What is the Microprocessor Market Size?

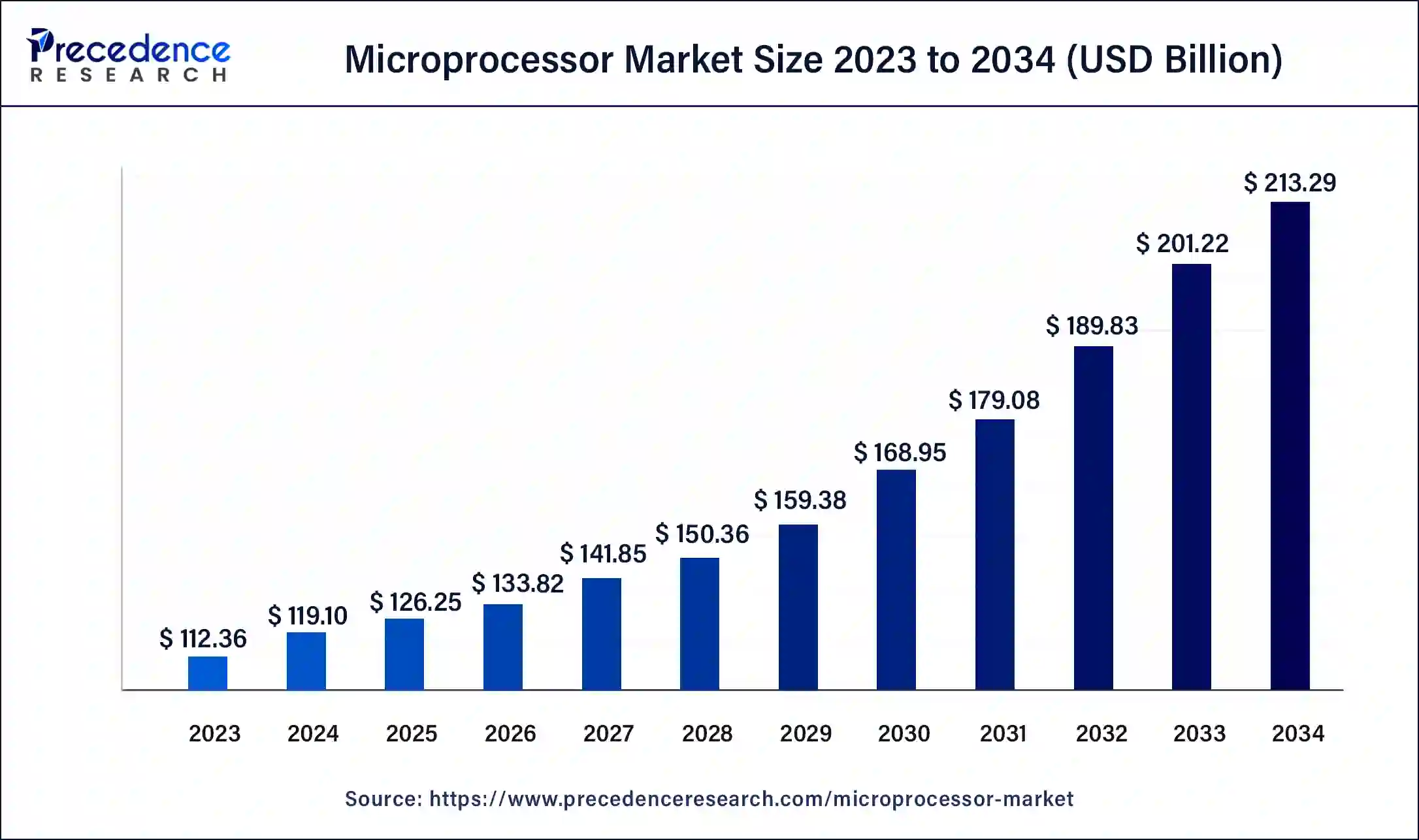

The global microprocessor market size accounted for USD 126.25 billion in 2025 and is expected to be worth around USD 224.91billion by 2035, at a CAGR of 6% from 2026 to 2035. The growing use of microprocessors insmartphones and the increasing use of embedded microprocessors in the healthcare electronics sector are the driving factors of the microprocessor market.

Microprocessor Market Key Takeaways

- In terms of revenue, the market is valued at $126.25 billion in 2025.

- It is projected to reach $224.91 billion by 2035.

- The market is expected to grow at a CAGR of 5.94% from 2026 to 2035.

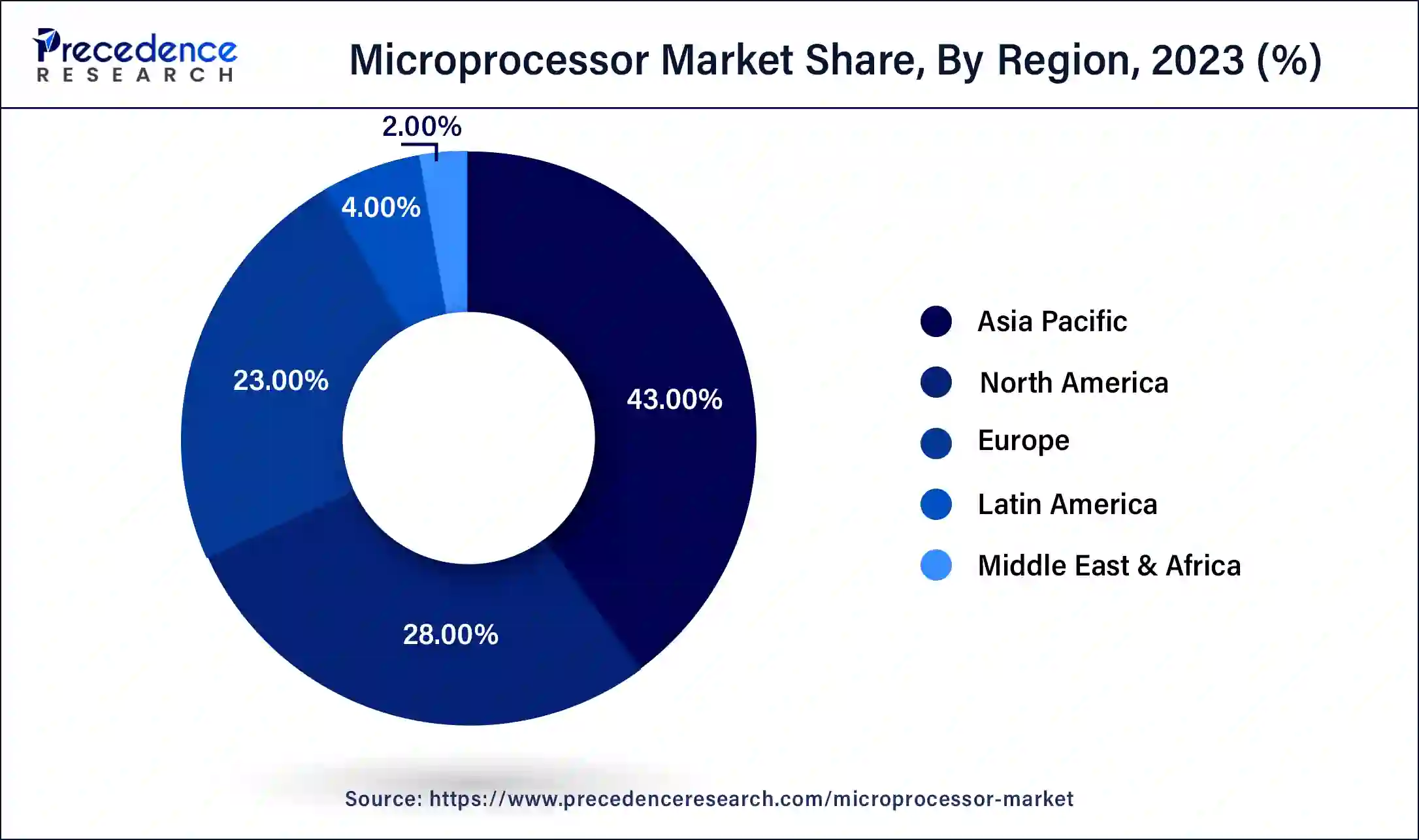

- Asia Pacific generated more than 43% of revenue share in 2025.

- North America is expected to grow at a CAGR during the forecast period.

- By Technology, the reduced instruction set microprocessor (RISC) segment has held the largest revenue share of 30% in 2025.

- By Technology, the ASIC segment is anticipated to grow at a remarkable CAGR during the projected period.

- By Application, the personal computer (PC) segment contributed more than 41% of revenue share in 2025.

- By Application, the server segment is expected to expand at the fastest CAGR over the projected period.

Microprocessor Market Growth Factors

In terms of market size and models, the smartphone industry has been continually evolving and rising. According to Ericsson, the number of smartphone subscriptions worldwide will surpass six billion in 2021, and will continue to expand by several hundred million in the next years. The countries with the most smartphone users are China, India, and the United States. By 2026, it is predicted that the number of smartphone subscribers would have risen to 7516 million. With the increasing demand of smartphones, the manufacturers are developing the efficient product. Because it is utilized to improve the speed and efficiency of a smartphone, the microprocessor improves its performance. Any smartphone's performance speed is directly related to the microprocessor's performance. As a result, the rapidly expanding demand for smartphones is likely to boost the microprocessor market forward.

Healthcare spending is directly related to an ageing population, rising per capita disposable income, and a better quality of life. Medical spending per person in the 60+ age group is significantly greater than in the 15–30-year age group. The world's elderly population is growing at an unprecedented rate, resulting in longer life expectancy but with a slew of comorbidities. Embedded microprocessors are utilized in a variety of healthcare electronic systems to improve quality of life and minimize medical costs, such as real-time patient monitoring systems, wireless patient body monitoring systems, and remote health monitoring systems. Nerve integrity monitors, for example, use embedded microprocessors to convert laryngeal muscle action into audible and visual electromyographic (EMG) signals in a variety of procedures. These factors have a favorable impact on the global microprocessor market's growth.

Market Outlook

What Is Driving Future Growth in the Global Microprocessor Market?

- Industry Growth Overview: The expansion of the microprocessor market is driven by an increased need for high-performance computing, growing numbers of AI-driven devices, the development of edge computing solutions, and a trend toward higher levels of processor integration across consumer electronic goods (such as TVs and computers), automotive technologies, and industrial automation.

- Sustainability trends: Sustainability (i.e., energy-efficient chip designs, increasing building-block power efficiencies, and increasing product life cycles) is still being pursued by chip manufacturers to align their processor innovations with global carbon reduction goals.

- Global Expansion: The microprocessor manufacturers are increasing the size of their fabrication and assembly operations in less developed economies (e.g., India, Brazil, and other vendors) in a bid to reduce supply chain risk, improve responsiveness in supplying processors to specific regions, and meet increasing demand for digital infrastructure around the world.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 224.91Billion |

| Market Size in 2025 | USD 126.25 Billion |

| Market Size in 2026 | USD 133.82 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.94% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Technology, Application, and Region |

| Regional Scope | North America, APAC, Europe, Latin America, MEAN, Rest of the World |

Segment Insights

Technology Insights

The Reduced Instruction Set Microprocessor (RISC) segment is the most dominating segment in the market and accounted for more than 30% share in 2025 due to its reduced chip complexity. It aids in maintaining the instruction size without the need of a microcode layer or the related overhead. With developments in the scaling and lower IC prices, the market for RISC-based processors is expected to grow at a higher pace.

The ASIC segment is expected to be the fastest growing in the forecast period due to the increasing adoption of ICs in the consumer electronics industry due to their advantages such as low consumption electric power, small size and others.

Application Insights

The personal computer (PC) segment is the most prominent segment in the market which contributed share of 41% in 2025. In the first quarter of 2021, global PC shipments totaled 69.9 million units, up 32% from the first quarter of 2020. Such high shipments of PCs offer opportunities to the market players across the globe.

Further, the server's segment is expected to be the fastest growing due to the various improvements and innovations in the servers' microprocessors. The storage capacity, clock rate, and increased transistors and resistors operating frequency are the new features which will further fuel the growth of the server's segment in the global microprocessor market.

Regional Insights

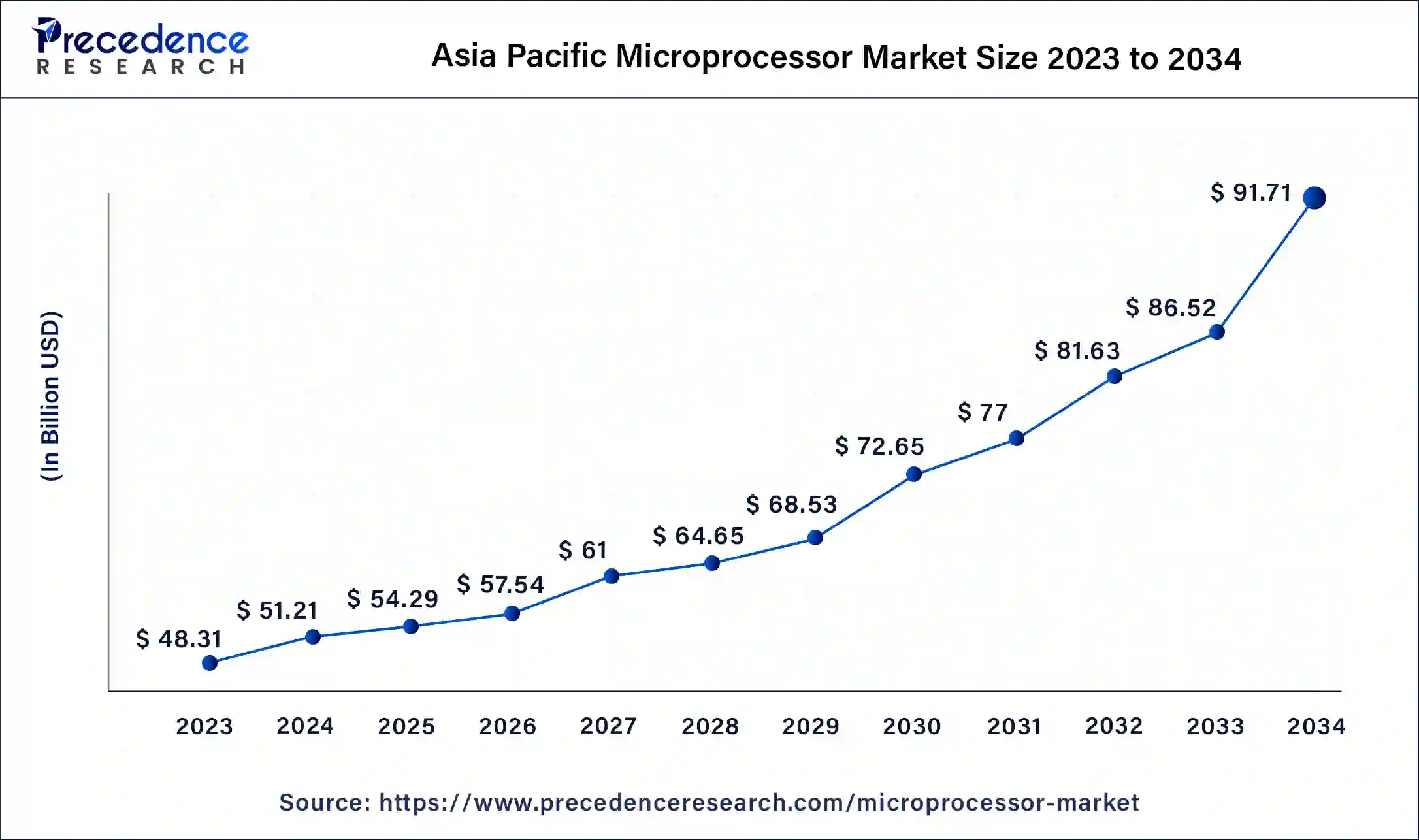

What is the Asia Pacific Microprocessor Market Size?

The Asia Pacific microprocessor market size is estimated at USD 54.29 billion in 2025 and is predicted to be worth around USD 96.70 billion by 2035, at a CAGR of 5.94% from 2026 to 2035.

The Asia Pacific held the largest share in the market due to the rising penetration of smartphones and other electronics. In 2025, the region was the largest contributor to the revenue with a market share of 43%. The consumer electronics market size was valued at USD 400 billion in 2020 in Asia Pacific. The growing urbanization and rising disposable income in the region are the major factors which are increasing the usage of consumer electronics in high and middle-income households. This will create a positive impact on the microprocessor market as microprocessors are used widely in the consumer electronics sector to increase efficiency of the overall product.

North America has the considerable share in the global microprocessors market due to the presence of market leaders in U.S. and Canada. The one of the major players which is having the large share are Intel Corporation., Qualcomm Technologies Inc., and Texas Instruments Inc. The rapid development of consumer electronics items, healthcare monitoring systems, and electric and hybrid automobiles in North America is a key element driving market expansion in the United States.

The European microprocessor market is expected to witness significant growth over the forecast period, due to technological improvements, further digitalization of the industrial sector, and rise of the rise of high-performance computing techniques. The digital transformation of the European continent is an ongoing process that requires more and more efficient, powerful, and energy-efficient microprocessors.

The automotive industry is one of the key growth factors in the region, especially considering the emerging popularity of electric vehicles (EVs), self-driving capabilities, and infotainment systems in cars. Such advances need fast microprocessors to process data, control, and AI integration. Other powers in the automotive industry, such as Germany, France, and the UK, lead in innovations, which form a strong base of microprocessor needs.

How does Europe approach the Microprocessor Market?

Europe is expected to grow at a considerable rate in the upcoming period. This is resulting from its strong automotive sector, which is a major consumer of microprocessors and relies heavily on them for autonomous driving, electric vehicle systems, and other advanced features. Furthermore, Europe has a robust research and development infrastructure and a significant investment in semiconductor manufacturing by European governments to reduce reliance on imports and encourage local production, which further contributes to market growth.

Boost in Digital Infrastructure Across Latin America

Rising levels of consumer electronics use, digital transformation programs, and improved IT infrastructure throughout the manufacturing/service economy are driving microprocessor adoption growth within Latin America. As the leading regional market for electronics manufacturing, Brazil is benefiting from government-supported technology initiatives that drive increased local semiconductor demand.

Strategic Development of the Microprocessor: Middle East and Africa

Microprocessor growth in the Middle East and Africa is being generated through investment in smart city development, expanding telecom infrastructures, and rising demand for connected devices in the energy and industrial sectors. The United Arab Emirates is seeing significant growth as a result of investments in smart infrastructure development.

Substantial investments are also being made into artificial intelligence and digital innovation, which will continue the growth of processor demand.

Value Chain Analysis of the Microprocessor Market

- Design & Architecture Development: The focus is largely on the innovation of processor architecture, as well as optimizing the instruction set and finding a balance between performance and efficiency.

Key Players: Intel, AMD, ARM. - Wafer Fabrication & Manufacturing: This phase of the value chain includes cutting-edge semiconductor fabrication processes, including node reduction, advanced lithography accuracy/precision, and maximum yield.

Key Players: TSMC, Samsung Electronics, GlobalFoundries. - Packaging, Testing, & Distribution: Advanced packaging techniques, quality testing, and a well-developed global distribution system allow microprocessor chips to be quickly delivered to OEM customers, while at the same time meeting high-performance levels, as well as compliance standards.

Key Players: ASE Group, Amkor Technology, Siliconware Precision Industries.

Microprocessor Market Companies

- Intel Corporation

- Taiwan Semiconductor Manufacturing Company, Limited

- SK Hynix Inc.

- Qualcomm Technologies

- Broadcom Inc.

- Micron Technology, Inc.

- Sony Corporation

- Nvidia Corporation

- Samsung Group

- Applied Materials, Inc.

Leaders' Announcement

- In July 2024, Taiwan Semiconductor Manufacturing Company (TSMC) announced a strategic acquisition. This acquisition of the Lisen Nuoke Baoshan Plant is a strategic move to bolster its manufacturing capabilities. This decision to acquire the Baoshan plant is part of a broader strategy to fulfill growing demand for semiconductor products, fueled by the rapid advancement of technologies such as AI, 5G, and IoT.

Key Companies Share Insights

Because of the presence of major competitors and regional players, the microprocessor market is fragmented and extremely competitive. All of the leading players outperform one another in one or two categories, increasing rivalry in the Microprocessor industry. Thus, the market is very competitive. Because fixed costs are high and marginal costs are low, manufacturers are under high pressure to reduce costs below the market average in order to attract customers while also covering some of their fixed expenses. This leads to a ‘Bertrand Trap,' in which the top companies compete on the same dimension, resulting in a ‘zero-sum game,' with one company gaining and the other losing.

Recent Developments

- In March 2025, the first production lots of the 32-bit microprocessors developed for space applications, VIKRAM3201 & KALPANA3201 were handed over to Dr. V. Narayanan, Secretary, DOS /Chairman, ISRO, by Shri S. Krishnan, Secretary, MeitY, in a function held at New Delhi by Semiconductor Laboratory (SCL) Chandigarh. The micro-processors were designed and developed by Vikram Sarabhai Space Centre of ISRO, together with SCL, Chandigarh. Dr. Unnikrishnan Nair, Director, Vikram Sarabhai Space Centre, also attended the function with the designers' teams.

(Source: https://www.isro.gov.in) - In September 2024, Microchip announced a new class of microprocessors (MPUs) that the company claims will provide generational improvements in the computational performance of spacecraft avionics. According to Chandler, an Arizona-based computing chip maker, the new family of PIC64 High Performance Spaceflight Computing (HSPC) MPUs is among the first new line of MPUs being developed specifically for the radiation and fault-tolerance challenges posed by operating computers within satellites and other spacecraft in low Earth orbit (LEO) and deep space or planetary exploration missions in more than 20 years.

(Source: https://www.mobilityengineeringtech.com) - In November 2024, NXP Semiconductors introduced the i.MX 94 family of application processors. This latest addition to the i.MX 9 series of applications processors is engineered to provide high-performance, low-latency real-time compute capabilities by setting a new standard in industrial and automotive connectivity, along with essential functionality for industrial automation and automotive telematics applications.

- In June 2024, AMD introduced the new AMD Ryzen™ 8000G Series desktop processors for the AM5 platform, including the Ryzen™ 7 8700G, with the world's most powerful built-in graphics.1 AMD is also offering the power of a dedicated AI neural processing unit (NPU) to desktop PC processors for the first time with the introduction of Ryzen™ AI to unlock more AI capabilities for consumers and enhance productivity, efficiency, and advanced collaboration.

- In January 2024, Renesas Electronics Corporation introduced a new 64-bit general-purpose microprocessor (MPU) for IoT edge and gateway devices that consumes significantly less power. The new MPU offers a PCI Express interface that enables high-speed connectivity with 5G wireless modules. Furthermore, the device boasts advanced security features such as tamper detection to ensure data security, too.

Segments Covered in the Report

By Technology

- CISC

- RISC

- ASIC

- Superscalar

- DSP

By Application

- Smartphones

- Personal Computers

- Servers

- Tablets

- Embedded Devices

- Others

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting