What is the Software As A Service (SaaS) Market Size?

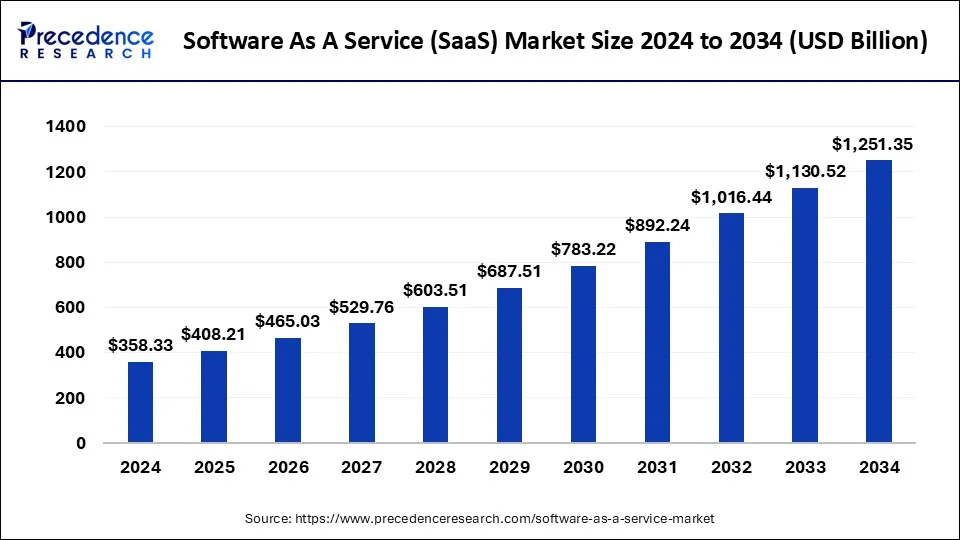

The global software as a service (SaaS) market size was estimated at USD 408.21 billion in 2025 and is predicted to increase from USD 465.03 billion in 2026 to approximately USD 1,367.68 billion by 2035, expanding at a CAGR of 12.85% from 2026 to 2035.

Software As A Service (SaaS) Market Key Takeaways

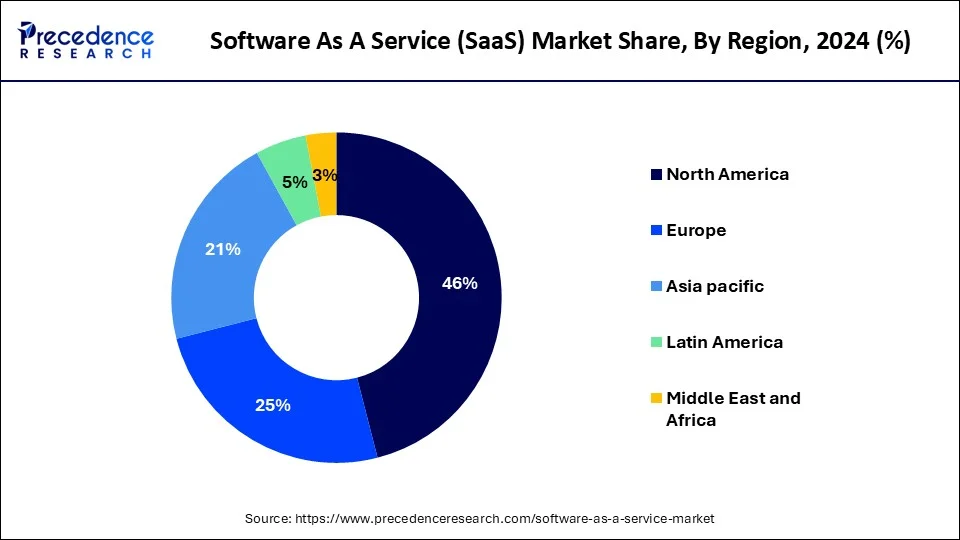

- North America dominated the global market with the largest market share of 46% in 2025.

- By Component, the software segment contributed the highest market share of 85% in 2025.

- By Deployment, the private cloud segment captured the biggest market share of 44% in 2025.

- By enterprise size, the large enterprises segment has accounted for a revenue share of 62% in 2025.

Market Overview

Software as a service (SaaS) refers to a method of licensing and software delivery wherein the software can be accessed online via a particular subscription. This method is different from buying and installing the software on every individual computer. The increasing adoption of public cloud servicesin various enterprises is one of the significant factors that is expected to drive the software as a service (SaaS) market growth during the study period. Considering the high cost of on-premises software deployment, many enterprises are shifting towards the SaaS model.

Software as a Service is delivered through a cloud delivery model. A software provider hosts a programmer and related data on its own servers, networks, computing resources, and databases. Software as a Service is highly correlated to on-demand computing software delivery models and application service providers.

As businesses aim to decrease their IT costs and enhance scalability, the adoption of Customer relationship management (CRM) SaaS solutions continues to increase. Configuration and customization of CRM SaaS solutions are becoming more accessible and easier. This allows companies to personalize their CRM systems as per to their particular requirements.

As the company grows, they require business-oriented SaaS platforms that are able to encode corporate policies, processes, and rules. SaaS platforms are also useful in improving communication, enhancing corporate efficiency, and exploring new revenue-generating market opportunities.

Artificial Intelligence: The Next Growth Catalyst in Façade

AI is profoundly impacting the SaaS industry by enabling a fundamental shift from generic functionality to personalized, intelligent services. Machine learning algorithms are integrated into SaaS platforms to automate complex tasks, analyze vast datasets for actionable insights, and provide predictive analytics that anticipate user needs and market trends. This enhances user experience and operational efficiency, allowing businesses to optimize decision-making with data-driven recommendations.

Software As A Service (SaaS) Market Growth Factors

- Adaptability and scalability- Software as a service (SaaS) solutions allow businesses to quickly scale resources according to demand, enabling agile processes. This adaptability is especially useful for startups and enterprises that may experience fluctuating workloads.

- Cost-effectiveness- SaaS can reduce spend by eliminating the requirement for on-premise infrastructure and the associated maintenance costs. Pricing models for SaaS applications are subscription-based, enabling small and medium enterprises to access advanced software priced beyond their budgets.

- Remote workforce adoption- The rise in remote and hybrid workforce models has increased the demand for cloud-based collaborative tools, driving SaaS applications across industries.

- Continuous innovation and updates- SaaS providers regularly deliver updates and new features, allowing users to continually access the latest and greatest technologies, without the need to conduct manual upgrades or pay additional fees.

Market Outlook

- Market Growth Overview: The software as a service (SaaS) market is expected to grow significantly between 2025 and 2034, driven by the increasing digital transformation and cloud adoption, accelerating demand for cloud-based tools that enhance work from anywhere, and rising consumer performance.

- Sustainability Trends: Sustainability trends involve the integration of ESG, green cloud infrastructure, and carbon footprint management.

- Major Investors: Major investors in the market include Sequoia Capital, Accel, Insight Partners, Bessemer Venture Partners, and Andreessen Horowitz.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 408.21Billion |

| Market Size in 2026 | USD 465.03 Billion |

| Market Size by 2035 | USD 1,367.68Billion |

| Growth Rate from 2026 to 2035 | CAGR of 12.85% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Deployment, Enterprise-size, Component, Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Growing cloud services all over the world are anticipated to boost the software as a service (SaaS) market drastically. The United States is a major destination for SaaS companies. Almost 56.67% of SaaS companies across the world are situated in the United States. The funding for software as a service (SaaS) platforms is increasing notably. Venture capital (VC) deals and investments in the United States in 2019 were valued at $35 billion. This amount increased to $38 billion in 2020. In 2021, the US SaaS VC investment accounted for $94 billion with 4,459 deals. Increasing investment is supporting the supply side of the SaaS market financially.

For enhancing the development of software as a service (SaaS), key market players can consider acquisition, collaboration, partnership, and joint ventures. Also, continuously evolving software technology can make the existing technology obsolete very soon. This is estimated to intensify the competition among the top market players.

Since the count of software as a service (SaaS) providers (suppliers) is less in comparison to the count of buyers, the bargaining power of suppliers is considerably high as compared to the bargaining power of buyers. Owing to remarkable profit margins, the threat of new entrants in the software as a service (SaaS) market is moderate as of now.

Our software as a service (SaaS) market report includes an in-depth analysis of the current market situation. The report includes essential aspects such as the competitive landscape, key players, the latest trends, and country-wise analysis. The analytical research on the impact of the pandemic of COVID-19 is helpful in knowing the effects on the demand and supply side. The segmental analysis provides a more distinct overview of different applications of software as a service (SaaS).

Segment Insights

Deployment Insights

The global software as a service (SaaS) market is segmented into public cloud, private cloud, and hybrid cloud. The private cloud segment held the largest market share in 2024. The private cloud segment is predicted to grow with the highest compounded annual growth rate (CAGR) during the study period.

Enterprise-size Insights

The global software as a service (SaaS) market is segmented into small & medium enterprises (SMEs) and large enterprises. The large enterprises segment had the highest revenue share in 2023. The large enterprises segment is estimated to grow with the highest compounded annual growth rate (CAGR) during the forecast period till 2034.

Application Insights

The software as a service (SaaS) market is segmented into customer relationship management (CRM); enterprise resource planning (ERP); human capital management; content, collaboration & communication; BI & Analytics; and others. The customer relationship management (CRM) segment is anticipated to hold a substantial share during the forecast period.

End-User Industry Insights

Based on the end-user, the global software as a service (SaaS) market is segmented into banking, financial services & insurance (BFSI); retail & consumer goods; healthcare; education; manufacturing; travel & hospitality; and others. The financial services & insurance (BFSI) segment is estimated to hold a significant revenue share during the study period.

Regional Insights

What is the U.S. Software As A Service (SaaS) Market Size?

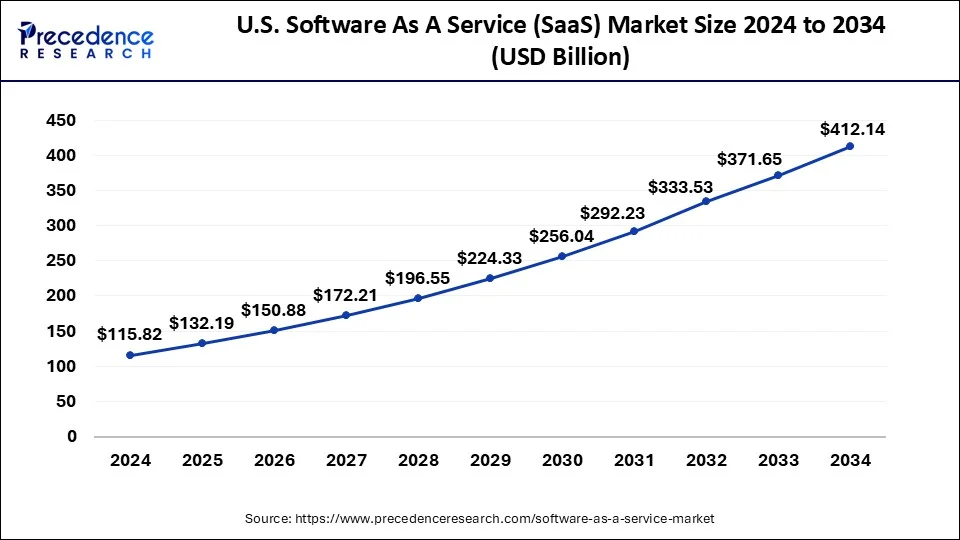

The U.S. software as a service (SaaS) market size was estimated at USD 132.19 billion in 2025 and is predicted to be worth around USD 451.05 billion by 2035, at a CAGR of 13.06% from 2026 to 2035.

The software as a service (SaaS) market is spread across North America, Europe, Asia Pacific (APAC), the Middle East and Africa, and Latin America. North America (NA) held the largest share of the global software as a service (SaaS) market in 2024. In 2024, the US accounted for the highest share followed by Canada and Mexico. Owing to the presence of countries with convenient economic policies, high gross domestic product (GDP), and quick adoption of the latest software as a service technology, the North American software as a service (SaaS) market is predicted to grow remarkably.

- As of March 2023, the count of SaaS companies in the US and Canada was 17,000 and 2,000 respectively. SaaS companies from the US cater to nearly 14 billion customers across the world. The SaaS industry across the US is anticipated to account for a value of $225 billion by 2025.

U.S. Software as a Service (SaaS) Market Trends

U.S.'s industrial pivot toward Vertical SaaS, where specialized solutions for healthcare and finance replace generic software to meet localized compliance and workflow needs. Consequently, providers are adopting usage-based pricing and mobile-first architectures to accommodate the fluctuating demands of a hybrid workforce.

The European software as a service (SaaS) market is segmented into Germany, France, the United Kingdom (UK), Italy, and the Rest of Europe. Germany is anticipated to hold the highest share of the European software as a service (SaaS) market during the study period. The count of SaaS unicorns raised from 44 in 2020 to 81 in 2021. In 2022, around 21% of the European tech community was of the opinion that hiring talent is one of the greatest challenges. This gave rise to the demand for various SaaS recruitment software. In 2020, the average European software as a service (SaaS) startup raised €1 million ($1.08 million) at seed. In 2021, this figure grew to €2.2 million ($2.49 million). The increasing funding is contributing enormously to the European software as a service (SaaS) market growth.

Germany Software as a Service (SaaS) Market Trends

Germany's integration of AI and automation is shifting towards industry-specific platforms tailored to the processes and regulations of sectors, such as healthcare, manufacturing, and the public sector. The rising digital sovereignty and compliance, and growing adoption in SME and hybrid work, fuel the market growth.

The software as a service (SaaS) market in the Asia Pacific (APAC) region is segmented into India, Japan, South Korea, China, and the rest of the Asia Pacific (APAC) region. In 2023, China held the highest share of the Asia Pacific (APAC) software as a service (SaaS) market followed by Japan and India. In 2020, the count of small and medium-sized enterprises (SMEs) in South Korea was approximately 7.3 million. This count is a remarkable rise from around 6.9 million small and medium-sized enterprises present in South Korea in 2019. The count of SMEs is increasing constantly in the Asia Pacific (APAC) region. Growing SMEs enhance the demand for respective software as a service (SaaS) promisingly.

India Software as a Service (SaaS) Market Trends

India has emerged as a global SaaS powerhouse, leveraging localized, AI-powered platforms that offer operational efficiency and scalability to a highly distributed, digital-first workforce. India's SaaS ecosystem is also expanding globally, with local startups scaling into international markets while tailored vertical solutions attract investment and adoption beyond traditional horizontal offerings.

Latin America, Middle East, and African (LAMEA) software as a service (SaaS) market is bifurcated into Saudi Arabia, United Arab Emirates (UAE), South Africa, North Africa, Brazil, Argentina, and the Rest of LAMEA. The Latin America region is predicted to account for notable growth in the software as a service (SaaS) market during the forecast period. In 2023, Brazil had the largest share in the LAMEA software as a service (SaaS) market region. Owing to unfavorable economic conditions, inadequate education, and lack of tech infrastructure in some African countries, the software as a service (SaaS) market in the African region is estimated to grow at a slower rate.

Software as a Service (SaaS) Market Companies

- Adobe Inc. primarily contributes to the SaaS market through its Creative Cloud and Adobe Experience Cloud, offering subscription-based access to essential creative and marketing software like Photoshop and Illustrator, which are managed and delivered entirely online.

- Microsoft is a major SaaS provider through offerings such as Microsoft 365, delivering productivity applications (Word, Excel, PowerPoint) via the cloud, and its Dynamics 365 suite, which provides cloud-based enterprise resource planning (ERP) and customer relationship management (CRM) solutions.

- Alibaba Cloud provides a range of SaaS applications as part of its comprehensive cloud computing platform, focusing heavily on e-commerce, data analytics, and collaboration tools tailored for businesses operating in the Asian market.

- IBM contributes to the SaaS market through its portfolio of cloud-based business solutions, leveraging its expertise in AI, data analytics, and enterprise integration to deliver industry-specific software services on a subscription model.

- Google LLC provides popular SaaS tools through Google Workspace, which includes cloud-native productivity and collaboration apps such as Gmail, Docs, and Meet, and also offers various enterprise software solutions accessible via its Google Cloud platform.

Other Major Key Players

- Salesforce, Inc.

- Oracle

- SAP SE

- Rackspace Technology, Inc.

- VMware Inc.

- IONOS Cloud Inc.

- Cisco Systems, Inc.

- Atlassian

- ServiceNow

Recent Developments

- In May 2025, Clearent by Xplor, a leading U.S. payment processor under Xplor Technologies, announced the launch of Xplor Capital, an innovative embedded financing solution for software providers and their merchants. With the successful launch of Xplor Capital for small businesses, this extension allows Software-as-a-Service (SaaS) providers to integrate merchant financing capabilities directly into their software ecosystems.

- In April 2025, SailPoint launched its first SaaS instance in the Middle East to strengthen its global strategy and accelerate digital transformation. This strategic investment is a key component of SailPoint's broader global expansion strategy, designed to meet the growing demand for robust identity security solutions across key markets worldwide.

- In February 2025, Zomato unveiled its SaaS suite plans with the launch of the AI-powered customer support tool, Nugget. Nugget is an AI-native, no-code customer support platform developed by Zomato Labs, which is the company's in-house incubator.

- In February 2025, Genpact launched "Service-as-Agentic-Solutions", using AI agents to enhance service delivery. This follows the introduction of its AI Gigafactory, aimed at providing tailored AI solutions. The first solution is "Genpact AP Capture", designed to improve the efficiency of invoice processing.

- In January 2023,Boxed, Inc. (NYSE: BOXD), a tech-driven company specializing as both an e-commerce enabler and an e-commerce retailer, announced the availability of Spresso on the Google Cloud Marketplace. Spresso is a SaaS modular solution platform and its availability on the Google Cloud Marketplace indicates the deepening of the partnership between Google Cloud and Boxed. The launch of Spresso has unlocked a novel value for joint customers and is creating promising scope for enhanced operational insights for various businesses.

- In November 2022,Nokia announced the launch of its pioneering Core SaaS for 5G. This offers enterprises and communication service providers (CSPs) the option of running their network through a fully automated, highly flexible, and scalable software model. Nokia Core SaaS permits enterprises and operators to shift from the legacy practice of deploying personalized software that runs on private infrastructure.

Segments Covered in the Report

By Deployment

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Enterprise-size

- Small & Medium Enterprises

- Large Enterprises

By Component

- Software

- Services

By Application

- Customer Relationship Management (CRM)

- Human Capital Management

- Enterprise Resource Planning (ERP)

- BI & Analytics

- Content, Collaboration & Communication

- Others

By End-User Industry

- Banking, Financial Services & Insurance (BFSI)

- Healthcare

- Retail & Consumer Goods

- Manufacturing

- Education

- Travel & Hospitality

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting