What is the Antiscalants Market Size?

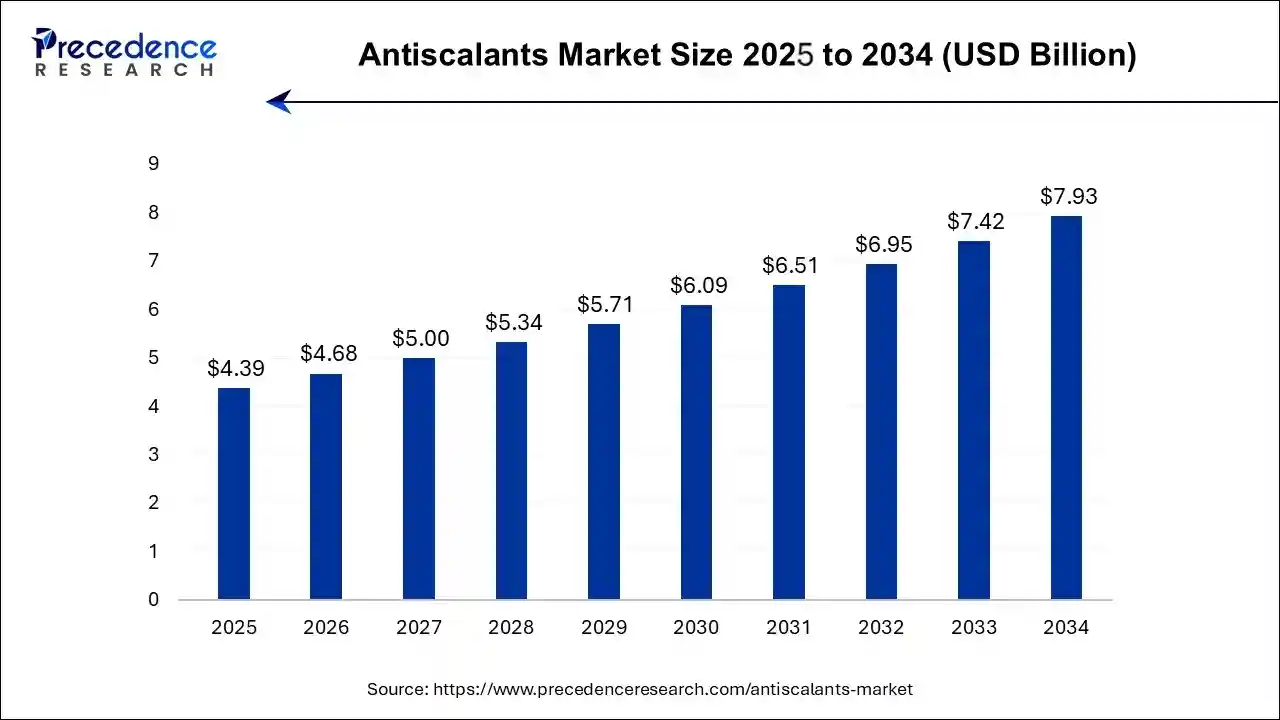

The global antiscalants market size is expected to be valued at USD 4.39 billion in 2025 and is anticipated to reach around USD 7.93 billion by 2034, expanding at a CAGR of 6.8% over the forecast period from 2025 to 2034.

Antiscalants Market Key Takeaways

- North America contributed the highest revenue share in 2024.

- Asia Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By type, the sulfonates segment has held the largest market share in 2024.

- By type, the phosphonate segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By application, the oil & gas segment generated the highest revenue share in 2024.

- By application, the waste & water treatment segment is expected to expand at the fastest CAGR over the projected period.

Strategic Overview of the Global Antiscalants Industry

Antiscalants are chemical substances or additives used to prevent or reduce the formation and accumulation of scale deposits in various industrial processes and water treatment systems. It is used primarily in water treatment processes, such as industrial and municipal water treatment, desalination, and various industrial applications, to prevent or mitigate the formation of scale deposits. Scale deposits can accumulate on surfaces, particularly in equipment like pipes, boilers, and heat exchangers, and they are often composed of minerals or salts like calcium carbonate, calcium sulfate, and silica.

Antiscalants work by inhibiting the crystallization and precipitation of these scale-forming minerals, helping to maintain the efficiency and performance of industrial equipment and water treatment systems. The antiscalants market encompasses the production, distribution, and sale of these chemical products to various industries that rely on efficient water management and scaling prevention to avoid costly maintenance and equipment damage. This market may also include related products and services, such as consulting and technical support for the proper use of antiscalants in different applications.

Artificial Intelligence: The Next Growth Catalyst in Antiscalants

AI is significantly impacting the antiscalants market by enabling smarter, more efficient, and cost-effective water treatment processes. Through the use of AI-driven analytics and predictive modelling, operators can now optimize antiscalant dosing in real-time, moving beyond traditional, time-consuming "jar tests" to achieve optimal performance with reduced chemical usage. For example, neural networks and machine learning algorithms analyze vast datasets on water quality, temperature, and flow rates to predict scaling potential more accurately, allowing for targeted and efficient antiscalant application.

Antiscalants Market Growth Factors

- The growth of various industries, such as power generation, oil and gas, chemical manufacturing, and mining, leads to higher water usage and a greater need for water treatment and scale prevention. As industrial activities expand, so does the demand for antiscalants.

- As freshwater resources become scarcer, industries are focusing on water recycling and reuse. This trend drives the need for effective water treatment solutions, including antiscalants, to maintain the quality of recycled water and prevent scaling issues.

- Desalination is a process that turns seawater into freshwater, and it relies heavily on antiscalants to prevent scaling in the desalination equipment. The increasing demand for fresh water in arid regions and coastal areas fuels the growth of the desalination industry and, in turn, the antiscalants market.

- Scaling in industrial equipment, such as boilers and heat exchangers, can reduce energy efficiency and increase operational costs. Businesses are increasingly aware of the importance of energy efficiency, driving the adoption of antiscalants to maintain the performance of their equipment.

- Environmental regulations and sustainability initiatives push industries to manage their water resources more responsibly. Using antiscalants can help reduce water wastage and ensure compliance with environmental regulations.

- The oil and gas industry relies on antiscalants to manage scale formation in drilling operations and production facilities. As global energy demands persist, this industry's growth contributes to the antiscalants market.

- Infrastructure projects like water treatment plants, power generation facilities, and manufacturing plants drive the demand for antiscalants, as these projects require efficient water management and scaling prevention.

- Economic development and urbanization lead to increased demand for water-related services, spurring the growth of water treatment and scaling prevention solutions like antiscalants.

Market Outlook

- Market Growth Overview: The Antiscalants market is expected to grow significantly between 2025 and 2034, driven by the industrial expansion, water scarcity, and stricter environmental regulations. The shift towards sustainable, bio-based formulations and the integration of AI-enabled smart dosing technologies.

- Sustainability Trends: Sustainability trends involve the stringent environmental regulations and corporate sustainability goals, driving a strong shift toward biodegradable and bio-based formulations.

- Major Investors: Major investors in the market include BASF SE, Dow Chemical Company, Kemira Oyj, and CriteriaCaixa.

- Startup Economy: The startup economy in the market is focused on green and bio-based solutions, AI and IoT integration, and innovation in niche technology.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.8% |

| Market Size in 2025 | USD 4.39 Billion |

| Market Size by 2034 | USD 7.93 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Growth of various industries such as power generation, chemical manufacturing, mining, and food and beverage

The growth of various industries, including power generation, chemical manufacturing, mining, and food and beverage, plays a pivotal role in driving the demand for the antiscalants market. In the power generation sector, antiscalants are crucial to maintaining the efficiency of boilers, heat exchangers, and cooling systems by preventing scale buildup, which can otherwise lead to reduced energy efficiency and increased operational costs. Similarly, the chemical manufacturing industry relies on antiscalants to safeguard its equipment from scaling issues, ensuring the uninterrupted production of chemicals and preventing costly downtime for maintenance.

In the mining industry, where water is extensively used for extraction and processing, antiscalants are indispensable for preventing scale deposits that can clog equipment and reduce productivity. Furthermore, the food and beverage industry, with its stringent quality and hygiene standards, employs antiscalants to keep its processing equipment free from scale formation, maintaining product quality and adherence to regulatory requirements.

The continuous expansion of these industries, driven by global economic growth and urbanization, underscores the ongoing and increasing demand for antiscalant solutions. As these sectors strive for operational efficiency and cost-effectiveness, antiscalants emerge as a vital component in their water management strategies, ensuring uninterrupted production processes and contributing to the overall success and sustainability of these industries.

Restraint

Environmental and health concerns

Environmental and health concerns pose significant restraints on the demand for the antiscalants market. Traditional antiscalant chemicals may contain substances that raise red flags in terms of environmental impact and human health. These chemicals can leach into water sources and, if not properly managed, can have adverse effects on aquatic ecosystems and potentially harm human health through consumption of contaminated water.

However, there is a growing emphasis on environmentally friendly and non-toxic alternatives that can mitigate these concerns. Moreover, the disposal of antiscalants and their byproducts, particularly when they contain hazardous substances, can be a cause for environmental alarm. If not managed responsibly, these chemicals can contaminate soil and water bodies, leading to long-term environmental degradation.

Regulatory bodies are increasingly stringent in their oversight of antiscalant usage, especially in industries with the potential for significant environmental impact. Compliance with these regulations often involves costly measures to mitigate the environmental risks associated with antiscalant application.

As public awareness of environmental and health issues continues to grow, industries and businesses are under pressure to adopt more sustainable and safe alternatives. This shift towards eco-friendly and health-conscious practices can restrain the demand for traditional antiscalants while promoting the development and adoption of environmentally responsible solutions in the antiscalants market. Companies that can offer safer and greener alternatives may find greater acceptance in the market.

Opportunity

Technological advancements

Technological advancements present significant opportunities for the growth and advancement of the antiscalants market. As industries and water treatment processes become more complex and demanding, innovative technologies play a critical role in addressing scaling issues efficiently and sustainably. Advanced formulations and chemistry are continuously evolving to produce more effective antiscalants. These formulations can inhibit scale formation across a broader range of water qualities and conditions, making them increasingly versatile and adaptable to various applications.

Moreover, development of environmentally friendly antiscalants. As environmental and regulatory concerns mount, the market is increasingly shifting towards eco-conscious solutions. Technological innovations are driving the creation of antiscalants that are biodegradable, non-toxic, and have minimal environmental impact.

Furthermore, automation and sensor technologies are improving dosing precision and real-time monitoring of antiscalant performance. This ensures optimal antiscalant dosing while reducing waste and operational costs. Nanotechnology is another promising area, offering the potential to create nanoscale antiscalant particles with enhanced scale inhibition properties.

These nanoparticles can deliver superior performance in preventing scale buildup, particularly in high-temperature and high-pressure environments. The integration of digitalization and data analytics into antiscalant systems enables more efficient scaling risk prediction and proactive management. Customized antiscalant solutions can be designed for specific industries and applications, ensuring a tailored approach to scale prevention.

Type Insights

In 2024, the sulfonates segment had the highest market share on the basis of the type. Sulfonates are antiscalants that contain sulfonic acid groups. They are used in diverse applications, including water treatment and the prevention of scale deposits. It is effective at inhibiting scale formation, especially in applications where calcium sulfate scaling is a problem. It is commonly employed in industries such as oil and gas, where sulfate scaling in drilling operations and production facilities can be a significant issue.

The phosphonates segment is anticipated to expand fastest over the projected period. Phosphonates are a type of antiscalant that contains phosphorous-based compounds. They are widely used in various industrial applications, including water treatment, to prevent scale formation. It is known for their effectiveness in inhibiting the precipitation of scale-forming minerals, such as calcium carbonate and calcium phosphate. It is often preferred in high-temperature and high-pressure industrial processes, making them suitable for applications like cooling systems and boilers.

Application Insights

In2024, the oil & gas segment had the highest market share on the basis of the end user industry. It plays a crucial role in ensuring the smooth flow of oil and gas and preventing blockages and equipment damage. The oil and gas industry relies on antiscalants to manage scale formation in drilling operations, pipelines, and production facilities. Scaling can occur due to the presence of minerals like calcium sulfate or barium sulfate in brine water used in oil and gas processes.

The water & waste treatment segment is anticipated to expand fastest over the projected period. Antiscalants help prevent scaling issues, ensuring the quality and reliability of water treatment processes, including desalination, reverse osmosis, and municipal water treatment. In the water and wastewater treatment sector, antiscalants are used to maintain the efficiency of treatment equipment, such as membranes, filters, and evaporators. Scaling can reduce the performance of these systems.

Regional Insights

North America has held the largest revenue share in2024. North America has stringent environmental regulations and standards, which influence the selection of antiscalant products. Eco-friendly and sustainable antiscalants are increasingly in demand. It benefits from ongoing technological innovations in the field of antiscalants, leading to more effective and environmentally friendly solutions.

The U.S. shift toward sustainable, biodegradable formulations is driven by stringent environmental regulations and corporate ESG goals. Integrating AI, IoT, and data analytics to optimize dosing and enhance operational efficiency in real time. Strong demand from the water treatment, desalination, and oil & gas sectors is propelling market growth.

Asia Pacific is estimated to observe the fastest expansion. The market is driven by rapid industrialization and population growth in countries such as China, India, Japan, and Southeast Asian nations. This region exhibits substantial market growth potential. The market serves a wide spectrum of industries, including power generation, oil and gas, mining, chemical manufacturing, agriculture, and water treatment. Each industry faces unique scaling challenges and relies on antiscalants to maintain operational efficiency.

China's Antiscalants market is driven by the growth of industries, such as chemical manufacturing, power generation, and oil and gas, growing trends towards regulation and global sustainability goals, towards environmentally friendly products, and the dominance of phosphonates and carbohydrates.

Europe Antiscalants Trends

Europe's Antiscalants market is stringent EU environmental regulations, which are driving a significant shift toward "green," biodegradable formulations. A key trend involves the integration of smart technologies like AI and sensor-based systems to optimize dosing and enhance efficiency. The demand for effective, compliant solutions is strong across mature industries, notably for facilitating water reuse and resource recovery initiatives.

The European antiscalants market is characterized by its adherence to stringent environmental standards, a strong emphasis on sustainable solutions, and a diverse range of industries that rely on antiscalants to ensure efficient operation and scaling prevention. It plays a crucial role in helping European industries maintain the integrity of their equipment and water treatment processes while addressing scaling challenges.

Antiscalants Market Value Chain Analysis

- Raw Material Procurement and Chemical Manufacturing: This foundational stage involves sourcing basic chemicals such as phosphonates, carboxylates, and polymers, and transforming them into specialized antiscalant formulations.

Key Players: BASF SE, Kemira Oyj, Solenis, and Veolia. - Formulation, Blending, and Customization: In this stage, the base chemicals are precisely blended and customized to meet specific customer water chemistry requirements.

Key Players: Nalco Water (Ecolab) and Solenis. - Distribution and Logistics: This stage focuses on getting the finished antiscalant products from manufacturing facilities to end-user sites efficiently and safely.

Key Players: Univar Solutions - Application, Dosing, and System Integration: This is the core service delivery stage where the antiscalants are applied to industrial and municipal water systems. Increasingly, this involves the integration of smart technologies like AI and IoT.

Key Players: Solenis and Veolia.

Antiscalants Market Companies

- Clariant AG

Clariant AG is a global specialty chemicals leader that contributes innovative, environmentally sound antiscalant solutions for industrial water treatment and reverse osmosis systems. The company enables customers to protect equipment and optimize water usage by offering advanced scale inhibition technologies. - Kemira Oyj

Kemira is a global chemical company that is heavily invested in the water treatment segment, where it provides antiscalant solutions to industries such as oil and gas, mining, and desalination. The company offers a wide array of antiscalant products, including phosphonates and carboxylates, for diverse water treatment applications. - General Electric

General Electric (GE) has contributed to the antiscalant market, particularly through its former water business, by providing innovative technologies for desalination and industrial processes. GE's past projects focused on replacing traditional acid dosing with more effective and environmentally friendly antiscalant technologies, showcasing the viability of advanced chemical treatment. - Dow Chemicals

Dow Chemicals is a premier supplier of specialty antiscalant solutions that protect reverse osmosis membranes and other water treatment systems from scale buildup. The company emphasizes sustainable, ecologically responsible chemistries that maximize water recovery rates while lowering operational expenses. - BWA Water Additives

BWA Water Additives is a global provider of specialty water treatment chemicals, including a range of phosphonate-based antiscalant and scale inhibitor products. Their products are crucial for preventing scale formation in challenging industrial environments, from oil and gas to desalination. - Ashland

Ashland provides specialty chemicals and functional ingredients for water treatment and other industries, with many of its products derived from renewable raw materials. The company has contributed by providing technologies and additives used in controlling the physical properties of aqueous systems and managing scale. - Avista Technologies

Avista Technologies, now a Kurita America company, specializes in antiscalant and cleaning solutions for membrane-based water systems, particularly reverse osmosis. It offers advanced, application-specific chemical formulations and technical support, including dosing software, to help optimize system performance. - Solenis

Solenis is a leading global producer of specialty chemicals for water-intensive industries, offering a wide portfolio of antiscalants for water and wastewater treatment. The company's expansion, including acquisitions, enhances its ability to provide improved water treatment chemicals and integrated service packages to industrial and municipal markets. - Solvay SA

Solvay SA offers innovative chemical solutions for the antiscalant market, helping to prevent scale formation in water treatment systems like reverse osmosis and industrial cooling processes. Their contributions focus on developing effective and sustainable products that enhance system efficiency and prolong equipment life.

Recent Developments

- In October 2022:Kurita announced that it offers an innovative 360° solution for the full water cycle of food and beverage plants, assisting to save water and energy and expand productivity. It include targeted antiscalants and cleaning chemicals maintain membrane health and maximize service life.

Segments Covered in the Report

By Type

- Phosphonates

- Carboxylates

- Sulfonates

By Application

- Power & Construction

- Mining

- Water & Waste Treatment

- Oil & Gas

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting