight automobiles, the requirement for high-performance and sustainable products, and growing construction activity. There is an increasing demand for environmentally friendly, water-driven, and low-emission adhesives.

- Global Expansion: The adhesives and sealants market is experiencing global expansion, as rising demand from significant sectors such as automotive, construction, aerospace, and packaging. Asia Pacific is dominated in the market by thriving automotive manufacturing, while Europe is the fastest growing in the market due to growing modern construction trends.

- Major investors: The major players in the adhesives and sealants market are a combination of large multinational corporations and specialized investment firms. It includes Henkel, H.B. Fuller, Sika, Arkema (Bostik), and 3 M.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 76.53Billion |

| Market Size in 2026 | USD 80.97Billion |

| Market Size by 2034 | USD 126.5 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.75% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Segment Insights

Technology Insights

Water-based technology led the market in the year 2024. In this technology, water is used as a diluting medium or carrier and allowed to set by evaporation or absorbed by the substrate. Furthermore, they reduce Volatile Organic Compound (VOC) emissions, increasing environmental awareness, and stringent government regulations are predicted to boost the growth of the segment in the forthcoming years.

In terms of revenue, hot melt technology expected to witness a growth rate of approximately 8% over the analysis period because of its excellent properties. They form rapid bond and therefore are implemented in highly automated manufacturing processes that include converting, assembly, bookbinding, packaging, and footwear.

Application Insights

Pressure-sensitive applications of adhesives captured a prominent value share in 2024. In this application, when pressure is applied to the adhesives, they form a bond with the adherent. Water or any other type of solvent is not required for this application. In addition, prominent demand for automotive interior trim assembly, safety labels for power equipment, pressure sensitive tapes, and sound or vibration damping films anticipated to propel the growth of the segment.

Moreover, the automotive adhesives market predicted to register the highest growth over the forecast period. Recent technological advancements in adhesive and sealants have helped to reduce the frequency of spot welding by almost 50% that has helped notably in reducing the overall weight of vehicles. In addition, stringent regulations in the U.S. for improved fuel efficiency have prompted leading manufacturers in the automotive industry to reduce the weight of automobiles thus prospering the demand of automotive adhesives and sealants. Further, an escalating growth of the automobile industry particularly in the BRIC nations expected to foster the growth of the segment over the analysis period.

Regional Insights

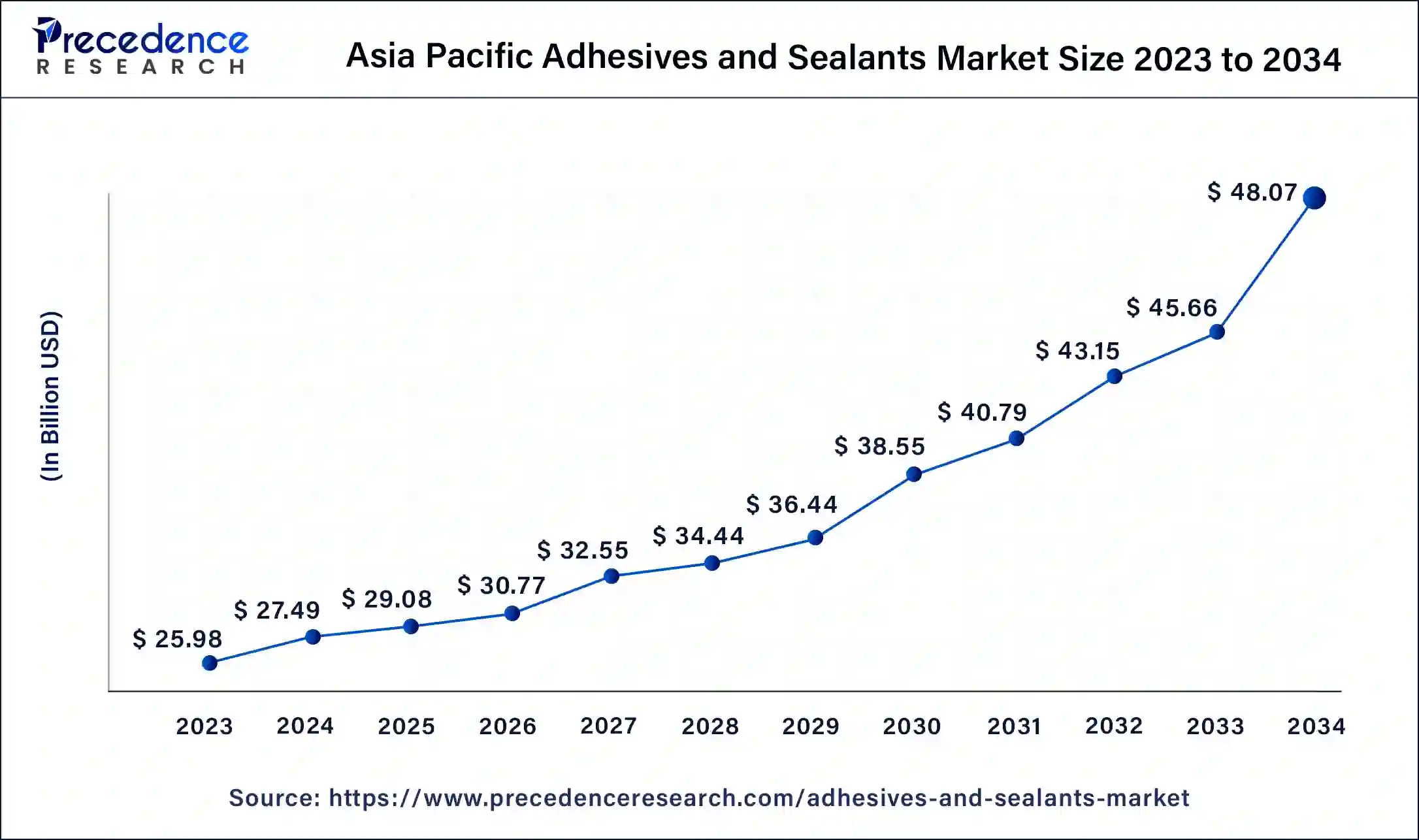

Asia Pacific Adhesives and Sealants Market Size and Growth 2025 to 2034

The Asia Pacific adhesives and sealants market size surpassed USD 29.08 billion in 2025 and is predicted to be worth around USD 48.70 billion by 2034, at a CAGR of 5.89% from 2025 to 2034.

Asia Pacific: Rise in construction activities

Asia Pacific dominated the adhesives and sealants market while holding the largest share in 2024. This is mainly due to the region's rapid industrialization, which boosted the demand for adhesives and sealants in various sectors, including packaging, automotive, and electronics. There is a significant rise in construction activities, especially in countries like India, China, and Japan, which created the need for construction-grade adhesives and sealants. In addition, the flourishing manufacturing sector is anticipated to fuel the demand for sealants from industrial machinery and other applications.

China: Increasing production of vehicles

China is a leading player in the market. This is mainly due to the increasing production of vehicles, which propels the demand for automotive-grade adhesives. Moreover, with the rising production of electronic devices and packaging products, the demand for high-performance adhesives is rising in China, supporting market growth.

Europe: increasing demand from the automotive industry

On the other hand, Europe considered as a significant market for adhesives because of a hub of large number of automobile manufacturers in the region. Adhesives have large application in the automotive industry that include friction, metal/composites bonding, glass, headlight assembly, exterior trims, interiors, body sealing, electrical motors & components, and noise vibration harshness. In terms of sealants, North America examined as the largest market with a revenue share of nearly 23%. This is attributed to the significant presence of end-use industries along with increased spending in the construction sector.

UK: Increasing automotive and electronics

The UK's developed e-commerce sector has led to a huge rise in demand for packaging adhesives used in tapes, labels, and carton sealing. Growth in sustainable and flexible packaging, which contributes to this demand. The automobile industry is a main consumer, using adhesives for a different type of applications, including vehicle assembly.

North America: Strong research and development

North America is significantly increasing in the market due to its vigorous construction and automotive sectors, increasing spending in R&D, and a massive DIY consumer base. The expansion is driven by the requirement for sustainability programmes, lightweight materials, regulatory infrastructure spending, and a high rate of home renovation. Extensive government spending in infrastructure projects, integrated with a strong commercial and residential construction market, creates continued demand.

U.S.: Technological Advancements

The U.S. is a leader in technological advancement, particularly in aerospace and electronics, which drives the requirement for progressive, high-performance sealants and adhesives. Major government policies encouraging sustainable building and the transition to zero-emission vehicles in the U.S. further increase the adoption of specialized adhesives and sealants.

Value Chain Analysis – Adhesives and Sealants Market

- Raw Material: Adhesives and sealants are made from various types of raw materials, containing synthetic polymers such as acrylics, epoxies, and polyurethanes; natural materials like collagen from animal by-products or starches from plants

Key Players: Arkema - Chemical Synthesis and Processing: The chemical synthesis of adhesives and sealants is largely based on polymer chemistry, application of specific raw materials to attain intended characteristics such as strength, flexibility, and resistance to ecological conditions.

Key Players: Sika and H.B. Fuller - Compound Formulation and Blending: Adhesive and sealant compound formulation and blending is a dedicated production process that combines a base material, usually a polymer or resin, with different additives under controlled conditions to produce an end product.

Key Players: Henkel and 3M

Top Vendors in the Adhesives and Sealants Market & Their Offerings

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

B. Fuller Company |

United States |

Diversified Product Portfolio |

H.B. Fuller leverages global adhesive manufacturing to innovate and share expertise, ensuring tailored solutions meet regional demands. |

|

3M Company |

Maplewood, Minnesota |

Innovation and R&D capabilities |

3M Company's major development in the adhesives and sealants sector |

|

Avery Dennison Corporation |

United States |

Robust financial performance |

Avery Dennison launches new labeling solutions advancing recycling, connectivity, and safety at Labelexpo. |

|

Dow Chemical Company |

United States |

Diversified product portfolio |

Dow's adhesive, bonding, and sealant formulations create reliable, long-lasting bonds for a wide range of substrates and applications. |

|

Bostik SA |

France |

Strong focus on innovation and sustainability |

In 2024, Bostik introduced the Fast Glue Ultra+, developed with 60% bio-based materials. This innovation marks a significant advancement in the adhesive industry. |

Recent Developments

- In March 2025, H.B. Fuller announced the launch of industry-grade commercial roofing adhesive with first-of-its-kind canister propellent technology. The H.B. Fuller Millennium PG-1 EF ECO 2 is a high-performance roofing adhesive that eliminates the need for chemical blowing agents by using naturally occurring atmospheric gases. ( Source: https://newsroom.hbfuller.com )

- First-of-its-Kind-Canister-Propellent-Technology/default.aspx In February 2025, Power Adhesives launched Tecbond 110B-PR, a new biodegradable bulk adhesive designed for high-speed case sealing and carton closing. This latest launch reinforces Power Adhesives' commitment to producing innovative bonding solutions and further expands the recently launched bulk adhesive range, providing customers with environmentally responsible options for large-scale industrial applications. (Source: https://thepackman.in )

Segments Covered in the Report

By Adhesives Product

- PVA

- Epoxy

- Acrylic

- Styrenic block

- Polyurethanes

- EVA

- Others

By Adhesives Technology

- Solvent based

- Water based

- Hot melt

- Reactive & Other

By Adhesives Application

- Packaging

- Pressure Sensitive Applications

- Furniture

- Construction

- Footwear

- Automotive

- Others

By Sealants Product

- Polyurethane [PU]

- Silicone

- Acrylic

- Polyvinyl Acetate [PVA]

- Others

By Sealants Application

- Automotive

- Construction

- Assembly

- Packaging

- Consumers

- Pressure Sensitive Tapes

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting