What is the Aerospace Adhesives & Sealants Market Size?

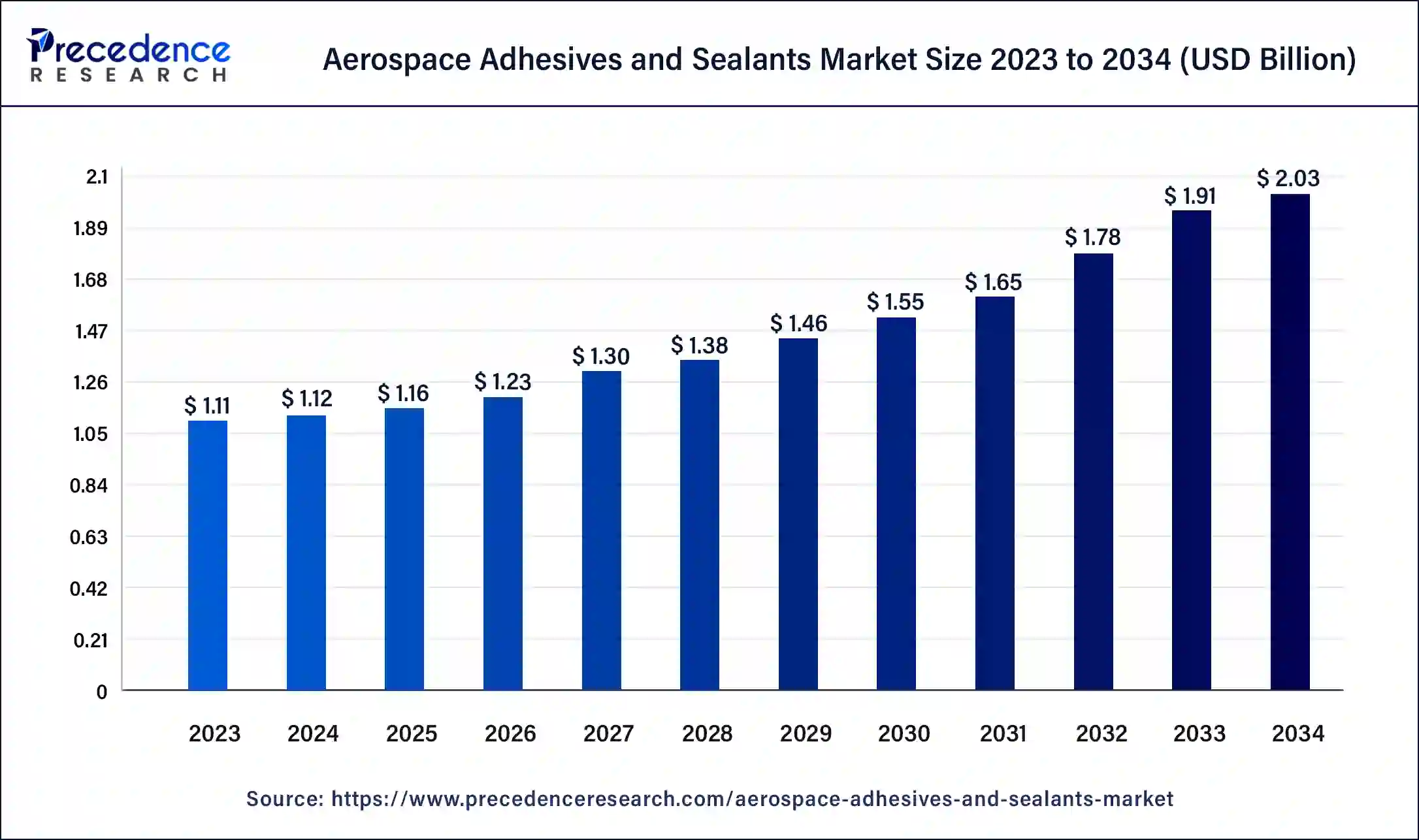

The global aerospace adhesives and sealants market size is accounted at USD 1.16 billion in 2025 and is predicted to increase from USD 1.23 billion in 2026 to approximately USD 2.15 billion by 2035, growing at a CAGR of 6.36% from 2026 to 2035.

Market Highlights

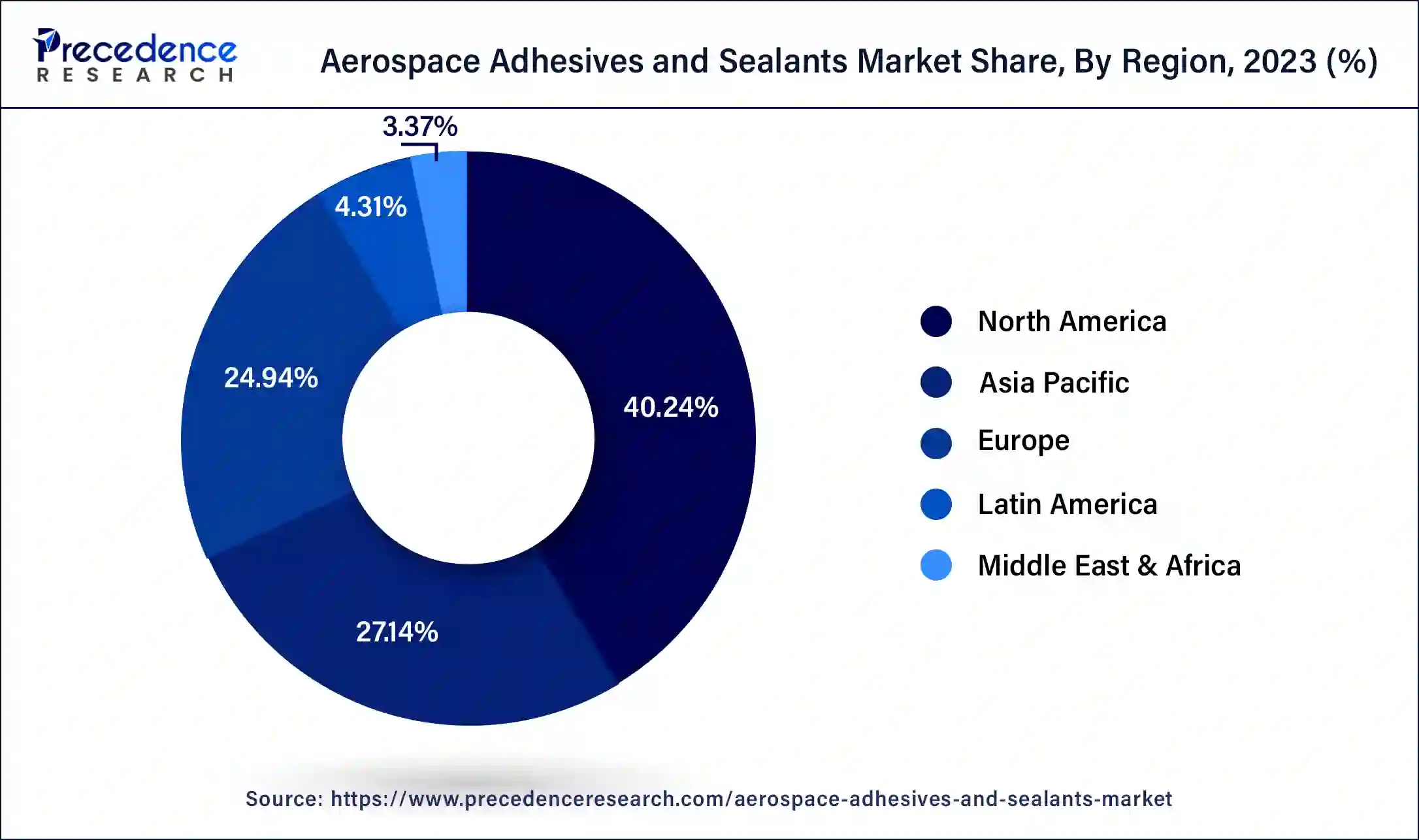

- North America contributed more than 40.24% of the revenue share in 2025.

- By Adhesive Resin, the epoxy segment held the largest market share in 2025.

- By Adhesive Resin, the Translation Research segment is anticipated to grow at a remarkable CAGR between 2026 and 2035.

What is the Aerospace Adhesives & Sealants Market?

The globalaerospace adhesives and sealants market deals with the production and distribution of specialized adhesives and sealants in the aerospace industry. These specialized materials are important in aircraft manufacturing and maintenance. They provide bonding and protection to crucial aircraft components and also prevent corrosion. The increasing demand for fuel-efficient and lightweight aircraft and the growing emphasis on safety and reliability in the aerospace industry are expected to boost the market significantly.

How is AI contributing to the Aerospace Adhesives & Sealants Market?

Artificial Intelligence contributes greatly to the Aerospace Adhesives and Sealants Market by shortening formulation cycles, enhancing material discovery, and allowing virtual performance prediction under the challenging aerospace conditions. It also supports manufacturing through real-time optimization, fault detection that is totally automated, and accurate application by robots. AI assists in maintenance that is predictive maintenance, safety of operations, and planning of the supply chain, which in turn helps the different parties predict demand and avoid risks. The very same features make it possible to use bonding solutions that are safer, cleaner, and more efficient in the aerospace sector throughout development, production, and maintenance.

Aerospace Adhesives & Sealants MarketGrowth Factors

- Significant growth of passengers in aviation industry predicted to be a key factor that propels the demand for sealants and adhesives products. Adhesives and sealants are used in wide range of applications in aerospace industry. Interior applications in airplane include retaining compounds, hydraulic thread systems, and thread-lockers. However, exterior application of adhesives and sealants in an aircraft includes wing spars, door moldings, and panels.

- The adhesives and sealants demand is witnessing a surge with the increasing usage ofcomposite materials. Applications for example primary and secondary assemblies in aircraft anticipated to offer alluring growth opportunities for the market vendors. Further, need for customization according to the manufacturer's requirement is the other most promising area in the aerospace adhesives and sealants market. The manufacturers of adhesives and sealants are able to modify the properties of materials that include viscosity, toughness, shorter cure time, and longer work time in line to the requirements in aerospace application.

- Additionally, prominent rise in the investment particularly for R&D activity and new product development is also the major factor that estimated to fuel the product demand over longer term. The market participants in the global aerospace adhesives and sealants market are largely focused towards enhancing the reliability of lightning protection technology, bonded composite structures, and new multifunctional surfacing. Hence, the aforementioned factors are likely to impart high growth for the adhesives and sealants in aerospace industry during the forthcoming years.

Market Outlook

Air travel expansion is the leading cause of demand, which is also what Henkel AG, 3M, PPG Industries, Huntsman, Solvay, H.B. Fuller, Bostik, and DuPont can strengthen through their innovations.

The market of eco-friendly formulations is moving forward with the support of Henkel AG, 3M, PPG Industries, Huntsman, Solvay, H.B. Fuller, Bostik, and DuPont since they are promoting more sustainable materials in the aeronautics field.

The rise of worldwide investment in aviation comes along with Henkel AG, 3M, PPG Industries, Huntsman, Solvay, H.B. Fuller, Bostik, and DuPont, making it possible for the industry to have wider use of the technology.

Through steady material innovation, Henkel AG, 3M, PPG Industries, Huntsman, Solvay, H.B. Fuller, Bostik, and DuPont lead the industry and reshape it by driving the transformation of the whole industry through their respective areas.

Startups create compatibility solutions with the support of Henkel AG, 3M, PPG Industries, Huntsman, Solvay, H.B. Fuller, Bostik, and DuPont, who are collaborating.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.16 Billion |

| Market Size in 2026 | USD 1.23 Billion |

| Market Size by 2035 | USD 2.15 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.36% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Technology, Sealants Resin, Adhesive Resin, Aircraft, and User Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Expnasion of the Aerospace Industry

The aerospace industry is expanding rapidly due to the increasing air traffic, expanding airline fleets, and rising investments in aircraft design technology. This significant growth of the aerospace industry impacts the demand for aerospace adhesives and sealants, which are essential for bonding and sealing components in aircraft construction and maintenance. These specialized materials are important for ensuring the longevity of aircraft components by preventing corrosion.

Restraint

Drawbacks Related to Adhesives & Sealants

The relative weakness of adhesives when bonding large objects with small bonding surface area is one of the major challenges that limit the widespread adoption of adhesives and sealants in the aerospace industry. This limits their utility in certain applications where stronger mechanical fasteners, such as bolts or rivets, might still be preferred. Many polymer-based adhesives have some limitations when exposed to high temperatures, which can affect their stability. Only specific silicon-based adhesives demonstrate significant heat resistance, which makes them the exception rather than the rule. The separation of bonded materials during testing or repair can be difficult, which also adds extra complexity to maintenance and repairs in the aerospace sector.

Opportunity

Rising Popularity of UAVs

The increasing adoption of unmanned aerial vehicles (UAVs), commonly known as drones, is one of the emerging trends that presents a significant growth opportunity for the aerospace adhesives and sealants market. UAVs are being deployed in various sectors, including delivery services, military operations, farming or agriculture, search and rescue, and surveillance. As the demand for UAVs increases, so does the need for specialized adhesives and sealants tailored to drone manufacturing and maintenance requirements.

UAVs often require lightweight and high-strength adhesives to maximize efficiency. In contrast, military drones and search-and-rescue drones require adhesives that can withstand extreme conditions, such as high temperatures, humidity, and exposure to chemicals. These drones also demand weather-resistant and heat-resistant adhesives to ensure durability and reliability in the field.

Aerospace Adhesives & Sealants MarketSegment Insights

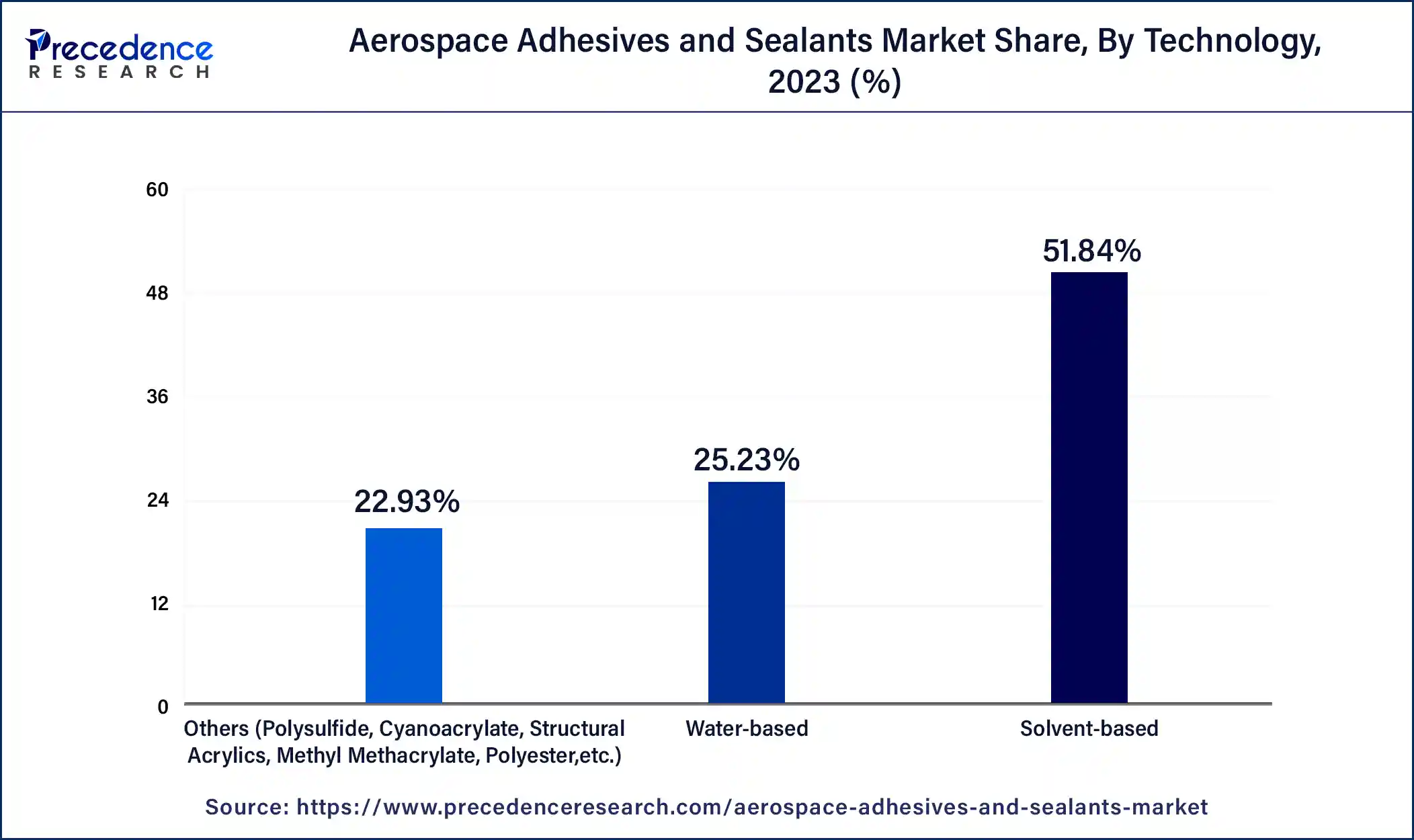

Technology Insights

The solvents segment led the aerospace adhesives and sealants market with the largest share in 51.84% in 2025. Solvents help improve the bonding characteristics of adhesives and sealants by enabling better adhesion to various substrates likealuminum, composites, and titanium, all of which are widely used in aerospace components. Solvent-based adhesives are often used in place of mechanical fasteners to reduce the overall weight of the aircraft, contributing to improved fuel efficiency and performance. Aerospace companies are focusing on greener alternatives by using solvent-based adhesives and sealants that reduce environmental impact without sacrificing performance.

Sealants Resin Insights

Thesilicone segment is anticipated to expand at a rapid pace in the coming years. This is due to its ability to provide adhesion to various substrates, such as plastics, metals, and composites. Silicone-based sealants provide excellent temperature resistance. Thus, they are suitable for applications where components are exposed to high temperatures. Furthermore, these sealants prevent leaks and cracks, thus enhancing the longevity of aerospace components.

User Type Insights

The MRO segment is expected to lead the market throughout the forecast period. The MRO segment encompasses maintenance, repair, and overhaul of aircraft. The segment growth is attributed to the rising maintenance and repair activities of aircraft. Aerospace adhesives and sealants are heavily used during the repair and maintenance of aircraft to protect surfaces from environmental factors, thus ensuring safety of the aircraft.

Adhesive Resin Insights

Epoxy led the adhesiveresins segment in the global aerospace adhesive & sealants market in the year 2025. Epoxy-based products are prominently used in sandwich panels, composite ribs, large wingskins, and other carbon composite substrates. It also offers higher coefficient of thermal expansion, higher compressive strength, as well as low elongation to fracture. The above-mentioned properties and its applications are likely to prosper the growth of the market in the coming years.

In terms of volume, polyurethane expected to be the most lucrative segment in adhesive resins during the forecast timeframe between 2026 and 2035. Bonding different substrates using adhesives expected to enhance the efficiency during aerospace manufacturing process. Joining or bonding permits assembly of separate materials along with the capability to bear higher loads. It also supports in uniform distribution of stresses and strains across joints.

Aircraft Insights

The commercial aircraft segment dominated the global aerospace adhesives and sealants market in 2025. The prominent growth of the segment is mainly due to rising passenger demand along with indirect demand for new commercial aircraft. For instance, Airbus and Boing have a collective order of around 9,000 for the new commercial aircrafts. Further, the passenger traffic has risen by 2.4 times from 2000 to 2019. As per the latest study published by Airbus, the passenger traffic is likely to double during the next 15 years.

Apart from the passenger traffic, aerospace companies are largely focusing on improving fuel efficiency with a purpose to meet the stringent environmental regulations. According to the study conducted by Airbus, from 2008 to 2018, average improvement in the fuel efficiency was greater than 2.0% per year. In order to meet such fuel efficiency norms, companies operating in the aviation industry are likely to replace their old aircrafts with the modern ones that are light-weight and fuel-efficient.

Furthermore, surge in demand for new and advanced military aircraft that include patrol, transports, and fighters projected to impel the growth of the aerospace adhesives and sealants market. Increase in defense spending particularly in the leading countries such as the U.S., India, and China is the other most promising factor responsible drive the aerospace adhesives and sealants market.

Aerospace Adhesives & Sealants MarketRegional Insights

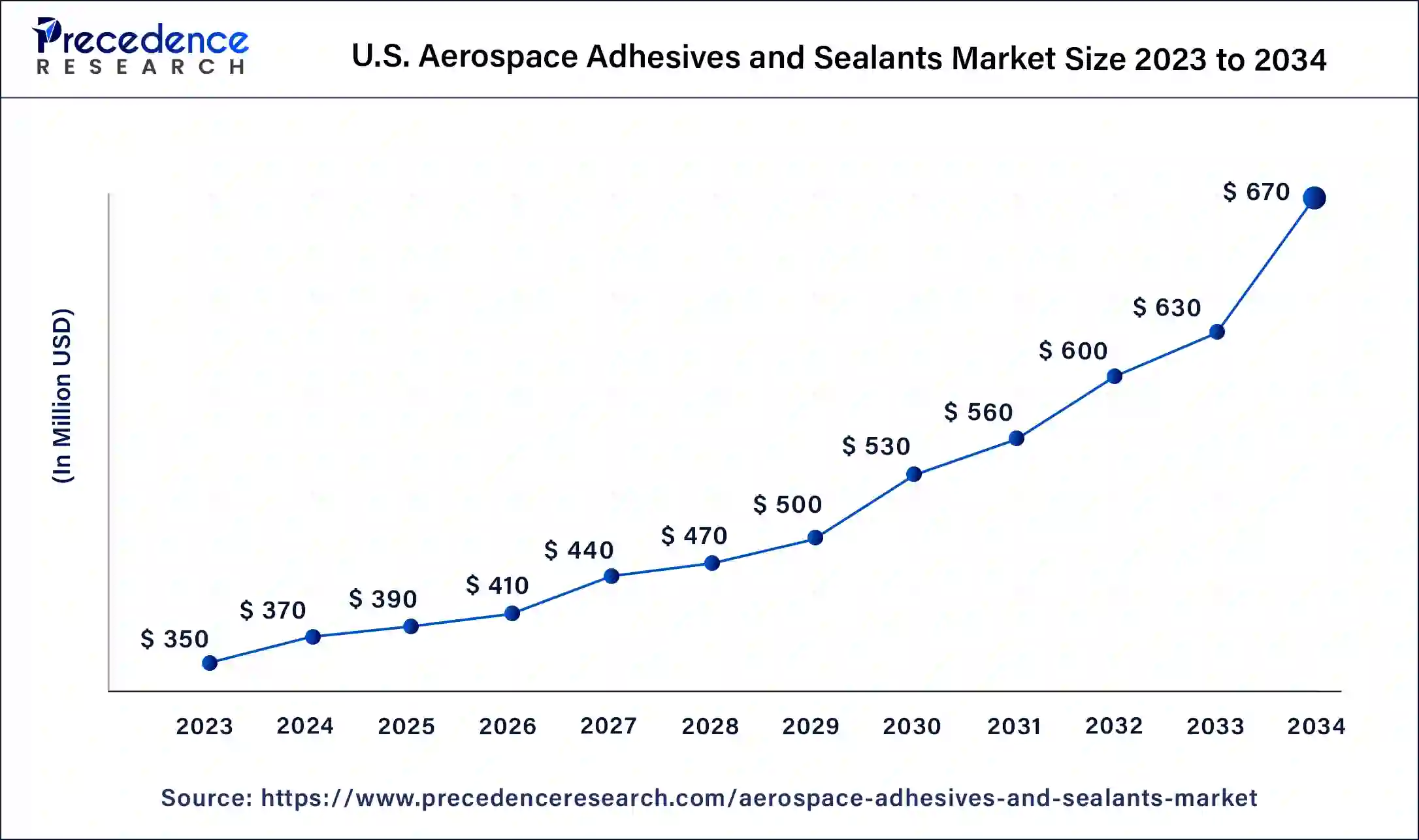

The U.S. aerospace adhesives and sealants market size is calculated at USD 390 million in 2025 and is expected to reach nearly USD 703 million in 2035, accelerating at a strong CAGR of 6.07% between 2026 and 2035.

United States Aerospace Adhesives & Sealants Market Trends

The big American market for aerospace, built-up production facilities, and rigorous regulations make the US the leader. Safety requirements compel the use of high-performance adhesives and sealants, which in turn drives the innovation and acceptance of products across main aircraft programs as well as maintenance areas.

North America is in the forefront due to its aerospace and defense industries being the strongest, a lot of manufacturing and R&D being done, and advanced technologies. Continuous use of high-performance aerospace bonding solutions is supported by new adhesive technologies, the growing demand across military initiatives, and space exploration.

North America led the global market with a volume share of over 40.24% in the year 2025. This is mainly because of the increased focus of the U.S. government to strengthen its military force. Hence, increased spending on the defense sector is likely to offer immense opportunities for the contractors along with their supply chains over a longer period.

The Asia-Pacific market is expanding quickly with the help of the growing demand for air travel, the setting up of new aerospace manufacturing plants, and maintenance activities. The aviation infrastructure of the region is being developed, and its investment in this field creates numerous opportunities for suppliers of lightweight, reliable, and high-quality adhesive and sealant materials.

However, the Asia Pacific exhibits a significant growth rate during the upcoming period, in terms of revenue. The key factors driving the growth of the region are a rapid boost in air passenger traffic coupled with the demand for new aircraft. China is likely to be the major revenue contributor in the Asia Pacific region which drives the growth of the region and accounts for a demand for more than 8,000 new aircraft over the upcoming 20 years.

China Aerospace Adhesives & Sealants Market Trends

China is at the forefront of the regional growth backed by the government, a lot of manufacturing capacity, and MRO expansion. There is a growing local market for top-quality adhesive products that help domestic aircraft programs and strengthen supply chain resilience across aerospace production environments.

Europe is into the use of green aviation technologies, the rise of composite materials, and the enforcement of pollution control regulations. Besides, the region's strong MRO sector pushes the demand for modern adhesive solutions that provide better bonding performance, durability, and compatibility with the materials used in the construction of next-generation aircraft.

Germany Aerospace Adhesives & Sealants Market Trends

Germany has a dominant aerospace industry that is sustained by original equipment manufacturers, first-level suppliers, and heavy investment in research and development. Partnerships with overseas firms and a focus on creative work go hand in hand in making the modern bonding materials for precision, reliability, and advanced aircraft assembly that are in demand.

Aerospace Adhesives & Sealants Market Value Chain

Securing necessary unprocessed materials needed for the production of aerospace adhesives and sealants. Key Players: BASF SE, Dow Inc., and ExxonMobil Chemical

Converting unprocessed materials into intermediates required for the production of aerospace adhesive and sealant. Key players: DuPont and Mitsubishi Chemical Corporation

Merging processed materials to produce final specialized products of the adhesive and sealant type. Key Players: Henkel, 3M, and Huntsman

Checking that products fulfill aerospace performance requirements and regulations before delivery. Key Players: SAE International

Marking and guarding materials prepared for delivery with proper labels and tags. Key Players: Henkel, 3M

Aerospace Adhesives & Sealants Market Companies

- B. Fuller

- Henkel Corporation

- 3M

- PPG Industries Inc.

- Huntsman International LLC

- Cytec Solvay Group

- Dowdupont

- Bostik

- Lord Corporation (Parker Hannifin Corp)

- Hexcel Corporation

Recent Developments

- In September 2025, the Clean Aviation Joint Undertaking launched 945 million for 12 projects focused on innovative aircraft and propulsion technologies, aiming for at least 30% emissions reduction by 2035. (Source:https://www.compositesworld.com)

- In August 2025, Foli Aerogel partners with Aerogel Technologies, combining 30 years of expertise to enhance aerogel distribution. They will debut Foli Aerogel Adhesive Tape, an innovative sealing solution designed to enhance sealing and thermal performance in extreme conditions. (Source:https://www.fibre2fashion.com)

- In March 2024, Henkel inaugurated a new production facility in California to cater specifically to the aerospace industry. This facility will focus on providing advanced adhesives for commercial and military aircraft, ensuring greater production efficiency and innovation.

- In April of 2024, in line with sustainability trends, H.B. Fuller introduced a new line of environmentally friendly aerospace adhesives. These new adhesives are designed to reduce the carbon footprint of aircraft manufacturing by utilizing ecofriendly materials without compromising on performance.

Aerospace Adhesives & Sealants MarketSegments Covered in the Report

By Technology

- Solvent-based

- Water-based

- Others (Polysulfide, Cyanoacrylate, Structural Acrylics, Methyl Methacrylate, Polyester,etc.)

By Sealants Resin

- Silicone

- Polysulfide

- Others

By Adhesive Resin

- Polyurethane

- Epoxy

- Others

By Aircraft

- Military

- Commercial

- Others

By User Type

- OEM

- MRO

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting