What is the Air Purifier Market Size?

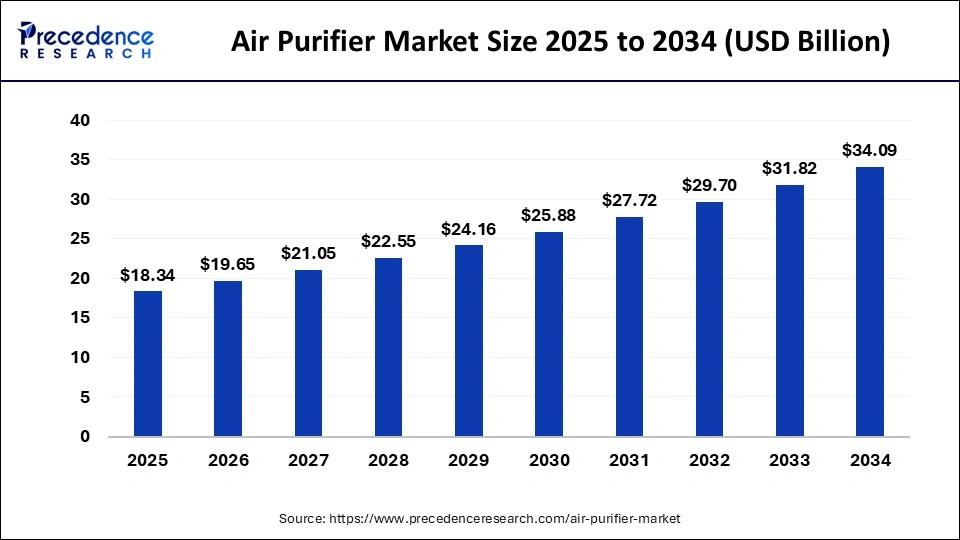

The global air purifier market size is accounted at USD 18.34 billion in 2025 and predicted to increase from USD 19.65 billion in 2026 to approximately USD 36.26 billion by 2035, expanding at a CAGR of 7.05% from 2026 to 2035

Market Highlights

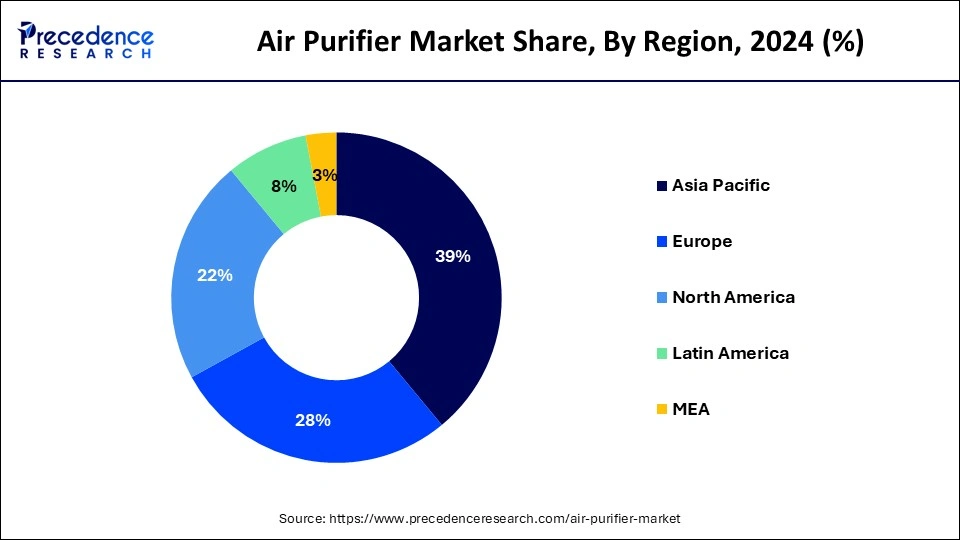

- Asia Pacific dominated the global market with the largest market share of 39% in 2025.

- By technology, HEPA technology segment captured the largest market share in 2025.

- By application, the commercial application segment contributed the biggest market share in 2025.

Air Purifier Market Trends

- Growing urbanization and a shift towards a greener lifestyle fuel the growth of the market.

- The growing pollution in the city amid rising environmental concerns increases the demand for the product.

- Technological advancement like HEPA filters and multi-function devices with combined features fuels the growth.

- Integration of AI and IoT due to the growing demand for smart homes fuels the adoption of connected purifiers.

How is AI contributing to the Air Purifier Industry?

Artificial intelligence is changing the idea of air purifiers into a smart system that constantly reads, analyses, and acts in response to pollution. High-level algorithms also vary the airflow, filtration strength, and energy consumption on the fly. Predictive models are models that are used to predict spikes of pollution based on the past and the environment. Smart maintenance notifications prolong the life of the filters and make the indoor air quality steady.

Air Purifier Market Growth Factors

Increasing prevalence of airborne diseases coupled with rising pollution levels in urban areas contribute as the prime factors for the air purifier market growth. Moreover, increasing disposable income, improved standard of living, and rising health consciousness are the other key factors expected to propel the growth of the industry. Increasing requirement for the adoption of air pollution control equipment, specifically in the developing countries anticipated to prosper the demand for air purifiers in the coming years.

As per a recent survey, clean air is of the utmost importance for the consumers to avoid various health problems. Besides this, growing industrialization along with rising construction & mining activities in developing countries prominently contributes to the air pollution that in turn expected to propel the demand for air purifier products over the analysis period. Availability of surplus natural resources in the developing and under-developed regions offers attractive opportunities for the industrial sector to raise their manufacturing facility.

Growing industrialization, stringent environmental protection laws, and awareness for controlling pollution are the important factors projected to influence positively on the market growth especially in the United States over the forecast period. The High-Efficiency Particulate Air (HEPA) technology segment projected to dominate the United States market over the analysis period as it is proved as the most effective technology for trapping the harmful airborne particles. The United States is projected as the most polluted country across the globe due to significant presence of industries as well as increased traffic population in the region. Transportation sector was examined to contribute nearly 20% for the overall pollution in the region. In the wake of same, government has issued stringent regulations to curtail the rising air pollution.

Market Outlook

Industry Overview

- The industry spans component suppliers, filters, fans, sensors, UV modules, OEMs producing finished appliances, HVAC integration partners, retailers, and service providers offering maintenance and filter-replacement subscriptions. Product differentiation is based on filter technology true HEPA, electrostatic, activated carbon, photocatalytic, sensor accuracy PM2.5, VOCs, COâ‚‚, noise and energy profiles, smart connectivity, and certifications.

- Distribution channels include e-commerce, big-box retailers, specialty appliance stores, and B2B procurement for institutional buyers. Aftermarket services filter replacements, warranty support, and air-quality consulting create recurring revenue and customer in. Regulatory and standards bodies influence product acceptance by defining performance and safety benchmarks.

Sustainability Trend

- Sustainability trends in the air-purifier market focus on lowering energy consumption, reducing waste from disposable filters, and sourcing recyclable or longer-life filter media. Manufacturers are developing washable or regenerable filters, improving motor and fan efficiency, and optimizing airflow design to deliver higher Clean Air Delivery Rates per watt. Packaging reductions, use of recycled plastics for housings, and take-back or filter-recycling programs are gaining traction.

- At the same time, lifecycle assessments are being used to compare the net environmental benefits of operating a purifier, reduced health impacts, and possibly reduced medication use against embodied emissions and disposal impacts, guiding product design toward materials and service models that minimize total environmental footprint.

Major Investment Themes

- Investors are targeting sensor and IoT-enabled platforms that combine air quality monitoring with actionable insights, low-power motors and aerodynamic designs that improve energy efficiency, advanced filter materials, e.g., high-efficiency activated carbons, nanofiber HEPA, and scalable service models such as filter-as-a-service subscriptions.

Sustainable Ecosystems and Startups

- Sustainable ecosystems combine materials innovation, recyclable or regenerative media, local recycling and refurbishing networks, certifying bodies that verify claims, and distribution partners that enable subscription and take-back services. Startups are active in niche areas: low-energy, ultra-quiet residential units; plug-and-play classroom air purifiers; sensors and analytics platforms that convert IAQ data into actionable HVAC adjustments; and regenerative filter technologies that extend lifetime and reduce waste.

- Partnerships between startups and building-management or facility-services companies can scale pilots into recurring contracts, while collaborations with NGOs and public-health programs can open procurement paths for schools and clinics in underserved regions.

Market Outlook

- Industry Growth Overview: The industry is growing at a faster pace due to increased awareness of smart interconnected energy-saving indoor purification systems.

- Sustainability Trends: Producers are moving towards environmentally friendly materials, reusable filters, and designs that are also energy efficient and environmentally friendly.

- Major investors: Uncork Capital, Sequoia Capital China, Social Alpha, First Inflection, and C-CAMP support innovative purifier brands.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 18.34 Billion |

| Market Size in 2026 | USD 19.65 Billion |

| Market Sizeby 2035 | USD 36.26 Billion |

| Growth Rate From 2026 to 2035 | CAGR 7.05% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Technology, Product, Mounting Type, CADR, Coverage Area, Application,Sales Channel, and region |

| Regional Scope | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Segment Insights

Technology Insights

HEPA technology segment captured the largest market share in 2025 and projected to exhibit substantial growth over the analysis period. HEPA filters are extremely efficient in trapping the airborne particles such as smoke, pollen, dust, and bio-contaminants.

On the other hand, activated carbon filters poses exceptional trapping capacity because of larger surface area of carbon granules that makes them very effective in trapping fumes, gases, and odors. Even so HEPA filters are significantly effective in trapping airborne particles they to trap odors, gases, and chemicals. Consequently, activated carbon filters are largely used in combination with HEPA filters to enhance the efficiency of the air purifiers.

Application Insights

The commercial application segment contributed the biggest market share in 2025, because of rising demand of air purifiers in educational institutions and office spaces. Commercial applications include hospitals, offices, shopping malls, hotels, educational centers, movie theaters, conference centers, and other recreational facilities. Air purifiers are installed at commercial spaces in account to maintain the indoor air quality. Furthermore, rapid urbanization across the globe expected to propel the growth of the segment over the forecast period.

Besides this, the residential application anticipated to witness the fastest CAGR over the analysis period. Residential applications include residential properties and small & large scale homes. The Asia Pacific anticipated to exhibits the fastest growth in the residential application over the forecast timeframe due to increasing pollution levels along with rapid urbanization in the developing countries that include India and China.

Key Companies & Market Share Insights

The global air purifier industry is highly diverse in nature because of the presence of several international and regional players in the market. Major market players mainly focus towards the new product development and enhancement. In the wake of same, they invest prominently in the research & development (R&D) activity that has led to the invention of several innovation products. For instance, integration of Internet of Things (IoT) and artificial intelligence (AI) in the air purifier to convert them into smarter and advanced product is one of the prominent leap in the air purifier technology.

Regional Insights

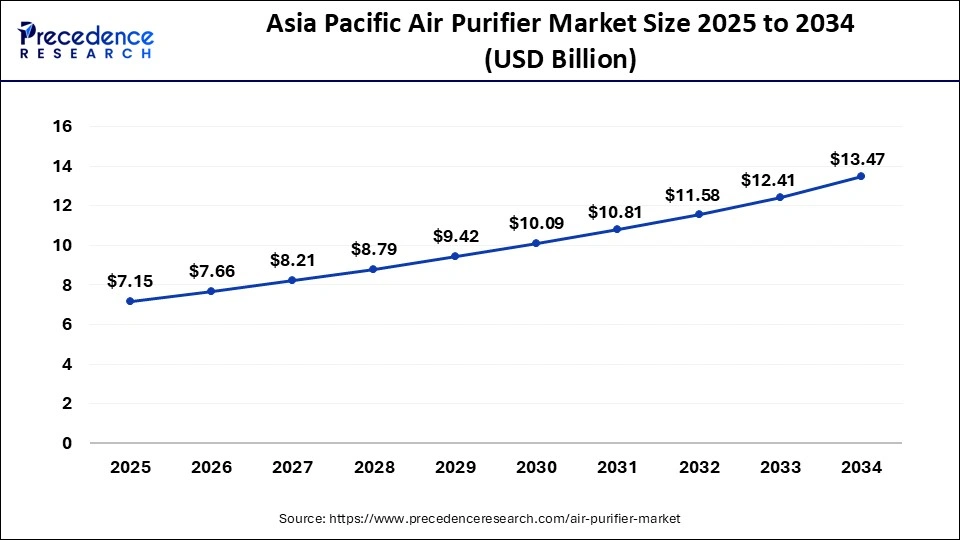

Asia Pacific Air Purifier Market Size and Growth 2026 to 2035

The Asia Pacific air purifier market size accounted for USD 7.15 billion in 2025 and is predicted to be worth around USD 14.37 billion by 2035, rising at a CAGR of 7.23% from 2026 to 2035.

The Asia Pacific fastest growing regional market in 2025 with share of 39%. In addition, the region expected to lead the global market on account of various factors that include rising industrialization & rapid urbanization along with rising population with increased disposable income. Apart from this, the region has prominent reserve of natural resource that attracts industries to establish their manufacturing facility in the region, thereby escalating the air pollution in the region that in turn triggers the demand for air purifiers.

Air pollution has become a major concern in the region, affecting hundreds of people and the environment. The countries with bad air quality are considered very unsafe, with the annual mean concentration of PM2.5 exceeding the recommended levels.

According to the article published by IQAir in March 2024, Bangladesh recorded a PM level of 79.9 micrograms per cubic meter, Pakistan has a PM level of 73.7 micrograms per cubic meter, India has a PM level of 54.4 micrograms per cubic meter, Tajikistan has a PM level of 49 micrograms per cubic meter, and Burkina Faso has a PM level of 46.6 micrograms per cubic meter.

On the other side, North America projected to maintain its significant market share in the upcoming years. The market has grown at a rapid pace because of notable contribution from technological advancement and numerous applications.

Additionally, the key players operating in the market are increasingly focused on adopting strategic initiatives like new product launches, acquisitions, and mergers to expand their presence and gain strategic benefits over competitors, driving the expansion of the air purifier market. For instance, in October 2024, Camfil USA, a global leader in air filtration solutions, announces the launch of the Absolute VG V-Bank HEPA filter family, an innovative solution for industries requiring high air purity, including life sciences, healthcare, and microelectronics. The Absolute VG HEPA Family combines lightweight construction, durability, and energy efficiency, now available with both polyurethane seamless and gel seal gaskets.

Can Latin America Clean the Air Without Breaking the Bank?

Latin America's air-purifier market reflects a balance between rising urban pollution concerns and strong sensitivity to price. Brazil and Mexico lead in scale with urban centres that experience particulate pollution and demand for residential and small-office purifiers; smaller markets follow with modest adoption focused on affordability. Institutional demand for schools, clinics, and offices grows where public-health programs or corporate wellness initiatives exist, but wider adoption is constrained by income levels and availability of reliable power and maintenance services. Cost-effective units with robust filters, low energy draw, simple sensor interfaces, and affordable filter-replacement programs are the most appropriate market fit. Local assembly, regional distribution partnerships, and subsidized procurement for public institutions can accelerate access while keeping lifecycle costs manageable.

Brazil Air Purifier Market Trends

Brazil's market can support a broader product mix including mid-range smart units and B2B solutions for institutions; Mexico's proximity to North American suppliers aids availability of higher-spec products; other countries may require low-CAPEX models and community-level deployment strategies e.g., schools or health centers to maximize public-health impact.

Will Middle East & Africa Prioritize Clean Indoor Air as Climate Risks Rise?

The Middle East & Africa region encompasses markets with divergent drivers: affluent Gulf states and some North African urban centres show demand for premium air-purification systems that address dust, sand intrusion, and industrial pollutants, often integrated into smart-home and building-management systems. Conversely, many Sub-Saharan African countries face infrastructural hurdles, intermittent power, limited after-sales networks, and constrained purchasing power that favor rugged, low-energy designs and simple maintenance models. Air purifiers in healthcare and educational settings can deliver high public-health value where deployed, but scaling requires innovative financing, leasing, service contracts, local manufacturing or assembly to reduce costs, and training for maintenance. Climate-related events dust storms, seasonal biomass burning, may create episodic demand spikes; durable, low-maintenance units with filter-supply logistics are best positioned for impact.

Saudi Arabia Air Purifier Market Analysis

Saudi Arabia adopts a high-end integrated IAQ solution across residential and commercial buildings, while lower-income countries benefit most from robust, low-energy units deployed in public institutions with centralized maintenance and supply chains often supported by public-private initiatives or donor-funded health programs.

| Country | Approx Revenue |

| South Korea | $ 2.96 billion (for 2021) |

| Sweden | $ 1 billion |

| China | $ 9 billion total revenue |

Value Chain Analysis of the Air Purifier Market

- Raw Material Procurement: The procurement of raw materials enhances the sensor reliability in terms of high-purity silicon wafers and specialty gases.

Key players: 3M, Toray Industries, Ahlstrom-Munksjö, Activated Carbon India - Wafer Fabrication: Intelligent microchips that will be used to detect air accurately and control the purifier responsively will be facilitated by the process of wafer fabrication.

Key Players: TSMC, Samsung, Intel, GlobalFoundries, SMIC - Photolithography and Etching: Photolithography and etching enhance the precision of the sensor by creating complex and stable patterns of microscopic circuits.

Key players: ASML, Applied Materials, Tokyo Electron (TEL), Nikon, Lam Research - Doping and Layering Processes: Doping and layering increase the electrical performance and provide the consistent, sensitive, and long-term functionality of the sensor.

Key Players: Applied Materials, Lam Research, Tokyo Electron (TEL), Veeco - Assembly and Packaging of Air Purifier: Testing sensors are installed in purifiers through assembly and packaging to provide protection, durability, and smooth operation.

Key players: ASE Technology (ASE), Amkor Technology, JCET Group, SPIL

Top Air Purifier Market Companies and their Offerings

- Honeywell International, Inc.: Provides residential, commercial, and industrial air purification systems with various filtration technologies to the indoor environment to make it cleaner.

- IQAir North America, Inc.: Makes high-performance smart air purifiers, which have sensors, can be connected to the app, and have advanced filtration to provide high-quality indoor air.

- LG Electronics, Inc.: Sells sleek, noisy, intelligent air purifiers that are home appliances that make the living spaces comfortable and healthier.

Other Air Purifier Market Companies

- Aerus LLC

- Unilever PLC

- Daikin Industries, Ltd.

- Panasonic Corporation

- Koninklijke Philips N.V.

- Whirlpool Corporation

- Hamilton Beach Brands, Inc.

Recent Development

- In July 2025, an Omani startup developed an innovative and environmentally sustainable air purification device that uses natural components such as natural algae to improve air quality, particularly in enclosed spaces like vehicles. The device was developed by a team of students and researchers aiming to provide a smart, effective, and locally adaptable solution to air pollution and heat-related hazards.

- In July 2025, Equator Advanced Appliances unveiled the APSH 430 W Air Purifier + Humidifier, a compact dual-function system designed to improve indoor air quality in homes with pets, allergens, and everyday environmental irritants. Combining HEPA filtration, UV-C sterilization, and negative ion generation, this 2-in-1 model offers broad-spectrum purification and moisture enhancement for spaces up to 431 square feet.

- In July 2025, Blueair, the global leader in air wellness, announced a strategic partnership with The Class, the transformative movement and mindfulness practice. As the official air wellness partner for The Class's flagship studio, Blueair will provide clean, fresh air to every class.

- In October 2024, Philips, under Versuni India, introduced a new range of air purifiers designed to offer both silent and powerful air purification. The new models, including the 3200, 4200 Pro, and 900 Mini, are built to deliver cleaner air while maintaining a quiet, undisturbed environment. These "Silent Protectors" come with advanced features aimed at improving indoor air quality and are now available in India.

- In April 2025, as global demand for indoor air safety reaches new heights in the post-pandemic era, COTELL trusted name in hospitality technology with over 21 years of industry experience, officially unveiled the COTELL+ Air Purifier series. Leveraging proprietary AOP-KF Registered technology, the new product line delivers a comprehensive and intelligent air purification solution tailored for hospitality, healthcare, education, offices, and residential environments.

- In November 2024, the Hero Group-owned smart devices maker Qubo launched two new models of smart air purifiers, the Q600 and Q1000, for larger living spaces. These air purifiers can be monitored and controlled via Qubo app, and through voice controls like Alexa and Google Assistant.

- In November 2024, Dyson launched a new air purifier, the Dyson Purifier Hot plus Cool Gen 1, in India. The announcement comes amid growing air pollution, with Delhi, Noida, Ghaziabad, and other parts of the National Capital Region (NCR) reporting low visibility from smog and “very poor” AQI levels. The highlight of this air purifier is that it is a relatively affordable option in Dyson's line-up, boasting room heating and cooling technology.

Segments Covered in the Report

By Technology

- Activated Carbon

- High Efficiency Particulate Air

- Ionic Filters

- Others

By Mounting Type

- Fixed

- Portable

By Product Type

- Upper Air

- In-duct

- Self Contained/Standalone

- Others (Coil & Drain Pans, etc.)

By CADR

- Smoke

- Dust

- Pollen

By Coverage Area

- Below 250 Sq. Ft.

- 250-400 Sq. Ft.

- 401-700 Sq. Ft.

- Above 700 Sq. Ft.

By Application

- Residential

- Commercial

- Industrial

By Distribution Channel

- Online

- Company Owned Websites

- e-Commerce Websites

- Offline

- Hypermarkets/

- Supermarkets

- Specialty Stores

- Others (Retail Stores, etc.)

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting