List of Contents

Direct-to-Consumer Genetic Testing Market Size and Forecast 2025 to 2034

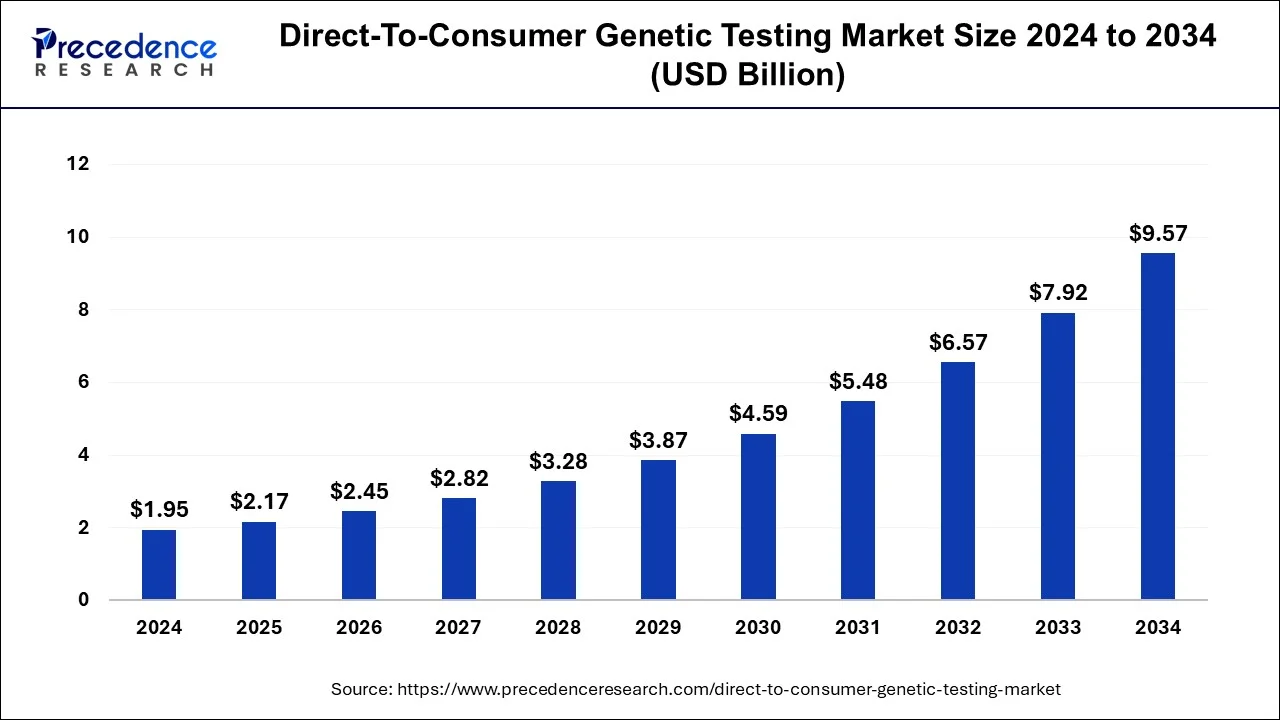

The global direct-to-consumer genetic testing market size was estimated at USD 1.95 billion in 2024 and it is projected to surpass around USD 9.57 billion by 2034, poised to grow at a CAGR of 17.90% over the forecast period 2025 to 2034. The direct-to-consumer market growth is attributed to the rising interest in pharmacogenetics and growing consumer awareness about the importance of genetics.

Direct-to-Consumer Genetic Testing Market Key Takeaways

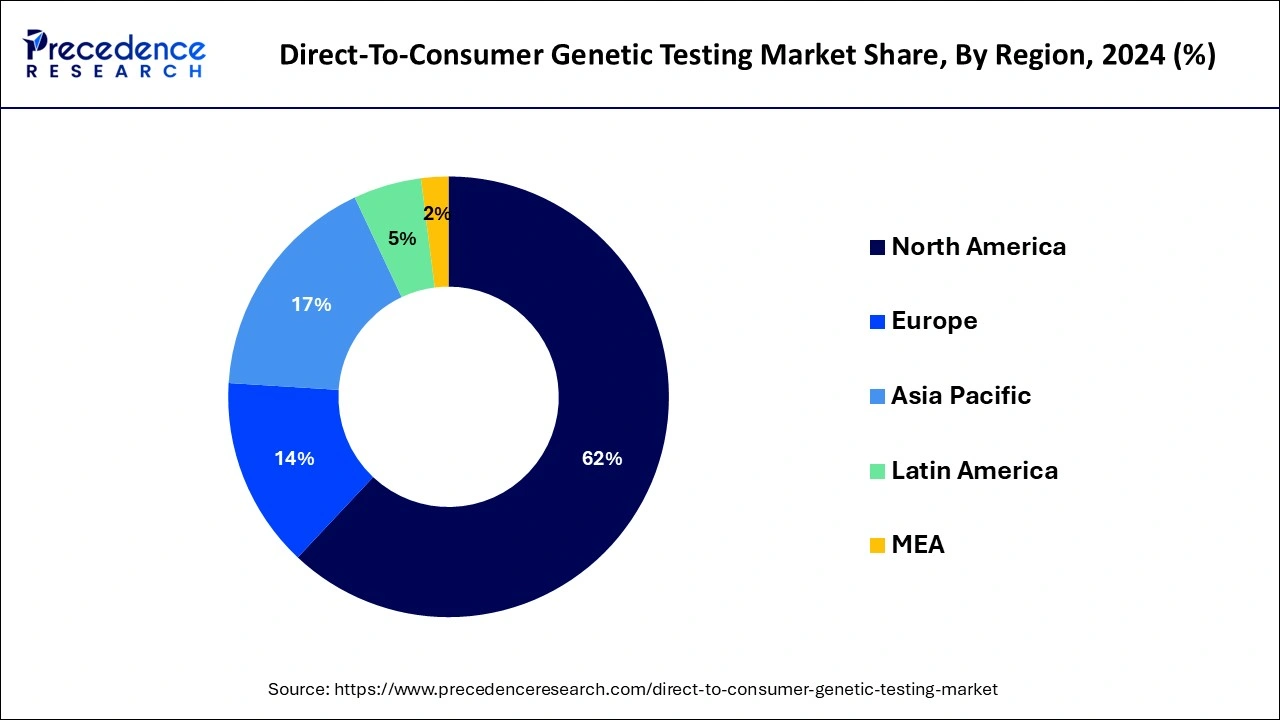

- North America led the global market with the highest market share of 62% in 2024.

- Europe has generated a revenue share of 17.54% in 2024.

- By Test Type, predictive testing has held a 19.5% revenue share in 2024.

- By Technology, the whole genome sequencing segment dominated the market and captured more than 40% of the revenue share in 2024.

How does AI impact the Direct-to-Consumer Genetic Testing Market?

The direct-to-consumer genetic testing market is witnessing transformative growth due to AI integration. Adopting AI techniques such as deep learning and machine learning provides new computational approaches to streamline major analytical issues in direct-to-consumer genetic testing. They process and analyze vast amounts of genetic data, leading to precise interpretation of genetic information. AI helps to improve understanding of genomic variation concerning disease and health and enhance discovery in genetic testing. AI can identify complex patterns within large datasets of phenotype and genetic information, leading to discoveries about the genetic basis of traits and diseases. AI can generate personalized testing that is tailored to genetic interests and profiles.

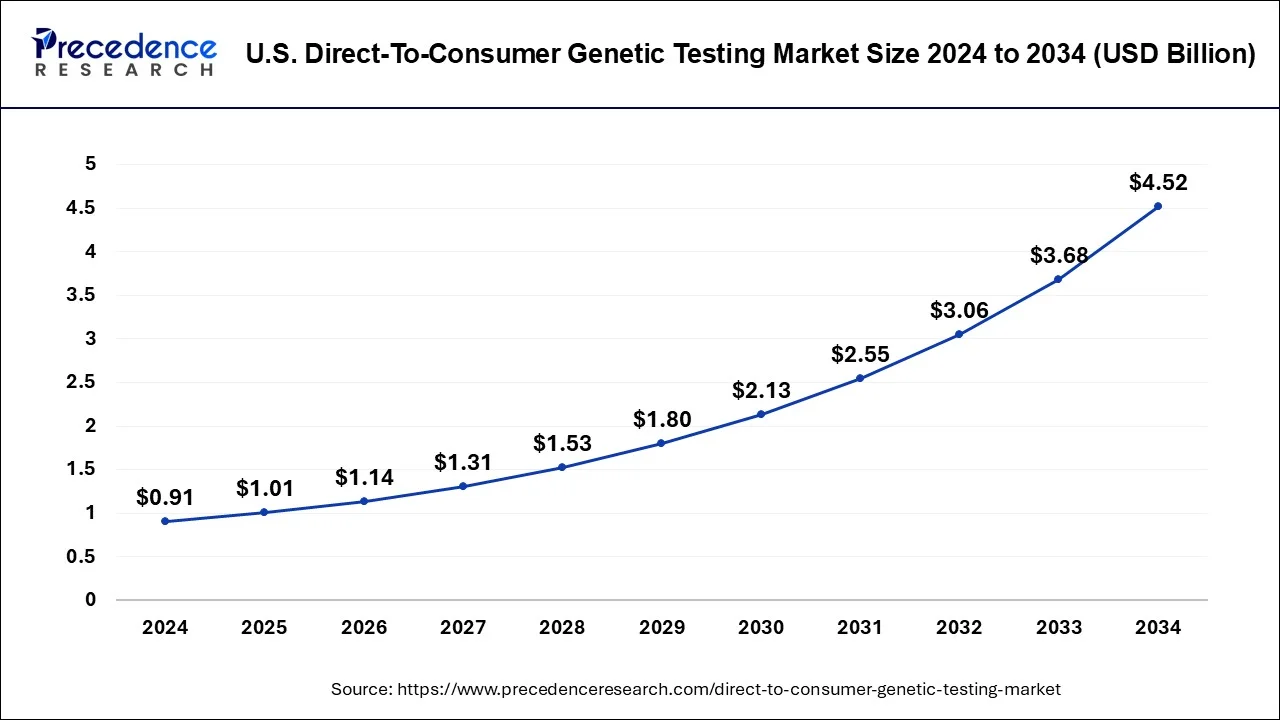

U.S. Direct-to-Consumer Genetic Testing Market Size and Growth 2025 to 2034

The U.S. direct-to-consumer genetic testing market size reached USD 0.91 billion in 2024 and is expected to be worth around USD 4.52 billion by 2034, poised to grow at a CAGR of 18.12% from 2025 to 2034.

North American market dominated the global DTC genetic testing market with a 62% market share in 2024.Consumer attitudes toward genetic testing dominate the North American region. An increase in expenditure promotes the growth of the need to direct-to-consumer (DTC) genetic testing throughout the forecast period. According to studies, around 8% of the U.S. population, or 26 million people

In addition, rising demand for personalized genetic testing services in the region and an increase in the prevalence of chronic and genetic disorders boost the market growth. According to Globocon 2020, 2,281,658 new cancer cases will be diagnosed in the United States in 2020, with 612,390 deaths. Breast cancer had the highest incidence of all cancers, with 253,465 points, followed by lung (227,875), prostate (209,512), and colon cancer (101,809).

The increasing number of product approvals and subsequent launches by the U.S. Food and Drug Administration (FDA) and the high concentration of key players involved in research activities to innovate novel genetic testing products are expected to drive market growth in North America. For example, F. Hoffmann-La Roche Ltd launched the AVENIO Tumor Tissue CGP Kit in October 2021, a comprehensive genomic profiling kit designed to make tailored cancer research more accessible. This kit allows for the comprehensive genomic profiling of solid tumors derived from formalin-fixed paraffin-embedded (FFPE) tissue samples. Furthermore, one of the primary reasons for developing the carrier testing segment in Latin America is acquisition and expansion.

Europe is expected to witness the fastest growth during the forecast period. This is mainly due to the increasing acceptance of personalized treatments and the increasing prevalence of genetic disorders. There is a high adoption rate of advanced genetic testing technologies in the region. In addition, regional players are focusing on developing novel technologies to address the increasing demand for early diagnosis. Furthermore, supportive government and reimbursement policies for gene-based therapies contribute to regional market growth.

Direct-to-Consumer Genetic Testing Market Growth Factors

- The global direct-to-consumer genetic testing market is expanding at a rapid pace due to the rising awareness among consumers about the benefits of gene-based therapies.

- The growing interest in pharmacogenetics is expected to boost market growth.

- Rising advancements in gene sequencing technologies contribute to market expansion.

- Increasing approvals for gene therapy further fuels the growth of the market. For instance, in December 2023, the U.S. FDA approved two cell-based gene therapies, Casgevy and Lyfgenia, for treating sickle cell disease (SCD) in patients aged 12 years and above.

- The rising demand for personalized therapies also propels market growth.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 17.90% |

| Market Size in 2025 | USD 2.17 Billion |

| Market Size by 2034 | USD 9.57 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Test Type, By Technology Type, and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Increase trend toward direct-to-consumer genetic testing boosting the market growth

The public understanding and acceptance of genetic testing are steadily increasing. A national survey found that awareness has increased dramatically in the United States, and a social media survey found that 47% of users are familiar with the direct-to-consumer concept. Across many sectors, there is an apparent rise in customers seeking customized products & experiences, with a rising willingness to pay for the identification & addressing of unique needs.

Customers are trying to express willingness to undergo testing & pay for genetic testing services. According to a recent survey conducted in the United States with a sample size of 2,000 people, 33% said they would be willing to pay for and use the advice provided by a direct-to-consumer genetic testing company.

Restrains

Privacy corns restrain the market growth

More than 65% of individuals are willing to use home direct-to-consumer genetic testing services. Privacy is one of the main concerns, especially the potential sharing of data with third parties, including pharmaceutical and insurance companies and consumer health. Almost all the respondents willing to use the service have concerns about a company owning their DNA profiles.

In submitting a sample for processing, individuals provide sensitive information about themselves and family members with whom they share a genetic link. Leakage of such data could negatively impact these individuals across various areas, including employment prospects, relationships, and insurance premiums. Cyber security breaches, database password & service hacking, Human error, or oversight by data custodians pose a risk.

Opportunities

Rising pharmacogenetic research Provide lucrative opportunities

The growing interest in pharmacogenetics is expected to expand the DTC genetic testing industry. Since genetic variations determined in Pharmacogenetics are expected to boost the DTC genetic testing industry. Since genetic variations determine which medical treatment is most likely to succeed, Pharmacogenetics is a dogmatic example of gene based personalization. In addition, the Interpretation and regulation of personalized tests depend on the knowledgeable user. Rising demand in business can be attributed to service providers' detailed description of test analytical and clinical validity.

Moreover, this individualized testing costs much lower than traditional genetic analysis. Furthermore, Direct to consumer genetic testing results are obtained rapidly with easy and noninvasive technologies. These variables will increase the market share worldwide.

Test Type Insights

Based on test type, carrier testing dominated the market in 2024. The proliferation of genetic illnesses caused by chromosomal and gene mutations has rapidly expanded the carrier testing domain. Most cases of genetic mutation result from preexisting conditions, a miscarriage of family history, or congenital disabilities. As a result, it is common practice for pregnant women to undergo carrier screening to ascertain the potential danger of passing on a specific genetic illness to their offspring. All these factors stimulate growth, which drives the expansion of the worldwide direct-to-consumer genetic testing market. In addition, growing recognition of the value of early detection and diagnosis of gene illness allows market participants to implement strategies in different regions.

On the other hand, the ancestry & relationship segment accounted for a more share in 2024. Genetic ancestry testing allows persons concerned with a family background to learn more about ancestors than they might from family or historical documents. Individuals of similar origins frequently share DNA testing variants. Many corporations and organizations provide genetic ancestry testing. Most organizations offer an online forum and other services that enable test takers to exchange or discuss results with others facilitating the discovery of previously undisclosed relationships. On a broader scale, Scientists can utilize the combined genetic ancestry test results of many individuals to examine the history of communities as they migrated, emerged, and interbred.

Technology Insights

Based on technology, whole genome sequencing dominated the director-to-consumer genetic testing market with a 40% market share. Whole genome sequencing is one of the best procedures for taking knowledge about special malignancies. It allows users to capture the complete range of variation through single base alterations to extensive chromosomal rearrangements. Demand for malignant tumor detection has increased with the market's growth.

Whole-genome sequencing (WGS) provides unprecedented insight into pathogenesis and cancer biology with implications for diagnostics, prognosis, and therapy selection. WGS can detect both sequence and structural variants, combining the central domains of cytogenetics and molecular genetics.

Direct-to-Consumer Genetic Testing Market Companies

- Ancestry

- Color Health, Inc.

- Easy DNA

- FamilyTreeDNA

- Full Genome Corporation

- Helix OpCo LLC

- Identigene

- Karmagenes

- Living DNA

- Mapmygenome

- MyHeritage

- Pathway genomics

- Genesis Healthcare

- 23andMe

Recent Developments

- In November 2024, a next generation biotech, genomics, and diagnostics company, ProPhase Labs announced the launch of a wholly owned subsidiary, DNA Complete, Inc., offering a groundbreaking direct-to-consumer DNA test that sequences virtually 100% of a customer's genome.

- In July 2023, Quest Diagnostics announced the launch of its first consumer-initiated genetic test. With advanced technology and end-to-end support that includes personalized health reports and access to genetic counseling, the new offering helps people understand their potential risk of developing certain inheritable health conditions.

Segments Covered in the Report:

By Test Type

- Nutrigenomics Testing

- Predictive Testing

- Carrier Testing

- Skincare testing

- Ancestry & Relationship testing

By Technology Type

- Target Analysis

- Single Nucleotide Polymorphism (SNP) chips

- Whole Genome Sequencing (WGS)

By Distribution Channel

- Online Platforms

- Over The Counter

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client