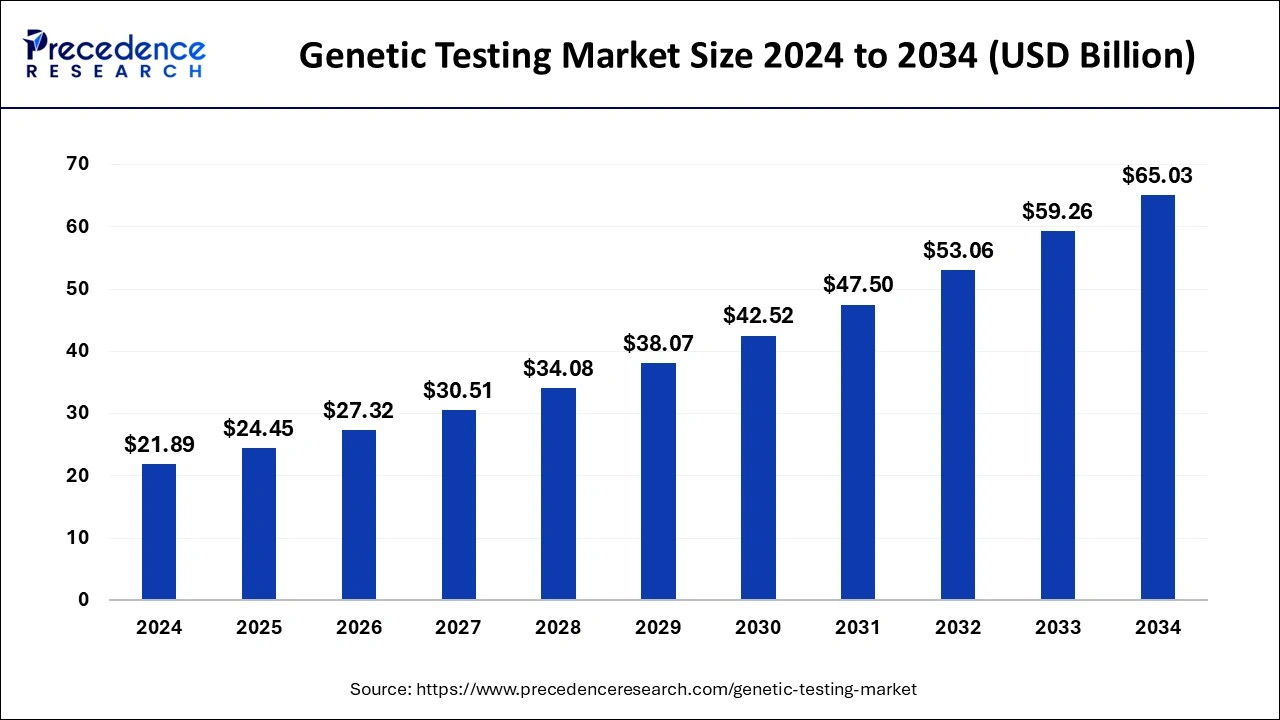

What is the Genetic Testing Market Size?

The global genetic testing market size is calculated at USD 24.45 billion in 2025 and is predicted to increase from USD 27.32 billion in 2026 to approximately USD 71.09 billion by 2035, expanding at a CAGR of 11.26% from 2026 to 2035.

Genetic Testing Market Key Takeaways

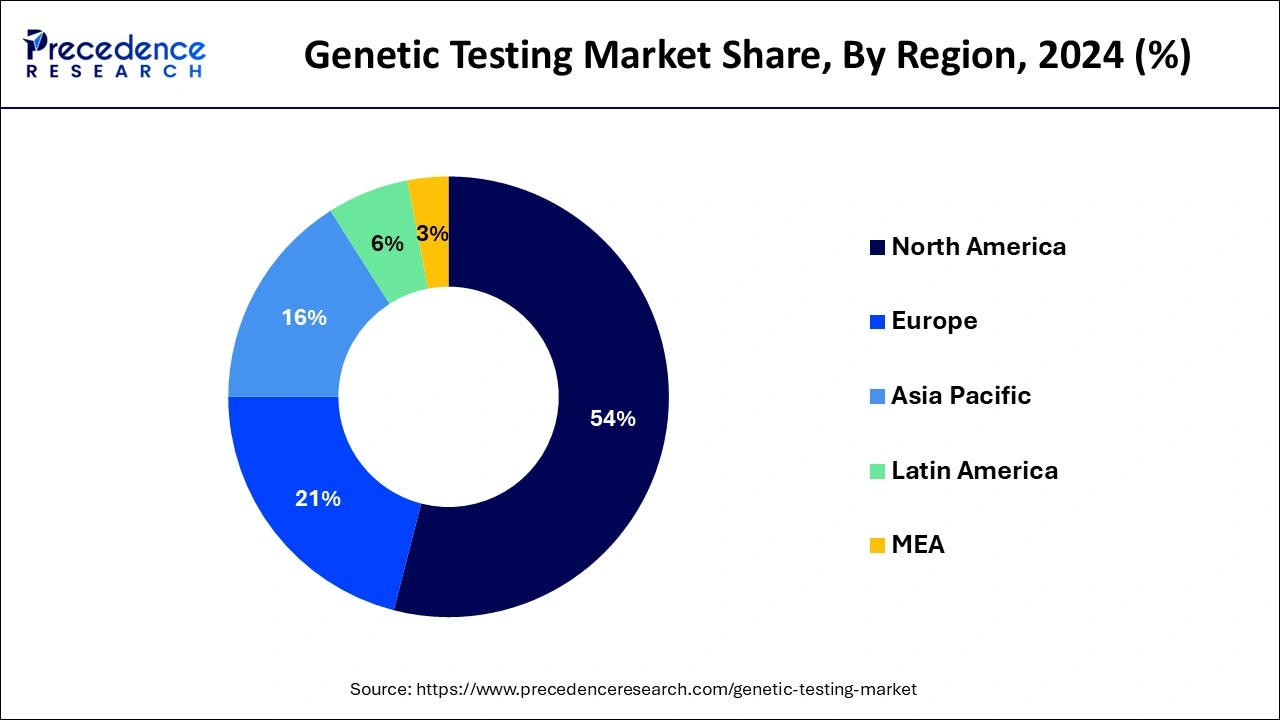

- North America has held the highest revenue share of 54% in 2025.

- Asia-Pacific is expected to expand at the fastest CAGR between 2025 and 2035.

- By Test Type, the diagnostic testing segment generated the largest market share in 2025.

- By Test Type, the prenatal & newborn testing segment is anticipated to grow at a notable CAGR during the projected period.

- By Disease Type, the cancer segment has held the maximum market share in 2025.

How has AI benefited the Market?

The speed, accuracy, and personalization of genetic testing systems are changing with the intervention of AI. It processes massive genomic datasets very fast-in a matter of seconds-manyfold faster than the traditional diagrammatic method; hence variations in genes and mutations causing diseases can be identified sooner, thus speeding up research, diagnostics, and drug discovery. Such a situation calls for treatment to be put into effect with less delay-either to prevent or restrict the progression of the disorder. The AI approach, which can recognize very subtle common patterns in genetic data, enables much-improved predictions of disease risk and treatment recommendations. By implementing personalized medicine, therapies can then be recommended that are specific to each patient based on the knowledge of the particular genes involved in their disorder, in this way minimizing the side effects of treatment options. It also helps in cost reductions with automation of complex analysis AIs that would otherwise be very expensive to have done. It can catch diseases early, allowing for preventative measures or correct treatments to be initiated. Hence, AI brings genetic testing on the platform of quick processing, greater accuracy, targeted therapies, and cost efficiencies, all along making healthcare a step ahead toward the domain of personalization.

Genetic Testing Market Growth Factors

The global genetic testing market is primarily driven by the rising prevalence of chronic and genetic diseases and the introduction of innovative testing kits owing to the technological advancements. The rising consumer awareness regarding the availability of advanced diagnostic tests is fueling the demand for the genetic testing. Moreover, growing geriatric population is expected to propel the market growth in the upcoming future. According to the United Nations, there were around 382 million old age people, aged 60 years or above, across the globe in 2017 ad this number is expected 2.1 billion by 2050. The old age people are prone to various chronic diseases, which can foster the demand for the genetic testing across the globe. The increased disposable income, rising consumer expenditure on healthcare, technological advancements, and easy availability of genetic testing services are the major factors that drive the growth of the genetic testing market across the globe.

The rising government initiatives to spread the awareness regarding the genetic testing are spurring the adoption of the genetic testing among the global population. Moreover, the presence of numerous top market players and their heavy investments in the research & development activities has encouraged innovation in the product design, improved distribution, and enhanced quality of the products. The growing popularity of the direct-to-consumer genetic testing kit has increased the adoption of the genetic testing kits among the population owing to its affordable costs, which is expected to boost the growth of the global genetic testing market. Moreover, the growing penetration of online websites like Ancestry.com and 23andme.com are popular for providing DNA testing kits to the consumers through home delivery. The ease and convenience associated with the self-testing kits is boosting the participation of people in the self-testing websites. Furthermore, the rising marketing activities adopted by the online websites has significantly played their part in spreading awareness regarding the genetic testing. For instance, Ancestry.com invested around US$ 109.0 million on TV ads in US, in 2016. These advertisements had played a crucial role in the development of the genetic testing market.

Major Trends Fuelling the Growth of the Genetic Testing Market

- The integration of artificial intelligence and big data allows for the use of AI and machine learning to improve the interpretation of genetic variants, decrease error rates, and accelerate the turnaround time for reports, particularly in oncology and profiling for rare diseases.

- The rapid growth of DTC testing through at-home testing kits enables consumers to access health, ancestry, wellness, and fitness genetic information directly without having to go through traditional clinical channels.

- In addition, there has been an increase in the adoption of DNA-based tests combined with personalized diet and lifestyle recommendations, which is leading to a growing number of consumers taking advantage of personalized wellness testing.

- Finally, due to convenience and changes in consumer behaviour that occurred during the COVID-19 pandemic, online and e-commerce channels now constitute a large share of global sales of genetic tests.

- New technologies such as liquid biopsies and multiplex platforms have enabled quicker diagnostic testing and created additional ability to guide patients into appropriate targeted therapy based on their genetic information.

Market Outlook

- Industry Growth Overview: Lower costs for genetic sequencing, options for payer reimbursement are steadily increasing for genetic testing, while information from genetics and genomics continues to transition into clinical care from the research setting.

- Sustainability Trends: Many companies within the genetic testing industry are implementing sustainable laboratory processes and utilizing digital reporting systems to reduce their physical waste. In addition, companies are using cloud-based data storage platforms to better manage their physical resources, as well as to minimize their carbon footprint by utilizing cloud services to access and share genomic and clinical data.

- Global Expansion: The majority of genetic testing growth is occurring in the Asia-Pacific and other developing economies. This growth is the result of government investments in national genomics projects, the advent of regulatory changes allowing for DTC genetic testing, and increased access to healthcare through expanding healthcare systems.

- Startup Ecosystem: Many early-stage companies are entering the genetic testing marketplace, with products focusing on genomic interpretation solutions, artificial intelligence-based diagnostic tools, and customized wellness testing systems. These companies are benefiting from a plethora of venture capital or other investments related to the healthcare technology sector.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 71.09 Billion |

| Market Size in 2025 | USD 24.45 Billion |

| Market Size in 2026 | USD 27.32 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 11.26% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Disease, Test Type, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market dynamics

The factors that drive growth of the genetic testing market include increase in incidences of genetic disorders and cancers and rise in awareness & acceptance of personalized medicines. In addition, advancements in genetic testing techniques are expected to boost the market growth during the forecast period. However, standardization concerns of genetic testing-based diagnostics and stringent regulatory requirements for product approvals hamper the market growth. Conversely, untapped emerging markets in developing countries are expected to provide remunerative opportunities for the market players.

Drivers

Increase in incidences of genetic disorders and cancer Recently, increase in incidences of cancer and genetic conditions has been witnessed globally. According to the American Cancer Society, almost 1.8 million new cancers were diagnosed in 2020, with 606,520 cancer deaths in the U.S. Cancer is the second highest death-causing disease worldwide. Many types of cancers are inherited from generation to generation due to genes. Thus, genetic testing is widely applicable to study this pattern for prevention, treatment, and drug discovery. In addition, cytogenetics aid in the study of chromosomes to provide a better knowledge of cancers such as breast cancer.

- Increase in incidences of genetic disorders and cancer.

- Rise in awareness & acceptance of personalized medicines

- Advancements in genetic testing techniques

Restraints

- Standardization concerns of genetic testing-based diagnostics

- Stringent regulatory requirements for product approvals

Complexity of Genetic Data and Interpretation

Customer problems arising from complex genetic data indeed play a major constraint on genetic testing markets with vast data and complex genomic information. The genetic data are perplexing to healthcare personnel and patients sometimes. In many cases, one kind of gene variation cannot be evaluated with respect to its clinical meaning, so that practical and pertinent guidance cannot be offered to patients. These situations are sometimes vague concerning diagnosis and treatment decisions. On the contrary, standard protocol for the interpretation of gene test results is lacking, whereas divergent laboratories and practitioners provide so-called conflicting recommendations based on the cons of each interpretation, further growing the confusion and undermining confidence. This situation left the actual use of the test within a clinical setup in limbo; hence, acceptance and the potential benefits incumbent on the test in personalized medicine are compromised.

- Untapped emerging markets in developing countries

Personalized Medicines - Rise awareness & acceptance

Personalized medicine is based on the principle that each patient is different and requires individualistic drug treatment. Large-scale drug discovery is essential to increase the feasibility and practicality of personalized medicines for detection of diseases and disorders. Genetic testing has been widely used in pharmacogenomics, also referred as drug-gene testing. It helps in accelerating drug discovery and development. Moreover, researchers are aware that customized disease treatments are seemingly possible through various genetic testing techniques such as cytogenetic testing (fluorescence in situ hybridization, microarray, and others), biochemical testing, molecular testing, and DNA sequencing. Moreover, requests of patienst to primary care

physicians for genetic testing is anticipated to rise, especially from healthy adults seeking for early detection or prevention of genetic disorders. This trend is anticipated to boost the market growth during the forecast period.

In addition, consumer awareness of personalized medicines increased to 33% in 2019 from 29% in 2018. In addition, consumer awareness has only grown by around 1% year-over-year ever since 2013.

Advancements in genetic testing techniques

Technological advancements in genetic testing include development of next-generation sequencing and chromosomal microarray analysis, which transforms the method of determination of structural and numerical abnormalities in chromosomes and, in turn, lead to detection of various rare genomic and genetic disorders. Technologies also contribute toward development of non-invasive cffDNA (cell-free fetal DNA) for identifying sub-chromosomal abnormalities, single-gene disorders, and chromosomal aneuploidy. Further, these technologies contribute toward development of carrier screens that allow simultaneous detection of various genetic disorders.

Key companies are investing in development of genetic testing. For instance, in July 2020, Myriad Genetics, Inc. launched proprietary AMPLIFY technology, which increases performance of its Prequel noninvasive prenatal screening (NIPS) test. In addition, Myriad also launched New GeneSight psychotropic patient collection kit in June 2020. This kit allows DNA sample collection, typically administered in a clinician's office, to be completed at home.

Moreover, in September 2019, Roche launched a blood-based genomic profiling test, FoundationOne Liquid. This test can detect 70 most common mutated genes in solid tumors and microsatellite instability. In addition, in May 2020, Myriad Genetics, Inc. announced that the U.S. Food and Drug Administration (FDA) has approved BRACAnalysis CDx for use as a companion diagnostic test by healthcare professionals to identify patients with metastatic pancreatic cancer, who have a germline BRCA mutation and are candidates for treatment with PARP (poly ADP ribose polymerase) inhibitor Lynparza (olaparib). These advancements in genetic testing products by major key players are projected to serve as growth factors for the cytogenetic market during the forecast period.

OPPORTUNITY

Untapped emerging markets in developing countries

Healthcare systems in developing countries such as Brazil, India, and China have experienced significant increase in investments in healthcare and infrastructure. In addition, emerging nations need to focus on costeffectiveness and scalability to cater to the needs of rising patient pool. In January 2017, the World Economic Forum in its project paper, Health Systems Advancing in Emerging Economies, stated that one-third of the global health expenditure would be focused on provision of healthcare services in emerging markets by 2023.

The need for genetic testing has increased in the scientific communities throughout the world, owing to rise in awareness of genetic disorders in developing economies. Ease and applicability of genetic testing methodologies have gradually benefitted R&D activities in Asia and other developing regions of the world.

Similarly, different genome-based projects in these regions, such as the China Genome, have stimulated the market growth.

Large population base, decrease in costs of genetic testing techniques, and rise in awareness about genetic disorders in Asia-Pacific are expected to provide numerous growth opportunities to the market players during the forecast period. For instance, in May 2020, Takara Bio USA, Inc. announced completion of a new GMP (Good Manufacturing Practice) facility for manufacturing gene and cell therapy products in Shiga, Japan.

Test Type Insights

The diagnostic testing segment dominated the global genetic testing market in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. This is simply attributed to the increased prevalence of various chronic diseases among the global population. According to a study, around 60% of the US population suffers from at least one chronic disease. Moreover, rapidly growing old age population and the increased demand for the diagnostic testing among them has fueled the segment's growth in the past few years.

On the other hand, the prenatal & newborn testing is expected to show highest growth rate during the forecast period. This is due to the increasing prenatal and newborn testing and screening in the developed regions like North America and Europe. The prenatal testing is conducted during the pregnancy to detect any birth defect in the new born babies. These are non-invasive tests. Prenatal and new born screening helps to determine abnormality or syndromes in babies, which is expected to boost the growth of this segment during the forthcoming years.

Disease Type Insights

The cancer segment dominated the global genetic testing market in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. This is simply attributed to the increased prevalence of cancer among the global population. The increased prevalence of various cancer such as breast cancer, lungs cancer, bowel cancer, and womb cancer are the major drivers of this segment.

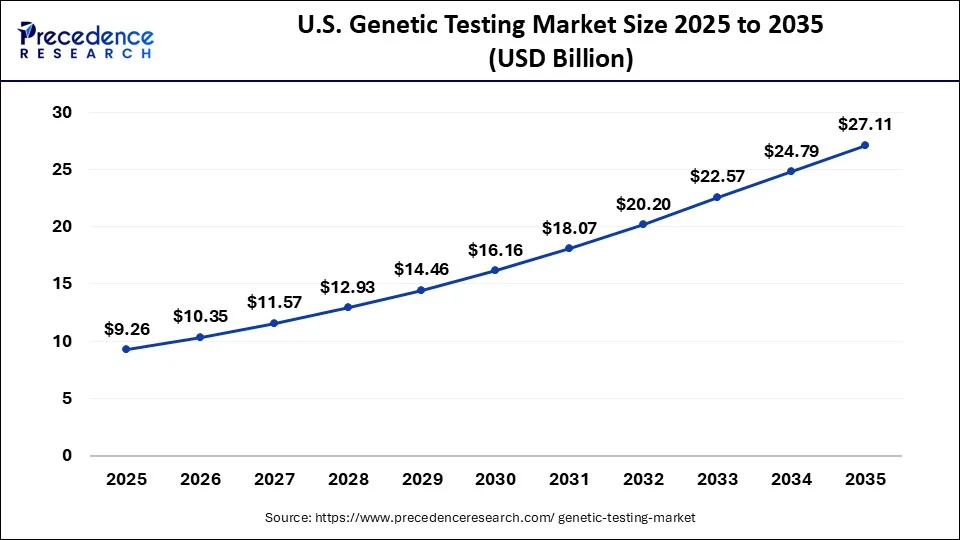

U.S. Genetic Testing Market Size and Growth 2026 to 2035

The U.S. genetic testing market was valued at USD 6.26 billion in 2025 and is expected to surpass USD 27.11 billion by 2035, poised to grow at a CAGR of 11.34% between 2026 to 2035.

North America dominated the global genetic testing market with the highest revenue share of 54% in 2024. In terms of revenue and is estimated to sustain its dominance during the forecast period. This can be attributed to the increased consumer awareness regarding the benefits of genetic testing among the population. Moreover, the easy availability of self-testing kits through online websites in the nation like US has boosted the adoption of the genetic testing kits among the population. Moreover, the increased prevalence of various chronic diseases among the majority of the population coupled with increased consumer expenditure on healthcare has exponentially boosted the market growth. The rising number of geriatric people in US is expected to drive the market in the forthcoming years. Furthermore, the rising popularity and adoption of personalized medicines among the population is expected to foster the market growth.

What Makes Asia Pacific the Most Opportunistic Market for Genetic Testing?

On the other hand, the Asia Pacific is estimated to be the most opportunistic market during the forecast period. Asia Pacific is characterized by the presence of huge population, rising prevalence of chronic diseases, and growing awareness regarding the genetic testing. The increasing disposable income and rising healthcare expenditure is further expected to drive the growth of the market.

China is the major contributor to the Asia Pacific genetic testing market due to its large population base, strong government support for genomics and precision medicine initiatives, and rapidly expanding healthcare infrastructure. Significant investments in biotechnology, widespread adoption of advanced sequencing technologies, and the presence of leading domestic genetic testing companies further strengthen China's dominant position in the regional market.

What Makes Europe a Notably Growing Region in the Genetic Testing Market?

Europe is expected to grow at a notable rate in the market. This is due to the rising prevalence of genetic disorders, the increasing adoption of genetic testing for disease diagnosis, and rapid advancements in genetic testing technologies. Technological advancements, including next-generation sequencing (NGS) and polymerase chain reaction (PCR), are gaining traction in the region. These advancements have improved the accuracy, speed, and cost-effectiveness of genetic testing, thereby propelling the market forward. The region also boasts several key players who offer a wide range of genetic testing products and services. Additionally, the region also benefits from supportive government initiatives that help promote genetic testing and personalized medicine.

What Potentiates the Genetic Testing Market in Latin America?

The market in Latin America is driven by technological innovations, the increasing awareness of personalized medicine, and the growing use of genetic data in medical and research applications. The region has been growing steadily as advancements in genomics, next-generation sequencing (NGS), and bioinformatics help make genetic tests more accurate, accessible, and affordable. Moreover, factors such as rising demand for preventive healthcare and increasing awareness of the role of genetics in disease prevention further drive the market.

What Opportunities Exist in the Middle East & Africa?

The Middle East & Africa (MEA) offers significant opportunities in the genetic testing market due to increasing healthcare investments, the rising awareness of genetic disorders, and advancements in medical technology. The rapid expansion of healthcare infrastructure, along with a growing focus on personalized medicine and preventive care, also opens new avenues for growth. Government initiatives and rising demand for genetic testing services also contribute to the region's market growth.

Value Chain Analysis

- Sample Collection

This stage involves obtaining a small sample of cells from an individual's body in order to analyze their genes and genome. - DNA Extraction

In this stage, cells are treated with a lysis buffer to help break down the cell membrane and release the DNA. - Data Analysis

In this stage, the DNA samples undergo comprehensive data analysis to understand an individual's genetic makeup.

Genetic Testing Market Companies

- Genentech Inc.

- Sorenson Genomics, LLC

- Abbott Molecular

- Bayer Diagnostics

- Biocartis

- BioHelix

- Celera Genomics

- Genomic Health

- HTG Molecular Diagnostics

- PacBio

Recent Developments

- In May 2025, Centogene announced the launch of its new Reproductive Genetics Portfolio, including both Preimplantation Genetic Testing for Aneuploidy (PGT-A) and comprehensive carrier screening services. The PGT-A test, strengthened by CENTOGENE's database of over one million sequences, provides high sensitivity, diagnostic accuracy, and an optional rapid turnaround of up to 24 hours for IVF embryos.

(Source:centogene.com ) - In May 2025, Hydreight Technologies, a leading digital health platform, launched a new direct-to-consumer genetic testing and personalized wellness solution via its VSDHOne platform.

(Source:globenewswire.com) - In January 2025, the PGIMER, in partnership with the Punjab government, launched the DBT-UMMID initiative to improve genetic disorder healthcare services in Moga.

(Source:hindustantimes.com)

Key Companies & Market Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

In August 2020, Guardant Health acquired the approval from FDA for its Guardant 360 CDx.

The various developmental strategies like acquisition, partnerships, mergers, and government policies fosters market growth and offers lucrative growth opportunities to the market players.

Segments Covered in the Report

By Test Type

- Carrier Testing

- Predictive Testing

- Diagnostic Testing

- Prenatal & Newborn Testing

- Nutrigenomics

- Pharmacogenomics

- Others

By Disease

- Cancer

- Alzheimer's

- Thalassemia

- Cystic Fibrosis

- Huntington's Disease

- Duchenne Muscular Dystrophy

- Other Diseases

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting