What is the Aggregates Market Size?

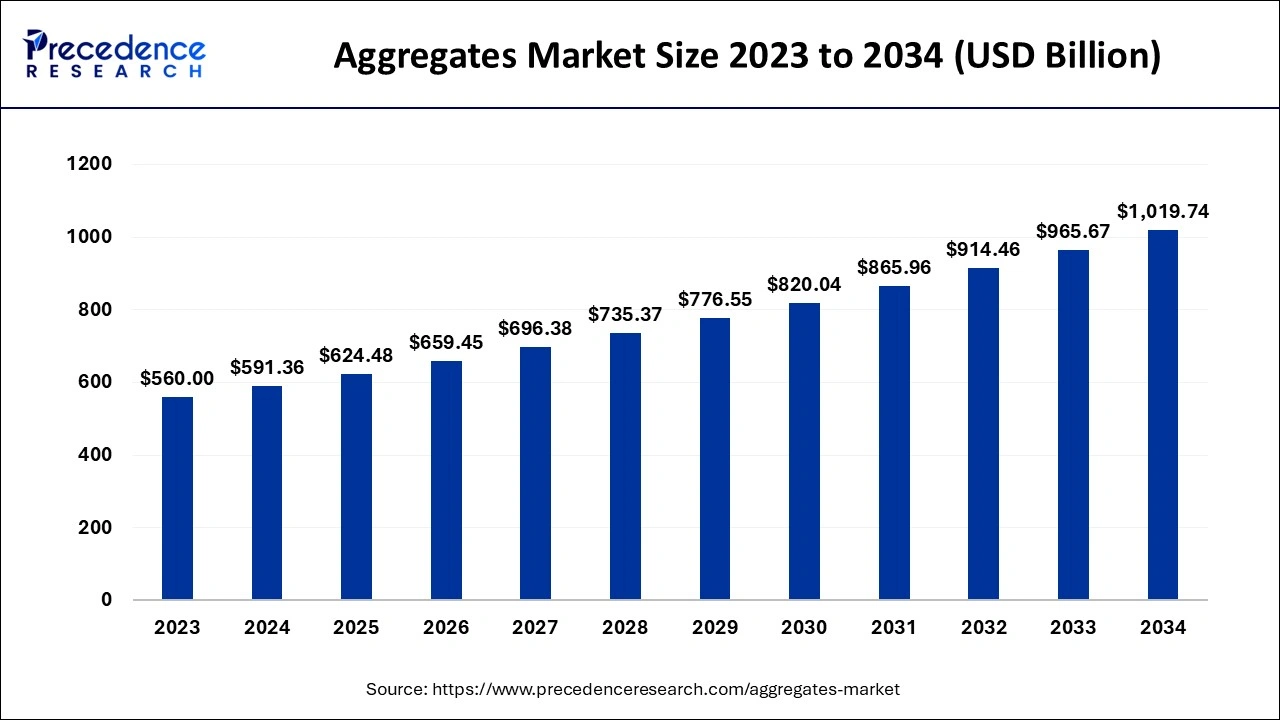

The global aggregates market size is calculated at USD 624.48 billion in 2025 and is predicted to increase from USD 659.45 billion in 2026 to approximately USD 1,071.90 billion by 2035, expanding at a CAGR of 5.55% from 2026 to 2035.

Market Highlights

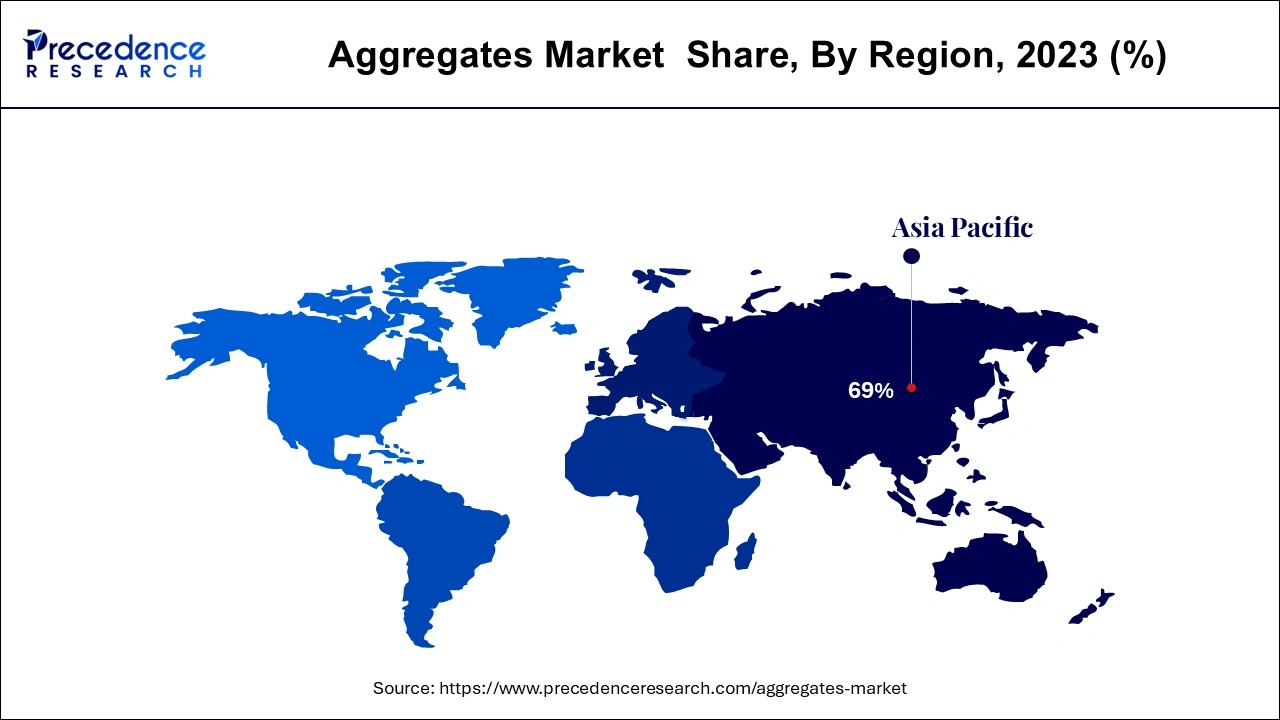

- The Asia Pacific market share of 69% in the year 2025.

- Concrete application is expected to grow at a CAGR of 5% from 2026 to 2035 due to residential construction.

- In 2025, the gravel segment accounted market share of 18% in terms of value

- In 2025, the commercial and infrastructure sectors contributed revenue of over 62%.

Market Overview

Aggregates are granular materials that are mixed with a cementing agent. They are essential components in the production of concrete, mortar, and other building materials, and they are used to build and maintain a variety of buildings, including roads, sidewalks, parking lots, runways at airports, and railways. Its components aid in compacting concrete mixtures. They are a necessary component in the building and upkeep of stiff structures since they also reduce the consumption of cement and water and increase the mechanical strength of the concrete.

It is mined naturally from quarries, deposits, and subsurface sediments. It includes crushed stone, gravel and sand. The rise in high-rise structures, which make extensive use of concrete, is largely responsible for the increase in product demand. Over the previous ten years, the high-rise structures have experienced substantial growth.

Aggregates Market Growth Factors

As the world becomes more urbanized, industries are springing up at a quicker rate in many places. Demand for construction, such as houses, hospitals, hotels, schools, and so on, has expanded, particularly in emerging countries. Moreover, the demand for residential to commercial buildings is rising due to rise in disposable income. One of the key elements driving up demand for such products is the government's many infrastructure projects and maintenance programs. Good infrastructure is sought after by governments because it protects the nation from an increasingly unpredictable natural environment, enables trade, supports industry, connects workers to jobs, and brings hope to suffering populations.

Urbanization and industrialization, which have fueled the demand for numerous projects like the building of bridges, expressways, and motorways, can be credited with the growth of the infrastructure sector. Sales of construction aggregates are projected to increase during the assessment period as a result of upward trends in such projects. Construction includes creating roads and public utility facilities as well as performing routine maintenance and repairs on buildings and other stationary structures. Additionally, it covers structural alterations such bearing walls, beams, and outside walls. Each form of construction project also has its own planning, finance, design, execution, and building processes, as well as improvements to work and repairs.

Market Outlook

- Market Overview: The aggregates market is experiencing growth driven by increasing construction and infrastructure development worldwide. Rising urbanization, industrialization, and government spending on roads, bridges, and buildings are key growth factors.

- Global Expansion:The market is expanding globally as developing economies invest heavily in infrastructure and housing projects. Emerging regions, particularly in Asia-Pacific and Latin America, present significant opportunities due to rapid urbanization and growing demand for construction materials.

- Major Investors: Major investors include multinational construction material companies, private equity firms, and infrastructure development funds that provide capital for production expansion and technology adoption. Their investments help enhance production capacity, improve supply chains, and support sustainable and innovative aggregate solutions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 624.48 Billion |

| Market Size in 2026 | USD 659.45 Billion |

| Market Size by 2035 | USD 1,071.90 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.55% |

| Asia Pacific Market Share in 2025 | 69% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, End User, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and the Middle East & Africa |

Segment Insights

Type Insights

The crushed stone garnered largest market share of around 60% in 2025. The commodity is mostly used as a construction material to make cement and build roads. The growing housing market in all emerging economies, particularly China, India, and Japan, is expected to have a substantial impact on the segment's growth. Additionally, the expansion of the demand for construction aggregates is influenced by activity in the public and private construction sectors as well as building projects connected to security measures put in place around the country.

The concrete blocks, pipes, bricks, and other building supplies for roads all frequently contain gravel. The rise in high-rise structures, which make extensive use of concrete, is largely responsible for the increase in product demand. Over the past ten years, the high-rise structures have experienced substantial growth. Hence, the gravel segment is also expected to grow.

Application Insights

Concrete segment accounted 70% market share in 2025 and is expected to reach at a CAGR of 5.8% over the forecast period. The road base & coverings segment hit at second position in 2025.

The infrastructure segment is expected to witness strong growth during forecast period. Due to growing infrastructure operations in the healthcare, education, energy, and electrical sectors in emerging countries, supported by rising government spending on infrastructural development.

The demand for building is rising as a result of strong economic growth in developing countries and cheap interest rates in many wealthier countries. In addition, it is estimated that the market would grow throughout the course of the forecast due to factors including increased private construction investments, technological improvements, and rising disposable income. Additionally, increased government spending on housing and infrastructure is promoting market expansion.

Regional Insights

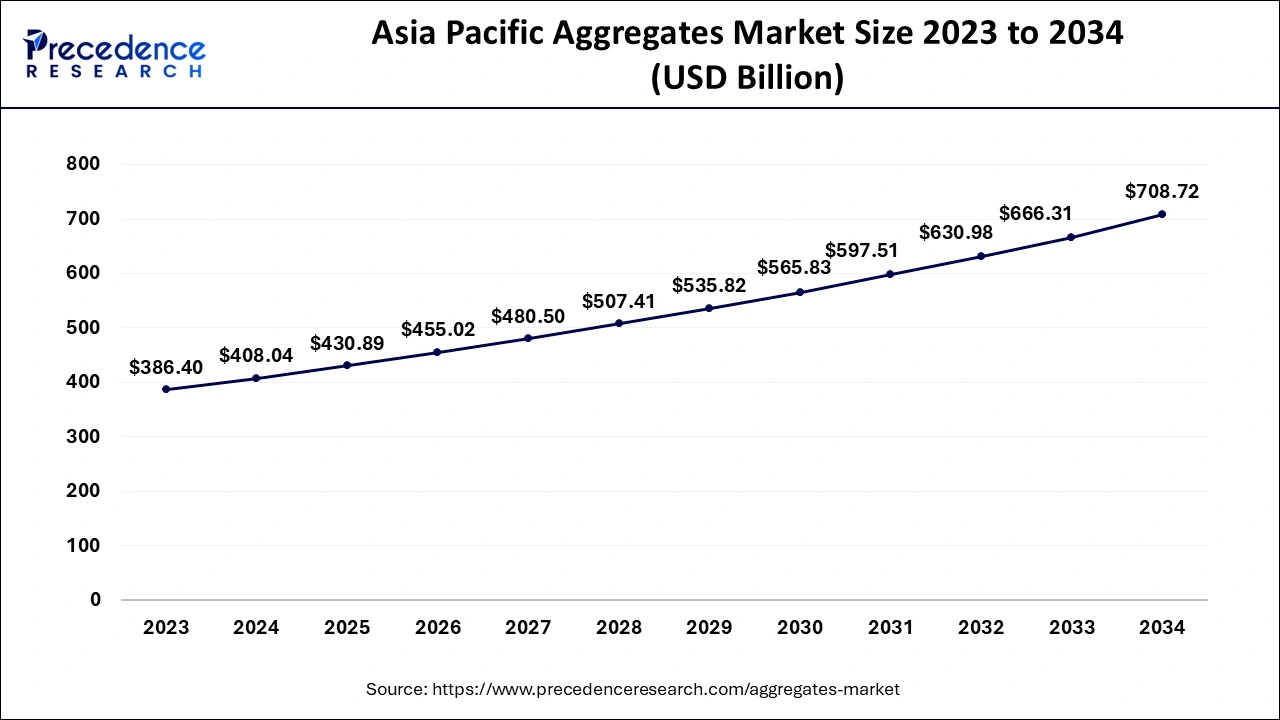

Asia Pacific Aggregates Market Size and Growth 2026 to 2035

The Asia Pacific aggregates market size is evaluated at USD 430.89 billion in 2025 and is predicted to be worth around USD 746.41 billion by 2035, rising at a CAGR of 5.65% from 2026 to 2035.

Asia Pacific accounted market share of around 69% in 2025. Asia-Pacific is proving to be a booming market for the growth of the aggregates market, due to increased industrialization and rising investments. There are numerous ongoing and upcoming building projects in the region as a result of the expansion of construction activity in nations like China, India, and Japan. Additionally, there are more producers of aggregates in this region than in any other, which is another factor driving market growth. Moreover, the surge in disposable income in this area has increased demand for residential and commercial buildings. Additionally, when the population grows, there is a greater need for hotels and schools, which drives up the price of aggregates.

What are the Factors Contributing to the fastest Growth of North America?

North America is expected to grow at the fastest rate during the forecast period, driven by increasing demand for construction aggregates resulting from major renovations of existing infrastructure, highway expansions, and high construction activity in the U.S. and Canada. Investments in Smart City projects, the need for sustainable building materials, and the renewal of commercial real estate also sustain steady demand. Additionally, North American countries have capitalized on advancements in aggregate extraction technology, efficient logistics systems, and greater use of recycled aggregates, making it one of the world's fastest-growing markets.

The growth of the market in the U.S. is driven by the Federal Government's unprecedented infusion of funds into infrastructure, highway modernization, and residential housing reconstruction. Persistent strong demand for concrete, asphalt, and road base applications reinforces the U.S.' role as the leading growth driver for construction aggregates in North America.

Why is Europe Considered a Notable Region in the Market?

Europe is expected to grow at a notable rate due to the increased need for construction aggregates resulting from urban revitalization efforts, green infrastructure initiatives, more stringent quality standards, and the overall commitment to and movement toward sustainable extraction practices. Investment in new transportation corridors and the redevelopment of residential real estate also support aggregate demand.

Germany is leading the market with a continual, consistent demand for construction aggregates from road construction, industrial manufacturing, and the modernization of urban communities. The consistent, high level of manufacturing production and stringent infrastructure quality standards continue to support market growth in Germany.

What Potentiates the Aggregates Market in the Middle East & Africa?

Due to major infrastructure projects, new city development, and urbanization, the market in the Middle East & Africa continues to grow. The increasing number of roads being built, construction driven by tourism, as well as energy sector projects, lead to higher consumption of aggregate materials. At the same time, several nations in Africa are developing their housing and transportation needs to support future growth, even with their varying economic circumstances.

Through continuous investments in smart cities, luxury real estate, and transportation hubs, the UAE drives growth across the Middle East and Africa while sustaining strong demand for aggregate materials. With rapid development of large-scale projects and urban infrastructure, the UAE has become one of the region's largest consumers of high-quality aggregates.

What Opportunities Exist in Latin America?

Latin America offers significant opportunities in the aggregates market, driven by factors like rapid urbanization and increasing government investments in transportation and residential infrastructure development projects. The region is also witnessing a rising demand for sustainable or recycled aggregates, along with technological advancements in mining and processing, thereby contributing to market growth. Moreover, the region's rapidly growing population and expanding middle class fuel the need for commercial and housing developments, further boosting market growth. Shift toward eco-friendly aggregates, driven by stringent environmental regulations and sustainability goals, creates opportunities in the market.

Value Chain Analysis

Extraction & Quarrying of Raw Materials: This stage involves drilling, blasting, and identifying natural rock to remove raw stone. It's about safely accessing quarries for mining, understanding the geological aspect of quarrying, and ensuring optimal conditions for quarrying in an environmentally friendly way.

- Key Players: Heidelberg Materials, Vulcan Materials Company, Martin Marietta Materials, CRH plc, Holcim Group

Crushing, Screening, & Processing: Rocks that have been extracted are crushed and screened, with graded stone sized as different types of aggregate. This is the point where aggregate has uniformity across all the same sized pieces and is improved in quality prior to use, either for construction, infrastructure, or industrial uses.

- Key Players: Metso Outotec, Sandvik, Terex Corporation, Astec Industries, Thyssenkrupp

Transportation & Logistics: Processed aggregates are transported by trucks, rail, and barges to construction sites or distribution points. Efficient logistics reduce transportation costs and provide construction companies with aggregate in a timely manner for large-scale projects.

- Key Players: CEMEX Logistics, Lafarge (Holcim) Logistics, CRH Transportation Partners, Martin Marietta Transport, Oldcastle Logistics

Distribution, Sales & End-Use Applications: Aggregates are delivered to contractors, builders, and manufacturers for use in producing concrete, asphalt, roadwork, and landscaping. At this stage, aggregates are tailored to meet the project's specific needs.

- Key Players: CEMEX and UltraTech Cement, Colas Group, Larsen & Toubro

Top Companies Operating in the Market

- HeidelbergCement AG: HeidelbergCement supplies a broad range of aggregates, including sand, gravel, and crushed stone, to support construction and infrastructure projects worldwide.

- Martin Marietta Materials Inc.: Martin Marietta Materials produces and distributes aggregates such as crushed stone, sand, and gravel for use in residential, commercial, and transportation construction.

- LSR Group: LSR Group offers a variety of aggregates, including sand, gravel, and crushed stone, catering to building, infrastructure, and road construction.

- LafargeHolcim Ltd:LafargeHolcim provides high-quality aggregates like sand, gravel, and crushed rock for concrete, asphalt, and general construction applications globally.

Other Aggregates Market Companies

- Cemex SAB de CV ADR

- Vulcan Materials Company

- CRH plc

- Adelaide Brighton Ltd

- Eurocement Group

- Rogers Group Inc.

- China Resources Cement Holdings Limited

Recent Developments

- In January 2025,Master Builders Solutions announced expansion into India, aiming to provide sustainable, high-performance construction materials, supporting infrastructure growth, and sustainable building initiativs with its advanced concrete admixture solutions. This shift not only addresses resource conservation but also aligns with global sustainability goals. (Source: https://master-builders-solutions.com)

- In July 2024, Heidelberg Materials AG announced a definitive purchase agreement to acquire Highway Materials, Inc., one of the largest independent aggregates and asphalt producers in the Greater Philadelphia market. The acquisition encompasses four crushed stone quarries, nine hot-mix asphalt plants, two clean fill operations, a concrete recycling facility, and a construction services business

- At Bauma Conexpo 2024 in December, Tata Motors showcased advanced aggregates, including live axles, trailer axles, and components engineered for durability and efficiency. The company also highlighted CEV BS V emission-compliant industrial engines with 55–138 HP, delivering high performance while meeting stringent emission standards for construction and industrial applications.

(Source: infra.tractorjunction.com)

Segments covered in the report

By Type

- Crushed Stones

- Gravel

- Sand

By Application

- Concrete

- Road Base & Coverings

- Others

By End User

- Commercial Use

- Residential Use

- Industrial Use

- Infrastructure Use

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting