What is the Air Filters Market Size?

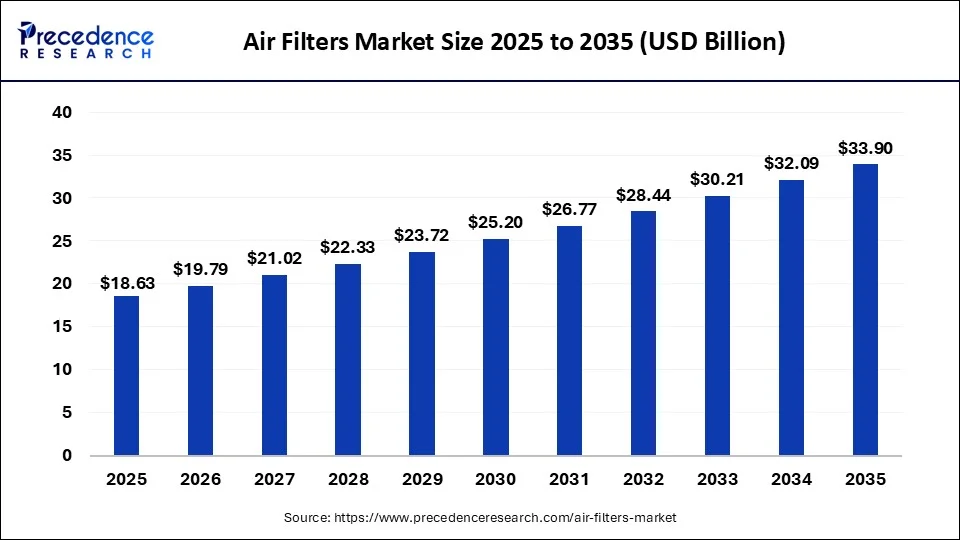

The global air filters market size is expected to be valued at USD 18.63 billion in 2025 and is anticipated to reach around USD 33.90 billion by 2035, expanding at a CAGR of 6.17% over the forecast period from 2026 to 2035.

Air Filters Market Key Takeaways

- The Asia-Pacific region is forecasted to have a significant CAGR between 2026 and 2035.

- The dust collectors type segment generated more than 28% of revenue share in 2025.

- The industrial end-user segment considering the majority of the market.

Strategic Overview of the Global Air Filters Indu

The air filters are a critical component of the HVAC system used in internal combustion engines to remove minute particulates. They are an essential component of air-moving devices like fan coils, terminal units, and air handlers. They clean the dirt that causes fan wheel imbalances and coil blockages. The principle is to protect people's health by keeping the ventilation system clean and ensuring a high level of hygiene (IAQ).

Furthermore, the increasing number of passenger cars on the roads, particularly in developing economies, the increased focus on environmental sustainability goals globally, the growth and expansion of the automotive industry, particularly in developing economies, and stringent government norms and regulations regarding pollution emission rate control parameters are the major factors driving the growth of the air filters market. Increasing airborne infections and rising pollution levels in urban areas are expected to propel the market.

Furthermore, rising health consciousness, as well as an improving standard of living and rising disposable income, are predicted to drive market expansion. Consumer health awareness is growing as the prevalence of airborne infectious diseases and viral infections rises. Furthermore, the emergence of several life-threatening epidemics such as Swine flu and Avian influenza has fueled the global air filter market growth over the last few decades.

However, over the forecast period, technical limitations related to air quality monitoring products are anticipated to impede market growth. Most portable and standalone air purifiers can only monitor air quality in a very small area and cannot collect data in three dimensions, which limits their acceptance to some extent.

The lockdown measures implemented by various governments in anticipation of the COVID-19 pandemic have increased sales of home products such as air purifiers, cleaning appliances, kitchen appliances, and water filtering equipment. Rising health consciousness has contributed to an increase in the global sales of air purifiers.

Artificial Intelligence: The Next Growth Catalyst in Air Filters

AI is transforming the air filters industry by shifting systems from passive filtration to autonomous, demand-controlled purification. Manufacturers are integrating AI-driven sensors that analyze real-time air quality data to automatically adjust fan speeds and filtration intensity, significantly reducing energy consumption. Furthermore, AI-powered predictive maintenance alerts users to filter saturation based on actual pollutant loading rather than fixed times, optimizing replacement cycles and reducing waste.

Air Filters Market Growth Factors

- The need for clean atmospheric air is the factor that propelled the market demand. The various factors are helping to drive the market are:

- Increasing health problems due to rising air pollution

- Stringent government policies to maintain air quality

- Growing usage of air filters in the hospitality as well as industrial sector.

Market Outlook

- Market Growth Overview: The air filters market is expected to grow significantly between 2025 and 2034, driven by the rising health awareness, strict regulations, and rapid urbanization and industrialization.

- Sustainability Trends: Sustainability trends involve biodegradable and bio-based media, transition to washable & reusable systems, and plastic-free & recyclable framing.

- Major Investors: Major investors in the market include HVAC and Filtration Leader, MANN+HUMMEL, Denso Corporation, MAHLE, and Cummins Inc.

- Startup Economy: The startup economy is focused on Sustainability, smart and IoT integration, and strong VC and government funding.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 18.63 Billion |

| Market Size by 2035 | USD 33.90 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.17% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Key Market Drivers

Increase in demand across the automotive industry to brighten the market prospect:

The demand for filter installation in all cars has increased significantly with the development of the automotive sector, which has an impact on that demand. The air filter's purpose is to keep dust, grime, and other environmental toxins out of the engine. The air filter develops dusty and clogged over time and must be updated. In addition, it has high usage in the automotive sector due to its advantages for aftermarket services. The main purpose of the filters is to clean internal combustion engines, increase efficiency, and protect car engine components from hazardous dust particles. An air filter is designed to strain the air that the engine consumes during a series of strokes.

Key Market Challenges

High initial installation and maintenance cost is causing hindrance to the market:

Filtration systems are becoming more popular as people become more concerned about the quality of their indoor air. However, one of the serious challenges hindering the market growth is the high maintenance cost of these filters. Filters are often highly expensive to replace, costing between $40 and $60, because they need to be changed and serviced every four to six months. Furthermore, many commercial and industrial end users choose low-cost filter equipment, which impedes the working environment in HVAC applications.

Key Market Opportunities

- These are the following factor which is likely to create opportunity over the forecast period.

- The rise in government initiatives as well as investments in clean air

- Rising Technological advancement in the air-conditioning system

- Increasing the installation of air filters promotes growth

Type Insights

On the basis of type, air filters are segmented cartridge filters, Dust collectors, HEPA filters, baghouse filters, and others (Mist filters). HEPA filters are expected to grow at an exponential rate over the forecast period due to rapid growth in the industrial, residential, and commercial sectors. It has the power to attract atoms using its implanted cutting-edge diffusion processes.

HEPA filters that remove airborne particles with an efficiency greater than 99.94% have the potential to gain traction in healthcare, automotive, commercial and residential buildings, and other applications.

Due to their capacity to control air quality, dust collectors dominate the market and account for more than 28% of revenue share in 2025. In addition to having a sizable air filter market share, MIS collectors, baghouse filters, and cartridge filters are also predicted to support market expansion.

End-User Insights

On the basis of end users, the air filter market is divided into residential, commercial, and industrial, with the industrial sector accounting for the majority of the market. Demand in the industrial sector is expected to rise significantly due to increased demand in manufacturing sites. These filters are used in the industrial sector to protect sensitive manufacturing processes by reducing the risk of microbiological and molecular contamination. As these filters play a dynamic role in all vehicles, the automotive industry captured the largest market share among industrial segments.

Air quality is an important consideration in many industrial applications. These applications need good air quality to maintain product integrity, reduce pollution, and, ultimately, enhance product safety. This excellent air quality is achieved by adding air filtering devices into industrial operations. Industrial air cleaning is the removal of solid particles and molecular pollutants from industrial operations to enhance the air quality inside a system or an environment. Due to the rising need for air purification in commercial and industrial structures, the commercial and industrial sectors account for significant shares.

Regional Insights

On the basis of geography, North America dominates the market owing to increasing pollution day by day and the high growth of the automotive industry in the region. Additionally, the American Government's increased use of preventive measures to address the problems created by air pollution from the manufacturing industry has increased demand for these filters.

The region in Asia-Pacific is anticipated to have the greatest CAGR because of the region's increasing industrialization and urbanization throughout China, India, and other nations. In China, India, and other nations, air pollution is being exacerbated by growing industrialization and urbanization. The government is implementing many steps to prevent air pollution. For instance, China introduced the largest air purifier in January 2018 and garnered favorable reviews from the nearby residential and business sectors.

Furthermore, because industrial expansion reaches its pinnacle in developing nations like China, India, Singapore, and Indonesia, the demand for air purifiers is anticipated to rise the demand, which is fueling the market expansion of the air filters market.

Indonesia plans to construct additional coal-fired power plants in Jakarta, which could exacerbate air pollution and lead to a rise in the use of air purifiers. Sales of Sharp's plasma cluster-equipped air purifier, which produces positive hydrogen ions and negative oxygen ions while inactivating some viruses, increased five-fold in Indonesia. Every month, Sharp sells close to 10,000 air purifiers using its plasma cluster technology. This is increasing the demand for proper-quality air filters.

The South Korean air filters market is rapidly developing, primarily owing to rising demand as consumers become more concerned about fine particles. A face mask with an integrated battery-powered air purifier was introduced by LG Electronics Co. Ltd. to provide filtered air both inside and outside.

U.S. Air Filters Market Trends

The U.S. market is defined by a rigorous push toward high-efficiency HEPA technology and the widespread integration of smart, IoT-enabled systems. Driven by post-pandemic health awareness and green building standards, the market is expanding rapidly across commercial, residential, and automotive sectors. Sustainability has become a core focus, with manufacturers prioritizing low-carbon and reusable materials to align with LEED certification requirements.

China Air Filters Market Trend

China's market is driven by growing health concerns and awareness, dominance of high-efficiency particulate air filters, and adoption of smart and connected systems. Innovation in multi-stage filtration technologies and the integration of AI are enhancing product performance. High levels of industrial activity, urbanization, and vehicle emissions are significant contributors to poor air quality, driving the need for efficient air filtration. Rising income levels in China are making premium, advanced air purifiers more accessible to a wider consumer base.

How did Europe Experience Notable Growth in the Air Filters Market?

Europe's convergence of stringent environmental directives and a heightened focus on public health. The regional leadership in technological innovation has birthed a new generation of smart, energy-efficient filtration systems integrated with IoT and sustainable materials. This demand is sustained by a powerful industrial base and widespread green building initiatives that mandate superior indoor air quality standards. Consequently, the European market has established itself as a global benchmark for high-performance, eco-friendly filtration solutions.

Germany Air Filters Market Trend

German sophisticated regulatory landscape and a national commitment to green building sustainability. Global leaders like MANN+HUMMEL and Freudenberg are driving growth through the integration of AI and IoT for predictive maintenance and optimized energy performance in industrial and commercial sectors. The market is increasingly prioritizing high-performance HEPA and activated carbon technologies to address both particulate matter and volatile organic compounds.

Value Chain Analysis of the Air Filters Market

- Raw Material and Component Supply: This foundational stage involves the sourcing of specialized materials such as fiberglass, activated carbon, non-woven fabrics, and increasingly, nanomaterials.

Key Players: Ahlstrom, Hollingsworth & Vose, 3M Company, and Toray Industries, Inc. - Filter Design and Manufacturing: In this stage, manufacturers convert raw media into finished products like HEPA, ULPA, or pleated filters using advanced pleating, bonding, and framing technologies.

Key Players: MANN+HUMMEL, Camfil AB, Donaldson Company, Inc., and Freudenberg Filtration Technologies. - Technological Integration (IoT & AI): This specialized stage involves the embedding of smart sensors and IoT modules into filtration units to enable real-time air quality monitoring.

Key Players: Honeywell International Inc., Siemens AG, Sensirion, and Johnson Controls. - Distribution and Sales Channels: Finished filters are distributed through a network of HVAC wholesalers, industrial suppliers, and increasingly, direct-to-consumer e-commerce platforms.

Key Players: Daikin Industries, Ltd., Parker Hannifin Corp, Grainger, and Amazon Business. - Installation and Post-Market Services: The final stage focuses on the integration of filters into residential, commercial, or industrial HVAC systems and the subsequent monitoring of their performance.

Key Players: Carrier Global Corporation, Trane Technologies, and Lennox International.

Top Companies in the Air Filters Market & Their Offerings:

- Camfil: A global leader in premium clean air solutions, Camfil contributes by providing ultra-high-efficiency HEPA filters and energy-saving HVAC systems for sensitive environments like hospitals and data centers. In 2025, they are scaling their predictive maintenance services through IoT sensors to reduce energy waste.

- MANN+HUMMEL: This company leads in automotive and industrial filtration, recently introducing eco-friendly filters that replace oil-based resins with plant-derived lignin to reduce carbon footprints. They contribute significantly to the market through advanced nanofiber cabin filters that capture ultra-fine particulates.

- CUMMINS, Inc.: Through its Fleetguard brand, Cummins provides high-durability air filtration for heavy-duty engines, focusing on NanoNet media that offers 99.99% efficiency. They are currently pioneering specialized cathode air filters essential for protecting hydrogen fuel cell stacks in zero-emission trucks.

- Donaldson Company, Inc.: Donaldson specializes in industrial air filtration and gas turbine systems, providing advanced dust collection and sterile air solutions for the life sciences sector. They contribute to the market via on-site integrity testing services and proprietary PowerCore filter technology.

- SPX Flow, Inc.: This company provides critical air treatment and filtration solutions for industrial manufacturing and food processing through its Airpel and Delair brands. They focus on delivering high-purity compressed air systems that ensure product safety and operational efficiency.

- Daikin Industries Ltd.: Daikin integrates high-performance air filters directly into its world-leading HVAC systems, utilizing advanced electrostatic filtration to remove indoor pollutants. They contribute by merging air conditioning technology with smart air purification for residential and commercial smart buildings.

- Parker Hannifin Corp: Through its Filtration Group, Parker offers a vast array of engine and industrial air filters, including specialized solutions for the aerospace and defense sectors. They are major contributors to the development of modular, high-capacity air intake systems for extreme environments.

- Absolent Group AB: Absolent focuses on the industrial sector by providing high-efficiency oil mist and dust filtration systems for metalworking and manufacturing plants. Their contribution lies in ensuring workplace safety and regulatory compliance through "clean-to-the-source" air purification technology.

- Purafil, Inc.: Purafil is a specialist in gas-phase filtration, providing chemical media that remove odors, corrosive gases, and volatile organic compounds from the air. They contribute to the market by protecting sensitive electronics in data centers and improving air quality in wastewater treatment facilities.

- Lydall Gutsche GmbH & Co. KG: As a part of the Lydall family, this company contributes high-performance non-woven needlefelt media used in industrial dust collection and baghouse filters. They focus on providing high-temperature and chemically resistant filter media for heavy industrial processes like cement and steel production.

- Freudenberg Filtration Technologies: A pioneer in multi-stage filtration, Freudenberg contributes through its Viledon and aeraulic brands, offering high-standard air filters for the automotive and energy sectors. In 2025, they are leading the shift toward fully recyclable filter frames and energy-rated HVAC filtration.

- American Air Filter (AAF Flanders): AAF Flanders provides a comprehensive range of air filtration products, from residential furnace filters to ultra-cleanroom HEPA systems. They contribute to the market through innovative "Energy-to-Filter" software that helps facility managers optimize filter life and energy costs.

- ANAND Group: This Indian automotive giant contributes to the market through its joint venture with MAHLE, producing high-quality air filters for the domestic and international automotive sectors.

Air Filters Market Companies

- Camfill

- MANN+HUMMEL

- CUMMINS, Inc

- Donaldson company, Inc.

- SPX flow, Inc.

- Daikin industries Ltd.

- Parker Hannifin corp.

- Absolent group AB

- Purafill, Inc.

- Lydall gutsche GmbH & co. Kg

- Freudenberg filtration Technologies SE & Co. Kg

- American air filters company Inc.

- ANAND Group

Recent Developments

- In October 2021,Dyson has introduced two new air purifiers that produce hot and cold air. This air purifier features HEPA 13 standard filtration that removes 99.95% of particles as small as 0.1 microns.

- In SEPT.2020,PURAFIL,.INC. installed 'PuraShield Smart 1000 portable filtration systems' to develop indoor air hygiene at Northwestern University Athletics and Recreation. It is a multi-stage original filtration solution that takes away nearly 99.99% of aerosols from the air, including bacteria and viruses.

- In April 2020,MANN+HUMMEL and its subsidiary Tri-Dim filter corporation began supplying HEPA filters in Ford respirators. These H13 HEPA Filters remove germs, microbiological contamination, and viruses from the supply air with consistency.

- In December 2020,Zeco Aircon unveiled a technique for air purification that can eliminate dangerous viruses, such as COVID-19, which is the source of SARS-CoV2. Zircon air purifiers can be utilised in standalone units and centralised ventilation systems and have been approved as an efficient anti-viral technology by the Centre for Cellular and Molecular Biology (CCMB).

Segments Covered in the Report

By Type

- Cartridge filters

- Dust collector

- HEPA filters

- Baghouse filters

- Others (Mist filters)

By End User

- Residential

- Commercial

- Industrial

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content