What is the Biofilter Market Size?

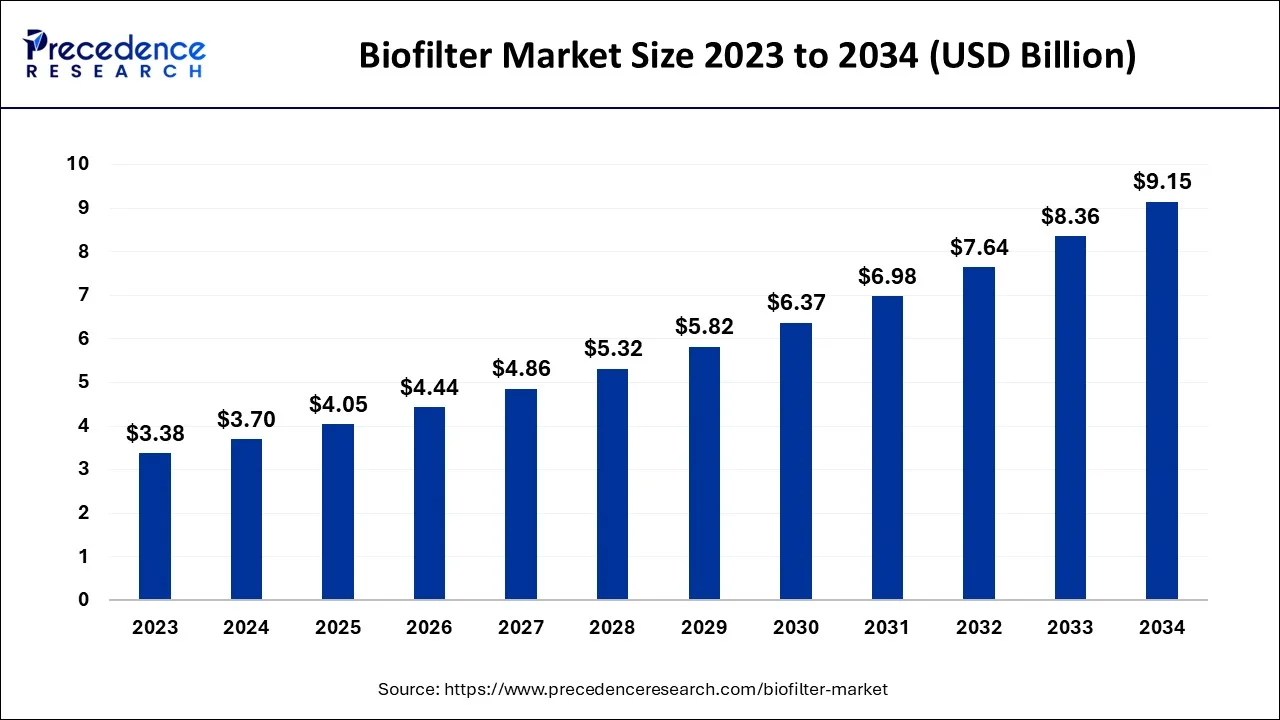

The global biofilter market size is calculated at USD 4.05 billion in 2025 and is predicted to increase from USD 4.44 billion in 2026 to approximately USD 9.94 billion by 2035, expanding at a CAGR of 9.39% from 2026 to 2035.

Key Takeaways:

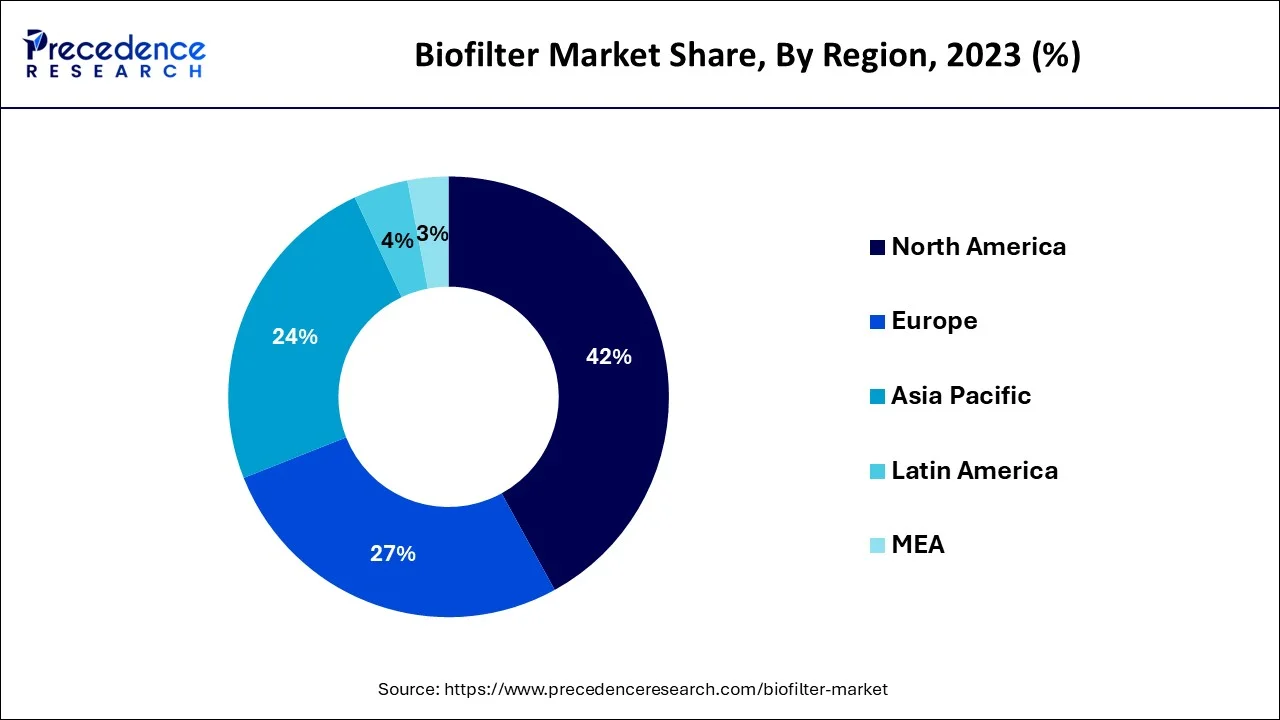

- North America generated more than 42% revenue share in 2025.

- By Type, the biological aerated biofilter system captured the maximum market share in 2025.

- By Filter Media, the ceramic rings segment contributed to the largest market share in 2025.

- By Application, the VOC Treatment segment generated the majority of the market share in 2025.

- By End-user, the biopharma segment captured the maximum market share in 2025.

Market Overview

A biofilter is an air or water purification system that uses microorganisms to break down pollutants and contaminants. The microorganisms in the biofilter are typically bacteria or fungi capable of metabolizing and removing organic compounds, such as volatile organic compounds (VOCs) or nitrogenous compounds, from the air or water. Biofilters are often used in industrial applications, such as wastewater treatment plants, to remove pollutants before the air or water is released into the environment.

They are also used in indoor environments, such as homes or offices, to improve indoor air quality and reduce the concentration of harmful pollutants. Additionally, aquaculture biofilters remove excess nutrients and waste from the water in fish tanks or ponds.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 4.05 Billion |

| Market Size by 2035 | USD 9.94 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 9.39% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type, By Filter Media, By Application, and By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Growing demand for clean water

The world's population is expected to reach 9.7 billion by 2050, increasing the demand for clean water for consumption, irrigation, and industrial use. With growing demand, effective and efficient water treatment technologies are becoming more critical. Biofilters are an attractive solution to address this growing demand for clean water. They use naturally occurring microorganisms to break down organic compounds, nitrogenous compounds, and other pollutants in water.

Biofilters are particularly effective in removing nutrients such as ammonia and nitrate, common contaminants in wastewater. These nutrients can cause environmental damage when they enter natural water bodies and harm human health if consumed. Biofilters are also a sustainable solution for water treatment, as they can be operated with low energy consumption and minimal chemical inputs.

They are also relatively easy to maintain and operate, which makes them an attractive solution for municipalities and industries looking for cost-effective and environmentally friendly water treatment technologies. The growing demand for clean water is driving the growth of the biofilter market, particularly in regions where water scarcity is a significant concern, such as in arid regions and areas experiencing droughts.

Additionally, the increasing use of biofilters in aquaculture and agriculture for water treatment is expected to contribute to the growth of the biofilter market as these industries seek to reduce their environmental impact and improve the quality of their products.

Restraint

High capital investment

The initial investment required to set up a biofilter system can be quite high, which can deter some potential buyers or limit adoption in smaller operations. Biofilters require specialized equipment such as fans, blowers, and air ducts to create airflow through the filter media. Additionally, biofilters require a significant amount of space to accommodate the filter bed, which can be expensive to construct and maintain.

The cost of media, such as compost, peat, or other organic material, can also be a significant expense. In addition to the initial capital investment, ongoing maintenance and operational costs are associated with biofilters. The filter media needs to be replaced regularly to maintain its effectiveness, which can add to the ongoing expenses of running a biofilter system.

Additionally, monitoring and maintaining the correct airflow rates and water content can be time-consuming and require specialized expertise. These costs can be a significant barrier to adoption, particularly for smaller operations that may not have the financial resources to invest in a biofilter system. For some applications, alternative technologies such as adsorption or catalytic oxidation may be more cost-effective, even though they may have higher operating costs. Thus, high capital investment is a significant restraint for the biofilter market.

While biofilters remain an effective option for many pollutants, installation, operation, and maintenance costs may limit their adoption in some industries or smaller functions. Addressing these cost barriers through innovative financing mechanisms or cost-sharing arrangements could help increase biofilter technology uptake.

Opportunity

Increasing demand for sustainable technologies in the food and beverage industry

As consumers become more environmentally conscious, there is a growing demand for sustainable and eco-friendly products. This trend is particularly strong in the food and beverage industry, where consumers are increasingly concerned about the environmental impact of their food choices. Biofilters can play a significant role in reducing the environmental impact of food and beverage production. One of the primary sources of air pollution in this industry is volatile organic compounds (VOCs) emitted during fermentation and other production processes.

Biofilters can effectively remove these pollutants by using microorganisms to break down the VOCs and convert them into harmless byproducts. The use of biofilters in the food and beverage industry presents several opportunities for the biofilter market. For instance, biofilters can reduce beer and wine production's environmental impact, which are primary VOC emissions sources. By using biofilters to treat the air emissions from these processes, breweries, and wineries can significantly reduce their environmental footprint.

Type Insights

Based on type, the biofilter market is segmented into Biological Aerated Biofilter Systems, Denitrification Biofilter Systems, Activated Carbon Biofilters, Fixed Films, and Fluidized Bed Filters. In 2023, the biological aerated biofilter system accounted for the highest market share. BABS have a high treatment efficiency and can remove a wide range of pollutants, making them an attractive solution for pollution control. They are especially effective in treating pollutants like volatile organic compounds (VOCs), odorous gases, and delicate particulate matter.

Moreover, BABS are relatively low-cost and require minimal maintenance compared to other pollution control technologies like activated carbon filters or wet scrubbers. This makes them an attractive solution for small to medium-sized applications where cost-effectiveness is critical. BABS can be used in various applications, including wastewater treatment, air pollution control, and odour control. Their versatility and adaptability make them an attractive solution for multiple industries, including chemical, petrochemical, food processing, and pharmaceuticals.

Furthermore, the increasing awareness of environmental sustainability and the need to reduce carbon emissions has led to adopt green technologies like BABS. As more companies strive to become environmentally responsible, the demand for BABS is expected to increase. In addition, technological advances have led to the development of more efficient and cost-effective BABS, which has led to increased adoption of this technology.

Newer technologies like membrane biofilters, hybrid biofilters, and hybrid membrane biofilters have improved the efficiency and effectiveness of BABS, driving their demand in the market. Therefore, these factors are driving the growth of the BABS segment in the biofilter market and making it an attractive option for pollution control in various industries.

Filter Media Insights

The biofilter market is segmented on filter media into Ceramic Rings, Bio Balls, Moving Bed Filter Media, and Others. In 2022, the ceramic rings segment accounted for the highest market share. The growth of this segment is due to increased demand for sustainable filtration solutions, a growing aquaculture industry, increasing wastewater treatment needs, and technological advancements.

As more and more people become aware of the importance of sustainability and environmental responsibility, there is a growing demand for effective, affordable, and eco-friendly biofiltration solutions. Ceramic rings are a natural, non-toxic filter media that can be reused many times, making them a popular choice for those seeking sustainable filtration options.

Moreover, the demand for wastewater treatment solutions is also increasing with global population growth and urbanization. Ceramic rings are an effective filter media for wastewater treatment systems, as they can remove organic matter, suspended solids, and other pollutants from wastewater. Therefore, the growing demand for sustainable filtration solutions increasing wastewater treatment needs.

Application Insights

Based on the application, the biofilter market is segmented into VOC Treatment, Nitrification, Denitrification, Odor Abatement, and Others. In 2022, the VOC Treatment segment accounted for the highest market share. Volatile organic compounds (VOCs) are organic chemicals that can harm human health and the environment. They are released into the air from various sources, such as industrial processes, transportation, and consumer products.

Biofilters treat VOCs by providing a medium for the growth of microorganisms that can break down the VOCs into less harmful substances—increasing environmental regulations and the growing demand for clean air drive segment growth. Biofilters offer an effective and sustainable solution for VOC treatment, making them a promising technology for various industries. The market for biofilters for VOC treatment is expected to experience steady growth in the coming years, driven by the need for effective and sustainable air pollution control solutions.

End-User Insights

Based on the end user, the market is segmented into Storm Water Management, Water & Wastewater Collection, Chemical Processing, Food & Beverage, Aquaculture, Biopharma Industry and Others. In 2022, the biopharma industry dominated the market, accounting for the highest market share. The biopharmaceutical industry uses biofilters to treat air emissions from their manufacturing processes, often involving solvents and other volatile organic compounds (VOCs).

The industry is under increasing pressure to reduce its environmental impact and comply with regulatory requirements, particularly in relation to air emissions. Biofilters offer a cost-effective and sustainable solution for treating these emissions, which makes them an attractive option for the biopharma industry. In addition to the environmental benefits, the use of biofilters in the biopharma industry can also lead to cost savings. Biofilters have low capital and operating costs compared to other air pollution control technologies, and they do not generate hazardous waste or require significant energy consumption.

These cost savings can be substantial for the biopharma industry, which operates in a highly competitive and cost-sensitive market. Therefore, the combination of regulatory compliance, environmental concerns, and cost-effectiveness is driving the growth of biofilters in the biopharma industry. As the industry continues to grow and innovate, the demand for effective and sustainable air pollution control solutions such as biofilters is expected to increase.

Regional Insights

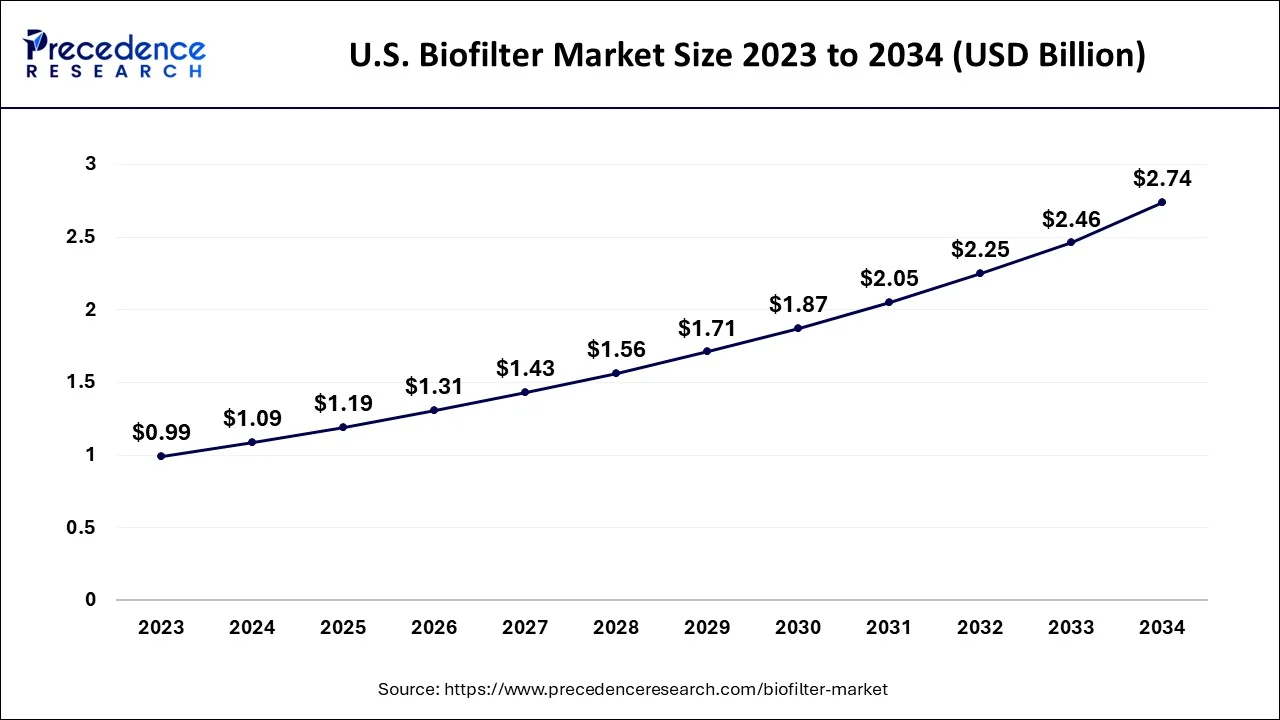

U.S. Biofilter Market Size and Growth 2026 to 2035

The U.S. biofilter market size accounted for USD 1.19 billion in 2025 and is expected to be worth around USD 3.02 billion by 2034, growing at a CAGR of 9.76% between 2026 and 2035.

In 2025, North America dominated the biofilter market, accounting for the highest market share of 42%. The increasing demand for sustainable air and water treatment solutions drives the region's growth. The United States and Canada are the major markets in the area, with the United States accounting for the largest share. The increase in the biofilter market in North America is primarily driven by the increasing adoption of advanced technologies and stringent environmental regulations promoting biofilters in various industries. Moreover, the region's well-established food and beverage industry drives the demand for sustainable water treatment solutions such as biofilters. The increasing demand for biopharmaceutical products is also expected to drive the growth of the biofilter market in the region.

Furthermore, the region has a well-established aquaculture industry, which is driving the demand for biofilters in the region. The increasing adoption of aquaponics and hydroponics systems is further propelling the growth of the biofilter market in North America.

U.S. Biofilter Market Analysis

The market in the U.S. is experiencing growth due to stringent environmental regulations, the rapid expansion of aquaculture, and advancements in technology. The U.S. Environmental Protection Agency (EPA) has introduced new standards aimed at ensuring zero emissions for new gas and oil facilities. Additionally, industrial sustainability goals are further driving the demand for innovative solutions, including biofilters, across various sectors.

Why is Asia Pacific Considered a Significant Region in the Biofilter Market?

Asia Pacific is a significant region in the market, driven by sustainable waste management practices, rapid industrialization, and urbanization. The development of biofiltration and environmental infrastructure is being strengthened by national biofoundry networks and the use of solar-powered biofilters. Moreover, the region's growing focus on sustainable solutions in waste management and environmental protection also boosts the demand for biofilters.

India Biofilter Market Analysis

The market in India is growing due to strategic policy support, sustainable agriculture practices, and net-zero goals. Increasing environmental regulations on air and wastewater pollution, rising industrialization, and the growing need for sustainable waste management solutions also drive the market. Additionally, expanding adoption of biofiltration technology in sectors such as food processing, pharmaceuticals, and chemical manufacturing is boosting market growth.

What Makes Europe a Notably Growing Area in the Biofilter Market?

Europe is expected to grow at a notable rate in the market during the forecast period. This is mainly due to advancements in system design that are expanding access to biofiltration. Additionally, government incentives and growing awareness of eco-friendly solutions in sectors like chemicals, pharmaceuticals, and food processing are driving market expansion. Germany is a major contributor to the European biofilter market due to its strong industrial base, strict environmental regulations, and widespread adoption of sustainable waste and air treatment technologies.

What are the Major Factors Contributing to the Biofilter Market within Latin America?

The market in Latin America is driven by growing industrialization, increasing environmental regulations, and rising demand for sustainable air and wastewater treatment solutions. Additionally, expanding adoption of eco-friendly technologies in sectors such as food processing, chemicals, and pharmaceuticals is supporting market growth across the region. Brazil is a major contributor to the Latin American market due to its large industrial sector, including food processing, chemicals, and pharmaceuticals, which drives demand for air and wastewater treatment solutions.

The ministers launched a global South-South effort to cut nitrous oxide and methane from agriculture, which is expected to boost the demand for biofilters.

What Opportunities Exist in the Middle East & Africa?

The Middle East & Africa (MEA) offers immense opportunities in the biofilter market. These opportunities arise from increased investments in infrastructure development and water management. Growing aquaculture development and a strong focus on developing green buildings further contribute to the market. Governments around the region are promoting bio-based solutions and circular industrial practices through several policies and regulations, which further create opportunities for the market.

Value Chain Analysis

- Raw Material Sourcing & Manufacturing

In this stage, key materials such as natural fibers, activated carbon, and microbial cultures are sourced and processed to build biofilter systems.

Key players: Ecolab, Veolia North America, Thermo Fisher Scientific, and Advanced Enviro Systems. - Biofilter Design & Integration

Design and engineering teams create customized biofilter solutions tailored to specific industries.

Key players: Xylem Inc., Veolia North America, Flextube Systems, and Trojan Technologies. - Distribution & Sales Channels

Biofilter systems are distributed through a combination of direct sales, distribution partners, and specialized contractors to end users.

Key players: Trojan Technologies, Veolia North America, Xylem Inc., and Advanced Enviro Systems.

Biofilter Market Companies

Market players attempt to increase their market share through investments, partnerships, acquisitions, and mergers. Businesses are also investing in the development of new products. Furthermore, they are concentrating on maintaining competitive pricing. Some of the prominent market players include:

- Evoqua Water Technologies LLC

- Pentair plc

- Veolia Water Technologies

- Xylem Inc.

- Suez SA

- Dürr AG

- BioAir Solutions, LLC

- Tecniplast SpA

- Aquatech International LLC

- Purafil, Inc.

Key Developments

- In March 2024, Premier Tech launched the Ecoflo linear biofilter in the U.S. through its Water and Environment business group. The on-site septic system, designed for homes off public sewage, was energy-free, easy to refurbish, and certified to NSF Standard 40 (Class 1), a leading U.S. residential wastewater treatment standard.

https://www.premiertechaqua.com

Segment Covered in the Report

By Type

- Biological Aerated Biofilter System

- Denitrification Biofilter System

- Activated Carbon Biofilters

- Fixed Films

- Fluidized Bed Filter

By Filter Media

- Ceramic Rings

- Bio Balls

- Moving Bed Filter Media

- Others

By Application

- VOC Treatment

- Nitrification

- Denitrification

- Odor Abatement

- Others

By End-User

- Storm Water Management

- Water & Wastewater Collection

- Chemical Processing

- Food & Beverage

- Aquaculture

- Biopharma Industry

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting