Automotive Aftermarket Fuel Additives Market Size and Forecast 2025 to 2034

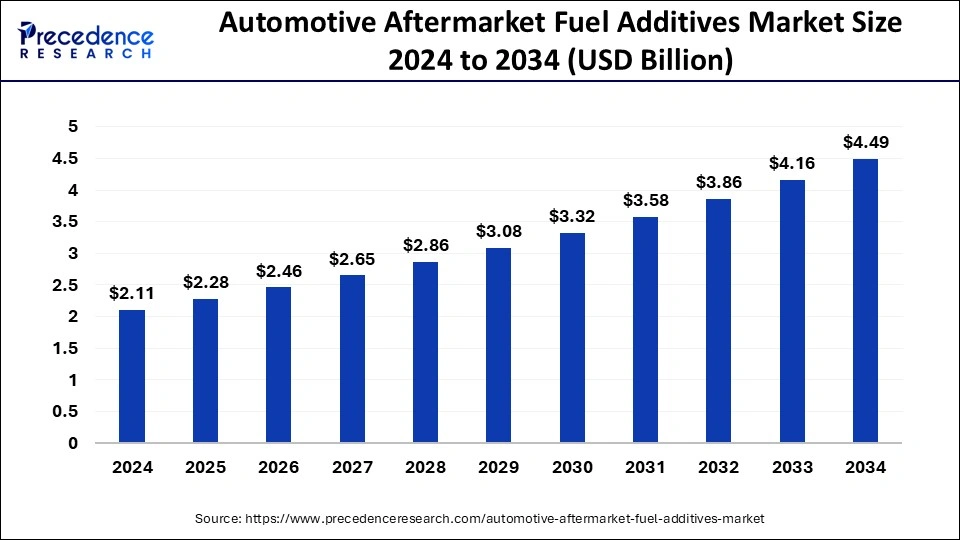

The global automotive aftermarket fuel additives market size was estimated at USD 2.11 billion in 2024 and is predicted to increase from USD 2.28 billion in 2025 to approximately USD 4.49 billion by 2034, expanding at a CAGR of 7.82% from 2025 to 2034.

Automotive Aftermarket Fuel Additives Market Key Takeaways:

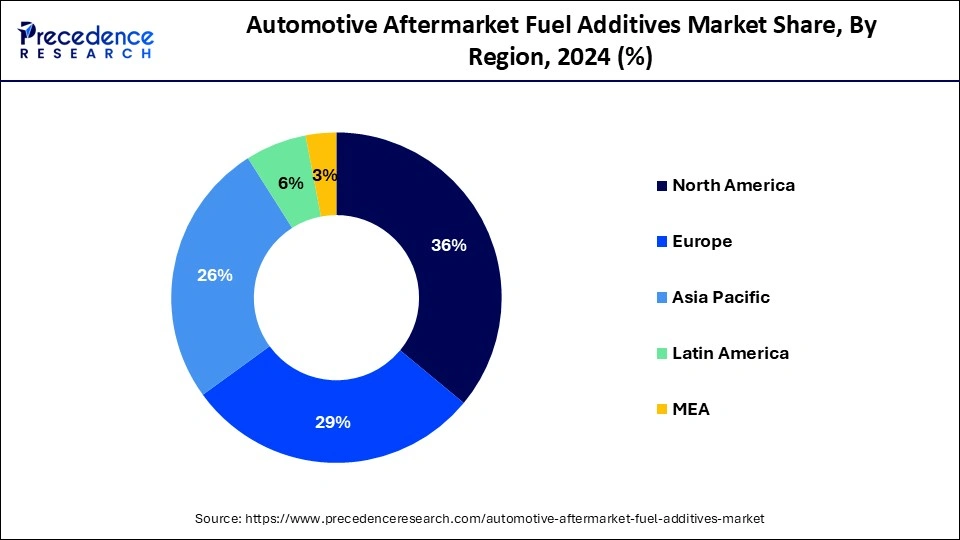

- North America generated more than 36% of revenue share in 2024.

- Asia-Pacific is expected to expand at the fastest CAGR from 2025 to 2034.

- By Application, the gasoline segment held a remarkable revenue share in 2024.

- By Distribution Channel, the 4S stores segment held a significant market share in 2024.

U.S. Automotive Aftermarket Fuel Additives Market Size and Growth 2025 to 2034

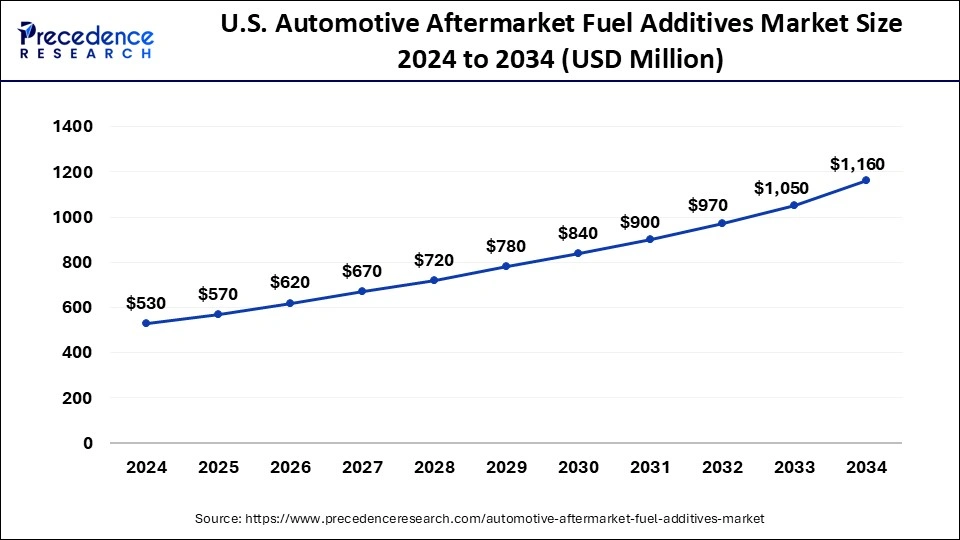

The U.S. automotive aftermarket fuel additives market size is estimated at USD 530 million in 2024 and is expected to be worth around USD 1,160 million by 2034, growing at a CAGR of 8.14% from 2025 to 2034.

North America held the largest revenue share of 36% in 2024. This is owing to the increasing demand for vehicles that are more fuel-efficient, as rising fuel costs and environmental concerns continue to be a major factors among consumers. Furthermore, stringent environmental regulations are also likely to support the regional growth of the automotive aftermarket fuel additives market during the forecast period. Additionally, the growing demand for high-performance vehicles is also expected to contribute to the growth of the automotive aftermarket fuel additives market in the region within the estimated timeframe.

Asia-Pacific is expected to grow at the fastest CAGR during the forecast period.This is attributable to the rapidly growing automotive industry along with increasing mandating and promotion of the use of fuel additives to reduce the carbon emissions in the economies like India and China. The rising government policies and incentives are likely to encourage the adoption of automotive aftermarket fuel additives which is driving market growth in the region. Further, the growing middle class population and disposable income of the consumers is also likely to support the regional growth of the automotive aftermarket fuel additives market during the forecast period.

Market Overview

The automotive aftermarket fuel additives deal with the production and sale of additives that can improve the performance and efficiency of vehicle engines. These fuel additives are typically added to the fuel tank of a vehicle and are designed to improve fuel economy, reduce emissions, and enhance engine performance. The use of fuel additives is once again being highlighted as a viable option to ease the price of filling up as efforts are cranked up to minimize emissions of modern automobiles and enhance fuel efficiency during the current cost of living crisis.

The factors such as rising environmental concerns, increasing demand for fuel-efficient vehicles, and a growing preference for cleaner and greener energy sources is anticipated to augment the growth of automotive aftermarket fuel additives during the forecast period. Additionally, the increasing use of additives in automotive lubricants, which are used to reduce wear and tear on engine components, is also contributing to the growth of the market in the years to come.

The market is expected to continue to grow in the coming years, as consumers become increasingly aware of the benefits of using fuel additives to improve the performance and efficiency of their vehicles. Additionally, advances in additive technology, such as the development of new synthetic fuel additives, are likely to drive further growth in the market. The key players in the market offer a range of fuel additives, including octane boosters, fuel system cleaners, fuel stabilizers, and diesel fuel additives further supporting the growth of the market in the near future.

Automotive Aftermarket Fuel Additives Market Growth Factors

The automotive aftermarket fuel additives market is growing rapidly due to increasing demand for fuel-efficient vehicles. As consumers seek to reduce their fuel costs and environmental impact, there is a growing demand for vehicles that are more fuel-efficient. This is driving demand for fuel additives that can reduce emissions, improve engine performance, and enhance fuel economy. Furthermore, rising environmental concerns and regulations that are leading to a greater focus on decreasing emissions and enhancing fuel efficiency is also likely to drive the demand for fuel additives that can help meet these goals in the years to come.

The automotive industry is continuously evolving, with different technologies and innovations emerging all the time. This is further leading to the development of new fuel additives that can improve engine performance and fuel efficiency. Additionally, the growing demand for aftermarket products and services as vehicles become more complex and sophisticated owing to help maintain and enhance their performance is also likely to contribute towards the growth of the market within the estimated timeframe. Also, the increasing demand for high-performance vehicles which need proper fuel additives to operate at peak performance is further anticipated to support the growth of the automotive aftermarket fuel additives market in the near future.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 2.11 Billion |

| Market Size in 2025 | USD 2.28 Billion |

| Market Size by 2034 | USD 4.49 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.82% |

| Largest Market | North America |

| Fastest Growing Market | Asia-Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Application, By Distribution Channel, and By Supply Mode |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing demand for fuel-efficient vehicles

The increasing demand for fuel-efficient vehicles is anticipated to augment the growth of the automotive aftermarket fuel additives market during the forecast period. Consumers are increasingly conscious of the cost of fuel and the impact of transportation on the environment. As a result, they are seeking vehicles that offer better fuel economy and lower emissions. Fuel additives not only help engines perform more effectively but also save money at the pump. Every drop is used, and none are ever left behind. Every time there is combustion, more petrol is burned, and the engine receives all of the energy. By merely adding fuel additives, one can actually improve MPG. Octane boosters also help an engine run more efficiently by facilitating easier fuel combustion. For high-performance vehicles, high octane fuel is the best choice.

Fuel additives primarily increase fuel economy by keeping the fuel system clean. Research shows that deposits in the diesel engine's fuel injectors or the petrol engine's air/fuel system have a negative impact on fuel economy. Deposit control additives work to disperse deposit precursors, maintaining clean, nearly "as-manufactured" metal surfaces. Today's low specific consumption, high specific output engines may achieve very high levels of cleanliness, which significantly helps to maximize fuel efficiency. The use of friction-reducing additives also directly impacts engine performance and may lead to further gains in fuel efficiency.

Automotive manufacturers are also responding to the demand by developing vehicles with more efficient engines and lighter-weight materials. However, these vehicles can still benefit from the use of fuel additives, which can further improve their performance and fuel efficiency. Fuel additives can enhance the combustion process within the engine, leading to more complete fuel burn and reduced emissions.

They can also reduce the build-up of deposits in the fuel system, which can lead to reduced fuel economy and engine performance over time. Furthermore, fuel additives can help extend the lifespan of the engine by reducing wear and tear on engine components, which can improve the overall efficiency of the vehicle. Thus, the increasing demand for fuel-efficient vehicles is expected to continue to drive the growth of the automotive aftermarket fuel additives market during the forecast period.

Restraints

Limited awareness & lack of understanding among consumers

Many consumers are not aware of the potential benefits of using fuel additives, or may not fully understand how these products work. This can make them less likely to seek out and purchase fuel additives, even if they could benefit from their use. In addition, the lack of understanding among consumers can make it difficult for manufacturers of fuel additives to market their products effectively. They may need to invest more in education and outreach efforts to help consumers understand the benefits of fuel additives and how to use them properly.

Furthermore, the lack of standardization and regulation in the fuel additives market can also contribute to confusion among consumers. Without clear guidelines and standards, it can be difficult for consumers to know which products to choose or how to use them correctly. This is expected to restrain the growth of the automotive aftermarket fuel additives market within the estimated timeframe.

Opportunities

Rising demand for aftermarket products & services in emerging economies

The growing demand for aftermarket products and services in emerging markets is helping to grow the automotive aftermarket fuel additives market. As emerging markets continue to grow and develop, there is a greater demand for vehicles, particularly in economies with rapidly growing middle classes. However, many of these markets have less developed automotive industries and infrastructure, which can make it more difficult for consumers to access high-quality fuel and automotive products. This has increased the demand for aftermarket products and services, including fuel additives, which help consumers, optimize the performance and efficiency of their vehicles.

In addition, many emerging markets have stringent emissions regulations, which can make fuel additives an attractive option for consumers who want to reduce their environmental impact. Furthermore, the growing demand for aftermarket products and services in emerging markets has resulted in an increase in the number of manufacturers and suppliers of automotive aftermarket products, which has helped to drive innovation and competition in the industry. This is further expected to increase the demand for automotive aftermarket fuel additives in the years to come.

Application Insights

The gasoline segment held a considerable revenue share in 2024. Consumers are now increasingly concerned about fuel efficiency and are looking for ways to improve the mileage of their vehicles. Gasoline fuel additives can help improve the fuel economy of gasoline-powered vehicles. Also, the gasoline additives normally escalate the gasoline octane rating of petrol or function as lubricants or corrosion inhibitors. This is likely to support the segment growth of the automotive aftermarket fuel additives market during the forecast period.

Distribution Channel Insights

The 4S stores segment held significant market share in 2024. 4S stores are automotive dealerships that offer a one-stop shop for car buyers. These stores not only sell cars but also provide aftersales services, including spare parts, maintenance, and repairs. In recent years, 4S stores have become increasingly popular in the automotive industry, particularly in emerging markets. The increasing demand for convenience among car buyers is a major factor for the growth of the segment of the market. With 4S stores, customers can get all their automotive needs met in one place, making the buying process easier and more streamlined. This convenience factor is particularly important in emerging markets, where car buyers may not have access to a wide range of automotive services.

Automotive Aftermarket Fuel Additives Market Companies

- Afton Chemical Corporation

- BASF SE

- Chemtura Corporation

- Chevron Oronite Company LLC

- Cummins Inc.

- Evonik Industries AG

- Fuel Performance Solutions, Inc.

- Infineum International Ltd.

- Lubrizol Corporation

- Total SA

- 3M Company

- Bardahl Manufacturing Corporation

Recent Developments

- In December 2021,following a mutual decision to modify the structure of the current partnership, the Automotive Asiatic Co, Ltd. (AAC) and ZF announced that their present partnership agreement will officially dissolve. Following this announcement, ZF and AAC will continue to work closely together, with their existing joint-venture organizations TAC-M and TRW Asiatic., Ltd. (TAC) taking on the exclusive role of distributing aftermarket products by TRW in Malaysia and Thailand.

Segments Covered in the Report:

By Application

- Diesel

- Gasoline

By Distribution Channel

- 4S Stores

- Big Stores

- Gas Stations

- Unauthorized Centers

- E-commerce

- Others

By Supply Mode

- Third Party

- OEM

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting