What is the Automotive Sensor Market Size?

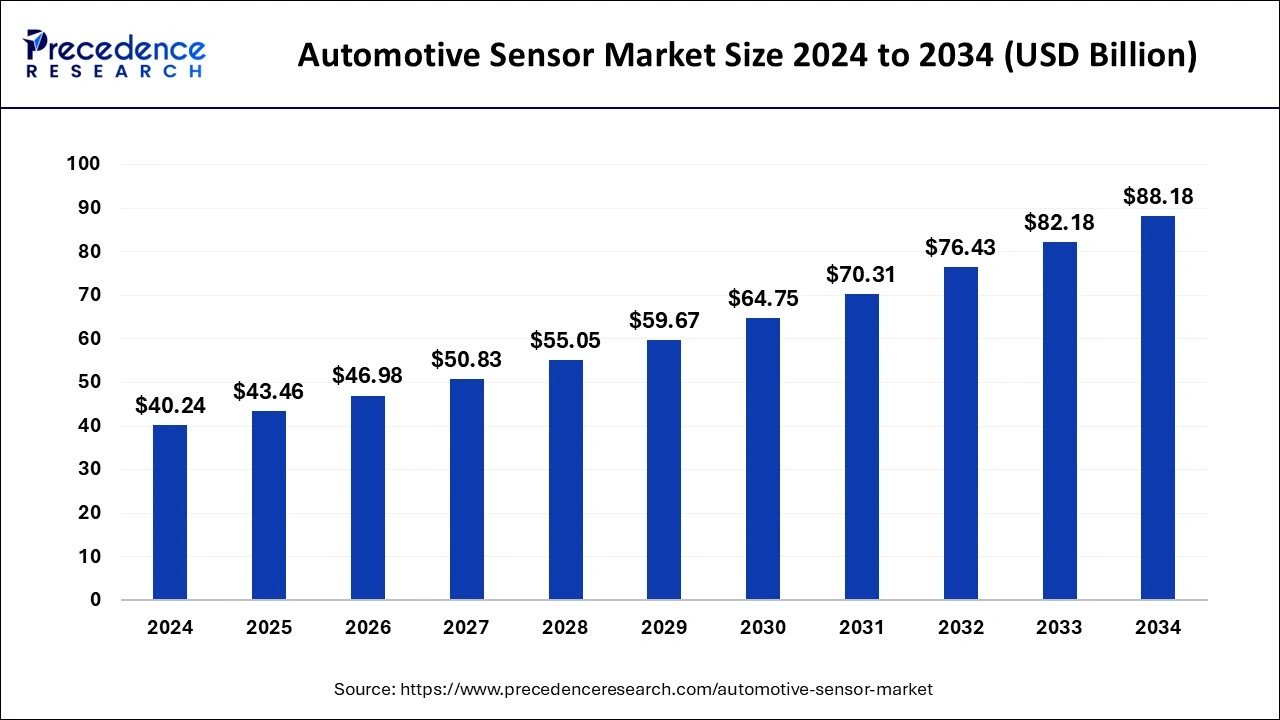

The global automotive sensor market size was valued at USD 43.46billion in 2025 and is expected to hit around USD 94.01 billion by 2035, expanding growth at a notable CAGR of 8.02% from 2026 to 2035.

Automotive Sensor Market Key Takeaway

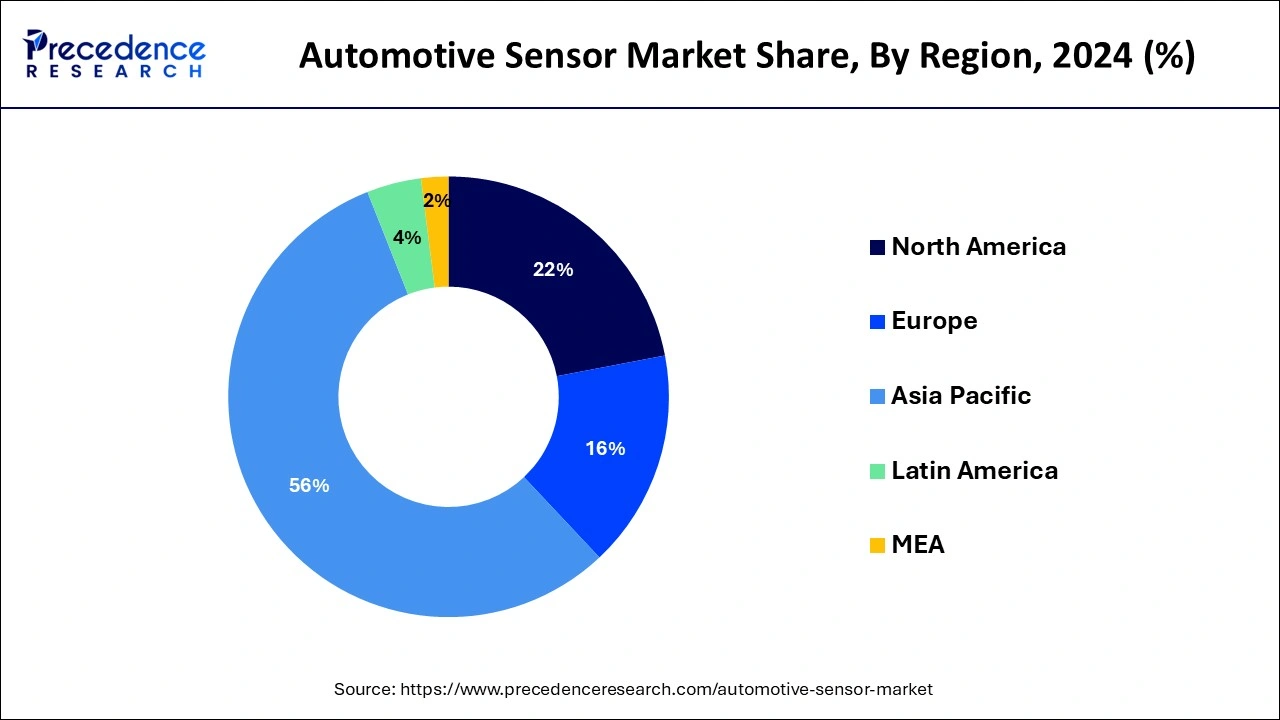

- Asia Pacific region has captured 56.11% of the total revenue share in 2025.

- By application, the ADAS & safety system segment has held a 42% revenue share in 2025.

- By vehicle type, the passenger vehicle segment has generated 86% of the total revenue share in 2025.

- By type, the image sensor segment accounted for 17% of revenue share in 2025.

Automotive Sensor Market Growth Factors

- Rising demand of sensors in electric and hybrid vehicles, increased application of pressure sensor in automotive industry, and significant growth in custom designed automotive electronic devices are some of the prime factors that fuel the automotive sensor market growth.

- Surge in demand for electric vehicles have been prominently accelerated in the past few years owing to stringent government regulation for harmful gas emission in the environment. Public awareness for safety and security has also driven the automotive sensors market growth prominently in the past few years. For instance, The World Forum for Harmonization of Vehicle Regulations had issued some Global Technical Regulation for enriched vehicle safety that include electronic stability control systems and technical requirements for OBD for road vehicles.

- On the other hand, high development cost associated to the automotive sensors expected to restrict the market growth. Moreover, frequent adoption of advanced technologies in the automotive industry offers lucrative growth opportunity for the implementation of sensor technology in automobiles.

Market Outlook

- Industry Growth Overview: The marketplace for automotive sensors continues to be a growing marketplace due to increasing electronic content per vehicle, increasing levels of ADAS being adopted, and the need for real-time monitoring of vehicles in both the passenger and commercial marketplaces.

- Sustainability Trends: Sensors are integral components of emissions control, reducing energy consumption, and regulating battery usage, assisting automobile manufacturers in reaching their greenhouse gas reduction goals and complying with new and more rigorous environmental laws being enforced worldwide.

- Global Expansion: The growth of automotive sensors is being supported by the manufacture of localized sensors, which is accompanied by an increase in the production of automobiles in emerging markets and growth in innovations in the area of smart mobility, connected vehicles, and charging infrastructure for electric vehicles.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 43.46 Billion |

| Market Size by 2035 | USD 94.01 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.02% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, Sales Channel, Vehicle, Engine, by Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Segment Insights

Type Insights

In 2025, speed sensor dominated the global automotive sensor market with significant revenue share. The main factors that drives the growth of the segment is increased application in monitoring and controlling the speed of the vehicles. Speed was determined as the major cause for rising number of accidents across the globe, thus speed sensors are the first most sensors to be implemented by automobile manufacturers for enhancing the vehicle safety.

On the contrary, gas sensor exhibits the fastest growth over the forecast period owing to increased emphasis of governments of various regions to control pollution and enhance the fuel efficiency of the vehicles. For instance, European government announced to impose heavy fines on the auto manufacturers if they didn't improves the fuel efficiency and reduces the CO2 emission in their upcoming vehicles. Gas sensor are largely used to monitors the release of harmful gases in the atmosphere along with improved fuel efficiency.

Application Insights

Powertrain held the major revenue share in the global automotive sensor market in 2025. This is mainly attributed to large number of sensors used in powertrain to monitor speed, position, gas, temperature, and pressure for safe and efficient operation. Furthermore, stringent emission regulations and fuel-efficiency norms formulated by governments of various countries drives the growth of automotive sensors in powertrain application. Collecting analog information related to temperature and pressure in automobile to be used by their digital control unit is crucial to fulfill emission regulation and fuel efficiency. Sensors help the automotive engines to burn fuel efficiently by using precise data of engine to optimize fuel consumption as per the requirement of the automobile.

However, safety & security and telematics exhibit lucrative growth opportunities in the coming years. Increasing number of road accidents over the past few years have forced the automobile manufacturers to enhance safety and security in the vehicle. World Health Organization (WHO) has also quoted that major death cause per is due to road accidents. Sensor technology provides assistance to the drivers and informs them from upcoming risk.

Automotive Sensor Market Companies & Market Share Insights

The global automotive sensors market offers high growth opportunity for the market players owing to increased application of sensor technology in the automotive industry. Denso Corporation and Robert Bosch cover more than 25% of the global revenue share and currently adopting strategies for market consolidation. Denso Corp. and Robert Bosch both are global companies with its several branches in different regions. They have adopted inorganic strategies such as merger & acquisition, collaboration, and regional to excel their growth in the market. Product development and advancement is the another growth strategy that significant number of players are adopting to secure their market position.

Regional Insights

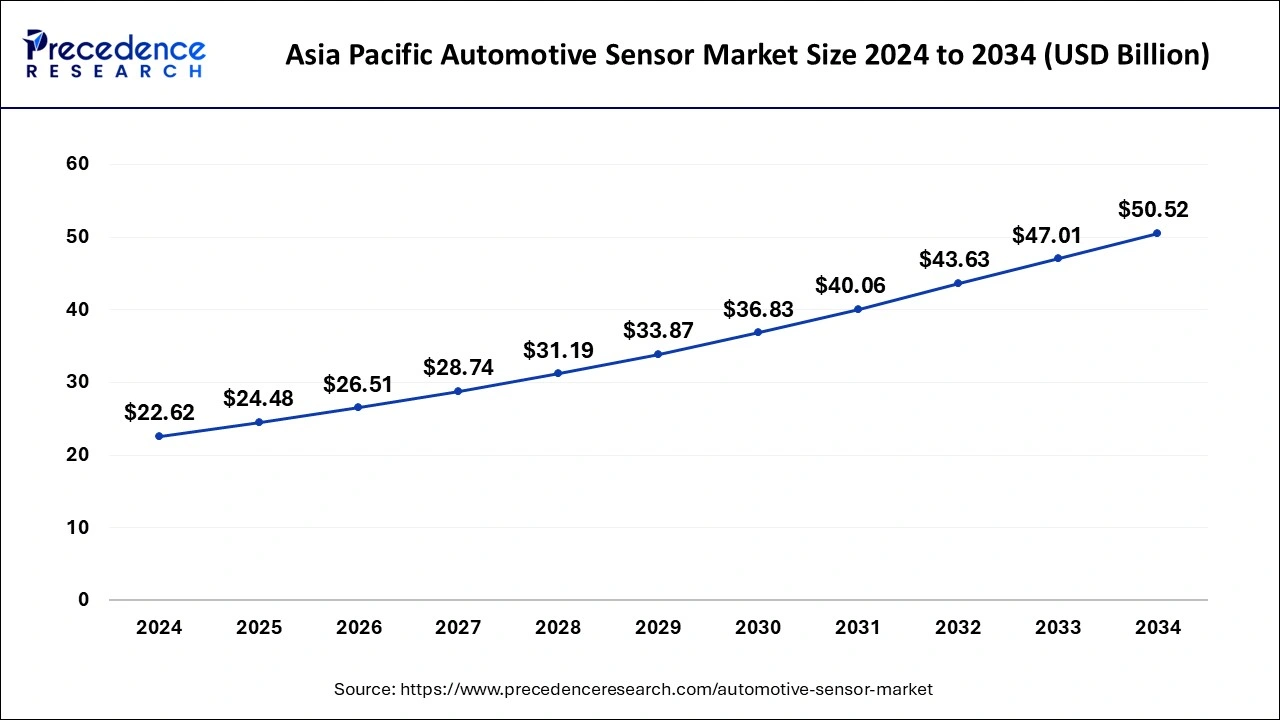

What is the Asia Pacific Automotive Sensor Market Size?

The Asia Pacific automotive sensor market size reached USD 24.48 billion in 2025 and is projected to surpass around USD 53.94 billion by 2035, growing at a CAGR of 8.36% from 2026 to 2035.

The automotive sensor market has been analyzed for North America, Europe, Asia Pacific, and Rest of the World. The Asia Pacific is the most prominent region in the global market. The region held significant revenue share in 2025 and exhibits lucrative growth aspect in the coming years. The prime factors attributed to this are rising demand for enhanced safety vehicle coupled with increasing purchasing power in the region. Emerging economies in the Asia Pacific such as India and China experience significant demand for automotive sensors. Large consumer base and green revolution drives in the region have flourished the application of sensor technology in automotive industry prominently.

North America and Europe are the other significant revenue contributors for the global automotive sensors market. Prior adopter of the technology and high Gross Domestic Product (GDP) are some of the prime factors that fuel the growth of the region. In addition, rising concern for pollution control and environment safety has forced the manufacturers to implement smart sensor technology in the automotive vehicles for controlling and monitoring the gas emission in the atmosphere.

Europe: Precision Engineering and Regulatory-Driven Expansion

Continues to be a lucrative marketplace as a result of strict safety regulations, high-class vehicle manufacturing, and quick uptake of ADAS and electric vehicles. Continuous R&D investment will help ensure that sensor innovation and implementation continue to be realized rapidly across all vehicle types. Germany's focus on developing autonomous driving and electric vehicle platforms has created an accelerated need for advanced automotive sensors.

Latin America: Gradual Modernization of Automotive Electronics

Latin America is experiencing moderate automotive electronics sales growth as manufacturers are increasingly focused on increasing safety in vehicles, including adding improved electronics. The increase in locally produced cars, along with improved regulatory alignment, will enhance mass market penetration of automotive electronics.

Brazil Automotive Sensor Market Trends

Brazil has an increasing number of automotive manufacturing facilities and is increasingly investing in technology to make its cars safer, both of which are contributing to an increased adoption of automotive electronics.

Middle East and Africa: Emerging Demand with Long-Term Potential

MEA is making gradual progress as a result of fleet modernization, infrastructure improvements, and increasing demand for fleet vehicles and premium vehicles with advanced sensing capabilities. The UAE's focus on intelligent mobility and high-end vehicles is fuelling an exponential increase in automotive electronics in the region.

Value Chain Analysis of the Automotive Sensor Market

- Raw Material Sourcing: The raw materials for high-precision automotive sensors, such as silicon wafers, MEMS materials, and rare earth elements, need to have consistent quality as they directly impact both the sensor's accuracy and its long-term durability and performance when used in an environmentally-challenging automotive setting.

Key Players: Infineon Technologies, STMicroelectronics, and TDK Corporation. - Component Manufacturing: The components manufactured for high-precision automotive sensors include the manufacture of MEMS, sensor chips, sensor packaging, and sensor assembly at the module level, with a focus on using advanced clean-room facilities and having calibration and functional testing capabilities to meet the automotive reliability requirements.

Key Players: Bosch, Denso Corporation, and Analog Devices. - Vehicle Assembly, Integration, and Aftermarket Services: Once the automotive sensors are integrated into the vehicle systems during OEM assembly, they require aftermarket support through diagnosis, replacement, and software updates.

Key Players: Continental, Valeo, and ZF Friedrichshafen.

Automotive Sensor Market Companies

- Robert Bosch

- AUTOLIV INC

- DENSO Corporation

- Valeo

- Continental AG

- Sensata Technologies

- Delphi Automotive Company

- STMicroelectronics N.V

- NXP Semiconductor

- Infineon Technologies AG

Segments Covered in the Report

By Type

- Position Sensors

- Clutch Position Sensors

- Gear Position Sensors

- Throttle Position Sensors

- Crankshaft Position Sensors

- Steering Angle Position Sensors

- Camshaft Position Sensors

- Safety Sensors

- Seat Belt Sensors

- Brake Switch Sensors

- Door Switch Sensors

- ADAS Sensors

- Blind Spot Detection

- Night Vision Sensors

- Light Sensors

- Parking Sensors

- Cruise Control

- Impact Sensors

- Anti-theft Sensors

- Knock Detection Sensors

- Level Sensors

- Fuel Level Sensors

- Coolant Level Sensors

- Oil Level Sensors

- Oxygen Sensors

- Pressure Sensors

- Tire Pressure Sensors

- EGR Pressure Sensors

- Airflow Rate Sensors

- Temperature Sensors

- Engine Coolant Temperature Sensors

- Rain/humidity Sensors

- Oil/Fuel Temperature Sensors

- Battery Temperature Sensors

- Air Temperature Sensors

- Speed Sensors

- Wheel Speed Sensors

- Speedometer

By Application

- Powertrain

- Safety & Security

- Body Electronics

- Steering system

- Chassis system

- Others

- ADAS & safety system

- Health, wellness, wellbeing (HWW)

- Telematics

By Vehicle

- Passenger Cars

- Compact

- Midsize

- Luxury

- SUVs

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By Engine Type

- Gasoline

- Diesel

- Hybrid

- Battery electric vehicles

- Fuel cell

By Sales Channel

- Original Equipment Manufacturers

- Original Equipment Supplier Spare Parts

- Independent Aftermarket

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting