What is the Remote Plasma Sources Market Size?

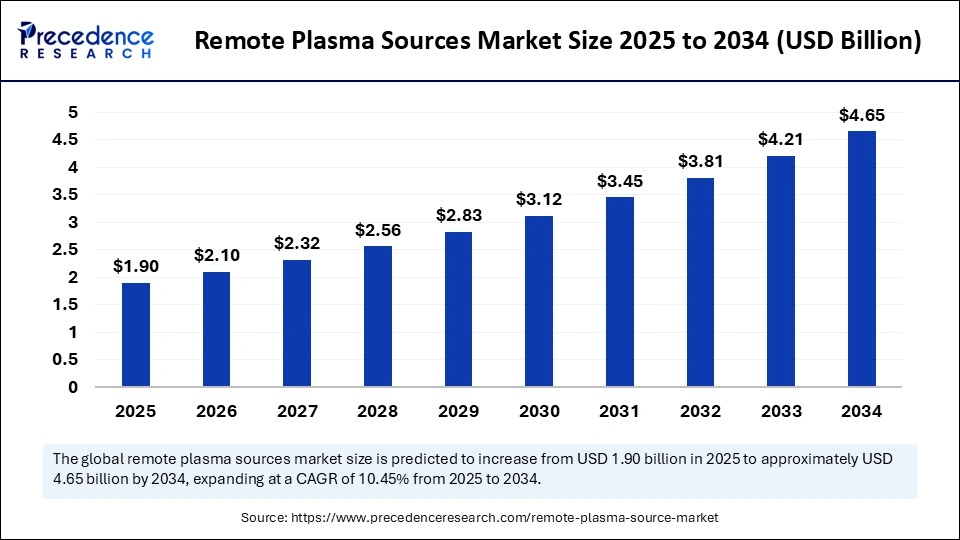

The global remote plasma sources market size was calculated at USD 1.72 billion in 2024 and is predicted to increase from USD 1.90 billion in 2025 to approximately USD 4.65 billion by 2034, expanding at a CAGR of 10.45% from 2025 to 2034. The market is witnessing steady growth, driven by semiconductor advancements, renewable energy adoption, and rising demand for efficient, contamination-free plasma processing technologies.

Remote Plasma Sources Market Key Takeaways

- In terms of revenue, the global remote plasma sources market was valued at USD 1.72 billion in 2024.

- It is projected to reach USD 4.65 billion by 2034.

- The market is expected to grow at a CAGR of 10.45% from 2025 to 2034.

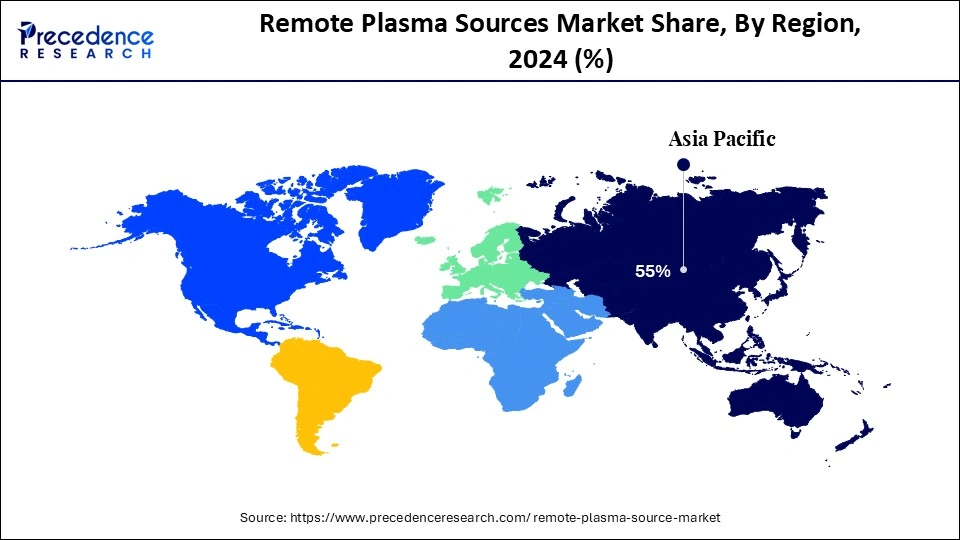

- Asia Pacific dominated the remote plasma sources market with the largest market share of 55% in 2024.

- North America is estimated to expand the fastest CAGR between 2025 and 2034.

- By plasma type, the oxygen plasma segment held the biggest market share of 40% in 2024.

- By plasma type, the fluorine plasma segment is anticipated to grow at the fastest CAGR between 2025 and 2034.

- By application, the photoresist removal and ashing segment captured the highest market share of 45% in 2024.

- By application, the thin film deposition (PEALD, PECVD) segment is expected to expand at a notable CAGR over the projected period.

- By end-use industry, the semiconductor and microelectronics segment contributed the maximum market share of 60% in 2024.

- By end-use industry, the solar and photovoltaics segment is expected to expand at a notable CAGR over the projected period.

- By plasma source technology, the inductively coupled plasma (ICP) segment generated the major market share of 50% in 2024.

- By plasma source technology, the microwave plasma sources segment is expected to expand at a notable CAGR over the projected period.

Market Overview

The remote plasma sources market refers to plasma generation devices that create reactive species (radicals, ions, and neutrals) outside the main process chamber and deliver them remotely for applications such as semiconductor manufacturing, surface cleaning, thin-film deposition, photoresist removal, and contamination control. Increasing reliance on plasma-based processes can also be attributed to the miniaturization and increased performance of electronic components and systems.

The demand is also growing because of government regulations focused on environmental sustainability that are eliminating traditional cleaning processes in favor of cleaner, drier alternatives. Remote plasma source manufacturers strive to design and integrate high-density, energy-efficient plasma systems to facilitate the development of next-generation fabrication processes in the semiconductor, microelectronics, and photovoltaic industries.

Smart Plasma: how AI is powering remote plasma sources

Artificial intelligence is changing the control and performance of remote plasma sources through real-time instability suppression of edge instabilities, predictive maintenance, and physics-aware simulations. Researchers at Princeton and PPPL developed machine-learning controllers that eliminated edge instabilities and predicted edge plasma disruptive tearing modes in milliseconds, benefiting from steady-state operation across fusion and plasma platforms.

AI models have also been shown by new AI-driven plasma simulators from academic groups, which delivered better modeling faster for device design and space-weather predictions. Industry summits revealed how AI was enhancing speed in plasma and fusion processing innovation for companies in the sector. Additionally, manufacturers in semiconductor fabrication for plasma etching and for industrial plasma cutting applications are piloting AI-assisted tuning and fault-prediction, showing how firms and design concepts for AI and plasma are developing in tandem.

Remote Plasma Sources Market Growth Factors

- Miniaturization of semiconductor circuitry: The transition to smaller, higher-performing chips drives precise plasma processes needed in wafer cleaning and etching, which contributes to growth directly.

- Manufacturing of next-generation displays: The continued growth of OLED and cutting-edge flat-panel displays requires highly-efficient plasma sources for even deposition of films and surface treatments.

- Environmental regulations: Stricter limitations on the use of wet chemical cleaning methods have encouraged the use and adoption of greener, dry-based cleaning methods derived from plasma.

- Growth in the photovoltaic sector: Increased usage and adoption of solar energy has dramatically increased the need and reliance on plasma processes for surface treatments during thin-film solar cell manufacturing.

- Continuous improvement in technology: Advances in high-density plasma sources that utilize energy-efficient methods allow for more reliable plasma processes for the increasing demands of advanced microelectronics and nanotechnology applications.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 4.65 Billion |

| Market Size in 2025 | USD 1.90 Billion |

| Market Size in 2024 | USD 1.72 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.45% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Plasma Type, Application, End-Use Industry, Plasma Source Technology, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

What is Growing the Remote Plasma Sources Market?

The growth of the remote plasma sources market has several important drivers. One of the important drivers is the rapid ramp of demand for advanced semiconductor manufacturing technologies. As the industry strives towards increasingly smaller, complex chip architectures, remote plasma sources are critical enablers for enabling ultra-clean etching and deposition that can be done without damaging sensitive nanostructures.

In November 2024, Hitachi High-Tech introduced the DCR Etch System 9060 Series, enabling precise isotropic etching for advanced 3D semiconductor devices using its plasma etching technology expertise. Recent investments made by several semiconductor fabs in the Asia Pacific region and the U.S., as part of government-sanctioned programs, highlight just how crucial plasma-based clean and thin film deposition tool sets have become. The ramp in semiconductor innovations is driving increases in remote plasma sources adoption around the world. (Source: https://www.hitachi-hightech.com)

Restraint

Does High Cost and Lack of Infrastructure Prevent Growth in the Remote Plasma Sources Market?

The high initial investment and limited supporting infrastructure a primary barriers limiting the remote plasma sources market from evolving. The cost of RPS technology is centered on the plasma generators and sophisticated vacuum chambers, and gas control, which place a significant financial burden on manufacturers. Since RPS is non-standard, any location, especially in the evolving economy, that isn't specially equipped with advanced cleanroom facilities or has no RPS supporting infrastructure, isn't designed to operate plasma-based systems.

Additionally, if separating RPS into an existing line, there are technology issues in terms of integrating it into existing lines, how manufacturing and workforce will adapt, training, and complex technical compliance issues throughout the process. Recent updates from the semiconductor industry indicate manufacturers are deferring the RPS technology due to financial and infrastructure challenges. This accounts for a significant market barrier to commercialization.

Opportunity

How has Renewable Energy Adoption Opened Up New Possibilities for Remote Plasma Sources?

The ongoing transformation toward renewable energy is providing a very interesting opportunity for remote plasma sources (RPS). Specifically, solar cell manufacturing relies heavily on plasma-based processes to clean wafer surfaces, deposit thin films, and passivate defects to have the greatest efficiency with their products. Globally, the shift from fossil to renewable energy is accelerating solar and clean energy availability while also driving demand for plasma systems.

Notably, recent expansions in solar panel manufacturing capacity in China and India underline their need for uniform processing and contamination-free manufacturing, where remote plasma sources provided both. Plasma treatments are also used to optimize materials in fuel cells and other renewable energy devices. This change places these companies in a good position to play a role in ushering in cleaner and more efficient renewable energy technologies throughout the world.

Plasma Type Insight

Which Plasma Type has the Highest Share of the Remote Plasma Sources Market?

The oxygen plasma segment leads the plasma type segment in the remote plasma sources market in 2024, due to the large usage of oxygen plasma for photoresist stripping, surface cleaning, and wafer preparation steps. Oxygen plasma is the type of plasma that has the highest reactivity with the least amount of damage to the substrate, making it the most suitable for semiconductor fabrication. As advanced devices require precision cleaning and a greater reduction of defects, the oxygen plasma segment will continue to lead the market.

The fluorine plasma segment will be the fastest-growing segment due to the increased demand in advanced etching and thin film processes. These plasma types are significant for the customization of material properties for better device performance and durability. The demand for plasma for advanced etching and thinner film processes will continue to gain momentum due to the growing complexity of semiconductor structures and the increased commercialization of device technologies in energy and display technologies.

Application Insights

Why is Photoresist Removal and Ashing Leading in the Remote Plasma Sources Market?

The photoresist removal and ashing segment is the largest section in the applications space, and future growth for this is driven by increased complexity in semiconductor devices, where precise cleaning is an important step to ensure proper patterning with defect-free surfaces. Remote plasma sources are the most efficient and residue-free means to remove even the most difficult photoresists and are considered indispensable in advanced lithography and wafer processing for not only logic, memory, but also other types of microelectronic devices.

The thin film deposition (PEALD, PECVD) segment is expected to grow at the fastest CAGR. This growth is based on the increased number of applications for thin films in semiconductor, display, and photovoltaic applications. Remote plasma sources improve film uniformity, adhesion, and performance in thin films, which are extremely important to next-generation transistors, flexible displays, and solar cells, and the growing investments being made into miniaturization and energy-efficient devices will perpetuate the growth of this segment.

End-Use Industry Insights

Which End-Use Industry has a Larger Share of the Remote Plasma Sources Market?

The semiconductor and microelectronics segment is expected to dominated the remote plasma sources market in 2024. Remote plasma sources are a crucial step in wafer cleaning, etching, and deposition in advanced chip manufacturing. As there is continual scaling with smaller nodes, the increased integration of AI and IoT devices, and demand for memory and logic devices, this segment will remain as the backbone of market uptake, as its reliance on accurate processes reinforced its leadership status.

The solar and photovoltaics segment will have the fastest growth in the forecasted period. As more countries push for renewable energy and increase installations of solar power globally, the adoption of plasma-based processes for surface treatment and thin film deposition is expected to grow. Because of this support for global and sustainable energy technology, remote plasma sources can provide the efficiencies and longevity required for solar cell technologies. In the global and sustainable energy technologies, it is expected to be a significant contributor to growth in the segmented forecast.

Plasma Source Technology Insights

Which Plasma Source Technology Dominates the Remote Plasma Sources Market in 2024?

The inductively coupled plasma (ICP) segment leads the remote plasma sources market with significant use in the semiconductor and microelectronics sectors that require high-density plasma with great uniformity to provide precision for etching, deposition, and cleaning in the fabrication of advanced devices. ICP became the leading technology because of its reliability, scalability, and a variety of applications.

The microwave plasma sources segment is expected to grow at the fastest rate due to their ability to provide stable, contamination-free plasma. As a result, microwave plasma sources are increasingly appealing to provide thin film deposition in display technology and in renewable energy sources with photovoltaic applications. Further, as demand continues to increase for plasma generation with cleaner and better methods for energy efficiency, microwave sources are constantly gaining traction as advanced alternative requirements for next-gen processing.

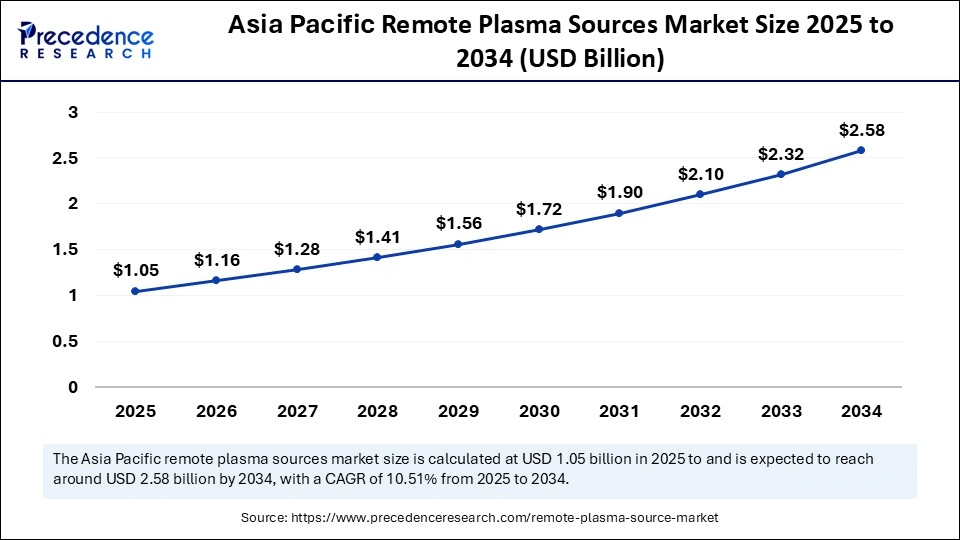

Asia Pacific Remote Plasma Sources Market Size and Growth 2025 to 2034

The Asia Pacific remote plasma sources market size is evaluated at USD 1.05 billion in 2025 and is projected to be worth around USD 2.58 billion by 2034, growing at a CAGR of 10.51% from 2025 to 2034.

Why is Asia Pacific the Largest Region for Remote Plasma Sources?

Asia Pacific is the largest region of remote plasma sources, due to a dominant reliance on plasma-based wafer cleaning, dielectric etching, and surface treatment in the high-volume fab world. Taiwan, South Korea, Japan, and China contain the world's largest foundries and memory manufacturers, all of which incorporate RPS units enabling plasma processing for particle-free, low-damage processes. The regional supply chains that are well integrated with local equipment vendors also allow for fast adoption of advanced RPS systems, which enable high-yield manufacturing.

China has positioned itself as the most significant contributor to the Asia Pacific RPS demand as it continues fab expansion projects backed by government semiconductor investment. RPS systems continue to gain traction for critical steps in plasma applications, enabling contamination-free cleanroom processes such as chamber cleaning, atomic-level surface preparation, and dielectric etching. Recent industry updates confirm that China has the highest spend globally in 2025 with its semiconductor equipment purchases, marking an increase to its RPS adoption rate, which creates opportunities for all suppliers, both global and domestic.

How is North America Becoming the Fastest-Growing Hub for Remote Plasma Sources?

North America is taking the lead in the remote plasma sources market. The demand for new fab developments and retrofits under the CHIPS and Science Act is booming. The North American remote plasma sources demand is largely ascribed to the advanced etch, deposition, and chamber-cleaning markets, of which the RPS technology allows the customers to reduce particle contamination and improve process uniformity. Business analysis shows large semiconductor manufacturers are focusing on RPS integration to obtain atomic-level precision in the fabrication of 3D devices and advanced logic nodes, where equipment reliability and tool uptime are becoming the differentiating competitive factor.

The U.S. is driving North America's growth due to a high density of previously announced mega-fabs and packaging sites. The engagements from the recent reports concerning TSMC's Arizona fabs, Intel's investments in Ohio, and Micron's memory supply chain will heavily lean on remote plasma sources for wafer chamber cleaning, surface activation, and contamination-free processing. The US is also viewing the opportunity to pair equipment makers with local R&D institutes to advance remote plasma sources, offering engineered designs aligning with high-volume manufacture principles. Not only is the end user looking for tool purchases, but long-lasting service, spares, and retrofitting opportunities will also provide the customers with solutions for their challenges at the fab.

Remote Plasma Sources Market Companies

- Advanced Energy Industries, Inc.

- MKS Instruments, Inc.

- Samco Inc.

- PVA TePla AG

- Axcelis Technologies, Inc.

- Lam Research Corporation

- ULVAC, Inc.

- Plasma Etch, Inc.

- PIE Scientific LLC

- Tokyo Electron Limited (TEL)

- Trion Technology, Inc.

- Diener Electronic GmbH and Co. KG

- Nordson MARCH

- Veeco Instruments Inc.

Recent Developments

- In April 2025, Intocore Technology earned A·A ratings in technical evaluation, meeting KOSDAQ's special-technology listing criteria. It develops plasma equipment for semiconductors and clean fuels, including hydrogen and SAF.(Source: https://cm.asiae.co.kr)

- In October 2024, Nisene (Polymatech Electronics) launched a Microwave-Induced Plasma (MIP) etching technology in the US, offering an eco-friendly, precise method for IC decapsulation versus traditional hazardous-chemical approaches.(Source: https://www.prnewswire.com)

- In February 2025, ULVAC unveiled its EWK-030 roll-to-roll lithium deposition system, set for launch in May 2025, to produce ultra-thin lithium films under vacuum for next-generation batteries, showcased at Battery Japan.(Source: https://cm.asiae.co.kr)

Segments Covered in the Report

By Plasma Type

- Oxygen Plasma

- Fluorine Plasma

- Nitrogen Plasma

- Hydrogen Plasma

- Mixed/Other Specialty Plasmas

By Application

- Photoresist Removal and Ashing

- Surface Cleaning and Pre-Treatment

- Thin Film Deposition (PEALD, PECVD)

- Etching Processes

- Contamination Control and Chamber Cleaning

- Others (Sterilization, R&D Applications)

By End-Use Industry

- Semiconductor and Microelectronics

- Flat Panel Displays (FPDs)

- Solar and Photovoltaics

- LED Manufacturing

- Research and Development Institutions

- Others (Medical Device Processing)

By Plasma Source Technology

- Inductively Coupled Plasma (ICP)

- Microwave Plasma Sources

- RF Plasma Sources

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting