Biobanking Market Size and Forecast 2025 to 2034

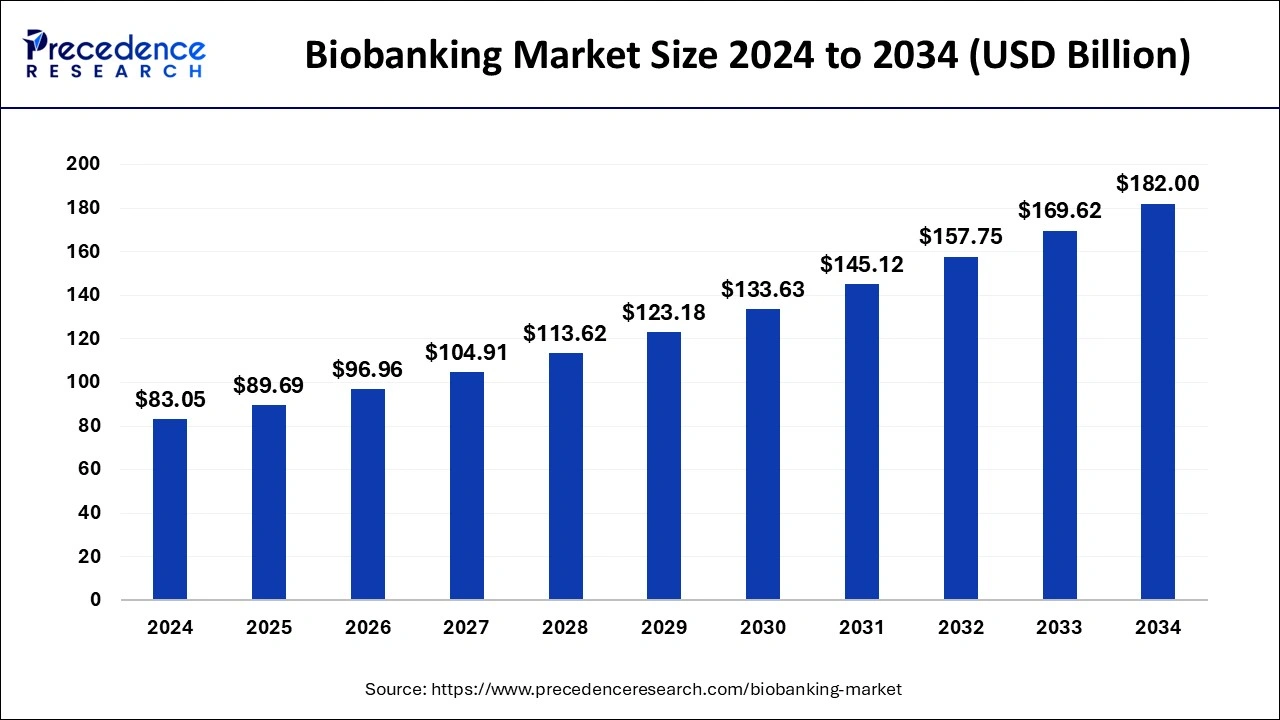

The global biobanking market size was valued at USD 83.05 billion in 2024 and it is expected to hit over USD 182 billion by 2034 with a registered CAGR of 8.16% from 2025 to 2034.

Biobanking Market Key Takeaways

- In terms of revenue, the global biobanking market was valued at USD 83.05 billion in 2024.

- It is projected to reach USD 182 billion by 2034.

- The market is expected to grow at a CAGR of 8.16% from 2025 to 2034.

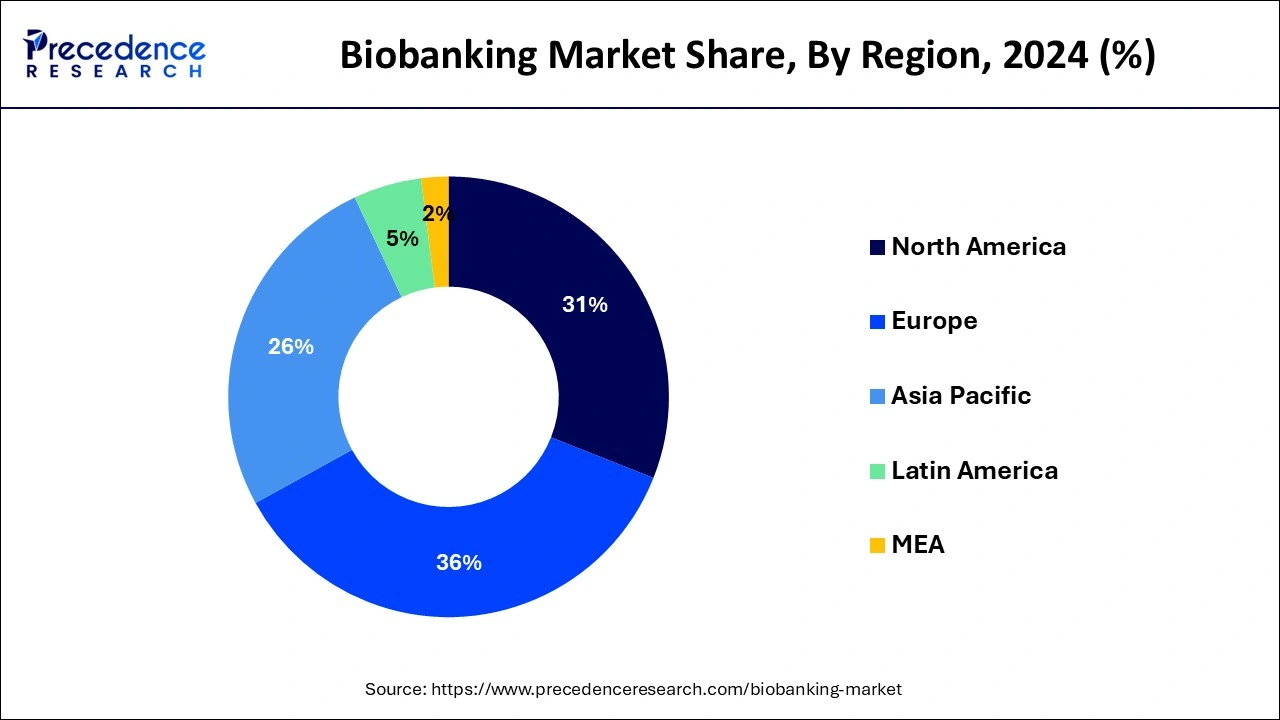

- Europe led the global market with the highest market share of 36% in 2024.

- Asia Pacific is expected to witness the highest growth rate during the forecast period.

- By product, the biobanking equipment segment dominated the market with a 45.60% share in 2024.

- By product, the laboratory information management systems (LIMS) segment is expected to grow at the highest CAGR of 8.90% in 2024.

- By service, the biobanking & repository segment held a 38.20% market share in 2024.

- By service, the cold chain logistics segment is expected to grow at the highest CAGR of 9.10% over the forecast period.

- By biospecimen type, the human tissues segment led the market by holding 42.50% share in 2024.

- By biospecimen type, the stem cells segment is expected to grow at the highest CAGR of 9.40% in 2024.

- By application, the drug discovery & clinical research segment dominated the market with a 36.90% share in 2024.

- By application, the therapeutics segment is expected to grow at the highest CAGR of 9.20% in 2024.

- By end use, the pharmaceutical & biotechnology companies segment held a 34.50% market share in 2024.

- By end use, the CROs & CMOs segment is expected to grow at the highest CAGR of 9.00% in 2024.

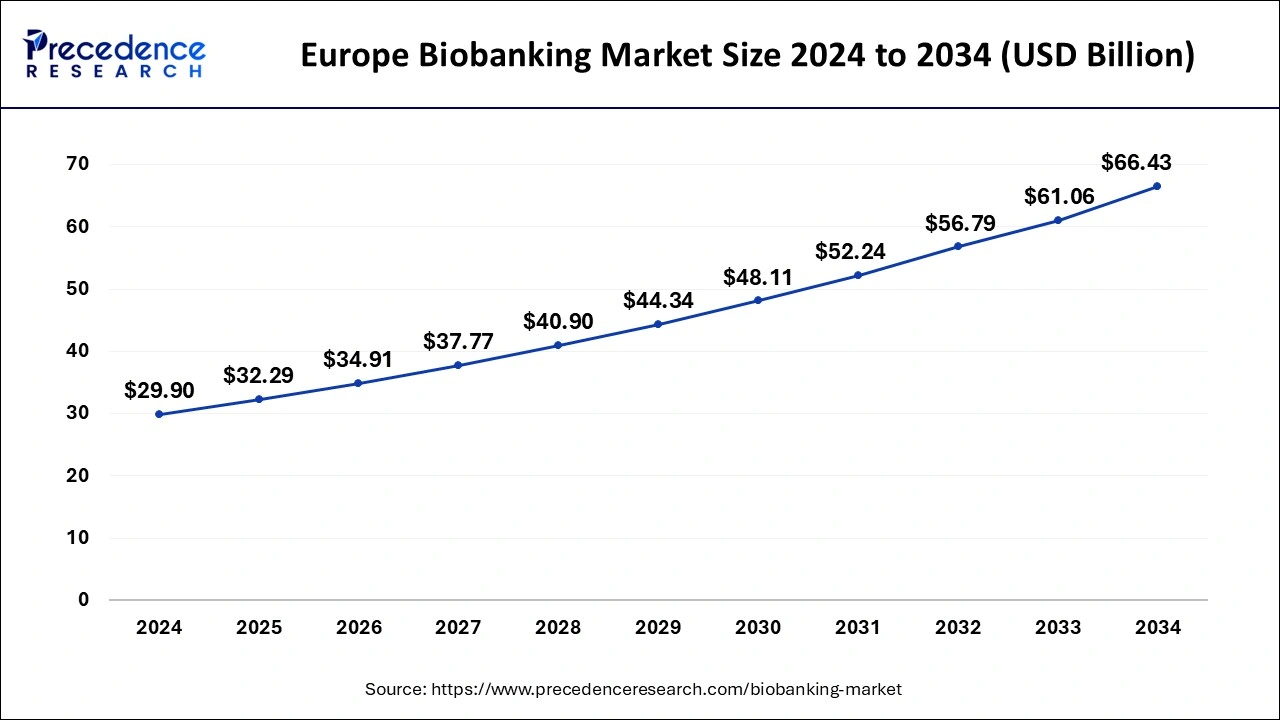

Europe Biobanking Market Size and Growth 2025 To 2034

The Europe biobanking market size reached USD 29.90 billion in 2024 and is anticipated to be worth around USD 66.43 billion by 2034, poised to grow at a CAGR of 8.31% from 2025 to 2034.

Europe was the leading biobanking market, constituting a market share of around 36% in 2024. The presence of well-established biobanks in European countries like Denmark, Norway, and Sweden has significant contributions towards market growth. As per an article of Global Engage, around 40% of the people in Iceland has donated DNA that has been stored in the biobanks. Therefore, the rising supply of samples in Europe has led to the growth of the biobanking industry. The rising investments by the pharmaceutical companies in the research and development and the increased adoption of the virtual biobanking technologies in Europe has favored the market growth in the past few years.

Asia Pacific is expected to witness the highest growth rate during the forecast period. This is attributable to the growing demand for cell samples and blood samples in the academic research institutes for studies. The rising investments in the establishment of well-structured biobanking facilities in the region are driving the growth of the Asia Pacific biobanking market.

Biobanking Market Growth Factors

The biobanking industry has evolved over time and is gaining rapid traction owing to the introduction of advanced technologies, automation technology, and data analytics, which has led to the rapid emergence of digital biobanks. The rising prevalence of numerous chronic diseases such as cancer, Alzheimer's, cardiovascular diseases, and respiratory diseases and the surging investments in drug development by pharmaceutical companies are the major factors that are significantly influencing the growth of the global biobanking market.

The most prominent drivers of the biobanking market include rising investments in genomic research studies, an increase in the trend of conservation of the cord blood stem cells of newborns, surging needs for drug development and drug discovery, and the significant increase in the corporate and government investments in the regenerative medicine research activities. The growing number of biobanks and the increasing number of human bio-samples are significantly contributing to the growth in the demand for the biobanking equipment.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 8.16% |

| Market Size in 2025 | USD 89.69 Billion |

| Market Size by 2034 | USD 182 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, ByService, By Biospecimen Type, By Biobank, By Application, ByType of Biobank,ByOwnership,ByStorage |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Collaborative Research Initiative

Several stakeholders combine their resources, knowledge, samples, and data in a collaborative biobanking research project in order to answer certain research questions or objectives. Researchers may access a wider and more varied range of samples thanks to this collaborative method, which may produce more reliable and broadly applicable results. Participants give other initiative participants access to their biobank collections, including samples and data. As a result, researchers have access to more samples than they could gather on their own. Governance structures are commonly implemented in collaborative ventures to supervise data sharing, guarantee adherence to ethical principles and regulations, and handle matters concerning data ownership, privacy, and permission.

Restraint

Public Trust and Perception

To establish and preserve public confidence in biobanks, operational and governance transparency is crucial. It is essential to communicate clearly about the goals of biobanking, the procedures used to gather, store, and use samples and data, as well as the security measures in place to maintain confidentiality and privacy. Strong security measures must be in place to guard against unauthorized access, breaches, and misuse due to the sensitive nature of biological samples and the data they are associated with. Building relationships with the communities where samples are gathered promotes trust and guarantees that the biobanking procedure complies with local norms and values. Ensuring ethical conduct in biobanking activities and proving accountability need adherence to pertinent regulatory frameworks and standards.

Opportunity

Data Monetization and Commercialization

By providing licenses to researchers, pharmaceutical companies, and other stakeholders who need access to high-quality biological samples and related data for their research and development operations, biobanks can make money off of their data. In order to pool their data for joint research and business uses, biobanks frequently collaborate with universities, pharmaceutical companies, and other organizations. For an extra cost, biobanks can provide their customers with value-added services including quality control, sample processing, data analysis, and bioinformatics. These services increase the data's usefulness and give the biobank new sources of income. Biobanks may be the holders of significant data-related intellectual property rights, such as patents on new biomarkers or medicinal targets identified by data analysis.

Product Insights

The biobanking equipment segment dominated the market with a 45.60% share in 2024. The rapid increase in the number of biobanks across the globe has led to a higher demand for biobank equipment, therefore driving the growth of this segment. The high capital investment involved in the acquisition of the equipment has resulted in higher revenue generation from this segment. There is a wider range of equipment available for various processes such as sample collection, storage, processing, and shipment.

The laboratory information management systems (LIMS) segment is expected to grow at the highest CAGR of 8.90% in 2024. owing to the outbreak of COVID-19 and the higher application of the LIMS in the COVID biobanking, research, and testing. Furthermore, the introduction of the cloud laboratory information management system is expected to play a crucial role in the growth of this segment.

Service Insights

The biobanking & repository segment held a 38.20% market share in 2024. This growth is attributable to the higher demand for disease-specific studies and the increased need for preserving biosamples for the development of precision medicine. The growth of the biobanking services is important for offering organized storage, management, and distribution of the samples.

The cold chain logistics segment is expected to grow at the highest CAGR of 9.10% over the forecast period. The growth of the segment can be credited to the increasing need for personalized medicine, along with the innovations in advanced therapies. Also, the use of AI and big data analytics optimizes logistics by enhancing specimen tracking and predicting storage needs.

Biospecimen Type Insight

The human tissues segment led the market by holding 42.50% share in 2024. The availability of a huge number of biobanks with increased availability of human tissue samples, facilities to store human tissues, and integration of advanced technology for the storage and retrieval of the stored specimens are the major factors that have led to the dominance of this segment.

The stem cells segment is expected to grow at the highest CAGR of 9.40% in 2024. The growth of the segment can be driven by the growing need for regenerative medicine and a surge in public awareness regarding the benefits of stem cells. Furthermore, advancements in stem cell technology preservation, processing, and storage are enhancing overall sample integrity and quality.

Application Insights

The drug discovery & clinical research segment dominated the market with a 36.90% share in 2024. The increased demand for biosamples for their application in drug tests and clinical research studies has fostered the growth of this segment in the global market. The rapid spread of the COVID-19 disease in 2020 has led to an increased demand for biosamples for the research and development of drugs for curing COVID-19.

The therapeutics segment is expected to grow at the highest CAGR of 9.20% in 2024. The growth of the segment can be linked to the increasing emphasis on precision medicine, coupled with the need for high-grade biological samples for chronic disease research. In addition, biobanks offer essential biological samples for all stages of clinical trials.

End-use Insights

The pharmaceutical & biotechnology companies segment held a 34.50% market share in 2024. The dominance of the segment is owing to the rising incidence of chronic diseases, which necessitates new treatment and growing demand for personalized medicine. Moreover, pharmaceutical and biotechnology companies are heavily investing in R&D, which directly fuels the demand for biobanking services.

The CROs & CMOs segment is expected to grow at the highest CAGR of 9.00% in 2024. The growth of the segment is due to the increasing demand for biosimilars and biologics, along with the rising R&D funding by pharmaceutical and biotechnology companies. Also, outsourcing research and production activities to CROs and CMOs can result in time and cost savings.

Biobanking Market Companies

- Thermo Fisher Scientific Inc.

- Tecan Trading AG

- QIAGEN

- Hamilton Company

- Brooks Life Sciences

- TTP Labtech

- VWR International, LLC.

- Promega Corporation

- Worthington Industries

- BD

- Merck KGaA

- Biokryo GmbH

- Cell&Co BioServices

- RUCDR Infinite Biologics

- Modul-Bio

Segments Covered in the Report

By Product

- Biobanking Equipment

- Temperature Control Systems

- Freezers & Refrigerators

- Cryogenic Storage Systems

- Thawing Equipment

- Incubators & Centrifuges

- Alarms & Monitoring Systems

- Accessories & Other Equipment

- Temperature Control Systems

- Biobanking Consumables

- Laboratory Information Management Systems

By Service

- Biobanking & Repository

- Lab processing

- Qualification/ Validation

- Cold Chain Logistics

- Other Services

By Biospecimen Type

- Human Tissues

- Human Organs

- Stem Cells

- Adult Stem Cells

- Embryonic Stem Cells

- IPS Cells

- Other Stem Cells

- Other Biospecimens

By Biobanks Type

- Physical/Real Biobanks

- Tissue Biobanks

- Population Based Biobanks

- Genetic (DNA/RNA)

- Disease Based Biobanks

- Virtual Biobanks

By Application

- Therapeutics

- Drug Discovery & Clinical Research

- Clinical Diagnostics

- Other Applications

By Ownership

- University Owned

- National/Regional Agencies Owned

- Non-profit Organizations Owned

- Private Organization Owned

By End-use

- Pharmaceutical & Biotechnology Companies

- CROs & CMOs

- Academic & Research Institutes

- Hospitals

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting