Microelectronics Market Size and Forecast 2025 to 2034

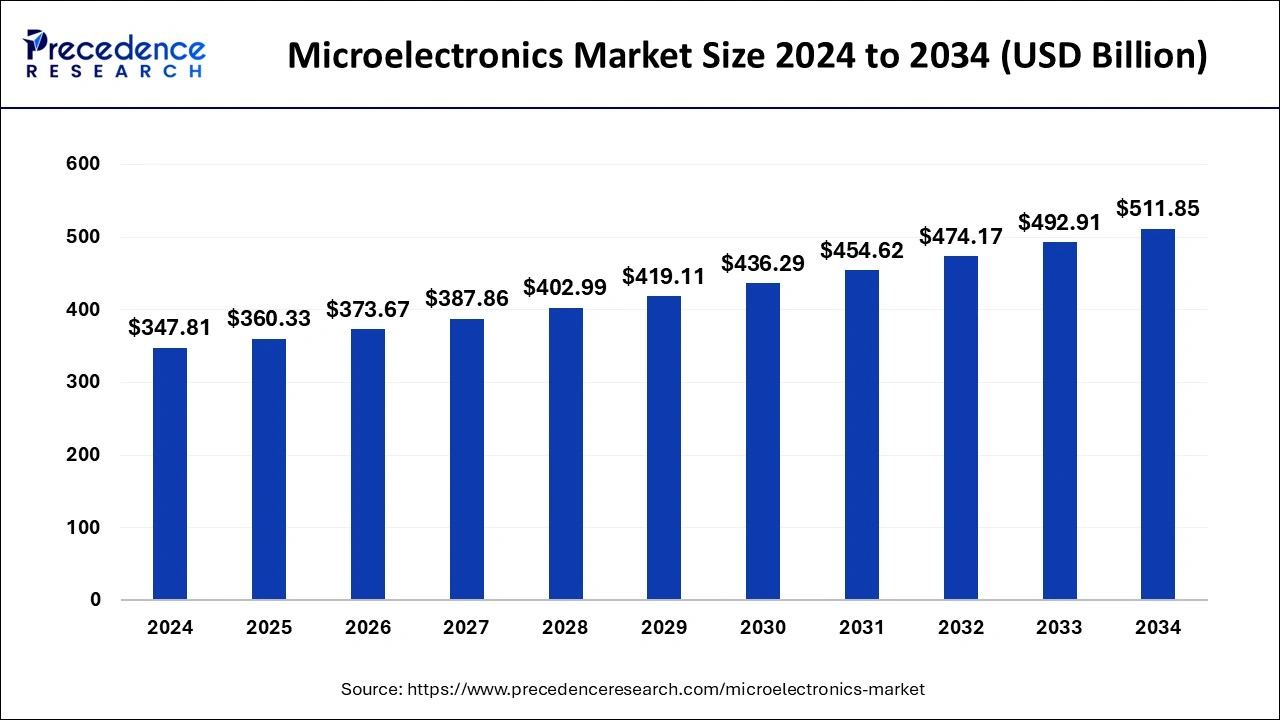

The global microelectronics market size was calculated at USD 347.81 billion in 2024 and is predicted to reach around USD 511.85 billion by 2034, expanding at a CAGR of 3.94% from 2025 to 2034. The rising trend of IoT devices among the people has boosted the growth of the microelectronics market.

Microelectronics Market Key Takeaways

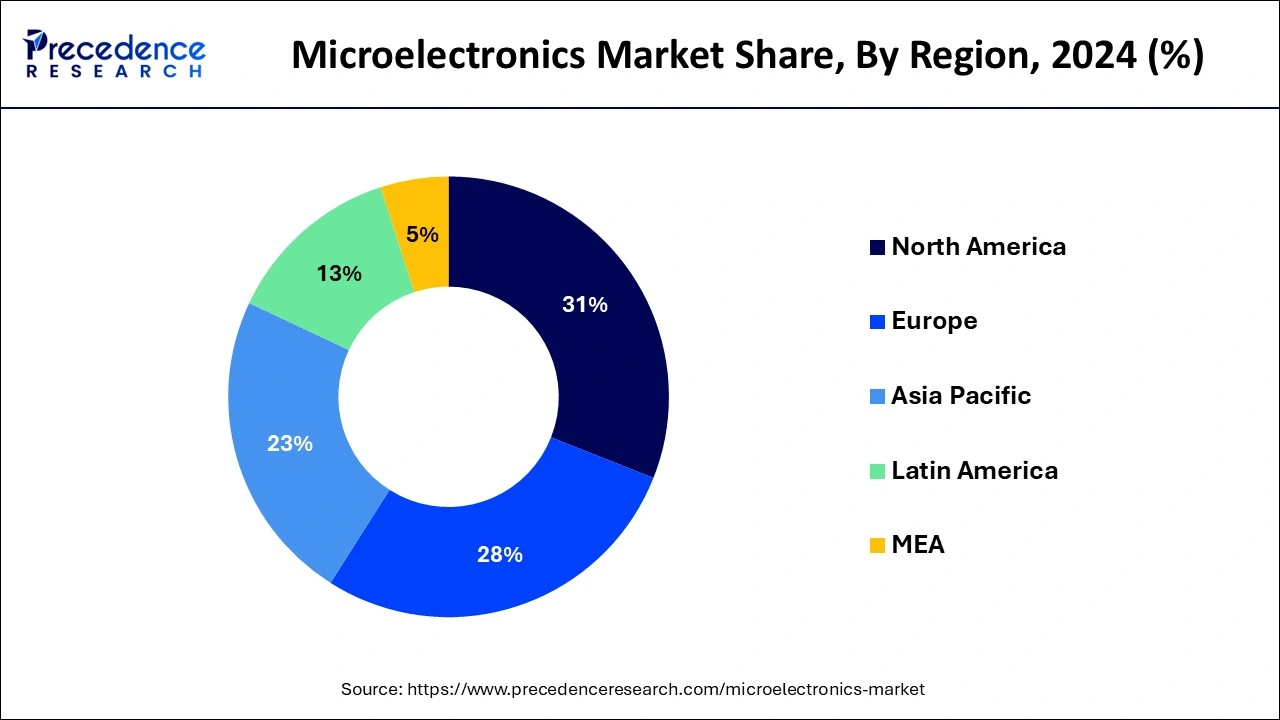

- North America dominated the microelectronics market in 2024.

- Asia Pacific is projected to grow with the highest CAGR during the forecast period.

- By technology, the semiconductors segment led the market in 2024.

- By technology, the integrated circuits segment is expected to grow with the highest CAGR during the forecast period.

- By product type, the digital integrated circuits segment held the dominant share of the market.

- By product type, the analog integrated circuits segment is likely to witness the highest growth rate during the forecast period.

- By application, the automotive segment held the largest market share in 2024.

- By application, the consumer electronics segment is expected to grow with the highest CAGR during the forecast period.

- By fabrication process, the CMOS segment held the largest share of the market.

- By fabrication process, the FinFET segment is anticipated to witness the highest growth rate during the forecast period.

- By packaging technology, the Ball Grid Array (BGA) segment generated the largest market revenue share in 2024.

- By packaging technology, the Quad Flat Package (QFP) segment is expected to witness significant growth in the forecast period.

What is the role of AI in Microelectronics?

The adoption of AI in semiconductor and electronics industry has led to numerous developments in recent times. The integration of AI in microelectronics sector helps in designing of GPUs, TPUs, and custom AI accelerators. Also, AI has the capability to detect defects in chips along with its capacity to automate several processes in the manufacturing plant. Moreover, AI can help in enhancing the testing of microelectronic devices coupled with its application in improving packaging. Further, AI has been integrated in various microchips that are used in consumer electronics such as smartphones and laptops to enhance their function ability for performing critical tasks. Thus, AI is playing a crucial role in boosting the growth of the microelectronics market.

- In November 2024, Ansys announced to integrate NVIDIA Modulus AI framework for semiconductor designing. This framework helps in designing GPUs, HPC chips, smartphone processors, and advanced analog integrated circuits.

U.S. Microelectronics MarketSize and Growth 2025 to 2034

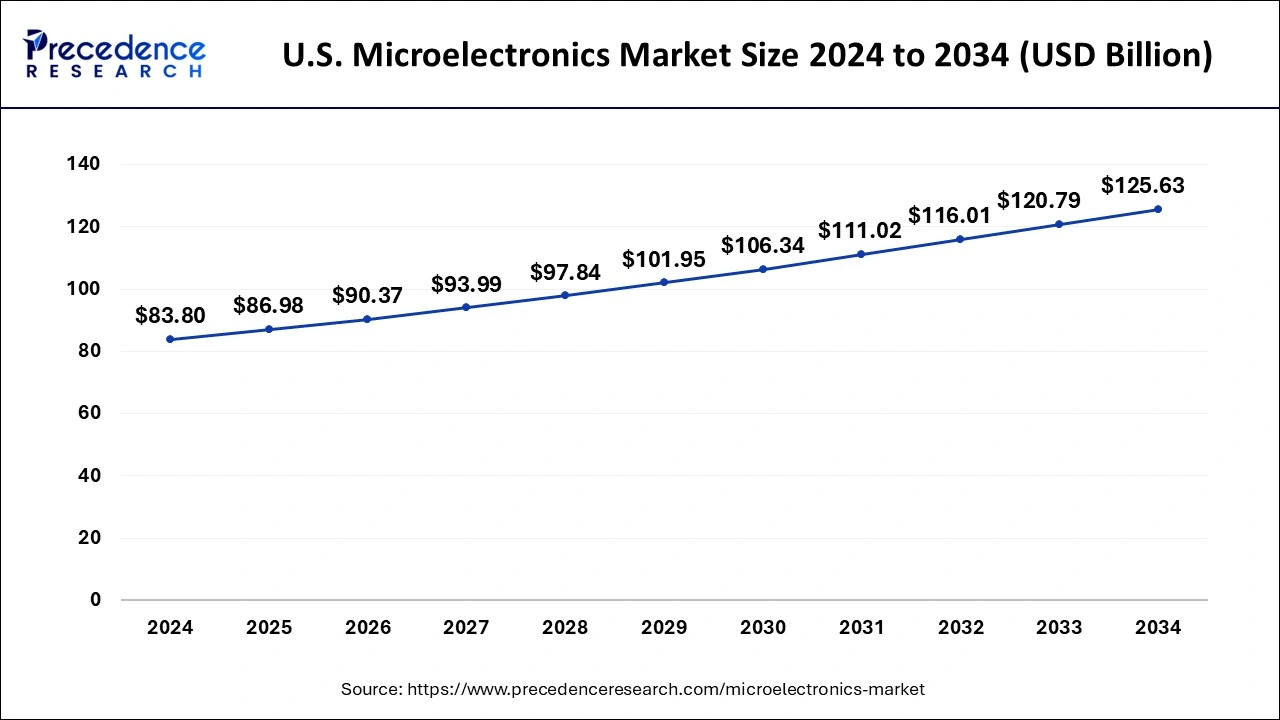

The U.S. microelectronics market size was exhibited at USD 83.80 billion in 2024 and is projected to be worth around USD 125.63 billion by 2034, growing at a CAGR of 4.13% from 2025 to 2034.

North America dominated the microelectronics market. The rising developments in healthcare industry has increased the demand for semiconductors for developing medical devices such as X-ray machines, CT scanners, MRI machines and some others has boosted the market growth. Also, the presence of well-established automotive industry has increased the application of microprocessors and memory devices, thereby driving the market growth.

In North America, there are several aerospace companies such as Boeing, Lockheed Martin, Northrop Grumman, BAE Systems and some others that increases the demand for microelectronics that in turn drives the market growth. Moreover, the presence of various microelectronics companies in U.S. and Canada such as AMD, Nvidia, Qualcomm, Texas Instruments and some others is expected to proliferate the growth of the microelectronics market in this region.

- In November 2024, Qualcomm launched Snapdragon 8 Elite in the U.S.. Snapdragon 8 Elite is an AI-enabled processor designed for flagship smartphones.

Asia Pacific is projected to grow with the highest CAGR during the forecast period. The rising emphasis on smart city initiatives by government of several countries such as India, China, South Korea, Japan and some others has increased the demand for semiconductors, thereby driving the market growth. Also, the advancements in the robotics industry along with rapid developments in industrial sector and numerous government investment in semiconductor industry has positively impacted the industrial expansion.

China leads the regional market with the highest revenue share. China is the world's largest semiconductor consumer, are growing producer of assembly and packaging. China has made significant progress in chip production. Government initiatives and support for the growth of the semiconductor industry, including investments in research and development, fuel the market expansion. Well-established supply chain environments of China support the growth of the microelectronics industry, including innovation and development initiatives.

The consumer electronics industry of Asia Pacific is highly developed due to presence of several market players such as Sony, Xiaomi, Toshiba, Asus, Lenovo and some others which increases the demand for processors and chips, thereby boosting the industry in a positive direction. Furthermore, the availability of raw materials coupled with presence of several market players such as TSMC, Infineon Technologies AG, Samsung Electronics Co. Ltd., SK Hynix Inc. and some others is accelerating the growth of the microelectronics market in this region.

- In November 2024, the government of Japan announced to invest around US$ 65 billion. This investment is done for developing the semiconductor and AI industry across the nation.

European Leadership in "More than Moore" Components Foster Microelectronic Manufacturing

Europe is expected to witness notable growth in the forecast period. Europe is the leader of advanced lithography equipment production, which is essential for chip manufacturing, including EUV equipment. Well-established industries like consumer electronics, automotive, healthcare, and aerospace & defense are driving high-volume adoption of microelectronics in Europe. Regions' strong focus on technologies like AI and 5G is transforming innovation and development of microelectronics.

Germany is leading the regional market due to factors like self-determinedly amidst geopolitical tensions. Government support and investments in research and development are fueling the German market. Germany is playing a major role in the "More than Moore" components and manufacturing of EUV lithography equipment. The strong research and development sector of Germany contributes to the market growth.

Market Overview

Electronics has a subsection called microelectronics. Microelectronics is the production of a very small electronic devices and gadgets. This usually refers to micrometer scale. Semiconductor materials are commonly used in microelectronic devices. Many elements of traditional electronic design have microelectronic counterparts. Due to the very small size of the devices, innovative wiring techniques such as wire interconnects are frequently utilized in microelectronics. This method necessitates specialist equipment and is costly in nature.

The size of microelectronic devices and gadgets has shrunk as technologies have developed. At lesser scales, inherent network features like linkages may have a greater impact. The purpose of the microelectronics design engineer is to find solutions to correct for or limit negative impacts while providing thinner, quicker, and less expensive devices. Electronic design automation software now plays a significant role in microelectronics design.

Microelectronics have wide range of applications in diverse sectors. Microelectronics parts and components are used in various gadgets and devices such as smartphones, laptops, and televisions. All these devices and gadgets are essential for the luxurious lifestyle of people. Hence, this factor is driving the growth of global microelectronics market.

Microelectronics Market Growth Factors

- The growth and expansion of electronics industry is also paving way for the growth of global microelectronics market.

- The government of developed and developing economies is taking constant efforts for the expansion of semiconductor industry.

- Government of several regions are providing tax benefits such as subsidies and tax incentives to the manufacturers of microelectronics.

- Major market players are adopting unique strategies such as joint venture, partnership, collaboration, merger, acquisition, and business expansion for enhancing their market position in the market.

- Microelectronics parts and components are used in various gadgets and devices such as smartphones, laptops, and televisions.

- Rising application of microelectronics in aerospace sector.

- Technological developments in the microelectronics industry.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 360.33 Billion |

| Market Size in 2034 | USD 511.85 Billion |

| Largest Market | North America |

| Growth Rate from 2025 to 2034 | CAGR of 3.94% |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Product Type, Application, Fabrication Process, Packaging Technology, Geography |

Market Dynamics

Drivers

Technological Developments and Other Factors Boosts the Market Expansion

The technological advancements in semiconductor sector in terms of various devices and gadgets are also driving the growth of global microelectronics market. Initially, semiconductor devices use to come in bigger size. But as technological developments are taking place, the size of semiconductor devices and gadgets is decreasing. This factor is supporting the growth and development of global microelectronics market as microelectronics devices are semiconductor materials.

Furthermore, government of emerging and established nations is heavily investing in new and advanced technologies such as industry 4.0, blockchain, and artificial intelligence. This factor is offering new opportunities for expansion of microelectronics in the global market. The government are also collaborating with market players for the development and launch of new microelectronic devices and gadgets.

Microelectronics are lightweight and low cost in nature. That's the reason microelectronics are in demand on a large scale. The technologies such as artificial intelligence and internet of things are providing lucrative opportunities for the growth of global microelectronics market over the forecast period. In addition, other technologies such as next generation sequencing, hybrid cloud storage, and wireless charging are creating growth prospects for microelectronics in the global market.

Restraints

High Capital Investment and Negative Effects Hinders the Industry

The microelectronics industry faces several problems in their day-to-day operations. Firstly, the manufacturing cost of microelectronic devices are growing rapidly due to rising labor costs and volatility in raw material prices. Secondly, microelectronics devices are prone to extreme humidity and heat. Thus, the above-mentioned factors is expected to restrain the growth of the microelectronics market during the forecast period.

Opportunity

Discovery of New Materials coupled with Advancements in New device technologies to Shape the Future

The microelectronics industry is rapidly growing due to the scientific advancements across the world. Recently, scientists have discovered new materials such as piezoelectric nanostructures and terahertz plasmas for microelectronics sector. Also, numerous technological advancements are taking place in devices such as spin lasers, embedded magnetic memories, and biocompatible microelectronics and some others. Thus, the discovery of new materials and rapid advancements in devices is expected to create numerous growth opportunities for the market players in the upcoming years to come.

Technology Insights

The semiconductors segment led the market. The rising trend of electronic devices has increased the demand for semiconductors, thereby driving the market growth. Also, there are several government initiatives aimed at developing the semiconductor manufacturing sector along with rapid investment by startup companies for manufacturing high-grade semiconductors has boosted the market expansion. Moreover, the rising application of semiconductors in various industries such as aerospace, automotive, healthcare and some others coupled with advancement in wireless communication technology is expected to drive the growth of the microelectronics market.

The integrated circuits segment is expected to grow with the highest CAGR during the forecast period. The growing proliferation of smartphones across the world has increased the use for ICs for several applications such as power management, signal processing, sensor integration, data transmission and some others, thereby propelling the market growth. Also, the rising demand for analog ICs for transmitting light and sound along with numerous applications of ICs in autonomous vehicles is boosting the industrial expansion. Moreover, the growing application of ICs in several industries such as aerospace, healthcare, telecommunication and some others is projected to drive the growth of the microelectronics market.

Product Type Insights

The digital integrated circuits segment held the dominant share of the market. The rising demand for scientific calculators has increased the application of digital integrated circuits, thereby driving the market growth. Also, digital integrated circuits are integrated in microcontrollers for performing complex tasks along with the rising use of these circuits in computers has boosted the market expansion. Moreover, there are several advantages of these ICs such as small size, high speed, superior reliability, enhanced speed, cost-effectiveness and some others that further accelerates the growth of the microelectronics market.

The analog integrated circuits segment is likely to witness the highest growth rate during the forecast period. The rising use of analog ICs in audio amplifiers to increase the amplitude of weak analog signals has boosted the market growth. Also, the growing use of analog ICs for power management and data conversion along with the integration of these ICs in advanced sensors is driving the industry in a positive direction. Moreover, there are various advantages of analog integrated ICs such as high accuracy, enhanced speed, less bandwidth, less power consumption and some others is expected to propel the growth of the microelectronics market.

Application Insights

The automotive segment led the industry. The growing application of semiconductor in automotive sector has driven the market growth. Also, the integration of LEDs in modern vehicles along with advancements in ADAS technology is boosting the industrial expansion. Moreover, the rising application of advanced sensors such as proximity sensors and accelerometer sensors in vehicles coupled with growing demand for application-specific integrated circuits (ASICs) and electric control units (ECUs) is driving the growth of the microelectronics market.

The consumer electronics segment is expected to grow with the highest CAGR during the forecast period. The growing demand for computers has increased the application of microprocessors for converting complex tasks into simpler ones is driving the market growth. Also, the rising use of chips in smartphones and smart gadgets for enhancing communication, data storage, information display and some others has boosted the market expansion. Moreover, the increasing application of microprocessors in television and tablets coupled with the surge in demand for game controllers and wireless remote is driving the growth of the microelectronics market.

Fabrication Process Insights

The CMOS segment held the largest share of the industry. The rising application of CMOS for manufacturing processors, memory chips and some others is driving the market expansion. Also, these semiconductors are used in the production of electronic circuits along with its rapid adoption of in smartphones and digital cameras has boosted the industrial growth. Moreover, there are various advantages of complementary metal oxide semiconductors such as low power consumption, high compatibility, fast image acquisition, easy integration, enhanced noise immunity and some others that is expected to propel the growth of the microelectronics market.

The FinFET segment is anticipated to witness the highest growth rate during the forecast period. The rising application of FinFET in mobile devices for improving battery life, enhancing processing speed, lowering power consumption and some others is driving the market growth. Also, the growing use of transistors in various devices such as laptops, tablets, HUDs, computers and some others has boosted the industrial expansion. Moreover, FinFET comes with several advantages such as less switching voltage, low power consumption, low static leakage current, fast switching speed, better channel control and some others is projected to accelerate the growth of the microelectronics market.

Packaging Technology Insights

The Ball Grid Array (BGA) segment dominates the market in 2024, driven by its use in high-speed and compact devices. The Ball Grid Array (BGA) packages offer high-density interconnections and high thermal performance, allowing efficient heat dissipation and reliability. The Ball Grid Array (BGA) packaging technology is mainly used in consumer electronics, automotives, industrial control systems, and automation applications.

The Quad Flat Package (QFP) is the second-largest segment, leading the market due to its high pin density, compact size, and ease of inspection. The Quad Flat Package (QFP) technology is mainly used in consumer electronics, automotive systems, communication equipment, and industrial control systems applications. The automotive industry is the major adopter of Quad Flat Package (QFP) technology, used to control functions such as navigation, safety, and infotainment systems. The Quad Flat Package (QFP) is easy to manufacture and more cost-effective compared to other packaging technologies.

Microelectronics Market Companies

- Acuity Brands Inc.

- ADT Corporation

- Control4 Corporation

- Crestron Electronics Inc.

- Cisco Systems Inc.

- Honeywell International Inc.

- United Technologies Corporation

- Johnson Controls Inc.

- Ingersoll Rand PLC

- Schneider Electric SE

Recent Developments

- In January 2025, eYs3D Microelectronics launched eSP936 multi-sensor image controller IC. This IC is designed for functioning in unmanned vehicles such as automated guided vehicles, autonomous mobile robots, and drones.

- In July 2024, ST Microelectronics launched VL53L4ED. VL53L4ED is a proximity sensor that is designed for performing several applications in robotics and industrial automation.

- In February 2024, Shenzhen Giant Microelectronics Company Limited launched GT1500 UWB. GT1500 UWB is a SOC designed for positioning, ranging and enhancing wireless connectivity applications.

Industry Leaders Announcements

- In October 2023, Andreas Gerstenmayer, the CEO of AT&S announced that the Austrian Government will invest around 3 billion euros for the microelectronics industry. He also stated that this investment is likely to change the demography of microelectronics industry by 2031.

Segments Covered in the Report

By Technology

- Semiconductors

- Integrated Circuits

- Transistors

- Resistors

- Capacitors

By Product Type

- Digital Integrated Circuits

- Analog Integrated Circuits

- Mixed-Signal Integrated Circuits

- Memory Microprocessors

By Application

- Automotive

- Consumer Electronics

- Industrial

- Healthcare

- Aerospace

- Defense

By Fabrication Process

- CMOS

- FinFET

- SOI

- GaN

- SiC

By Packaging Technology

- Ball Grid Array (BGA)

- Quad Flat Package (QFP)

- Small Outline Integrated Circuit (SOIC)

- Ceramic Pin Grid Array (CPGA)

- Chip-on-Board (COB)

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting