Smartphones Market Size and Growth 2025 to 2033

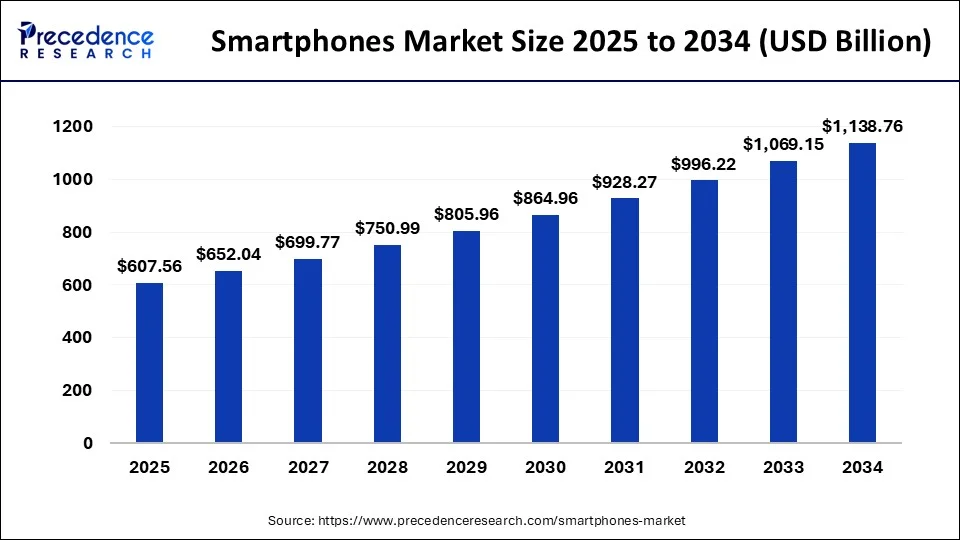

The global smartphones market size accounted at USD 566.12 billion in 2024 and is predicted to reach around USD 1138.76 billion by 2034, growing at a CAGR of 8% from 2025 to 2034. Several technological advancements, including the integration of augmented reality and virtual reality, are observed to drive the growth of the smartphones market.

Smartphones Market Key Takeaways

- In terms of revenue, the smartphones market is valued at $607.56 billion in 2025.

- It is projected to reach $1,138.76 billion by 2034.

- The smartphones market is expected to grow at a CAGR of 8% from 2025 to 2034.

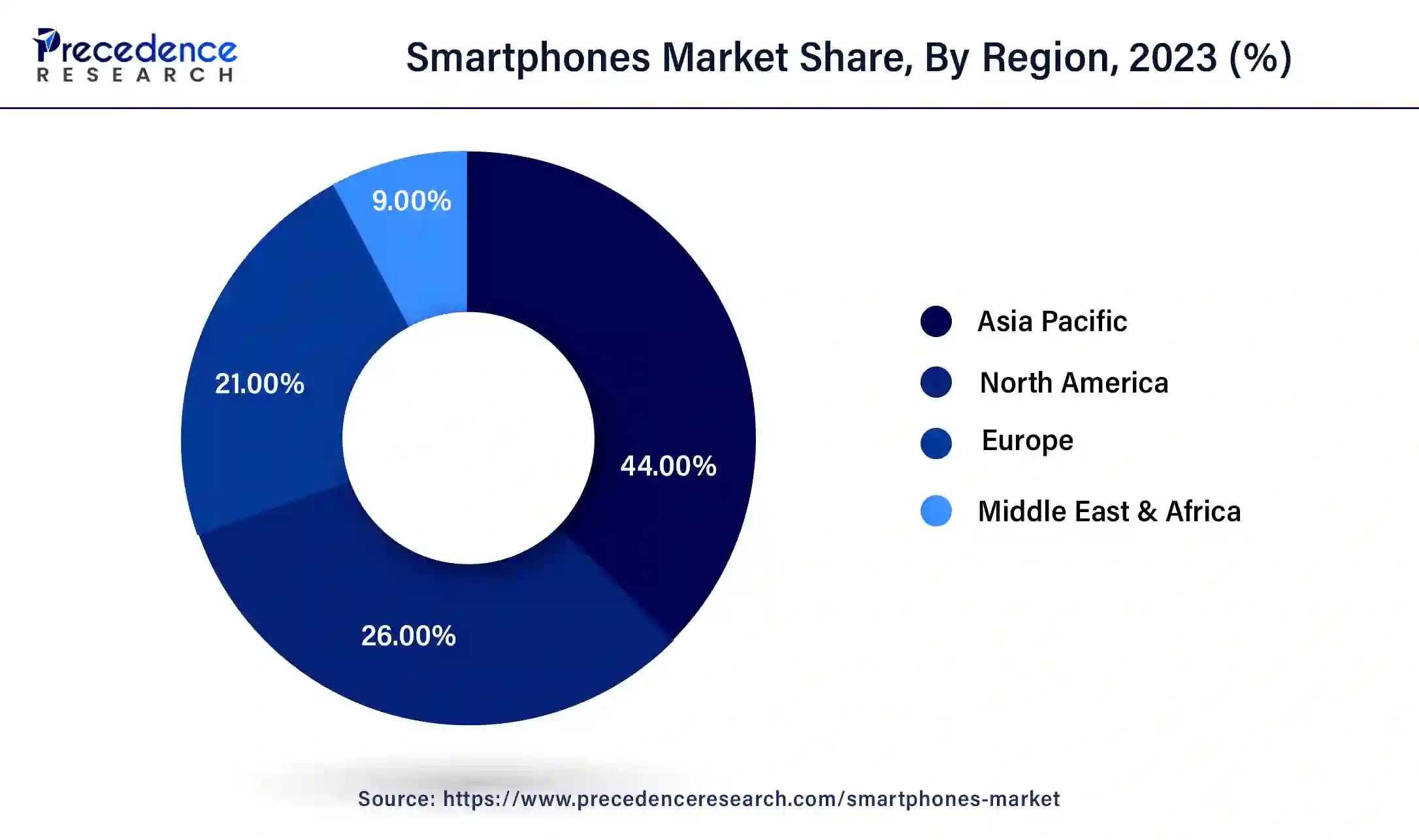

- Asia Pacific dominated the market with the largest revenue share of 44% in 2024.

- North America is expected to grow to the highest CAGR in the market during the forecast period.

- By operating the system, the iOS segment dominated the market in 2024.

- By operating the system, the Android segment is expected to grow to the highest CAGR in the market during the forecast period.

- By distribution channels, the e-commerce segment has held the major revenue share of 43% in 2024.

- By distribution channels, the retailer segment is expected to grow to the highest CAGR in the market during the forecast period.

Asia Pacific Smartphones Market Size and Growth 2025 to 2034

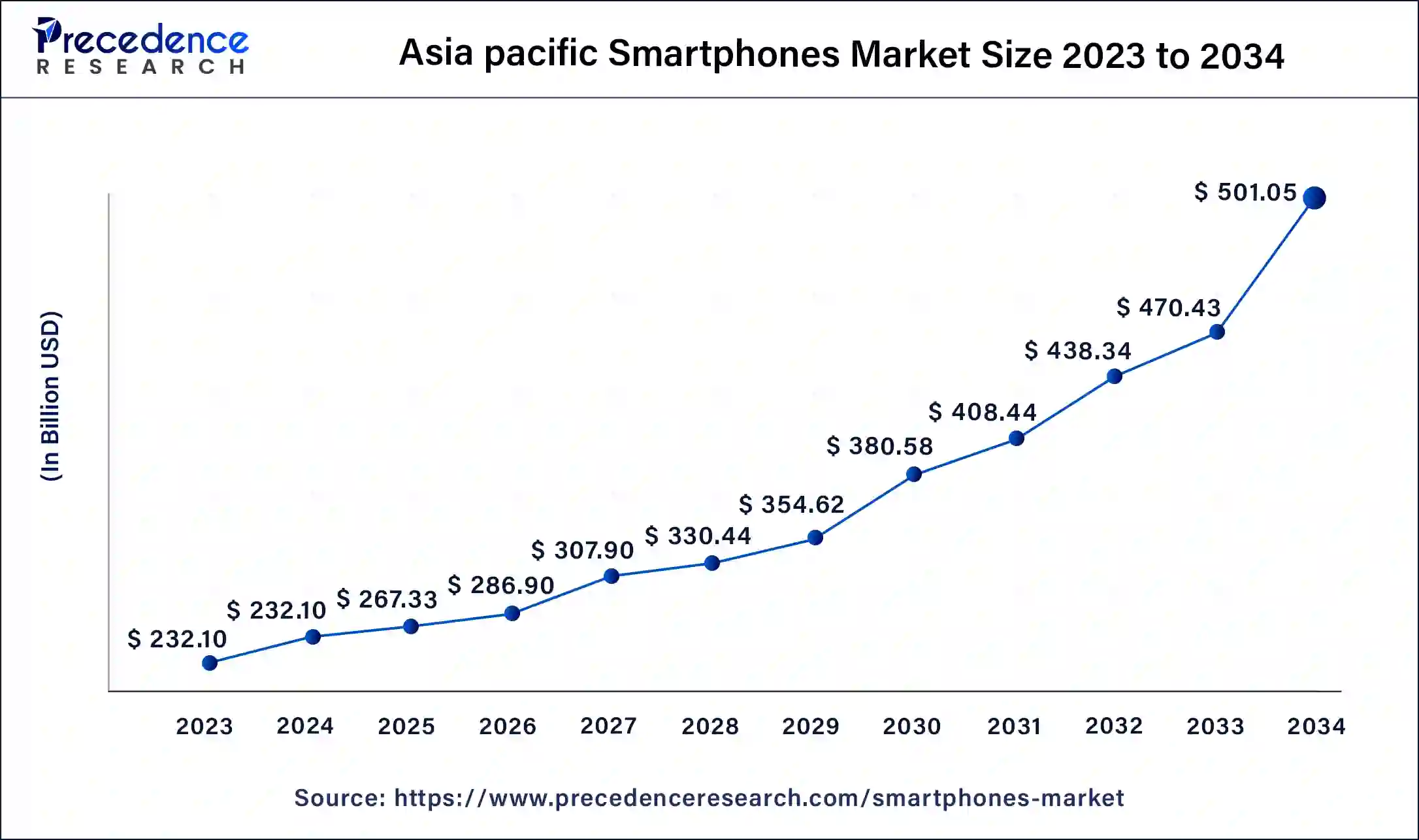

The Asia Pacific smartphones market size was estimated at USD 232.10billion in 2024 and is predicted to be worth around USD 501.05 billion by 2034 at a CAGR of 8.10% from 2025 to 2034.

Asia Pacific dominated the Smartphones market in 2024. Due to a number of factors, including a sizable and increasingly affluent consumer base, robust manufacturing capabilities, and the presence of major Smartphones companies such as Samsung, Huawei, Xiaomi, and Oppo, which offer cutting-edge products at a range of price points and cater to diverse market segments, the region leads the global market. The demand for smartphoness for business, leisure, and communication has also increased due to the region's quick urbanization and digitization.

Currently, Asia Pacific is dominating the smartphone market. Within the region, China holds the largest market share. This region is the innovative and advanced center of various smartphone brands, expanding globally, and is reshaping and developing in the technological sector. The popular brands Samsung and Xiaomi of Asia Pacific have ruled the smartphone industry for years.

- China will still produce more than one billion smartphoness in 2022, roughly 70-80 percent of the global total. Moreover, much of the capacity that has been redistributed to other countries has focused predominantly on lower-value final assembly.

- In 2023, China remained the top exporter of parts to Vietnam, with more than 90 percent of the total value of imported “telephones and parts” coming from China. China is also India's largest provider of electronics and parts, providing USD 27.6 billion worth of electrical machinery and parts in 2023.

- In January 2024, OnePlus, the Chinese tech giant, launched the OnePlus 12 on January 23, 2024, in India. According to reports, the OnePlus 12 series' starting price is likely to be ₹60,000. The base model will have a 6.82-inch 2K Super Fluid AMOLED display with an LTPO panel.

North America is expected to grow at the fastest rate in the Smartphones market during the forecast period. Due to factors like the growing adoption of 5G and other advanced technologies, growing demand for smartphoness with more features and capabilities, ongoing innovation in smartphones design and functionality, and the growth of digital services and applications that encourage smartphones usage, North America is expected to have a larger share of the market.

The smartphones market in the United States is one of the world's largest, with over 310 million smartphones users as of 2023. In line with the overall growth of the market worldwide, the smartphones penetration rate in the United States has continuously risen over the past several years, reaching around 92 percent in 2023.

- In September 2022, Samsung Electronics Co., Ltd. and Comcast announced that Comcast is working with Samsung to deliver 5G Radio Access Network (RAN) solutions that can be used to enhance 5G connectivity for Xfinity Mobile and Comcast Business Mobile customers in Comcast service areas.

Market Overview

The smartphones market refers to a portable device that integrates phone and computer features. Typically, they provide portable devices with functions like email, applications, cameras, and other internet connections, among others. The iPhone from Apple, the Galaxy series from Samsung, the Pixel phones from Google, and many more are well-known brands.

Smartphones Market Growth Factors

- The Smartphones market is primarily driven by the increasing number of mobile applications for a diverse range of functions.

- Growing prevalence of online merchants and reliable e-commerce platforms selling smartphoness.

- The rise of connectivity between several electronic devices gives the user a better overall experience.

- Aesthetically pleasing casing and other accessories are popular among the younger generation.

Smartphones Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 8% |

| Market Size in 2024 | USD 566.12 Billion |

| Market Size in 2025 | USD 607.56 Billion |

| Market Size by 2034 | USD 1138.76 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Operating System, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising adoption of smartphoness in the younger generation

The rising adoption of smartphoness by the younger generation can grow thesmartphones market. The younger generation is usually the first to adopt new technologies and settings trends, affecting the older group and their friends. People have become more dependent on smartphoness as they use them for work, entertainment, and communication, which has expanded the market for smartphoness. Younger consumers also tend to be more interested in the newest features and updates, which encourage constant innovation and competitiveness in the market.

Restraint

Environmental impact of smartphones production

The environmental impact of Smartphones production slows down the smartphones market. The growing environmental limits may result in increased cost of production of the market and decreased profit margins for procedures or higher pricing for consumers of the market.

Opportunity

Rising production of 5G connectivity smartphoness

The rising production of 5G connectivity smartphoness can be an opportunity to grow the smartphones market. There are numerous strategies to grow the market with the growing supply of devices with 5G connection. First of all, it satisfies consumers' need for smooth streaming, gaming, and browsing experiences by meeting the rising need for faster and more dependable mobile internet access. Second, it encourages customers to replace their outdated gadgets with ones that can connect to 5G networks, boosting income and sales in the market.

Technological Advancement

Technological advancements in the smartphone market feature foldable displays, 5G connectivity, generative AI, and AR/VR integration. The foldable display is a device that presents the combination of expansive screen real estate with compact design, supporting applications such as gaming. The 5G connectivity in smartphones is a first preference of customers. The connection offers faster data speed, which enhances customer experience. The generative AI technology is a development and advantage for new brands to adopt this technology briefly, to compete and survive in the long-term market race. The AR/VR integration technology offers a thrilling and virtual experience mainly in entertainment and gaming. Furthermore, the smartphone market is prone to new technology and advancement. The fastest adaptive market seeks innovation and expansion.

Operating System Insights

The iOS segment dominated the smartphones market in 2023. Due to a number of factors, including its reputation for security, the ecosystem's interaction with other Apple goods, regular software upgrades across devices, and a strong focus on user experience and design, iOS manages to hold a sizable portion of the market. Furthermore, Apple's marketing approaches and brand loyalty help it maintain its supremacy in particular markets and demographics.

The number of Apple iPhone unit sales dramatically increased between 2007 and 2022. Indeed, when the iPhone was first introduced in 2007, Apple shipped around 1.4 million smartphoness. By 2022, this number reached over 232 million units.

The android segment is expected to grow at a significant CAGR in the smartphones market during the forecast period. Android is more accessible to a wider spectrum of customers due to its abundance of devices in different price ranges. Furthermore, customers who value customization choices will find Android more enticing than iOS since it offers greater customization and flexibility. Moreover, the fact that Android is available on devices made by several manufacturers encourages innovation and competition, which advances both software and hardware features. Lastly, the adaptability of Android and its substantial presence in emerging markets.

- There are 3.3 billion Android OS users in the world as of 2023. Android has a 71.74% mobile operating systems' market share globally as of 2024. Android 12.0.0_r46 (SSV1.210916.062) is the latest version of Andriod OS, which was released on April 10, 2023. Samsung owns more than 34% share of the android market. 1.57 billion android devices were sold in 2022.

Distribution Channel Insights

The e-commerce segment dominated the smartphones market in 2024. The ease that e-commerce provides is a major factor in its domination in the smartphones industry. The users can explore, compare, and buy things from anywhere at any time with only a few clicks on their phones. Furthermore, mobile-friendly user experiences are a common feature of e-commerce platforms, which makes it easy for customers to buy on their Smartphoness. Because of its usability and accessibility, e-commerce has expanded rapidly in the market.

- At least 79% of Smartphones users have made a purchase online using their mobile device in the last six months. It's estimated over 50% of all eCommerce purchases during the 2022 holiday season were made on a Smartphones. The eCommerce dollars now comprise 15% of ALL retail revenue.

The retailer segment is expected to grow at a rapid pace in the smartphones market during the forecast period. In the smartphones industry, the retailer segment is anticipated to expand because of a number of causes. First off, merchants are investing in developing smooth mobile purchasing experiences for their customers as they become more aware of the significance of mobile commerce, or m-commerce. This includes creating mobile applications, making websites mobile-friendly, and putting in place mobile-friendly payment methods. Second, merchants now have a larger pool of prospective customers because of the widespread use of cell phones.

Etailers may interact with customers who choose to purchase on their mobile devices and reach a wider audience as more individuals have access to Smartphoness globally. Furthermore, by enabling shoppers to view things before making a purchase, technological innovations like augmented reality (AR) and virtual reality (VR) are improving the mobile shopping experience. As more shops incorporate these technologies into their mobile platforms, it is anticipated that the retailer section of the market will rise as a result of this immersive shopping experience.

Almost three-quarters (74%) of retailers said mobile technology has made them more accessible to customers, while 66% said it has led to higher customer satisfaction. Other benefits of mobile technology include greater efficiency (cited by 62% of retailers) and lower customer service costs (33%). Only 18% of retailers said mobile technology makes it hard to service customers.

Smartphones Market Companies

- Samsung Electronics Co. Ltd

- Huawei Technologies Co. Ltd

- Apple Inc.

- Xiaomi Corporation

- BBK Electronics Corporation

- Lenovo Group Limited

- HTC Corporation

- HMD Global Oy

- Sony Corporation

- ZTE Corporation

- Google LLC

Recent Developments

- In May 2025, Samsung Electronics launched the slimmest flagship model, with enhanced artificial intelligence features, to get ahead of rival Apple. The competition is raising the quality standard and choices in the smartphone market. Source: reuters.com

- In May 2025, Qualcomm launched the Snapdragon 7 Gen 4 mobile platform capable of handling gen AI tasks. It will succeed the Snapdragon 7 Gen 3 mobile processor and is likely to power mid-tier smartphones. Source: thehindu.com

- In May 2025, Xiaomi announced its first self-developed smartphone chip, XRING 01. The brand is successfully expanding and entering a new era of smartphone companies. An addition to the brand's decades of achievement is leveraging customer expectations. Source: gizmochina.com

- In February 2024, OnePlus announced the launch of the 12 series, which includes two Smartphoness- the OnePlus 12 and the OnePlus 12R. The flagship OnePlus 12 Smartphones starts at Rs 64,999 and is powered by the Snapdragon 8 Gen 3 chipset.

- In January 2024, Xiaomi launched the Redmi Note 13 series in India on January 4, 2024. As per reports, the upcoming handset will boast AMOLED displays with a 120Hz refresh rate. The Redmi Note 13 series will be driven by Qualcomm and MediaTek Dimensity 5G chipsets while having up to 12GB RAM.

- In September 2022, Apple announced the launch of the iPhone 14 and iPhone 14 Plus new, larger 6.7-inch size joins the popular 6.1-inch design, featuring a new dual-camera system, Crash Detection, a Smartphones industry-first safety service with Emergency SOS via satellite, and the best battery life on iPhone.

Segment Covered in the Report

By Operating System

- Android

- iOS

- Windows

- Others (Linux)

By Distribution Channel

- OEMs Stores

- Retailer

- E-Commerce

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting