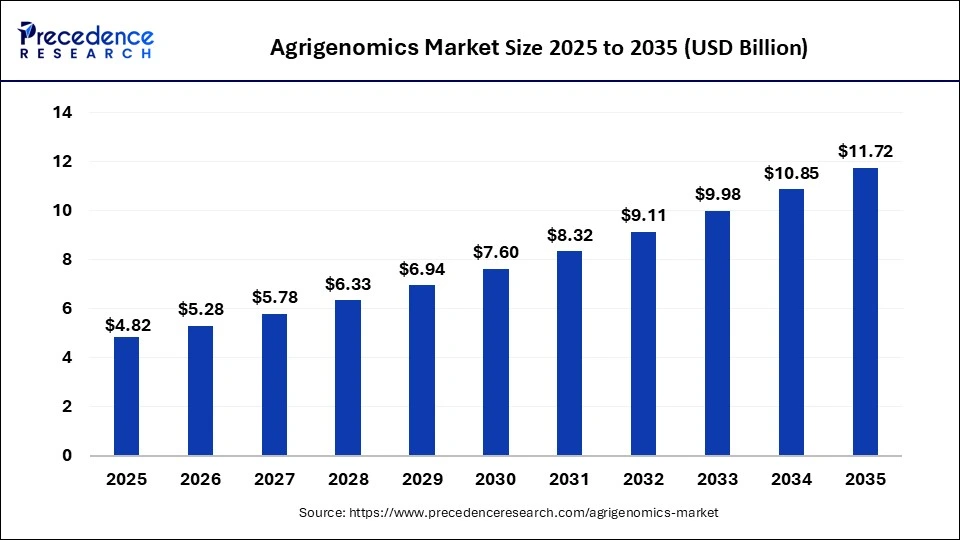

What is the Agrigenomics Market Size?

The global agrigenomics market size is valued at USD 4.82 billion in 2025 and is predicted to increase from USD 5.28 billion in 2026 to approximately USD 11.72 billion by 2035, expanding at a CAGR of 9.29% from 2026 to 2035.

Key Takeaways

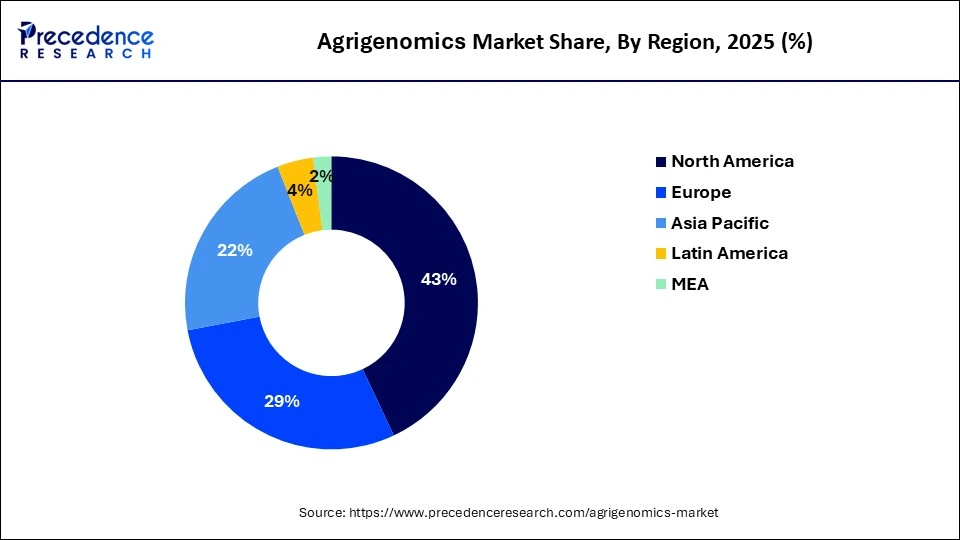

- North America dominated the market with the largest share of 43% in 2025.

- Asia Pacific is expected to witness the fastest rate of growth in the market during the forecast period.

- By sequencer, the illumina HiSeq family segment held the largest share of 36% in 2025, the segment is expected to sustain the position throughout the forecast period.

- By sequencer, the PacBio sequencing segment is expected to grow at a significant rate during the forecast period.

- By application, the crops segment held the dominating share of 65% in 2025.

- By application, the livestock segment is expected to grow at a notable rate.

Agrigenomics Market Overview

Agrigenomics, also known as agricultural genomics, refers to the application of genomics and advanced molecular biology techniques in the study of crops, livestock, and other agricultural organisms. It involves the analysis of the genetic material (DNA, RNA, and proteins) of plants and animals to understand their genetic makeup, traits, and interactions.

The primary goal of agrigenomics is to enhance agricultural productivity, sustainability, and the overall efficiency of food production. The market encompasses a range of technologies and services, including DNA sequencing, genotyping, marker-assisted selection, gene editing, and bioinformatics. These tools allow researchers, breeders, and farmers to gain insights into the genetic variations that influence traits such as yield, disease resistance, and nutritional content.

The agrigenomics market has seen significant growth due to advancements in genomic technologies, increased demand for sustainable and high-yielding agricultural practices, and the need to address global food security challenges. Companies in the agrigenomics market may offer sequencing services, genetic testing kits, bioinformatics tools, and other solutions to support research and development in agriculture.

Agrigenomics Market Data and Statistics

- According to the Asia Food Journal, the cutting-edge genomics technology behind strawberry variety creates an opportunity to advance the $12 trillion agriculture business.

- In February 2023, Tecan announced its collaboration with Singular Genomics to support the turnkey MagicPrep NGS system to generate sequencing-ready libraries for the G4 sequencing platform. The collaboration will help in combining Tecan's capability in bioinformatics, laboratory automation, and genomics with Singular Genomics', highly accurate and fast flexible sequencing technology to streamline life in the lab.

Growth Factors

- Continuous advancements in DNA sequencing technologies, genotyping methods, and bioinformatics tools contribute to the growth of the agrigenomics market. These technologies allow for more efficient and cost-effective analysis of the genetic information of plants and animals.

- The growing global population and concerns about food security have heightened the demand for sustainable agricultural practices. Agrigenomics plays a crucial role in developing crops and livestock with improved yield, resistance to diseases, and adaptability to changing environmental conditions.

- Agrigenomics enables precision agriculture by providing farmers with valuable genetic information about their crops and livestock. This information allows for optimized resource allocation, better pest and disease management, and improved overall farm efficiency.

- As climate change and other environmental factors impact agricultural productivity, there is an increasing need to develop crops with traits such as drought resistance, heat tolerance, and nutrient efficiency. Agrigenomics aids in identifying and developing these desirable traits.

- Awareness about the benefits of agrigenomics among researchers, breeders, and farmers is growing. As more stakeholders recognize the potential of genomic technologies in agriculture, there is an increased adoption of agrigenomic tools and services.

- Governments and regulatory bodies in various countries are recognizing the importance of agrigenomics in addressing agricultural challenges. Initiatives and funding support for research and development in agrigenomics contribute to market growth.

- The development and adoption of genetic modification (GM) and gene editing technologies, such as CRISPR-Cas9, have opened new possibilities for precise manipulation of genes in crops and livestock. These technologies drive innovation and contribute to the growth of the agrigenomics market.

- Collaborations between academic institutions, research organizations, and private companies facilitate the exchange of knowledge and resources, accelerating advancements in agrigenomics and fostering market growth.

- Growing consumer awareness and demand for nutritious and sustainably produced food drive the agricultural industry to focus on developing crops with improved nutritional profiles, which can be achieved through agrigenomic approaches.

Agrigenomics Market Dynamics

Driver: Advances in genetic modification and gene editing technologies

- In February 2023, Singrow, a Singapore-based Agri-genomics startup, announced that it has developed a proprietary genomics technology platform to launch 1st climate-resilient strawberry variety.

Advances in genetic modification (GM) and gene editing technologies have catalyzed a surge in demand for the agrigenomics market, revolutionizing the landscape of modern agriculture. GM techniques, such as CRISPR-Cas9, enable precise manipulation of genes in crops and livestock, allowing for targeted modifications that enhance desirable traits. This has significantly accelerated the development of genetically modified organisms (GMOs) with improved yields, resistance to pests and diseases, and enhanced nutritional profiles. Gene editing technologies offer unprecedented precision, enabling researchers to modify specific DNA sequences without introducing foreign genes. The ability to edit the genome at the molecular level has opened up new avenues for crop improvement, allowing for the creation of novel varieties with desired traits, including drought resistance, increased nutritional content, and optimized growth characteristics.

The demand for agrigenomics services has surged as researchers, breeders, and agricultural companies seek advanced tools for genetic analysis, marker-assisted selection, and bioinformatics to harness the full potential of these technologies. As the global population grows and environmental challenges intensify, the agrigenomics market plays a pivotal role in developing sustainable, high-yielding, and resilient agricultural solutions that address the evolving needs of the industry and contribute to global food security. The convergence of genetic modification and gene editing with agrigenomic advancements marks a transformative era for agriculture, driving innovation and shaping the future of food production.

Restraint: High initial costs

The implementation of advanced genetic technologies, including DNA sequencing, genotyping, and gene editing, requires substantial financial investment in equipment, laboratory infrastructure, and skilled personnel. Small and medium-sized farms, as well as agricultural enterprises with limited resources, may find these upfront expenses prohibitive, impeding their ability to embrace agrigenomic solutions. The high initial costs not only encompass the acquisition of cutting-edge technologies but also the ongoing expenses related to maintenance, training, and staying abreast of rapidly evolving methodologies. This financial barrier could create disparities in the adoption of agrigenomics, potentially limiting access for certain stakeholders within the agricultural community.

Moreover, the economic viability of agrigenomic applications may be a concern for farmers who face uncertainties regarding the return on investment and the time it takes to realize benefits. Overcoming this challenge requires strategic efforts from industry players, policymakers, and financial institutions to develop cost-effective solutions, offer financial incentives, and facilitate technology transfer.

Opportunity: Precision breeding and crop improvement

Precision breeding and crop improvement represent a significant growth avenue for the agrigenomics market, positioning it as a cornerstone in the evolution of modern agriculture. With the advent of advanced genomic technologies, such as DNA sequencing and marker-assisted selection, agrigenomics enables researchers and breeders to identify and understand specific genetic traits within crops. This precision breeding approach allows for the development of crops with enhanced characteristics, including improved yield, disease resistance, and adaptability to varying environmental conditions.

Agrigenomics facilitates the selection of desirable traits at the molecular level, accelerating the breeding process by providing insights into the genetic makeup of plants. This targeted approach not only streamlines the development of high-performing crop varieties but also contributes to the creation of sustainable and resilient agricultural systems. The ability to precisely manipulate the genetic composition of crops empowers farmers to address challenges such as climate change, pests, and resource limitations. As the demand for more efficient and sustainable agricultural practices intensifies globally, the agrigenomics market plays a pivotal role in optimizing crop improvement strategies.

Sequencer Insights

The Illumina HiSeq family segment is recorded more than 36% of revenue share in 2025; the segment is observed to continue the trend throughout the forecast period. Illumina HiSeq family is a widely adopted next-generation sequencing (NGS) technology. It utilizes a sequencing-by-synthesis approach, enabling the simultaneous sequencing of millions of DNA fragments. The HiSeq platform is known for its high throughput, speed, and cost-effectiveness, making it a prominent choice in agrigenomics research.

The PacBio Sequencing segment is expected to grow at a significant rate throughout the forecast period. Pacific Biosciences (PacBio) sequencing, also known as single-molecule real-time (SMRT) sequencing, offers long-read capabilities. This technology excels in providing comprehensive genome information, facilitating the study of complex genetic structures and variations in crops and livestock.

Application Insights

The crops segment held the largest market share of 65% in 2025. Agrigenomics plays a pivotal role in crop research and improvement. By analyzing the genetic makeup of various crops, researchers can identify key traits related to yield, disease resistance, nutritional content, and environmental adaptability. Precision breeding techniques, enabled by agrigenomic technologies, contribute to the development of genetically enhanced crop varieties. This includes the creation of plants that are more resilient to changing climatic conditions, exhibit improved resistance to pests and diseases, and have enhanced nutritional profiles. The application of agrigenomics in crops aligns with the global imperative to ensure food security, sustainability, and increased agricultural productivity.

The livestock segment is expected to generate a notable rate of growth in the market. Agrigenomics is equally essential in the context of livestock farming. Genetic analysis of livestock enables the identification of desirable traits related to meat quality, milk production, disease resistance, and overall animal health. By leveraging agrigenomic tools, breeders can selectively enhance genetic traits in livestock, resulting in improved productivity and the development of breeds that are better suited to specific environmental conditions. The application of agrigenomics in livestock is crucial for ensuring sustainable and efficient animal farming practices, addressing challenges such as disease outbreaks and resource constraints.

Regional Insights

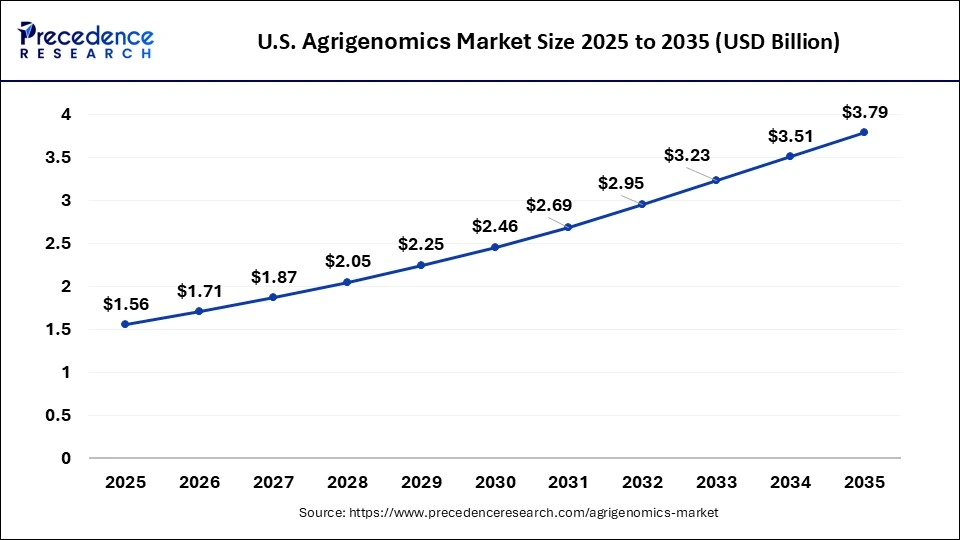

U.S.Agrigenomics Market Size and Growth 2026 to 2035

The U.S. agrigenomics market size is valued at USD 1.56 billion in 2025 and is anticipated to reach around USD 3.79 billion by 2035, poised to grow at a CAGR of 9.28% from 2026 to 2035.

North Americaled the market with the biggest market share of 43% in 2025 due to North America is often at the forefront of technological innovations, and this applies to the field of agrigenomics. Advances in DNA sequencing technologies, gene editing tools, and bioinformatics contribute to the growth of the agrigenomics market. North America has a robust and technologically advanced agricultural sector. The adoption of agrigenomic technologies is driven by the need to enhance crop yields, improve livestock productivity, and address challenges related to climate change and sustainability. Moreover, ongoing research and development activities in genomics and molecular biology, conducted by academic institutions, private companies, and government agencies, contribute to the expansion of agrigenomics applications in North America.

U.S. Market Trends

The agrigenomics market in the U.S. is growing due to increasing demand for high-yield, disease-resistant, and climate-resilient crops driven by a growing population and the need for sustainable agriculture. Advanced genomic technologies, such as gene editing, molecular markers, and sequencing, are enabling precision breeding and improved livestock traits.

Additionally, Government support through funding, grants, and favorable regulatory frameworks can play a crucial role in promoting the adoption of agrigenomic technologies. Policies that encourage sustainable and innovative agricultural practices further drive market growth.

Asia-Pacific is poised for rapid growth in the agrigenomics market due to Asia-Pacific region is home to diverse climates and a wide range of crops and livestock. The agrigenomics market benefits from the need to optimize agricultural productivity, improve crop resilience, and ensure food security. With a rapidly growing population, there is an increasing demand for food. Agrigenomics technologies can contribute to developing high-yielding crops and improving livestock productivity to meet the rising food requirements in the region.

China Market Trends

China's agrigenomics market is being driven by the adoption of advanced technologies to improve crop yields and livestock traits, including disease resistance. With a large population and limited arable land, the country is heavily investing in genomic solutions to enhance productivity, resilience, and sustainability in key crops and livestock, ensuring food security and efficient agricultural output.

How is the Opportunistic Rise of Europe in the Market?

Meanwhile, Europe is growing at a notable rate in the agrigenomics market. Europe has a strong tradition of research and innovation in the fields of genomics, molecular biology, and agriculture. Ongoing research initiatives and collaborations between academic institutions, research organizations, and biotechnology companies contribute to the growth of the agrigenomics market. Europe has established regulatory frameworks that address biotechnological applications in agriculture, including genetically modified organisms (GMOs). The approval and regulation of genetically modified crops and gene-edited organisms can impact the adoption of agrigenomics technologies in the region.

What Potentiates the Market in Latin America?

Latin America's agrigenomics market is expected to grow notably during the forecast period, driven by major players like Brazil and Argentina investing in genomic technologies to enhance disease resistance, food security, and crop yields. Agrigenomics is being applied to develop crops with improved yield, nutritional value, and resistance to pests or diseases, while also enhancing livestock traits such as meat quality and milk production, supporting sustainable agricultural growth in the region.

What Opportunities Exist in the Middle East & Africa for the Market?

The Middle East & Africa (MEA) presents significant opportunities in the agrigenomics market, driven by growing food security concerns, government initiatives, and the need for climate-resilient agriculture. Adoption of advanced technologies such as CRISPR, AI-driven genomics, and precision breeding enables higher crop yields and improved livestock traits in challenging climates. Countries like Qatar are investing in genomics to achieve self-sufficiency and sustainable farming in hyper-arid conditions, creating opportunities for solutions that enhance productivity, resilience, and sustainability across the region.

Recent Developments

- In June 2023, Complete Genomics, Inc. launched updated vision/mission to reflect transformed drives for a better world. The new mission will help Complete Genomics to announce several donations for evolving cancer care and genomics education, as well as crucial partnerships with numerous biotechnology companies.

- In April 2023, Singrow, an Agri-genomics startup company announced its business expansion by opening a new indoor farm to serve as its main R&D hub in Singapore. The hub will improve novel crop varieties using Singrow's proprietary genomics technology in Singapore.

- In April 2022, PacBio collaborated with Corteva Agriscience to develop pest, custom, end-to-end workflows for plant, custom, and microbial sequencing. The collaboration will focuses on establishing high-throughput workflows in library preparation and DNA extraction in alignment with the tens of thousands of samples sequenced annually as share of Corteva's crop and seed safety production and research pipelines.

Agrigenomics Market Companies

- Thermo Fisher Scientific, Inc.

- Agilent Technologies, Inc.

- Tecan Genomics Inc.

- BGI

- Illumina, Inc.

- Eurofins Scientific SE

- LGC Limited

- Arbor Biosciences

- Biogenetic Services Inc.

- Galseq Srl Via Italia

Segments Covered in the Report

By Sequencer

- Sanger Sequencing

- Illumina Hi Seq Family

- PacBio Sequencing

- Solid Sequencers

- Other Sequencers

By Application

- Crop

- Livestock

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting