What is the AI Governance Market Size?

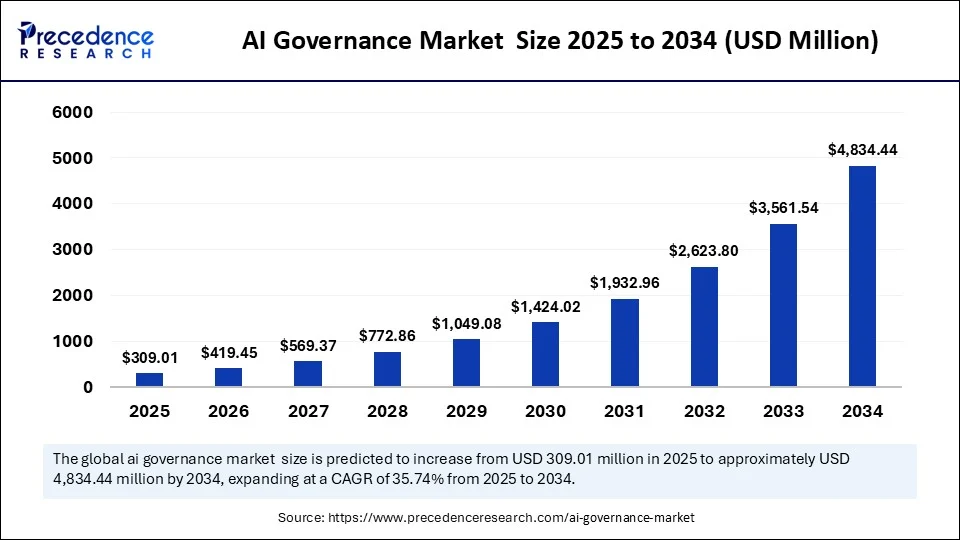

The global AI governance market size is valued at USD 309.01 million in 2025 and is predicted to increase from USD 419.45 million in 2026 to approximately USD 4,834.44 million by 2034, expanding at a CAGR of 35.74% from 2025 to 2034. The market growth is attributed to the rising adoption of AI across various industries and the need for transparent, accountable decision-making frameworks.

AI Governance MarketKey Takeaways

- In terms of revenue, the global AI governance market was valued at USD 227.65 million in 2024.

- It is projected to reach USD 4,834.44 million by 2034.

- The market is expected to grow at a CAGR of 35.74% from 2025 to 2034.

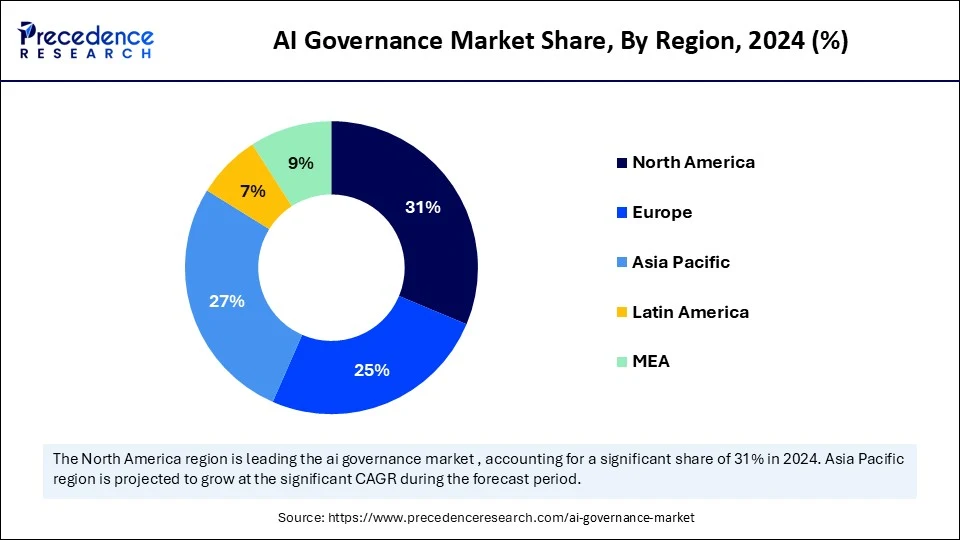

- North America dominated the AI governance market with the largest share of 31% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2034.

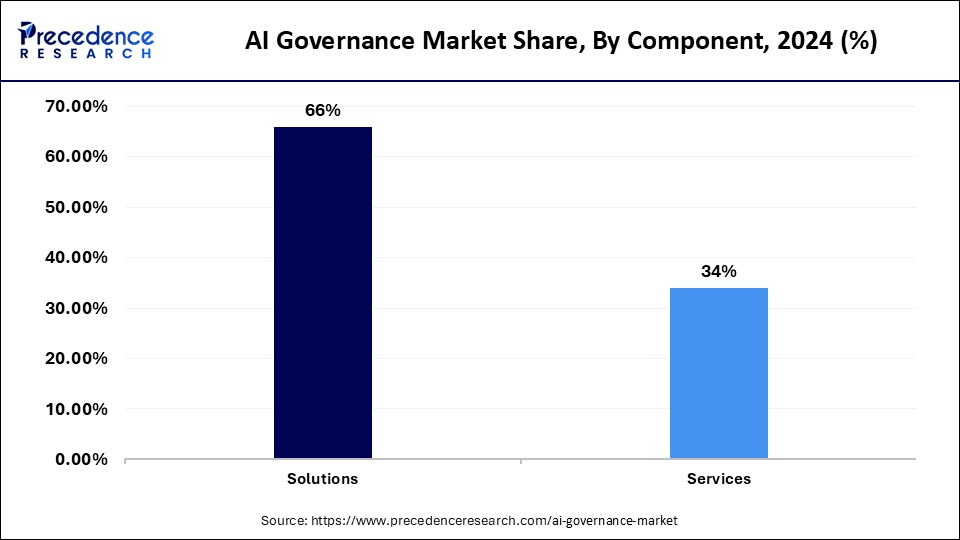

- By component, the software segment held the major market share of 66% in 2024.

- By component, the service segment is projected to grow at a significant CAGR between 2025 and 2034.

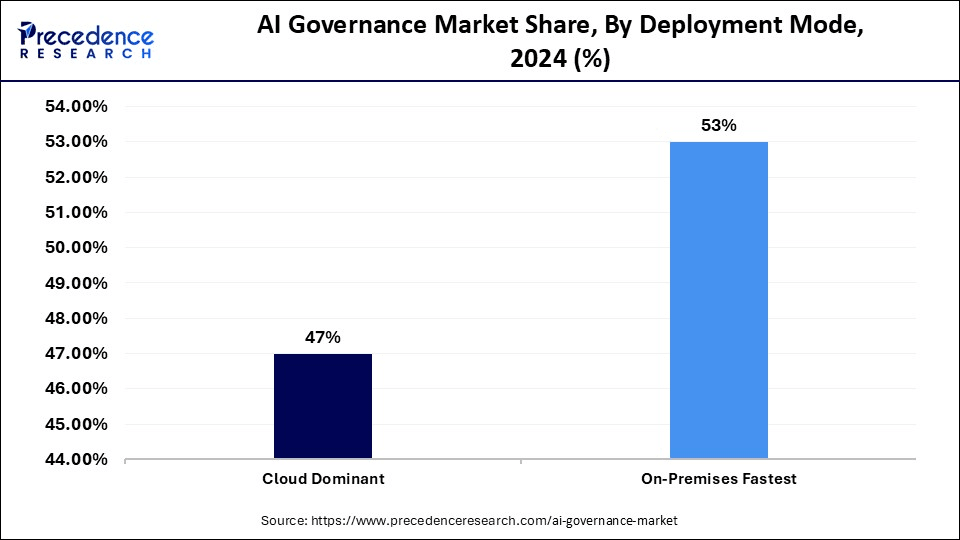

- By deployment mode, the on-premises segment contributed the biggest market share of 53% in 2024.

- By deployment mode, the cloud segment is expanding at a significant CAGR between 2025 and 2034.

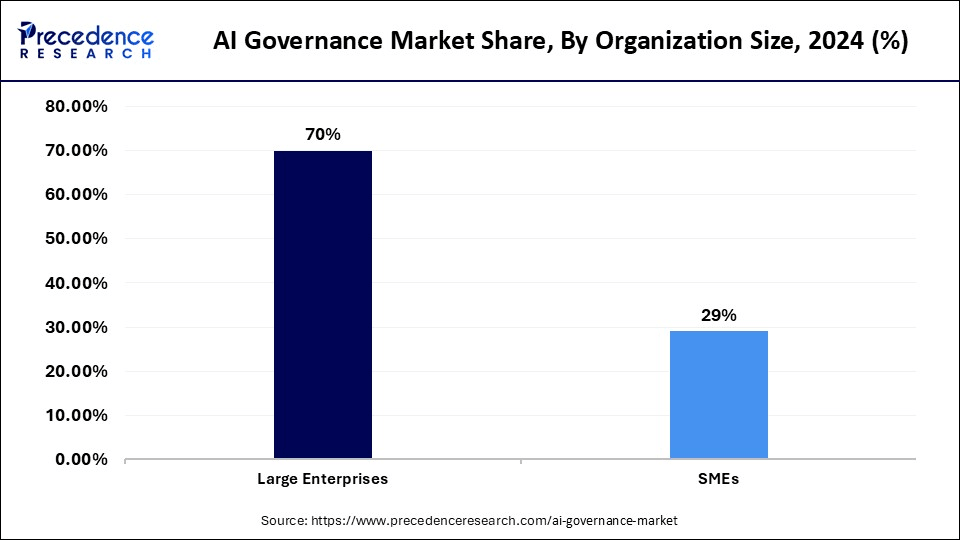

- By organization size, the large enterprises segment generated the major market share of 70% in 2024.

- By organization size, the SMEs segment is expected to grow at a significant CAGR over the projected period.

- By end-use industry, the BFSI segment accounted for the significant share in 2024.

- By end-use industry, the government and public segment is expected to grow at a notable CAGR from 2025 to 2034.

Market Overview

The rapid expansion of AI regulation by the public sector is also increasing the spread of AI governance. Governments in North America, Europe, and the Asia-Pacific region are establishing formal systems to manage the evolving changes in transformative AI. AI governance encompasses tools and processes that oversee AI development and deployment, ensuring ethical, accountable, and transparent practices. This includes model documentation, bias detection, audit trails, human oversight, and ongoing risk monitoring.

The World Economic Forum AI Governance Alliance, with over 350 organizations as of January 2024, is likely to spread best practices, promoting common governance structures. These trends suggest that businesses in other sectors will likely increase their investment in governance mechanisms, addressing the ethical and operational challenges of AI. Moreover, rising stakeholder demand for reliable AI is expected to enhance governance ecosystems, further driving market growth.(Source: https://www.weforum.org)

AI Governance MarketGrowth Factors

- Rising Integration of AI in Military and Defense Operations: Expanding deployment of autonomous systems and AI-assisted decision tools is fuelling demand for strict oversight and accountability frameworks.

- Boosting AI Adoption in Legal and Judicial Systems: Courts and legal agencies implementing AI for document review and case analysis are driving the need for transparent, auditable AI governance mechanisms.

- Growing Emphasis on Ethical AI Certification Programs: International demand for certified trustworthy AI systems is propelling adoption of governance protocols across high-risk sectors.

- Driving Data Localization Mandates Globally: National regulations requiring local data storage are boosting the need for governance tools that ensure AI compliance across jurisdictions.

- Accelerating AI Use in Educational Technology Platforms: EdTech firms leveraging AI for personalized learning are fuelling investments in bias mitigation and student data protection governance models.

- Propelling AI Vendor Risk Management Protocols: Enterprises increasingly relying on third-party AI providers are strengthening governance to assess transparency, fairness, and operational control.

- Expanding Influence of Human Rights Advocacy in AI Policy: Rising pressure from global rights groups and NGOs is driving institutional focus on AI governance to prevent discrimination, surveillance, and exclusion.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 4,834.44 Million |

| Market Size in 2025 | USD 309.01 Million |

| Market Size in 2026 | USD 419.45 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 35.74% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Deployment Mode,Organization Size, End-Use Industry and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Does Widespread AI Adoption in Critical Sectors Boosting the Demand for Governance Solutions?

Increased AI adoption in high-stakes sectors is expected to boost the growth of the market. This growing adoption in a range of sectors is likely increases the need for robust governance. Industries like medical, financial, legal services, and critical infrastructure are integrating AI into decision-making systems that impact human lives and economic stability. The FDA's approval of 570 AI-enabled medical devices in 2024 indicates rapid adoption of AI in healthcare diagnostics and therapies.

Enterprise AI use in financial services was highest at 70% in 2024, with companies using AI for fraud detection, credit risk scoring, and algorithmic trading. The research industry has documented widespread use of internal Algorithm Review Boards in finance and health, ensuring model behavior aligns with ethical requirements and risk levels. In June 2024, the OECD emphasized that health data governance should prioritize privacy, transparency, and human control to prevent bias in AI's clinical deployment. Additionally, institutions rely on GPAI, OECD, and IEEE frameworks to make their governance programs more innovative, balanced with safety and human-centric implications, thus fueling market growth in the coming years.

(Source: https://www.medtechdive.com)

(Source: https://www.statista.com)

(Source: https://www.oecd.org)

Restraint

Lack of Standardization in AI Governance Frameworks

Regional standardization is expected to limit the expansion of the AI governance market, hindering its growth. Differing state regulatory and national government definitions of regulations and ethical standards create friction. This disharmony challenges multinational enterprises trying to apply unified governance protocols across borders. Organizations must spend heavily on regional compliance adaptation, delaying deployment and manual operations. Furthermore, the lack of consensus on technical standards reduces scalability and slows the development of interoperable AI governance infrastructure.

Opportunity

How Is Rising Public and Stakeholder Demand for Trustworthy AI Creating New Opportunities in the AI Governance Market?

Surging public and stakeholder demand for trustworthy AI is likely to reinforce governance frameworks, creating immense market opportunities. Business forecasts predict that increasing investments in AI technologies in emerging economies will boost governance adoption. Asia-Pacific, Latin America, and Africa are rapidly developing, popularizing, and commercializing AI. By 2024, over 65 nations had published national AI plans, and several developing economies were implementing infrastructure, policy, and capacity-building initiatives. In January 2025, the World Economic Forum released its “Blueprint of Intelligent Economies,” planning regional AI activation to deploy context-aware governance networks, starting with Regional AI Activation Networks in Southeast Asia, Africa, and the Middle East. Furthermore, the increasing integration of generative AI into enterprise workflows is expected to elevate governance needs, further driving market growth in the coming years.

(Source:https://www.iesalc.unesco.org)

(Source: https://www.weforum.org)

Segment Insights

Component Insights

The solutions segment dominated the AI governance market with the largest share of 66% in 2024. This is due to the rapid adoption of specialized tools that govern explainability, bias detection, risk modeling, and compliance audits. In 2024, regulators, including the EU and OECD, focused on integrating automated governance modules into machine learning pipelines. Organizations deployed model interpretability, audit trails, and policy-based access controls to meet the requirements of both internal compliance teams and external auditors. The Stanford 2025 AI Index indicated that 78% of surveyed organizations used AI in 2024, compared to 55% in 2023, driving the uptake of solution platforms across industries. Moreover, major platforms offered more deployment options, whether in the cloud or on-premise, supporting various enterprise architectures and simplifying large-scale deployment.

(Source: https://hai.stanford.edu)

The services segment is expected to grow at the fastest rate in the coming years, owing to the increasing regulatory complexity and the need for customized AI governance approaches. Organizations were relying more on outside assistance to shape AI policy, plan governance infrastructure, and audit deployment. Stanford HAI prioritized scientific and practical methodologies for governing technologies. This has been increasing rapidly, so roadmaps to governance need specialists. Moreover, the collaboration between GPAI and OECD in July 2024 formalized the standards of global governance further, thus leading to a demand for third-party implementation and compliance support.

(Source: https://www.oecd.org)

Deployment Mode Insights

The on-premises segment dominated the market with the largest share of 53% in 2024, owing to benefits such as cost control, data sovereignty, and control of critical AI operations. According to a 2024 TechTarget survey, 45% of CIOs in the U.S. intend to use on-prem AI or hybrid approaches for future applications. The increasing cost of cloud infrastructure and the necessity to own hardware encouraged enterprises to deploy privately, usually through the support of vendors such as HPE and Dell. Furthermore, stringent regulations in some industries, including finance and healthcare, to have complete control of sensitive information further facilitate segment growth.

The cloud segment is expected to the grow at the fastest CAGR during the forecast period., as it is highly scalable, cost-efficient, and fast to attain high levels of AI governance. European and Middle Eastern IT decision-makers revealed that a major portion of their investment in cloud computing goes toward facilitating AI adoption, indicating a heavy reliance on cloud-based governance solutions. The transfer of AI workloads to public clouds grew in U.S. firms due to the low cost and the ready availability of dedicated AI infrastructure providers like AWS, Microsoft Azure, and Google Cloud. Additionally, firms like AWS and Google also significantly contributed to putting cloud deployment status as the key antecedent of AI governance deployment in enterprises

(Source:https://www.techtarget.com)

Organization Size Insights

The large enterprises segment captured the biggest market share of 70% in 2024 due to the complicated regulatory and technical requirements that prompted the deployment of strong governance systems. Finance, healthcare, and tech corporations spent significantly on governance platforms to regulate global compliance regulations, including the EU AI Act and OECD policy changes. These regulations integrate explainability layers, audit pipeline tools, and risk dashboards into AI systems. Moreover, businesses incorporated in-built AI ethics units and vendor-neutral control components into hybrid frameworks, which intensified the hierarchical domination of markets through amassing internal capabilities and regulatory expertise.

The SMEs segment is projected to grow at the fastest rate in the coming years, owing to enhanced access to scalable governance services and digital infrastructure. According to a survey conducted by the OECD, by early 2025, the number of SMEs using AI applications has increased to 39% compared to 26% in 2024. There was a rise in digital capability in SMEs, which had lower-mass governance plug-in and template compliance mechanisms for regulation compliance. Additionally, these concurrent changes underline the rising preparedness and resource positioning of SMEs to adopt AI applications led by governance, thus further boosting the market.

(Source: https://www.oecd.org)

End-user Industry Insights

The BFSI segment held the largest revenue share of the AI governance market in 2024, as this industry is exposed to risks such as algorithm bias, systemic risk, and increasing regulatory compliance demands. Regulators in the European Union, North America, and East Asia have allowed or mandated new compliance regimes for AI-driven mechanisms in credit scoring, fraud detection, insurance pricing, and algorithmic trading. Financial services are one of the categories of the EU AI Act, which is expected to be enforced in August 2024, where providers must demonstrate the transparency, robustness, and human oversight of the AI lifecycle.

Canada expanded its Directive on Automated Decision-Making (DADM) and directly included lending platforms and robo-advisors in its governance demands, legally obliging banks and fintech companies. Furthermore, the growing use of AI in BFSI further necessitates the implementation of AI governing technology.

(Source: https://commission.europa.eu)

The government segment is expected to grow rapidly during the projection period, owing to national and transnational policy changes, sovereign AI implementations, and the growing demand for transparent delivery of public services. Other examples of AI applications in the sector include predictive systems aimed at social welfare eligibility determination and an automatic document verification system in the immigration process. An October 2024 OECD-UNESCO G7 AI Toolkit provided governments with organized implementation models of AI transparency, explainability, and control to quicken the progression of endowed governance vaults. Furthermore, such actions compelled governmental forces to prioritize the governance infrastructure that traces model behavior and ensures that AI failures are addressed with complete accountability.

(Source: https://www.oecd.org)

Regional Insights

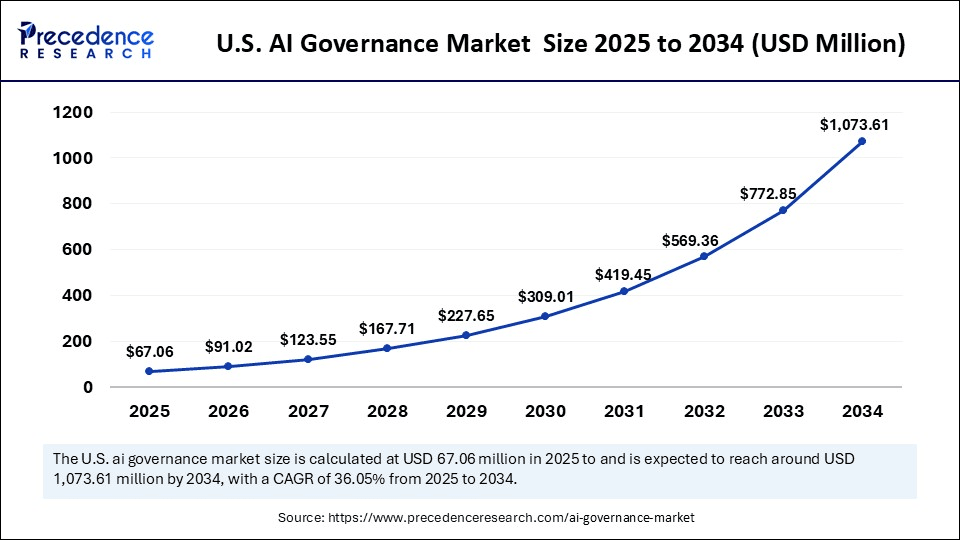

U.S. AI Governance Market Size and Growth 2025 to 2034

The U.S. AI governance market size is exhibited at USD 67.06 million in 2025 and is projected to be worth around USD 1,073.61 million by 2034, growing at a CAGR of 36.05% from 2025 to 2034.

North America dominated the AI governance market, capturing the largest revenue share of 31% in 2024, due to early law-making, a well-established digital infrastructure, and cross-sector cooperation. The Artificial Intelligence Research, Innovation, and Accountability Act of 2024 in the U.S. imposed important requirements on companies operating AI, such as required impact statements and bias review on high-risk AI applications. Such legal guidelines made the adoption of governance platforms popular even in non-IT specific industries, including bio-financial services, health, and defense. In line with Stanford University's 2025 AI Index, U.S. federal agencies implemented 59 regulations concerning AI in 2024, compared to just 29 in 2023.

United States AI Governance Market Trends:

In the United States, the market for AI governance is propelled by a blend of corporate actions and new regulatory measures focused on tackling ethical issues related to AI. Major technology firms in the U.S. are investing significantly in governance tools, focusing on transparency, reducing bias, and responsible AI deployment to mitigate reputational and legal risks. Additionally, there is increasing demand from consumers and advocacy organizations for tougher AI regulations, especially concerning privacy and discrimination.

In 2024, the Global Partnership on AI (GPAI), co-chaired by the U.S. and Canada, initiated a multi-stakeholder collaboration to align approaches to managing AI risks globally. This further reflects North American influence in constructing AI governance and policy frameworks. The IEEE Standards Association produced new versions of its ethical AI frameworks (IEEE 7000 series), which are piped directly into commercial governance software employed by North American companies. Moreover, this well-coordinated interaction of academia, public organizations, and the private sector is expected to fuel the market in this region.

(Source:https://www.hpcwire.com)

(Source: https://oecd.ai)

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, owing to innovation sandboxes and pilot zones, regional AI systems, and national strategies on the ethical use of AI. The OECD Asia Capital Markets Report 2025 pointed out that various economies such as Singapore, Korea, Hong Kong, India, and Malaysia increased their regulatory sandboxes and capacity-building initiatives in 2024 to ready themselves to roll out AIs at large scale.

India AI Governance Market Trends:

The AI governance sector in India is a fast-growing part of the nation's comprehensive AI market, fueled by major government efforts and investments from the private sector. In 2023, the Indian Government recognized the swiftly changing AI environment in the nation and pledged to a proportional, forward-looking, and flexible governance system to address its evolving requirements. India's strategy for AI governance is unique, prioritizing flexible, industry-specific regulations instead of a universal AI law to prevent stifling innovation. The newly issued India AI Governance Guidelines (November 2025) establish a framework based on seven principles.

Hong Kong's Monetary Authority launched the GenAI Sandbox in late 2024, focusing on real-time compliance and fraud detection in banking, with a focus on fairness audits and explainability. In 2024, India updated its National Strategy on Responsible AI, emphasizing ethical testing, human oversight, and AI literacy. This ecosystem of regulatory innovation and collaboration makes Asia-Pacific a key market for AI governance solutions.

(Source: https://www.oecd.org)

(Source: https://www.globalgovernmentfintech.com)

Germany AI Governance Market Trends:

Germany is becoming a frontrunner in the AI governance sector, fueled by its dedication to ethical and responsible AI implementation. In accordance with the EU's Artificial Intelligence Act, the nation highlights transparency, data privacy, and responsibility in AI systems. These frameworks hold significant importance for Germany's industrial foundation, with industries such as manufacturing and automotive incorporating AI governance into Industry 4.0 efforts to guarantee adherence and ethical application. This method not only reduces risks but also boosts operational efficiency and confidence in AI-driven solutions.

Europe is expected to witness a notable growth in the coming years, as the EU Artificial Intelligence Act became enforceable in phases starting August 2024. The Act brought in phased risk stratification, binding conformity evaluations, the reporting of events, and confidentiality of AI systems that are applicable in high-impact areas, including healthcare, employment, frontier control and fiscal departments. A survey by EU/Digital Europe in April 2024 showed that 13.5% of surveyed enterprises had begun AI-based compliance programs. French (CNIL) and German (Bundesnetzagentur) regulators issued AI-specific guidance on transparency and redress for automated decisions. This positions Europe as a global reference for democratic AI governance, influencing adoption beyond its borders.

(Source:https://ec.europa.eu)

Middle East and Africa AI Governance Market Trends:

The market for AI governance in the Middle East and Africa is expanding quickly. This expansion is fueled by the rising adoption of AI, substantial investments from both government and private sectors, and an emphasis on establishing regulatory frameworks.

Major markets consist of Saudi Arabia and the UAE, whereas nations such as Nigeria, South Africa, and Egypt are experiencing significant growth, with healthcare and BFSI as the primary end-user sectors. The United Arab Emirates (UAE) is quickly establishing itself as a worldwide authority in artificial intelligence (AI) governance. By implementing innovative regulatory measures and adhering to international standards, the UAE seeks to promote responsible AI growth while guaranteeing alignment with new global norms.

AI Governance Market Companies

- TIBCO

- Tata Consultancy Services (TCS) Ltd

- Siemens SA

- SAP SE

- Oracle Inc

- NTT Data

- Microsoft Corporation

- Infosys Ltd

- IBM Corporation

- DXC Technology Company

- ABB Ltd

Recent Developments

- In June 2025, IBM unveiled the industry's first unified platform that integrates AI security with governance capabilities. This new release combines watsonx.governance, IBM's comprehensive AI governance tool, with Guardium AI Security, a solution built to secure AI models, data, and usage. Designed to provide organizations with a centralized view of AI-related risk posture, the integration aims to enhance enterprise-level control over autonomous AI systems. “AI agents are set to revolutionize enterprise productivity, but the very benefits of AI agents can also present a challenge,” said Ritika Gunnar, General Manager, Data and AI, IBM. She emphasized the importance of securing and governing these agents to prevent significant consequences.

- In May 2025, KPMG International launched KPMG AI Trust, a suite of services developed to ensure transparency, accountability, and reliability in AI implementations. The service offering builds upon KPMG's Trusted AI framework and integrates with ServiceNow's AI Control Tower, introduced at the Knowledge 2025 conference. The initiative helps clients scale AI responsibly throughout its full lifecycle.

(Source: https://newsroom.ibm.com)

(Source: https://kpmg.com)

Latest Announcements by Industry Leaders

- In June 2025,

Announcement - Riskonnect, a leader in integrated risk management (IRM) solutions, has announced the release of its AI Governance solution. Integrated into Riskonnect's broader risk management platform, the new capabilities equip organizations to address AI-related risks and compliance requirements confidently while preserving room for innovation. "AI has the power to unlock extraordinary value, but only if it's governed with intention and integrity," stated Kathryn Carlson, chief product officer at Riskonnect. "Our new AI governance capabilities are built to help organizations turn uncertainty into opportunity by embedding responsible AI oversight into the fabric of their risk strategy. This new solution is all about enabling innovation safely, ethically, and transparently."(Source: https://finance.yahoo.com)

Segments covered in the report

By Component

- Solutions

- Risk & Compliance Management Tools

- Data Quality & Lineage Solutions

- Fairness & Bias Monitoring

- Explainability Tools

- Model Monitoring & Lifecycle Management

- Services

- Consulting & Advisory

- System Integration

- Support & Maintenance

- Regulatory & Audit Services

By Deployment Mode

- Cloud Dominant

- Public

- Private

- Hybrid

- On-Premises Fastest

By Organization Size

- Large Enterprises

- SMEs

By End-Use Industry

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare & Life Sciences

- Retail & Consumer Goods

- Government & Public Sector

- Automotive

- Telecommunications

- Manufacturing

- Technology Providers

- Education

- Media & Entertainment

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting