What is the Alpha Emitter Market Size?

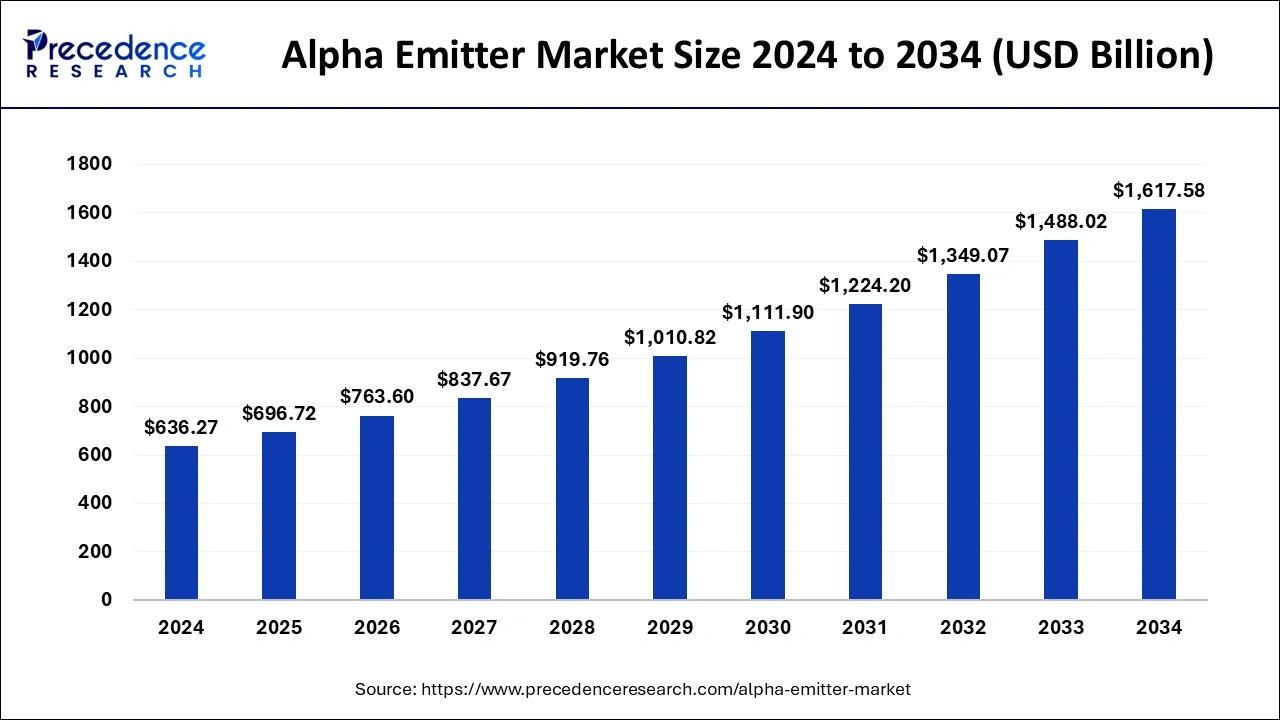

The global alpha emitter market size is calculated at USD 696.72 billion in 2025 and is predicted to increase from USD 763.60 billion in 2026 to approximately USD 1,617.58 billion by 2034, expanding at a CAGR of 9.78% from 2025 to 2034.

Alpha Emitter MarketKey Takeaways

- The global alpha emitter market was valued at USD 636.27 billion in 2024.

- It is projected to reach USD 1,617.58 billion by 2034.

- The alpha emitter market is expected to grow at a CAGR of 9.78% from 2025 to 2034.

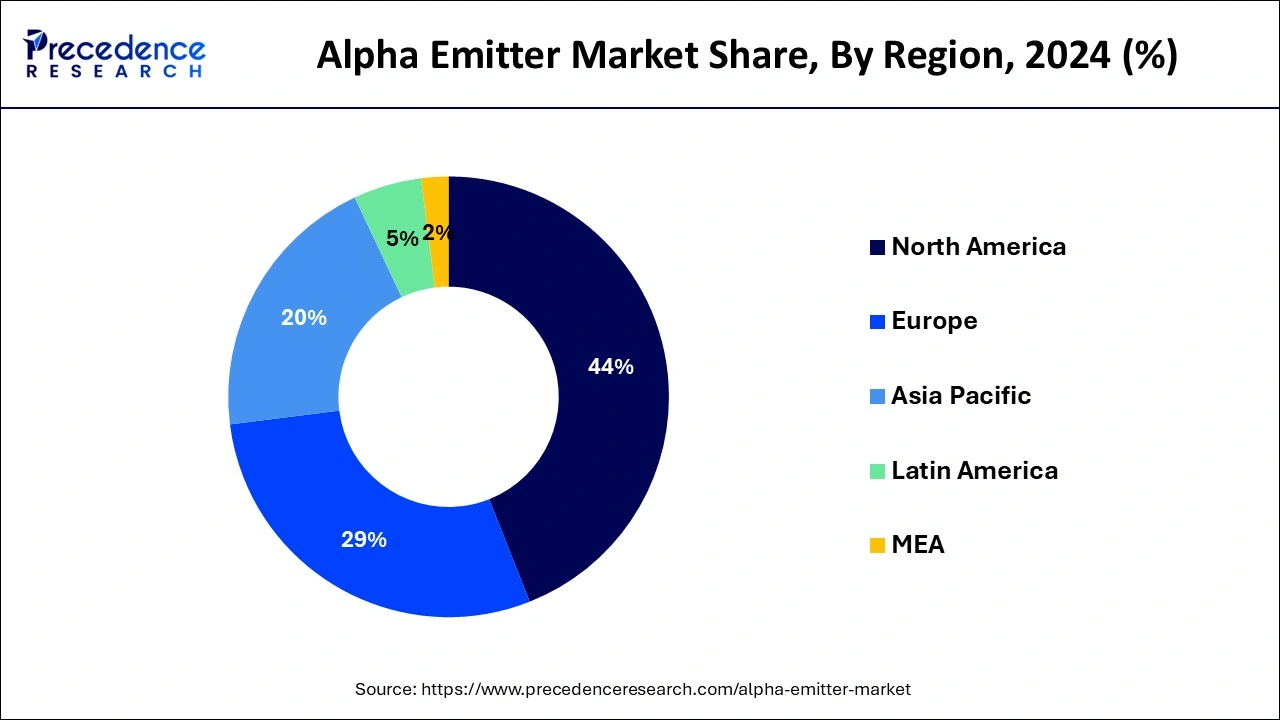

- North America contributed more than 44% of the market share in 2024.

- Asia-Pacific is estimated to expand at the fastest CAGR between 2025 and 2034.

- By type of radionuclide, the actinium (Ac-225) segment has held the largest market share of 38% in 2024.

- By type of radionuclide, the radium (Ra-223) segment is anticipated to grow at a remarkable CAGR of 10.16% between 2025 and 2034.

- By application, the bone metastases segment generated over 36% of the market share in 2024.

- By application, the prostate cancer segment is expected to expand at the fastest CAGR over the projected period.

- By source, the natural sources segment generated over 54% of the market share in 2024.

- By source, the artificially produced sources segment is expected to expand at the fastest CAGR over the projected period.

Alpha Emitters: From Radioactive Decay to Real-World Applications

An alpha emitter is a type of radioactive substance that releases alpha particles. Alpha particles consist of two protons and two neutrons, making them relatively large and positively charged. Due to their size and charge, alpha particles have low penetration abilities, and they are usually stopped by a sheet of paper or human skin. Common examples of alpha emitters include certain isotopes of uranium and thorium. The process of alpha decay occurs when an unstable atomic nucleus emits an alpha particle to achieve a more stable state. While alpha emitters can pose health risks if not handled properly, their properties make them useful in various scientific and medical applications, such as in smoke detectors and cancer treatments.

Alpha Emitter Market Growth Factors

- The increasing incidence of chronic diseases, such as cardiovascular conditions and cancer, drives the demand for diagnostic imaging procedures. Alpha emitters play a crucial role in enhancing the visibility of abnormalities, contributing to early and accurate disease detection.

- Ongoing advancements in imaging technologies, including the development of high-resolution scanners and innovative contrast agents, fuel the growth of the alpha emitter market. The continuous evolution of diagnostic tools enhances the overall effectiveness and precision of medical imaging procedures.

- The global demographic shift towards an aging population contributes to the demand for diagnostic imaging. As elderly individuals are more susceptible to various health conditions, there is a growing need for diagnostic tools, including alpha emitters, to aid in the diagnosis and monitoring of age-related diseases.

- Growing investments in healthcare infrastructure, coupled with increased healthcare spending globally, contribute to the expansion of diagnostic services. Governments and private entities investing in advanced medical facilities and equipment positively impact the market for alpha emitters.

- Heightened awareness among both healthcare professionals and the general public regarding the importance of early disease detection drives the demand for advanced diagnostic tools. Alpha emitters enable healthcare providers to obtain clearer and more detailed images, facilitating early intervention and treatment.

- The utilization of alpha emitter is diversifying across multiple medical specialties, including radiology, cardiology, and oncology. The expanding applications of contrast-enhanced imaging in different healthcare domains contribute to the sustained growth of the market, as these lines become integral components of various diagnostic procedures.

Market Outlook

- Industry Growth Offerings- The market is growing due to rising cancer prevalence, increasing adoption of targeted alpha therapies, advancements in isotope production, expanding clinical trials, and strong investments by pharmaceutical companies in precision oncology and radiopharmaceutical development.

- Global Expansion- The global market is expanding as countries adopt targeted alpha therapies, invest in radiopharmaceutical infrastructure, support clinical research, and form international collaborations, with growing demand in North America, Europe, and Asia-Pacific for advanced cancer treatments.

- Startup ecosystem- The alpha emitter startup ecosystem is growing with companies developing novel radiopharmaceuticals, advanced isotope production methods, and targeted cancer therapies, supported by incubators, research partnerships, venture funding, and increasing demand for precision oncology solutions worldwide.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 9.78% |

| Market Size in 2025 | USD 696.72 Billion |

| Market Size in 2026 | USD 763.60 Billion |

| Market Size by 2034 | USD 1,617.58 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type of Radionuclide, Application, Source |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Driver

Increasing incidence of cancer

The increasing incidence of cancer is a major driving factor behind the growing demand for alpha emitters in the market. As more people are diagnosed with cancer globally, there is a pressing need for effective and innovative treatments.

- According to the GLOBOCAN 2020 report, which tracks cancer statistics, there were 274,364 new cancer cases worldwide in 2020.

This rise in cancer cases has created a significant market demand for advanced therapies, and alpha emitters, with their unique properties in targeting cancer cells, have become crucial players in this scenario. Patients and healthcare providers are seeking treatments that offer better outcomes, and alpha emitters show promise in addressing this need. The demand for these technologies is fueled by the urgency to find solutions for the increasing burden of cancer, making the alpha emitter market a key player in the ongoing efforts to improve cancer treatment options globally.

Restraint

Concerns regarding contrast agent safety

Concerns about radiation exposure act as a significant restraint on the market demand for alpha emitters. Despite the targeted nature of alpha radiation, there exists apprehension among both healthcare providers and patients regarding potential side effects and safety. People may be hesitant to embrace alpha emitter treatments due to the lingering fears associated with radiation, even though these therapies are designed to minimize damage to healthy tissues. Building confidence in the safety of alpha emitters and addressing misconceptions is crucial for market growth.

Education and awareness campaigns can play a pivotal role in helping healthcare professionals and patients understand the controlled and focused nature of alpha radiation, highlighting its benefits in targeted cancer treatment. Overcoming these concerns is essential for the alpha emitter market to gain broader acceptance and meet the rising demand for effective and safer cancer therapies.

Opportunity

Expanding applications beyond oncology

Expanding applications beyond oncology presents significant opportunities for the alpha emitter market. While alpha emitters are currently recognized for their role in cancer treatment, their unique properties make them promising in other medical fields. For instance, in imaging and diagnostics, alpha emitters can offer more precise and detailed information for healthcare professionals, leading to improved diagnostics and patient care.

Furthermore, exploring applications in non-oncological conditions, such as certain autoimmune diseases or targeted therapies, can broaden the market's appeal. This diversification not only positions alpha emitters as versatile tools in the medical field but also attracts attention from a wider range of healthcare sectors. As research expands into these new applications, the alpha emitter market has the potential to become a key player in addressing various medical challenges beyond cancer, enhancing its overall market presence and impact.

Type of Radionuclide Insights

The actinium (Ac-225) segment held the highest market share of 38% in 2024. The actinium (Ac-225) segment in the alpha emitter market refers to the utilization of the radionuclide Actinium-225 for medical applications, particularly in cancer treatment. Ac-225 emits alpha particles, making it suitable for targeted alpha-particle radiotherapy. Recent trends indicate a growing interest in Actinium-225 due to its effectiveness in delivering localized radiation to cancer cells while minimizing damage to surrounding healthy tissues. This segment's prominence reflects the increasing recognition of Actinium-225 as a promising tool in the evolving landscape of precision oncology and targeted therapies.

The radium (Ra-223) segment is anticipated to witness rapid growth at a significant CAGR of 10.16% during the projected period. In the alpha emitter market, the radium (Ra-223) segment refers to the use of radium-223, a radioactive isotope, primarily recognized for its application in targeted alpha-particle therapy for prostate cancer metastases in bones. This segment is witnessing a growing trend as Ra-223 demonstrates efficacy in addressing skeletal metastases, offering a targeted approach to alleviate symptoms and improve patient outcomes. The increasing focus on precision medicine and advancements in radionuclide therapies contribute to the upward trajectory of the radium (Ra-223) segment in the alpha emitter market.

Application Insights

The bone metastases segment held a 36% market share in 2024. In the alpha emitter market, the bone metastases segment refers to the application of alpha emitters in treating cancer that has spread to the bones. This segment addresses the specific challenge of metastatic bone lesions, providing targeted radiation to reduce tumor growth. A growing trend in this application involves ongoing research to optimize the efficacy of alpha emitters for bone metastases, offering patients a potentially more effective and less invasive treatment option compared to traditional therapies. The focus on refining these treatments signifies a positive trend in addressing the complexities of bone metastases using alpha emitters.

The prostate cancer segment is anticipated to witness rapid growth over the projected period. In the alpha emitter market, the prostate cancer segment focuses on utilizing alpha-emitting isotopes for targeted therapy in prostate cancer patients. This application involves delivering radiation precisely to prostate cancer cells, minimizing damage to surrounding healthy tissues. Current trends in this segment include ongoing research to optimize treatment protocols, improve patient outcomes, and enhance the overall efficacy of alpha emitter therapies specifically tailored for prostate cancer. The aim is to provide a more targeted and efficient treatment option for individuals diagnosed with prostate cancer, aligning with the broader trend towards personalized and precision medicine in oncology.

Source Insights

The natural sources segment held a 54% market share in 2024. In the alpha emitter market, the natural sources segment refers to alpha-emitting radionuclides that occur naturally, such as certain isotopes of uranium and thorium. These sources have gained attention for their use in medical applications, including cancer treatments. A trend in this segment involves harnessing the therapeutic potential of naturally occurring alpha emitters, aligning with a growing interest in exploring and optimizing the use of these elements for targeted and effective medical interventions, thereby contributing to advancements in the field of oncology.

The artificially produced sources segment is anticipated to witness rapid growth over the projected period. Artificially produced sources in the alpha emitter market refer to those generated through human-controlled processes, distinct from natural sources. These sources often involve the synthesis of specific isotopes with desirable properties for medical applications. A notable trend in this segment is the continuous refinement of production methods, enabling the creation of alpha emitters with enhanced targeting capabilities and reduced side effects. Advancements in artificial production techniques contribute to the development of more effective and precise alpha emitter therapies, driving innovation in the market.

Regional Insights

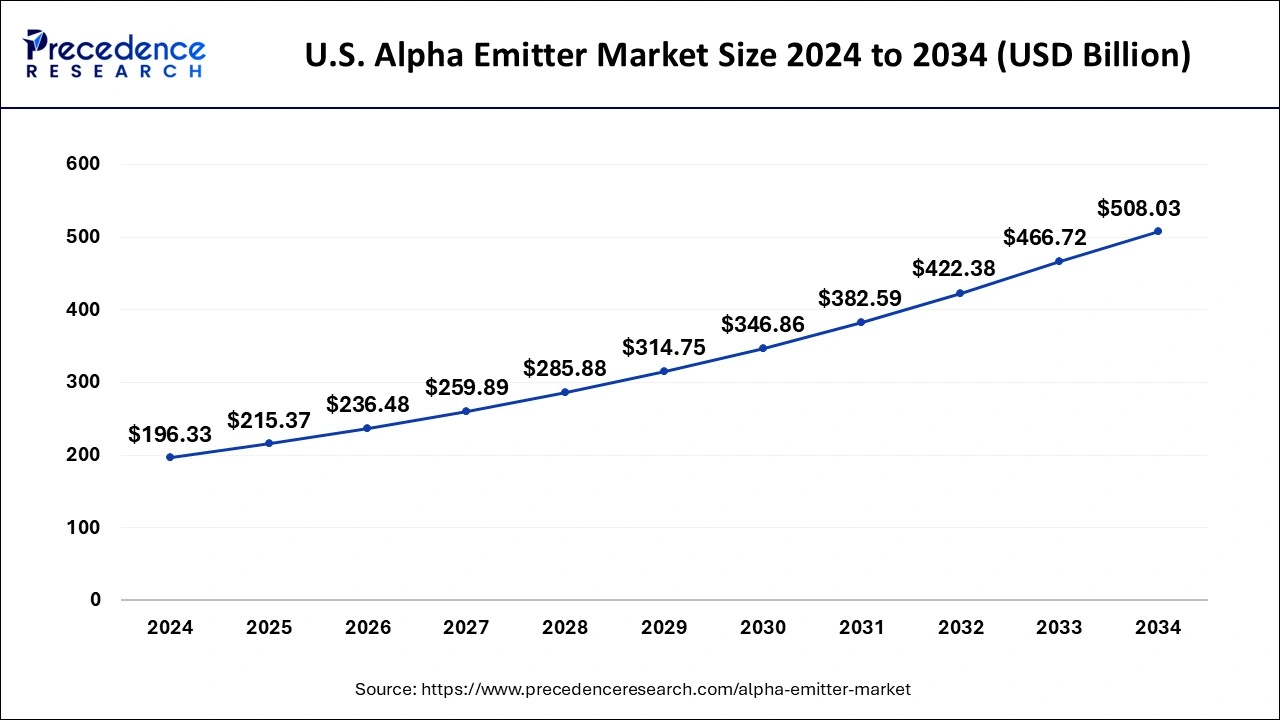

U.S.Alpha Emitter Market Size and Growth 2025 to 2034

The U.S. alpha emitter market size is exhibited at USD 215.37 billion in 2025 and is projected to be worth around USD 508.03 billion by 2034, growing at a CAGR of 9.97% from 2025 to 2034.

What Power North America's Dominance in the Alpha Emitters Market?

In 2024, North America held a share of 44% in the alpha emitter market due to advanced healthcare infrastructure, extensive research and development activities, and a high prevalence of cancer cases. Robust regulatory frameworks and increased investments in cutting-edge medical technologies contribute to the region's dominance. Moreover, the presence of key market players and a well-established healthcare system enhance the adoption of alpha emitter therapies. The region's focus on technological advancements and a strong commitment to cancer research solidify North America's prominent position in the alpha emitter market.

Asia-Pacific's Rapid Rise in the Global Alpha Emitters Landscape

Asia-Pacific is positioned for rapid growth in the alpha emitter market due to increasing healthcare investments, rising cancer incidences, and growing awareness of advanced treatments. The region's expanding population and improving healthcare infrastructure create a conducive environment for the adoption of innovative therapies. Additionally, collaborative efforts between governments, research institutions, and industry players contribute to the development and accessibility of alpha emitter technologies. These factors collectively drive the market's expansion, making the Asia-Pacific region a key player in advancing alpha emitter applications for effective cancer treatment.

Advancing Cancer Care: Europe's Expanding Alpha Emitters Market

Meanwhile, Europe is witnessing notable growth in the alpha emitter market due to a combination of factors. Increased healthcare expenditure, a proactive approach to research and development, and a growing aging population contribute to the demand for advanced cancer therapies. The region's emphasis on technological innovations, coupled with supportive regulatory frameworks, fosters the development and adoption of alpha emitter technologies. Moreover, collaborations between industry and research entities enhance the market's momentum. These factors collectively position Europe as a significant hub for the expansion and advancement of alpha emitter applications in cancer treatment.

Why is the U.S. Alpha Emitters Market Accelerating Rapidly?

The U.S. market is growing due to increasing use of targeted alpha therapies in cancer treatment, expanding nuclear medicine research, and strong investments in radiopharmaceutical manufacturing. Rising demand for precision oncology, supportive FDA approvals, and collaborations between healthcare institutions and isotope developers also accelerate adoption. Additionally, advanced healthcare infrastructure and growing clinical trials further strengthen the market's expansion across the country.

What's Driving the Fast Growth of China's Alpha Emitters Market?

China's market is expanding due to rising adoption of nuclear medicine, increasing cancer incidence, and strong government investment in advanced radiotherapy technologies. The country is rapidly improving its isotope production capacity and strengthening partnerships between hospitals, research institutes, and radiopharmaceutical manufacturers. Growing demand for precision cancer therapies, improved healthcare infrastructure, and supportive regulatory initiatives further accelerate market growth across China.

Why is the UK Witnessing a Surge in the Alpha Emitters Market?

The UK market is increasing due to rising adoption of targeted alpha therapies in oncology, strong support from the National Health Service (NHS), and growing investment in nuclear medicine research. Expansion of radiopharmaceutical production facilities, active academic–industry collaborations, and an increasing number of clinical trials are strengthening the market. Additionally, the UK's focus on precision treatments and advanced diagnostic technologies is accelerating demand for alpha-emitting isotopes.

Value Chain Analysis

R&D

- Research centers on Targeted Alpha Therapy (TAT), which delivers alpha-emitting isotopes directly to tumors for highly selective cancer cell killing.

- Efforts include enhancing production and purification of key isotopes such as Actinium-225, Radium-223, and Lead-212.

- Development of radiopharmaceuticals that link alpha isotopes with tumor-targeting antibodies or peptides is a major priority.

- R&D also aims to upgrade manufacturing, safety, and handling protocols to support broader clinical adoption.

Key Players: Bayer, Novartis, Actinium Pharmaceuticals, Orano Med, TerraPower Isotopes.

Clinical Trials

- Ongoing trials are evaluating alpha-emitting therapies across multiple cancers such as prostate, ovarian, breast, and lung tumors.

- Studies are testing how well alpha emitters work alone and how they perform when paired with chemotherapy, immunotherapy, or targeted drugs.

- Researchers aim to assess safety, dosage optimization, tumor targeting accuracy, and long-term treatment outcomes.

- Trials also explore new delivery molecules to improve precision and reduce side effects.

Key Players: Novartis, Bayer, Actinium Pharmaceuticals, Orano Med

Regulatory Approvals

- Approval of alpha-emitter therapies follows strict evaluation by agencies like the FDA, EMA, and other national regulators due to their radioactive nature.

- Only a few alpha-based treatments have cleared regulatory pathways, while many others remain in clinical development.

- Authorities assess safety, radiation handling, manufacturing quality, and therapeutic effectiveness before granting approval.

- Regulatory reviews also emphasize long-term monitoring, isotope stability, and patient risk management.

Key Players: Bayer, Novartis, Orano Med, Actinium Pharmaceuticals, TerraPower Isotopes.

Top Vendors and their Offerings

- IBA Worldwide – IBA provides medical isotopes, radiopharmaceutical production solutions, and targeted alpha therapy support, enabling hospitals and research institutions to access high-quality isotopes for cancer treatment and diagnostics.

- Bayer AG – Bayer develops and commercializes alpha-emitter-based radiopharmaceuticals, focusing on targeted cancer therapies, clinical research support, and innovative treatment solutions for precision oncology.

- Orano Med – Orano Med specializes in production, purification, and supply of alpha-emitting isotopes and radiopharmaceuticals, supporting clinical trials and therapeutic applications in oncology.

- Eckert & Ziegler – Eckert & Ziegler offers production, processing, and distribution of alpha-emitting isotopes, radiopharmaceutical components, and targeted therapy solutions for hospitals and research centers.

- Curium Pharma – Curium Pharma provides radiopharmaceuticals and alpha-emitter isotopes for cancer therapy, along with clinical support, isotope supply, and nuclear medicine solutions worldwide.

Recent Developments

- In November 2022, NorthStar Medical Radioisotopes, a pharmaceutical company, and IBA Worldwide, a medical technology firm, unveiled a new agreement. NorthStar will acquire its third Rhodotron TT300 HE electron beam accelerator from IBA. This accelerator plays a crucial role in producing no-carrier added actinium-225 (Ac225), a vital therapeutic radioisotope facing limited supply and lacking commercial-scale production technology.

- In January 2022, biotechnology companies RadioMedix and Orano Med announced the commencement of a Phase II clinical trial for AlphaMedix. The trial, initiated on December 21, 2021, assesses the safety and efficacy of 212Pb-DOTAMTATE (AlphaMedix) in Peptide Receptor Radionuclide Therapy (PRRT) for patients with somatostatin receptor-expressing neuroendocrine tumors (NET) who are new to treatment.

- In June 2022, medical technology company Alpha Tau Medical Ltd. received approval from the U.S. Food and Drug Administration (FDA) for its Investigational Device Exemption (IDE) application. This green light allows the initiation of a multi-center pivotal study using Alpha DaRT for the treatment of recurrent cutaneous Squamous Cell Carcinoma (SCC).

Alpha Emitter Market Companies

- Alpha Tau Medical Ltd.

- NorthStar Medical Radioisotopes

- IBA Worldwide

- RadioMedix

- Orano Med

- Bayer AG

- Novartis International AG

- Actinium Pharmaceuticals, Inc.

- Fusion Pharmaceuticals Inc.

- Eckert & Ziegler

- Telix Pharmaceuticals Limited

- Curium Pharma

- AAA (Advanced Accelerator Applications)

- Isotopen Technologien München AG (ITM)

- Nordion (Canada) Inc.

Segments Covered in the Report

By Type of Radionuclide

- Radium (Ra-223)

- Actinium (Ac-225)

- Lead (Pb-212)

- Astatine-211

- Bismuth-213

- Others

By Application

- Bone Metastases

- Prostate Cancer

- Neuroendocrine Tumors

- Ovarian Cancer

- Others

By Source

- Natural Sources (Uranium-238, Radium-226)

- Artificially Produced Sources (Plutonium, Americium, Curium, Californium)

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting