What is the Software Market Size?

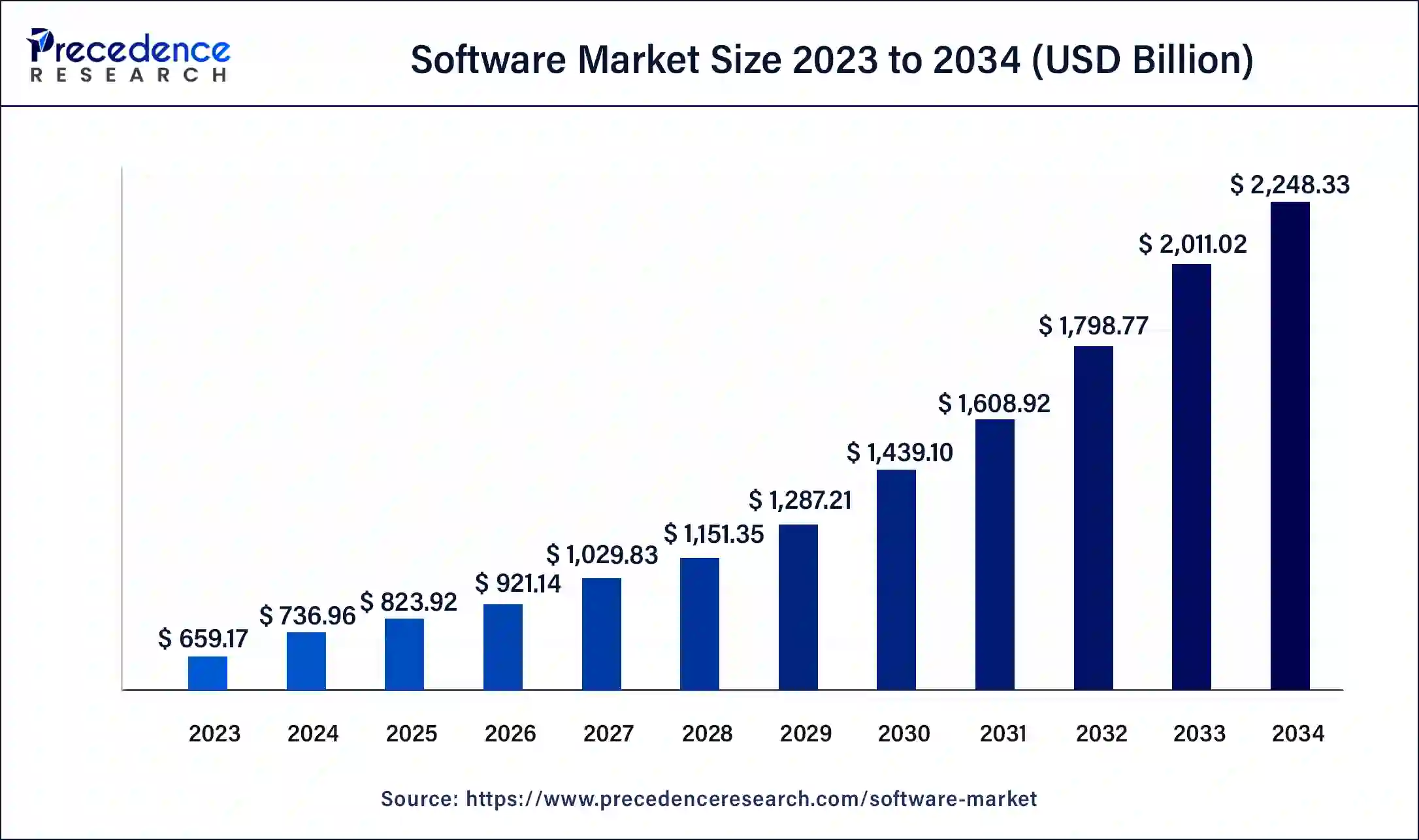

The global software market size accounted for USD 823.92 billion in 2025 and is expected to reach around USD 2,248.33 billion by 2034, expanding at a CAGR of 11.8% from 2025 to 2034.

Market Highlights

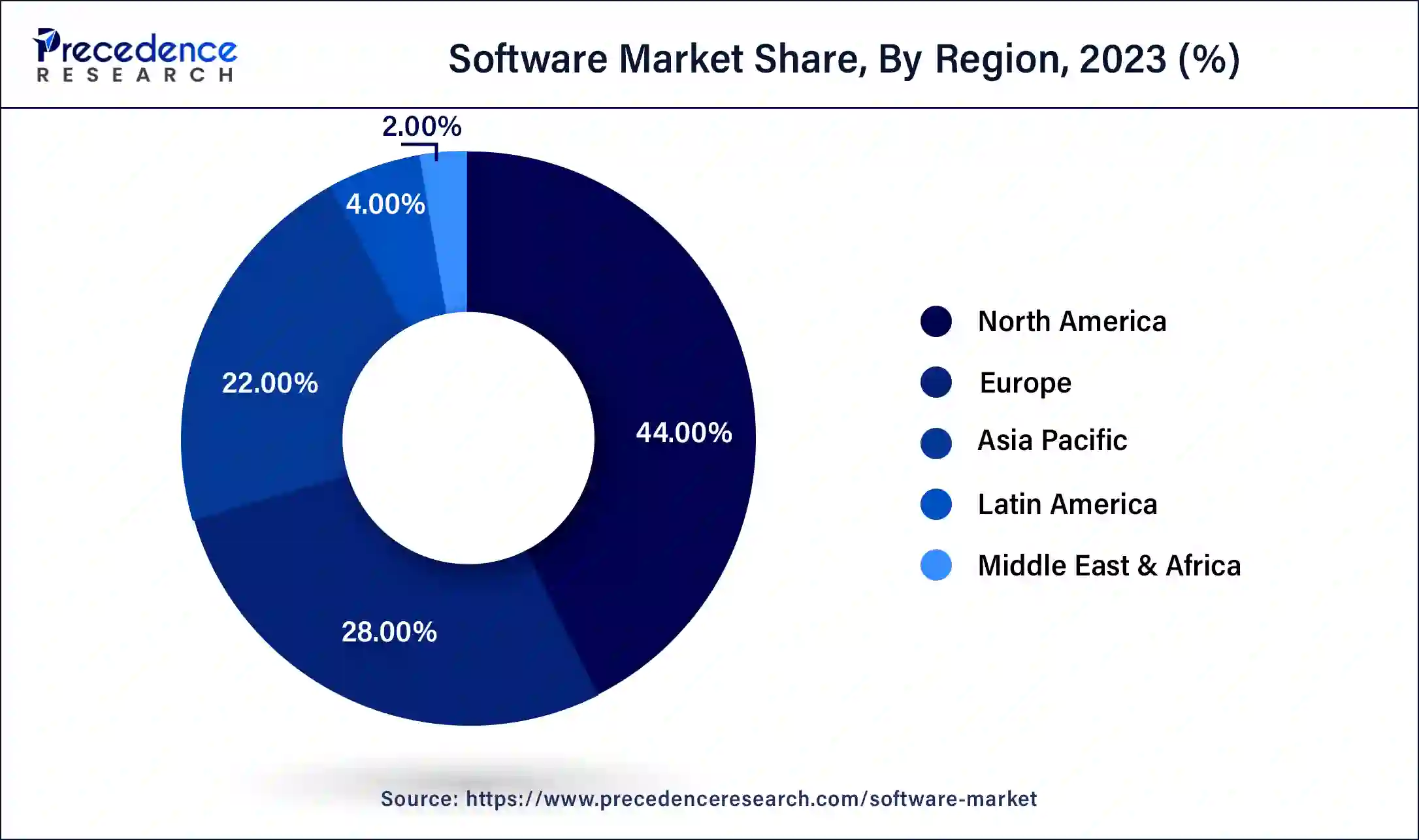

- North America contributed more than 44% of revenue share in 2025.

- By enterprise size, the large enterprises segment held a major market share in 2025.

- By vertical, the IT & telecom segment captured the largest market share in 2025.

- By deployment, the on-premises segment dominated the global market in 2025.

- By type, the application software segment led the global market in 2025.

Market Size and Forecast

- Market Size in 2025: USD 823.92 Billion

- Market Size in 2026: USD 921.14 Billion

- Forecasted Market Size by 2034: USD 2,248.33 Billion

- CAGR (2025-2034): 11.80%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Market Overview

The software market refers to the industry that encompasses developing, distributing, and selling software products and services. The software market is characterized by a wide range of software types and categories. Some common types of software include operating systems (e.g., windows, macOS), productivity software (e.g., word processors, spreadsheets), business applications (e.g., CRM, ERP), design and multimedia software (e.g., graphic design tools, video editing software), and specialized industry-specific software (e.g., healthcare management systems, banking software). The software market has been increasing significantly in recent years. The transition to cloud computing and software-as-a-service (SaaS) models is a significant development.

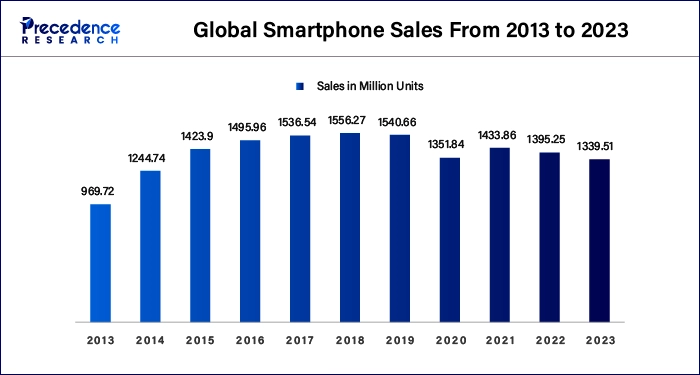

The increased emphasis on software development for mobile devices is another trend. Mobile applications have become a crucial component of people's everyday lives due to the widespread use of smartphones and tablets. For instance, according to a report, about 1.39 billion smartphones were sold worldwide in 2022 and about 1.34 billion units were sold in 2025.

The emergence of AI is revolutionizing the market

Artificial intelligence (AI) has a significant impact on the software market. Natural language processing and machine learning have the ability to automate repetitive tasks in the software development process, reducing human errors and increasing efficiency. With AI and ML technologies, software can automate procedures, make informed predictions, and improve user experiences. Applications powered by AI have been developed as a result of this trend in different sectors.

Software Market Growth Factors

The usage of smartphones, tablets, and internet access has increased dramatically in the past few years, resulting in increased demand for mobile and online apps. Mobile and web applications are essential for corporate and consumer communication. As a result of software developers creating and delivering cutting-edge and streamlined mobile and web apps, this trend expands the software market. Organizations are placing a high priority on data security and privacy due to the frequency and sophistication of cyberattacks and data breaches. Strong data protection and cybersecurity software solutions are in high demand. The software industry is addressing this need by providing cutting-edge compliance solutions, encryption technology, and security applications.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 823.92 Billion |

| Market Size in 2026 | USD 921.14 Billion |

| Market Size by 2034 | USD 2,248.33 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 11.8% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Enterprise, Vertical, Deployment, Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Cloud computing and remote employment

Cloud computing has completely changed the software industry by providing scalable and affordable infrastructure. Cloud-based software solutions are being used by businesses in greater numbers to increase accessibility, save costs, and streamline operations. The demand for software solutions that promote collaboration and communication across geographically distributed teams has increased as a result of globalization and remote work. Both enterprises and individuals now require software solutions for remote project management, video conferencing, and virtual collaboration.

Digitization

Rising digitization resulted in the growing adoption of IoT and smart devices. However, these devices require sophisticated software to run. This, in turn, propels the demand for software that supports these devices.

Restraint

Software update

The software market is expanding as a result of technical developments, yet these advancements can also pose difficulties. Frequent technological advancements necessitate ongoing software updates in order to remain competitive. It may be challenging for businesses to keep up with the rate of change and invest in research and development. It can be challenging to guarantee compatibility and interoperability between different software engineers as software systems get more complex. When attempting to link software solutions from several suppliers or when upgrading existing systems, integration problems might occur. The adoption and application of software solutions may be hampered as a result.

Data Security

Data security and privacy have evolved into major issues in the software industry. There is a rising need for reliable cybersecurity software and solutions to secure sensitive data due to increased cyber threats and data breaches. For instance, according to a report published by Forbes, in 2025, the incidence of cyberattacks has increased significantly across the globe, resulting in over 343 million victims. The rate of data breaches increased by 72% between 2021 and 2025.

Opportunity

Increasing demand for AI-powered software

There are several possibilities for creating AI-powered software that streamline operations. AI-powered software offer insightful data, improve judgment, and enhance user experience by reducing human errors. Numerous industries, including healthcare, banking, retail, and manufacturing, require AI-driven software solutions, to streamline and automate processes.

Challenge

Legal and regulatory issues

The software industry is governed by several laws, including those pertaining to data protection, intellectual property rights, and business-specific rules. It can be difficult and time-consuming to ensure compliance with these rules, especially for software firms that operate across different jurisdictions. Non-compliance may have legal repercussions and harm the reputation of the business.

Rapid shifts towards remote labor and virtual operations were brought on by the pandemic. To support distant collaboration, communication, and business continuity, organizations adopted digital technologies. The demand for software programs and platforms that facilitate remote work, video conferencing, project management, and cybersecurity increased as a result. Organizations used cloud computing to help their operations as remote work became more common. The ability to access data, apps, and resources from a distance has been made possible by cloud-based software solutions.

During the pandemic, the demand for cloud services, notably software-as-a-service (SaaS) solutions, increased significantly. During the pandemic, the healthcare industry faced unprecedented difficulties. However, usage of software programs that assists in telemedicine, remote patient monitoring, contact tracking, vaccination delivery, and data analytics spiked in demand for health technology (Health Tech) software solutions.

The need for educational technology software solutions increased as more schools and educational institutions shifted to remote learning. Virtual classrooms, learning management systems, and software for creating digital material all saw significant growth. During the epidemic, EdTech providers saw a rise in use and expansion. Cyber risks and assaults increased as a result of the pandemic. The significance of cybersecurity solutions increased as a result. In order to protect their data and provide enhanced threat detection, businesses started investing in software solutions.

Segments Insights

Enterprise Size Insights

The large enterprises segment dominated the market in 2025. Large enterprises run complicated operations; therefore, they need efficient software solutions to handle several facets of their operations. Large firms frequently use business intelligence tools, supply chain management solutions, customer relationship management (CRM) software, and enterprise resource planning (ERP) software. Rising investments by large enterprises in deploying cutting-edge software solutions drive the segment.

The SMEs segment is projected to grow rapidly during the forecast period due to the increasing number of startups across the globe. Startups are frequently small or mid-sized firms. They often look for flexible software solutions that are economical and help them start and grow their businesses. The rising requirements from SMEs to minimize operating expenses and streamline workflows increase the demand for cutting-edge software.

Vertical Insights

The IT & telecom segment held a large market share in 2025 due to the rapid expansion of the IT industry across the globe. The proliferation of 5G technology requires advanced software solution to leverage the high-speed connectivity. Furthermore, IT businesses heavily use smart devices and IoT, which require sophisticated software to manage the data.

The BFSI segment is likely to register a considerable growth rate in the coming years. The BFSI industry heavily uses software solutions for banking operations, payment processing, risk management, and fraud detection. Software solutions that enable online banking, mobile payments, and financial analytics are in great demand as a result of the growth of digital banking. The segment growth is further attributed to the rising usage of finance apps. According to the Mobile Apps Growth Statistics, 6 out of 10 people prefer online finance apps to manage their finances.

The e-commerce segment is anticipated to expand at a rapid pace during the forecast period. The rise of e-commerce and online shopping has led to a digital shift in the retail sector. Online retail administration, inventory management, order processing, customer relationship management, and logistics all depend heavily on software solutions. Retailers frequently use point-of-sale (POS) systems, e-commerce platforms, and consumer analytics software. The retail sector increasingly uses software for supply chain optimization, thereby boosting the segment.

Deployment Insights

The on-premises segment held a major share of the market in 2025. On-premises software is the process of installing and using software applications on a company's own servers and infrastructure. On-premises deployment has always been the preferred method among businesses or enterprise, as it offers enhanced security. This kind of deployment gives businesses immediate access to their software and data, making it appropriate for sectors with strict security and compliance standards, including government, healthcare, and finance.

The cloud segment is projected to expand rapidly in the coming years, as cloud software offers scalability, flexibility, and cost-effectiveness by enabling users to access programs and data remotely through the Internet. Moreover, the rising adoption of cloud computing among enterprises is anticipated to drive the market. Several organizations are embracing cloud computing technology for its scalability and efficiency. According to a survey by Cloud Security Alliance, as of 2024, about 98% of organizations use some form of cloud computing, up from 91% in 2020.

Type Insights

The application software segment dominated the market in 2025 and is anticipated to continue its dominance throughout the forecast period. The segment growth is primarily attributed to the rising digital transformation among businesses. As businesses undergo digital transformation, the demand for application software increases, as this software support various business operations. Furthermore, rising demand for industry-specific software drives the segment.

Regional Insights

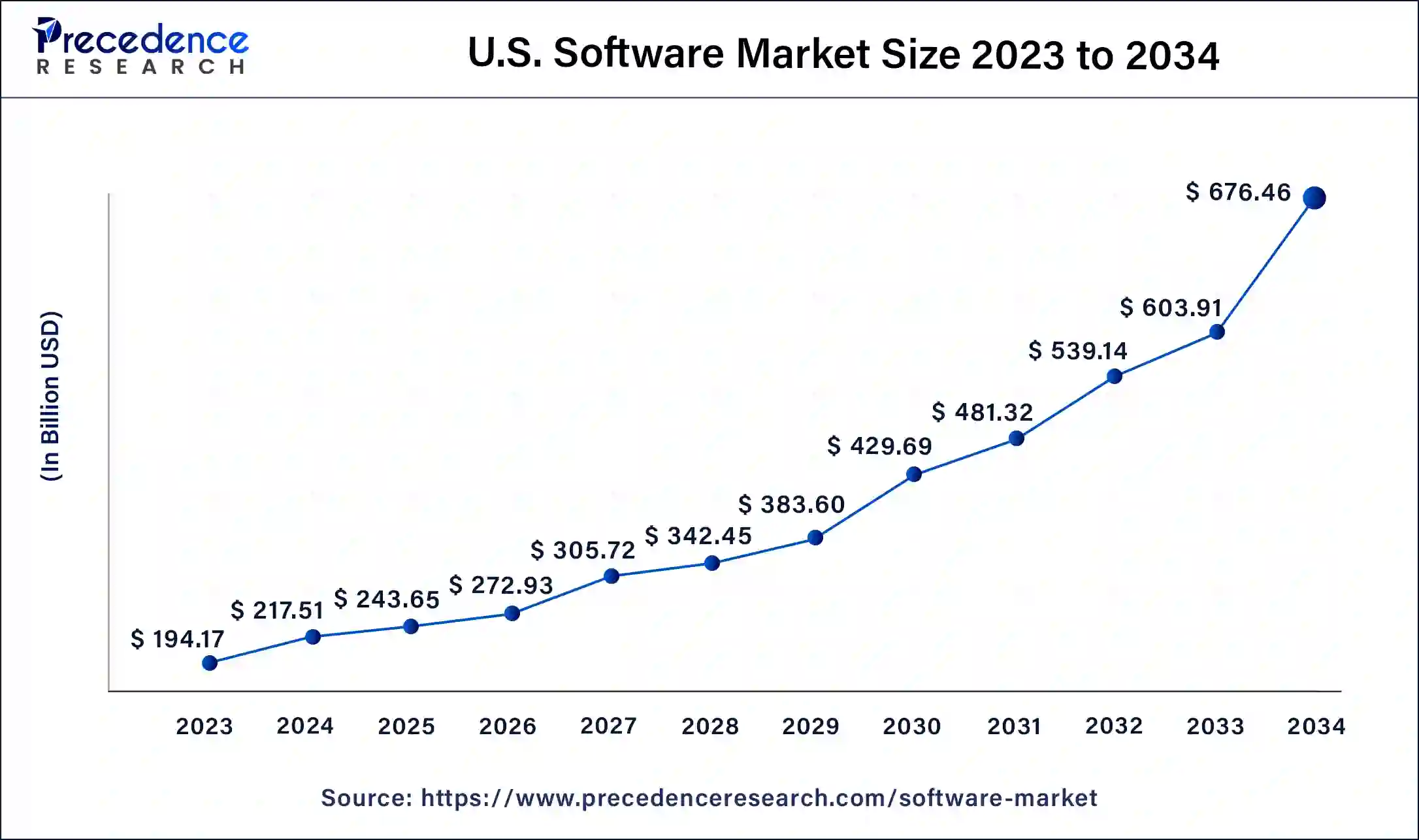

U.S. Software Market Size and Growth 2025 to 2034

The U.S. software market size was estimated at USD 243.65 billion in 2025 and is predicted to be worth around USD 676.46 billion by 2034, at a CAGR of 12% from 2025 to 2034.

North America dominated the market in 2025 due to the adoption of cutting-edge software among various industries. Industries in the region, such as technology, banking, healthcare, and e-commerce industries, heavily use software solutions to manage their operation. North America is at the forefront of technological advancements. Additionally, the presence of a large number of tech giants in the region are developing advanced industry-specific software, which propels the market.

The market in Asia Pacific is projected to grow at a fastest CAGR in the coming years. The market growth in the region is attributed to the proliferation of smart devices and the rapid expansion of IT and e-commerce industries. Moreover, regional players are collaborating to develop solutions that are user-friendly.

Software Market Companies

- Adobe Inc.

- IBM Corporation

- NortonLifeLock Inc.

- McAfee Corporation

- Oracle

- SAP SE

- Microsoft

- VMware Inc.

- Block, Inc.

- Intuit Inc.

Recent Developments

- In July 2024, Adobe Inc. announced breakthrough innovations in its Adobe Illustrator and Adobe Photoshop. These industry-leading apps speed up everyday creative workflows and offer more control to creators. The new release of Illustrator opens up new ways for designers to bring their vision to life across brand graphics, product packaging, logos and icons, marketing deliverables, pattern creation, and beyond.

- In March 2024, Oracle announced the availability of Java 22. It is the latest version of the world's number-one programming language and development platform.

- In June 2023, the Gujarat Industrial Development Corporation considered giving the Gift City administration control over the construction of the planned IT cluster. Prior to the pandemic, the project was scheduled; However, due to delays, it is currently anticipated that GIDC would transfer the project to Gift City for construction.

- In May 2023, Apax Funds disclosed that it had reached a legally binding agreement to pay $450 million for Blackstone's minority stake in the travel technology business IBS Software. IBS Software's founder and executive chairman, V. K. Mathews, would still own a majority interest in the company after the transaction. Blackstone acquired a minority stake in IBS Software in 2015 for $170 million, or roughly 30% of the business. Since its founding in 1997, IBS Software has provided SaaS (software as a service) solutions to companies operating in the logistics, airline, hotel, tour, and cruise sectors. The 4,000-person company has offices in Singapore, Chennai, Kochi, Bengaluru, and Trivandrum for its product, research, and development teams.

- In June 2023, the computer operating system OpenKylin made its debut in China. To reduce the country's dependency on US technology, a group of Chinese companies working under the guidance of China Electronics Corp. developed OpenKylin 1.0. The OpenKylin 1.0 Linux operating system was created by a team of nearly 4,000 programmers. The system, which is based on the open-source, free Linux operating system, is used by several industries, including banking, energy, and even the national space project. In recent years, the creation of an operating system that is independent on US technology has taken primacy in China's IT industry. The development of the OpenKylin system has involved contributions from several companies and organizations.

Segments Covered in the Report

By Enterprise

- Large Enetrprise

- SMEs

By Vertical

- IT & Telecom

- Banking, Financial Services and Insurance (BFSI)

- E-commerce

- Others

By Deployment

- On-premises

- Cloud

By Type

- Productivity Software

- Application Software

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content