What is the Laser Processing Market Size?

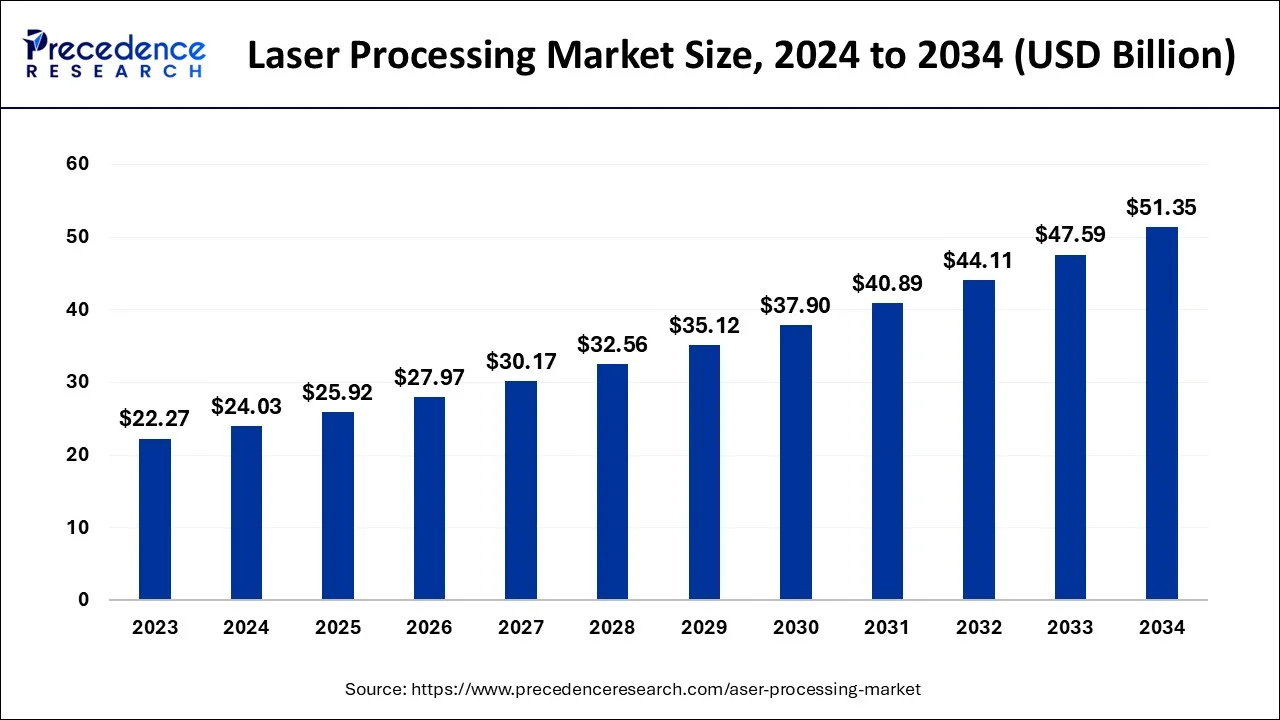

The global laser processing market size was exhibited at USD 25.92 billion in 2025, and is anticipated to hit around USD 27.97 billion by 2026, and is predicted to surpass around USD 54.92 billion by 2035, growing at a CAGR of 7.80% from 2026 to 2035.

Laser Processing MarketKey Takewayes

- In terms of revenue, the market is valued at $25.92 billion in 2025.

- It is projected to reach $54.92 billion by 2035.

- The market is expected to grow at a CAGR of 7.80% from 2026 to 2035.

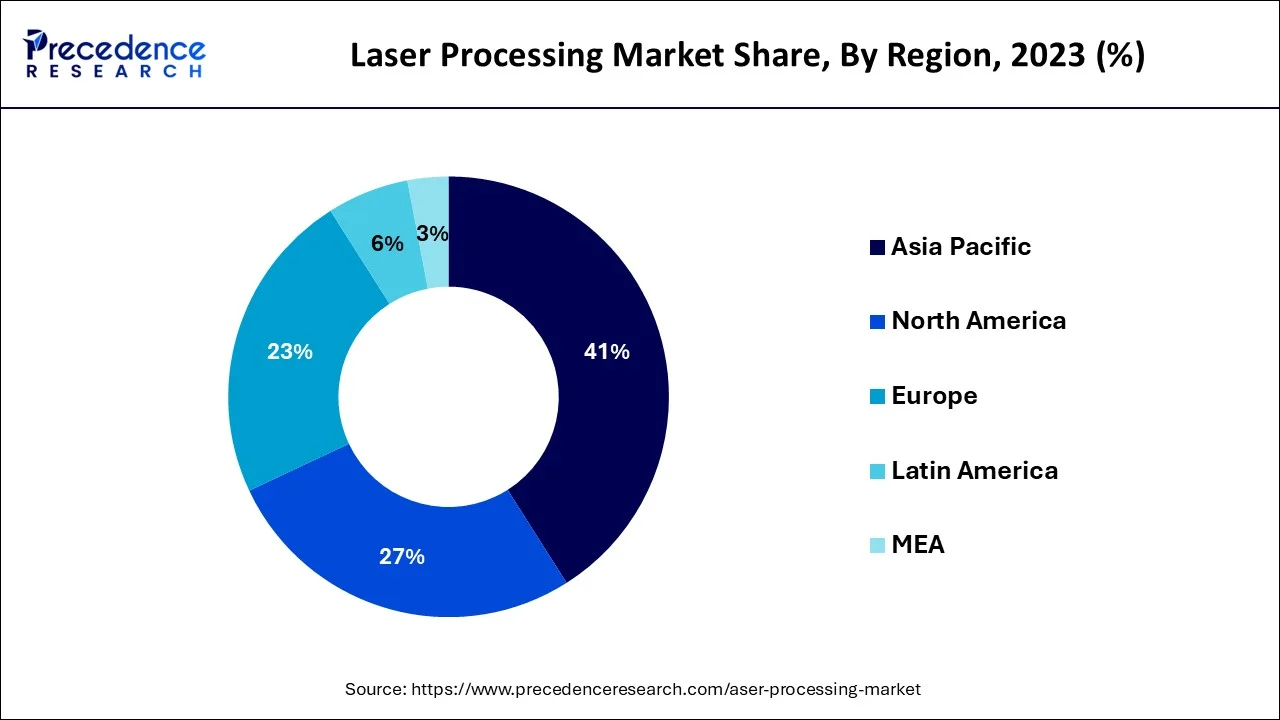

- The Asia Pacific will lead the market and generate more than 41% of the revenue share in 2025.

- Europe is predicted to grow at the fastest CAGR from 2026 to 2035.

- By product, the material processing segment dominated the market.

- By product, the micro-processing segment is the fastest-growing segment from 2026 to 2035.

- By process, the material processing segment dominated the market in 2025.

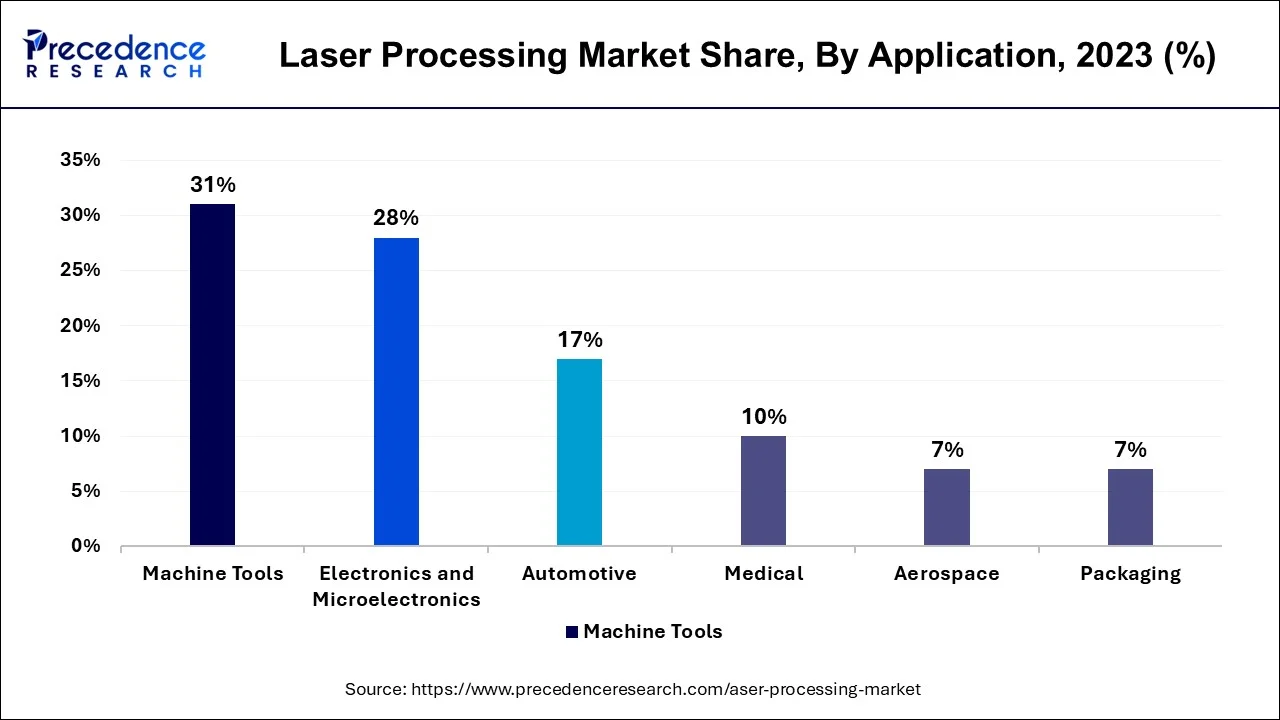

- By application, the machine tools segment led the market with a revenue share of more than 31%, in 2025.

- By application, the electronic µelectronics segment will be the quickest-growing segment from 2026 to 2035.

What is Laser Processing?

Laser systems use electromagnetic radiation to enable material processing activities such as welding, cutting, lithography, and engraving. The increased use of lasers in medical devices and surgery applications is attributed to market growth. Additionally, the rapid advancement of nanofabrication technology is expected to expand the global market.

Furthermore, due to numerous advantages over traditional material processing, the manufacturing sector has increased its adoption of laser technology for material processing, which is anticipated to be one of the key factors propelling the market.

Market Outlook

- Industry Growth Overview: The growth in the electric vehicle production, integration of lasers in microelectronic fabrication, and technological advancements are responsible for industry growth.

- Major Investors: Massive institutional asset managers, strategic corporates, and private equity firms are the major investors in the market. IPG Photonics and TRUMPF are some of the major investors.

- Startup Ecosystem: The startup ecosystem is focusing on high-throughput micro processing, green manufacturing, and AI-powered beam orchestration. Civan Lasers, Xarion Lasers Acoustics, and FemtoPrint are actively participating in the market.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 54.92 Billion |

| Market Size in 2025 | USD 25.92 Billion |

| Market Size in 2026 | USD 27.97 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 7.80% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Europe |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Process, Application and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Rapidly increasing application of laser processing in the automotive sector

The growing use of laser processing in the automotive industry is propelling the market due to the growing demand for high-power carbon dioxide lasers for manipulating automotive components. Moreover, the rising proclivity of automobile manufacturers to implement laser-wielding sheet assemblies as a replacement for resistance spot welding is expected to be a significant driving factor in the market.

Lasers will be used at every stage of the car manufacturing process in 2022, from design and development to final assembly. For instance, Volkswagen AG employs more than 800 high-power lasers in its global assembly plants.

In January 2025, ArcelorMittal partnered with TRUMPF to combine ArcelorMittal's expertise in advanced automotive steel with TRUMPF's cutting-edge laser technology, enabling the precise shaping of laser-welded, hot-stamped MPI parts for modern vehicle design. The partnership aims to meet the evolving demand for lighter, safer, and more sustainable vehicles in the automotive industry.

Pros of laser processing over traditional material processing

The benefits of laser material processing over traditional methods are anticipated to increase laser adoption for material processing during the forecast period. Laser cutting is becoming more popular as the demand for microelectronics miniaturization grows. Compared to traditional cutting methods, laser processing has an extremely high level of precision.

This is because the laser beam does not wear out during the cutting process, resulting in a consistent, distortion-free cut. It is quick and produces items without the need for retooling. Furthermore, the laser weld has increased weld strength because it is thin and has an excellent depth-to-width ratio.

Restraints

Complex as well as an expensive process

The installation of laser technology for the required application is difficult and costly. The enormous resources required to process a wide range of applications are impacting the overall growth of the laser processing market. According to a survey, the maintenance costs for conventional plasma cutting are around USD 5000 per year.

In contrast, the maintenance costs for laser processing and cutting machines are around USD 10000 per year. Although the prices of products processed with laser technology are declining, the technology remains expensive.

Opportunities

Rising use in the medical as well as the additive manufacturing sector

Nd: YAG lasers and carbon dioxide are the most often used technology in the medical sector. Lasers are used frequently to treat skin, eyes, and hair cancer. Laser technology has made many therapies possible, including artery cleansing, surgery for a detached retina, and other aesthetic procedures. Furthermore, the technology can remove permanent birthmarks on the skin, skin imperfections, and other skin treatments. Lasers are used in hospitals & dispensaries for processing medical items such as implants & surgical instruments.

Segment Insights

Product Insights

Based on the product, the laser processing market is segmented into gas, solid, and fiber. In 2024, the gas segment dominated the market. Copper, nitrogen, carbon dioxide, carbon monoxide, argon-ion, and helium-neon lasers are all part of the gas segment.

The benefits of the gas segment include strong coherence, a stable central wavelength, high spectral purity, and good beam and alignment quality, among others. Furthermore, gas lasers are inexpensive and widely available. Helium-neon (HeNe) lasers are anticipated to gain popularity over the forecast period due to their dependability and high range of applications.

Over the forecast period, the solid laser industry is expected to grow rapidly. This laser minimizes material waste in the active medium while producing high-quality continuous and pulse output. Endoscopy in medicine, drilling holes in metals, and military targeting are some of the applications for solid lasers. The rising demand for these lasers in various industries, including automotive, aerospace, machine tools, medical, and packaging, is anticipated to propel global market growth over the forecast period.

Process Insights

The laser processing market is segmented into material processing, marking & engraving, and micro-processing. In 2024, the material processing segment dominated the industry.

Material processing includes hybrid processes, laser beam welding development and implementation, micro-drilling, surface modifications, cutting, and machining. It is also used in direct manufacturing in the formation of micro deposition and removal of bulk material & coating, which is anticipated to propel the market growth.

On the other hand, the microprocessor segment is the fastest-growing segment during the forecast period. A microprocessor is an electronic component integrated into a single integrated circuit (IC) and contains millions of small parts that work together, such as diodes, transistors, and resistors. This chip performs various functions, including timing, data storage, and interaction with peripheral devices.

These integrated circuits are found in multiple electronic devices, including servers, tablets, smartphones, and embedded devices. Demand for smartphones and tablets is anticipated to propel market growth over the forecast period.

Application Insights

Based on the application, the laser processing market is segmented into automotive, aerospace, machine tools, electronics and microelectronics, medical, and packaging. In 2024, the machine tools segment led the industry with a revenue share of more than 31%.

The growing use of lasers in the industrial sector for various material processing applications such as cutting, welding, drilling, and engraving is expected to fuel the machine tools application segment. Machine tools are also likely to become more popular as the demand for passenger and electric vehicles grows. Industry 4.0 can improve machine tools used in manufacturing operations by reducing idle time.

The electronic & microelectronics segment will be the fastest-growing segment from 2024 to 2034. The growing demand is due to the extensive use of welding in the manufacture of medical devices. Pacemakers, implantable devices, and surgical tools are vital medical applications requiring ultra-fine wires and non-porous and sterile surfaces used in cardiac procedures. This led to an increasing requirement for microelectronics.

Regional Insights

What is the Asia Pacific Laser Processing Market Size?

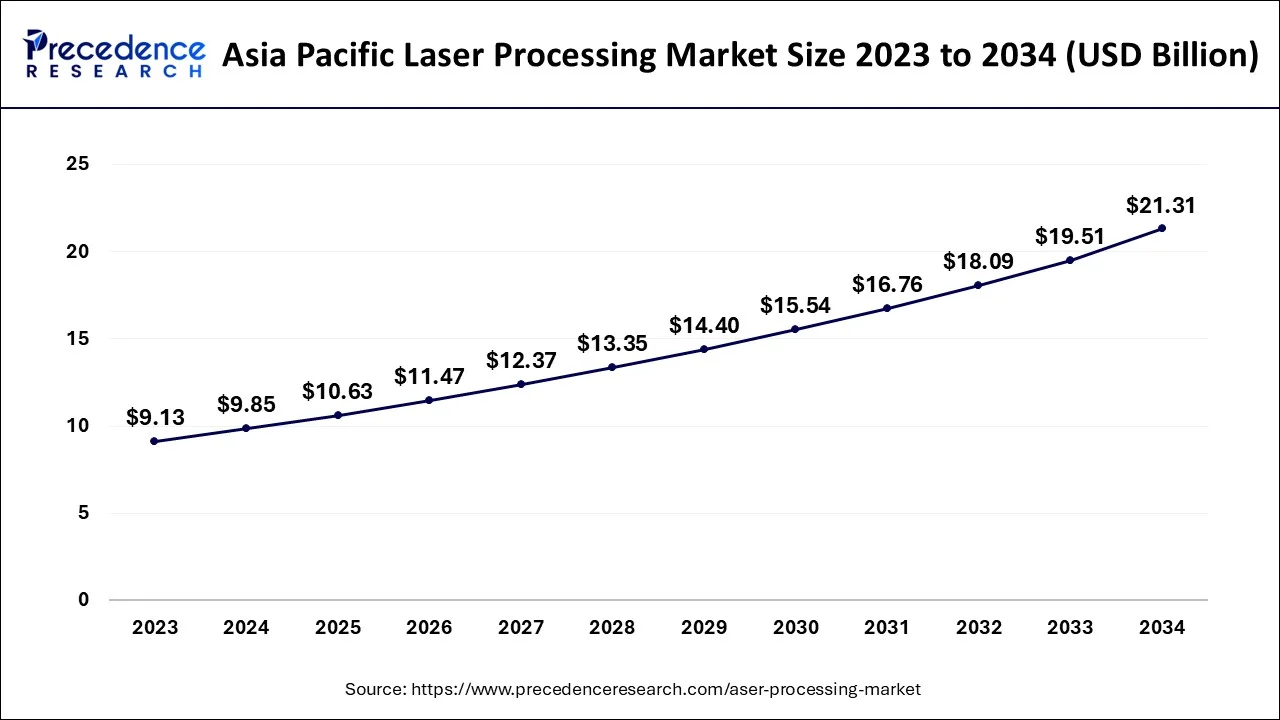

The Asia Pacific laser processing market size is estimated at USD 10.63 billion in 2025 and is expected to be worth around USD 22.86 billion by 2035, rising at a CAGR of 7.96% from 2026 to 2035.

Rising OEMs Boost Asia Pacific Laser Processing Industry

In 2024, Asia Pacific will lead the market with a revenue share of more than 41%. It is expected to grow significantly due to the rising number of OEMs. China will likely become a significant consumer of industrial lasers, materials processing, and micro-processing systems. Countries such as India, South Korea, Japan, and China are expected to grow rapidly due to factors such as increasing OEMs and automobile industry growth.

China Laser Processing Market Trends

China consists of a large manufacturing hub that drives the demand for laser processing solutions. At the same time, the growing industries are also increasing their use, where they are also being combined with automation and robotics. Additionally, the growing government support is also encouraging their adoption rates.

Furthermore, the region's increasing adoption of laser systems across different application areas is expected to drive market growth. Government regulations requiring permanent and clear markings on consumer goods are expected to increase the adoption of laser processing technology in several countries.

In March 2025, HSG Laser unveiled next-gen fabrication solutions and expanded R&D presence in Japan. The company announced a strategic R&D collaboration with Chiba University and the establishment of the HSG Tokyo Laser Process Center, reinforcing its commitment to innovation in precision and automation. HSG Laser introduced three cutting-edge fabrication solutions, including the Store Pro automation system, the all-new GH Series high-power laser cutting machine, and the TS2 Tube Laser.

Increasing Healthcare Applications Drive European Laser Processing Industry

Europe is anticipated to grow over the fastest period. The market's growth can be attributed to the increasing use of lasers in medical equipment and activities. Moreover, the rapid advancement of nanofabrication technology is expected to aid market expansion. Since the system has several advantages over traditional material processing, the manufacturing industry has increased its acceptance of laser technology for material processing.

Government laws governing the use of laser techniques in product marking and engraving are expected to fuel market growth. The market is expected to grow rapidly in the coming years due to the technology used in various applications such as welding, marking, piercing, cutting, and engraving.

The UK Laser Processing Market Trends

The presence of advanced industries in the UK is increasing the adoption of laser processing solutions across the aerospace, healthcare, and automotive sectors. Furthermore, the growing use of electric vehicles is also increasing their use to accelerate their manufacturing. Additionally, the companies are developing next-generation laser technologies.

Increasing Applications Stimulate North America

North America is expected to grow significantly in the laser processing market during the forecast period, due to growing aerospace applications. This, in turn, is increasing the use of laser processing for various components and surface treatments, where the advanced manufacturing base is also increasing its use, promoting the market growth.

U.S. Laser Processing Market Trends

China consists of a large manufacturing hub that drives the demand for laser processing solutions. At the same time, the growing industries are also increasing their use, where they are also being combined with automation and robotics. Additionally, the growing government support is also encouraging their adoption rates.

The growing use of electric vehicles across the U.S. is increasing the use of laser processing solutions for their production. Additionally, their growing healthcare and defence applications are also increasing their demand. Furthermore, growing innovations are also encouraging their adoption rates.

Laser Processing Market-Value Chain Analysis

- Raw Material Procurement (Silicon Wafers, Gases)

Raw material procurement of laser processing involves the sourcing of ultra-high purity gases, rare earth elements, and optical grade crystals.

Key players: Coherent Crop, Linde, IPG Photonics. - Testing and Quality Control

The testing and quality control of the laser processing focus on real-time beam profiling, AI-powered weld inspection, and interferometric depth monitoring.

Key players: Ophir, Precitec, TRUMPF. - Lifecycle Support and Recycling

The focus on circular economy refurbishment is involved in the lifecycle support and recycling of the laser processing.

Key players: Coherent Crop, IPG Photonics, TRUMPF.

Laser Processing Market Companies

- Bystronic Laser AG: Sheet and tube metal processing solutions are provided by the company.

- Han's Laser Technology Industry Group Co., Ltd.: The company provides high-volume turnkey systems.

- IPG Photonics Corporation: YLS-ECO Series and LightWELD are the products provided by the company.

- Coherent Inc.: The company offers EDGE FL Series, diamond series, and Axon FP.

- Trumpf GmbH + Co. KG: The company provides TruLaser Station 7000, Scientific Lasers, and TruLaser Cell 5030.

Other Major Key Players

- Altec GmbH

- Alpha Nov laser

- Amada Co., Ltd.

- Epilog Laser, Inc.

- Eurolaser GmbH

- Newport Corporation (MKS Instruments, Inc.)

- LaserStar Technologies Corporation

- IPG Photonics Corporation

- Newport Corporation

- Universal Laser Systems, Inc.

- Xenetech Global Inc.

Recent Developments

- In October 2024, nLIGHT, Inc., a leading provider of high-power semiconductor and fiber lasers used in the industrial, microfabrication, aerospace, and defense markets, today announces the global launch of two new products: nfinity and ProcessGUARD, designed specifically to support the increasing demand in advanced metal fabrication.

- In January 2025, Laser Photonics Corporation (LPC), a leading developer of industrial laser systems for laser cleaning and other material processing applications, announced the unveiling of a transformative laser cleaning-enabled robotic crawler alongside a visual concept of the technology. This breakthrough technology was demonstrated at the Pearl Harbor Naval Shipyard & Intermediate Maintenance Facility Technology & Capabilities Demo on 22nd January 2025.

- In April 2025, AkzoNobel bonds with IPG Photonics over laser curing for powder coatings. The partnership between AkzoNobel and IPG Photonics focused on applying laser technology for curing powder coatings. The two companies have signed an agreement for the partnership to exclusively serve customers in the EMEA (Europe, Middle East, and Africa) region. ?

- The Spectra-Physics Talon 532-70 laser, a high-power green member of the Talon series of nanosecond pulsed diode-pumped solid-state (DPSS) lasers, was released by MKS Instruments, Inc. in July 2022.

- In March 2022, MADA entered the European market with its ENSIS-6225AJ fiber laser cutting equipment.

- The newest ranges of TruMicro ultrashort pulse lasers, the TruMicro 6000 and TruMicro 2000, were unveiled by TRUMPF in April 2022. The product range provides new technological platforms that increase versatility and provide accurate power. Additionally, the two most recent generations of TruMicro lasers would expand the product line for microprocessing and offer solutions to satisfy the market's high demands.

- In March 2022, Mitsubishi Electric Corporation, a leading Japanese multinational electronics & electrical equipment manufacturer, announced the launch of two new wire-laser metal 3D printers. The AZ600 is available in two models: the AZ600-F20 and the AZ600-F40.

- On March 2022, IPG Photonics introduced LightWELD XR, the third product in its handheld laser welding and cleaning line. By producing a tiny spot size with six times greater energy thickness, the laser offers a wide range of cleaning capabilities and handheld laser welding to manage more materials and width than previous LightWELD products.

- In June 2020, Yamazaki Mazak, a market leader, announced the release of their latest laser processing machine. Compared to existing laser processing machines, the device can cut many tubes of varying diameters at a rapid pace. Furthermore, the machine can cut materials such as copper, aluminum, mild steel, brass, and stainless steel, commonly used in automotive, construction materials, and furniture industries.

- Om May 2021, Pulse Systems, a laser processing company, was acquired by Heraeus Medical Components.

- In March 2021, Opt Lasers, one of the leading companies, introduced the PLH3D-15W, a newer version of the laser processing machine. The machine is regarded as the most versatile engraving laser in terms of materials; its compact size allows it to fit into any industrial application and process a wide range of materials, including wood, leather, textiles, and plastic. The machine uses blue laser light, which is more efficient than infrared lasers. This machine is ideal for large industrial purposes.

- In February 2021, Jenoptik and 4JET introduced laser processing technology.

Segments Covered in the Report

By Product

- Gas

- Solid-state

- Fiber

By Process

- Material Processing

- Marking & Engraving

- Micro-processing

By Application

- Automotive

- Aerospace

- Machine Tools

- Electronics and Microelectronics

- Medical

- Packaging

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting