What is Automotive Aftermarket Size?

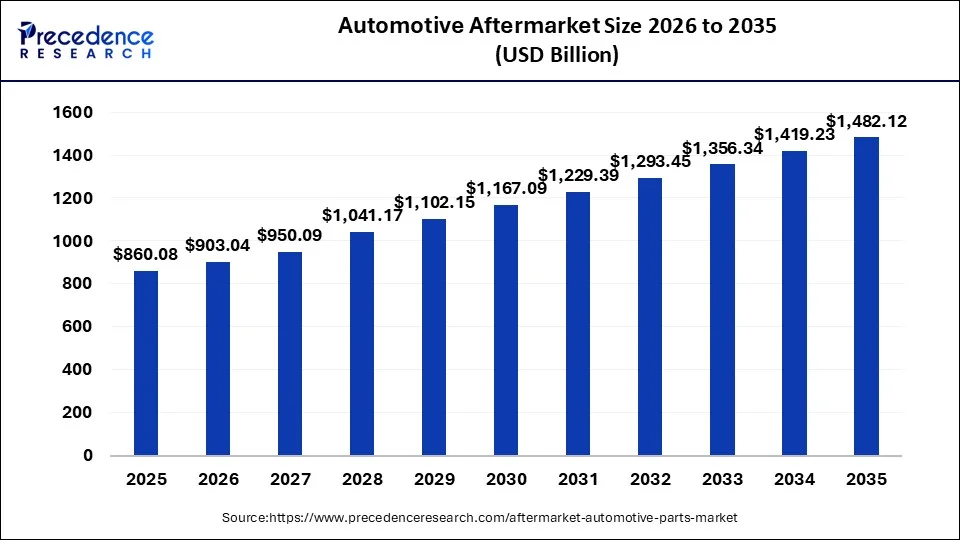

The global automotive aftermarket size is estimated at USD 860.08 billion in 2025 and is predicted to surpass around USD 1,482.12 billion by 2035, poised to grow at a noteworthy CAGR of 5.59% during the forecast period from 2026 to 2035.

Market Highlights

- North America led the global market with the highest market share of 35.05% in 2025.

- By product, the exhaust components segment is anticipated to show considerable growth in the market over the forecast period.

- By application, the DIY segment is anticipated to show considerable growth in the market over the forecast period.

- By distribution channel, the wholesalers & distributors segment is anticipated to show considerable growth in the market over the forecast period.

- By certification, the certified parts segment is anticipated to show considerable growth in the market over the forecast period.

Automotive Aftermarket Growth Factors

Regulatory bodies including the U.S. Environmental Protection Agency and the JASMA monitor the environmental impact and built standards related to automotive components such as noise emission level from mufflers and resonators in automotive exhaust systems expected to trigger advancement in the automotive parts. In addition, digitization of sales and service of component delivery and online distribution portals for aftermarket components in synchronization with global automotive suppliers, is expected to bring prominent investment from the market players. Because of online and digitized delivery gateways, the automotive aftermarket expected to witness significant growth in the developing countries. In addition, rising trend for online sale of automotive aftermarket parts projected to further boost the market growth in the coming years.

Though, the automotive aftermarket is highly influenced by the digitized gateway pattern, high cost of research & development expected to hamper the market growth. Additionally, the consumer shift towards smart and intelligent automobile parts also uplift the overall cost of the components.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 860.08Billion |

| Market Size in 2026 | USD 903.04 Billion |

| Market Size by 2035 | USD 1482.12 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.59% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Application, Distribution Channel, Certification, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Rise in technological advancement

- The demand for aftermarket parts such as catalytic converters and electronic chips to increase fuel economy on older vehicles has risen in response to the demand for environmentally sustainable vehicles. Owners are particularly interested in adding new features to their older cars which serves as a key driver for the market growth of automotive aftermarket industry.

Government regulations aid in market growth

- In many countries the government has imposed strict car emission regulations, putting pressure on product manufacturers to produce environmentally friendly and high-efficiency automobile parts for both domestic and international markets that enhances the demand of automotive aftermarket and estimated to pace at increasing rate in the coming years.

Increasing demand for comfort in vehicles

- In order to meet consumer demands for comfort and convenience in vehicles, OEMs have launched additional accessories in vehicles that can be personalized in the aftermarket which helps in fueling the development of the automotive aftermarket.

Increase in disposable income

- The changing lifestyles, increase in standard of living along with rise in disposable income lead to demand for aftermarket. Increase in disposable income may result in luxurious life therefore demanding for luxury vehicles. Growing number of millionaires in the world who tend to design or remodel their unique vehicles owing to the demand for automotive aftermarket products.

Globalization of Original Equipment Manufacturers (OEM)

- The tremendous growth in the global vehicle registration has put pressure on OEMs to accelerate the use of global platforms and modular architecture. This means that the number of vehicles produced will rise rapidly, increasing the demand for spare parts and other car service facilities. This opens more opportunities for the automotive aftermarket companies.

Restraints

Ratification of vehicles safety techologies

- With the growing technological changes, the vehicles are well equipped with sensors which leads to excellent driving behaviour and thereby lessens the wear tear of brakes and other component in vehicles. This factor hinders the replacement of components and hampers the market growth of automotive aftermarket.

High Operational Cost

- The cost of vehicle modification is high for most of the population. The parts of vehicles are sold as a premium option to the comparatively upper-class consumers who choose to pay a premium price for them. However, if this becomes more widely used, the price would have to come down so that the common people can afford. Therefore, it hinders the market expansion of automotive aftermarket

Legal Constraints

- In some countries, the vehicles are inbuilt with eco-friendly components to protect the environment from carbon emissions and maintain the atmosphere. The consumers cannot opt for frequent modification for parts which emits more carbon and harms the environment. Hence, this factors restraints the automotive aftermarket.

Opportunities

Increasing in older vehicles and their age -

- The average age of vehicles continues to rise with passenger cars and the light truck segment, average age stands at 11.3 years. The older vehicles become; the more parts require remaining on the road. There has been a 14% increase in the age of automobiles from the past six years which serves as a positive sign for the development of the market.

E-commerce changed the automotive aftermarket

- The digitalization which is digital influence has transformed the way a consumer makes a purchase. Aftermarket customers read everything possible, including reviews and videos. Year after year, consumers are besieged with online advertising, both on desktops and smartphones. Wheel and tire websites and aftermarket touch-up paint websites are two fastest growing segments in the industry. Thus, the aftermarket industry is catching up the rest of the world by using smartphone e-commerce technologies.

Widespread of Aftermarket and unorganized industry

- Globalization of the aftermarket industry has impacted every intersection of the globe. Automakers are supporting modular architecture i.e., similar parts from various manufacturers can be applied to the same vehicle. Increased global competition for Generic vehicle has several long-term benefits to the automotive aftermarket industry.

Growing complexity of parts

- More intricate parts, including electric and hybrid vehicles, are more attractive to both ends of the supply chain. They are more expensive and usually require specialists to correctly install them i.e. fewer do it yourself mechanics (DIY). Thus, increasing complexity in auto parts makes demand for more automotive aftermarket products

Market Challenges

Decreased retails and workshop business

- Many people delay inspections or discretionary repairs, and some government transportation agencies are relaxing deadlines for mandatory technical controls and inspections. Consumers with lower incomes are also delaying avoidable repairs. These changes are dramatically reducing visits to garages, service stations, and repair workshops, even though these businesses are typically allowed to remain open and can still easily receive parts from distributors.

Smooth transition to the electric vehicles industry

- Smooth transition to the electronic powertrain is one of the fundamental challenges for the auto after-market sector in the next 5-10 years. The biggest challenge, particularly for small players in the segment, would be to technologically adapt themselves for EVs. Experts believe that those into manufacturing engine parts will face the maximum heat due to a shift in focus from fuel efficiency and engine management to drive motors and batteries.

Inadequate management of large vehicle data bases and catalogs

- Automotive aftermarket parts are very huge in number which becomes difficult for manufacturers to show all the data and catalogs properly to the customers. Thus this may result in improper installation parts.

Automotive Aftermarket Segment Insights

Product Insights

The tire segment held the largest share in automotive aftermarket in 2024. There are many different kinds of tires, including performance, off-road, summer, winter, and all-season tires. Specialty tires like low-profile or run-flat tires are also available. Every variety is engineered to provide distinct performance attributes appropriate for varying road conditions and car kinds. Wide-ranging tire sizes are available to fit a variety of vehicles, including big trucks and tiny sedans. Customers usually emphasize that they get the appropriate size and type of tire for their vehicle because proper fitment is crucial for both safety and performance. Tires for the aftermarket are produced by a wide range of companies, from tiny, specialty producers to well-known international brands. A variety of tire models with varying features, performance levels, and pricing points may be available from each brand.

Many contemporary tires have cutting-edge innovations that improve comfort, safety, and performance. Advanced tread designs for increased traction, creative rubber compounds for increased longevity and fuel economy, and technologies like run-flat or self-sealing capabilities are a few examples of these qualities. Tire costs can differ significantly based on a number of variables, including type, size, performance features, and brand. Customers have access to a variety of options, from high-end, high-performance tires to more affordable options. In the automotive aftermarket, tires are distributed via a number of channels, such as independent tire dealers, tire chains, internet merchants, and auto parts stores. Pricing, skill, and service levels may vary depending on the channel.

The exhaust components segment is expected to grow at a significant CAGR over the forecast period. Driven by the growing demand of consumers for the performance and customization of vehicles, as well as efficiency. Aftermarket exhaust systems produce improvements over regular OEM equipment, offering better engine flow-through, lower back pressure, and a purer or rougher exhaust note depending upon the user. Such systems tend to use higher grade materials, e.g., renewed stainless steel or aluminized steel, which is more durable, corrosion resistant, and thermally efficient. The segment is further being pushed by the rising popularity of customization of vehicles and the advent of performance parts, which can be identified more easily using an online channel.

Global Automotive Aftermarket, By Product, 2020-2023 (USD Billion)

| By Product | 2020 | 2021 | 2022 | 2023 |

| Battery | 57.52 | 60.49 | 63.72 | 67.24 |

| Tire | 139.19 | 145.96 | 153.33 | 161.37 |

| Filters | 35.60 | 37.16 | 38.86 | 40.70 |

| Brake Parts | 53.79 | 55.67 | 57.72 | 59.95 |

| Turbochargers | 39.84 | 41.53 | 43.37 | 45.36 |

| Lighting & Electric Component | 89.29 | 93.57 | 98.21 | 103.26 |

| Exhaust Component | 95.53 | 99.46 | 103.74 | 108.39 |

| Body Parts | 27.21 | 28.21 | 29.30 | 30.48 |

| Wheel | 34.06 | 35.51 | 37.08 | 38.80 |

| Others | 121.06 | 123.58 | 126.28 | 129.16 |

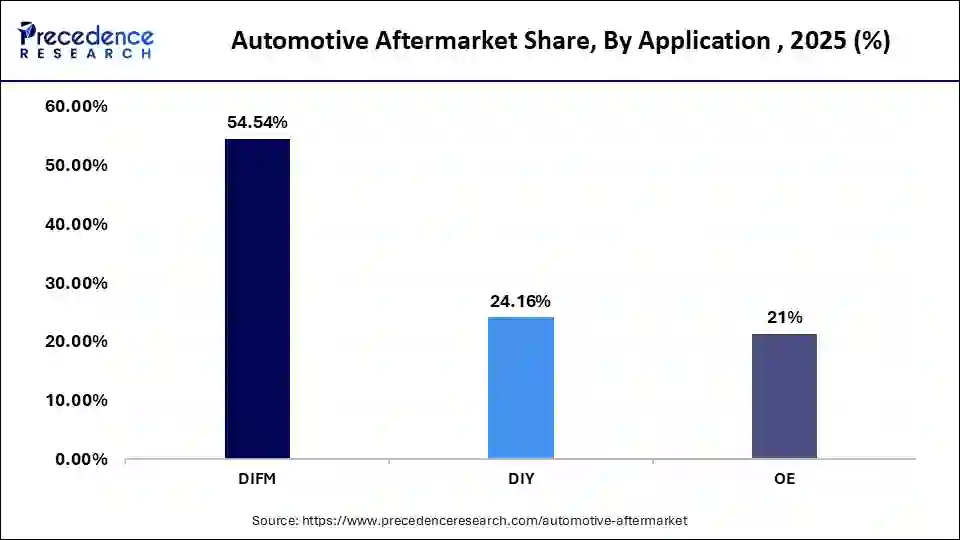

Application Insights

The DIFM (Do it for Me) segment held the largest share in automotive aftermarket. In the automobile aftermarket, a group of customers known as "Do It For Me" (DIFM) prefers to hire specialists to handle chores related to car maintenance, repair, and modification instead of doing them themselves (DIY). Customers in the DIFM market usually look for auto repair shops, service centers, or specialized shops to handle maintenance on their cars, including tire rotations, brake replacements, oil changes, and other mechanical and cosmetic procedures. These customers are prepared to pay for the convenience and knowledge offered by qualified automobile technicians even though they might not have the time, resources, knowledge, or desire to complete these jobs themselves.

Serving the DIFM market requires companies in the automotive aftermarket to provide top-notch products and services, clear pricing, first-rate customer support, and a convenient experience. Services like online appointment booking, car pickup and drop-off, shuttle services, parts and labor warranties, and open communication during the repair or maintenance procedure are a few examples of what this might encompass. Aftermarket companies comprehend and cater to the DIFM segment well because it accounts for a sizeable chunk of the industry and offers chances for expansion and profit. In order to provide value-added services and keep a competitive advantage, it is necessary to be abreast of industry trends, technology developments, and consumer preferences in order to meet the demands and expectations of DIFM clients.

- The DIFM (Do it for Me) segment was valued at USD 428 billion in 2023 and is expected to grow at a CAGR of 4.45% over the forecast period.

- The DIY (Do it Yourself) segment was surpassed at USD 189.57 billion in 2023 and is projected to grow at a CAGR of 5.60% during the forecast period.

The DIY segment is expected to grow substantially in the automotive aftermarket. Due to the increasing availability of automotive parts and tools in e-commerce, DIY users will feel secure to make even complex repairs at home. The trend is especially high in the developed markets that are characterized by high vehicle ownership and consumers looking to maintain cars in the most cost-efficient manner.

Also, the increasing access to inexpensive and easy-to-operate diagnostic tools and non-dealer kits promotes the growth of the DIY segment. These factors, along with the increase in vehicle knowledge, the ease of access to parts online, and the cost-cutting mentality of the consumers, are driving the DIY part of the auto aftermarket into another growth wave.

Distribution Channel Insights

The retailers segment held the largest share in automotive aftermarket. Businesses that sell automotive parts, accessories, and services directly to customers make up the retailing component of the automotive aftermarket. These are conventional physical stores with a focus on selling motor accessories and parts. AutoZone, Advance Auto Parts, and O'Reilly Auto Parts are a few examples. Many retailers now operate largely or solely online due to the growth of e-commerce. Online retailers such as Amazon, eBay Motors, and RockAuto provide a large selection of car accessories and parts. These merchants concentrate on particular categories of automotive goods or services. Specialty stores, for instance, offer accessories, restoration parts, and performance parts for particular car models.

A number of major retail chains, including Costco and Walmart, also sell a variety of automotive goods online and in their physical locations. These are stores, like NAPA Auto Parts locations, that run under a franchise arrangement with a bigger parent corporation. Additionally, there are individual car parts retailers serving regional markets. Automotive aftermarket retailers generally carry a large selection of goods, such as tools, maintenance supplies (such engine oil and fluids), performance enhancements, floor mats and car audio systems, and replacement components (including brake pads, filters, and belts). Additionally, they might offer services like installation, maintenance, and repair either internally or by forming alliances with nearby service facilities or mechanics.

- The retailers segment surpassed USD 587.71 billion in 2023 and is projected to grow at a CAGR of 4.74% during the forecast period.

- The wholesalers & distributors segment was valued at USD 197 billion in 2023 and is expected to grow at a CAGR of 3.45% over the forecast period.

The wholesalers & distributors segment is expected to grow at a significant CAGR over the forecast period. An extensive amount of variety of automobile parts, both as replacements and accessories, such as performance items, are supplied by wholesalers and distributors, which allows for faster and more general access by employing the regional and local markets. They have wide networks of distribution channels and are well connected with the repair shops and auto dealers, which helps maintain a stable chain of supply. Moreover, the distribution process has been streamlined with the invention of better inventory management systems, logistics, and online ordering systems, enabling wholesalers to reach diverse customers around the world.

Certification Insights

The genuine parts segment held the largest share in automotive aftermarket. Parts made by a vehicle's original equipment manufacturer (OEM) or its approved suppliers are referred to as authentic parts in the automotive aftermarket. The car manufacturer's specifications and quality standards are met by the design of these parts. Since genuine components are manufactured to the same specifications as the original parts fitted during construction, they are frequently thought to be of the finest quality and most compatible with the vehicle. For their cars, consumers frequently go with genuine parts since they provide excellent performance, dependability, and warranty coverage. Using authentic parts can also assist keep the car's resale value high and guarantee that it keeps up with safety and legal requirements.

- The certified parts segment was valued at USD 188.67 billion in 2023 and is expected to grow at a CAGR of 4.64% over the forecast period.

- The genuine parts segment was surpassed at USD 479.76 billion in 2023 and is projected to grow at a CAGR of 4.63% during the forecast period.

The certified parts segment is expected to grow substantially in the automotive aftermarket. Certified parts are subjected to replacement of components not produced by the manufacturer of the original equipment (OEM), which is then tested by and certified by third-party institutions of third parties, e.g., Certified Automotive Parts Association (CAPA). Solid testing is done on these parts so that they always have the same level of performance, fit, and safety level as OEM parts. With this, the certification of the parts ensures that they provide a stable and usually cost-effective alternative to the original manufacturer-supplied part, which is quite appealing and desirable to do-it-yourself hobbyists as well as the large full-time repair industries.

Furthermore, the insurance companies and the collision repair outlets are increasingly accommodating certified parts as a feasible option in their repair work, which will increase the demand further. The growth of online sites in which the product certification details are labeled and create authentication also aids the consumer in making a knowledgeable purchase.

Automotive Aftermarket Regional Insights

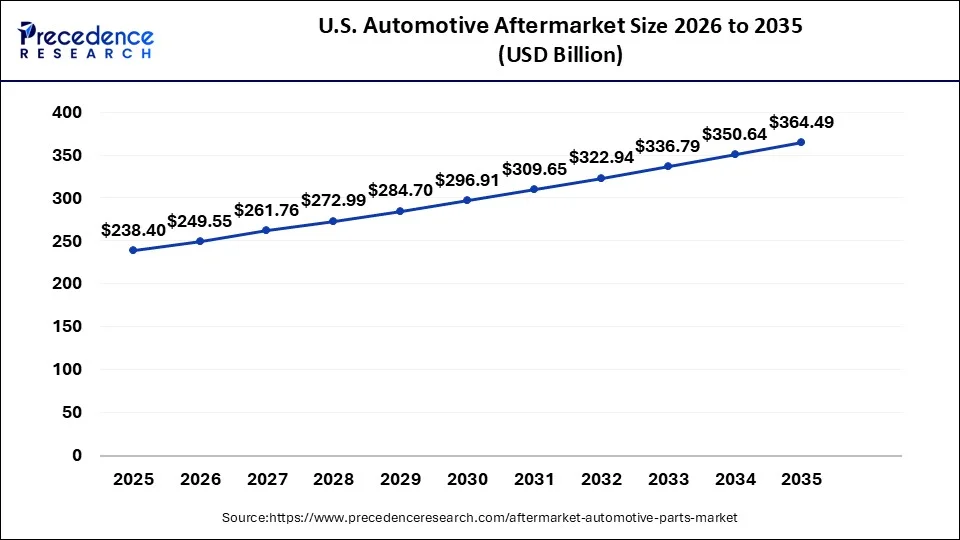

The U.S. automotive aftermarket size is estimated at USD 238.4 billion in 2025 and is predicted to be worth around USD 364.49 billion by 2035, at a CAGR of 4.34% from 2026 to 2035

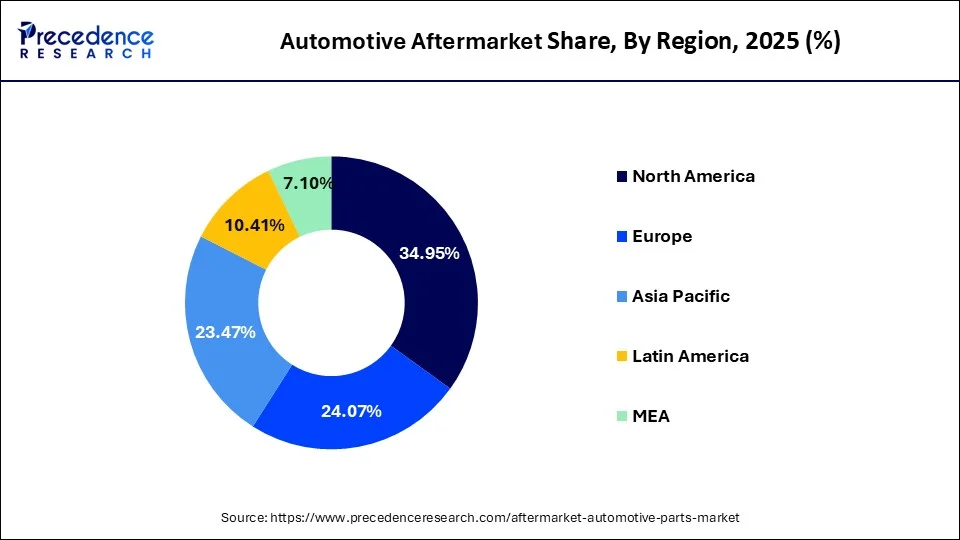

Based on region, North America led the automotive aftermarket in terms of revenue at 34.95% in 2025 and analyzed to witness prominent growth over the forecast period. The surge in demand for passenger cars, use of advanced technology while fabrication of auto parts, and digitalization of component delivery services projected to spur the market growth in the region. Strict emission rules in the region have forced component manufacturers to make necessary upgradation in automotive components to meet the government rules and norms.

Rising environment degradation from automotive emissions has significantly spurred the need for high efficiency and environment-friendly automotive components for global as well as native markets. The trend of sales of pre-owned vehicles is rising and creating a huge demand for automotive aftermarket in the forecasting period. Also, the vehicles or components of vehicle demand replacement after certain years of usage which serves as the key factors in expanding the market in U.S. Furthermore, increasing consumer expenditure and the presence of well-established industry is also fueling the growth of the overall regional market to a large extent. However, the demand shrank during coronavirus pandemic, but it is estimated to rebound in the coming years.

Europe is a prominent revenue contributor in the global automotive aftermarket owing to a regional home for several automotive OEM manufacturers. In addition, high purchasing power coupled with green revolution to transform the transportation into environment-friendly is some of the major factors that spur the market growth. The Europe region has accounted market share of 24.07% over the period 2024 to 233. Germany is one of the most prominent manufacturers of automotive vehicles and has high demand and sales for automobiles which further leads to increase in demand for replacement of several automotive parts thereby expected to drive the market growth in the next few years.

Furthermore, innovative business models and online tailored services is expected to boost the market during the forecast period. Combined with the linkages between GDP growth rates, this German sector is anticipated to persist being a home to some of the most technologically enhanced aftermarket companies of the world, which will aid the country to maintain a strong position in the future.

Japan is one of the most technologically advanced country. Thus, Japan is using its advanced technology in automotive aftermarket to produce innovative body parts and other products of cars more efficiently. As Japanese automotive aftermarket is becoming more environmentally aware thus consumers are making more demand. Thus, technological advancements and huge investment in research and development has resulted in development of automotive aftermarket in the region.

Brazil is well urbanized and the population is conscious about the trending automotive accessories which create a huge demand for aftermarket of various vehicles. Also, the up growing digital market has provoked the market to expand as the consumers can visit the various websites and by comparing make the best choice are some of the prominent drivers determining the market growth.

In the region, the demand for vehicle modification is steadily increasing. Moreover, the government policies aimed at reducing greenhouse emissions have resulted in a higher demand for automotive vehicle repairs. With the growing regulatory regulations and the provision of high-quality automotive parts would provide a favorable growth environment.

GCC - In this region, customers are interested in customizing and improving the appearance of their vehicles in order to enhance their performance. Many vehicle modifications have been demanded in recent years, especially among the region's young people. Also, the per capita income in Saudi Arabia is high which allows the people to indulge in the frequent purchasing of premium products and indulge in luxurious automotive accessories. Hence, this pattern is expected to continue in the coming years lead to increasing demand for automotive parts in the region.

Asia Pacific is estimated to grow at the fastest CAGR during the forecast period. There has been a growth of the vehicle fleet in the region, increasing the demand for services in terms of maintenance, repair, and replacement parts. Also, the process of asset distribution chains digitalization, such as online channels and mobile applications, is making the delivery of products more streamlined and increasing customer contact. The expansion of the aftermarket is increasing further with technological changes in the manufacturing of auto parts, as well as an increase in the number of sales of consumers and passenger cars.

China is the key to the development of the Asia Pacific auto aftermarket. China is the largest automotive market in the world with enormous potential to expand the aftermarket, which is supported by the huge number of vehicles, an exponentially growing average vehicle age, and a solid digital infrastructure. Major Chinese companies are taking advantage of developed logistics, AI-enabled inventory management, and B2B e-commerce to become more efficient in supply chains and deliver more efficiently.

Recent Developments

- In April 2024, a new product called "Schaeffler TruPower" CV Coolant was introduced in the Korean market by Schaeffler Korea, a prominent motion technology business, through its Automotive Aftermarket division. The 4-liter (L) specification commercial vehicle coolant is sold by 'Junwoo APS,' a specialist automotive aftermarket distributor. The additives in Schaeffler TruPower commercial vehicle coolant help to prolong the engine's life by preventing corrosion of internal components and the engine itself.

- In September 2024, Dana Incorporated (NYSE: DAN) will showcase additions to its expanding portfolio of aftermarket products and digital support under the Victor Reinz, Glaser, and Spicer brands at Automechanika 2024 the world's largest trade fair for the light- and commercial-vehicle aftermarket.

- In August 2024, Delphi, a brand under PHINIA Inc., expanded its product lineup by launching over 2,000 new parts in the first half of 2024, covering a total of 632 million vehicles internationally. There were also advancements in significant categories such as Braking, Steering, Suspension, and Sensors, which included an increase in first-to-market launches, compared to the previous year, by 35%. The company also launched new diagnostic software and expanded coverage for electric vehicle models, reaffirming its commitment to keeping vehicles on the road longer with optimal efficiency.

(Source: https://www.motorindiaonline.in)

(Source: https://www.businesswire.com)

Automotive Aftermarket Companies

- p.A.

- 3M Company

- Continental AG

- Robert Bosch GmbH

- Federal-Mogul Corporation

- Denso Corporation

Automotive Aftermarket Segments Covered in the Report

By Product:

- Battery

- Tire

- Filters

- Brake Parts

- Turbochargers

- Lighting & Electronic Components

- Body Parts

- Exhaust Components

- Wheels

- Others

By Application

- DIFM (Do it for Me)

- DIY (Do it Yourself)

- OE (Delegating to OEMs)

By Distribution Channel

- Wholesalers & Distributors

- Retailers

- OEMs

- Repair Shops

By Certification

- Certified Parts,

- Genuine Parts,

- Uncertified Parts

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting