Fuel Cell Market Size and Forecast 2026 to 2035

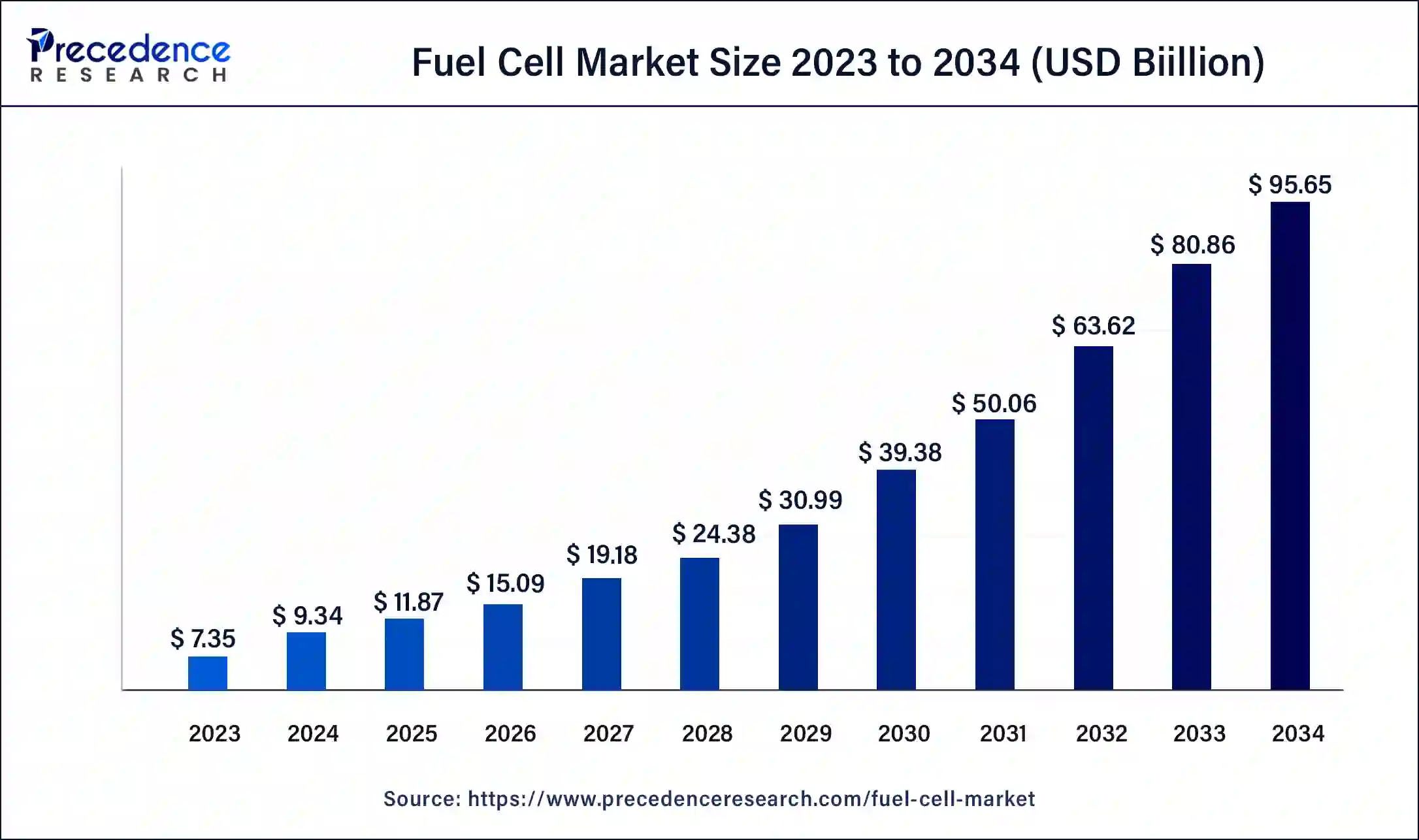

The global fuel cell market size is calculated at USD 11.87 billion in 2025 and is predicted to increase from USD 15.09 billion in 2026 to approximately USD 112.07 billion by 2035, expanding at a CAGR of 25.17% from 2026 to 2035.

Fuel Cell Market Key Takeaways

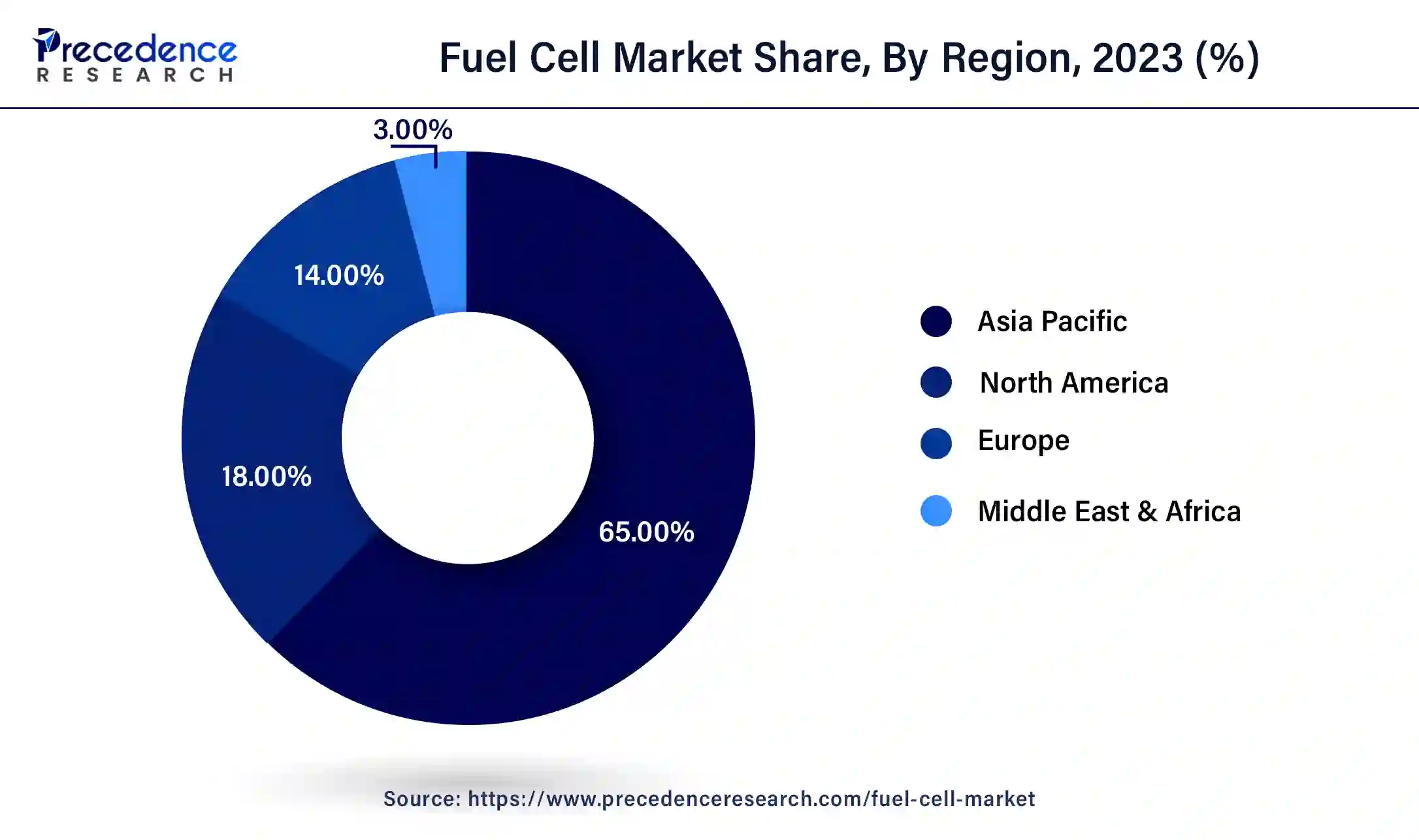

- Asia Pacific dominated the fuel cell market with largest revenue share of 65% in 2025.

- By Product, the proton exchange membrane fuel cell segment dominated the fuel cell market in 2025.

- By Product, the solid oxide fuel cell segment is fastest growing segment of the fuel cell market in 2025.

- By Application, the stationary segment dominated the fuel cell market in 2025.

Fuel Cell Market Growth Factors

A fuel cell generates electricity using the chemical energy of hydrogen or other fuels in a clean and efficient manner. Water, electricity, and heat are the only results when hydrogen is used as a fuel. Fuel cells have a wide range of applications, including industrial, residential, transportation, commercial structures.

Fuel cells have a number of advantages over traditional combustion-based technologies, which are being employed in a number of power plants and automobiles. When compared to combustion engines, fuel cells emit fewer or no emissions. As hydrogen fuel cells emit only water and no carbon dioxide, they can help to address crucial climate issues.

The major market players are taking enormous steps to increase their market position throughout developing countries, including increasing research and development investments and constant mergers and acquisitions. The product deployment is being aided by ongoing technology advancements and a decrease in the overall cost of fuel cell installations. The rising government investments in the construction of hydrogen-based infrastructure, together with the rising demand for fuel cells electric vehicles, are expected to propel the growth of the fuel cell market.

Furthermore, rising demand for portable devices, strict government restrictions aimed at reducing rising pollution levels, and improved fuel cell efficiency are some of the fuel cell market's major driving factors. The influence of these factors is projected to grow dramatically as the benefits of fuel cell become more widely known. The high cost of the catalyst, which boosts the cost of the fuel cell, and the absence of fuel cell infrastructure are factors hindering the growth of the global fuel cell market during the forecast period.

The implementation of favorable regulations and incentives to encourage the use of renewable energy, as well as increased financing for electrification of distant and off-grid areas, is expected to boost the system installation. The adoption of various investment projects aimed at putting a greater emphasis on distributed power generating techniques and expanding fuel cell setup would boost the growth of the fuel cell market. However, product implementation has several key limitations, including insufficient infrastructure, hydration, and excessive fuel cell costs, and storage.

The growing consumer awareness of clean energy solutions, as well as an increase in the use of favorable governmental subsidies to promote fuel cell electric vehicles, will boost the product demand in the transportation sector. The recent technological advancements, such as the incorporation of high efficiency portable technology, are more likely to create lucrative opportunities for the growth of the fuel cell market during the forecast period.

Fuel Cell Market Outlook

The start-ups are enjoying the prominent growth in the fuel cell market, which is characterised by the consistent use of technology, government support and elevating the demand for clean energy solutions. To achieve certain decarbonisation goals, the new approaches will give a potential push to mitigate greenhouse gas emissions, promoting an impressive low-emission option to the vast market.

The increasing demand for clean and reliable power is accelerating the fuel cell market. Alongside, the government contribution and decarbonisation goals have developed a national hydrogen strategy across the globe, specifically covering the EU, South Korea, Japan, China and the US and have strengthened the rigorous carbon emission regulations.

Fuel Cell Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 112.07 Billion |

| Market Size in 2025 | USD 11.87 Billion |

| Market Size in 2026 | USD 15.09 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 25.17% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2025 |

| Segments Covered | Product, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Fuel Cell Market Segment Insights

Product Insights

The proton exchange membrane fuel cell segment dominated the fuel cell market in 2025. The substantial market share of proton exchange membrane fuel cell is attributed to its widespread use is fixed, transit, and portable applications.

The solid oxide fuel cell segment is fastest growing segment of the fuel cell market in 2024. The ability of solid oxide fuel cell to work at high temperatures eliminates the need for expensive catalysts like ruthenium. Solid oxide fuel cells are most commonly used in stationary applications.

Application Insights

In 2025, the stationary segment dominated the fuel cell market. During the forecast period, the stationary segment is expected to become the most popular application. The stationary application segment is predicted to develop because of the factors such as high efficiency and the ability to use a variety of fuels.

The transportation segment, on the other hand, is predicted to develop at the quickest rate in the future years. Due to the growing demand for fuel cell automobiles and fuel cell powered forklifts, the transportation application segment is predicted to increase at the quickest rate over the forecast period. Moreover, the industry is expected to grow due to increased research and development activities in the developed and developing countries to produce hydrogen powered hybrid vehicles.

Fuel Cell Market Regional Insights

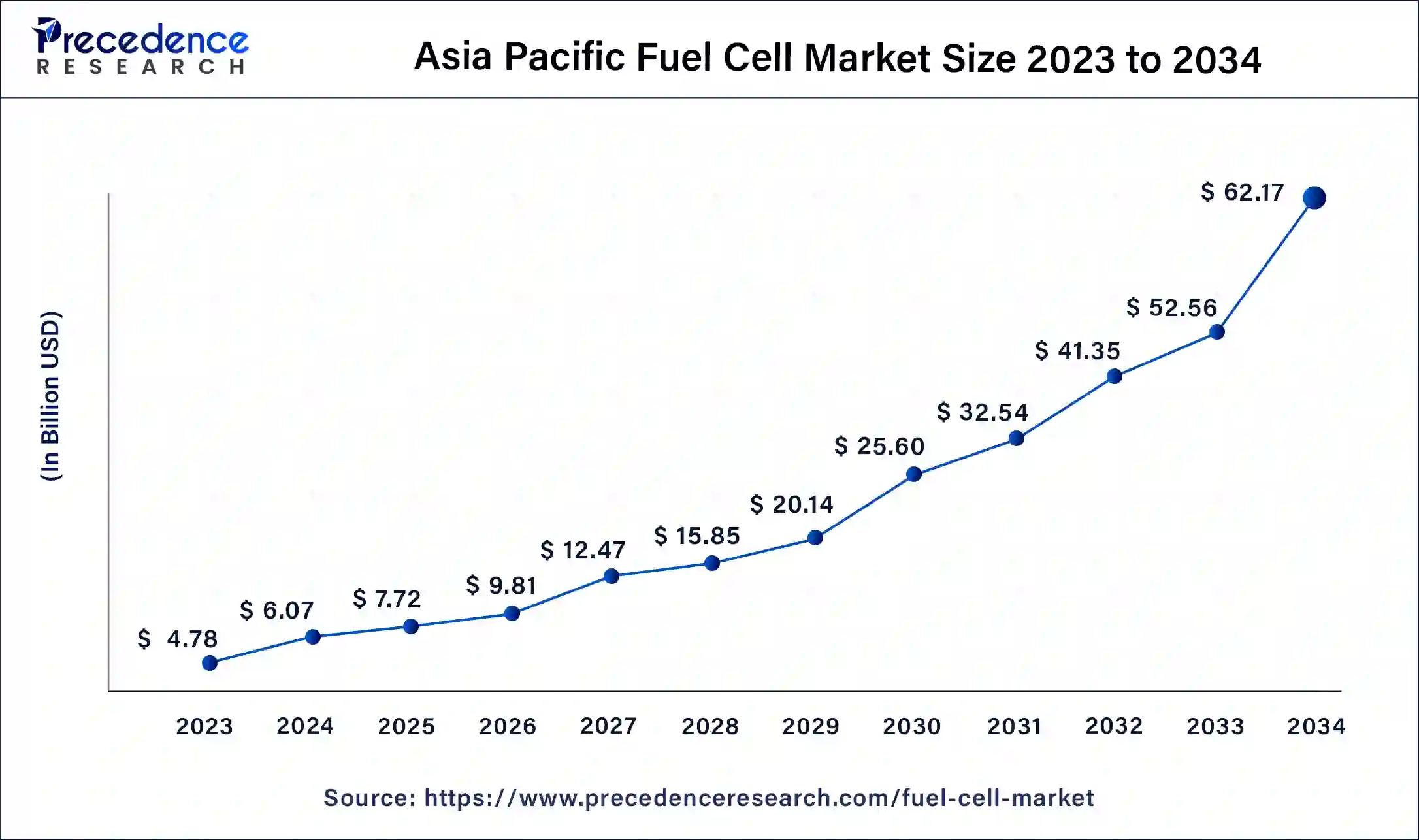

The global fuel cell market size is valued at USD 7.72 billion in 2025 and is expected to be worth around USD 73.49 billion by 2035, at a noteworthy CAGR of 25.27% from 2026 to 2035.

Asia Pacific dominated the fuel cell market in 2025. The expansion of the fuel cell market in the Asia-Pacific region has been propelled by policies and strategies that encourage fuel cell systems for transportation applications in India, China, Japan, and South Korea. This is due to the presence of supportive legislation in the North America region aimed at reducing carbon emissions, as well as the availability of financing for fuel cell research and development initiatives.

The growing emphasis on lowering carbon emissions and advocating for clean energy alternatives is a key factor driving market expansion. In addition to this, the increasing utilization of fuel cells, because of their high efficiency and minimal to zero emissions, is supporting market expansion. Furthermore, the establishment of government incentives and regulations that promote the use of clean technologies is fostering an optimistic perspective for market expansion. In addition to this, the expansion of hydrogen refueling stations and advancements in hydrogen production techniques, particularly green hydrogen production via renewable energy sources, are driving market growth.

- On a global scale, the leading three exporters of Fuel Cells are the United States, Botswana, and China. The United States tops global Fuel Cell exports with 7,738 shipments, followed by Botswana at 2,971 shipments, and China in third place with 2,825 shipments.

North America, on the other hand, is expected to develop at the fastest rate during the forecast period. This is due to the presence of supportive legislation in the North America region aimed at reducing carbon emissions, as well as the availability of financing for fuel cell research and development initiatives.

The heightened emphasis on lowering carbon emissions and advancing clean energy alternatives is a key driver of market expansion of United States. In addition, the increasing use of fuel cells, attributed to their high efficiency and minimal to zero emissions, is promoting market expansion. Additionally, the introduction of government incentives and rules promoting the use of clean technologies is fostering a favorable outlook for market expansion. In addition, the expansion of hydrogen refueling stations and advancements in hydrogen production techniques, such as the generation of green hydrogen through renewable energy sources, are aiding market growth.

- In November 2024, the Export-Import Bank of the United States has completed a deal under its Project & Structured Finance Program to assist FuelCell Energy Inc., an exporter based in Connecticut. This transaction involves a loan guarantee nearing $10 million, which will aid in financing fuel cell modules.

Different funding initiatives, like the National Innovation Program Hydrogen and Fuel Cell Technology (NIP), offer financial assistance for R&D, demonstration projects, and the market launch of hydrogen technologies, thus promoting Europe fuel cell market growth. Advancements in incorporating hydrogen infrastructure into national decarbonization strategies are anticipated to enhance the adoption of fuel cell technologies across Europe. The EU's ambitious goal of achieving climate neutrality by 2050 and implementing hydrogen strategies at the national level will drive product demand.

The expanding development of hydrogen infrastructure is boosting the German Fuel Cell Market. The German government has emphasized hydrogen as a key element of its energy transition plan, backed by substantial investments and legislative support. In July 2024, Germany allocated USD 3.21 Billion to create its Hydrogen Core Network, aiming to convert current gas pipelines and construct new ones for transporting hydrogen.

Panasonic launched Germany's inaugural Proof-of-Concept for its sustainable energy solution, known as Panasonic HX, on 27 March 2025, utilizing locally sourced green hydrogen, at its Munich campus in Ottobrunn.

The region is propelling with its robust strategies, targeting decarbonisation via hydrogen and exponential investment in the fuel cell market. Europe's comprehensive policy framework involving the Net-Zero Industry Act, EU Hydrogen Strategy and REPowerEU Plan that has represented electrolysers and fuel cells as smart net-zero technologies that will fulfil the market purpose and deliver accurately. Apart from the framework, the investment, innovation, funding and research are stimulating the growth of the market in Europe.

The region's innovation is highly focused on accelerating its massive renewable energy resources and scaling the production for export and domestic use. The initial stage to drive innovation is producing green hydrogen with electrolysis sponsored by massive wind and solar energy. Following this, Chile's Atacama Desert have the vast solar radiation levels. The cooperation with existing industries is a conversational initiative of Latin America to establish growth in the fuel cell market.

Latin America Fuel Cell Market Trends

Latin America is witnessing significant growth in the fuel cell market. This growth is due to its growing focus on clean energy, rapid industrial development, and strong focus on energy reliability. Countries such as Brazil, Chile, and Argentina are leading players in the region and are actively exploring hydrogen-based technologies for decarbonizing mining, refining, and energy production processes. The region also benefits from abundant renewable resources, particularly solar and wind, and thus highlights market potential

Brazil Fuel Cell Market Trends

The market is witnessing rapid growth, driven by supportive government policies, increased investments in renewable energy, and industrial decarbonization initiatives. The expansion of rural electrification projects, technological advancements, and strategic international partnerships are accelerating adoption across various domains and strengthening Brazil's shift toward sustainability.

The Middle East and Africa (MEA) region is witnessing steady growth and is expected to maintain this growth trajectory in the upcoming years. Countries such as Saudi Arabia, the UAE, and South Africa are leading players in the region as they are seen actively investing in hydrogen strategies and projects that are focused on transport, power generation, and industrial decarbonization.

Fuel cells are vital for power generation in mining, construction, and remote communities, making them valuable tools in regions with limited grid access. The region also benefits from abundant solar resources and has a growing interest in green hydrogen production, which helps fuel the market.

Saudi Arabia Fuel Cell Market Trends

The market shows promising potential in various sectors, such as stationery, transportation, and portable. Factors such as the increasing demand for fuel cell cars, advancements in fuel cell research and development, strong government initiatives, and strict pollution standards are propelling the market forward.

Fuel CellMarket Value Chain Analysis

The supportive activities analysis bolstering the fuel cell market are material sourcing, regulatory landscape and technology and R&D. The lengthening innovative chain is crucial for improving durability, reducing cost and enhancing efficiency volume. The government policies promoting incentives and emission balance are recharging the fuel cell development.

The value chain analysis of component manufacturing operations and material cost for bipolar plates, catalysts, and MEAs circulates the whole operation of the fuel cell market. The system assembly operation refers to a unification of the fuel cell stack with different important systems like air compressors, humidifiers and thermal management.

The inbound and outbound logistics are essential to make hydrogen production travel to the specific unmet areas and promote green and clean hydrogen. The storage and transportation evaluates the logistics of storing and moving hydrogen is crucial. It features the understanding of the cost and complexity of liquefaction, safety and compression regulations.

Fuel Cell Market Companies

- AFC Energy PLC

- SFC Energy

- ITM Power PLC

- Hydrogenics

- Fuji Electric India Pvt. Ltd

- Proton Power Systems PLC

- Plug Power Inc.

- Ballard Power Systems Inc.

- United Technologies

- Fuel Cell Energy Inc.

Recent Developments

- In April 2025, Toyota Motor Corporation revealed that it has created a new fuel cell (FC) system, its third-generation FC system, as part of its ongoing commitment to achieving a hydrogen society.

- In May 2025, scientists at the University of Leicester reached a significant achievement in fuel cell recycling, enhancing methods to effectively extract precious catalyst materials and fluorinated polymer membranes (PFAS) from catalyst-coated membranes (CCMs). This advancement tackles significant environmental issues caused by PFAS, commonly called 'forever chemicals' which are recognized for polluting drinking water and posing severe health risks.

- In March 2025, Rampini's division H2EUPower, an Italian manufacturer of zero-emission buses, introduced a range of hydrogen fuel cell power system solutions, offering power from 30 to 140 kilowatts for commercial vehicles, stationary applications, and off-highway use in Europe. H2EUPower presents a range of solutions in the power spectrum of 30 to 140 kilowatts, suitable for various applications including midi-buses and medium to heavy-duty vehicles, along with off-highway and stationary models that are configured as modular solutions specifically designed for their intended uses.

- Hydrogenics opened a new facility in California, in October 2018. The facility's primary goal would be the integrate hydrogen fuel cell systems onto heavy duty truck and bus platforms for California customers. Hydrogenics was able to improve its position in the U.S. market due to the establishment of this manufacturing plant.

- Plug Power introduced a new plant in March 2019 to expand its hydrogen-based fuel cell line. The ProGen 30kW engine is a cost-effective solution for electric vehicle, with high utilization and reliable performance in severe settings, as well as quick fueling and zero emissions.

- SFC Energy entered into a contract with AuroraHut, a Finnish Company, in October 2019. AuroraHut will include the EFOY fuel cells into its new all season igloo houseboats for highly customized trips under the terms of the deal. In all igloos, the fuel cell provides a fully automated and ecologically beneficial power source.

- MHI announced in October 2020 that it has received a contract to supply solid oxide fuel cell system, making the company's first in Europe. As part of the KWK.NRW 4.0 project, the hybrid solid oxide fuel cell system will be integrated at the GWI in Germany.

- Navistar Inc., General Motors, and OneH2 established an agreement in January 2021 to provide complete solutions for long haul transportation systems with low emissions. The group's combined efforts are expected to strengthen the hydrogen-powered truck ecosystem.

- In February 2025, Bloom Energy announced the expansion of its modular fuel cell production facility in Frankfurt, Germany. The upgraded plant aims to accelerate the manufacturing of prefabricated, medium- and high-product electrical houses tailored for rapid deployment in industrial, utility, and renewable energy projects. This strategic investment highlights the growing global demand for compact, plug-and-play power solutions, especially as infrastructure developers seek faster, more flexible alternatives to traditional on-site substation construction.

(Source: bing.com)

The major market players are highly investing in research and development to improve the technical features of fuel cells and modules, which offer cheaper battery costs, longer life, and greater performance. Several strategic initiatives have been attempted by industry players, including supplying varied product ranges, joint ventures, mergers, acquisitions, and collaborations. These tactics help firms and market players to gain a stronger presence in the global fuel cell market.

Fuel Cell Market Segments Covered in the Report

By Product

- Proton Exchange Membrane Fuel Cell

- Phosphoric Acid Fuel Cell

- Solid Oxide Fuel Cell

- Molten Carbonate Fuel Cell

- Others

By Application

- Stationary

- Transportation

- Portable

By Geography

- North America

- U.S.

- Canada

- Mexico

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting